DLF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

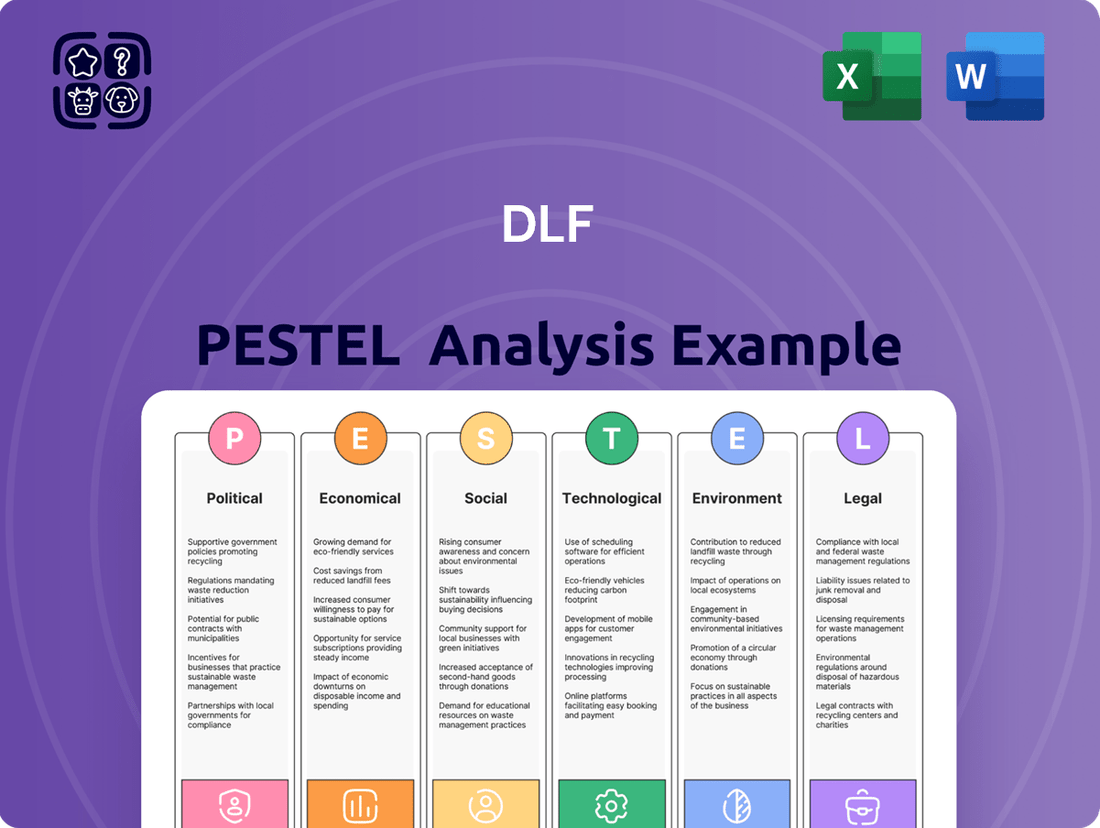

Unlock the critical external factors shaping DLF's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are impacting the company's operations and future growth. Don't just react to change; anticipate it. Purchase the full PESTLE analysis now for actionable intelligence and a strategic advantage.

Political factors

Government policy stability is a critical factor for DLF, especially concerning urban development and housing regulations. Consistent policies in areas like land acquisition, zoning, and environmental clearances allow DLF to plan and invest with greater confidence. For instance, the Indian government's focus on affordable housing through initiatives like PMAY, which saw significant budgetary allocations in the 2023-24 fiscal year, provides a stable framework for developers. However, abrupt changes in these policies, such as unexpected shifts in taxation or development norms, can introduce considerable risk and impact the financial viability of ongoing and future projects.

The regulatory environment for real estate development in India, impacting companies like DLF, is characterized by evolving policies and compliance requirements. Approvals for land acquisition, construction permits, and environmental clearances are critical, with delays often stemming from bureaucratic processes. For instance, in 2023, the average time for obtaining key construction permits across major Indian cities remained a significant concern for developers.

Streamlined regulatory frameworks, such as those promoted by the RERA (Real Estate Regulation and Development) Act, aim to enhance transparency and efficiency, potentially reducing project timelines and associated costs. However, the consistent implementation and interpretation of these regulations across different states can still present challenges, impacting DLF's project execution and financial planning.

Government investment in infrastructure projects, such as the National Infrastructure Pipeline which aims for ₹111 lakh crore (approximately $1.3 trillion) of investment by 2025, directly influences the value and accessibility of DLF's real estate developments. These projects, including highways, metros, and smart city initiatives, can significantly boost connectivity and desirability for DLF's residential and commercial properties.

