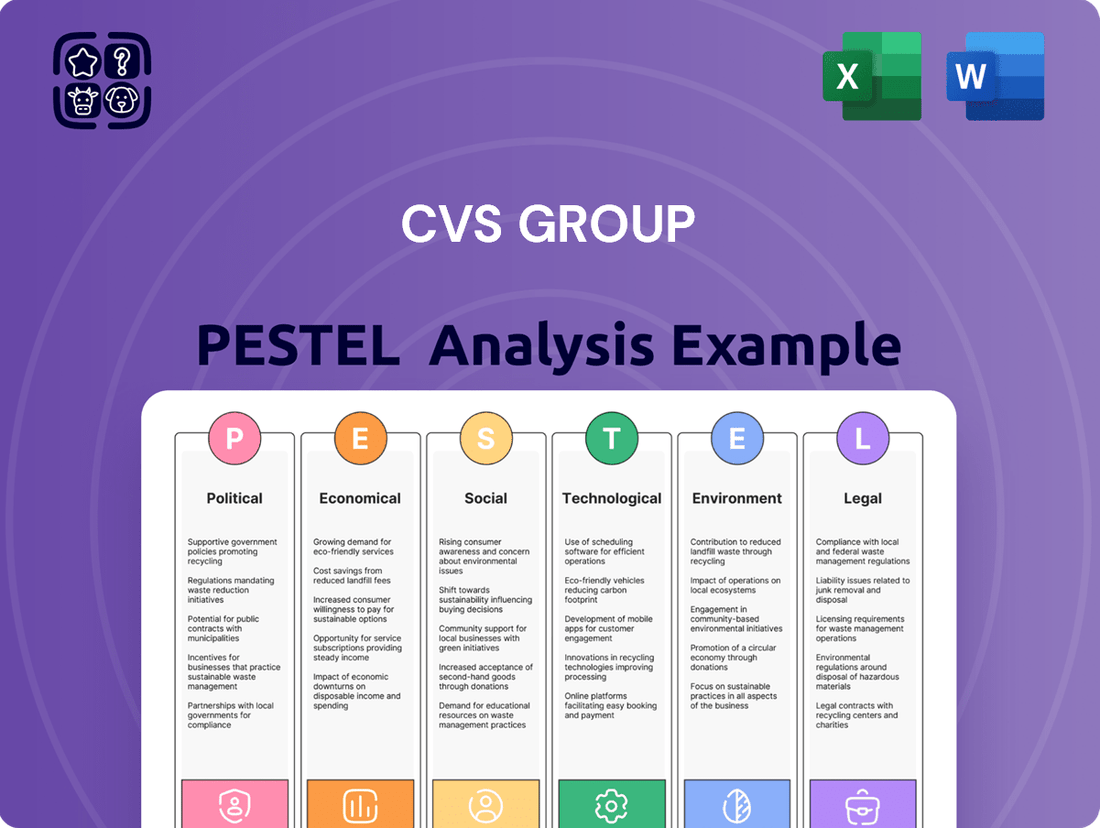

CVS Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping CVS Group's trajectory. Our PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Download the full report to gain actionable intelligence and refine your strategic planning.

Political factors

CVS Group operates in a heavily regulated veterinary sector across the UK, Ireland, and the Netherlands. Shifts in government policies concerning animal welfare, veterinary practice standards, and market competition can materially influence their business. For example, the UK's Competition and Markets Authority (CMA) is actively investigating the veterinary services market, with a particular focus on pricing and transparency. This ongoing scrutiny directly impacts CVS Group's strategic planning and its approach to acquisitions within the UK.

The ongoing evolution of animal welfare laws in the UK and EU significantly impacts veterinary operations. For instance, the UK introduced new penalty notices for animal welfare offenses in January 2024, increasing accountability for practices.

