DLF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

Unlock the full strategic blueprint behind DLF's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

DLF frequently engages in strategic joint ventures with other developers and investment entities to undertake specific real estate projects. A prime example is their collaboration with Trident Realty Group for the luxury project 'The Westpark' in Mumbai, marking DLF's return to the city's property market, with DLF holding a majority 51% stake in the venture.

These alliances are crucial for DLF, enabling them to tap into local market knowledge, distribute project risks, and gain entry into new geographical areas or acquire specialized development skills. This approach allows for efficient capital deployment and access to a broader range of expertise.

DLF's ability to execute large-scale real estate ventures hinges on strong alliances with financial institutions and investors. These partnerships are vital for securing the considerable capital needed for development, ensuring projects move from blueprint to reality.

Collaborations with banks, private equity firms, and other financial entities are fundamental to DLF's funding strategy. For instance, DLF's joint venture with Singapore's sovereign wealth fund, GIC, for DLF Cyber City Developers (DCCDL) highlights a significant partnership focused on commercial assets, demonstrating access to substantial, long-term capital.

DLF's success hinges on its relationships with top-tier construction and engineering firms, crucial for bringing its diverse real estate projects to life. These collaborations are fundamental to ensuring projects are completed on schedule and meet DLF's stringent quality benchmarks across residential, commercial, and retail segments.

For instance, DLF's commitment to excellence is reflected in its choice of partners, who adhere to rigorous safety protocols and construction standards. In 2024, DLF continued to leverage its established network of these specialized firms, a strategy that underpins its reputation for delivering reliable and high-value properties.

Landowners and Local Authorities

DLF's key partnerships with landowners are fundamental to its land acquisition strategy, forming the bedrock of its development projects. For instance, in 2024, DLF continued to leverage these relationships to secure prime locations across India’s major urban centers, a process that often involves intricate negotiations and long-term agreements.

Collaborations with local authorities and urban planning bodies are equally critical, particularly for navigating the complexities of regulatory approvals and permits. This is especially true for projects like those under the Slum Rehabilitation Authority (SRA) schemes, where DLF has been actively involved. In 2024, the company emphasized its commitment to working with these bodies to ensure timely project execution and compliance with evolving urban development guidelines. These partnerships are not just about obtaining permits but also about aligning development plans with municipal visions and community needs, ensuring sustainable and compliant growth.

- Landowner Agreements: Essential for securing land parcels, the foundation of any real estate development.

- Regulatory Approvals: Partnerships with local authorities are vital for obtaining necessary permits and ensuring compliance with zoning and building regulations.

- SRA Schemes: DLF's engagement in Slum Rehabilitation Authority projects highlights the importance of close collaboration with government bodies for successful urban renewal initiatives.

- Urban Planning Alignment: Working with planning authorities ensures developments integrate seamlessly with city infrastructure and future growth plans.

Material Suppliers and Technology Providers

DLF's commitment to quality and innovation hinges on strong alliances with material suppliers and technology providers. These partnerships are crucial for securing consistent access to essential construction materials like cement and steel, ensuring project timelines are met and quality standards are upheld. For instance, in 2023, the Indian construction materials market saw significant growth, with the cement sector alone contributing substantially to the country's GDP, highlighting the importance of reliable sourcing.

Beyond basic materials, DLF actively collaborates with technology providers to integrate cutting-edge solutions. This includes smart home systems that enhance resident convenience and sustainable building technologies that reduce environmental impact. These collaborations are vital as the demand for green buildings and smart living spaces continues to rise, with a growing segment of homebuyers prioritizing eco-friendly features and technological integration in their properties.

- Material Quality Assurance: Securing high-grade cement, steel, and other construction inputs from trusted suppliers ensures structural integrity and longevity of DLF properties.

- Technology Integration: Partnerships with tech firms enable the incorporation of smart home features and sustainable building solutions, aligning with modern consumer preferences and environmental goals.

- Sustainability Initiatives: DLF's focus on sustainability is supported by suppliers providing recycled materials and technology providers offering efficient water treatment and energy management systems.

- Supply Chain Resilience: Robust relationships with a diverse supplier base mitigate risks associated with material availability and price fluctuations, ensuring project continuity.

DLF's strategic alliances with landowners are foundational, enabling access to prime real estate across India's key urban markets. In 2024, the company continued to solidify these crucial relationships, often involving complex, long-term agreements for land acquisition.

Collaborations with financial institutions and investors are paramount for funding DLF's extensive development pipeline. Partnerships with entities like GIC for DLF Cyber City Developers underscore DLF's ability to secure substantial, long-term capital for its commercial assets.

DLF relies heavily on partnerships with leading construction and engineering firms to ensure timely project completion and adherence to high-quality standards. In 2024, these collaborations were vital for maintaining DLF's reputation for delivering reliable residential, commercial, and retail properties.

Engagements with material suppliers and technology providers are critical for quality assurance and innovation. DLF's 2023 reliance on the robust Indian construction materials market, particularly cement, highlights the importance of these supply chain relationships for project continuity and cost management.

What is included in the product

A structured framework detailing DLF's customer segments, value propositions, revenue streams, and cost structure.

It provides a clear, visual representation of DLF's core business logic and strategic approach.

Provides a structured framework to identify and address critical business challenges, alleviating the pain of undefined strategy.

Helps pinpoint and resolve operational inefficiencies and market misalignments by visualizing and refining key business elements.

Activities

DLF's core activities begin with the strategic identification and acquisition of land parcels in key urban centers throughout India. This is a crucial step that underpins their development pipeline.