The proximity of DLF's land banks and ongoing projects to planned or under-construction infrastructure can enhance property demand and pricing power. For instance, improved metro connectivity in Delhi-NCR has historically driven up property values in adjacent areas where DLF has significant holdings, informing their land acquisition and development strategies.

Political Stability and Elections

India's political stability is a crucial factor for the real estate market, directly impacting investor confidence. The outcomes of national and state elections, such as the upcoming general elections in 2024, can introduce uncertainty or provide clarity, influencing investment decisions in sectors like DLF. A predictable political landscape generally translates to a more favorable business environment, which is essential for long-term real estate development and growth.

The government's policy decisions and regulatory framework significantly shape the real estate sector. For instance, policies related to foreign direct investment (FDI) in real estate, infrastructure development initiatives, and urban planning reforms directly affect companies like DLF. The government's commitment to ease of doing business and its approach to land acquisition and development can either stimulate or hinder market activity. In 2023, the government continued its focus on affordable housing and urban infrastructure, aiming to boost demand and improve supply chain efficiencies.

- Political Stability: India has maintained a generally stable political environment, though regional variations and election cycles can introduce short-term volatility.

- Electoral Impact: National elections, like the anticipated 2024 polls, can influence investor sentiment due to potential shifts in economic policies and regulatory approaches.

- Government Policies: Pro-growth policies and regulatory reforms aimed at boosting the real estate sector, such as those promoting smart cities and infrastructure development, are key drivers.

- Regulatory Environment: The effectiveness of regulatory bodies like RERA (Real Estate Regulatory Authority) in ensuring transparency and accountability plays a vital role in building trust and attracting investment.

Foreign Direct Investment (FDI) Policies

Government policies on foreign direct investment in real estate significantly influence the capital available for DLF's large-scale projects and joint ventures. Favorable FDI policies can unlock international funding and expertise, directly supporting DLF's expansion strategies.

For instance, India's FDI policy, as of early 2024, allows 100% foreign investment in the real estate development sector through the automatic route for projects like townships, housing, built-up infrastructure, and built-up real estate. This has historically been a key enabler for developers like DLF.

- Access to Capital: Favorable FDI policies allow DLF to tap into global capital markets, crucial for funding large, capital-intensive real estate developments.

- Technology and Expertise Transfer: International investors often bring advanced construction techniques, project management skills, and market insights, benefiting DLF's operational efficiency.

- Regulatory Environment: Changes in FDI regulations, such as relaxation or tightening of rules regarding foreign ownership or repatriation of profits, directly impact DLF's strategic planning and investment decisions.

- Economic Growth Impact: Policies that encourage FDI in real estate are often linked to broader economic growth objectives, which can positively correlate with increased demand for DLF's properties.

Government policies on urban development and housing significantly shape DLF's operational landscape. For example, the Indian government's continued emphasis on affordable housing, evidenced by substantial budgetary allocations in the 2023-24 fiscal year, provides a foundational framework for developers. Conversely, sudden policy shifts in taxation or development norms can introduce substantial risk, impacting the financial viability of DLF's projects.

The regulatory environment, including land acquisition and construction permits, remains a critical consideration. While initiatives like the RERA Act aim to boost transparency, the inconsistent application of regulations across states can still pose execution challenges for DLF. In 2023, the average time for obtaining key construction permits across major Indian cities continued to be a concern for developers.

Government investment in infrastructure, such as the National Infrastructure Pipeline targeting ₹111 lakh crore by 2025, directly enhances the value and accessibility of DLF's real estate offerings. Improved connectivity through projects like metro expansions in Delhi-NCR has historically driven up property values in areas where DLF holds significant land banks.

Political stability is paramount for investor confidence in the real estate sector. Upcoming national elections in 2024, for instance, can influence market sentiment due to potential policy changes. A predictable political climate generally fosters a more favorable environment for long-term real estate development, benefiting companies like DLF.

What is included in the product

This DLF PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The DLF PESTLE Analysis offers a structured framework to identify and understand external factors, alleviating the pain of navigating market uncertainties and enabling more informed strategic decisions.

Economic factors

India's economic trajectory is a significant driver for DLF. The country's GDP growth directly influences consumer spending power and their ability to invest in property. For instance, India's GDP is projected to grow by a robust 6.5% in FY2025, according to the Reserve Bank of India, indicating a healthy economic environment that typically translates to increased demand for real estate.

A strong GDP growth rate fuels demand across DLF's residential and commercial segments. Higher disposable incomes mean more people can afford to buy homes, while expanding businesses require more office and retail space. This positive correlation supports DLF's strategy of developing and managing a diverse range of properties.

