DLF Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

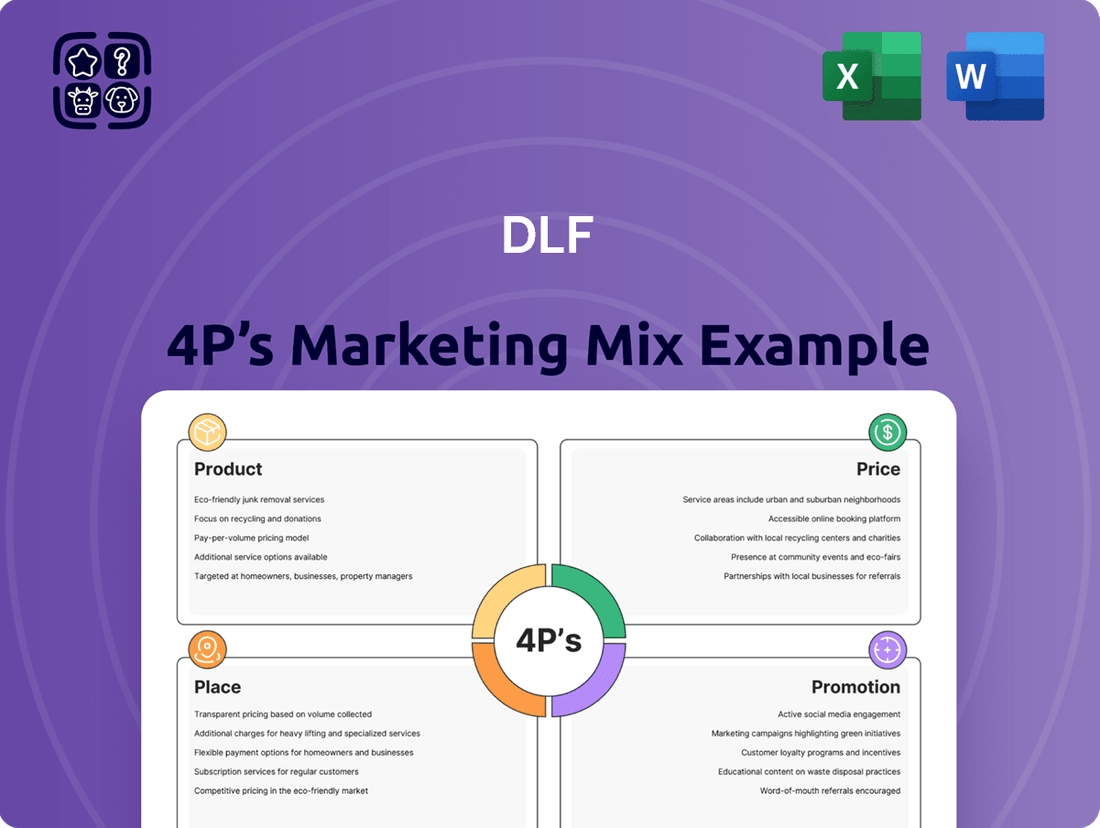

Uncover the strategic brilliance behind DLF's success by delving into their Product, Price, Place, and Promotion. This analysis reveals how each element synergizes to create a powerful market presence, offering actionable insights for your own business strategies.

Go beyond the surface-level understanding and gain a comprehensive grasp of DLF's marketing prowess. Our full 4Ps analysis provides a detailed breakdown, equipping you with the knowledge to benchmark and elevate your marketing efforts.

Save invaluable time and effort with our expertly crafted, ready-to-use DLF Marketing Mix analysis. This editable document is your shortcut to strategic understanding, perfect for professionals and students alike.

Product

DLF's diverse real estate portfolio spans residential, commercial, and retail spaces, catering to a broad customer base. This includes high-end apartments, integrated townships, and independent floors for individual homeowners, alongside premium office spaces and vibrant retail destinations like DLF Promenade and DLF Avenue Saket for businesses and shoppers.

