Douglas Dynamics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

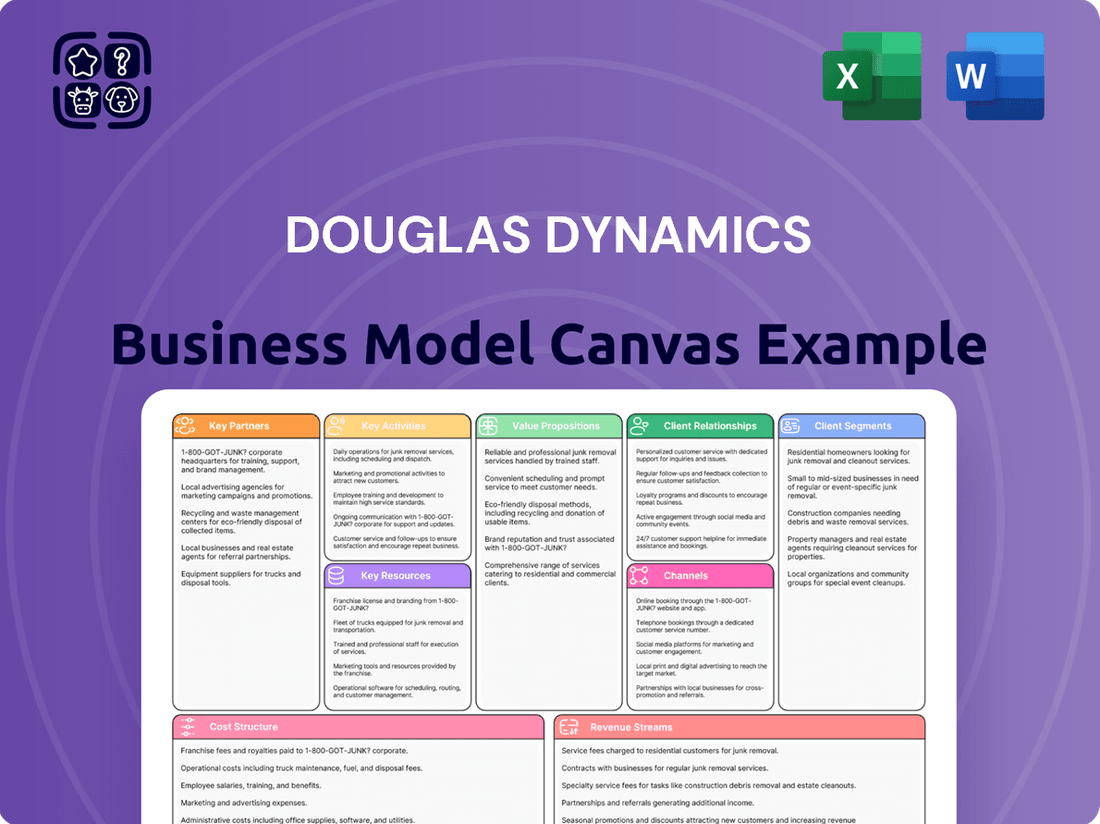

Curious about how Douglas Dynamics dominates the snow and ice management industry? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the strategic blueprint behind Douglas Dynamics's market leadership. This detailed Business Model Canvas reveals their value propositions, cost structure, and competitive advantages, providing invaluable insights for any business strategist.

Dive into the operational excellence of Douglas Dynamics with our full Business Model Canvas. Understand their core activities, key partners, and channels to market, empowering your own strategic planning and competitive analysis.

Partnerships

Douglas Dynamics' strategic dealer network is fundamental to its business model, acting as the primary channel for its snow and ice control equipment. In 2024, this network's strength was evident in its ability to ensure widespread product availability and provide localized customer support, crucial for meeting seasonal demand.

These authorized dealers are more than just sales points; they are integral partners for installation and service, fostering strong customer relationships and brand loyalty. This deep integration allows Douglas Dynamics to effectively reach diverse markets and maintain high levels of customer satisfaction across its product lines.

Douglas Dynamics relies heavily on key raw material and component suppliers, particularly for steel, plastics, and hydraulic parts, which are vital for their product manufacturing. Maintaining robust relationships ensures a consistent flow of these essential materials, directly impacting production efficiency and mitigating potential supply chain disruptions. The company's strategic focus on a predominantly U.S.-based supply chain in 2024 helped them navigate potential tariff impacts and secure a more predictable material flow.

Douglas Dynamics' key partnerships with commercial work truck Original Equipment Manufacturers (OEMs) are foundational to its business model. These relationships ensure their snowplows, salt spreaders, and other vehicle attachments are designed for perfect fit and function with popular light truck and work truck chassis. For instance, in 2024, the North American commercial vehicle market saw robust demand, with light commercial vehicle sales projected to remain strong, underscoring the importance of these OEM integrations for Douglas Dynamics’ market access and product relevance.

Technology and Innovation Collaborators

Douglas Dynamics actively seeks partnerships with technology providers and research institutions to foster ongoing product innovation and enhance manufacturing efficiency. These collaborations are crucial for developing next-generation products, such as advanced materials or intelligent control systems for their equipment. For instance, in 2024, the company continued to explore integrations with smart technologies that could improve the user experience and operational capabilities of their snow and ice control equipment.

These alliances are vital for staying at the forefront of the industry. By working with external experts, Douglas Dynamics can accelerate the adoption of new technologies, optimize production processes through automation, and ensure their offerings remain competitive. This focus on cutting-edge solutions and operational excellence underpins their strategy for sustained growth and market leadership.

- Focus on Advanced Materials: Collaborations to integrate lighter, more durable materials into product designs.

- Smart Control Systems: Partnerships to develop and implement IoT capabilities for enhanced equipment performance and data collection.

- Manufacturing Process Optimization: Alliances aimed at leveraging automation and AI to improve production speed and quality.

