DLF SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

DLF's strategic landscape is a dynamic interplay of robust market presence and evolving industry challenges. Understanding these core strengths, potential weaknesses, significant opportunities, and looming threats is crucial for informed decision-making.

Want the full story behind DLF's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DLF Limited stands as India's largest real estate developer by market capitalization, a testament to its substantial influence and expansive operations in the sector. This leadership is built on a foundation of over 78 years of experience across real estate investment, development, and management.

The company's long-standing presence is marked by an exceptional track record of project delivery and a deep-rooted commitment to customer satisfaction. This dedication has cultivated unparalleled brand trust and recognition among consumers in India, reinforcing its market leadership.

DLF has showcased remarkable financial strength, with its net profit soaring by an impressive 60% to ₹4,367 crore in the fiscal year 2025. This robust performance is further underscored by a total income of ₹8,996 crore for the same period.

The company's market appeal is evident in its record sales bookings, which reached ₹21,223 crore in FY25. This figure not only surpassed its own projections but also highlights a strong and sustained demand for DLF's properties.

DLF boasts a significant land bank, a critical asset for sustained growth. This extensive reserve offers substantial development potential, estimated at a remarkable 280 million square feet across residential and commercial ventures.

This robust land holding is not static; it's actively expanding. A recent example is the acquisition of a 29-acre plot in Gurugram for ₹825 crore. This strategic move unlocks an additional estimated 7.5 million square feet of development capacity.

Diversified Portfolio and Annuity Business

DLF's diversified property portfolio is a significant strength, encompassing residential projects, commercial office spaces, and retail centers. This broad market presence mitigates risk and captures opportunities across different real estate segments.

The company's annuity business, driven by rental income from its commercial and retail assets, provides a stable and predictable revenue stream. This segment is a cornerstone of DLF's financial resilience.

- Diversified Asset Base: Includes residential, commercial office, and retail properties.

- Strong Annuity Income: Rental revenues from commercial and retail assets offer recurring income.

- High Occupancy Rates: Achieved a robust 94% occupancy rate in its annuity business in FY25.

- Projected Rental Growth: Rental revenues are anticipated to surpass ₹10,000 crore in the medium term.

Healthy Balance Sheet and Low Leverage

DLF's financial health is a significant advantage, marked by a strong balance sheet and remarkably low leverage. This financial prudence translates into considerable operational flexibility.

The company has achieved a net cash positive position, a testament to its efficient cash management. Furthermore, DLF has consistently kept its debt-to-equity ratio below a very conservative 0.10, demonstrating a low reliance on borrowed funds.

This robust financial footing equips DLF with substantial capacity for strategic capital allocation. It allows the company to pursue high-margin opportunities and expansion plans with reduced financial risk.

- Net Cash Positive Status: DLF maintains a net cash positive position, indicating strong liquidity.

- Low Debt-to-Equity Ratio: The company consistently maintains a debt-to-equity ratio below 0.10, highlighting minimal financial leverage.

- Financial Flexibility: A healthy balance sheet and low debt provide DLF with significant flexibility for strategic investments and growth initiatives.

- Reduced Financial Risk: The conservative financial structure minimizes the company's exposure to interest rate fluctuations and financial distress.

DLF's diversified asset base, encompassing residential, commercial, and retail properties, provides a resilient revenue structure. The company's annuity business, fueled by rental income, is a significant strength, projected to exceed ₹10,000 crore in medium-term rental revenues, supported by a robust 94% occupancy rate in FY25.

| Strength Category | Specific Strength | FY25 Data/Projection |

|---|---|---|

| Asset Diversification | Residential, Commercial, Retail Portfolio | N/A (Portfolio composition) |

| Annuity Business | Rental Income Stability | Projected > ₹10,000 crore (medium term) |

| Annuity Business | High Occupancy Rates | 94% (FY25) |

What is included in the product

Delivers a strategic overview of DLF’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured approach to identify and address strategic weaknesses, relieving the pain of uncertainty.

Weaknesses

DLF's significant focus on luxury projects in Gurugram and its recent Mumbai re-entry, while strategic, creates a vulnerability. For instance, Gurugram accounted for a substantial portion of DLF's sales in FY24, highlighting this concentration. This reliance on specific geographies and the high-end segment means any localized economic slowdown or a dip in luxury demand in these areas could disproportionately affect DLF's revenue and profitability.

