Douglas Dynamics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

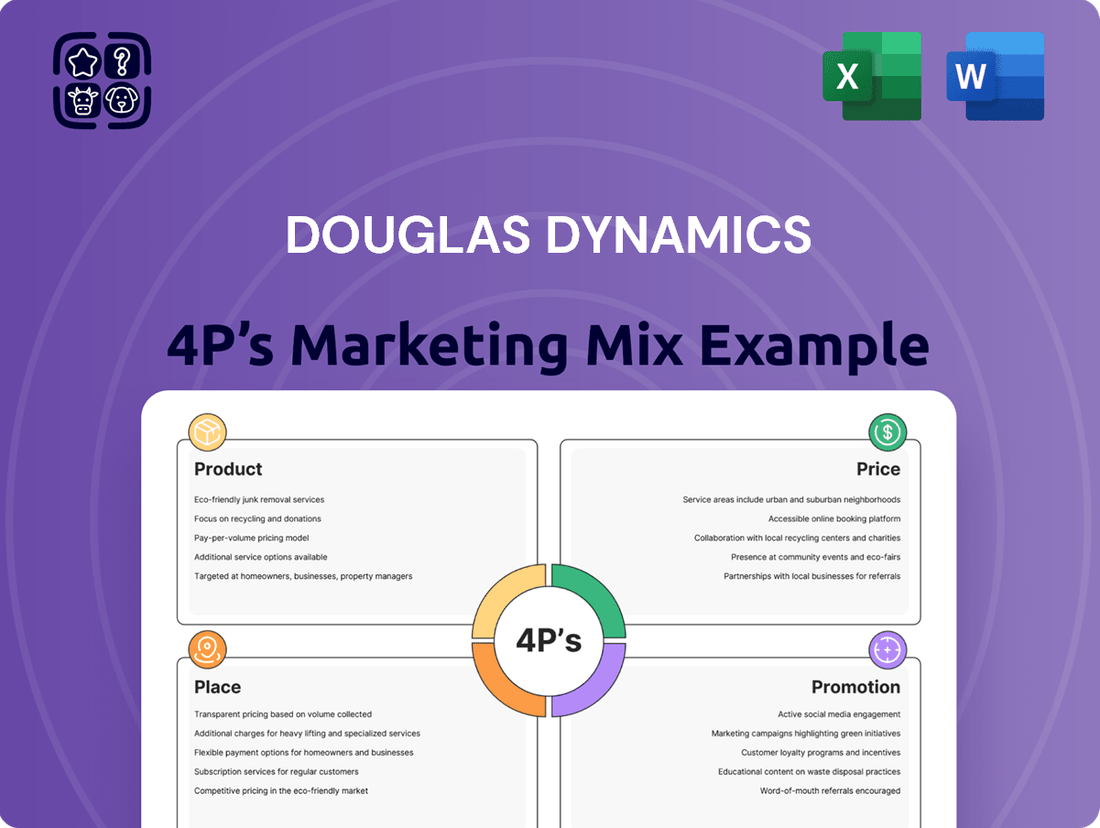

Douglas Dynamics masterfully leverages its product innovation, strategic pricing, extensive distribution network, and targeted promotions to maintain its market leadership. This analysis delves into how each element of their 4Ps strategy contributes to their competitive advantage.

Unlock the full picture of Douglas Dynamics' marketing success by exploring their product development, pricing strategies, distribution channels, and promotional campaigns in detail. Get instant access to a comprehensive, editable report that provides actionable insights for your own business strategy.

Product

Douglas Dynamics' Work Truck Attachments segment is a powerhouse in snow and ice control, offering a comprehensive suite of products like snowplows and spreaders. This segment is built on the strength of its iconic brands, FISHER, SNOWEX, and WESTERN, all of which boast over 75 years of innovation. In 2023, this segment demonstrated robust performance, contributing significantly to Douglas Dynamics' overall revenue, with sales reaching $519.6 million, a notable increase from $437.3 million in 2022.

The Work Truck Solutions segment focuses on up-fitting Class 4-8 trucks with essential attachments and storage, transforming standard chassis into specialized work vehicles. This is crucial for industries like construction and municipal services, where customized functionality is key. In 2023, Douglas Dynamics saw significant demand in this area, with their Work Truck Solutions segment contributing to overall revenue growth.

Douglas Dynamics places a strong emphasis on innovation and development, leveraging its Douglas Dynamics Management System (DDMS) to drive continuous improvement. This system ensures that product lines consistently evolve to meet changing customer needs and market trends.

