DLF Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

DLF's competitive landscape is shaped by powerful forces, from the bargaining power of buyers to the threat of new entrants. Understanding these dynamics is crucial for navigating the real estate market effectively. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore DLF’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to make informed strategic decisions.

Suppliers Bargaining Power

Landowners, especially in sought-after urban locations, hold considerable sway because developable land is scarce and the acquisition process is intricate. For instance, in 2023, land prices in major Indian metros saw an average increase of 8-12%, directly affecting developers like DLF.

The escalating cost of land directly influences DLF's project profitability and can even determine whether a project is viable, particularly in areas with high demand. This scarcity often forces DLF into higher initial expenditures, thereby diminishing their bargaining strength.

While basic construction materials like cement and steel have numerous suppliers, giving developers some leverage, specialized components or custom-fabricated items often originate from a more limited pool of vendors. This concentration can significantly amplify the bargaining power of those suppliers, especially if they offer unique quality or proprietary technology essential for a project. For instance, in 2024, the global construction materials market experienced price volatility, with steel prices fluctuating by as much as 15% throughout the year due to geopolitical factors and production constraints, directly impacting developers' input costs.

Supply chain disruptions, a persistent issue in recent years, also bolster supplier power. When lead times extend or availability becomes uncertain, developers like DLF may find themselves compelled to accept less favorable terms or pay premiums to secure necessary materials, potentially delaying project timelines. Reports from early 2024 indicated ongoing challenges in the logistics of certain imported building materials, leading to increased costs for domestic developers.

Furthermore, the specific quality and quantity requirements of a project can create dependencies. If a developer needs materials that meet stringent performance standards or are required in very specific batches, suppliers who can reliably meet these demands gain a considerable advantage. This can translate into higher prices or less flexibility in payment terms, as the developer prioritizes the successful completion of their construction projects.

The availability of skilled labor, project managers, and specialized contractors significantly influences supplier power. In a robust construction environment, high demand for these professionals can outpace supply, driving up labor costs and potentially impacting project schedules.

DLF's reliance on a network of contractors means that their specialized expertise or high demand can bolster their bargaining leverage. For instance, in 2024, the construction industry in many regions experienced a shortage of skilled tradespeople, with some reports indicating wage increases of 5-10% for specialized roles.

Financial Institutions

Financial institutions, such as banks, hold significant bargaining power as suppliers of essential capital for real estate ventures. They determine the cost of borrowing through interest rates and set the terms and collateral requirements for construction finance and long-term debt. For major developers like DLF, securing favorable financing is paramount, underscoring the importance of cultivating robust relationships with these lenders to manage their influence.

In 2024, the Reserve Bank of India (RBI) maintained its repo rate at 6.50%, influencing the cost of capital for developers. This stability, however, still allows banks to leverage their position in setting loan covenants and risk assessments. The ability of financial institutions to demand higher collateral or stricter repayment schedules directly impacts a developer's project feasibility and profitability.

- High Dependency: Real estate developers, including DLF, are heavily reliant on banks for project funding, giving lenders considerable leverage.

- Interest Rate Influence: Banks can dictate interest rates, directly affecting the cost of capital and project viability.

- Collateral Requirements: Lenders' demands for collateral can limit a developer's financial flexibility and increase risk.

- Relationship Management: Maintaining strong ties with financial institutions is critical for DLF to negotiate favorable terms and ensure access to funds.

Regulatory and Legal Services

Suppliers of legal, regulatory, and consulting services in India, crucial for DLF's real estate ventures, exert moderate bargaining power. These professionals possess specialized knowledge essential for navigating the nation's intricate property laws and securing necessary project approvals, making their expertise highly valuable.

The indispensability of these services for ensuring compliance and facilitating smooth project execution grants these suppliers a degree of leverage. For instance, a delay in obtaining a crucial environmental clearance, a service provided by regulatory consultants, could push back a project launch by months, directly impacting revenue streams and increasing overall development costs for DLF.

