DLF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DLF Bundle

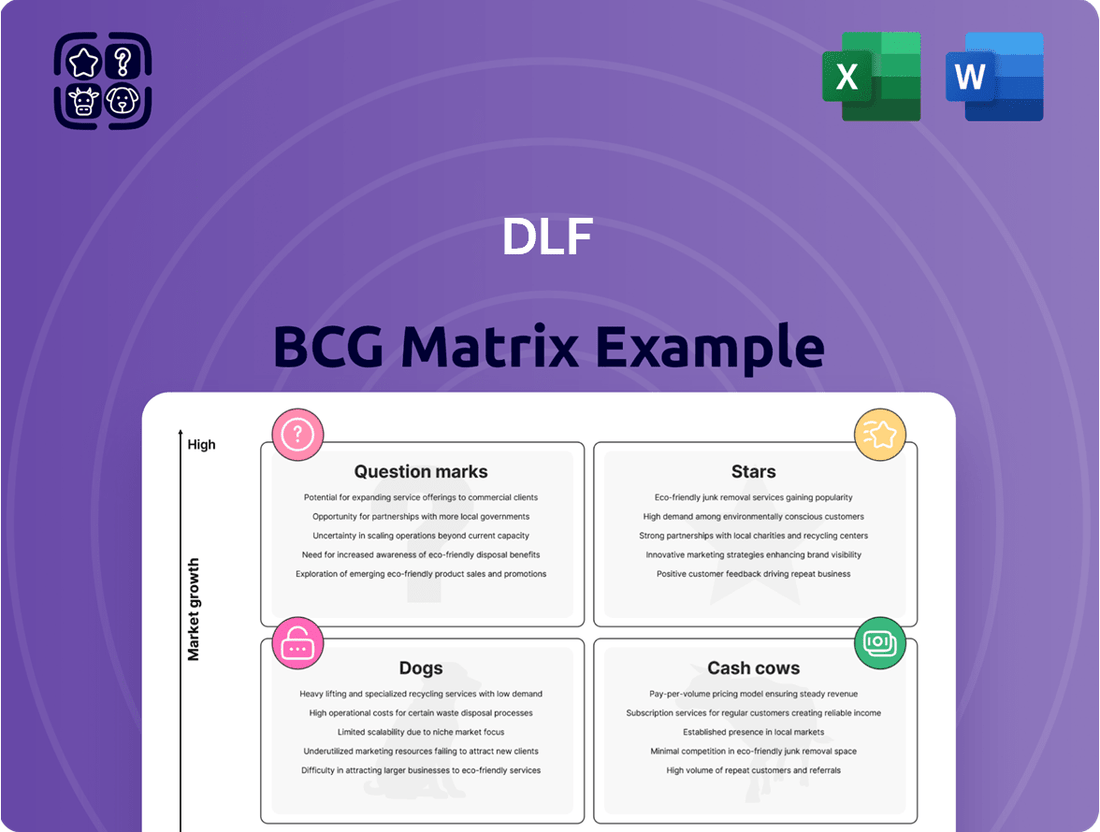

Unlock the strategic power of the BCG Matrix to understand your product portfolio's potential. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and identify growth opportunities. Purchase the full BCG Matrix to get a comprehensive analysis and actionable insights for smarter resource allocation and market positioning.

Stars

DLF's ultra-luxury projects like The Dahlias and Privana Series in Gurugram are prime examples of their Stars. These developments command a significant share in the premium housing market, evidenced by their rapid sell-outs and substantial sales bookings, attracting affluent buyers and Non-Resident Indians (NRIs).

The strong demand and consistent sales performance for these high-end projects, such as the Privana series which saw bookings worth over ₹5,100 crore in its launch phase in 2023, highlight their growth potential. While they require substantial investment for development, their market leadership and consistent demand indicate a strong future as cash cows for DLF.

DLF's strategic re-entry into Mumbai with 'The Westpark' project highlights its aggressive expansion into high-demand metropolitan areas. This move positions the company to capitalize on burgeoning luxury housing markets outside its established NCR base.