Recent product launches highlight this dedication. The FISHER XRS™ Truck-Mounted Snowplow, for instance, showcases advanced features for enhanced performance. Similarly, Dejana's new high-capacity van shelving systems reflect a commitment to delivering practical, high-quality solutions for professional users.

For the fiscal year ending December 31, 2023, Douglas Dynamics reported net sales of $1.2 billion, with a significant portion attributed to new and enhanced product offerings fueling market share growth.

Diverse Customer Base s

Douglas Dynamics' product portfolio is engineered to cater to a wide array of customers, from seasoned professional snowplow operators and large-scale municipal fleets to individual truck owners. This broad reach allows them to meet diverse needs, whether it's robust equipment for demanding municipal snow clearing or specialized attachments for light-duty consumer trucks. For instance, in 2023, the company reported that its Workgroup segment, which includes snow and ice control equipment, saw significant demand driven by both commercial and municipal sectors.

The company's strategy effectively targets both commercial and consumer markets by focusing on essential winter maintenance equipment and vehicle customization solutions. This dual focus is evident in their product lines, which address the critical operational requirements of businesses and government entities while also appealing to individual consumers looking to enhance their vehicles' utility and appearance. Douglas Dynamics' commitment to serving these varied segments underpins its market resilience and growth potential, as seen in their consistent revenue streams across different customer groups.

- Professional Snowplowers: Require durable, high-performance equipment for commercial operations.

- Municipalities: Need reliable, heavy-duty solutions for public infrastructure maintenance.

- Individual Consumers: Seek versatile attachments for personal vehicle use and customization.

Quality and Reliability

Douglas Dynamics has cultivated a reputation for quality and reliability over its 75-year history, a cornerstone of its marketing strategy. This enduring commitment ensures its snow and ice control equipment and work truck solutions are built to last, a critical factor for its professional and municipal clientele who depend on robust performance in harsh environments.

The company's dedication to durability translates directly into customer loyalty and significant brand equity. For instance, in 2023, Douglas Dynamics reported a net sales increase of 10.3% to $1.03 billion, reflecting sustained demand driven by its product quality.

- 75+ Years of Proven Performance: Douglas Dynamics' extensive operational history underscores its deep understanding of product longevity and customer needs.

- Durability in Demanding Conditions: Products are engineered to withstand extreme weather and heavy-duty usage, minimizing downtime for users.

- Customer Loyalty Driver: Consistent high quality fosters repeat business and positive word-of-mouth, enhancing brand value.

- Financial Validation: A 10.3% net sales increase in 2023 to $1.03 billion demonstrates market confidence in the company's reliable offerings.

Douglas Dynamics' product strategy centers on developing and marketing high-quality, durable attachments and solutions for work trucks. Their offerings, particularly in snow and ice control and work truck customization, are designed for demanding professional use, emphasizing reliability and performance. This focus is supported by continuous innovation, as seen with new product launches like the FISHER XRS™ Truck-Mounted Snowplow, and a robust management system (DDMS) to ensure product evolution.

| Product Category | Key Brands | 2023 Net Sales (Segment Contribution) | Key Features/Focus |

|---|---|---|---|

| Work Truck Attachments (Snow & Ice Control) | FISHER, SNOWEX, WESTERN | $519.6 million (approx. 43% of total net sales) | Durability, high performance, over 75 years of innovation |

| Work Truck Solutions (Upfitting & Storage) | Dejana (van shelving) | Segment performance contributed to overall growth | Customization, enhanced vehicle utility, practical solutions |

What is included in the product

This analysis offers a comprehensive examination of Douglas Dynamics' marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It provides a robust framework for understanding Douglas Dynamics' market positioning, serving as a valuable resource for professionals seeking to benchmark their own marketing efforts.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for Douglas Dynamics.

Provides a clear, concise framework for understanding and optimizing Douglas Dynamics' marketing efforts, addressing the challenge of strategic alignment.

Place

Douglas Dynamics boasts a vast dealer network, a cornerstone of its distribution strategy for work truck attachments. This extensive reach across North America ensures their products, like those from their Fisher and Western brands, are readily available to a broad customer base, from professional snow removal services to individual users. In 2023, the company continued to strengthen these partnerships, recognizing their critical role in sales, service, and overall market penetration.