This multi-faceted approach allows DLF to capture demand across different economic cycles and customer needs. For instance, in the fiscal year ending March 31, 2024, DLF reported a significant increase in residential sales bookings, reaching ₹11,065 crore, demonstrating strong demand for their housing projects.

The company's commercial leasing segment also remains robust, with a rental income of ₹3,492 crore for FY24, highlighting the sustained demand for quality office and retail spaces in their strategically located properties.

DLF's residential offerings are meticulously segmented into Super Luxury, Luxury, and Premium categories, ensuring a tailored approach to diverse buyer preferences and financial capacities. This strategic division is crucial for effectively reaching specific customer demographics.

Within these broad segments, DLF further diversifies its product formats, offering a range of condominiums, duplexes, and apartments of varying sizes. For instance, in the fiscal year ending March 31, 2024, DLF reported strong sales across its luxury and premium residential projects, reflecting robust demand for its varied product formats.

This granular segmentation allows DLF to precisely cater to distinct customer needs and purchasing power, maximizing market penetration. The company's focus on quality and varied offerings, as evidenced by its sales performance in early 2024, underscores the success of this strategy.

DLF's end-to-end property development strategy covers the entire journey from acquiring land to managing properties post-completion. This integrated model means they handle everything, ensuring a seamless experience and consistent quality for buyers. For instance, DLF's commitment to this approach is evident in projects like The Crest in Gurgaon, where they managed construction and are now involved in resident services, reflecting a full lifecycle engagement.

Focus on Luxury and Premium Projects

DLF's strategy in recent fiscal years, particularly FY2024-25 and FY2025-26, centers on high-value luxury and super-luxury residential projects. This focus is evident in launches like 'The Dahlias' and 'DLF Privana North' in Gurugram, and 'The Westpark' in Mumbai.

These premium developments are distinguished by their sophisticated design, comprehensive amenities, and elevated pricing, specifically targeting affluent customer segments. The robust demand for these properties validates DLF's strategic positioning within this lucrative market niche.

- Targeting Affluent Buyers: Projects like 'The Dahlias' and 'The Westpark' are designed to appeal to individuals with significant disposable income.

- Premium Features: These developments boast high-end finishes, expansive living spaces, and exclusive community features.

- Market Validation: Strong sales figures for these luxury offerings in FY2024-25 and FY2025-26 confirm the market's appetite for premium real estate.

- Strategic Niche: DLF's concentration on luxury projects allows for higher profit margins and brand differentiation in a competitive landscape.

Growing Annuity Business

DLF's annuity business, a cornerstone of its marketing mix, focuses on generating consistent revenue through its extensive portfolio of leased commercial office and retail spaces. This segment is crucial for providing DLF with a stable income stream, acting as a reliable counterbalance to the more cyclical nature of its development projects.

The company's commitment to this annuity stream is underscored by substantial planned investments aimed at portfolio expansion. This strategic move signals DLF's intent to further solidify its position in the rental income market, anticipating continued demand for high-quality commercial and retail real estate.

For instance, DLF's rental income for the fiscal year ending March 31, 2024, reached approximately ₹3,920 crore, demonstrating the significant contribution of its annuity business. This figure highlights the success of their strategy to build and maintain a robust portfolio of income-generating assets.

- Stable Revenue: The annuity business provides a predictable and recurring revenue stream, insulating DLF from development project timelines and market fluctuations.

- Portfolio Expansion: DLF plans to significantly invest in growing its annuity portfolio, focusing on acquiring and developing new income-generating assets.

- Strategic Importance: This segment is vital for DLF's long-term financial health, complementing its core development activities and enhancing overall business resilience.

- Rental Income Growth: The company reported a substantial increase in rental income, with the annuity segment contributing significantly to its financial performance in recent fiscal periods.

DLF's product strategy is characterized by a dual focus on high-value residential developments and a robust annuity business generating stable rental income. This approach allows them to cater to diverse market needs while ensuring consistent revenue streams.