- Research & Development Initiatives: Joint projects with universities or tech firms to explore future product concepts and technological advancements.

Logistics and Transportation Providers

Douglas Dynamics relies heavily on a robust network of logistics and transportation providers to ensure the smooth flow of goods. These partnerships are vital for moving raw materials into their manufacturing plants and then getting finished products, like snowplows and truck accessories, to their extensive dealer network and end-users throughout North America.

The efficiency of these logistics operations directly impacts Douglas Dynamics' ability to meet fluctuating seasonal demand, particularly for snow and ice management equipment. Timely deliveries and cost-effective shipping are not just operational necessities but are critical for maintaining high customer satisfaction levels. For instance, in 2024, Douglas Dynamics continued to focus on optimizing its supply chain, recognizing that a well-managed logistics network is a significant competitive advantage.

These partnerships are foundational to the company's operational success. They enable:

- Timely inbound delivery of raw materials, supporting consistent production schedules.

- Efficient outbound distribution of finished goods to a wide geographical area.

- Cost management through optimized shipping routes and carrier negotiations.

- Enhanced customer service by ensuring product availability when and where it's needed most.

Douglas Dynamics' key partnerships extend to financial institutions and investors, providing the capital necessary for growth, acquisitions, and research and development. These relationships ensure the company has the financial flexibility to pursue strategic initiatives and manage its operations effectively.

In 2024, Douglas Dynamics continued to leverage its strong financial backing to support its expansion plans and maintain a healthy balance sheet. Access to capital markets allowed them to fund capital expenditures and explore new market opportunities.

What is included in the product

Douglas Dynamics' Business Model Canvas focuses on manufacturing and selling innovative work-ready vehicle attachments and equipment, serving a broad customer base of professional contractors and fleet managers through a robust distribution network.

Douglas Dynamics' Business Model Canvas offers a structured approach to pinpointing and alleviating customer pain points by clearly defining value propositions and key customer relationships.

It provides a one-page snapshot of how Douglas Dynamics addresses market needs, effectively relieving the pain of inefficient or inadequate solutions for their target customers.

Activities

Douglas Dynamics actively designs and engineers new snow and ice control equipment and work truck attachments, a core activity for staying ahead in the market. This focus on innovation drives improvements in productivity, user-friendliness, and equipment longevity.

The company's commitment to enhancing features like reliability and serviceability is crucial for customer satisfaction and retention. For instance, in 2023, Douglas Dynamics reported a net sales increase of 11.1% to $1.04 billion, reflecting strong demand for their continuously improved product lines.

Utilizing lean manufacturing principles, Douglas Dynamics streamlines its product development, aiming to cut expenses and speed up the time it takes to bring new designs to market. This efficiency is key to maintaining their competitive edge and responding quickly to evolving customer needs.

Douglas Dynamics' key manufacturing and assembly activities revolve around creating a wide array of work truck attachments, such as snowplows and spreaders, distributed across its well-known brands. This process is deeply rooted in a philosophy of durable craftsmanship, often summarized by the company's ethos: Built Strong, Built by Hand, Built by People.

The company's commitment to operational excellence is evident in its Douglas Dynamics Management System (DDMS). This system actively drives continuous improvement initiatives across all production lines, ensuring efficiency and quality in every unit produced.

In 2024, Douglas Dynamics continued to leverage its manufacturing expertise. While specific production volume figures are proprietary, the company's strong market position in the snow and ice management sector, which saw significant activity in 2024 due to varied weather patterns across North America, underscores the scale and importance of these operations.

A core activity for Douglas Dynamics' Work Truck Solutions is the expert upfitting of commercial and municipal work trucks with top-tier attachments and storage systems. This specialized service ensures trucks are equipped precisely to customer needs, enhancing their functionality for various tasks.

This customization is vital, especially when securing significant contracts with municipalities. For instance, in 2024, Douglas Dynamics continued to focus on these value-added services, which are critical for differentiating their offerings in a competitive market and meeting the stringent demands of government clients.

Sales, Marketing, and Brand Management

Douglas Dynamics actively drives growth by managing its sales and marketing initiatives across its well-recognized brands like FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA. This involves strategically expanding its reach through a robust distribution network and fostering cross-selling opportunities to maximize value from its diverse product lines. The company also focuses on engaging with a broad spectrum of customer segments, ensuring its brands resonate with their specific needs.

Effective brand management is a cornerstone of Douglas Dynamics' strategy, aimed at solidifying market presence and cultivating lasting customer loyalty. This proactive approach ensures that each brand maintains its distinct identity and value proposition in the competitive landscape.

In 2023, Douglas Dynamics reported net sales of $558.9 million, a slight increase from $557.0 million in 2022, demonstrating consistent market engagement and sales performance.

- Brand Portfolio Strength: The company leverages its trusted brands such as FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA to capture market share.

- Distribution Network Expansion: Key activities include growing and optimizing the sales channels to reach more customers effectively.

- Cross-Selling Initiatives: Douglas Dynamics actively promotes the synergy between its brands to offer comprehensive solutions to its customer base.

- Customer Segment Engagement: Tailored marketing and sales approaches are employed to connect with diverse customer groups, from professional contractors to fleet managers.

Supply Chain and Inventory Optimization

Douglas Dynamics engages in the strategic management of its supply chain, encompassing the procurement of raw materials and the efficient control of inventory. This is a dynamic process, constantly refined to streamline operations, adapt to market shifts, and balance stock levels to meet customer demand without incurring excessive holding costs.

In 2024, the company continued to refine its inventory strategy. For instance, efforts were made to reduce inventory in certain product lines where demand softened, while simultaneously increasing stock in others to bolster support for a growing backlog of customer projects. This targeted approach aims to optimize capital allocation and ensure product availability for key growth areas.