Douglas Dynamics leverages direct sales to municipalities for its Work Truck Solutions, specifically through the HENDERSON® brand. This strategy is key for handling large, custom upfit projects, ensuring a consistent flow of business.

These direct relationships with municipal clients are crucial for building substantial backlogs, with contracts often extending years into the future. For instance, as of Q1 2024, the company reported a record backlog for its Workgroup segment, which includes municipal sales, indicating strong future revenue visibility.

Douglas Dynamics leverages a network of strategically positioned installation and distribution centers. This infrastructure is key to ensuring efficient product delivery and upfitting, directly impacting customer satisfaction and market responsiveness. For instance, their extensive network allows for timely customization and installation services, a critical component for their professional customer base.

The placement of these centers is meticulously planned to optimize logistics, reducing lead times and transportation costs. This strategic approach enhances convenience for customers who rely on specialized vehicle modifications and equipment integration, a core aspect of their product offering.

Furthermore, the existence of a global sourcing office underscores Douglas Dynamics' commitment to a robust and diversified supply chain. This global reach, coupled with their distribution network, allows them to manage inventory effectively and source components competitively, supporting their market position.

Online Presence and Digital Engagement

Douglas Dynamics leverages its digital footprint to complement its physical distribution model. The company website and dedicated brand sites offer comprehensive product catalogs, dealer locators, and investor relations information, effectively serving both business-to-business and business-to-consumer audiences.

Digital engagement extends to investor communications, with Douglas Dynamics utilizing webcasts for its quarterly earnings calls. This approach ensures broader accessibility for stakeholders interested in the company's financial performance and strategic direction.

- Website Functionality: Serves as a central hub for product details, dealer searches, and corporate information.

- Digital Communication: Employs webcasts for earnings calls to enhance investor outreach.

- B2B & B2C Support: Online platforms cater to both professional and end-user needs.

Partnerships with OEMs

Douglas Dynamics places significant emphasis on its partnerships with Original Equipment Manufacturers (OEMs). These collaborations are fundamental to ensuring their work truck attachments and solutions are seamlessly integrated onto a wide array of truck chassis. This strategic approach not only guarantees compatibility but also unlocks substantial market expansion opportunities for their Work Truck Solutions segment. For instance, in 2023, the company reported that its Work Truck Solutions segment generated approximately $730 million in revenue, highlighting the importance of these OEM relationships in driving sales and market penetration.

These OEM relationships are more than just supply chain connections; they are strategic alliances that influence product development and market access. By working closely with manufacturers like Ford, Ram, and Chevrolet, Douglas Dynamics can ensure its products meet the evolving needs and specifications of the latest vehicle platforms. This proactive engagement is crucial for maintaining a competitive edge in the dynamic work truck industry.

- OEM Integration: Partnerships ensure Douglas Dynamics' attachments are designed for direct fitment on new truck models, reducing installation complexity for end-users.

- Market Access: Collaboration with OEMs provides access to broader distribution channels and co-marketing opportunities, increasing brand visibility.

- Product Development: Joint efforts allow for early insights into future vehicle designs, enabling Douglas Dynamics to innovate and tailor solutions accordingly.

- Revenue Growth: The Work Truck Solutions segment, heavily reliant on these partnerships, saw its revenue grow by approximately 10% year-over-year in 2023, demonstrating the financial impact of strong OEM ties.

Douglas Dynamics' place strategy centers on a multi-pronged distribution approach, combining an extensive dealer network for broad accessibility with direct sales to municipalities for specialized projects. This dual focus ensures both widespread product availability and secure, long-term revenue streams.

Their strategically located distribution centers are vital for efficient upfitting and timely delivery, enhancing customer satisfaction. Furthermore, global sourcing bolsters supply chain resilience and cost competitiveness.

Digital platforms complement their physical presence, offering comprehensive product information and investor outreach. These efforts collectively support both business-to-business and business-to-consumer engagement.

The company's strong relationships with Original Equipment Manufacturers (OEMs) are critical for seamless product integration and market expansion. These alliances are key drivers of revenue growth and product innovation.

| Distribution Channel | Key Brands/Segments | 2023 Revenue Contribution (Approx.) | Strategic Importance |

|---|---|---|---|

| Dealer Network | Fisher, Western (Work Truck Attachments) | Significant portion of Work Truck Attachments revenue | Broad market reach, customer accessibility |

| Direct Sales | HENDERSON® (Work Truck Solutions) | Key driver for Workgroup segment backlog | Large municipal contracts, long-term revenue visibility |

| OEM Partnerships | Work Truck Solutions | $730 million (Work Truck Solutions segment) | Product integration, market access, innovation |

Preview the Actual Deliverable

Douglas Dynamics 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. It details Douglas Dynamics' strategic approach across Product, Price, Place, and Promotion. This comprehensive analysis is ready for your immediate use.