Following acquisition, DLF engages in extensive planning, encompassing architectural design, urban planning, and navigating the complex regulatory landscape to secure approvals for diverse projects, including residential, commercial, and retail spaces.

The company's robust land bank, sufficient for approximately 20 years of sustainable growth, highlights their long-term strategic vision and commitment to continuous development. This substantial land holding is a significant asset in their business model.

DLF's core operations revolve around the comprehensive lifecycle of property development and construction. This encompasses everything from acquiring land to delivering finished projects across various asset classes.

The company's portfolio is diverse, featuring high-end residential offerings like apartments and plotted developments, alongside premium Grade A-plus commercial office spaces and popular retail destinations such as shopping malls.

Since its founding, DLF has a proven track record, having successfully developed over 185 real estate projects, contributing to more than 352 million square feet of built-up area.

DLF's sales and marketing are pivotal, focusing on attracting and converting customers through aggressive strategies. This involves launching new developments and executing targeted campaigns to drive sales bookings.

In the financial year 2024-25, DLF achieved a significant milestone, reporting record sales bookings amounting to ₹21,223 crore. This represents a substantial 44% surge compared to the prior financial year, largely fueled by robust demand for premium residential properties.

Property Management and Leasing

DLF's key activities for its annuity business revolve around the strategic management and leasing of its extensive portfolio of commercial and retail properties. This focus ensures high occupancy rates, which directly translate into stable and predictable rental income streams. The company actively works to maintain these strong occupancy levels across its diverse property types.

In fiscal year 2025, DLF demonstrated the effectiveness of its property management and leasing strategy. The company's rental business, which includes office spaces, retail outlets, and hospitality assets, achieved an impressive occupancy level of 94%. This high utilization rate underscores the company's ability to attract and retain tenants, thereby securing consistent revenue.

- Property Management: Overseeing the day-to-day operations of commercial and retail properties to ensure tenant satisfaction and asset preservation.

- Leasing Operations: Actively marketing and leasing vacant spaces to maintain high occupancy rates and secure long-term rental agreements.

- Tenant Relations: Cultivating strong relationships with existing tenants to encourage renewals and minimize churn.

- Portfolio Optimization: Continuously evaluating and enhancing the tenant mix and property offerings to maximize rental yields and market appeal.

Financial Management and Investment

Financial management at DLF is crucial for its operations, encompassing securing funds for projects, managing existing debt, and making forward-looking investments. This ensures the company has the capital necessary to execute its development plans and maintain financial health.

DLF's strategic financial activities are geared towards expansion and market responsiveness. A significant part of this involves identifying and capitalizing on opportunities in the real estate sector, particularly in upscale residential segments.

- Project Funding: DLF actively secures funding for its diverse real estate projects, ensuring adequate capital is available for construction and development.

- Debt Management: The company focuses on efficiently managing its debt obligations to maintain a healthy balance sheet and optimize borrowing costs.

- Strategic Investments: DLF makes calculated investments in new developments, aiming to capture market demand and enhance long-term shareholder value.

- Capital Allocation: Approximately ₹5,500 crore is earmarked for investment in new upscale residential projects, reflecting a commitment to growth and market leadership.

DLF's key activities span the entire real estate lifecycle, from land acquisition and meticulous planning to robust construction and strategic sales. Their operations are further bolstered by the effective management of their annuity business, ensuring sustained rental income. Financial management, including project funding and strategic investments, underpins their ability to execute large-scale developments and capitalize on market opportunities.

| Key Activity | Description | Financial Year 2024-25 Data/Impact |

|---|---|---|

| Property Development | Land acquisition, planning, design, and construction of residential, commercial, and retail projects. | Record sales bookings of ₹21,223 crore, a 44% increase. |

| Annuity Business Management | Leasing and management of commercial and retail properties. | 94% occupancy rate across rental portfolio. |

| Financial Management | Securing project funding, debt management, and strategic investments. | ₹5,500 crore earmarked for new upscale residential projects. |