Fluctuations in interest rates, particularly those set by the Reserve Bank of India (RBI), directly impact DLF's business. For instance, a 25 basis point hike in the repo rate, a key policy rate, can increase borrowing costs for developers and make home loans more expensive for potential buyers.

In early 2024, the RBI maintained its repo rate at 6.50%, a stance that has generally supported housing demand by keeping borrowing costs relatively stable. However, any future upward revisions could lead to a slowdown in sales volumes for DLF as affordability decreases.

Lending policies also play a crucial role. Stricter lending norms from banks, perhaps requiring higher down payments or more stringent credit checks, can reduce the pool of eligible homebuyers, thereby affecting DLF's project sales and revenue streams.

Inflationary pressures are significantly impacting the Indian real estate sector, with raw material costs like steel and cement seeing substantial increases. For DLF, this translates directly into higher construction expenses, potentially squeezing project profitability. For instance, cement prices saw an average increase of around 6-8% in early 2024 compared to the previous year, while steel prices have also remained volatile, impacting overall project budgets.

Managing these escalating input costs is paramount for DLF to maintain healthy profit margins and offer competitive pricing in a dynamic market. The ability to forecast and mitigate these cost fluctuations through strategic procurement and efficient project management will be a key determinant of their financial performance throughout 2024 and into 2025.

Disposable Income and Consumer Spending

Disposable income is a key driver for DLF's residential and retail segments. As household incomes rise, consumers have more discretionary funds available to purchase homes or spend in retail environments. For instance, India's nominal GDP per capita saw a significant increase, reaching an estimated USD 2,847.5 in FY24, up from USD 2,601.1 in FY23, indicating a general uplift in earning potential which directly impacts real estate affordability.

Higher disposable income levels directly translate into greater purchasing power for residential properties. This increased affordability not only boosts demand for DLF's housing projects but also signals a greater willingness among consumers to invest in real estate as a long-term asset. The Reserve Bank of India's Consumer Confidence Survey for March 2024 indicated a continued positive sentiment regarding current conditions and future expectations, suggesting a favorable environment for property purchases.

The growth in income levels also fuels demand for retail spaces, as consumers with more disposable income tend to spend more on goods and services. DLF's retail malls benefit directly from this trend, experiencing higher footfalls and increased sales. With India's retail sector projected to grow robustly, driven by urbanization and rising consumerism, DLF is well-positioned to capitalize on this expansion.

- Rising Disposable Income: India's nominal GDP per capita estimated at USD 2,847.5 in FY24 signifies increased earning potential.

- Enhanced Affordability: Higher incomes boost purchasing power for residential properties, benefiting DLF's housing sales.

- Retail Sector Growth: Increased consumer spending due to higher disposable income drives demand for DLF's retail spaces.

- Positive Consumer Sentiment: RBI's March 2024 survey shows optimism, supporting property investment and retail spending.

Foreign Investment and Capital Flows

The influx of foreign investment, particularly from private equity and institutional funds, is a critical driver for India's real estate sector, directly benefiting developers like DLF. These capital flows provide the necessary funding for large-scale projects and expansion. For instance, in the fiscal year 2023-24, India's real estate sector attracted approximately $5.5 billion in foreign direct investment, a significant portion of which is channeled into residential and commercial projects.

Global economic conditions and overall investor confidence in emerging markets like India play a pivotal role in determining the volume and stability of these capital inflows. A robust global economy and positive sentiment towards India's growth prospects in 2024 and early 2025 would likely translate into increased foreign investment, offering DLF greater access to capital for its development pipeline.

- Foreign Investment Influx: In FY24, India's real estate attracted an estimated $5.5 billion in FDI, bolstering capital availability for developers.

- Investor Confidence Impact: Global economic health and positive sentiment towards India directly influence the volume and cost of foreign capital for DLF.

- Sectoral Focus: A significant portion of this FDI is directed towards residential and commercial real estate segments where DLF operates.

- Capital for Growth: Increased foreign investment provides DLF with the financial muscle to undertake new projects and expand its market presence.

India's economic growth is a primary catalyst for DLF's expansion. The nation's GDP is anticipated to expand by 6.5% in FY2025, according to the Reserve Bank of India, fostering an environment conducive to real estate demand. This growth directly correlates with increased consumer spending and investment capacity, benefiting both DLF's residential and commercial ventures.

Interest rate fluctuations, particularly RBI's repo rate, significantly influence DLF's borrowing costs and buyer affordability. The RBI's decision to maintain the repo rate at 6.50% in early 2024 has supported housing demand, but any future increases could dampen sales. Inflationary pressures are also a concern, with rising material costs impacting construction expenses and profit margins.