Furthermore, proposed legislation aims to raise the minimum age for imported dogs and cats, potentially altering import volumes and associated veterinary checks. Stricter rules on breeding, selling, and importing companion animals, alongside campaigns against practices like ear cropping, directly influence the demand for certain veterinary services and ethical standards for companies like CVS Group.

Brexit has created a more complex operating environment for CVS Group, even though its core markets are the UK, Ireland, and the Netherlands. The UK's departure from the European Union means CVS Group must now manage distinct regulatory frameworks, especially for veterinary medicines. This divergence requires careful attention to ensure compliance across different jurisdictions.

The UK's independent approach to veterinary medicine regulations, following Brexit, necessitates CVS Group to adapt its product sourcing and distribution strategies. This also impacts the ease of movement for veterinary professionals between the UK and EU countries, potentially affecting staffing and service delivery. For instance, the Veterinary Medicines Directorate (VMD) in the UK now sets its own standards, which may differ from those in the EU.

Political Stability and Healthcare Policy

Political stability in the UK, Ireland, and the Netherlands provides a foundational element for CVS Group's operations. Fluctuations in government stability can impact investment climates and regulatory consistency. For instance, the UK's recent general election cycle in 2024 has introduced a period of political recalibration, potentially influencing future healthcare and economic policies that could indirectly affect the veterinary sector.

National healthcare policies, while primarily focused on human health, can have ripple effects on veterinary services. Government funding for animal health initiatives, such as disease surveillance or vaccination programs, directly benefits veterinary practices. Furthermore, public health campaigns addressing zoonotic diseases, which are increasingly a focus for governments, can boost demand for preventative veterinary care and diagnostics.

Regulatory frameworks concerning antimicrobial and anti-parasitic resistance are a significant political factor. The European Union's ongoing efforts to combat resistance, echoed in national policies like Ireland's updated strategies, directly shape how veterinary medicines are prescribed and utilized. CVS Group must navigate these evolving regulations, which aim to preserve the efficacy of critical treatments, impacting product sales and treatment protocols.

- UK Political Landscape: The 2024 UK general election outcome will shape economic policy and potentially influence funding for public health initiatives relevant to animal welfare.

- EU Veterinary Regulations: Continued enforcement of EU directives on antimicrobial stewardship, such as the Veterinary Medicinal Products Regulation (VMPR), impacts prescribing practices and product availability across member states where CVS operates.

- Irish Public Health Focus: Ireland's commitment to tackling zoonotic diseases and antimicrobial resistance through national action plans creates opportunities for veterinary services offering diagnostic and preventative solutions.

Competition Authority Scrutiny

Competition authorities, like the UK's Competition and Markets Authority (CMA), are increasingly scrutinizing sectors where large players operate, including veterinary services. The CMA's ongoing market investigation into the UK veterinary sector, launched in 2023 and expected to conclude in 2024, directly impacts CVS Group, a major player in this market. This investigation aims to understand how competition is working and identify potential issues that could harm pet owners, such as higher prices or reduced choice.

The potential outcomes of such investigations are significant for CVS Group. Mandated changes could affect their business practices, pricing strategies, and even future acquisition plans. For instance, if the CMA identifies concerns about market concentration, CVS Group might face restrictions on acquiring new practices, a key driver of its growth. This political pressure underscores the importance of compliance and proactive engagement with regulatory bodies to mitigate potential disruptions to strategic expansion, especially within its largest market, the UK.

- CMA Market Investigation: The CMA's investigation into the UK veterinary sector is a significant political factor, focusing on competition and potential consumer harm.

- Impact on CVS Group: As a leading veterinary group in the UK, CVS Group is directly subject to the scrutiny and potential remedies arising from this investigation.

- Strategic Implications: Findings could lead to mandated changes in pricing, business practices, or ownership structures, affecting CVS Group's growth strategy.

- 2024 Outlook: The conclusion of the CMA investigation in 2024 will provide clarity on the specific regulatory landscape CVS Group must navigate.