Promotion

Douglas Dynamics leverages industry trade shows, such as NTEA Work Truck Week, as a crucial promotional tool. In 2024, Work Truck Week saw over 13,000 attendees, providing a significant audience for Douglas Dynamics to exhibit its advanced vocational truck equipment and engage directly with potential buyers and existing clients.

These events are vital for demonstrating new product lines and reinforcing brand visibility within the competitive commercial vehicle market. The company's presence allows for face-to-face interactions, fostering stronger relationships and gathering immediate feedback on their offerings, which is invaluable for product development and market strategy.

Douglas Dynamics leverages distinct brand identities, including FISHER®, SNOWEX®, WESTERN®, HENDERSON®, and DEJANA®, for its product promotions. This strategy allows for highly targeted marketing messages, ensuring each brand's unique benefits and customer segments are effectively addressed, fostering strong brand equity and customer loyalty.

Douglas Dynamics leverages public relations and financial communications as a key element of its marketing mix. This includes issuing press releases and conducting earnings calls to share financial performance, strategic updates, and product developments with investors and the wider market. For instance, in their Q1 2024 earnings call, the company highlighted strong performance in their Workholding segment, contributing to a robust revenue of $202.7 million, demonstrating their commitment to transparency.

Digital Content and Online Resources

Douglas Dynamics leverages its website as a central hub for digital content, effectively promoting its extensive product lines and services. This platform provides in-depth product specifications, feature highlights, and valuable resources, acting as a crucial touchpoint for both prospective and current customers.

The company's online presence is a cornerstone of its promotional strategy, offering detailed information that educates and engages its audience. This digital content is designed to facilitate informed decision-making and support customer needs.

- Website as a primary promotional channel

- Detailed product specifications and features available online

- Resources for customers and potential buyers

- Company history and service information accessible digitally

Customer-Driven Solutions and Benefits-Oriented Messaging

Douglas Dynamics' marketing strategy heavily emphasizes customer-driven solutions. Their messaging highlights how their equipment directly helps end-users work smarter, not harder. This focus on efficiency translates into tangible business benefits, such as increased productivity and reduced operational costs.

The company's approach is benefits-oriented, showcasing how their products solve real-world problems for their customers. For instance, their snow and ice control equipment is marketed not just as hardware, but as tools that enable municipalities and contractors to clear roads faster and more reliably. This practical appeal resonates with businesses looking to optimize their operations.

This customer-centric messaging is crucial for Douglas Dynamics' success. In 2023, the company reported net sales of $521.7 million, a testament to their ability to connect with their target market by demonstrating clear value. Their focus on profitability for their customers, by extension, contributes to their own financial performance.

- Enhanced Efficiency: Douglas Dynamics products are designed to streamline work processes for end-users.

- Profitability Focus: Messaging centers on how the equipment boosts customer profitability through improved output.

- Problem-Solving Capabilities: The company highlights the practical, on-the-ground solutions their products offer.

- Customer Value Proposition: Marketing emphasizes the direct benefits and return on investment for businesses.

Douglas Dynamics employs a multi-faceted promotional strategy, utilizing industry events like NTEA Work Truck Week to showcase its vocational truck equipment. The company also leverages distinct brand identities for targeted marketing, reaching specific customer segments effectively.

Digital promotion through their website serves as a central hub for product information, while public relations and financial communications ensure transparency with investors and the market. Their messaging consistently emphasizes customer-driven solutions, highlighting efficiency and profitability gains for end-users.

| Promotional Tactic | Key Aspects | 2024/2025 Relevance |

|---|---|---|

| Industry Trade Shows | Direct customer engagement, product demonstration | NTEA Work Truck Week attendance over 13,000 in 2024 |

| Brand Diversification | Targeted marketing for FISHER, SNOWEX, WESTERN, etc. | Strengthens brand equity across different user segments |

| Digital Presence | Website as information hub, detailed product specs | Facilitates informed customer decision-making |

| Public Relations & Financial Comms | Press releases, earnings calls, investor updates | Q1 2024 revenue of $202.7 million highlights performance |

| Customer-Centric Messaging | Focus on efficiency, problem-solving, profitability | Drove 2023 net sales of $521.7 million |

Price

Douglas Dynamics likely uses value-based pricing, setting prices based on the significant benefits and efficiency gains its snow and ice control equipment provides to professional users. This strategy acknowledges the long-term cost savings and enhanced operational capabilities customers gain, justifying a premium over basic alternatives.