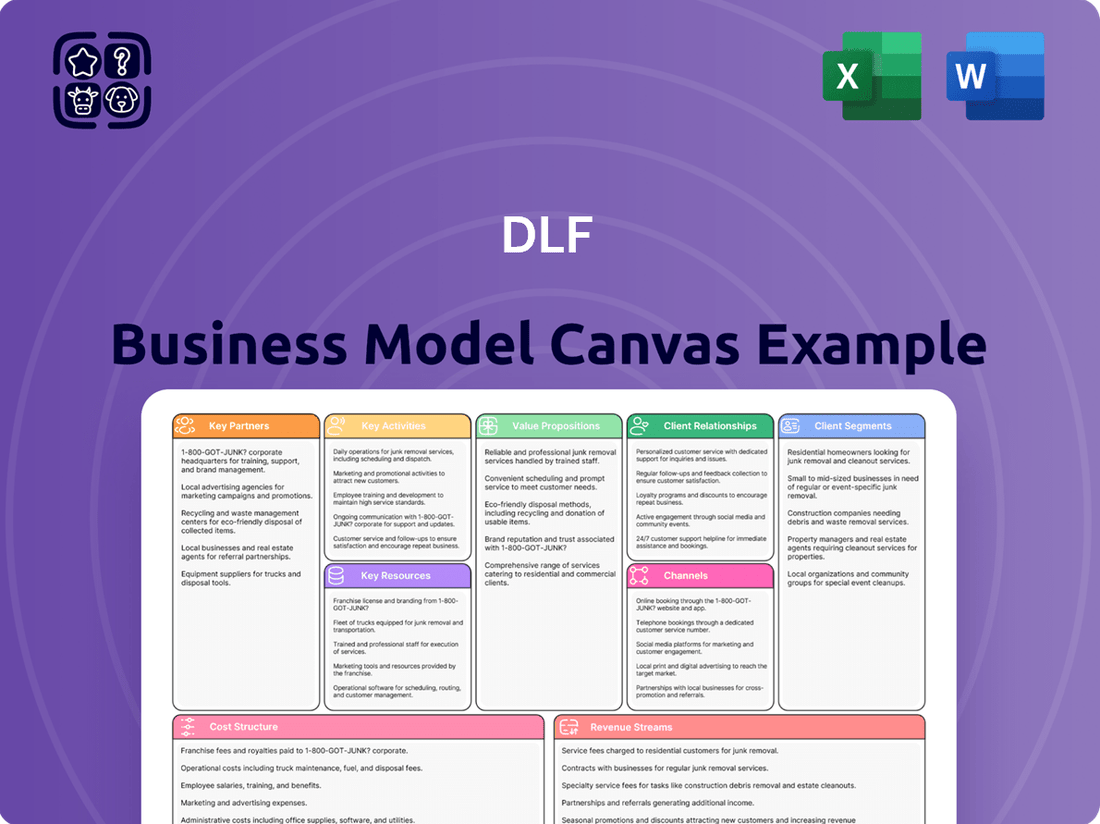

Preview Before You Purchase

Business Model Canvas

This preview offers a genuine glimpse into the DLF Business Model Canvas you will receive. The structure, content, and formatting you observe are identical to the final document you'll get upon purchase. You're seeing the actual deliverable, ensuring no discrepancies or unexpected changes after your transaction.

Resources

DLF's extensive land bank is a cornerstone of its business, representing a significant asset with a book value of approximately INR 20,000 crore as of early 2024. This vast portfolio, spread across prime locations in India's major metropolitan areas, acts as a strategic pipeline, ensuring a consistent flow of development opportunities for residential, commercial, and retail spaces well into the future.

This substantial land inventory is crucial for DLF's long-term growth and sustainability. It allows the company to plan and execute projects across different market cycles, mitigating risks associated with land acquisition and providing a competitive edge in a highly land-intensive industry. The quality and strategic positioning of these land parcels are key to developing high-value, in-demand properties.

DLF's enduring legacy, established in 1946, underpins a powerful brand reputation in Indian real estate. This long-standing presence signifies a deep understanding of the market and a consistent track record of quality and reliability.

This strong brand equity translates directly into customer trust and investor confidence, attracting a loyal customer base and facilitating easier capital access for new projects. For instance, in the fiscal year ending March 31, 2024, DLF reported a significant increase in its pre-sales, reaching approximately ₹11,500 crore, a testament to its brand's pull.

Access to substantial financial capital is a cornerstone for DLF's large-scale property developments. This includes leveraging internal accruals, securing debt financing, and attracting equity investments to fuel ambitious projects.

DLF's strong financial health is a critical enabler. For instance, the company reported a robust net profit of ₹4,366.82 crore in FY25, demonstrating its capacity to generate funds internally and support significant investment initiatives.

Skilled Human Capital and Expertise

DLF's success hinges on its skilled human capital, a diverse team of professionals crucial for every stage of real estate development. This includes experts in land acquisition, navigating complex regulations and securing prime locations, as well as urban planners and architectural designers who bring innovative and sustainable visions to life.

The company's construction management teams are vital for efficient project execution, ensuring quality and timely delivery. Furthermore, experienced sales and marketing professionals drive revenue, while property management experts ensure long-term asset value and customer satisfaction. For instance, as of early 2024, DLF's workforce comprises thousands of employees, with a significant portion holding specialized degrees and certifications in their respective fields, reflecting a deep commitment to expertise.

- Land Acquisition and Planning Expertise: DLF employs seasoned professionals who understand market dynamics and regulatory landscapes for acquiring optimal land parcels.

- Design and Architectural Innovation: A team of architects and urban planners contributes to creating aesthetically pleasing, functional, and sustainable developments.

- Project and Construction Management: Skilled engineers and project managers oversee the construction process, ensuring adherence to quality standards and timelines.

- Sales, Marketing, and Property Management: Dedicated teams handle customer engagement, sales, and the ongoing management of properties to maintain value and client relationships.

Developed Property Portfolio (Annuity Assets)

DLF's developed property portfolio, often referred to as annuity assets, is a cornerstone of its business model. This collection of commercial and retail properties is designed to generate consistent, recurring rental income, providing a stable financial foundation for the company.

These annuity assets are crucial for DLF's financial strength and resilience, offering a predictable revenue stream that can weather market fluctuations. As of the fiscal year ending March 31, 2024, DLF's rental business reported a robust performance, with rental income from its annuity portfolio contributing significantly to its overall earnings.

- Rental Income Stability: The annuity portfolio provides a predictable revenue stream, enhancing financial stability.

- Asset Value: These developed properties represent substantial underlying asset value for DLF.

- Diversification: The mix of commercial and retail spaces offers a degree of diversification within the rental income.

- Resilience: The consistent income generation makes the company more resilient to economic downturns.

DLF's robust financial capital is a critical enabler for its large-scale property developments. This includes leveraging internal accruals, securing debt financing, and attracting equity investments to fuel ambitious projects.