Disposable income is a key driver for DLF's residential and retail segments, with India's nominal GDP per capita projected to reach USD 2,847.5 in FY24, up from USD 2,601.1 in FY23. This rise in earning potential enhances purchasing power for homes and boosts consumer spending in retail spaces, benefiting DLF's mall operations.

Foreign investment is crucial for DLF's large-scale projects. India's real estate sector attracted an estimated $5.5 billion in FDI during FY23-24, with a substantial portion directed towards residential and commercial properties. Global economic health and positive sentiment towards India in 2024-2025 will be vital for continued capital inflows.

| Economic Factor | 2024/2025 Outlook | Impact on DLF |

| GDP Growth | Projected 6.5% in FY2025 (RBI) | Increased demand for residential and commercial properties |

| Interest Rates (Repo Rate) | Maintained at 6.50% (early 2024) | Supports housing demand; potential slowdown if rates rise |

| Inflation | Rising material costs (steel, cement) | Increased construction expenses, potential margin pressure |

| Disposable Income | Nominal GDP per capita USD 2,847.5 (FY24 est.) | Boosts purchasing power for homes and retail spending |

| Foreign Direct Investment (FDI) | Est. $5.5 billion in real estate (FY23-24) | Provides capital for large-scale projects; dependent on global sentiment |

What You See Is What You Get

DLF PESTLE Analysis

The preview shown here is the exact DLF PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain immediate access to this comprehensive analysis upon completing your purchase.

The content and structure shown in the preview is the same DLF PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

India's urbanization rate is projected to reach 43.2% by 2030, with a significant portion of this growth concentrated in major metropolitan areas where DLF has a strong presence. This influx of people fuels a continuous demand for residential properties and commercial real estate, directly benefiting DLF's core business.

The migration from rural to urban centers, particularly to cities like Delhi NCR, Mumbai, and Bengaluru, is a powerful driver for the real estate sector. DLF's strategic land banks and ongoing projects are well-positioned to capitalize on this demographic trend, offering housing and retail spaces to a growing urban population.

Consumer preferences are shifting, with a growing demand for amenities that support healthier and more active lifestyles. This includes more green spaces, fitness centers, and community areas within residential developments. For instance, surveys in 2024 indicated that over 60% of homebuyers in metropolitan areas prioritize access to parks and recreational facilities.

There's also a significant surge in interest for sustainable living options. Buyers are increasingly looking for energy-efficient homes, rainwater harvesting systems, and waste management solutions. DLF's focus on incorporating these features aligns with market trends, as a 2025 report by a leading real estate consultancy found that properties with strong sustainability credentials command a premium of up to 8%.

The integration of smart home technology is no longer a niche offering but a key expectation. Features like automated lighting, climate control, and enhanced security systems are becoming standard. DLF's investment in smart infrastructure for its new projects directly addresses this evolving preference, aiming to attract a tech-savvy buyer base.

Furthermore, the appeal of integrated townships, offering a mix of residential, commercial, and retail spaces, continues to grow. This "live-work-play" concept caters to a desire for convenience and community. DLF's strategy of developing self-sufficient townships reflects this, with their larger projects often including schools, hospitals, and shopping centers to enhance resident convenience and property value.

India's demographic structure, particularly its substantial youth population and expanding middle class, presents a significant opportunity for the real estate sector. This demographic dividend fuels demand for housing across various segments.

The age profile of India's population directly influences the type of real estate DLF develops. Younger demographics often seek starter homes and apartments, while an aging population might require different housing solutions, impacting DLF's product development and sales strategies.

As of 2024, India's median age is around 28.7 years, with a significant portion of the population under 35, indicating a large pool of potential first-time homebuyers. The growing middle class, projected to expand significantly by 2025, will further drive demand for mid-to-high-end residential properties.

Affordability and Income Levels

The affordability of real estate directly impacts DLF's market positioning. As of early 2024, India's median household income was approximately INR 3.5 lakhs per annum, meaning that many potential buyers are sensitive to price points. DLF must therefore consider a range of offerings to cater to different income segments.

Understanding the purchasing power of target audiences is crucial for DLF's success. For instance, in metropolitan areas like Delhi NCR, where DLF has a significant presence, property prices can vary widely. In 2023, the average property price in Gurugram ranged from INR 8,000 to INR 12,000 per square foot, a significant outlay for the average Indian household.

- Price Sensitivity: A substantial portion of the Indian population has limited disposable income, making affordability a primary concern for real estate purchases.

- Income Growth vs. Property Appreciation: While incomes are growing, property appreciation in prime locations often outpaces wage growth, widening the affordability gap.