The real estate market's inherent cyclicality, driven by economic shifts and interest rate changes, poses a significant challenge for DLF. As a large developer, the company's performance is closely tied to these broader market trends.

DLF's stock has experienced periods of volatility, mirroring the sector's sensitivity to economic downturns and changes in consumer confidence. For instance, in early 2024, the sector faced headwinds impacting buyer sentiment and project execution timelines, directly affecting developers like DLF.

Developing super-luxury projects, while promising high margins, comes with substantially higher construction expenses. For example, DLF's premium developments like 'The Dahlias' incur construction costs between ₹15,000 to ₹20,000 per square foot.

These elevated input costs demand robust sales velocity and premium pricing to ensure profitability. Consequently, DLF faces a vulnerability to any downturn in luxury market demand or unforeseen increases in construction expenses.

Operational Profit Margin Fluctuations

DLF's operational profit margin has shown significant fluctuations, presenting a key weakness. Despite a rise in total revenue, the company saw its operating profit drop by 14.9% year-on-year in FY25. This resulted in a notable decline in operating profit margins, falling from 33.0% in FY24 to 22.6% in FY25.

These shifts indicate potential issues with cost management or operational efficiency. Such volatility in margins can make it harder for DLF to maintain consistent profitability and may signal underlying challenges in controlling expenditures relative to revenue generation.

- Revenue Growth vs. Profit Decline: Total revenue increased, but operating profit decreased by 14.9% in FY25.

- Margin Contraction: Operating profit margins fell from 33.0% in FY24 to 22.6% in FY25.

- Efficiency Concerns: The fluctuation points to possible difficulties in managing operational costs effectively.

- Profitability Impact: Unaddressed cost pressures could negatively affect DLF's overall financial performance.

Intense Competition in a Fragmented Market

DLF faces a significant challenge from intense competition within India's fragmented real estate market. Despite its dominant position, the sector is populated by numerous developers, both large and small, vying for land and customers. This crowded environment often forces aggressive pricing, potentially squeezing profit margins.

The Indian real estate market, while growing, remains highly fragmented. In 2023, for instance, while DLF reported strong sales, it still contended with a multitude of players across various segments. This fragmentation means that even market leaders must remain agile and competitive to maintain their edge, as competitors can quickly gain traction by offering attractive pricing or unique project offerings.

- Fragmented Market Dynamics: Numerous developers, from national players to regional specialists, actively compete for prime land parcels and customer attention across India's major urban centers.

- Pricing Pressures: The presence of many competitors can lead to price wars, especially in popular residential and commercial segments, impacting overall profitability for all players, including DLF.

- Land Acquisition Challenges: Competition extends to securing desirable land, with developers often engaging in bidding wars, driving up acquisition costs and potentially limiting future project pipelines.

DLF's significant reliance on the Gurugram luxury market presents a key weakness, as demonstrated by Gurugram's substantial contribution to its FY24 sales. This geographical and segment concentration makes the company vulnerable to localized economic downturns or shifts in luxury demand.

The company's operational profit margins have shown considerable volatility, dropping from 33.0% in FY24 to 22.6% in FY25, a 14.9% year-on-year decrease in operating profit. This contraction suggests potential inefficiencies in cost management or operational execution, impacting consistent profitability.

Intense competition in India's fragmented real estate market is another significant weakness. Numerous developers actively compete for land and customers, often leading to aggressive pricing strategies that can compress profit margins for all players, including DLF.