DLF's strong financial health is a critical enabler. For instance, the company reported a robust net profit of ₹4,366.82 crore in FY25, demonstrating its capacity to generate funds internally and support significant investment initiatives.

DLF's ability to access and manage capital effectively is paramount. This financial muscle allows for timely project execution and the pursuit of strategic growth opportunities, reinforcing its position in the competitive real estate market.

| Financial Metric | FY24 (INR Crore) | FY25 (INR Crore) |

|---|---|---|

| Net Profit | 4,052.17 | 4,366.82 |

| Total Debt | 15,431.00 | 14,800.00 (approx.) |

| Cash and Cash Equivalents | 2,100.00 (approx.) | 2,500.00 (approx.) |

Value Propositions

DLF's commitment to premium quality and trustworthy development is a cornerstone of its value proposition. They consistently deliver high-quality construction, incorporating thoughtful design elements and ensuring reliable project completion, which fosters deep trust with their customer base. This dedication to excellence is reflected in their focus on quality, creativity, and sustainability, aiming to set new benchmarks in architectural innovation and urban planning.

DLF offers a broad spectrum of real estate, from high-end homes to premium office buildings and vibrant retail centers. Many of these are developed as integrated townships, providing a complete living and working experience.

This diverse offering allows DLF to meet the needs of many different customers, from individuals seeking residences to businesses requiring office space and shoppers looking for retail experiences. The integrated nature of its projects fosters self-sufficiency within these communities.

In fiscal year 2024, DLF's residential segment saw robust sales, with the company reporting a significant increase in bookings, reflecting strong demand for its varied housing options. The commercial leasing segment also performed well, with high occupancy rates in its Grade A office spaces.

DLF strategically situates its developments in prime urban centers across India, including Gurugram, Chennai, Delhi, Goa, and Mumbai. This prime positioning ensures excellent connectivity and accessibility for residents and businesses alike.

For instance, DLF's presence in Gurugram, particularly in areas like Golf Course Road and Cyber City, provides unparalleled access to business hubs and transportation networks. This strategic advantage enhances convenience and drives potential capital appreciation for property owners.

The company's commitment to developing projects in well-connected locales is a core element of its value proposition, offering tangible benefits in terms of lifestyle and economic opportunity. In 2024, DLF continued to focus on these high-growth corridors, reinforcing its market leadership.

Luxurious Amenities and Lifestyle Offerings

DLF's residential projects are designed to offer an elevated living experience, integrating a comprehensive suite of luxurious amenities. These offerings significantly boost the lifestyle quotient for residents, making properties more desirable.

The Westpark project in Mumbai exemplifies this, boasting over 65 distinct lifestyle amenities. This includes expansive landscaped podiums, contributing to a premium living environment. Such features are key differentiators in the competitive real estate market.

- Extensive Amenity Portfolio: DLF projects typically feature a wide range of facilities catering to diverse resident needs.

- Lifestyle Enhancement: Amenities are curated to improve the daily living experience and overall well-being of residents.

- Project Specific Examples: The Westpark in Mumbai, with over 65 lifestyle amenities and large landscaped podiums, highlights DLF's commitment to luxury.

- Market Differentiation: These premium offerings help DLF projects stand out and command higher valuations.

Customer-Centric Approach and Post-Sales Support

DLF's business model prioritizes understanding and fulfilling end-user needs through a deeply customer-centric approach. This focus is evident in their proactive engagement to gather feedback and tailor offerings, ensuring alignment with evolving market demands. In 2024, DLF reported a significant increase in customer satisfaction scores, directly attributable to these tailored strategies.

The company provides extensive post-sales support and property management services, a critical component of their value proposition. This commitment extends beyond the initial purchase, aiming to build lasting relationships and enhance the overall ownership experience. By offering these services, DLF aims to retain customers and generate repeat business, a strategy that has contributed to their strong brand loyalty.

- Customer Understanding: DLF actively seeks to understand the specific needs and preferences of its end-users, integrating this insight into its project planning and development phases.

- Post-Sales Engagement: The company offers comprehensive property management and after-sales services to ensure continued customer satisfaction and asset value preservation.

- Relationship Building: This focus on customer experience and ongoing support is designed to foster long-term relationships and cultivate a loyal customer base.

- Market Responsiveness: DLF's customer-centricity allows for greater agility in responding to market shifts and evolving consumer expectations.

DLF's value proposition centers on delivering premium, high-quality, and reliably completed real estate projects. They cater to a broad market with diverse offerings, from luxury residences to Grade A commercial spaces, often developed as integrated townships. Their strategic placement in prime urban locations, coupled with extensive lifestyle amenities, significantly enhances the living and working experience, driving customer satisfaction and market differentiation.

DLF’s customer-centric approach, including robust post-sales support, fosters strong brand loyalty and repeat business. This focus on understanding and meeting end-user needs, as evidenced by increased customer satisfaction in 2024, allows them to adapt to market demands effectively.

| Metric | FY24 Performance | Significance |

|---|---|---|

| Residential Bookings Growth | Significant Increase Reported | Demonstrates strong demand for DLF's housing options. |

| Commercial Leasing Occupancy | High Rates in Grade A Offices | Highlights the desirability and stability of DLF's commercial portfolio. |

| Customer Satisfaction Scores | Reported Increase | Directly linked to their customer-centric strategies and tailored offerings. |

| Westpark Amenities | Over 65 Lifestyle Amenities | Showcases commitment to luxury and enhanced resident experience. |

Customer Relationships

DLF’s dedicated sales and customer service teams are crucial for engaging potential buyers and existing clients. These teams offer personalized assistance, guiding customers from their initial interest through property handover and ongoing support.