- Demand for Affordable Housing: There's a consistent demand for well-located, affordable housing solutions, a segment DLF could further explore.

- Impact on Sales Velocity: Property affordability directly correlates with sales velocity; higher affordability generally leads to quicker absorption rates.

Social Infrastructure Development

The availability and quality of social infrastructure, like schools and hospitals, significantly boost the appeal of DLF's real estate projects. For instance, DLF's integrated townships often include schools and healthcare facilities, creating self-sufficient and desirable living environments.

Developers like DLF strategically consider proximity to, or even invest in, social infrastructure to foster attractive and well-rounded communities. This approach enhances property values and resident satisfaction, making projects more competitive in the market.

- Enhanced Project Appeal: High-quality schools and hospitals near DLF developments increase their desirability for families and individuals.

- Integrated Community Development: DLF's strategy often involves developing or ensuring access to recreational facilities, promoting a holistic living experience.

- Property Value Appreciation: The presence of robust social infrastructure is a key driver of long-term property value growth for DLF's portfolio.

- Market Competitiveness: In 2024, the demand for properties with established social amenities remained strong, with projects offering such facilities commanding premium pricing.

India's significant youth population and expanding middle class are key sociological drivers for DLF. With a median age around 28.7 years in 2024, a large segment of potential first-time homebuyers exists, fueling demand across various property types. The growing middle class, expected to further expand by 2025, will boost demand for mid-to-high-end residential offerings.

Consumer preferences are evolving towards healthier lifestyles and sustainable living, with over 60% of homebuyers in metropolitan areas prioritizing green spaces and fitness centers as of 2024. This shift influences DLF's development strategies, as properties with sustainability credentials can command up to an 8% premium, according to a 2025 report.

The increasing demand for integrated townships, offering a blend of residential, commercial, and retail spaces, caters to a desire for convenience and community. DLF's focus on developing self-sufficient townships aligns with this trend, enhancing resident convenience and property value.

Affordability remains a critical factor, with India's median household income around INR 3.5 lakhs per annum in early 2024. Property prices in areas like Gurugram, ranging from INR 8,000 to INR 12,000 per square foot in 2023, highlight the sensitivity of buyers to price points, necessitating a diverse product portfolio from DLF.

| Sociological Factor | Impact on DLF | Supporting Data (2024/2025) |

| Demographics (Youth & Middle Class) | Drives demand for housing across segments. | India's median age ~28.7 years (2024); growing middle class. |

| Lifestyle Preferences | Increases demand for amenities, green spaces, and smart homes. | >60% of metro homebuyers prioritize parks/recreation (2024); sustainable properties command up to 8% premium (2025). |

| Urbanization & Migration | Fuels demand for residential and commercial real estate in metro areas. | India's urbanization projected at 43.2% by 2030. |

| Affordability | Influences pricing strategies and product mix. | Median household income ~INR 3.5 lakhs p.a. (early 2024); Gurugram property prices INR 8,000-12,000/sq ft (2023). |

Technological factors

DLF is increasingly leveraging advanced construction techniques like prefabrication and modular building, aiming to boost project efficiency and shorten delivery timelines. These methods, coupled with the use of high-strength materials, are projected to improve build quality and potentially reduce overall construction costs for DLF's upcoming developments.

The global modular construction market, for instance, was valued at approximately USD 108.9 billion in 2023 and is expected to grow significantly, indicating a strong trend that DLF can capitalize on to enhance its operational performance and competitive edge in the real estate sector.

Proptech is reshaping real estate, and DLF is poised to benefit. By integrating virtual reality tours, DLF can offer immersive property experiences to a global audience, potentially increasing sales velocity. Online property management platforms streamline tenant interactions and maintenance, boosting operational efficiency. For instance, in 2024, the global proptech market was valued at over $20 billion, demonstrating significant adoption and potential for growth.

Digital transformation is crucial for DLF to enhance customer engagement and internal processes. Leveraging data analytics provides deeper market insights, enabling more targeted marketing campaigns and informed development decisions. This digital shift is vital for DLF to remain competitive and reach a broader customer base in the evolving real estate landscape.

The increasing adoption of smart home and building automation technologies is a significant technological factor influencing DLF. These systems, integrating Internet of Things (IoT) devices, are becoming standard in new residential and commercial developments, boosting property appeal and functionality by offering enhanced convenience, robust security, and improved energy efficiency.

For instance, by 2024, it's projected that over 300 million smart home devices will be in use globally, a trend that directly impacts consumer expectations for modern living spaces. DLF's ability to incorporate these advanced features into its projects, such as smart lighting, climate control, and integrated security systems, positions its properties favorably in a competitive market, potentially leading to higher occupancy rates and rental yields.