Preview Before You Purchase

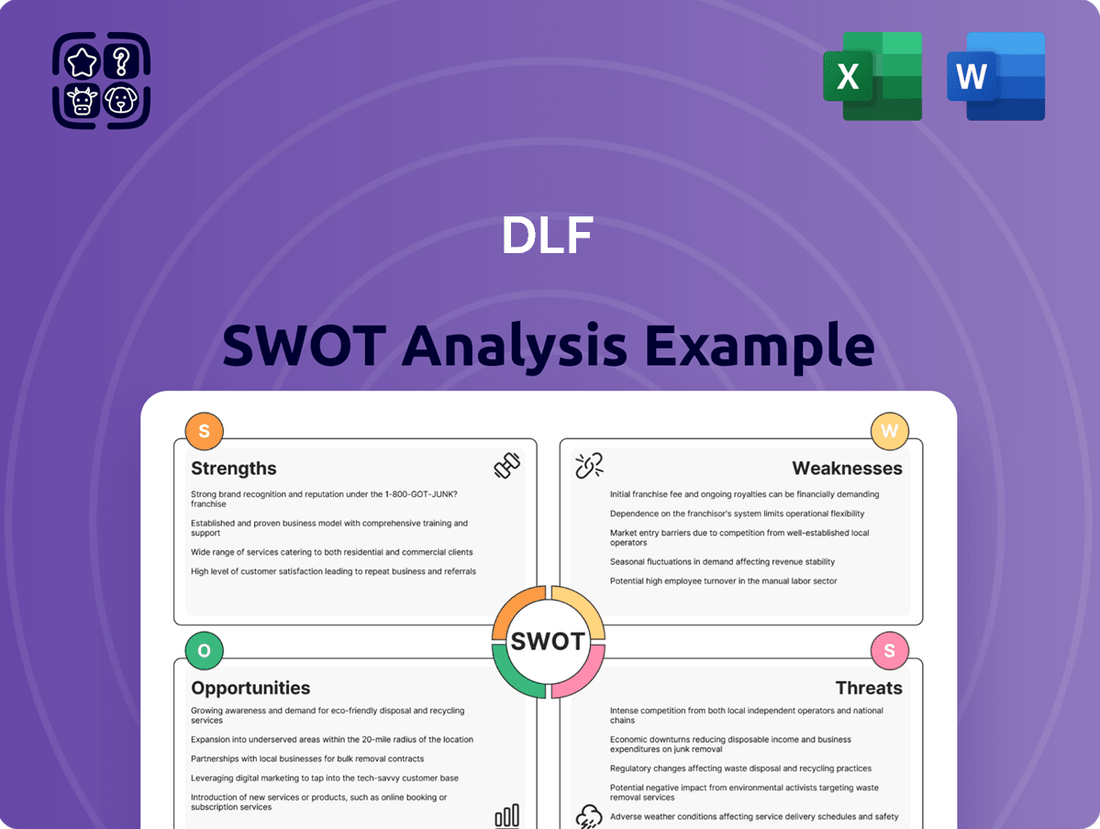

DLF SWOT Analysis

This is the actual DLF SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full DLF SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

You’re viewing a live preview of the actual DLF SWOT analysis file. The complete version, packed with detailed strategic recommendations, becomes available after checkout.

Opportunities

The Indian real estate sector is experiencing a significant upswing, offering a prime growth avenue for DLF. The residential segment alone is forecast to surge from an estimated USD 227.26 billion in 2024 to USD 687.27 billion by 2029, reflecting a robust CAGR of 24.77%.

Further bolstering this outlook, the entire Indian real estate market is anticipated to reach a staggering USD 1.184 trillion by 2033. This expansion is fueled by ongoing urbanization trends and sustained economic development across the nation.

There's a noticeable and growing trend in India where people are increasingly looking for luxury and more expensive homes. This isn't just a small change; it's a significant shift in what consumers want.

Data from Q1 2025 shows that the demand for homes costing ₹2.5 crore or more has surged dramatically. It's gone from just 3% of the market in 2021 to a substantial 22% in early 2025, which is a fourfold increase.

DLF is in a prime position to benefit from this trend. With their proven track record and expertise in developing high-quality, premium properties, they are perfectly suited to meet this rising demand for luxury residences.

DLF is actively pursuing expansion into new geographies, with significant new developments planned in key cities such as Chennai, Delhi, and Goa. This strategic move aims to diversify its revenue streams and capture growth opportunities in previously underserved or emerging markets.

The company's successful re-entry into the competitive Mumbai market is a testament to its ability to identify and capitalize on high-potential areas. This expansion into new urban centers is crucial for increasing market share and achieving broader national penetration.

Furthermore, DLF's focus on strengthening its commercial and retail segments in these new locations provides diversified avenues for revenue generation. By broadening its geographical footprint and deepening its presence in various property types, DLF is positioning itself for sustained growth and enhanced market penetration.