- Strategic Procurement: Focuses on securing necessary materials at competitive prices while ensuring quality and reliability from suppliers.

- Inventory Management: Implemented a data-driven approach to manage stock levels, balancing the need to meet demand with the cost of holding inventory.

- Adaptability: The supply chain is designed to be flexible, allowing for adjustments in response to fluctuating market conditions and project-specific needs.

- Cost Optimization: Continuous efforts are made to identify and implement efficiencies throughout the supply chain to minimize operational expenses.

Douglas Dynamics' key activities center on designing and engineering innovative snow and ice control equipment, alongside manufacturing a diverse range of work truck attachments. These operations are supported by a robust supply chain and strategic sales and marketing efforts across its established brands. The company also emphasizes operational excellence through its management system and focuses on value-added upfitting services for commercial and municipal clients.

| Key Activity | Description | 2024 Relevance/Data |

| Product Design & Engineering | Developing new and improved snow/ice control equipment and truck attachments. | Continued focus on enhancing productivity and user-friendliness. |

| Manufacturing & Assembly | Producing a wide array of work truck attachments with a focus on durability. | Leveraging manufacturing expertise amidst strong market demand in the snow and ice sector. |

| Upfitting Services | Customizing commercial and municipal work trucks with attachments and storage. | Securing contracts with municipalities, crucial for differentiation. |

| Sales & Marketing | Managing brand initiatives and distribution networks for brands like FISHER and WESTERN. | Focus on expanding reach and fostering cross-selling opportunities. |

| Supply Chain Management | Procuring materials and managing inventory efficiently. | Refining inventory strategy to balance demand and costs, adapting to market shifts. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Douglas Dynamics' strategic framework is presented in its final, ready-to-use format, ensuring no discrepancies between the preview and the delivered product. You can be confident that the detailed sections and insights displayed here are precisely what you will gain access to, allowing for immediate application and analysis.

Resources

Douglas Dynamics' proprietary brand portfolio is a cornerstone of its business model, featuring highly respected names like FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA. These brands are not just names; they represent significant intellectual property and deep market recognition within the snow and ice control sector, solidifying the company's leading market position.

The strength of this brand equity directly translates into customer loyalty and acquisition. For instance, in 2023, Douglas Dynamics reported that its brands consistently achieve high customer satisfaction ratings, a testament to their perceived quality and reliability. This established trust is a powerful differentiator in a competitive landscape.

Douglas Dynamics' advanced manufacturing capabilities are a cornerstone of its business model, featuring sophisticated facilities and cutting-edge equipment. These physical assets are crucial for producing the high-quality, durable snow and ice control equipment and work truck attachments that define the company's product lines.

The company leverages lean manufacturing practices within these facilities to optimize production efficiency and ensure consistent product quality. This operational excellence allows Douglas Dynamics to meet current market demand effectively while also positioning itself for future expansion and innovation.

For instance, in 2023, Douglas Dynamics reported a net sales increase to $590.7 million, reflecting strong demand for its products, a testament to the effectiveness of its manufacturing investments. These capabilities directly translate into a competitive advantage, enabling the company to deliver reliable equipment to its customers.

Douglas Dynamics relies heavily on its skilled workforce, encompassing engineers, manufacturing specialists, and sales professionals. This human capital is fundamental to their ability to innovate and maintain operational excellence. For instance, in 2023, the company highlighted the dedication of its team in navigating market dynamics and ensuring product quality.

Experienced management expertise is another cornerstone resource, guiding strategic decisions and fostering a culture of performance. This leadership ensures the company effectively leverages its technical talent and manufacturing capabilities to meet market demands and drive growth. The company’s management team consistently focuses on optimizing processes and building strong customer partnerships.

Extensive Distribution and Service Network

Douglas Dynamics leverages an extensive distribution and service network, a crucial asset in its business model. This widespread network of authorized dealers and service centers across North America is fundamental to its operations. It ensures efficient sales, product delivery, installation, and vital after-sales support, granting access to a broad spectrum of customers.

The company actively focuses on expanding and optimizing this network to enhance its reach and service capabilities. This strategic imperative is key to maintaining a competitive edge and meeting evolving customer demands in the work-ready vehicle upfitter market.

- North American Reach: A robust network of dealers and service centers across the United States and Canada.

- Customer Access: Facilitates sales, delivery, installation, and crucial after-sales support for diverse customer segments.

- Strategic Focus: Continuous efforts to expand and optimize this network for improved market penetration and customer satisfaction.

- Operational Efficiency: The network underpins the company's ability to efficiently serve its customer base.

Douglas Dynamics Management System (DDMS)

The proprietary Douglas Dynamics Management System (DDMS) is a cornerstone intellectual resource. It underpins the company's dedication to enhancing operations, ensuring high-quality products, and ultimately boosting shareholder value.

This integrated system, comprising various tools and processes, is designed to cultivate operational excellence. It also serves as a framework for effective problem-solving across the organization.

DDMS plays a crucial role in driving efficiency and maintaining consistency in product delivery. For instance, in 2023, Douglas Dynamics reported net sales of $1.08 billion, reflecting the operational effectiveness facilitated by systems like DDMS.

- Intellectual Resource: DDMS is a proprietary system that guides continuous improvement.

- Operational Excellence: It fosters efficiency and consistent product delivery.

- Value Creation: DDMS supports the company's commitment to shareholder value.

- Problem-Solving: The system provides a framework for addressing operational challenges.

Douglas Dynamics' intellectual property extends beyond its brand portfolio to include its proprietary Douglas Dynamics Management System (DDMS). This system is instrumental in driving operational excellence, ensuring consistent product quality, and fostering a culture of continuous improvement across the organization. DDMS acts as a framework for effective problem-solving, directly contributing to the company's ability to deliver value and maintain its competitive edge in the market.