The bargaining power of these suppliers is further influenced by the concentration of specialized firms and the demand for their services. In 2023, the Indian legal services market was valued at approximately USD 25 billion, indicating a substantial demand for expertise, which can empower established firms.

- Specialized Expertise: Legal and regulatory consultants offer niche skills vital for Indian real estate compliance.

- Project Criticality: Their services are often non-negotiable for project initiation and smooth progression.

- Impact of Delays: Inefficiencies from these suppliers can lead to significant cost overruns and timeline disruptions for developers like DLF.

- Market Dynamics: The demand for these services in India's growing real estate sector influences supplier pricing and terms.

Suppliers of essential raw materials and specialized components wield significant influence due to scarcity and concentration. For instance, in 2024, the price of key construction metals like steel saw notable increases due to global supply chain pressures, directly impacting developer costs.

DLF's reliance on these suppliers for critical project elements, coupled with potential supply chain disruptions, necessitates careful management of these relationships to mitigate cost escalations and project delays.

Financial institutions, as capital suppliers, hold substantial power through interest rates and loan terms. In 2024, the prevailing repo rate of 6.50% in India, while stable, still allowed banks to dictate financing conditions, impacting developer profitability.

Skilled labor and specialized contractors also represent a supplier group with growing bargaining power, particularly in high-demand markets. Reports in early 2024 indicated wage increases of 5-10% for specialized construction roles, reflecting this trend.

| Supplier Type | Bargaining Power Factors | Impact on DLF | 2024 Data Point |

|---|---|---|---|

| Landowners | Scarcity of prime locations, complex acquisition process | Increased acquisition costs, project viability concerns | 8-12% average land price increase in metros (2023) |

| Material Suppliers | Concentration of specialized vendors, supply chain disruptions | Higher input costs, potential project delays | 15% steel price volatility (2024) |

| Financial Institutions | Control over interest rates, collateral requirements | Increased cost of capital, stricter financing terms | Repo rate at 6.50% (2024) |

| Skilled Labor & Contractors | High demand, shortage of specialized skills | Rising labor costs, potential schedule overruns | 5-10% wage increase for specialized roles (early 2024) |