Favorable Government Policies and Infrastructure Development

The Indian government's focus on infrastructure development, including the Pradhan Mantri Awas Yojana (PMAY) and the Smart Cities Mission, directly benefits large-scale developers like DLF. These initiatives aim to boost urbanization and housing demand. For instance, the government allocated ₹111 lakh crore for the National Infrastructure Pipeline (NIP) for 2020-2025, signaling a strong commitment to development that fuels real estate growth.

Easing interest rates, a trend observed through 2024 and projected into 2025, further enhances affordability for potential homebuyers. This economic tailwind, coupled with favorable government policies, creates a robust environment for DLF to capitalize on increased demand for residential and commercial properties.

DLF is well-positioned to leverage these opportunities:

- Government support for infrastructure: Initiatives like the NIP are driving urban development, creating demand for integrated townships and commercial spaces.

- Increased homebuyer affordability: Lower interest rates, with the repo rate potentially stabilizing or seeing modest reductions in 2024-2025, make property ownership more accessible.

- Urbanization push: Policies promoting rapid urbanization directly translate into greater demand for housing and commercial real estate in key growth corridors where DLF operates.

Growth in Rental Income and Commercial Spaces

DLF's annuity business, centered on its office and retail rental portfolio, is poised for substantial expansion. The company projects its rental income to exceed ₹10,000 crore in the medium term, bolstered by strong pre-leasing activity. This growth is a key opportunity for DLF.

Further strengthening this steady income source, DLF plans to launch new retail properties covering 1.4 million square feet in fiscal year 2026. This expansion directly contributes to the anticipated surge in rental revenues.

- Projected Rental Revenue Growth: DLF anticipates its rental revenues to surpass ₹10,000 crore in the medium term.

- New Retail Space Launches: 1.4 million square feet of new retail properties are scheduled to open in FY26.

- Annuity Business Strength: The rental portfolio of office and retail spaces forms a significant and growing annuity income stream for DLF.

The burgeoning Indian real estate market presents a significant growth runway for DLF, with the residential segment alone projected to reach USD 687.27 billion by 2029. This expansion is further supported by a notable shift towards luxury housing, with demand for homes over ₹2.5 crore surging from 3% in 2021 to 22% in Q1 2025.

DLF's strategic expansion into new geographies like Chennai, Delhi, and Goa, coupled with its successful re-entry into Mumbai, positions it to capture growing market share. The company's annuity business, focused on office and retail rentals, is also a key opportunity, with projected rental income exceeding ₹10,000 crore and 1.4 million square feet of new retail space planned for FY26.

| Opportunity Area | Key Data Point | Implication for DLF |

|---|---|---|

| Residential Market Growth | Indian residential market to reach USD 687.27 billion by 2029 (CAGR 24.77%) | Capitalize on increasing demand, especially for premium properties. |

| Luxury Housing Demand | Demand for homes ₹2.5 Cr+ increased from 3% (2021) to 22% (Q1 2025) | Leverage expertise in high-quality, premium developments. |

| Geographical Expansion | New developments planned in Chennai, Delhi, Goa; re-entry into Mumbai | Diversify revenue streams and increase national market penetration. |

| Annuity Business Expansion | Projected rental income > ₹10,000 crore; 1.4 million sq ft new retail space (FY26) | Strengthen recurring revenue and create stable income streams. |

Threats

A potential economic slowdown in India, coupled with persistent inflationary pressures, presents a significant threat to DLF's operations. These macroeconomic conditions could directly impact consumer spending power, leading to reduced demand for real estate, especially in more affordable segments. For instance, if inflation remains elevated, discretionary spending on big-ticket items like homes may decline.

While interest rates have seen some easing, any future upward revision by the Reserve Bank of India (RBI) could lead to an increase in home loan EMIs. For instance, if the repo rate were to increase by 50 basis points in late 2024 or early 2025, it would directly impact the cost of borrowing for homebuyers.

Higher borrowing costs for consumers can deter potential homebuyers, especially in the mid-to-affordable housing segments where price sensitivity is higher. This could negatively affect sales bookings and collection rates for DLF, potentially impacting revenue streams from new project launches and existing customer payments.