Political factors significantly shape CVS Group's operational environment, particularly concerning regulatory oversight and policy shifts. The UK's Competition and Markets Authority (CMA) investigation into the veterinary sector, ongoing through 2024, directly impacts CVS Group's market practices and acquisition strategies due to its substantial UK presence. Evolving animal welfare legislation, such as new penalty notices introduced in the UK in early 2024, increases accountability and influences veterinary standards. Furthermore, post-Brexit regulatory divergence between the UK and EU necessitates careful navigation of distinct frameworks for veterinary medicines and professional mobility.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CVS Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces present both challenges and strategic opportunities for CVS Group's growth and market positioning.

A concise, actionable summary of the CVS Group PESTLE analysis, designed to immediately highlight key external threats and opportunities for strategic decision-making.

Economic factors

The ongoing trend of pet humanization is a powerful economic driver for the veterinary industry. Pet owners are demonstrating a greater willingness to invest in premium services, advanced medical treatments, and proactive health management for their animal companions. This elevated spending directly benefits veterinary service providers like CVS Group.

This commitment to pet well-being is further amplified by a notable increase in pet ownership observed in the wake of the COVID-19 pandemic. This surge in the pet population translates into sustained and growing demand for veterinary care, ensuring a resilient market for CVS Group's services even amidst broader economic fluctuations.

CVS Group is navigating a landscape marked by persistent inflation, which is notably affecting crucial operational expenses like wages and energy. For instance, the US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose by 3.4% in April 2024 compared to the previous year, indicating broad-based cost increases across the economy.

These escalating costs directly challenge CVS Group's profitability, even with ongoing efforts to boost operational efficiency. The company must carefully manage its finances, potentially leading to strategic decisions about service pricing to offset these pressures and maintain healthy profit margins in the face of a dynamic economic environment.

The economic health of the UK, Ireland, and the Netherlands significantly impacts how much people can spend on their pets. In 2024, the UK's GDP growth is projected to be around 0.5%, indicating a cautious economic environment. This can make pet owners more mindful of discretionary spending on veterinary services.

While economic slowdowns might typically curb spending on non-essential services, the ongoing trend of pet humanization, where pets are treated as family members, could offer some resilience for the veterinary sector. Even with tighter budgets, owners may prioritize their pets' well-being, potentially buffering demand for essential care.

In Ireland, economic growth forecasts for 2024 hover around 4.7%, suggesting a more robust consumer environment. Similarly, the Netherlands is expected to see GDP growth of approximately 1.5% in 2024. These stronger economic indicators generally translate to higher disposable income, potentially supporting increased spending on pet healthcare services for CVS Group.

Market Consolidation and Acquisition Activity

The veterinary market, especially in Ireland, is seeing a trend where larger companies are buying up smaller veterinary practices. CVS Group is a prime example of this, actively acquiring smaller clinics to grow its presence. This consolidation offers CVS a chance to increase its market share, but it also brings challenges like the costs of integrating new practices and facing competition from other firms doing the same.

This market consolidation is a significant economic factor for CVS Group. For instance, in the UK and Ireland, the veterinary sector has witnessed substantial M&A activity. By the end of 2023, the number of independent practices had continued to decline as larger corporate groups expanded their portfolios. CVS Group itself reported continued strategic acquisitions as a key growth driver in its 2024 financial updates, aiming to leverage economies of scale and enhance service offerings across its expanding network.

- Market Consolidation: The veterinary industry, particularly in Ireland, is consolidating, with larger entities like CVS acquiring smaller practices.

- Growth Opportunity: This trend allows CVS Group to expand its market share and operational footprint.

- Integration Challenges: CVS faces potential hurdles related to the costs and complexities of integrating acquired practices.

- Competitive Landscape: Increased competition arises from other consolidators vying for market dominance.