The swift sell-out of Phase 1 of 'The Westpark', achieving over Rs 2,300 crore in sales, underscores DLF's capability to penetrate and dominate new, lucrative urban centers. This rapid success validates the strategy of targeting high-growth segments in markets with significant unmet demand.

DLF's aggressive expansion in the luxury segment, with over Rs 17,000 crore in new project launches planned for FY25, positions these developments as Stars in its portfolio. This substantial investment, targeting a medium-term sales potential of Rs 1.14 lakh crore, underscores a strategic focus on high-demand premium real estate.

The company is actively capitalizing on the enduring demand for luxury homes, aiming to solidify its market leadership and expand its share. This consistent investment in high-value, growth-oriented projects is a clear indicator of a Star strategy, designed to drive significant future revenue and profitability.

Premium Residential Offerings in Established NCR Micro-markets

DLF's premium residential offerings in established NCR micro-markets, like Golf Course Road in Gurugram, represent its Stars in the BCG Matrix. These locations boast a dominant market share for DLF.

Projects such as 'The Arbour' are specifically designed for a premium clientele, indicating robust demand and DLF's strength in achieving premium pricing. This segment benefits significantly from DLF's strong brand legacy and recognition.

- Dominant Market Share: DLF holds a leading position in prime NCR micro-markets.

- Premium Project Success: Projects like 'The Arbour' demonstrate high demand and pricing power.

- Brand Equity: Strong brand recognition and legacy drive sustained growth.

Focus on Integrated Townships with High-End Amenities

DLF's focus on integrated townships with high-end amenities positions these projects as Stars in the BCG Matrix. These developments offer a complete lifestyle, blending residential, retail, and commercial spaces, which resonates strongly with affluent buyers. This comprehensive approach captures a significant market share and reinforces DLF's dominance in the premium real estate segment.

- Integrated Townships as Stars: DLF's strategy of creating self-sufficient communities with a wide array of amenities, from residential units to retail and entertainment hubs, directly targets a high-demand market segment.

- High Market Share & Brand Leadership: These large-scale projects, often featuring premium finishes and sought-after locations, consistently achieve high sales velocity and contribute to DLF's reputation for quality and luxury. For instance, DLF's projects in Gurugram have seen robust demand, reflecting the success of this integrated township model.

- Attracting a Growing Buyer Segment: The appeal of a holistic living experience, where daily needs and leisure activities are within easy reach, is a key driver for the success of these townships, particularly among discerning buyers.

DLF's Star projects are characterized by their strong market share in high-growth segments and significant investment potential. These developments, often in prime locations like Gurugram's Golf Course Road, demonstrate rapid sales and command premium pricing, reflecting DLF's brand strength and strategic focus on luxury real estate. The company's aggressive expansion into new metropolitan areas and its commitment to integrated townships further solidify these projects as key growth drivers.

| Project/Segment | Market Position | Sales Performance (Illustrative) | Investment Focus |

|---|---|---|---|

| Ultra-Luxury (e.g., The Dahlias, Privana Series) | Dominant in premium NCR | ₹5,100 crore bookings (Privana Phase 1, 2023) | High growth, substantial investment |

| New Metro Expansion (e.g., The Westpark, Mumbai) | Penetrating new luxury markets | ₹2,300 crore sales (The Westpark Phase 1) | Capitalizing on unmet demand |

| Integrated Townships | Market leadership in holistic living | Robust demand in Gurugram projects | Capturing affluent buyer segment |

| Planned FY25 Launches | Targeting high-demand premium | ₹17,000 crore planned launches | Medium-term sales potential ₹1.14 lakh crore |

What is included in the product

The DLF BCG Matrix provides a strategic overview of a company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Instantly visualize your portfolio's health, alleviating the pain of strategic uncertainty.

Cash Cows

DLF's majority stake in DLF Cyber City Developers Ltd (DCCDL), managing 37.9 million square feet of commercial office spaces, functions as a significant cash cow. These mature market assets boast high occupancy and consistent rental income, with office rental income climbing 7% to Rs 3,460 crore in FY24. This predictable, substantial cash flow requires minimal promotional investment, freeing capital to support other business segments.

The established retail assets, primarily shopping malls within DLF's portfolio, function as significant cash cows. These properties, totaling 4 million square feet, are strategically situated in well-established markets, drawing consistent and high footfall.

This consistent patronage translates into substantial and growing rental income, evidenced by a notable 18% increase to Rs 865 crore in retail income during FY24. The mature nature of these locations limits aggressive expansion needs, allowing for optimized operational efficiency and high profit margins.

The predictable and robust cash flow generated by these retail assets provides DLF with the flexibility to reinvest in other growth areas or distribute returns to stakeholders.

Completed and largely sold-out residential projects in prime locations, especially those developed years ago, function as DLF's cash cows. These mature developments, like DLF Magnolias in Gurgaon, represent fully monetized assets that continue to provide stable income. For instance, DLF's rental income from its completed projects, which includes these mature residential assets, stood at approximately ₹1,000 crore in FY24, highlighting their consistent revenue generation.

Property Management and Maintenance Services for Existing Portfolio

Property management and maintenance services for DLF's existing portfolio are a classic cash cow. This segment consistently generates revenue with minimal need for further investment, thanks to DLF's established market presence. It's an annuity-like business that provides a steady, high-margin income stream.

This business model capitalizes on DLF's extensive existing infrastructure and strong customer relationships. The recurring nature of these services ensures a predictable cash flow, making it a reliable contributor to the company's overall financial health. For instance, in FY24, DLF's rental income, which is heavily influenced by these services, stood at approximately ₹3,323 crore, showcasing the consistent revenue generation capability.

- Consistent Revenue: Provides a stable, annuity-like income stream.

- High Margins: Benefits from leveraging existing infrastructure and relationships.

- Low Growth, High Cash Flow: Characterizes a mature business unit.

- Strategic Importance: Supports the overall portfolio and customer retention.

Long-Term Leasehold Income from Land Parcels

DLF's strategically held land parcels, particularly those under long-term leasehold agreements, function as robust cash cows. These assets, often in mature development phases, provide a consistent and predictable rental income stream with minimal need for further capital expenditure, bolstering DLF's recurring revenue.

- Stable Recurring Revenue: These leased land parcels generate predictable income, reducing financial volatility.

- Low Capital Intensity: Once leased, these assets require minimal ongoing investment, maximizing profit margins.

- Mature Monetization: DLF benefits from established cash flows from these long-term agreements.

- Risk Mitigation: The predictable nature of lease income offers a low-risk component to DLF's overall financial portfolio.

DLF's established commercial office spaces, particularly those within DLF Cyber City Developers Ltd (DCCDL), are key cash cows. These mature assets, totaling 37.9 million square feet, generate consistent rental income, which saw a 7% increase to Rs 3,460 crore in FY24. This segment requires minimal investment for promotion, allowing capital to be redirected to other growth areas.

Mature residential projects, especially those completed and sold in prime locations, also act as cash cows for DLF. These fully monetized assets contribute stable income, with rental revenue from completed projects reaching approximately ₹1,000 crore in FY24. Their established nature means low capital expenditure is needed, ensuring high profitability.

DLF's property management and maintenance services for its existing portfolio represent a classic cash cow. This segment provides a steady, high-margin income stream with minimal new investment, leveraging DLF's established infrastructure and customer base. Rental income, influenced by these services, was around ₹3,323 crore in FY24.

Strategically leased land parcels contribute to DLF's cash cow portfolio by offering predictable rental income with low capital intensity. These mature assets, under long-term leasehold agreements, bolster recurring revenue and provide a low-risk component to DLF's finances.

| Asset Class | FY24 Rental Income (Approx.) | Key Characteristics | Strategic Role |

|---|---|---|---|

| Commercial Office (DCCDL) | Rs 3,460 crore | High occupancy, consistent rental growth | Stable, significant cash generation |

| Retail Malls | Rs 865 crore | High footfall, mature markets | Consistent revenue, optimized operations |

| Completed Residential Projects | ₹1,000 crore | Fully monetized, prime locations | Stable income, low capex |

| Property Management Services | (Influences ₹3,323 crore rental income) | Annuity-like, high margin | Predictable cash flow, customer retention |

| Leased Land Parcels | (Part of recurring revenue) | Long-term agreements, low capex | Stable income, risk mitigation |

Delivered as Shown

DLF BCG Matrix

The DLF BCG Matrix preview you are viewing is the identical, fully functional document you will receive upon purchase. This means you get the complete strategic analysis, free from any watermarks or placeholder content, ready for immediate application in your business planning. You can confidently assess your product portfolio's strategic positioning with this comprehensive tool.

Dogs

DLF might possess undeveloped land parcels in areas with sluggish real estate markets or those outside its core strategic interests. These holdings represent a low market share and offer minimal growth potential, effectively immobilizing capital without generating substantial revenue or supporting future development initiatives.

Such assets are prime candidates for divestment to unlock capital or could be held long-term with very limited investment. For instance, in 2024, the Indian real estate sector saw varying growth rates across regions; while prime metros experienced robust activity, Tier-II and Tier-III cities often showed slower appreciation and development, making undeveloped land in these areas a potential candidate for this BCG category.

Older commercial properties that don't align with today's Grade A office or contemporary retail standards can be categorized as Dogs in the DLF BCG Matrix. These assets often face challenges such as reduced occupancy and rental income, necessitating substantial capital for upgrades that may not guarantee favorable returns.

In 2024, the commercial real estate market, particularly for older office buildings, continued to show a bifurcated performance. For instance, while prime office spaces in major metropolitan areas maintained strong occupancy, older, less amenity-rich buildings experienced vacancy rates that could exceed 20% in some submarkets, impacting their market share and investment appeal.

Unsold residential inventory in saturated micro-markets where DLF doesn't hold a dominant position would be classified here. These properties often necessitate significant price reductions to find buyers, which can severely impact profitability and tie up valuable capital. For instance, a micro-market with a 15% year-over-year increase in unsold inventory, as observed in some secondary Indian cities during early 2024, could present this challenge.

The subdued demand in these specific locations means that pouring additional investment into them is unlikely to yield productive returns. This situation is exacerbated when the overall market growth rate for residential properties slows, as projected by some analysts for certain regional markets in late 2024, potentially leading to a 5-10% dip in absorption rates.

Legacy Projects with Significant Legal or Regulatory Hurdles

Projects entangled in protracted legal battles, environmental impact assessments, or intricate regulatory frameworks often find themselves in a state of stagnation. These legacy projects, while potentially holding long-term promise, are currently characterized by their inability to progress due to these external roadblocks.

The primary issue for these ventures is the significant drain on resources. Legal fees, compliance costs, and administrative overheads escalate without any corresponding revenue generation or market penetration. For instance, in 2024, infrastructure projects facing extensive environmental reviews saw their development timelines extend by an average of 18 months, significantly increasing capital costs.

The low growth aspect stems directly from these external impediments. The sheer difficulty and often prohibitive cost of navigating complex legal and regulatory landscapes make further investment or development economically unviable in the short to medium term. This situation is exemplified by several large-scale real estate developments that have been stalled for years awaiting zoning board approvals, with associated carrying costs mounting.

- Resource Drain: Projects bogged down by legal or regulatory issues consume substantial financial and human capital without generating returns.

- Extended Timelines: External approvals and legal processes can add years to project completion, increasing overall costs.

- Economic Unviability: The high cost of compliance and the uncertainty of resolution can make further investment unattractive.

- Stalled Progress: These projects often represent significant sunk costs with little to no current market impact or growth potential.

Divested or Non-Strategic Business Units/Subsidiaries

Divested or non-strategic business units within DLF's portfolio, as per the BCG matrix, represent assets that no longer fit the company's primary focus on large-scale, luxury real estate and its annuity income streams. These units often exhibit low market share and minimal growth prospects, making them prime candidates for divestment. Such a strategy allows DLF to reallocate capital towards more promising ventures and streamline its operations.

For instance, DLF's strategic review in recent years has often involved assessing its diverse business interests. While specific divestments are not always publicly detailed in the context of a BCG matrix analysis, the principle applies to any smaller acquired entities or developed projects that do not contribute significantly to the company's core growth objectives or its annuity business, such as rental income from commercial properties. The goal is to enhance overall portfolio efficiency.

- Low Market Share: Units with a negligible presence in their respective markets, failing to capture significant customer segments.

- Limited Growth Potential: Businesses unlikely to experience substantial expansion due to market saturation or lack of competitive advantage.

- Strategic Misalignment: Operations that do not complement DLF's core competencies in premium residential and commercial real estate development.

- Capital Reallocation: Divestment frees up financial resources that can be reinvested in higher-return strategic initiatives or debt reduction.

Dogs in DLF's BCG Matrix represent underperforming assets with low market share and minimal growth prospects. These could include undeveloped land in slow markets or older commercial properties needing significant upgrades. Unsold residential inventory in saturated areas also falls into this category, often requiring price cuts and tying up capital.

DLF's strategy for these assets typically involves divestment to unlock capital or minimal investment to maintain them. For instance, in 2024, the Indian real estate market saw slower growth in Tier-II and Tier-III cities, making land parcels there potential Dogs. Similarly, older office buildings in 2024 faced vacancy rates that could exceed 20% in some submarkets, impacting their appeal.

Projects stalled by legal issues or regulatory hurdles also function as Dogs, draining resources without generating revenue. The economic unviability of further investment due to high compliance costs and uncertain resolution timelines characterizes these situations, with extended development timelines for infrastructure projects in 2024 averaging 18 months.

DLF may also divest non-strategic business units that do not align with its core focus on premium real estate. These units typically have low market share and limited growth potential, allowing DLF to reallocate capital to more promising ventures.

| Asset Type | Characteristics | 2024 Market Context | DLF Strategy |

| Undeveloped Land | Low market share, minimal growth potential | Slower appreciation in Tier-II/III cities | Divestment or minimal investment |

| Older Commercial Properties | Reduced occupancy, rental income, high upgrade costs | Vacancy rates >20% in some submarkets for older buildings | Divestment or strategic repositioning |

| Unsold Residential Inventory | Saturated micro-markets, price reductions needed | Potential 5-10% dip in absorption rates in certain regional markets | Divestment or aggressive sales |

| Stalled Projects (Legal/Regulatory) | Resource drain, extended timelines, economic unviability | Infrastructure projects facing environmental reviews delayed by ~18 months | Divestment or long-term holding with minimal intervention |

| Non-Strategic Business Units | Low market share, limited growth, strategic misalignment | Focus on core premium real estate and annuity income | Divestment to reallocate capital |

Question Marks

DLF's planned ultra-luxury villa projects in Goa, with prices exceeding ₹50 crore, are classified as Question Marks in the DLF BCG Matrix. This strategic move into new, high-value geographies signifies a high-growth potential market for luxury real estate in India, which is projected to grow significantly in the coming years.

However, DLF's current market share in these specific nascent luxury geographies like Goa is minimal, making these ventures unproven. Significant capital infusion will be necessary to build brand recognition and capture market share, posing a risk of these projects underperforming and potentially becoming Dogs if market penetration is unsuccessful.

DLF's foray into specialized commercial assets, such as data centers in Noida, positions them within a high-growth, albeit nascent, market segment for the company. This strategic move taps into the burgeoning demand for digital infrastructure. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow significantly, with some estimates reaching over $350 billion by 2028.

However, DLF currently holds a low market share in this specialized area. To establish a competitive advantage and capture a meaningful portion of this expanding market, substantial investment in cutting-edge technology, skilled personnel, and robust operational frameworks is crucial. This requires a commitment to building specialized expertise beyond their traditional real estate development focus.

DLF's ventures into new residential formats like co-living or senior living are currently in the exploratory phase. These emerging segments, while showing strong growth potential in India, represent a minimal portion of DLF's existing market share. For instance, the co-living market in India was projected to reach $1.7 billion by 2025, indicating a significant opportunity.

To elevate these nascent segments into Stars within the DLF BCG Matrix, substantial capital investment and a demonstrated ability to gain significant market traction are essential. Success hinges on DLF's capacity to adapt its established brand and operational expertise to the unique demands of these niche markets, a challenge that requires careful strategic planning and execution.

Residential Projects in Untapped Tier 2/3 Cities with High Growth Potential

DLF could strategically explore residential projects in Tier 2 and Tier 3 cities exhibiting robust future growth potential, even without an existing footprint. These markets, while offering high growth rates, would necessitate substantial initial investments from DLF. This would cover land acquisition, establishing brand recognition, and ensuring efficient project execution to secure a notable market share.

Such an expansion aligns with a potential Stars or Question Marks category in a BCG Matrix, depending on DLF's existing brand strength and competitive landscape in those specific cities. For instance, cities like Indore and Coimbatore have shown significant economic uplift. Indore's real estate market, for example, saw a notable increase in property registrations in 2023, indicating rising demand.

- High Market Growth: Cities like Surat and Pune are projected to experience substantial population and economic growth, driving residential demand.

- Zero Market Share: DLF would enter these markets as a new player, requiring significant marketing and development efforts to build brand awareness and customer trust.

- Investment Requirements: Substantial capital would be needed for prime land acquisition, construction, and aggressive marketing campaigns to compete effectively.

- Potential for High Returns: Early entry into high-growth markets can yield significant long-term returns if DLF successfully captures market share and establishes a strong brand presence.

Re-entry into Specific Market Segments after a Long Hiatus

DLF's strategic re-entry into specific market segments, like Mumbai's residential sector after a ten-year hiatus, initially positioned it as a Question Mark within the BCG framework. This classification stemmed from the high growth potential of the Mumbai market juxtaposed with DLF's then-limited recent market share in that particular region.

The company's return to Mumbai in 2024, for instance, required substantial investment and meticulous strategic planning to re-establish its presence and capture market share. This effort aligns with the characteristics of a Question Mark, where significant investment is needed to capitalize on a potentially lucrative but uncertain market position.

- Mumbai's residential market growth: The Indian real estate market, particularly in Tier 1 cities like Mumbai, has shown robust growth, with residential property prices in Mumbai seeing an appreciation of around 8-10% year-on-year in 2023-2024.

- DLF's investment strategy: DLF committed significant capital for its Mumbai re-entry, aiming to leverage its brand reputation and development expertise in a competitive landscape.

- Market share challenge: Rebuilding market share after a long absence necessitates aggressive marketing, competitive pricing, and superior product offerings to attract buyers and developers.

Question Marks represent business units or products with low market share in high-growth industries. DLF's ventures into niche markets like co-living or its re-entry into Mumbai exemplify this category. These require significant investment to gain traction and could potentially become Stars or Dogs.

The key challenge for DLF's Question Marks is converting potential into market leadership. This demands substantial capital, strategic marketing, and operational adaptation to new market dynamics. Success hinges on DLF's ability to execute effectively in these high-potential but unproven areas.

DLF's investments in data centers and ultra-luxury villas in Goa are prime examples of Question Marks. These sectors offer high growth but require DLF to establish a strong foothold against existing players and market uncertainties.

The company's strategic expansion into Tier 2 and Tier 3 cities also falls under this classification. While these markets promise high growth, DLF's minimal existing presence necessitates significant investment to build brand awareness and market share.

| DLF Venture | Market Growth | DLF Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Ultra-Luxury Villas (Goa) | High | Low | High | Star or Dog |

| Data Centers (Noida) | High | Low | High | Star or Dog |

| Co-living/Senior Living | High | Low | High | Star or Dog |

| Residential (Tier 2/3 Cities) | High | Low | High | Star or Dog |

| Residential (Mumbai Re-entry) | High | Low (initially) | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, competitor analysis, economic indicators, and consumer behavior insights for robust strategic guidance.