What is included in the product

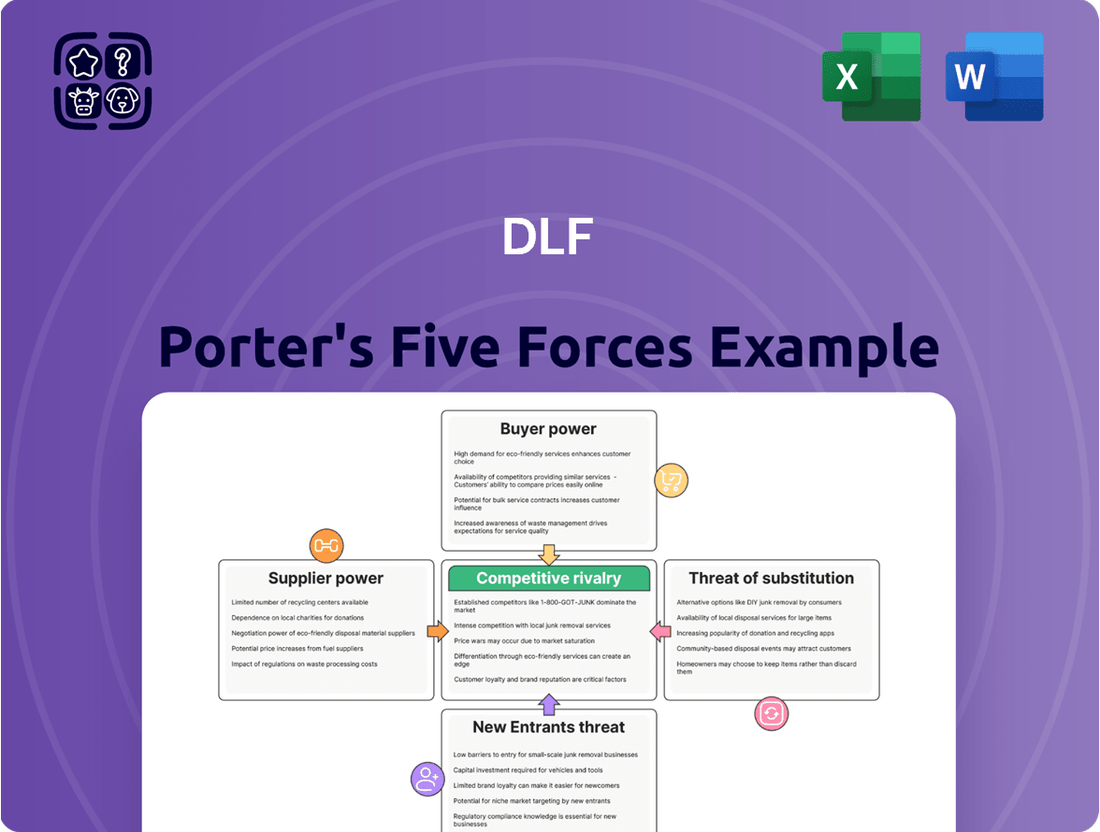

DLF's Porter's Five Forces analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Instantly identify and mitigate competitive threats with a clear visualization of each of Porter's Five Forces, empowering proactive strategy adjustments.

Customers Bargaining Power

Customers, particularly individual homebuyers, often display significant price sensitivity. This is understandable given that purchasing property represents a major financial commitment. For instance, in 2024, the average home price in many metropolitan areas continued to be a substantial portion of household income, making even small price differences impactful.

The digital age has dramatically increased information availability for these customers. Online real estate portals and aggregators now offer a wealth of data, allowing buyers to easily compare prices, features, and developer track records across numerous projects. This transparency empowers them to negotiate from a more informed position, seeking the best possible value for their investment.

DLF operates in a highly competitive real estate market, offering a wide spectrum of residential, commercial, and retail properties. This abundance of choices for consumers directly amplifies their bargaining power.

Customers can readily shift their allegiance to rival developers if DLF's projects fall short on crucial aspects like pricing, location, build quality, or amenities. For instance, in 2024, the Indian real estate market saw a significant increase in new project launches across major cities, providing ample alternatives for homebuyers and commercial lessees.

This constant availability of comparable or even superior options empowers customers to negotiate better terms, demand higher quality, and expect more competitive pricing from DLF, as they are not locked into a single provider.

Economic conditions, including interest rates and inflation, directly impact DLF's customer bargaining power. For instance, in late 2023 and early 2024, rising interest rates in India, with the Reserve Bank of India maintaining its repo rate at 6.5%, increased borrowing costs for homebuyers. This can lead to softer demand, forcing DLF to offer more competitive pricing or flexible payment structures to attract buyers, thereby enhancing customer negotiation strength.

Bargaining Power of Large Corporate/Retail Tenants

Large corporate clients and anchor retail tenants wield significant bargaining power in the commercial office and retail space markets. Their capacity to commit to substantial leases and drive customer traffic means they can often negotiate better rental rates, more flexible lease terms, and tailored fit-out packages. This is particularly relevant for developers like DLF, where securing these major tenants is crucial for occupancy and consistent revenue streams, thereby amplifying the tenants' leverage.

For instance, in 2024, the demand for prime office spaces remained robust, especially in metropolitan hubs. Major corporations, seeking to consolidate operations or establish new headquarters, found themselves in a strong position to negotiate concessions. This trend is supported by reports indicating that while vacancy rates in key Indian cities like Gurugram and Bengaluru saw minor fluctuations, the availability of large, contiguous spaces suitable for these anchor tenants was limited, further strengthening their negotiating stance.

- Tenant Leverage: Large corporate and retail tenants can demand favorable terms due to their significant lease commitments and ability to draw in customers.

- Impact on Developers: DLF's revenue and occupancy rates are heavily influenced by the terms negotiated with these key tenants.