In the residential segment, DLF targets affluent buyers with premium and super-luxury projects, as seen with launches like 'The Dahlias' and 'The Westpark' in FY2024-25 and FY2025-26, which feature sophisticated design and exclusive amenities.

The annuity business, comprising commercial office and retail spaces, provides a steady income, with rental income reaching approximately ₹3,920 crore for FY24, demonstrating the segment's significant contribution to DLF's financial stability.

| Product Segment | Key Offerings | Target Audience | FY24 Rental Income (INR Crore) | Recent Project Examples (FY24-25/25-26) |

|---|---|---|---|---|

| Residential | Super Luxury, Luxury, Premium Apartments, Townships, Independent Floors | Affluent Individuals, Homeowners | N/A (Sales Bookings: ₹11,065 Crore for FY24) | The Dahlias, DLF Privana North, The Crest |

| Commercial & Retail (Annuity Business) | Premium Office Spaces, Retail Destinations | Businesses, Shoppers | 3,920 | DLF Promenade, DLF Avenue Saket |

What is included in the product

This analysis provides a comprehensive, data-driven breakdown of DLF's marketing strategies across Product, Price, Place, and Promotion. It offers actionable insights for marketers and managers to benchmark their own approaches against DLF's established practices.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Provides a clear, concise framework to diagnose and address marketing challenges, easing the burden of identifying effective solutions.

Place

DLF's extensive Pan-India presence is a cornerstone of its marketing strategy, with a strong focus on major metropolitan areas like Delhi NCR, Mumbai, Chennai, Kolkata, and Hyderabad. This strategic concentration allows DLF to tap into high-demand urban markets, as evidenced by its significant project pipeline in these regions. For instance, as of early 2024, DLF's development pipeline included substantial projects in Gurugram, reinforcing its commitment to key growth corridors.

DLF's strategic expansion into new, high-growth markets is a key element of its marketing strategy. The company's re-entry into Mumbai with projects like 'The Westpark' signifies a deliberate move to capture demand in a prime real estate hub. This expansion is crucial for diversifying DLF's revenue streams and reducing reliance on existing markets.

Further plans include new launches in other promising regions, such as Goa, indicating a proactive approach to identifying and capitalizing on emerging opportunities. These new market entries are designed to tap into customer bases with significant purchasing power, thereby driving future sales and profitability.

DLF employs a diverse distribution strategy, utilizing both direct sales through its own offices and dedicated sales teams, alongside a robust network of property brokers and consultants. This multi-channel approach is crucial for reaching a wide customer base. For instance, in the fiscal year ending March 31, 2024, DLF reported a significant increase in pre-sales, underscoring the effectiveness of its varied distribution channels in driving demand across its residential and commercial portfolios.

Development of Integrated Townships

DLF's product strategy heavily features the development of expansive integrated townships, a prime example being the 116-acre DLF Privana in Gurugram. These developments are designed as self-contained ecosystems, blending residential, commercial, and retail components to foster self-sufficiency.

This integrated approach significantly boosts property appeal by offering residents unparalleled convenience, consolidating living, working, and shopping within a single, well-planned community. This strategy aims to capture a larger share of the real estate market by providing a holistic living experience.

- Integrated Ecosystem: Townships like DLF Privana offer a mix of residential, commercial, and retail spaces, creating a self-sufficient environment.

- Enhanced Convenience: This model provides residents with easy access to daily amenities, work, and leisure activities, increasing property desirability.

- Market Attractiveness: The comprehensive nature of these townships appeals to a broad customer base seeking a complete lifestyle solution.

- Strategic Land Use: Large-scale developments allow for efficient land utilization and the creation of distinct community zones.

High-Occupancy Commercial Assets

DLF's annuity business thrives on its high-occupancy commercial assets, primarily premium office and retail spaces. These properties are strategically situated in prime locations such as Gurugram, Chennai, Delhi, and Noida, ensuring consistent demand from businesses and shoppers. The company's commitment to these rent-yielding assets is evident in its ongoing investment plans for further expansion.