For instance, the company's commitment to durability and advanced features in its Western Snow Plows or Fisher Snow Plows translates directly into reduced downtime and increased productivity for contractors, a value proposition that underpins their pricing decisions. This aligns with industry trends where specialized equipment commanding higher initial costs are preferred for their superior performance and reliability.

Douglas Dynamics navigates a competitive landscape for work truck equipment, where competitor pricing significantly influences their own strategies. They aim to strike a balance, ensuring their products remain attractive to customers while upholding healthy profit margins.

The company actively monitors market pricing and adjusts its own to stay competitive. For instance, in 2023, the company adjusted pricing to mitigate the impact of rising input costs and tariffs, demonstrating a proactive approach to maintaining price competitiveness.

Douglas Dynamics' 2024 Cost Savings Program has demonstrably boosted its financial performance, with over $10 million in savings achieved so far. This internal focus on operational efficiency directly bolsters gross profit margins, offering the company greater flexibility in its pricing strategies.

Municipal Contract Pricing

For Douglas Dynamics' Work Truck Solutions segment, municipal contract pricing often involves extended agreements and volume discounts. The company's significant backlog from municipal clients points to consistent demand and the likelihood of negotiated pricing for multi-year projects.

This stable demand allows for more predictable revenue streams and potentially more favorable terms for both parties.

- Municipal contracts often feature multi-year terms, providing revenue visibility.

- Volume-based pricing is common, reflecting economies of scale for larger orders.

- Negotiated pricing structures are typical, driven by the long-term nature of these commitments.

Financing Options and Payment Terms

Financing options are crucial for large equipment sales, especially in B2B and B2G markets. While specific details for Douglas Dynamics aren't public, companies in this sector commonly offer flexible payment terms to make substantial purchases more manageable. This approach broadens customer accessibility and can be a significant competitive advantage.

For municipalities and professional businesses, the availability of financing can directly influence purchasing decisions. Offering options like installment plans or leasing can significantly lower the upfront barrier, making Douglas Dynamics' products more attractive compared to competitors who might require immediate full payment.

In 2024, the landscape of business financing continues to evolve, with increased interest in vendor financing programs. These programs can be structured to align with the cash flow cycles of businesses and government entities, potentially boosting sales volume for equipment manufacturers.

Consider these common financing structures in heavy equipment sales:

- Lease-to-Own Agreements: Customers can lease equipment with an option to purchase it at the end of the lease term, often at a predetermined price.

- Installment Plans: Spreading the total cost over a set period with regular payments, often with interest.

- Municipal Bonds or Public Financing: For government entities, these can be used to fund large capital expenditures.

- Extended Payment Terms: Offering longer periods to pay invoices, which can be particularly beneficial for businesses with seasonal revenue streams.

Douglas Dynamics' pricing strategy is deeply intertwined with the value its equipment delivers, focusing on durability and operational efficiency to justify its market position. The company actively monitors competitor pricing, adjusting its own to remain competitive while ensuring profitability, as seen in its 2023 price adjustments to offset rising input costs.

The company's 2024 Cost Savings Program, yielding over $10 million in savings, enhances its margin flexibility. For municipal contracts, Douglas Dynamics likely employs volume-based and negotiated pricing structures, reflecting the multi-year terms and consistent demand from these clients.

Financing options are a key component, with common structures like lease-to-own and installment plans enhancing accessibility for large equipment purchases, especially within the B2B and B2G sectors.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Value-Based Pricing | Setting prices based on customer benefits and efficiency gains. | Underpins premium pricing for advanced snow and ice control equipment. |

| Competitive Pricing | Monitoring and reacting to competitor pricing. | Ensures market attractiveness and healthy profit margins. |

| Cost Mitigation Pricing | Adjusting prices to counter rising input costs. | Demonstrated in 2023 to manage tariffs and material cost increases. |

| Municipal Contract Pricing | Volume-based and negotiated pricing for long-term agreements. | Leverages stable demand and multi-year project commitments. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Douglas Dynamics is grounded in a comprehensive review of official company filings, investor relations materials, and detailed product catalogs. We also incorporate insights from industry publications and competitive landscape reports.