- Market Dynamics: Limited availability of large, prime spaces in 2024 empowered major tenants to negotiate better rental rates and lease conditions.

Long-Term Commitment and High-Value Purchase

Purchasing real estate, whether residential or commercial, is a significant, long-term commitment for customers, representing a high-value transaction. This substantial financial outlay naturally increases the perceived risk for buyers.

To mitigate this risk, customers engage in extensive due diligence, scrutinizing project details, developer reputation, and legal documentation. They actively seek clear contractual terms, assurances on construction quality, and dependable post-sales service.

This heightened awareness and desire for security often empower customers, giving them stronger negotiation leverage. They tend to push for favorable pricing, flexible payment schedules, and robust guarantees from developers like DLF.

- High Transaction Value: Real estate purchases are among the largest financial decisions an individual or business makes. For instance, average property prices in prime Indian markets like Delhi NCR, where DLF operates, can range from INR 1 crore to over INR 10 crores for residential units and significantly higher for commercial spaces.

- Long-Term Commitment: A property is typically held for many years, even decades, making the initial purchase decision critical.

- Information Asymmetry & Due Diligence: Buyers invest considerable time and resources in research to understand market trends, developer track records, and project specifications, aiming to bridge any information gap.

- Demand for Guarantees: Customers often seek assurances on timely project completion, quality of construction, and adherence to promised amenities, which influences their willingness to pay a premium or negotiate terms.

Customers' bargaining power is amplified by the sheer volume of choices available in the real estate market. In 2024, the Indian real estate sector continued to see a steady stream of new project launches across major cities, offering a diverse range of options for homebuyers and commercial lessees. This abundance of alternatives means customers can easily switch to competitors if DLF's offerings don't meet their expectations on price, location, or quality.

The significant financial commitment involved in property acquisition also empowers customers. For instance, in 2024, the average home prices in India's Tier 1 cities remained substantial, often exceeding ₹1 crore, making buyers highly sensitive to price differences and keen on negotiating favorable terms and payment plans.

Furthermore, increased transparency through online platforms allows customers to compare DLF's projects with those of its rivals, facilitating informed negotiations. This ease of comparison, coupled with the high value of real estate transactions, grants buyers considerable leverage to demand better pricing and superior amenities.

| Factor | Description | Impact on DLF | 2024 Data Point |

| Price Sensitivity | Customers are highly aware of prices due to the large financial outlay. | Forces DLF to offer competitive pricing and flexible payment options. | Average home prices in top Indian cities often exceed ₹1 crore. |

| Information Availability | Online portals provide easy comparison of projects and developers. | Empowers customers to negotiate from an informed position. | Increased usage of online real estate aggregators for property research. |

| Availability of Substitutes | Numerous competing projects and developers exist in the market. | Customers can easily switch, increasing their negotiation power. | Continued new project launches across major Indian metropolitan areas. |

Full Version Awaits

DLF Porter's Five Forces Analysis

The preview you see is the exact DLF Porter's Five Forces Analysis document you will receive upon purchase, offering a comprehensive examination of competitive forces within the industry. This detailed report will equip you with critical insights into the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. You're looking at the actual document, ready for download and immediate use the moment you buy.

Rivalry Among Competitors

The Indian real estate sector is a crowded space, with a multitude of developers, from large national entities to smaller local players, all competing fiercely for a slice of the market. This fragmentation means DLF encounters significant rivalry across its residential, commercial, and retail offerings, facing off against both seasoned developers and newer, agile companies.

This intense competition often drives aggressive pricing and marketing tactics as companies strive to capture customer attention and loyalty. For instance, in 2024, the residential segment saw a notable increase in new project launches, intensifying the battle for homebuyers.

The Indian real estate market, particularly residential segments, frequently witnesses intense price wars. This is especially true when there's an oversupply of units or when demand growth slows down. Developers like DLF often engage in competitive pricing strategies, offering attractive payment schemes and launching aggressive marketing campaigns to stand out and attract buyers.