The strength of DLF's commercial portfolio is reflected in its robust occupancy rates. For instance, as of the fiscal year ending March 31, 2024, DLF reported a significant occupancy level across its key commercial assets, demonstrating the enduring appeal of its well-located and high-quality properties. This consistent demand translates into a reliable stream of rental income, a cornerstone of DLF's annuity revenue model.

- High Occupancy Rates: DLF's commercial assets consistently achieve high occupancy, a testament to their prime locations and quality.

- Strategic Locations: Key markets include Gurugram, Chennai, Delhi, and Noida, offering access to a strong tenant base.

- Investment in Growth: Significant capital is allocated to expand the rent-yielding commercial portfolio, boosting future annuity income.

- FY24 Performance: The company's commercial leasing segment showed robust performance in FY24, contributing substantially to its overall revenue.

DLF's 'Place' strategy focuses on developing integrated townships and strategically locating commercial assets in prime urban centers. This approach creates self-sufficient communities and ensures consistent rental income from high-occupancy properties. The company's presence spans major metros like Delhi NCR, Mumbai, and Chennai, with ongoing expansion into promising new markets such as Goa.

| Market Presence | Key Locations | Recent Developments | FY24 Commercial Performance |

|---|---|---|---|

| Pan-India | Delhi NCR, Mumbai, Chennai, Kolkata, Hyderabad | Re-entry into Mumbai, new launches planned for Goa | High occupancy across key commercial assets |

| Integrated Townships | Gurugram (e.g., DLF Privana) | Focus on blending residential, commercial, and retail | Strong rental income stream |

| Commercial Assets | Gurugram, Chennai, Delhi, Noida | Ongoing investment in expansion of rent-yielding portfolio | Robust leasing segment performance |

Full Version Awaits

DLF 4P's Marketing Mix Analysis

The preview you see here is the exact DLF 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies, offering valuable insights. Rest assured, there are no surprises; you're viewing the complete, ready-to-use analysis.

Promotion

DLF's Integrated Marketing Communications (IMC) strategy is a cornerstone of its 4Ps analysis, orchestrating a 360-degree approach. This involves a blend of broad-reach mass marketing campaigns designed to elevate brand awareness across its extensive property offerings, from luxury apartments to commercial spaces.

Complementing this, DLF leverages targeted direct marketing, utilizing data analytics to reach specific customer segments with personalized messaging. This dual approach is crucial for generating interest and driving conversions for their diverse real estate projects, which saw DLF's revenue grow to approximately INR 14,778 crore in FY24.

The company’s communication efforts are dynamic, constantly evolving to mirror prevailing market trends and shifting consumer preferences. This adaptability ensures that DLF remains relevant and resonates with potential buyers in a competitive landscape, a strategy that has contributed to their significant market presence.

DLF's robust digital marketing initiatives are a cornerstone of its strategy, leveraging social media and SEO to boost brand visibility and generate leads. This digital-first approach allows DLF to connect with a vast online audience, crucial for engagement in today's market. For instance, in Q4 FY24, DLF reported a significant increase in website traffic, partly attributed to their enhanced digital campaigns.

DLF leverages traditional advertising extensively, placing print ads in leading publications like The Economic Times and India Today, alongside prominent hoarding placements in metro cities. This strategy aims to reach a broad audience and reinforce brand visibility.

Public relations efforts are central to DLF's communication, focusing on community engagement and corporate social responsibility initiatives. For instance, DLF's commitment to sustainability and urban development projects often garners positive media coverage, enhancing its reputation.

Direct Customer Engagement

Direct customer engagement is a cornerstone of DLF's marketing strategy, focusing on personalized communication to build relationships and convey value. This involves distributing informative brochures and rich digital content, such as engaging video and audio presentations, directly to potential buyers. This direct channel ensures DLF can clearly articulate product benefits and project specifics, creating a more impactful connection.