The company's robust financial resources are a critical component of its business model, enabling strategic investments in manufacturing, product development, and market expansion. These financial assets provide the stability and flexibility needed to navigate market fluctuations and capitalize on growth opportunities. Douglas Dynamics' strong financial position supports its commitment to innovation and its ability to execute its long-term strategic vision.

In 2023, Douglas Dynamics reported net sales of $1.08 billion, demonstrating the strength of its financial foundation. This financial performance underscores the effectiveness of its business strategies and its capacity for sustained growth. The company's access to capital and its prudent financial management are key enablers of its operational success and market leadership.

| Financial Metric | 2023 Value | Significance |

|---|---|---|

| Net Sales | $1.08 billion | Indicates strong market demand and operational effectiveness. |

| Gross Profit Margin | 40.2% (as of Q4 2023) | Reflects efficient production and pricing power. |

| Operating Income | $196.4 million (as of Q4 2023) | Demonstrates profitability from core operations. |

Value Propositions

Douglas Dynamics' commitment to superior quality and durability is a cornerstone of its value proposition. Their snow and ice control equipment, like BOSS snowplows and SALTDOGG spreaders, are engineered to endure extreme winter conditions and rigorous daily use, a critical factor for professionals who rely on their gear day in and day out.

This emphasis on robust construction translates directly into tangible benefits for customers. By minimizing the likelihood of equipment failure, Douglas Dynamics helps reduce costly downtime, allowing users to maintain operational efficiency even during the most challenging weather events. For instance, their products are designed with heavy-duty materials and advanced engineering to ensure longevity, a key differentiator in a competitive market.

The long-lasting nature of Douglas Dynamics' equipment also means a lower total cost of ownership over time. Customers benefit from fewer repairs and replacements, making their investment more economical. This focus on durability not only serves the immediate needs of the user but also contributes to a stronger resale value, further enhancing the overall economic advantage.

Douglas Dynamics' offerings are meticulously designed to boost how much work professional snowplowers and municipalities can get done, making their tasks simpler and faster. For example, their Western Snow Plows are known for their durability and ease of operation, allowing users to clear more area in less time.

By equipping customers with superior tools for managing winter conditions and customizing their work vehicles, Douglas Dynamics directly helps them operate more effectively. This enhanced operational capability translates into greater profitability for their clients.

In 2023, Douglas Dynamics reported net sales of $790.9 million, a significant portion of which is driven by the demand for products that increase customer efficiency. This demonstrates the tangible financial impact of their value proposition.

Douglas Dynamics provides a wide array of specialized equipment and upfitting services, addressing everything from light truck snowplows to extensive municipal snow and ice management systems. This broad spectrum of products, spanning its Work Truck Attachments and Work Truck Solutions divisions, allows customers to find integrated solutions perfectly suited to their operational demands.

The company's portfolio is structured around distinct brands, each targeting specific market segments and customer needs. This strategic branding ensures that specialized solutions are readily available for various niches within the work truck industry.

Trusted Brand Reputation

Douglas Dynamics leverages its deeply ingrained trusted brand reputation, cultivated over more than 75 years, as a cornerstone of its business model. This extensive history in the industry translates into a powerful signal of reliability and quality for customers. For instance, in 2023, the company reported net sales of $592.1 million, a testament to the ongoing market trust in its product offerings.

This long-standing market leadership and heritage directly instill confidence in consumers regarding both product performance and the company's commitment to support. This established trust acts as a significant draw for new clientele while simultaneously nurturing strong loyalty among its existing customer base.

- Decades of Industry Presence: Over 75 years of operation.

- Market Leadership: A recognized leader in its sectors.

- Customer Confidence: Builds trust in product quality and support.

- Brand Loyalty: Attracts new customers and retains existing ones.

Innovation and Continuous Improvement

Douglas Dynamics’ commitment to innovation and continuous improvement, driven by their Douglas Dynamics Management System (DDMS), ensures they consistently offer advanced solutions. This dedication to daily betterment translates into tangible customer advantages through technological, design, and functional enhancements.

This proactive development strategy is crucial for maintaining market leadership. For instance, in 2024, the company continued to invest in research and development, focusing on enhancing the efficiency and durability of their snow and ice control equipment, a key segment for their business.

- Product Innovation: Ongoing development of new features and product lines to meet evolving customer demands and industry standards.

- Operational Efficiency: Implementing process improvements through DDMS to streamline manufacturing and reduce costs, benefiting both the company and its customers.

- Market Responsiveness: Actively monitoring market trends and customer feedback to quickly adapt product offerings and strategies.

Douglas Dynamics offers a comprehensive suite of specialized equipment and upfitting services, catering to a wide range of work truck needs, from light snowplows to large-scale municipal systems. This broad product portfolio, organized across their Work Truck Attachments and Work Truck Solutions segments, ensures customers can find integrated solutions tailored to their specific operational requirements.

Their value proposition centers on providing highly durable and efficient equipment that minimizes downtime and lowers the total cost of ownership for professionals. This focus on quality and longevity directly translates into increased productivity and profitability for their clients, a crucial factor in demanding industries.

With over 75 years of industry presence, Douglas Dynamics has cultivated a strong reputation for reliability and quality, fostering significant customer confidence and brand loyalty. This established trust is a key differentiator, attracting new customers and retaining existing ones by assuring them of superior product performance and ongoing support.

The company's commitment to innovation, guided by the Douglas Dynamics Management System, ensures they consistently deliver advanced solutions that enhance efficiency and durability. For example, their continued investment in research and development in 2024 aims to further improve their snow and ice control equipment, a vital area for their customer base.

| Value Proposition Element | Description | Key Benefit |

|---|---|---|

| Product Durability & Quality | Engineered for extreme conditions and rigorous use. | Reduced downtime, lower total cost of ownership. |

| Operational Efficiency | Designed to simplify and speed up tasks. | Increased productivity, greater profitability for clients. |

| Comprehensive Solutions | Wide array of specialized equipment and upfitting. | Integrated solutions tailored to specific operational demands. |

| Trusted Brand Reputation | Over 75 years of industry leadership and trust. | Customer confidence in product performance and support. |

| Continuous Innovation | Ongoing development and technological enhancements. | Access to advanced, market-leading solutions. |

Customer Relationships

Douglas Dynamics views its dealers and distributors not just as sales channels, but as integral partners in its success. This collaborative approach is backed by tangible support, including comprehensive product training and robust marketing collateral designed to boost their sales efforts.