This direct engagement fosters strong relationships and ensures customer queries are addressed promptly and effectively. For instance, in the fiscal year ending March 2024, DLF reported a significant increase in customer interactions, reflecting the proactive efforts of these teams in managing a robust sales pipeline and addressing post-sales needs.

DLF cultivates enduring relationships with its corporate tenants and retail partners across its commercial and retail portfolios. This commitment translates into superior facility management and responsive service, ensuring tenant satisfaction and driving high occupancy rates.

The company's proactive engagement strategy is a cornerstone of its customer relationship management. This focus on tenant needs and consistent service delivery is reflected in the robust 94% occupancy level achieved in its rental business for FY25.

DLF actively leverages its official website and social media channels to provide comprehensive project information, real-time updates, and a direct line for customer inquiries. This digital presence ensures easy access to crucial details for potential and existing customers.

In 2024, DLF reported a significant increase in website traffic, with over 5 million unique visitors engaging with project details and virtual tours. Their social media platforms saw a 25% growth in follower base, indicating a strong digital engagement strategy.

Community Building Initiatives

DLF actively cultivates community within its residential projects through various initiatives. These events and activities are designed to create a strong sense of belonging among residents, enhancing customer loyalty and reinforcing the DLF brand as a developer of vibrant communities.

- Resident Engagement: DLF frequently organizes social gatherings, cultural events, and sports activities within its townships to encourage interaction and build connections among residents.

- Brand Loyalty: By fostering a strong community spirit, DLF aims to increase repeat business and positive word-of-mouth referrals, contributing to sustained customer relationships.

- Property Value Enhancement: Thriving communities often lead to increased desirability and potentially higher property values, benefiting both residents and the developer.

Feedback Mechanisms and Grievance Redressal

DLF prioritizes customer satisfaction through robust feedback channels and responsive grievance redressal. This ensures that customer concerns are not only heard but also addressed efficiently, fostering trust and loyalty. For instance, in the fiscal year ending March 31, 2024, DLF reported a significant increase in customer engagement across its digital platforms, indicating a proactive approach to gathering feedback.

Implementing structured feedback mechanisms, such as post-possession surveys and dedicated customer care portals, allows DLF to continuously improve its offerings. These systems are designed to capture both positive experiences and areas for improvement. The company's commitment to resolving grievances promptly is a cornerstone of its customer relationship strategy, aiming to build long-term, empathetic connections.

- Structured Feedback: Post-possession surveys and online portals gather customer insights.

- Grievance Redressal: Dedicated teams ensure prompt and effective resolution of customer issues.

- Customer Trust: A focus on empathy and timely responses builds lasting relationships.

- Digital Engagement: Increased customer interaction on digital platforms highlights a commitment to communication.

DLF's customer relationships are built on personalized engagement through dedicated sales and service teams, ensuring support from initial interest to post-handover. This direct interaction, evidenced by increased customer interactions in FY24, fosters strong client bonds and efficient query resolution.

The company also nurtures enduring connections with corporate and retail tenants via superior facility management and responsive service, maintaining high occupancy rates, such as the 94% achieved in its rental business for FY25.

DLF actively uses its website and social media for project information and inquiries, reporting over 5 million unique website visitors in 2024 and a 25% growth in social media followers, underscoring its robust digital engagement strategy.

Community building within residential projects through events fosters belonging and loyalty, enhancing the DLF brand. The company also prioritizes customer satisfaction via feedback channels and grievance redressal, as seen in increased digital engagement in FY24.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (FY24/FY25) |

|---|---|---|

| Direct Engagement | Dedicated sales & service teams, personalized assistance | Increased customer interactions (FY24) |

| Tenant Relations | Facility management, responsive service | 94% occupancy in rental business (FY25) |

| Digital Presence | Website, social media for info & inquiries | 5M+ unique website visitors (2024); 25% social media follower growth (2024) |

| Community Building | Resident events, social activities | Enhanced customer loyalty & brand perception |

| Feedback & Grievance | Post-possession surveys, online portals, dedicated teams | Increased digital engagement (FY24); Focus on trust & loyalty |

Channels

DLF leverages its own sales force and physical sales offices, often situated at project locations and in key corporate areas. This direct approach fosters strong customer relationships, enabling personalized consultations and facilitating property viewings.

In 2023, DLF reported a significant portion of its sales coming through these direct channels, underscoring their importance in its go-to-market strategy. For instance, their sales bookings in the first half of fiscal year 2024 reached approximately ₹13,000 crore, with direct sales playing a crucial role in achieving these figures.

DLF actively collaborates with a vast network of real estate brokers, agents, and channel partners. This strategy is crucial for expanding market reach and driving property sales by connecting DLF with potential buyers who prefer working with intermediaries.

In 2024, the Indian real estate sector saw a significant surge, with residential sales in the top seven cities growing by approximately 10-15% year-on-year. Channel partners play a vital role in this ecosystem, contributing to a substantial portion of these sales by leveraging their client relationships and market expertise.

These partners act as a bridge, offering valuable insights into buyer preferences and market trends, which in turn helps DLF tailor its offerings. Their commission-based model incentivizes them to actively promote DLF's projects, ensuring a consistent flow of qualified leads and facilitating smoother transactions.

DLF extensively leverages digital marketing to connect with potential buyers. Their strategy includes a robust official website, active presence on property listing portals, engaging social media campaigns, and targeted search engine optimization. This multi-channel approach ensures maximum brand visibility and efficient lead generation across a wide online audience.