Sustainable Building Materials and Methods

Technological advancements in green building materials and sustainable construction methods are significantly impacting the real estate sector, offering DLF opportunities to develop environmentally friendly properties. Innovations in areas like recycled content, low-VOC paints, and energy-efficient insulation are becoming more accessible and cost-effective.

This trend not only helps DLF comply with increasingly stringent environmental regulations, such as those promoting net-zero energy buildings, but also taps into a growing market segment of consumers prioritizing eco-conscious living. For instance, the global green building materials market was valued at approximately USD 250 billion in 2023 and is projected to grow substantially in the coming years, indicating strong consumer preference.

Furthermore, the adoption of these technologies can lead to reduced operational costs for DLF and its residents through lower energy and water consumption. The integration of smart home technologies and sustainable design principles can further enhance property value and marketability.

- Technological Advancements: Development of advanced materials like cross-laminated timber (CLT) and recycled plastics for construction.

- Market Demand: Growing consumer preference for sustainable and healthy living spaces, driving demand for green certifications like LEED and IGBC.

- Cost Reduction: Potential for long-term savings on energy, water, and maintenance through efficient building design and materials.

- Regulatory Alignment: Compliance with evolving environmental standards and incentives for green construction projects.

Data Analytics and AI for Market Insights

DLF can leverage big data analytics and artificial intelligence to gain a more profound understanding of evolving market trends and customer preferences. This enhanced insight is crucial for refining land acquisition strategies, optimizing project designs to meet demand, and improving the accuracy of sales forecasts. For instance, by analyzing vast datasets of past sales, demographic shifts, and economic indicators, DLF could better predict which micro-markets will experience the highest demand for specific property types in 2024 and 2025.

The application of AI in real estate can significantly improve decision-making processes. By processing information on consumer behavior, such as online search patterns and social media sentiment related to housing, DLF can tailor its offerings more effectively. This data-driven approach allows for more precise pricing strategies, potentially leading to faster sales cycles and improved revenue generation. DLF's investment in digital transformation is expected to continue, with AI playing a more central role in operational efficiency and strategic planning throughout 2024-2025.

Key benefits of integrating data analytics and AI for DLF include:

- Enhanced Market Trend Identification: AI algorithms can process real-time data to spot emerging patterns in property demand and supply, allowing DLF to be proactive.

- Optimized Consumer Behavior Analysis: Understanding customer preferences through data analytics enables DLF to design projects that resonate better with target demographics.

- Improved Sales Forecasting Accuracy: Predictive analytics can lead to more reliable sales projections, aiding in financial planning and resource allocation.

- Data-Informed Pricing Strategies: Utilizing AI for dynamic pricing can help DLF maximize revenue by adjusting prices based on market conditions and demand elasticity.

DLF's technological adoption is accelerating, with a focus on Proptech and smart building solutions. The company is integrating virtual reality for property tours and online platforms for streamlined tenant management, capitalizing on a global Proptech market valued over $20 billion in 2024. These digital tools enhance customer engagement and operational efficiency, crucial for DLF's competitive edge.

Legal factors

The Real Estate (Regulation and Development) Act, RERA, has fundamentally reshaped India's real estate landscape, fostering greater transparency and accountability. DLF, like all developers, must meticulously adhere to RERA's stringent requirements, including project registration, adherence to delivery timelines, and comprehensive financial disclosures, to maintain its market standing and investor confidence.

Land acquisition laws in India, including those governing compensation and consent, significantly influence DLF's capacity to secure land for new developments. For instance, the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, mandates specific compensation frameworks and consent percentages from landowners. These regulations directly impact the cost and timeline for DLF's land assembly process, a crucial early stage in any real estate project.

Any shifts in these land acquisition statutes can introduce volatility into DLF's project pipeline. For example, an increase in mandated compensation rates or stricter consent requirements could elevate development costs and potentially delay project launches. This was evident in discussions around potential amendments to the 2013 Act in recent years, which aimed to streamline acquisition but also raised concerns about fair compensation for affected parties, a factor DLF closely monitors.

DLF, like all real estate developers in India, must navigate a complex web of environmental regulations. For instance, the Environmental Impact Assessment (EIA) Notification, 2006, and its subsequent amendments, mandate environmental clearances for projects exceeding certain thresholds. Failure to comply can result in significant fines and project delays, impacting profitability. For example, in 2023, several large infrastructure projects faced scrutiny and temporary halts due to non-compliance with environmental norms, highlighting the critical need for proactive adherence.