The company ensures its network is well-equipped through efficient supply chain management, facilitating timely delivery of products to meet end-user demand. This focus on operational excellence helps dealers and distributors maintain high customer service levels, reinforcing Douglas Dynamics' brand reputation.

In 2023, Douglas Dynamics reported net sales of $541.9 million, a significant portion of which is driven by the strength and reach of this dedicated dealer and distributor network. Their ability to effectively serve a broad customer base is a cornerstone of the company's market penetration and ongoing growth.

Douglas Dynamics offers specialized professional and technical services to its commercial and municipal clients. This ensures customers select the right equipment, install it correctly, and maintain it effectively for optimal performance.

This hands-on approach is particularly vital for the complex, large-scale solutions Douglas Dynamics provides. For instance, in 2024, the company continued to emphasize its commitment to customer success, with a significant portion of its service revenue derived from these value-added support offerings.

By providing expert guidance, Douglas Dynamics helps clients extend the operational life of their investments and achieve peak performance, a key differentiator in the heavy-duty vehicle equipment market.

Douglas Dynamics fosters long-term relationships with municipalities, frequently securing multi-year contracts for essential snow and ice control equipment and fleet upfitting. This approach moves beyond single sales, emphasizing continuous collaboration and dedicated support tailored to each municipality's unique fleet requirements.

These enduring partnerships create a stable and predictable demand stream for Douglas Dynamics' Work Truck Solutions segment. For instance, in 2023, the company reported that its municipal business represented a significant portion of its revenue, demonstrating the value of this long-term engagement strategy.

Customer Feedback Integration

Douglas Dynamics places significant emphasis on customer feedback, actively integrating it into their product development and ongoing improvement cycles. This commitment is a cornerstone of their Douglas Dynamics Management System (DDMS), ensuring their offerings consistently align with evolving market needs and customer preferences.

This customer-centric philosophy not only drives innovation but also cultivates strong customer loyalty. By demonstrating a clear responsiveness to customer input, Douglas Dynamics builds trust and reinforces its dedication to delivering value that truly resonates with its user base.

- Customer Feedback Integration: Douglas Dynamics actively solicits and incorporates customer feedback to refine its product lines and services.

- DDMS Foundation: The Douglas Dynamics Management System (DDMS) is designed to channel this feedback into actionable improvements, keeping products relevant.

- Market Responsiveness: This approach allows the company to adapt quickly to shifts in market demand and user requirements.

- Loyalty Building: By actively listening and responding, Douglas Dynamics enhances customer satisfaction and fosters long-term relationships.

Brand-Specific Loyalty Programs/Communities

Douglas Dynamics likely leverages brand-specific loyalty programs and communities to deepen customer engagement across its portfolio, including brands like FISHER, SNOWEX, and WESTERN. These initiatives are crucial for fostering repeat business and building lasting customer relationships.

- Brand Communities: Online forums and social media groups dedicated to specific brands like FISHER or WESTERN allow users to share experiences, tips, and product feedback, creating a sense of belonging.

- Owner Events: Organizing regional or national owner events, perhaps tied to trade shows or seasonal activities, provides opportunities for direct customer interaction and brand advocacy.

- Specialized Support: Offering dedicated customer support channels or exclusive content for owners of specific product lines enhances the perceived value and strengthens brand loyalty.

- Loyalty Rewards: While not explicitly stated, a points-based system or tiered rewards program for repeat purchases or referrals could further incentivize customer retention, especially given the significant investment in their equipment.

Douglas Dynamics cultivates strong relationships through its dealer and distributor network, offering training and marketing support to ensure their success. This partnership approach, coupled with efficient supply chain management, underpins the company's market penetration. In 2023, net sales reached $541.9 million, a testament to this network's effectiveness.

Specialized professional and technical services are provided to commercial and municipal clients, ensuring proper equipment selection, installation, and maintenance. This focus on customer success, particularly evident in 2024 service revenue, helps clients maximize equipment lifespan and performance.

Long-term municipal contracts, a significant revenue driver for the Work Truck Solutions segment in 2023, highlight Douglas Dynamics' strategy of continuous collaboration and tailored support for fleet needs.

Customer feedback is actively integrated into product development via the Douglas Dynamics Management System (DDMS), fostering market responsiveness and customer loyalty.

Channels

Douglas Dynamics' Work Truck Attachments segment relies heavily on its extensive network of authorized dealers and distributors throughout North America. This channel is the backbone for reaching customers, offering direct sales, expert installation, and crucial local support for both professional snowplowers and individual users.

This widespread physical presence ensures product accessibility and reinforces customer relationships through hands-on service. In 2023, Douglas Dynamics reported that approximately 85% of its Work Truck Attachments revenue was generated through this dealer and distributor network, highlighting its critical importance to the business.

For its Work Truck Solutions segment, Douglas Dynamics often employs a direct sales channel for significant municipal contracts. This approach leverages specialized sales teams and project managers who collaborate closely with government entities to deliver bespoke solutions and oversee intricate installation processes.

This direct engagement model is crucial for managing the complexities inherent in large-scale municipal projects. It ensures that specific requirements are met, from initial consultation to final implementation, fostering strong relationships with these high-volume clients and facilitating tailored service delivery.