This approach facilitates a deeper understanding of DLF's offerings and allows for immediate addressing of customer inquiries. In 2024, DLF reported significant engagement through these direct channels, with a notable increase in leads generated from targeted digital campaigns and personalized outreach. For instance, their digital content strategy saw a 15% rise in conversion rates for property viewings booked via direct online channels compared to the previous year.

- Targeted Digital Outreach: DLF leverages personalized emails and social media campaigns to deliver project updates and exclusive offers directly to segmented customer lists.

- Interactive Content: The company utilizes virtual tours and detailed project walkthrough videos, enhancing the customer's ability to experience properties remotely.

- Direct Sales Support: Dedicated sales teams are equipped to handle individual customer queries, providing tailored information and guidance throughout the purchase journey.

- Customer Feedback Integration: Direct engagement mechanisms allow DLF to gather valuable customer feedback, which informs future product development and marketing efforts.

Strategic Partnerships and Branding

DLF strategically leverages partnerships with property brokers, consultants, and financial institutions offering home loans. These collaborations expand its promotional reach, tapping into established client bases and providing potential buyers with integrated financial solutions. For instance, DLF's tie-ups with banks in 2024-2025 aim to streamline the mortgage process, making property acquisition more accessible.

Historically, DLF has invested in high-profile sponsorships to boost brand visibility. A notable example is its past association with the Indian Premier League (IPL), a move that significantly amplified brand recognition among a vast demographic. This approach in 2024-2025 continues with targeted digital marketing campaigns and collaborations with influential real estate personalities to maintain brand prominence.

- Broker Networks: DLF collaborates with over 5,000 registered property brokers across major Indian cities, enhancing sales reach.

- Financial Tie-ups: Partnerships with leading banks like HDFC and ICICI Bank in 2024-2025 offer preferential home loan rates, facilitating sales.

- Brand Sponsorships: While IPL sponsorships were significant, current branding efforts in 2024-2025 focus on digital content creation and influencer marketing to reach younger demographics.

DLF's promotional strategy is a multi-faceted approach, integrating mass media, digital outreach, and direct engagement to build brand equity and drive sales. Their efforts in 2024-2025 focus on enhancing digital presence, leveraging partnerships, and maintaining brand visibility through targeted campaigns.

The company utilizes traditional advertising, including print and outdoor placements, to reach a broad audience, while its digital marketing initiatives, featuring social media and SEO, aim to boost online visibility and lead generation. Public relations and corporate social responsibility activities further bolster DLF's reputation.

Direct customer engagement through personalized communication, informative brochures, and digital content is key to building relationships and conveying value, with a notable increase in conversion rates observed from these channels in 2024.

DLF also strategically partners with brokers, consultants, and financial institutions to expand its promotional reach and offer integrated financial solutions, enhancing property accessibility for buyers.

| Promotional Tactic | Description | 2024-2025 Focus/Data |

|---|---|---|

| Digital Marketing | Social media, SEO, targeted online ads | Increased website traffic, 15% rise in conversion rates for property viewings via digital channels (Q4 FY24) |

| Traditional Advertising | Print ads, hoardings | Continued presence in leading publications and metro cities |

| Direct Marketing | Brochures, digital content, personalized outreach | Significant engagement, notable lead generation increase |

| Partnerships | Brokers, financial institutions | Tie-ups with banks for preferential home loan rates, collaboration with over 5,000 brokers |

| Public Relations | CSR, community engagement | Positive media coverage for sustainability and development projects |

Price

DLF's pricing strategy is fundamentally value-based, a direct reflection of the superior quality, sophisticated design, and extensive amenities integrated into its residential, commercial, and retail projects. This approach ensures that pricing aligns with the substantial perceived value and the exclusive experience its developments offer to customers.

As DLF targets the luxury and premium segments of the Indian real estate market, its property prices are typically positioned above the industry average. For instance, in fiscal year 2024, DLF reported a net profit of ₹2,174 crore, indicating strong demand and pricing power for its premium offerings, which allows for premium pricing that matches the high standards and brand reputation.