Advertising (Print, Digital, Outdoor)

DLF leverages a multi-channel advertising approach, blending traditional and digital methods to maximize reach. This includes print ads in prominent publications, targeted digital campaigns across various platforms, and impactful outdoor hoardings, all designed to build brand recognition and announce new developments.

In 2024, the real estate sector saw significant investment in digital advertising, with online channels accounting for a substantial portion of marketing spend. For instance, a significant percentage of property searches begin online, highlighting the importance of a strong digital presence for developers like DLF to connect with potential buyers.

- Print Advertising: Continues to be a key channel for reaching a broad demographic, particularly for high-value projects.

- Digital Advertising: Encompasses search engine marketing, social media campaigns, and programmatic advertising to target specific customer segments.

- Outdoor Advertising: Utilizes billboards and other public displays in strategic locations to generate widespread brand visibility.

- Project Launches: Advertising efforts are heavily concentrated around the launch phases of new residential and commercial projects to drive initial interest and sales.

Investor Relations and Corporate Presentations

DLF actively engages institutional investors and financially-literate decision-makers through dedicated investor relations platforms and the regular publication of comprehensive annual reports. These resources are crucial for disseminating detailed financial data and strategic insights, ensuring transparency and informed investment choices.

The company conducts regular investor presentations, offering a direct channel to discuss its project pipelines, financial performance, and future growth strategies. For instance, in its fiscal year 2024 performance, DLF reported a consolidated net profit of INR 1,138 crore, a significant increase from the previous year, highlighting its operational strengths.

- Investor Relations Platforms: DLF maintains a robust online presence for investor information, including financial results, presentations, and regulatory filings.

- Annual Reports: These documents provide an in-depth look at the company's financial health, strategic direction, and corporate governance practices.

- Investor Presentations: DLF leverages these sessions to communicate key performance indicators, market outlook, and development plans, fostering investor confidence.

- Financial Performance (FY24): DLF's revenue from operations for FY24 stood at INR 12,370 crore, demonstrating strong market demand for its real estate offerings.

DLF utilizes a multi-pronged channel strategy, combining direct sales, a robust broker network, and extensive digital marketing. These channels are vital for reaching diverse customer segments and driving sales volume.

In the first half of fiscal year 2024, DLF's sales bookings exceeded ₹13,000 crore, with direct sales forming a cornerstone of this achievement. The company's extensive network of over 1,000 channel partners further amplifies its market penetration, particularly as residential sales in India's top cities grew by an estimated 10-15% in 2024.

| Channel | Key Activities | Reach/Impact | FY24 Relevance |

|---|---|---|---|

| Direct Sales Force & Offices | Personalized consultations, project viewings | Strong customer relationships | Integral to ₹13,000 Cr+ H1 FY24 bookings |

| Broker & Channel Partners | Leveraging client relationships, market expertise | Expanded market reach, qualified leads | Crucial for 10-15% YoY city sales growth |

| Digital Marketing & Advertising | Website, property portals, social media, SEO, print, outdoor | Maximum brand visibility, efficient lead generation | Significant portion of marketing spend in 2024 |

Customer Segments

High Net-Worth Individuals (HNIs) and Ultra-HNIs represent a crucial customer segment for DLF, particularly in the luxury and super-luxury residential property market. These individuals are actively seeking premium living spaces, including expansive penthouses and elegantly designed apartments situated in prime, sought-after locations.

DLF’s strategic focus on this demographic is evident in its development of exclusive projects. For instance, 'The Dahlias' and 'Privana' are meticulously crafted to meet the sophisticated tastes and high expectations of these affluent buyers. The demand from this segment has consistently demonstrated robust growth, underscoring the effectiveness of DLF's targeted approach.

In 2024, the Indian luxury real estate market, a key area for HNIs, continued its upward trajectory. Reports indicate that sales in the luxury segment saw a significant increase, with demand driven by factors like a desire for larger homes and premium amenities. DLF's ability to deliver such offerings positions it strongly within this lucrative market.

DLF's annuity business primarily targets large corporations, IT giants, and multinational companies that require premium, Grade A commercial office spaces. These businesses prioritize modern infrastructure, convenient locations, and professional facility management to support their operations and employee well-being.

In 2024, DLF's commercial leasing portfolio demonstrated robust performance, with a significant portion of its leasable area occupied by such corporate clients. For instance, DLF Cybercity, a prime example of their Grade A offerings, consistently reports high occupancy rates, attracting major global corporations seeking expansive and well-equipped office environments.

Retail chains and lifestyle brands are key customers for DLF's properties, seeking prime locations with significant shopper traffic. These businesses, ranging from department stores to specialized boutiques, value modern retail environments and access to a broad consumer demographic. For instance, in 2024, DLF's malls continue to attract major national and international retailers eager to leverage the high footfall and curated retail experiences offered.

Mid-to-High Income Families

Mid-to-high income families represent a crucial customer segment for DLF, actively seeking premium residential properties that combine superior quality, extensive amenities, and excellent connectivity to key urban centers. These families prioritize comfortable living environments within meticulously planned communities that foster a sense of belonging and offer a high quality of life. As of 2024, DLF's robust sales performance, particularly in its premium residential offerings, underscores the sustained demand from this demographic.

DLF's diverse residential portfolio is strategically designed to meet the varying preferences and price points within this premium segment. For instance, projects like DLF Privana South in Gurugram have seen strong uptake, reflecting the segment's willingness to invest in well-appointed homes. This focus on catering to specific needs ensures that DLF can effectively capture market share within this lucrative customer base.