While specific contract values fluctuate, municipal sales represent a substantial portion of the Work Truck Solutions revenue. For instance, in 2024, the municipal sector continued to be a key driver, with demand for specialized equipment like snowplows and salt spreaders remaining robust due to ongoing infrastructure maintenance needs across various cities and towns.

Douglas Dynamics utilizes its primary corporate website and various brand-specific digital platforms to serve as central hubs for information. These channels offer detailed product catalogs, customer support resources, and dedicated investor relations sections, ensuring accessibility for all stakeholders.

These online presences are crucial for disseminating company news and updates, acting as primary touchpoints for customers exploring their offerings and investors seeking financial data. In 2023, their digital platforms likely saw significant traffic as the company continued to innovate in the snow and cold weather management sector.

Industry Trade Shows and Events

Douglas Dynamics actively participates in key industry trade shows like NTEA Work Truck Week. This is a vital channel for showcasing new product innovations and demonstrating their performance to a targeted audience of potential customers and industry stakeholders.

These events are instrumental for direct customer engagement. They provide a prime opportunity to highlight the company's advanced solutions and gather valuable market feedback. In 2024, NTEA Work Truck Week saw significant attendance, with over 15,000 attendees and more than 500 exhibitors, underscoring the importance of these platforms for industry visibility and lead generation.

- Product Showcase: Demonstrating new and existing product lines to a concentrated industry audience.

- Customer Engagement: Direct interaction with current and potential customers to build relationships and understand needs.

- Market Intelligence: Gathering insights on competitor activities and emerging industry trends.

- Brand Visibility: Reinforcing brand presence and establishing Douglas Dynamics as an industry leader.

Specialized Commercial Sales Teams

Beyond its extensive dealer network, Douglas Dynamics leverages specialized commercial sales teams. These dedicated professionals focus on cultivating relationships with larger commercial accounts and influential fleet operators.

This direct engagement allows for the delivery of highly tailored solutions, competitive volume pricing structures, and consistent, proactive account management. These specialized teams are crucial for addressing the distinct and often complex requirements of significant organizational buyers, ensuring their specific needs are met efficiently and effectively.

- Targeted Outreach: Sales teams directly engage major commercial clients and fleet managers.

- Customized Offerings: Solutions are tailored, including volume-based pricing and dedicated support.

- Relationship Management: Ongoing account management ensures client satisfaction and retention.

- Strategic Importance: This channel is vital for capturing high-value business from large organizations.

Douglas Dynamics reaches its diverse customer base through multiple channels, each serving a distinct purpose in its go-to-market strategy. The company's extensive dealer and distributor network is paramount for its Work Truck Attachments segment, ensuring broad product accessibility and localized customer support. For its Work Truck Solutions, direct sales are key for securing large municipal contracts, supported by specialized teams managing complex project requirements.

Digital platforms and industry trade shows also play crucial roles, facilitating information dissemination, product showcases, and direct customer engagement. Furthermore, dedicated commercial sales teams cultivate relationships with major fleet operators, offering tailored solutions and volume pricing.

| Channel | Segment Focus | Key Activities | 2023/2024 Data Point |

|---|---|---|---|

| Dealer/Distributor Network | Work Truck Attachments | Direct Sales, Installation, Local Support | ~85% of Work Truck Attachments revenue |

| Direct Sales (Municipal) | Work Truck Solutions | Bespoke Solutions, Project Management | Robust demand in 2024 for municipal equipment |

| Digital Platforms | All Segments | Product Catalogs, Customer Support, Investor Info | Key for news dissemination and customer exploration |

| Industry Trade Shows (e.g., NTEA) | All Segments | Product Innovation Showcase, Customer Engagement | Over 15,000 attendees at 2024 NTEA Work Truck Week |

| Commercial Sales Teams | Work Truck Solutions | Fleet Operator Relationships, Tailored Solutions | Focus on high-value business from large organizations |

Customer Segments

Professional snow and ice management contractors are a core customer segment for Douglas Dynamics. These are the businesses and individuals who keep our roads, sidewalks, and parking lots safe during winter. They rely on equipment that can withstand harsh conditions and perform consistently, day in and day out.

Douglas Dynamics understands these demands, offering a robust line of plows and spreaders specifically designed for professional use. For instance, their Western® brand plows are known for durability, a critical factor for contractors who face constant wear and tear. In 2024, the snow and ice management industry continued to see steady demand, with many contractors investing in upgrades to improve efficiency and meet client expectations for rapid response times.

Municipalities and government agencies, encompassing city, county, state, and provincial levels, represent a critical customer segment for Douglas Dynamics. These entities are directly responsible for the essential task of maintaining public roads, highways, and vital infrastructure, especially during harsh winter conditions. Their needs are typically for heavy-duty, durable, and often customized snow and ice control equipment, such as large plows and specialized upfitting services for their extensive fleet vehicles.

The demand from this governmental sector has consistently shown resilience and strength. For instance, in 2024, government spending on infrastructure maintenance, including snow removal equipment, is projected to remain a significant portion of municipal budgets, reflecting the ongoing necessity for reliable public services.

Individual consumers and light commercial users represent a significant portion of Douglas Dynamics' customer base, primarily homeowners and small business owners. These users rely on light trucks for personal property upkeep and light commercial snow removal. In 2024, the demand for user-friendly, durable, and effective snow and ice control equipment for personal vehicles remained strong, driving sales within the Work Truck Attachments segment.

Commercial Fleet Operators

Commercial fleet operators, managing extensive collections of work trucks across numerous sectors beyond just snow and ice management, represent a significant customer base for Douglas Dynamics. These businesses often need versatile attachments and upfitting services to cater to a wide array of operational needs. They prioritize equipment that is not only standardized and dependable but also simple to maintain across their entire vehicle fleet.