Availability and Cost of Pet Insurance

The increasing availability and affordability of pet insurance is a significant economic factor for CVS Group. As more pet owners opt for insurance, their sensitivity to the cost of veterinary care diminishes. This can lead to greater demand for higher-value treatments and services, directly benefiting veterinary groups like CVS.

In 2024, the pet insurance market continued its robust growth, with estimates suggesting it could reach over $10 billion globally by 2027, driven by increased pet ownership and a greater willingness to spend on pet healthcare. This trend directly impacts CVS Group by potentially increasing the volume and value of services utilized by insured pets.

- Increased Service Utilization: Pet insurance encourages owners to seek veterinary care for conditions they might otherwise forgo due to cost, boosting service revenue for CVS.

- Higher Average Transaction Value: Owners with insurance are more likely to opt for advanced diagnostics and treatments, increasing the average revenue per patient.

- Market Growth Correlation: The expansion of the pet insurance sector, projected to see compound annual growth rates of 14-16% in key markets through 2025, directly correlates with potential revenue growth for veterinary service providers like CVS Group.

Economic factors significantly shape CVS Group's operational environment, with inflation posing a direct challenge to managing rising costs like wages and energy. For instance, the UK's inflation rate was 2.3% in April 2024, impacting operational expenses. Conversely, varying economic growth across key markets like Ireland (projected 4.7% GDP growth in 2024) and the Netherlands (1.5% GDP growth in 2024) influences consumer spending power on pet healthcare.

Market consolidation within the veterinary sector, particularly in the UK and Ireland, presents both opportunities and challenges for CVS Group. The ongoing acquisition of smaller practices by larger entities, including CVS, allows for market share expansion but also necessitates careful management of integration costs and competitive pressures.

The increasing adoption of pet insurance is a positive economic trend for CVS Group, as it reduces cost sensitivity among pet owners, leading to greater utilization of higher-value veterinary services. The global pet insurance market is expected to exceed $10 billion by 2027, indicating a strong correlation with potential revenue growth for veterinary service providers.

| Economic Factor | Impact on CVS Group | Supporting Data (2024/2025) |

| Inflation | Increased operational costs (wages, energy) | UK CPI: 2.3% (April 2024) |

| Economic Growth | Influences consumer spending on pet healthcare | Ireland GDP: ~4.7% (2024 proj.); Netherlands GDP: ~1.5% (2024 proj.) |

| Market Consolidation | Opportunity for market share growth; integration costs | Continued M&A activity in UK/Ireland veterinary sector; CVS strategic acquisitions |

| Pet Insurance Penetration | Increased demand for higher-value services | Global pet insurance market projected >$10 billion by 2027 |

Same Document Delivered

CVS Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CVS Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping CVS Group's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element with actionable analysis for strategic planning.

Sociological factors

The growing trend of pet humanization, where pets are increasingly seen as family members, is a major sociological influence on CVS Group. This shift means owners are more inclined to spend on high-quality veterinary services, preventative care, and specialized treatments, which directly benefits CVS Group's business.

This trend is reflected in market growth figures. For instance, the global pet care market was valued at an estimated $261 billion in 2022 and is projected to reach $350 billion by 2027, showcasing a strong demand for premium pet products and services, including advanced veterinary care offered by companies like CVS Group.

Demographic shifts, like an aging population, can affect pet ownership trends and the demand for specific veterinary services. For example, an increasing number of older adults may opt for smaller, less demanding pets, influencing the types of treatments and products sought.

Despite potential demographic shifts, the surge in pet ownership, which saw a significant increase following the COVID-19 pandemic, continues to bolster the market for veterinary groups like CVS Group. In the UK, for instance, pet ownership remained high in 2023, with an estimated 60% of households owning at least one pet, a trend that has sustained demand for veterinary care.

Public perception of animal welfare is increasingly shaping consumer choices in veterinary services. Growing awareness means clients expect higher standards of care, influencing their choice of veterinary providers. For CVS Group, this translates to a greater demand for services that demonstrably prioritize ethical treatment and well-being, aligning with their stated commitment to clinical governance and providing the best possible care.