This heightened rivalry directly impacts profitability by squeezing profit margins. For instance, in 2023, the residential sector saw a significant increase in new launches, leading to greater competition. Developers had to allocate substantial budgets towards marketing and sales promotions to capture market share, a trend expected to continue into 2024.

DLF faces significant hurdles in differentiating its core product of land and construction, despite efforts in design, amenities, and location. Competitors can readily copy successful features, making it a constant battle to maintain a unique market position.

In 2024, the Indian real estate market saw a surge in new launches, with reports indicating over 1.75 lakh new units across major cities in the first half of the year. This intense activity underscores the difficulty DLF has in setting itself apart when many developers offer similar value propositions.

To counter this, DLF must continuously invest in innovation and uphold superior quality standards. For instance, DLF's commitment to integrated townships and lifestyle amenities, like those in DLF City, Gurugram, aims to build brand loyalty, but the threat of replication remains high.

High Exit Barriers

The real estate sector, including companies like DLF, faces substantial challenges in exiting the market. This is largely due to the immense capital tied up in land banks and the extended timelines required to complete projects, which can span several years.

These high exit barriers mean that even developers experiencing financial difficulties often remain in the market for extended periods. This persistence by less successful competitors intensifies the competitive rivalry that DLF must navigate.

- High Fixed Asset Investment: Real estate development demands significant upfront investment in land acquisition and construction, making divestment costly and complex.

- Long Project Lifecycles: The lengthy gestation period from project conception to completion and sale locks in capital, deterring quick exits.

- Persistence of Competitors: The inability to easily exit keeps less profitable firms in the market, sustaining a higher level of rivalry for established players like DLF.

Brand Reputation and Project Delivery

Competitive intensity in real estate is significantly shaped by brand reputation and a proven history of delivering projects on time and with high-quality construction. Developers like DLF, with decades of experience, benefit from substantial brand equity, which naturally draws in buyers. However, the market also sees newer, more nimble competitors carving out success by targeting specific market segments or showcasing exceptional execution capabilities.

DLF's established brand name is a powerful asset, attracting customers who value reliability and a proven track record. This long-standing reputation, built over many years, allows them to command customer loyalty and often premium pricing. For instance, DLF's residential projects in Gurugram have consistently seen strong demand, reflecting this trust.

Yet, the landscape is evolving. Smaller, more agile developers can challenge established players by focusing on niche markets or demonstrating superior project management and delivery. This can involve faster construction timelines, innovative designs, or a more personalized customer experience, allowing them to gain market share even without the same level of brand recognition.

- Brand Equity: DLF's long-standing reputation is a key differentiator, attracting customers seeking reliability and quality.

- Project Delivery: A track record of timely project completion and superior construction quality is crucial for maintaining competitive advantage.

- Agile Competitors: Newer, nimble developers can disrupt the market by focusing on specific niches or demonstrating exceptional execution.

- Reputation Management: Sustaining a strong brand reputation is paramount for DLF to navigate the competitive real estate environment effectively.

The competitive rivalry within India's real estate sector is intense, characterized by numerous developers vying for market share across residential, commercial, and retail segments. This crowded landscape often leads to aggressive pricing and marketing strategies, as seen with the surge in new residential project launches in 2024, which intensified the battle for homebuyers.

DLF, despite its established brand and quality, faces challenges in product differentiation, as competitors can readily replicate successful features, necessitating continuous investment in innovation and quality. The market's fragmentation means DLF contends with both large, established players and smaller, agile companies, creating a dynamic competitive environment.

The persistence of competitors, even those struggling financially, due to high exit barriers like significant capital tied up in land and long project lifecycles, further fuels this rivalry. This environment demands that DLF maintain its brand equity and project delivery excellence to retain its competitive edge against both seasoned rivals and emerging disruptors.

| Metric | DLF (Example) | Industry Average (2024 Estimate) | Impact on Rivalry |

|---|---|---|---|

| New Project Launches (H1 2024) | Significant | High (e.g., >1.75 lakh units across major cities) | Increases competition for buyers and market share. |

| Marketing Spend as % of Revenue | Moderate to High | Variable, but increasing | Drives up customer acquisition costs for all players. |

| Price Adjustments/Discounts | Strategic | Frequent, especially in competitive micro-markets | Squeezes profit margins and necessitates value-added offerings. |

| Brand Recognition Score | Very High | Varies greatly by developer | DLF's strength, but agile competitors target niche segments. |

SSubstitutes Threaten

For residential properties, renting stands as a primary substitute for buying, especially for those prioritizing flexibility or lower initial expenses. This is particularly relevant for younger demographics and those in careers with frequent relocation. In 2024, the rental market continues to show strength, with national average rents experiencing steady increases, making the decision to rent versus buy a more nuanced calculation for many consumers.

The rise of co-working spaces and remote work presents a significant substitute threat to traditional commercial office spaces. These flexible arrangements offer businesses, particularly startups and SMEs, cost savings and agility not found in long-term leases. For instance, by mid-2024, the global flexible office market was projected to grow significantly, with many companies re-evaluating their physical space needs in favor of hybrid models.

This shift directly impacts demand for conventional office footprints, potentially reducing occupancy rates and rental income for property developers like DLF. The increasing acceptance of remote and hybrid work models, accelerated by recent global events, means fewer companies may require large, dedicated office spaces, thereby diminishing the attractiveness of traditional commercial real estate.

The most significant substitute for traditional retail spaces, such as shopping malls, is the ever-growing e-commerce sector. Online platforms offer unparalleled convenience, a vast array of products, and often more competitive pricing, directly siphoning consumer spending away from physical stores. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense scale of this substitute threat.

This persistent shift towards online shopping compels physical retail destinations, like those managed by DLF, to innovate beyond mere product display. To remain relevant and capture consumer attention, these properties must increasingly focus on creating unique experiential retail and entertainment offerings that cannot be replicated online.

Hospitality: Alternative Accommodation Options

The hospitality sector, even for a real estate giant like DLF, faces significant pressure from substitute accommodation options. These aren't just other hotels; they encompass a wide array of choices that cater to different traveler needs and budgets.

Budget hotels, guesthouses, and importantly, online short-term rental platforms like Airbnb, represent formidable substitutes. These platforms, in particular, have revolutionized travel by offering unique, often more affordable, and localized experiences. For instance, in 2024, the global short-term rental market was projected to reach over $100 billion, highlighting its substantial reach and appeal.

These alternatives directly compete for market share, potentially siphoning off guests who might otherwise choose traditional hotel offerings. This can lead to reduced occupancy rates and downward pressure on pricing for DLF's hospitality assets, impacting overall revenue and profitability in this segment.

- Budget Hotels: Offer basic amenities at lower price points, attracting cost-conscious travelers.

- Guesthouses/B&Bs: Provide a more personal and often localized experience, appealing to those seeking authenticity.

- Online Short-Term Rentals (e.g., Airbnb): Offer a wide variety of unique properties, from single rooms to entire homes, often with kitchen facilities and local immersion opportunities. In 2023, Airbnb reported over 1.5 million listings in Europe alone, demonstrating significant scale.

Investment: Alternative Asset Classes

From an investor's viewpoint, real estate, including properties from developers like DLF, faces competition from other asset classes. Stocks, bonds, mutual funds, and even gold represent alternative avenues for capital deployment. For example, in early 2024, the S&P 500 saw significant gains, potentially drawing investor interest away from real estate if perceived returns were lower.

The appeal of these substitutes hinges on prevailing market conditions and an individual investor's tolerance for risk. If alternative investments provide superior returns or a more favorable risk-reward profile, capital may be diverted from the real estate sector. Consider the bond market in late 2023 and early 2024, where rising interest rates made fixed-income investments more attractive to risk-averse investors.

- Real Estate vs. Stocks: In 2023, the S&P 500 returned approximately 24%, while real estate market performance varied by region, with some areas experiencing slower appreciation.