Douglas Dynamics serves these operators by offering a broad range of solutions designed for durability and ease of integration. For instance, in 2024, the demand for adaptable snowplows and salt spreaders continued, but also saw increased interest in specialized attachments for landscaping, construction, and municipal services. Companies like those operating large utility fleets, for example, require robust, interchangeable equipment that minimizes downtime and ensures operational efficiency throughout the year.

- Diverse Fleet Needs: Operators require versatile attachments for various industries, not just snow and ice.

- Standardization and Reliability: Emphasis on uniform, dependable equipment across their entire vehicle fleet.

- Maintenance Efficiency: Preference for solutions that are easy to service and maintain, reducing operational disruptions.

- Market Demand: In 2024, alongside traditional snow and ice equipment, there was growing demand for attachments supporting construction, landscaping, and utility services.

Vehicle Customization and Upfitting Businesses

Vehicle customization and upfitting businesses represent a significant, albeit indirect, customer segment for Douglas Dynamics. These specialized companies often purchase attachments and components from Douglas Dynamics to integrate into their own custom vehicle builds for various industries, such as construction, landscaping, and municipal services. For example, a business focused on creating specialized snow-removal vehicles might source plows and salt spreaders from Douglas Dynamics to complete their product. This segment underscores the demand for high-quality, reliable truck attachments across a wider ecosystem of vehicle service providers.

The reliance of these upfitters on Douglas Dynamics highlights the latter's role as a key supplier in the broader truck attachment market. Their purchasing decisions are driven by the need for durable and effective equipment that enhances the functionality of the vehicles they customize. Douglas Dynamics' ability to provide a range of attachments allows these businesses to offer more comprehensive solutions to their end customers, contributing to their own revenue streams. In 2024, the aftermarket truck accessory market, which includes upfitting services, continued to show robust growth, with industry reports indicating a compound annual growth rate (CAGR) of over 5% in recent years, demonstrating the sustained demand for such components.

Key aspects of this customer segment include:

- Specialization: These businesses focus on niche vehicle modifications, requiring specific types of attachments.

- Quality Dependence: Their reputation is tied to the quality of the components they integrate, making Douglas Dynamics' product reliability crucial.

- Broader Market Reach: They extend the application and reach of Douglas Dynamics' products into diverse specialized vehicle markets.

Vehicle customization and upfitting businesses are crucial indirect customers, integrating Douglas Dynamics' products into their specialized vehicle builds for sectors like construction and landscaping. These businesses rely on the quality and reliability of attachments to enhance their custom vehicle offerings. In 2024, the aftermarket truck accessory market, including upfitting, demonstrated strong growth, with reports indicating a CAGR exceeding 5% in recent years, highlighting sustained demand for such components.

Cost Structure

Manufacturing and production expenses represent a substantial part of Douglas Dynamics' cost structure, directly tied to creating their snow and ice control equipment. These costs encompass the price of raw materials like steel and plastics, essential component parts, and the wages paid to direct labor involved in assembly.

In 2024, Douglas Dynamics likely continued to focus on optimizing these significant manufacturing outlays. For instance, efficient production techniques, such as lean manufacturing principles, are crucial for controlling costs related to direct labor and factory overhead, ultimately impacting the company's profitability.

Selling, General, and Administrative (SG&A) costs for Douglas Dynamics encompass the expenses tied to their sales efforts, marketing initiatives, maintaining their distribution network, and overall corporate administration. This includes the compensation for their sales and administrative teams, the investment in marketing campaigns to promote their products, and the day-to-day operational overhead required to run the business.

In 2024, Douglas Dynamics implemented a Cost Savings Program specifically targeting a reduction in these SG&A expenses. This strategic initiative aimed to enhance operational efficiency, which directly impacts the company's profitability by controlling these significant overheads.

Douglas Dynamics consistently allocates significant resources to Research and Development (R&D) to solidify its market position and foster ongoing innovation. These expenditures cover the creation of novel products, the enhancement of current offerings, and the development of cutting-edge technologies for their equipment lines.

For instance, in 2023, the company reported R&D expenses of $18.7 million. This investment is fundamental to remaining competitive and effectively addressing the dynamic requirements of their customer base.

Distribution and Logistics Costs

Douglas Dynamics incurs significant expenses for distributing its finished goods. These costs encompass the transportation of products from its manufacturing plants to a wide network of dealerships and, in some cases, directly to end-users. Efficient management of these logistics is crucial, particularly considering the seasonal demand for many of its offerings, ensuring products reach markets when needed.

The company's commitment to timely delivery directly impacts its cost structure. For instance, in 2023, Douglas Dynamics reported that its cost of goods sold, which includes many of these distribution-related expenses, amounted to $514.9 million. This figure highlights the substantial investment required to move products through its supply chain.

- Transportation Expenses: Costs associated with freight, shipping, and carrier fees for moving inventory.

- Warehousing and Storage: Expenses for maintaining facilities to store finished products before they are distributed.

- Inventory Management: Costs related to tracking, managing, and optimizing stock levels across the distribution network.

- Logistics Technology: Investments in systems and software to enhance supply chain visibility and efficiency.

Debt Servicing and Capital Expenditures

Douglas Dynamics manages costs associated with its debt, primarily through interest payments on its various credit facilities. These financing costs are a significant component of its overall expenses.

Capital expenditures are another key cost driver, encompassing investments in facility improvements, new machinery, and strategic growth initiatives. In 2023, capital expenditures were $42.4 million, reflecting ongoing investment in operational efficiency and capacity.

The company has actively worked to reduce its long-term debt. As of December 31, 2023, total debt stood at $429.1 million, a decrease from $477.5 million at the end of 2022. This reduction enhances financial flexibility and lowers the burden of interest expenses.

- Debt Servicing: Interest expense on outstanding debt.

- Capital Expenditures: Investments in property, plant, and equipment, including facility upgrades and new equipment.

- Debt Reduction: Strategic efforts to lower outstanding debt, impacting interest costs.