Work-Life Balance and Veterinary Staff Well-being

The veterinary industry, including practices operated by CVS Group, faces significant sociological challenges related to staff well-being. Recruitment and retention are ongoing concerns, with many practices struggling to find and keep qualified veterinary professionals. This is exacerbated by widespread staff shortages, which place immense pressure on existing teams.

These pressures directly impact service delivery and operational costs. For instance, a 2023 survey by the Veterinary Practice Management Association (VPMA) indicated that over 60% of UK veterinary practices reported difficulty in recruiting veterinary surgeons. This scarcity drives up labor costs and can lead to longer waiting times for clients, affecting client satisfaction.

- Staff Shortages: A significant percentage of UK veterinary practices report challenges in recruiting veterinary surgeons, impacting service availability.

- Work-Life Balance: High stress levels and demanding schedules contribute to burnout, a prevalent issue among veterinary professionals.

- Retention Issues: Poor work-life balance and high stress directly contribute to a higher turnover rate, increasing training and recruitment expenses for companies like CVS Group.

Influence of Social Media and Online Information

The explosion of social media and easily accessible online content significantly shapes how pet owners understand and approach pet health. This digital landscape empowers owners with information, potentially leading to more engaged and knowledgeable clients. For instance, platforms like TikTok and Instagram saw a surge in pet health content throughout 2024, with user-generated videos on topics like "common dog illnesses" and "cat nutrition tips" garnering millions of views.

However, this readily available information also presents challenges. Misinformation and the spread of unverified health advice can create unrealistic expectations or lead to self-diagnosis, potentially impacting client communication and the effective delivery of veterinary services. A 2024 survey indicated that over 60% of pet owners consult online resources before or instead of speaking with a veterinarian, highlighting the need for clear, evidence-based communication from veterinary professionals.

This trend necessitates that veterinary practices, like those under the CVS Group umbrella, adapt their client engagement strategies.

- Increased Client Engagement: Social media allows for direct interaction with pet owners, fostering community and providing a platform for educational content.

- Information Overload & Misinformation: The sheer volume of online data can be overwhelming, with a significant portion being inaccurate or misleading.

- Shifting Expectations: Owners may arrive with preconceived notions or demands based on anecdotal online evidence, requiring careful management by veterinary staff.

- Digital Literacy Gap: While many owners are tech-savvy, there's a need to ensure all clients can access and critically evaluate reliable pet health information.

The increasing humanization of pets means owners view them as family, driving demand for premium veterinary services and advanced care, which directly benefits CVS Group. This trend is supported by the global pet care market, projected to grow from an estimated $261 billion in 2022 to $350 billion by 2027.

Societal shifts like an aging population can influence pet ownership, potentially favoring smaller pets and specific veterinary needs. Despite this, sustained high pet ownership, with around 60% of UK households owning pets in 2023, continues to fuel demand for veterinary services.

Public perception of animal welfare is paramount, with clients expecting higher standards of ethical treatment and well-being from veterinary providers. This aligns with CVS Group's commitment to clinical governance and optimal patient care.

The veterinary sector, including CVS Group's operations, faces significant sociological challenges related to staff shortages and well-being. Over 60% of UK veterinary practices reported difficulties recruiting veterinary surgeons in 2023, increasing labor costs and potentially impacting service delivery.

Technological factors

The surge in telemedicine and virtual consultations is reshaping veterinary services, allowing for remote patient assessments and ongoing care management. This shift not only boosts convenience for pet owners but also presents an opportunity for CVS Group to streamline operations, particularly in initial case assessment and continuous patient support.

By the end of 2024, it's projected that over 60% of veterinary practices in the UK will offer some form of telemedicine, a significant jump from just 20% in 2022, according to industry reports. This technological integration allows CVS Group to expand its reach, offering advice and preliminary diagnoses without requiring physical visits, which can be particularly beneficial for routine check-ups or post-operative monitoring.

Artificial intelligence is significantly transforming veterinary medicine, with AI-powered tools now capable of analyzing medical images like X-rays and ultrasounds with impressive accuracy, aiding in disease detection. For CVS Group, this means potential for faster, more precise diagnoses, improving patient outcomes and operational efficiency. For instance, AI algorithms can identify subtle anomalies that might be missed by the human eye, leading to earlier intervention for conditions like osteoarthritis or dental disease in pets.

The ability of AI to predict disease risks based on patient data allows for proactive and personalized treatment strategies. This can lead to better preventative care plans, potentially reducing the incidence of costly or severe illnesses within CVS Group's patient base. Furthermore, AI can streamline clinical workflows by automating tasks such as record-keeping and preliminary analysis, freeing up veterinarians to focus more on direct patient care and complex cases, thereby enhancing the overall quality of service provided.

Ongoing advancements in medical equipment, such as next-generation ultrasound technologies and sophisticated robotic surgery systems, are significantly enhancing veterinary care capabilities. CVS Group's strategic investment in and seamless integration of these innovations, including 3D printing for bespoke prosthetics, will be paramount to maintaining its leadership in providing comprehensive, high-quality veterinary services.

Data Integration and Electronic Health Records

The increasing adoption of data integration and electronic health records (EHRs) is transforming patient care within the veterinary sector. This technological shift enables more effective management of patient histories, facilitates the identification of emerging health trends across animal populations, and supports the development of personalized wellness plans. For instance, by 2024, a significant majority of veterinary practices are expected to have transitioned to digital record-keeping, streamlining data accessibility and analysis.

Cloud-based solutions are particularly impactful, offering enhanced accessibility and efficiency for veterinary records. This not only improves day-to-day operations but also empowers a more data-driven approach to preventive care, allowing for earlier detection of potential issues and more proactive health management strategies. The global veterinary EHR market size was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially in the coming years.

- Data Integration: Enables a holistic view of patient health, improving diagnostic accuracy and treatment planning.

- EHR Adoption: By 2024, over 80% of veterinary practices in developed markets are anticipated to utilize EHR systems.

- Cloud Solutions: Enhance data accessibility, security, and facilitate remote collaboration among veterinary professionals.

- Preventive Care: Data analytics from EHRs support predictive modeling for disease outbreaks and personalized preventative health recommendations.

Wearable Technology and Remote Monitoring

Wearable technology for pets is opening up new frontiers in veterinary care, allowing for continuous monitoring of vital signs and activity levels. This real-time data collection empowers both pet owners and veterinarians with insights previously unavailable, fostering a more proactive and personalized approach to animal health.

The burgeoning market for pet wearables is a testament to this trend. For instance, the global pet wearable market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $6 billion by 2030, driven by advancements in sensor technology and increasing consumer adoption. This growth directly impacts companies like CVS Group, particularly its Aetna and Caremark segments, by offering new data streams for preventative health programs and chronic condition management for insured pets or through pharmacy loyalty programs.

- Preventative Care: Wearables can detect subtle changes in a pet's behavior or physiology, alerting owners to potential health issues before they become serious, thereby reducing the need for costly emergency treatments.

- Remote Monitoring: Veterinarians can remotely track patient data, enabling early intervention and more efficient management of chronic conditions, potentially improving patient outcomes and reducing clinic visits.

- Data-Driven Insights: The aggregated data from these devices can provide valuable insights into breed-specific health trends and the efficacy of different treatments, informing future product development and service offerings.

Technological advancements are revolutionizing veterinary care, with telemedicine adoption accelerating rapidly. By late 2024, over 60% of UK vet practices are expected to offer virtual consultations, enhancing accessibility for pet owners and streamlining initial assessments for CVS Group.