DLF's pricing strategy is highly segmented, reflecting the diverse nature of its real estate offerings and the varying economic conditions across different geographies. This approach ensures that each property is positioned optimally within its respective market to maximize revenue and appeal to targeted customer segments.

For example, in the ultra-luxury segment, DLF's project 'The Westpark' in Mumbai saw apartment prices ranging from ₹4 crore to ₹7.5 crore. The per-square-foot pricing for these premium residences fell between ₹42,000 and ₹47,000, underscoring the significant value attributed to prime locations and high-end amenities.

This dynamic pricing model allows DLF to adapt to specific market demands, property specifications, and competitive landscapes. By tailoring prices to the perceived value and affordability of each segment, DLF effectively captures a broader market share and enhances its profitability across its diverse portfolio.

DLF's revenue streams are robust, stemming from both property sales and rental income. The development arm focuses on selling residential and commercial properties, while the annuity business generates consistent rental income from its extensive portfolio of commercial and retail spaces.

For the fiscal year ending March 31, 2024, DLF reported record sales bookings of approximately ₹11,000 crore, a significant increase compared to previous years. This strong performance highlights the demand for its residential offerings.

The annuity business also contributed substantially, with rental income reaching around ₹1,500 crore for the same period. This consistent rental income provides a stable financial foundation, diversifying DLF's overall revenue generation and mitigating risks associated with the cyclical nature of property development.

Strong Sales Performance and Future Targets

DLF's sales performance in FY2024-25 was exceptional, reaching a record high of ₹21,223 crore in bookings. This represents a substantial 44% jump compared to the prior fiscal year, underscoring robust market demand. The company’s confidence in continued growth is reflected in its ambitious sales target of ₹20,000-₹22,000 crore for FY2025-26.

- Record Sales: DLF achieved its highest-ever sales bookings of ₹21,223 crore in FY2024-25.

- Significant Growth: This figure marks a 44% increase from the previous fiscal year's performance.

- Future Outlook: The company has set a strong sales guidance of ₹20,000-₹22,000 crore for FY2025-26.

- Market Confidence: This guidance signals DLF's optimism regarding sustained demand, especially in the luxury segment.

Strategic Investments for Rental Growth

DLF is strategically investing ₹10,000 crore by FY2027 to bolster its rental income. This significant capital outlay is earmarked for developing premium office spaces and new shopping malls, aiming to create high-value commercial assets that will drive recurring revenue growth.

This investment reflects a deliberate pricing strategy focused on long-term rental appreciation and occupancy rates in prime markets. By enhancing its portfolio with sought-after commercial properties, DLF anticipates a substantial uplift in its rental income streams.

- Investment: ₹10,000 crore by FY2027.

- Focus Areas: Premium office spaces and shopping malls.

- Objective: Enhance rental income and recurring revenue.

- Strategy: Long-term pricing for high-value commercial assets.

DLF's pricing is anchored in value, reflecting the premium quality and amenities of its developments, often exceeding market averages. For FY2024-25, DLF achieved record sales bookings of ₹21,223 crore, a 44% increase year-on-year, demonstrating strong pricing power and market demand for its luxury and premium properties.

The company's pricing strategy is segmented, adapting to diverse offerings and locations, as seen with the ₹4 crore to ₹7.5 crore price range for apartments in its Mumbai project, 'The Westpark'. This approach ensures optimal market positioning and revenue maximization across its portfolio.

| Metric | FY2023-24 | FY2024-25 |

|---|---|---|

| Sales Bookings | ₹11,000 crore (approx.) | ₹21,223 crore |

| Rental Income | ₹1,500 crore (approx.) | Not specified |

| Sales Growth (YoY) | Not specified | 44% |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is constructed using a robust blend of primary and secondary data sources. We leverage proprietary market research, direct company disclosures, and publicly available financial reports to ensure comprehensive coverage of Product, Price, Place, and Promotion strategies.