Douglas Dynamics' cost structure is heavily influenced by its manufacturing operations, including raw materials and direct labor, with a significant portion dedicated to selling, general, and administrative expenses. The company also invests in research and development to maintain its competitive edge.

Distribution and logistics represent another substantial cost area, ensuring products reach their markets efficiently. Furthermore, financing costs, particularly interest on debt, and capital expenditures for operational improvements are key components of their overall spending.

In 2023, Douglas Dynamics reported cost of goods sold at $514.9 million and R&D expenses of $18.7 million, while capital expenditures totaled $42.4 million, underscoring the significant investments in production, innovation, and infrastructure.

The company is actively managing its debt, reducing it from $477.5 million in 2022 to $429.1 million by the end of 2023, which in turn lowers its interest expenses.

| Cost Category | 2023 Data (USD Millions) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | 514.9 | Raw materials, direct labor, manufacturing overhead |

| R&D Expenses | 18.7 | New product development, product enhancements |

| Capital Expenditures | 42.4 | Facility improvements, machinery, growth initiatives |

| Total Debt (End of Year) | 429.1 (2023) / 477.5 (2022) | Interest payments, debt servicing |

Revenue Streams

Douglas Dynamics generates its main income from selling snowplows, sand and salt spreaders, and associated parts and accessories through its Work Truck Attachments division. These are marketed under popular brands like FISHER, SNOWEX, and WESTERN, reaching both professional contractors and individual buyers.

The financial performance of this segment is directly tied to the severity and duration of winter weather. For instance, in 2023, Douglas Dynamics reported that its Work Truck Attachments segment, which heavily features these snow and ice control products, saw significant sales, reflecting a strong demand driven by weather conditions.

Revenue streams for Douglas Dynamics' Work Truck Upfitting and Solutions segment are primarily driven by the manufacturing and sale of municipal snow and ice control products, alongside specialized attachments and storage solutions. These offerings are marketed under established brands like HENDERSON and DEJANA, catering to a critical need within the public sector.

This segment experiences strong and consistent demand from municipal clients, frequently secured through significant, multi-year contracts. For instance, in 2023, the Work Truck Solutions segment reported net sales of $436.6 million, demonstrating substantial market penetration and reliance on these long-term agreements for revenue stability.

Douglas Dynamics generates a consistent revenue stream from selling aftermarket parts and accessories for its wide range of installed equipment. This ensures customers can maintain and extend the life of their products.

This aftermarket segment provides a stable income source, offering resilience against fluctuations in new equipment sales. For instance, in the first quarter of 2024, Douglas Dynamics reported a 10.5% increase in their aftermarket segment revenue, highlighting its growing importance.

Seasonal Product Sales

Douglas Dynamics’ revenue from seasonal product sales, particularly snow and ice control equipment, is heavily concentrated in the periods leading up to and during the winter months. This seasonality directly impacts sales cycles and necessitates careful inventory management.

For instance, in fiscal year 2024, the company's performance in the fourth quarter, which typically includes the peak winter season, often shows a significant uplift in revenue compared to other quarters. This pattern is consistent with industry trends where demand for snow removal equipment surges with the onset of colder weather.

- Seasonal Concentration: Revenue peaks in Q4 and Q1 due to winter demand.

- Inventory Management: Seasonality requires strategic stock levels to meet demand spikes.

- Diversification Efforts: The company actively works to balance this seasonality through product line expansion and solutions for other seasons.

- Impact on Financials: Seasonal sales patterns influence cash flow and operational planning throughout the year.

Potential Future Acquisition-Driven Revenue

Douglas Dynamics' strategic direction emphasizes both internal development and external expansion through acquisitions. This approach aims to broaden its market presence and product offerings.

Acquisitions, especially within the attachment sector, are anticipated to unlock new revenue avenues. These could stem from integrating more diverse product lines or tapping into previously unreached customer bases, thereby fueling sustained sales increases.

For instance, if Douglas Dynamics were to acquire a company specializing in agricultural attachments, it could immediately gain access to a new customer segment and a complementary product range. This would represent a direct addition to its revenue streams.

- Diversification Strategy: Douglas Dynamics actively pursues both organic growth and strategic acquisitions to diversify its revenue base.

- Attachment Sector Focus: Future acquisitions are particularly targeted within the attachment space to leverage synergies and expand product portfolios.

- New Revenue Streams: Acquisitions are expected to introduce revenue from expanded product lines and access to new customer segments.

- Long-Term Growth: This strategy is designed to contribute to the company's long-term sales growth and market position.

Douglas Dynamics' revenue streams are primarily built on the sale of snow and ice control equipment, including plows and spreaders, under well-known brands like FISHER and WESTERN. This segment is highly sensitive to winter weather patterns, with strong sales typically seen in the lead-up to and during colder months.

Additionally, the company generates substantial revenue from its Work Truck Solutions segment, which focuses on municipal snow and ice control products and specialized attachments, often secured through multi-year contracts. The aftermarket parts and accessories segment also provides a stable and growing income source, enhancing overall revenue resilience.

| Revenue Segment | Key Products | 2023 Net Sales (Millions USD) | Key Drivers |

|---|---|---|---|

| Work Truck Attachments | Snowplows, spreaders, parts, accessories | $687.0 | Winter weather severity, contractor demand |

| Work Truck Solutions | Municipal snow/ice control, specialized attachments | $436.6 | Municipal contracts, public sector spending |

| Aftermarket Parts & Accessories | Replacement parts, maintenance items | Not separately reported, but growing | Installed equipment base, product longevity |

Business Model Canvas Data Sources

The Douglas Dynamics Business Model Canvas is informed by a blend of internal financial reporting, detailed market research on the work truck and trailer industries, and competitive analysis of industry players. This ensures a robust and data-driven representation of the company's strategic framework.