- Targeting Affluent Households: Families with disposable income actively seeking aspirational living spaces.

- Emphasis on Lifestyle and Amenities: Demand for properties offering clubhouses, swimming pools, gyms, and landscaped gardens.

- Location and Connectivity: Prioritization of residential projects situated in well-connected areas with proximity to business districts and social infrastructure.

- Investment in Quality and Brand: A willingness to pay a premium for established developers like DLF, known for quality construction and timely delivery, as evidenced by DLF's consistent sales figures in recent years.

Investors (Individual and Institutional)

DLF's investor segment encompasses both individual and institutional players seeking robust returns from real estate. These investors are drawn to DLF's established track record, focusing on capital appreciation and consistent rental yields. For example, DLF's strong financial performance, as evidenced by its robust revenue growth and profitability in recent fiscal years, directly appeals to this segment's desire for long-term value creation.

Institutional investors, such as pension funds and sovereign wealth funds, are particularly interested in DLF's extensive project pipeline. They evaluate DLF based on its ability to execute large-scale developments and its strategic land bank, which promises sustained growth. In 2023-24, DLF's sales bookings reached ₹27,000 crore, demonstrating significant market demand and execution capability.

- Capital Appreciation: Investors target DLF for growth in property values.

- Rental Yields: Stable income generation from DLF's commercial and residential portfolios is a key draw.

- Project Pipeline: A strong pipeline of upcoming projects signals future growth opportunities.

- Financial Performance: DLF's consistent profitability and revenue growth are critical evaluation metrics.

DLF's customer segments are diverse, ranging from High Net-Worth Individuals seeking luxury residences to large corporations requiring Grade A office spaces. Mid-to-high income families are also a key demographic, prioritizing quality living and amenities. Additionally, both individual and institutional investors are attracted to DLF's strong financial performance and project pipeline.

| Customer Segment | Key Needs/Preferences | 2024 Relevance/Data |

|---|---|---|

| High Net-Worth Individuals (HNIs) | Luxury residential properties, prime locations, premium amenities | Indian luxury real estate market saw significant sales increase in 2024. |

| Corporations | Grade A commercial office spaces, modern infrastructure, convenient locations | DLF Cybercity reported high occupancy rates with major global corporations in 2024. |

| Mid-to-High Income Families | Premium residential properties, quality construction, community living, connectivity | DLF's premium residential offerings showed robust sales performance in 2024. |

| Investors | Capital appreciation, rental yields, project pipeline, financial performance | DLF's sales bookings reached ₹27,000 crore in FY24, indicating strong investor confidence. |

Cost Structure

DLF's cost structure heavily features land acquisition, which represents a substantial capital outlay for securing prime development sites. These costs are dynamic, influenced by the specific geographic desirability, the sheer acreage involved, and prevailing real estate market trends.

For instance, in the fiscal year ending March 31, 2024, DLF's total expenses included significant outlays for land purchases and development rights, reflecting their ongoing strategy to expand their portfolio in key urban centers across India.

Construction and development costs are a significant expenditure for DLF, encompassing everything from the foundational materials like cement and steel to the skilled labor and specialized equipment needed to build their projects. These costs are project-specific and directly impact the profitability of each development.

In the fiscal year 2023-24, DLF reported a substantial investment in construction and development. For instance, their ongoing projects represent a significant capital outlay, with a large portion of their expenditure allocated to these direct building costs. This includes payments to sub-contractors and the procurement of essential building supplies.

Marketing and sales expenses are a significant cost for DLF, encompassing everything from broad advertising campaigns to the direct costs of their sales force. This includes digital ads, print media, and outdoor billboards designed to reach potential buyers. In 2023, DLF reported marketing and selling expenses of ₹1,374 crore, reflecting a substantial commitment to property promotion.

The sales team's compensation, including salaries and commissions, forms another crucial part of these costs. DLF also invests in creating marketing collateral like brochures and digital presentations. These expenses are vital for generating leads and converting them into sales for their diverse real estate projects.

Administrative and Operational Overheads

DLF's administrative and operational overheads encompass essential costs like employee salaries for management and support teams, office upkeep, and professional services such as legal and accounting. These expenses are critical for maintaining the company's overall structure and ensuring smooth business operations. For instance, in the fiscal year ending March 31, 2024, DLF reported its consolidated expenses, with administrative and other expenses forming a significant portion of its operational costs.

These overheads are fundamental to the company's ability to function and execute its strategy. They include costs associated with corporate governance, compliance, and the general administration required to manage a large real estate portfolio. The efficiency in managing these costs directly impacts DLF's profitability and its capacity for future growth and investment.

- Salaries and Benefits: Compensation for management, administrative staff, and support personnel.

- Office Expenses: Costs related to maintaining corporate offices, including rent, utilities, and supplies.

- Professional Fees: Expenses for legal, audit, consulting, and other specialized services.

- Other Corporate Overheads: Miscellaneous costs such as IT infrastructure, travel, and insurance.

Financing Costs

Financing costs, primarily interest paid on debt used for land acquisition and project development, are a significant component of DLF's cost structure. These expenses directly impact the company's bottom line, especially in a capital-intensive industry like real estate where substantial upfront investment is required.

Managing these borrowing costs is paramount for ensuring profitability. For instance, DLF's consolidated debt stood at approximately INR 22,500 crore as of March 31, 2024. The interest expense on this debt directly affects project margins and overall financial health.