- Real Estate vs. Bonds: As of early 2024, benchmark bond yields offered attractive income streams, providing a stable alternative to the illiquidity and volatility sometimes associated with property investments.

- Real Estate vs. Gold: Gold prices saw fluctuations in early 2024, driven by geopolitical tensions, making it a potential safe-haven asset that could compete for investor capital during uncertain economic periods.

The threat of substitutes for real estate, particularly for a developer like DLF, is multifaceted, encompassing alternative living arrangements, evolving work environments, and competing investment vehicles.

For residential properties, renting remains a key substitute, especially for those valuing flexibility or lower upfront costs, a trend observed in 2024 with rising rental averages. In commercial real estate, co-working spaces and remote work offer agile, cost-effective alternatives to traditional leases, a shift supported by the projected growth of the flexible office market by mid-2024.

The retail sector faces intense competition from e-commerce, with global online sales expected to exceed $6.3 trillion in 2024, necessitating physical spaces to offer unique experiences. Similarly, the hospitality industry sees short-term rentals, like Airbnb, which boasted over 1.5 million listings in Europe in 2023, as a significant substitute, potentially impacting occupancy and pricing.

From an investment perspective, real estate competes with stocks, bonds, and gold; for instance, the S&P 500's approximate 24% return in 2023 may divert capital from property markets, while attractive bond yields in early 2024 also present a stable alternative.

| Substitute Category | Key Substitutes | 2024/Recent Data Point | Impact on DLF |

|---|---|---|---|

| Residential | Renting | National average rents increasing steadily. | Nuanced buy vs. rent decision for consumers. |

| Commercial | Co-working Spaces, Remote Work | Flexible office market projected for significant growth. | Reduced demand for traditional office footprints. |

| Retail | E-commerce | Global e-commerce sales projected to exceed $6.3 trillion. | Need for experiential retail to compete. |

| Hospitality | Short-Term Rentals (e.g., Airbnb) | Over 1.5 million Airbnb listings in Europe (2023). | Potential pressure on occupancy and pricing. |

| Investment | Stocks, Bonds, Gold | S&P 500 returned ~24% in 2023; attractive bond yields in early 2024. | Capital may shift based on relative returns and risk. |

Entrants Threaten

The real estate development sector, particularly for extensive projects akin to those DLF undertakes, necessitates enormous capital for acquiring land, constructing buildings, and developing essential infrastructure. These substantial financial demands create a formidable barrier for any new company looking to enter the market.

For instance, in 2024, major integrated township projects often require investments running into billions of dollars, a figure that is exceedingly difficult for emerging developers to amass. The sheer scale of funding needed for land acquisition alone can be a deal-breaker, as seen with prime land parcels in major metropolitan areas commanding astronomical prices.

Securing the necessary financing for such capital-intensive ventures is a significant challenge, often involving complex debt structures and equity partnerships. This hurdle effectively limits the number of new entrants capable of competing with established players like DLF.

Navigating India's complex regulatory landscape, including zoning laws, environmental clearances, and multiple government approvals, presents a significant barrier for new real estate developers. This intricate process is not only time-consuming but also requires specialized knowledge and established relationships to manage efficiently. For instance, obtaining all necessary permits for a large-scale residential project can take years, significantly impacting project timelines and budgets.

New entrants often struggle with these bureaucratic hurdles due to a lack of experience and pre-existing networks. This can lead to substantial delays and unexpected cost escalations, making it difficult to compete with established players. DLF, with its decades of experience, has cultivated the expertise and relationships needed to streamline these approval processes, giving it a distinct advantage.

Established brand reputation and trust act as a significant barrier to new entrants in the real estate sector. DLF, for instance, has cultivated decades of strong brand recognition and consumer confidence, a crucial element for high-value purchases. This deeply ingrained trust makes it challenging for newcomers to gain traction without a comparable history of successful projects and customer satisfaction.