The need for various environmental clearances, such as those related to water pollution, air quality, and waste management, directly influences project timelines and design modifications. DLF's commitment to sustainable development practices, including efficient resource utilization and waste reduction, is crucial not only for regulatory compliance but also for long-term brand reputation and operational efficiency. The company's ability to secure these clearances efficiently will remain a key factor in its project execution speed and overall success in the 2024-2025 period.

Taxation Policies on Real Estate

Government taxation policies significantly shape the real estate market for DLF. The Goods and Services Tax (GST) on construction services, stamp duty, and property taxes directly influence property affordability for buyers and developer profitability. For instance, in 2024, the GST rate on residential construction generally remains at 5% for under-construction properties without input tax credit, and 12% for completed properties where input tax credit is available. These rates, along with varying state-level stamp duties that can range from 2% to 7% of property value, impact the final purchase price and overall investment attractiveness.

Changes in these tax structures can lead to fluctuations in demand and investment patterns. For example, a reduction in stamp duty by a state government could stimulate sales and encourage more property transactions, benefiting developers like DLF by increasing buyer interest. Conversely, an increase in property taxes could deter potential investors and impact the resale market, requiring developers to adjust pricing strategies or offer incentives to maintain sales momentum.

- GST on Construction Services: Typically 5% for under-construction properties without ITC, impacting buyer costs.

- Stamp Duty Variations: State-specific rates, often between 2% and 7%, directly affect property transaction expenses.

- Property Taxes: Annual levies that influence the ongoing cost of ownership and long-term investment appeal.

- Impact on Demand: Tax policy changes can either boost or dampen buyer sentiment and investment activity.

Contractual and Consumer Protection Laws

DLF's operations are significantly influenced by contractual and consumer protection laws, particularly those governing builder-buyer agreements. These regulations are designed to safeguard property buyers by clearly defining project timelines, specifications, and payment schedules. For instance, the Real Estate (Regulation and Development) Act, 2016 (RERA) in India mandates transparency and accountability from developers, with compliance being crucial for DLF's market standing.

Consumer rights are paramount, and DLF must ensure its practices align with these protections, which often include rights to timely possession, quality construction, and fair redressal. In 2023, consumer complaints related to real estate in India saw a notable increase, highlighting the importance of robust dispute resolution mechanisms. DLF's commitment to effectively addressing customer grievances is vital for maintaining its reputation and minimizing the risk of costly legal battles and potential penalties.

- RERA Compliance: Adherence to RERA regulations, including project registration and timely disclosure, is essential for DLF's legal standing and buyer trust.

- Consumer Grievance Redressal: Establishing efficient channels for addressing customer complaints, as mandated by consumer protection laws, is key to mitigating disputes.

- Contractual Clarity: Ensuring builder-buyer agreements are transparent, fair, and legally sound protects DLF from future legal challenges and enhances customer satisfaction.

DLF must navigate a dynamic legal environment, with RERA, consumer protection laws, and land acquisition statutes significantly impacting its operations. Compliance with RERA, particularly regarding project registration and timely disclosures, is paramount for maintaining buyer trust and market credibility, as emphasized by the increase in consumer complaints seen in 2023.

Changes in land acquisition laws, such as the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, directly affect DLF's land procurement costs and project timelines. Similarly, environmental regulations like the EIA Notification require rigorous adherence, with non-compliance leading to potential project delays and financial penalties, as observed with other infrastructure projects in 2023.

Taxation policies, including GST on construction services and varying state stamp duties, influence property affordability and DLF's profitability. For instance, in 2024, GST on under-construction properties without input tax credit remained at 5%, while stamp duties can range from 2% to 7%, directly impacting transaction costs for buyers and sales momentum for developers.

Environmental factors

Climate change is increasingly impacting real estate. The rising frequency of extreme weather events, such as floods and storms, poses significant risks to construction projects and existing properties. For DLF, this means potential disruptions, increased insurance costs, and the need for more robust building materials and designs.

In 2024, the global economic impact of natural disasters was estimated to be in the hundreds of billions of dollars, with weather-related events accounting for the majority. DLF must proactively integrate resilient design and construction practices to safeguard its assets and maintain their long-term value against these growing environmental threats.

The increasing emphasis on green building norms is significantly shaping the real estate sector. Developers like DLF are increasingly integrating sustainable practices, driven by both growing environmental awareness and regulatory mandates. This trend is evident in the rising demand for certifications such as LEED (Leadership in Energy and Environmental Design) and GRIHA (Green Rating for Integrated Habitat Assessment), which signal a commitment to reduced environmental impact.