The Indian real estate sector is crowded, with numerous developers vying for market share. This intense competition, featuring both national giants and local players, often translates into significant pricing pressures, particularly in areas with high supply or during economic downturns. For DLF, this could mean tighter profit margins and a constant challenge to defend its market position.

Regulatory Changes and Delays in Approvals

The real estate industry, including major players like DLF, operates within a dynamic regulatory landscape. Unexpected shifts in government policies, land acquisition rules, environmental standards, or building codes can significantly affect project viability and financial returns. For instance, changes in Foreign Direct Investment (FDI) norms for real estate, which have seen revisions over the years, can impact capital inflows and project funding strategies.

Delays in securing essential regulatory approvals for new developments pose a substantial threat. These postponements can lead to extended project timelines, escalating costs, and missed market opportunities. In 2023, several major Indian cities experienced delays in construction permits, impacting the pace of new project launches across the sector.

- Policy Uncertainty: Fluctuations in government housing policies and taxation can disrupt business models.

- Approval Bottlenecks: Lengthy approval processes for new projects, such as those related to environmental clearances or RERA (Real Estate Regulatory Authority) registrations, can cause significant delays.

- Compliance Costs: Evolving environmental and safety regulations often necessitate increased expenditure on compliance, impacting project budgets.

Geopolitical and Macroeconomic Instability

Broader geopolitical events and global economic downturns pose a significant threat to DLF. For instance, a widespread economic slowdown in major economies could dampen investor sentiment globally, potentially reducing foreign direct investment (FDI) into India's real estate market. This could impact DLF's ability to attract international capital for its large-scale projects.

Unforeseen macroeconomic instability beyond India's borders, such as supply chain disruptions or inflationary pressures in key trading partners, can indirectly affect the Indian economy. This could lead to capital outflows from emerging markets, including India, thereby impacting liquidity and the overall investment climate for major developers like DLF. The Reserve Bank of India's repo rate, currently at 6.50% as of early 2024, could also be subject to changes influenced by global monetary policies, impacting borrowing costs for developers.

- Geopolitical Tensions: Ongoing international conflicts or trade disputes can create uncertainty, leading to a reduction in global investment flows into real estate.

- Global Economic Slowdown: A projected global GDP growth rate of 2.7% for 2024, according to the IMF, might be revised downwards due to unforeseen events, impacting investor confidence in emerging markets like India.

- Capital Outflows: Increased risk aversion among global investors during periods of instability can trigger capital flight from developing economies, affecting the availability of funding for large real estate projects.

- Currency Fluctuations: Volatility in exchange rates can impact the cost of imported materials and the repatriation of profits for foreign investors, indirectly affecting the real estate sector's attractiveness.

DLF faces significant threats from a potential economic slowdown and persistent inflation in India, which could dampen consumer spending on real estate. Any increase in the Reserve Bank of India's repo rate, currently at 6.50% as of early 2024, could raise home loan EMIs, deterring buyers, especially in the mid-to-affordable segments. Intense competition within the Indian real estate sector also puts pressure on pricing and profit margins.

Regulatory uncertainty, including potential shifts in government policies, land acquisition rules, and environmental standards, poses a risk. Delays in obtaining project approvals, a common issue in major Indian cities in 2023, can escalate costs and lead to missed market opportunities. Furthermore, global geopolitical tensions and economic slowdowns, with the IMF projecting 2.7% global GDP growth for 2024, could reduce foreign investment in India's real estate market.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Macroeconomic | Economic Slowdown & Inflation | Reduced consumer spending, lower demand for real estate | Elevated inflation could curb discretionary spending on homes. |

| Monetary Policy | Interest Rate Hikes | Increased home loan EMIs, reduced affordability | A 50 basis point repo rate hike could significantly impact buyers. |

| Competition | Intense Market Competition | Pricing pressure, tighter profit margins | Numerous developers compete for market share, especially in high-supply areas. |

| Regulatory & Policy | Policy Uncertainty & Approval Delays | Project viability issues, increased costs, missed opportunities | Changes in FDI norms or lengthy environmental clearance processes are key concerns. |

| Geopolitical & Global | Global Economic Downturn & Capital Outflows | Reduced foreign investment, impact on liquidity | Global GDP growth projections and investor risk aversion can affect capital flows. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from the DLF's official financial statements, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate SWOT assessment.