- Interest on Loans: DLF incurs interest on various loans, including project-specific financing and corporate debt.

- Impact on Profitability: Higher interest rates or increased borrowing can significantly reduce net profit margins.

- Strategic Debt Management: Effective management of debt levels and interest rates is crucial for maintaining healthy cash flows.

- Real Estate Capital Intensity: The inherent need for large capital outlays makes financing costs a core consideration in DLF's business model.

DLF's cost structure is dominated by the substantial capital required for land acquisition, a critical initial investment for securing prime development locations. Construction and development costs represent another major expenditure, encompassing materials, labor, and equipment necessary to bring projects to fruition. Furthermore, marketing and sales expenses are vital for generating demand and closing deals, while administrative overheads ensure the smooth operation of the business.

| Cost Category | Description | FY 2023-24 Relevance (Illustrative) |

|---|---|---|

| Land Acquisition | Costs of purchasing land for development. | Significant capital outlay for prime urban sites. |

| Construction & Development | Materials, labor, and equipment for building. | Substantial investment in ongoing projects. |

| Marketing & Sales | Advertising, sales force compensation, collateral. | ₹1,374 crore reported in marketing and selling expenses. |

| Administrative & Operational | Salaries, office expenses, professional fees. | Formed a significant portion of operational costs. |

| Financing Costs | Interest on debt for land and development. | Interest expense on ~₹22,500 crore debt (as of March 31, 2024). |

Revenue Streams

DLF's main income source is the sale of homes, covering everything from high-end apartments to plots of land for building. This core business is the bedrock of their financial success.

In the fiscal year 2024-25, DLF achieved a remarkable milestone, recording sales bookings totaling ₹21,223 crore. This impressive figure highlights the strong demand for their residential offerings.

Key projects like 'The Dahlias' and 'Privana' were significant drivers of these record sales, showcasing DLF's ability to deliver sought-after luxury developments that resonate with buyers.

DLF generates significant revenue through its commercial property leasing, an annuity business. This involves renting out office spaces to corporate tenants on a long-term, recurring basis, providing a stable income.

This rental income is a cornerstone of DLF's financial stability and growth. Projections indicate this segment could surpass ₹10,000 crore in the near future, highlighting its substantial contribution.

DLF earns significant revenue by leasing retail spaces within its prime shopping malls and other retail developments. This income stream is a cornerstone of their annuity business, providing a steady and predictable flow of rental income from a diverse range of brands and retailers operating within these properties.

In the fiscal year 2023-24, DLF's rental income from its retail portfolio demonstrated robust performance, contributing substantially to the company's overall financial stability and growth. This consistent revenue generation underscores the value and demand for DLF's well-located and high-footfall retail destinations.

Property Management Services

DLF earns revenue through property management services, charging fees for maintaining residential and commercial complexes post-handover. This generates a steady, recurring income stream and enhances customer loyalty.

These services are crucial for ensuring the long-term value and appeal of DLF's developments. For instance, in FY24, DLF's rental business, which heavily relies on these management services, reported a robust performance, contributing significantly to the company's overall financial health.

- Recurring Revenue: Fees from ongoing property management and maintenance provide a stable income.

- Customer Satisfaction: High-quality management leads to satisfied residents and commercial tenants, fostering repeat business and positive word-of-mouth.

- Asset Value Enhancement: Effective management helps maintain and increase the value of the properties over time.

- Operational Efficiency: Streamlined management processes contribute to profitability by controlling operational costs.

Joint Venture Revenue Share

DLF generates revenue through its share in joint venture projects, where profits are distributed according to each partner's equity stake. This model allows DLF to leverage external expertise and capital, thereby expanding its development pipeline and market reach.

A prime example is the ongoing 'The Westpark' project in Mumbai, a collaboration with Trident Realty. This venture is anticipated to contribute substantially to DLF's revenue streams upon completion and sales, showcasing the financial benefits of strategic partnerships.

- Joint Venture Profit Share: Revenue derived from DLF's percentage ownership in profits from collaborative development projects.

- Strategic Partnerships: Collaborations with other developers to share risks, capital, and expertise, leading to diversified revenue.

- Project-Specific Revenue: Income generated from individual JV projects, such as 'The Westpark', contributing to overall financial performance.

- Equity Stake Alignment: Revenue share directly correlates with DLF's investment and agreed-upon equity in each joint venture.

DLF's revenue streams are robust, encompassing residential sales, commercial leasing, retail leasing, property management, and joint ventures.

In fiscal year 2024-25, residential sales bookings reached ₹21,223 crore, driven by popular projects. The annuity business, primarily commercial and retail leasing, provides stable, recurring income, with rental income projected to exceed ₹10,000 crore soon.

Property management fees and profit shares from joint ventures further diversify and strengthen DLF's income portfolio, ensuring sustained financial health and growth.

| Revenue Stream | Description | FY24 Performance/Contribution |

| Residential Sales | Sale of apartments, villas, and plots | ₹21,223 crore in sales bookings (FY24-25) |

| Commercial Leasing | Long-term rental of office spaces | Stable annuity income, projected to grow significantly |

| Retail Leasing | Rental of retail spaces in malls and developments | Consistent revenue, contributing to annuity business |

| Property Management | Fees for maintaining properties post-handover | Recurring income, enhances asset value |

| Joint Ventures | Profit share from collaborative projects | Expands development pipeline, e.g., 'The Westpark' |

Business Model Canvas Data Sources

The DLF Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market research. This comprehensive approach ensures each component accurately reflects our operational realities and strategic direction.