As of early 2024, the Indian Green Building Council (IGBC) has certified over 7.5 billion square feet of green building space, highlighting a substantial shift towards sustainability. DLF's own projects are increasingly incorporating features like rainwater harvesting, solar energy utilization, and efficient waste management systems, aligning with these norms. This not only helps in reducing operational costs for the end-users but also appeals to a growing segment of environmentally conscious buyers, a trend expected to accelerate through 2025.

The construction industry, a core sector for DLF, faces significant challenges from resource scarcity. Water availability is a growing concern, with global freshwater stress projected to affect over 5 billion people by 2050, impacting project timelines and costs. Similarly, sand, a key aggregate for concrete, is becoming increasingly scarce and expensive due to overexploitation and environmental regulations, with some regions already experiencing critical shortages.

DLF's strategic approach must prioritize efficient resource management. This includes adopting water-saving construction techniques and investing in technologies that reduce water consumption on-site. Furthermore, exploring and integrating alternative, sustainable building materials like recycled aggregates, fly ash, or manufactured sand can significantly de-risk the business from the volatility of traditional resource markets.

Waste Management and Pollution Control

Environmental regulations are becoming increasingly stringent, pushing companies like DLF to prioritize responsible waste management and pollution control. Public expectations for sustainable practices in the construction sector are also on the rise, demanding a proactive approach to minimize environmental impact. This means DLF needs to focus on reducing construction waste, increasing recycling efforts, and implementing robust measures to control air and water pollution to ensure compliance and uphold its corporate social responsibility.

For instance, India's Solid Waste Management Rules, 2016, and various state-level pollution control board directives mandate proper handling and disposal of construction and demolition waste. DLF's commitment to these regulations is crucial. By adopting advanced waste segregation techniques and exploring partnerships for recycling construction debris, DLF can not only meet legal requirements but also potentially reduce material costs. In 2023, the Indian government also emphasized stricter emission norms for construction equipment, further highlighting the need for DLF to invest in cleaner technologies and operational practices to manage air quality effectively at its project sites.

- Regulatory Compliance: Adherence to India's Solid Waste Management Rules, 2016, and state pollution control board guidelines for construction waste and emissions.

- Public Scrutiny: Growing public demand for environmentally conscious construction practices and transparent pollution control measures.

- Operational Efficiency: Implementing waste reduction and recycling programs can lead to cost savings on materials and disposal.

- Technological Investment: Adopting cleaner construction equipment and pollution mitigation technologies to meet evolving environmental standards.

Biodiversity and Ecological Impact

DLF's development projects, particularly in expanding urban areas, inherently carry the risk of impacting local biodiversity and ecological balance. Consider the Noida region where DLF has significant projects; increased construction can lead to habitat fragmentation for species like the Indian Grey Mongoose and various bird species.

To mitigate these effects, DLF is increasingly focused on conducting comprehensive Environmental Impact Assessments (EIAs) before commencing new developments. For instance, their upcoming residential project in Gurugram, spanning over 100 acres, includes provisions for preserving existing green cover and creating dedicated ecological zones, aiming to offset potential disruptions.

DLF's strategy emphasizes minimizing ecological disruption through careful site selection and implementing conservation measures. This includes:

- Habitat Conservation: Identifying and protecting existing natural habitats within project boundaries, such as wetlands or forested patches, which are crucial for local fauna.

- Biodiversity Offsetting: Investing in conservation projects in nearby areas to compensate for any unavoidable habitat loss, potentially supporting initiatives like afforestation drives.

- Sustainable Land Use: Adopting practices that promote responsible land management, including water conservation techniques and the use of native plant species in landscaping to support local ecosystems.

- Compliance and Monitoring: Ensuring strict adherence to environmental regulations and establishing ongoing monitoring programs to track ecological impacts and adapt mitigation strategies as needed.

Environmental factors present both risks and opportunities for DLF. Climate change necessitates resilient building designs and increased insurance costs, while a growing focus on green building norms drives demand for sustainable features. As of early 2024, India has over 7.5 billion square feet of green building space, indicating a strong market trend.

Resource scarcity, particularly water and sand, impacts construction costs and timelines, pushing DLF towards efficient resource management and alternative materials. Stringent environmental regulations and public demand for sustainability require DLF to focus on waste reduction, pollution control, and cleaner technologies, with India's Solid Waste Management Rules, 2016, being a key compliance area.

DLF's projects must also address biodiversity impacts, with strategies like Environmental Impact Assessments and habitat conservation becoming crucial. For example, their Gurugram project includes provisions for preserving green cover. By adopting these measures, DLF can mitigate risks and align with evolving environmental expectations through 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a diverse array of data sources, including official government publications, reports from international organizations like the UN and WTO, and reputable industry-specific market research. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscape.