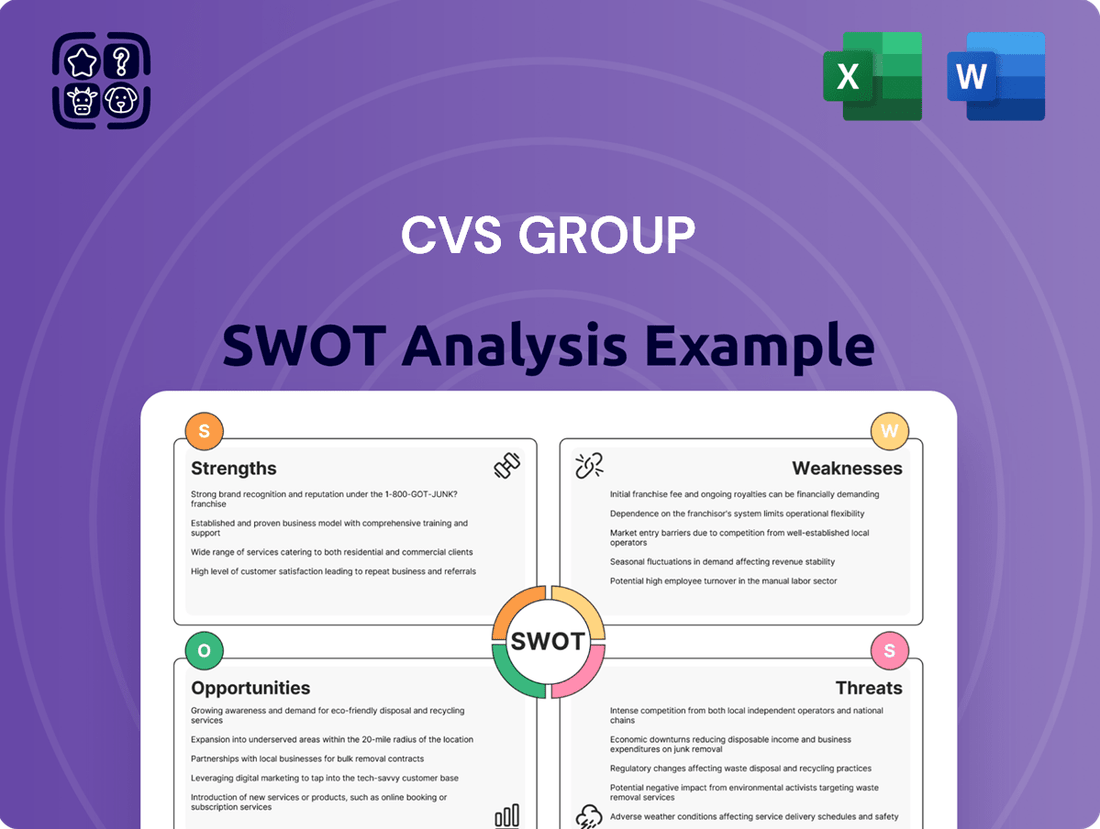

CVS Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

CVS Group's robust market presence and strong brand recognition are significant strengths, but they also face challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind CVS Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CVS Group boasts an extensive network of veterinary practices, with a significant presence across the UK and Australia. This broad reach allows them to serve a diverse clientele, from pet owners to those with equine and farm animals, offering a comprehensive suite of healthcare services.

Their service portfolio is wide-ranging, encompassing essential preventative care, advanced diagnostics, surgical procedures, and even ancillary services like online pharmacies and cremation. This multi-faceted approach caters to a large and varied customer base, strengthening their market position.

CVS Group’s dedication to superior clinical care forms the bedrock of its operational strategy, directly impacting patient outcomes and client trust.

This focus is reinforced by a strong emphasis on cultivating a skilled and motivated workforce, evidenced by a growing number of employed veterinarians, which reached an average of 1,000 vets in early 2024. This investment in human capital is crucial for maintaining high standards of service.

CVS Group's strategic international expansion, notably into Australia, is a significant strength. The company views Australia as a market with robust opportunities and a more predictable regulatory landscape than its home market in the UK. This geographical diversification is crucial for reducing the company's vulnerability to any single market's economic or regulatory fluctuations.

In 2023, CVS Group reported that its Australian operations contributed £31.8 million in revenue, demonstrating tangible progress in this key international market. This move aligns with their strategy to build a more resilient and globally diversified business, aiming to capture growth beyond the UK's competitive veterinary sector.

Strong Financial Performance and Capital Management

CVS Group has shown impressive financial resilience, with reported revenue growth and a notable increase in adjusted EBITDA, even amidst challenging market conditions. This financial strength underpins its operational stability and capacity for future expansion.

The strategic divestment of its crematoria business in late 2023 significantly bolstered CVS Group's financial position. This move generated substantial capital, which is earmarked for strategic growth initiatives and potential acquisitions, demonstrating prudent capital management.

- Revenue Growth: Reported a 7% increase in revenue for the year ended December 31, 2023, reaching £645.8 million.

- EBITDA Improvement: Adjusted EBITDA saw a 10% rise to £168.3 million for the same period.

- Balance Sheet Strengthening: Divestment of crematoria operations provided significant capital infusion, enhancing financial flexibility.

- Leverage Management: The company maintained a healthy net debt to adjusted EBITDA ratio, indicating effective financial control.

Growing Pet Ownership and Humanization Trends

The veterinary market in the UK and Europe is seeing robust growth, largely fueled by a significant increase in pet ownership and the ongoing trend of pet humanization. Owners increasingly view their pets as integral family members, driving demand for premium veterinary services and products. This fundamental shift in consumer behavior directly benefits CVS Group by creating a strong and expanding customer base.

This humanization trend means owners are more willing to invest in advanced treatments and preventative care for their pets. For instance, the UK pet care market was valued at approximately £13.2 billion in 2023, with veterinary services representing a substantial portion of this. CVS Group is well-positioned to capitalize on this by offering a comprehensive suite of high-quality veterinary care solutions.

- Growing Pet Population: Pet ownership continues to rise across the UK and Europe, providing a larger pool of potential clients.

- Increased Spending per Pet: Owners are spending more on their pets' health and wellbeing, seeing them as family.

- Demand for Advanced Care: This translates to higher demand for specialized veterinary services, diagnostics, and treatments offered by groups like CVS.

CVS Group's extensive network of veterinary practices across the UK and Australia provides significant market reach. Their broad service portfolio, from preventative care to advanced diagnostics and surgery, caters to a diverse clientele, strengthening their market position. A commitment to clinical excellence, supported by a growing number of employed veterinarians, currently around 1,000 as of early 2024, underpins high service standards.

The company's strategic international expansion, particularly into Australia, diversifies risk and taps into a market with robust growth opportunities and a more predictable regulatory environment. Australian operations contributed £31.8 million in revenue in 2023, showcasing tangible progress in this key growth area.

Financially, CVS Group demonstrated resilience with a 7% revenue increase to £645.8 million and a 10% rise in adjusted EBITDA to £168.3 million for the year ending December 31, 2023. The divestment of its crematoria business in late 2023 provided a substantial capital infusion, enhancing financial flexibility for future strategic initiatives.

| Financial Metric | 2023 Performance | Significance |

| Revenue | £645.8 million (+7%) | Demonstrates strong market demand and operational growth. |

| Adjusted EBITDA | £168.3 million (+10%) | Indicates improved profitability and operational efficiency. |

| Australian Revenue | £31.8 million | Highlights successful international expansion and market penetration. |

What is included in the product

Delivers a strategic overview of CVS Group’s internal and external business factors, detailing its strengths in pharmacy and healthcare services, weaknesses in retail integration, opportunities in expanding telehealth, and threats from competition and regulatory changes.

Provides a clear breakdown of CVS Group's competitive landscape, highlighting areas for strategic intervention and growth.

Weaknesses

CVS Group is under significant regulatory scrutiny in the UK due to an ongoing market investigation by the Competition and Markets Authority (CMA) concerning veterinary services for pets. This investigation, initiated due to concerns about escalating costs, a lack of clear pricing, and restricted consumer choice, has directly affected CVS Group's acquisition strategies within the UK market, introducing an element of considerable uncertainty for the company's growth trajectory and operational stability.

CVS Group's profitability has faced headwinds from rising wage and utility costs. This inflationary pressure has directly impacted the company's profit margins, making it more expensive to operate its veterinary practices and support services. For instance, in 2023, CVS Group reported that higher staff costs, including those influenced by the UK Autumn Budget's increase in the National Living Wage, contributed to a squeeze on earnings.

CVS Group, like many in the UK veterinary sector, grapples with persistent workforce shortages, especially for qualified vets and nurses. This scarcity directly impacts operational capacity and can intensify existing staff workloads, contributing to burnout.

Post-Brexit immigration policies have further complicated the recruitment landscape, making it harder to attract and retain talent from overseas, a crucial source for the industry. Consequently, CVS Group faces ongoing challenges in maintaining adequate staffing levels, which can affect service delivery and growth.

Dependence on UK Market Despite Diversification Efforts

Despite efforts to diversify, CVS Group's reliance on the UK market remains a significant weakness. In 2023, the UK accounted for approximately 80% of the group's revenue, highlighting a substantial concentration risk. This makes the company particularly vulnerable to the prevailing softer market conditions and ongoing regulatory uncertainty within the United Kingdom.

The UK's veterinary sector has faced headwinds, including increased competition and evolving consumer spending habits. For CVS Group, this translates to a potential disproportionate impact on its overall financial performance should these domestic challenges intensify.

- UK Revenue Concentration: Approximately 80% of CVS Group's revenue was derived from the UK in 2023.

- Market Sensitivity: The company's performance is highly sensitive to UK economic conditions and consumer confidence.

- Regulatory Exposure: Evolving veterinary regulations in the UK present a direct and significant risk to operations and profitability.

Cybersecurity Risks and Reputational Damage

CVS Group has faced significant cybersecurity challenges, including a notable breach in early 2024 that impacted its operations and profitability. Such incidents not only result in direct financial losses from remediation efforts and potential fines but also create substantial operational disruptions. The trust of clients and partners can be severely eroded, leading to long-term reputational damage that is difficult and costly to repair.

The financial implications of these breaches are substantial. For instance, the 2024 cybersecurity incident at CVS Group reportedly cost the company millions in lost revenue and increased operational expenses. Beyond immediate financial hits, the ongoing threat of cyberattacks necessitates continuous investment in advanced security measures, diverting resources that could otherwise be allocated to growth initiatives.

- Cybersecurity Breaches: CVS Group experienced a significant cybersecurity incident in early 2024, leading to financial losses and operational disruptions.

- Reputational Impact: Such breaches can severely damage CVS Group's reputation and erode customer trust, impacting long-term brand value.

- Financial Costs: Remediation, regulatory fines, and lost business due to security incidents represent a considerable financial burden.

- Operational Disruptions: Cybersecurity events can halt or impair critical business functions, affecting service delivery and revenue generation.

CVS Group's significant reliance on the UK market, accounting for approximately 80% of its revenue in 2023, presents a substantial concentration risk. This makes the company highly susceptible to domestic economic downturns and evolving regulatory landscapes, as seen with the ongoing CMA investigation into veterinary services.

The company is also burdened by rising operational costs, including wages and utilities, which directly squeezed profit margins in 2023. Furthermore, persistent workforce shortages, exacerbated by post-Brexit immigration policies, challenge CVS Group's ability to maintain adequate staffing levels and operational capacity.

A critical weakness identified is CVS Group's vulnerability to cybersecurity threats, highlighted by a significant breach in early 2024. This incident resulted in millions in financial losses, operational disruptions, and potential long-term reputational damage, underscoring the need for continuous investment in security measures.

| Weakness | Description | Impact | Supporting Data (2023/2024) |

| UK Revenue Concentration | Heavy reliance on the UK market | Vulnerability to UK-specific economic and regulatory risks | ~80% of revenue from UK in 2023 |

| Rising Operational Costs | Increased wages and utility expenses | Pressure on profit margins | Higher staff costs cited as impacting earnings |

| Workforce Shortages | Difficulty in recruiting and retaining vets/nurses | Impacts operational capacity and increases staff workload | Exacerbated by post-Brexit immigration policies |

| Cybersecurity Vulnerability | Exposure to data breaches and cyberattacks | Financial losses, operational disruption, reputational damage | Early 2024 breach led to millions in losses |

Full Version Awaits

CVS Group SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the CVS Group SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file for CVS Group. The complete version, offering a comprehensive breakdown of their strategic positioning, becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, providing critical insights into CVS Group's competitive landscape.

Opportunities

The global pet healthcare market is experiencing robust expansion, with projections indicating continued growth through 2025. This upward trend is fueled by a rising number of pet owners prioritizing their pets' well-being, leading to increased spending on veterinary services, pharmaceuticals, and preventative care. For CVS Group, this represents a significant opportunity to leverage its existing infrastructure and expertise to capture a larger share of this expanding market.

In Europe specifically, the pet care sector is also showing strong performance. Factors like the increasing humanization of pets and a greater emphasis on advanced veterinary treatments are driving demand. CVS Group can capitalize on this by enhancing its service offerings, potentially introducing specialized treatments or expanding its diagnostic capabilities to meet evolving pet owner expectations and generate further revenue streams.

The online pet pharmacy and e-commerce pet care sectors are booming, with consumers increasingly opting for digital channels to buy pet medications and supplies. This trend is evidenced by the projected growth of the global online pet care market, which is expected to reach over $30 billion by 2028, showcasing a substantial opportunity for CVS Group to expand its digital footprint and capture a larger share of this expanding market.

The rise of telemedicine presents a compelling avenue for CVS Group to integrate virtual consultations and digital health solutions into its pet care offerings. By leveraging these technologies, the company can enhance customer convenience, offer personalized advice, and potentially improve pet health outcomes, aligning with the growing demand for accessible and tech-enabled healthcare services.

CVS Group's robust financial position, bolstered by capital from recent divestments, creates a significant opportunity for strategic acquisitions. This financial flexibility allows the company to pursue growth through inorganic means, particularly in markets offering a stable and supportive regulatory landscape, such as Australia.

The Australian market, for instance, presents a favorable environment for expansion. In 2023, the Australian veterinary services market was valued at approximately AUD 10 billion and is projected to grow at a compound annual growth rate of 5.5% through 2028, indicating strong underlying demand and potential for market share gains.

Diversification into Specialist and Niche Services

The veterinary market's increasing complexity presents a significant opportunity for practices like CVS Group to expand into specialized and niche services. This strategic move can attract a broader clientele and boost revenue streams by offering advanced veterinary care.

These specialized offerings can encompass areas such as:

- Advanced Diagnostics: Implementing cutting-edge imaging technologies and laboratory services.

- Specialized Surgeries: Developing expertise in complex orthopedic, oncological, or soft tissue surgeries.

- Niche Preventative Care: Creating tailored wellness plans for specific breeds, life stages, or chronic conditions.

- Referral Services: Positioning the practice as a go-to for difficult cases requiring specialized knowledge.

For instance, the global veterinary diagnostics market was valued at approximately USD 4.5 billion in 2023 and is projected to grow, indicating a strong demand for these advanced services. By investing in specialized equipment and training, CVS Group can capitalize on this trend, differentiating itself and enhancing its competitive edge.

Leveraging Technology for Operational Efficiency and Client Engagement

CVS Group can significantly boost its operations and client interactions by continuing its investment in technology. Upgrading to cloud-based systems and refining online platforms are key to streamlining processes and offering a smoother experience for pet owners. This technological advancement also supports better communication channels, ensuring clients are well-informed and engaged.

The integration of artificial intelligence (AI) presents a substantial opportunity to elevate the standard of veterinary care. AI can assist in diagnostics, treatment planning, and even predictive health monitoring, leading to more precise and effective patient outcomes. For instance, AI-powered diagnostic tools are increasingly being adopted in veterinary medicine, with market growth projected to be robust in the coming years.

- Enhanced Operational Efficiency: Continued investment in cloud infrastructure and digital platforms can reduce administrative burdens and improve workflow management across CVS Group's clinics.

- Streamlined Client Experience: Advanced online portals and communication tools will offer clients easier access to appointment booking, pet health records, and veterinary advice, improving satisfaction.

- AI-Powered Veterinary Care: Exploring AI for diagnostic support and personalized treatment plans can lead to higher quality patient care and potentially better health outcomes.

- Data-Driven Insights: Technology enables better data collection and analysis, providing valuable insights into operational performance and client needs, informing strategic decisions.

The expanding global pet healthcare market, projected for continued growth through 2025, offers CVS Group a prime opportunity to increase its market share by leveraging its existing infrastructure and expertise.

The increasing humanization of pets and demand for advanced veterinary treatments in Europe present a chance for CVS Group to enhance its service offerings and potentially introduce specialized treatments.

The booming online pet pharmacy and e-commerce sectors, expected to exceed $30 billion by 2028, provide a significant avenue for CVS Group to expand its digital presence and capture a larger share of this rapidly growing market.

The integration of telemedicine and AI in veterinary care can enhance customer convenience, improve diagnostics, and lead to more precise patient outcomes, aligning with the growing demand for tech-enabled healthcare solutions.

| Market Segment | 2023 Value (USD) | Projected Growth (CAGR) | Opportunity for CVS Group |

|---|---|---|---|

| Global Pet Healthcare | N/A (Robust Growth) | Continued Growth through 2025 | Expand market share with existing infrastructure |

| European Pet Care | N/A (Strong Performance) | N/A | Enhance services, introduce specialization |

| Online Pet Pharmacy | N/A | Exceed $30 billion by 2028 | Expand digital footprint |

| Veterinary Diagnostics | ~$4.5 billion | Projected Growth | Invest in advanced equipment and training |

Threats

The UK veterinary sector is seeing a significant rise in corporate ownership, with major groups now owning a substantial percentage of veterinary practices. This trend, evident as of early 2024, intensifies competition, potentially forcing price adjustments and creating hurdles for smaller or independent practices trying to compete.

This consolidation means that larger, well-funded entities are increasingly setting the market's pace. For instance, by the end of 2023, the top five corporate groups in the UK were estimated to own over 40% of all veterinary practices, a figure that continues to grow, putting pressure on smaller players to maintain profitability and market share.

The ongoing Competition and Markets Authority (CMA) investigation into the pharmacy sector presents a considerable threat to CVS Group. Potential regulatory changes could mandate greater pricing transparency, restrict cross-selling opportunities, and alter the existing market structure.

Any new regulations stemming from the CMA's findings, expected to be released in late 2024 or early 2025, could directly impact CVS Group's operational strategies and, consequently, its profitability. For instance, if the CMA enforces stricter rules on how pharmacies can bundle services or advertise prices, CVS Group might need to significantly adapt its business model.

The CMA's scrutiny, which began in 2023, is examining competition in the provision of pharmacy services. If the investigation leads to interventions, it could affect CVS Group's ability to leverage its scale for favorable pricing or to implement integrated health service offerings, potentially impacting its competitive edge.

Persistent inflation and the ongoing cost-of-living crisis are significant economic headwinds for CVS Group. As household budgets tighten, consumers may defer or reduce discretionary spending on pet care, including non-essential veterinary services or premium products. For instance, in early 2024, inflation in the UK remained elevated, impacting disposable incomes, which directly affects how much pet owners can allocate to veterinary bills.

Veterinary Professional Burnout and Mental Health Concerns

Veterinary professionals face significant burnout due to demanding workloads and persistent staff shortages. This strain on the workforce directly impacts mental well-being, leading to increased stress and potential health issues. For instance, a 2023 survey by the American Veterinary Medical Association (AVMA) indicated that over 35% of veterinarians reported experiencing burnout, a figure that has been on the rise.

These mental health concerns can severely affect employee retention rates within veterinary practices. When staff members are overwhelmed and struggling, the quality of patient care can also suffer, creating a cycle of stress and decreased satisfaction. This is particularly challenging for companies like CVS Group, as maintaining consistent staffing levels and high service standards is crucial for operational success and client trust.

- Staff Shortages: Persistent understaffing exacerbates workload for existing veterinary teams.

- Burnout Impact: High stress levels contribute to mental health issues, reducing job satisfaction.

- Quality of Care: Overworked staff can lead to errors and a decline in the standard of veterinary services provided.

- Retention Challenges: Burnout and stress are key drivers of professionals leaving the industry, making recruitment and retention difficult.

Increased Competition from Online Pharmacies and Alternative Providers

The burgeoning online pet pharmacy sector presents a significant competitive challenge for CVS Group. These digital platforms, including major e-commerce players and specialized online pet retailers, are rapidly expanding their reach and product offerings. In 2024, the global online pet pharmacy market was valued at approximately $10.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, driven by consumer demand for convenience and often lower prices compared to brick-and-mortar veterinary clinics. This trend directly impacts traditional veterinary channels, including those associated with CVS Group's pet health services, by potentially siphoning off prescription and over-the-counter medication sales.

Pet owners are increasingly prioritizing the ease of ordering pet supplies and medications from their homes, a convenience that online providers excel at delivering. Furthermore, competitive pricing strategies employed by these digital competitors can make them a more attractive option for budget-conscious consumers. This shift in consumer behavior poses a direct threat to revenue streams that have historically relied on in-clinic prescription fulfillment. For instance, a significant portion of veterinary practice revenue can come from dispensing medications, and this is directly at risk from online alternatives.

- Online pet pharmacies offer greater convenience for prescription refills and general pet supplies.

- Competitive pricing from e-commerce platforms attracts price-sensitive pet owners.

- The digital shift in pet healthcare threatens traditional veterinary revenue from medication sales.

The increasing consolidation within the UK veterinary market, with major groups owning over 40% of practices by late 2023, intensifies competition and pressures independent practices. Furthermore, the ongoing CMA investigation into pharmacy services, with findings anticipated in late 2024 or early 2025, could lead to regulatory changes impacting pricing and service bundling for CVS Group.

Economic pressures like persistent inflation and the cost-of-living crisis, evident in early 2024 UK inflation rates, may cause pet owners to reduce discretionary spending on pet care. Simultaneously, the veterinary sector faces significant staff shortages and burnout, with over 35% of veterinarians reporting burnout in a 2023 AVMA survey, impacting retention and quality of care.

The rapidly expanding online pet pharmacy sector, valued at approximately $10.5 billion globally in 2024 and growing at a 7% CAGR, poses a direct threat by offering convenience and competitive pricing, potentially eroding CVS Group's revenue from in-clinic medication sales.

SWOT Analysis Data Sources

This CVS Group SWOT analysis is built upon a foundation of comprehensive data, including their latest financial statements, detailed market research reports, and insights from industry experts to ensure a robust and accurate strategic overview.