Land Bank and Sourcing Challenges

The threat of new entrants in the real estate sector, particularly concerning land acquisition, is significantly shaped by existing players' entrenched advantages. Established developers like DLF often possess substantial land banks, secured through years of operation and strategic foresight. This gives them preferential access to prime locations and a considerable edge in sourcing future development opportunities. For instance, in 2024, major Indian developers continued to consolidate their land holdings, with reports indicating that companies with extensive land reserves were better positioned to navigate market fluctuations and secure project pipelines.

Newcomers face steep hurdles in acquiring suitable land parcels at competitive prices, especially in sought-after urban centers where land scarcity drives up costs. This difficulty in securing affordable and well-located land makes it challenging for new entrants to scale their operations effectively and compete with established entities. The capital investment required for land acquisition alone can be prohibitive, creating a substantial barrier to entry.

- Land Banking Advantage: Established developers maintain significant land banks, providing a buffer against market volatility and ensuring future project pipelines.

- Access to Prime Locations: Existing players often have preferential access to prime urban land, a critical factor for project success and profitability.

- Capital Intensity: The high cost of land acquisition in desirable areas presents a major financial barrier for new entrants seeking to establish a presence.

- Sourcing Challenges: New developers struggle to secure land deals on par with established firms, limiting their ability to compete on price and location.

Economies of Scale and Supply Chain Integration

Large, established developers like DLF possess significant advantages due to economies of scale. This allows them to procure materials, labor, and technology at more favorable rates, translating into substantial cost efficiencies. For instance, in 2024, major developers often secured bulk discounts on construction materials, which new entrants, operating on a smaller scale, simply cannot access.

Furthermore, DLF benefits from deeply integrated supply chains and established relationships with a vast network of suppliers, contractors, and financial partners. These long-standing connections ensure reliability and preferential terms. New entrants, conversely, struggle to replicate this extensive network, facing higher initial costs and greater logistical hurdles, which directly impacts their competitiveness.

- Economies of Scale: DLF's large-scale operations in 2024 provide cost advantages in material procurement, labor, and technology adoption.

- Supply Chain Integration: Established developers leverage extensive networks of suppliers, contractors, and financing partners.

- New Entrant Disadvantage: Start-ups face higher operational costs and logistical challenges due to a lack of scale and established relationships.

- Competitive Barrier: These factors create a significant barrier to entry, making it difficult for new players to compete effectively on price and efficiency.

The threat of new entrants in the real estate sector is considerably low due to the immense capital requirements for land acquisition and project development. For example, in 2024, a large integrated township project could easily demand investments exceeding billions of dollars, a sum that is exceptionally difficult for emerging developers to secure. This financial barrier, coupled with the need for specialized expertise in navigating complex regulatory frameworks, effectively deters many potential new players from entering the market and competing with established entities like DLF.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

|---|---|---|---|

| Capital Intensity | High cost of land, construction, and infrastructure development. | Prohibitive financial hurdle; requires substantial funding. | Major projects in 2024 often require multi-billion dollar investments. |

| Regulatory Hurdles | Complex and time-consuming approval processes (zoning, environmental, etc.). | Delays, cost escalations, and need for specialized knowledge. | Permit acquisition for large projects can still take years. |

| Brand Reputation & Trust | Established players have decades of proven track record and customer confidence. | Difficulty in building credibility and attracting buyers. | Consumer preference for established developers in high-value real estate transactions. |

| Land Banking Advantage | Existing developers possess significant land reserves in prime locations. | Limited access to competitive land parcels for new entrants. | Consolidation of land holdings by major developers in 2024 continued. |

| Economies of Scale | Larger firms benefit from lower input costs (materials, labor). | Higher operational costs for smaller, new competitors. | Bulk discounts on construction materials in 2024 favored large developers. |

Porter's Five Forces Analysis Data Sources

Our DLF Porter's Five Forces analysis leverages a comprehensive dataset including DLF's annual reports, investor presentations, and publicly available financial statements. We also incorporate industry-specific market research reports and data from real estate analytics firms to provide a robust competitive landscape assessment.