AI is improving diagnostic accuracy, particularly in medical imaging analysis, leading to earlier disease detection and better patient outcomes. Furthermore, AI's predictive capabilities enable personalized treatment strategies and proactive health management, reducing the incidence of severe illnesses.

The integration of electronic health records (EHRs) and cloud-based solutions is transforming patient data management. By 2024, over 80% of veterinary practices in developed markets are anticipated to use EHRs, facilitating efficient data access, analysis, and the development of personalized wellness plans.

Wearable technology for pets is expanding, with the global market projected to exceed $6 billion by 2030. This trend offers continuous monitoring of vital signs, providing valuable data for preventative care, remote patient management, and deeper insights into animal health trends for CVS Group.

| Technology Area | 2024/2025 Projection/Data | Impact on CVS Group |

|---|---|---|

| Telemedicine Adoption | 60%+ UK practices offering by end of 2024 | Expanded reach, streamlined initial assessments |

| AI in Diagnostics | Increased accuracy in image analysis | Faster, more precise diagnoses, improved patient outcomes |

| EHR Utilization | 80%+ developed market practices by 2024 | Enhanced data management, personalized care plans |

| Pet Wearables Market | Projected to exceed $6 billion by 2030 | New data streams for preventative health, chronic condition management |

Legal factors

The UK's Competition and Markets Authority (CMA) is currently examining the veterinary services market, a significant legal consideration for CVS Group. This investigation scrutinizes market concentration, pricing practices, and overall transparency within the sector.

Potential outcomes from the CMA's review could impose legal remedies impacting CVS Group's operational strategies, especially concerning its acquisition activities within the United Kingdom. For instance, the CMA's findings could influence future merger approvals or necessitate divestitures, affecting CVS Group's market share and growth trajectory.

CVS Group navigates a stringent regulatory landscape for veterinary medicines across its operating regions. New EU veterinary medicinal products regulations implemented in 2022, alongside specific Irish regulations effective late 2024, are key. These mandates include the adoption of electronic prescription systems, a move designed to enhance traceability and combat antimicrobial resistance.

Compliance with these evolving rules, particularly those focusing on reducing antimicrobial usage, is critical for CVS Group's operational integrity and market standing. The financial implications of adapting to new technological requirements, such as electronic prescribing platforms, represent a significant consideration for the group in 2024 and beyond.

CVS Group must strictly adhere to a complex web of national and regional animal health and welfare legislation to maintain its operational license and public trust. This encompasses stringent rules regarding animal care standards, ethical breeding practices, and the intricate regulations governing the import and export of animals across different jurisdictions.

The evolving legal landscape, exemplified by the introduction of new penalty notices in the UK from early 2024 for animal welfare offenses, underscores the critical need for proactive compliance. Failure to meet these legal obligations can result in significant fines, reputational damage, and operational disruptions, directly impacting CVS Group's financial performance and market standing.

Data Protection and Privacy Laws (GDPR)

CVS Group, like any business managing sensitive customer and animal health information, must navigate a complex landscape of data protection and privacy laws. Regulations like the General Data Protection Regulation (GDPR) in the European Union, and its UK equivalent, impose strict requirements on how personal data is collected, processed, and stored. Failure to comply can lead to substantial financial penalties and severe damage to the company's reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The implications for CVS Group are significant, particularly given the volume of personal data it handles through its veterinary services and retail operations. Ensuring robust data security measures and transparent privacy policies is paramount. This includes obtaining clear consent for data usage, providing individuals with access to their data, and implementing procedures for data breach notifications. The company's ongoing commitment to these legal frameworks directly impacts its operational integrity and customer trust.

Key considerations for CVS Group in this area include:

- Data Minimization: Collecting only the data that is absolutely necessary for specific purposes.

- Consent Management: Ensuring explicit and informed consent is obtained for all data processing activities.

- Security Safeguards: Implementing strong technical and organizational measures to protect data from unauthorized access or breaches.

- Data Subject Rights: Establishing clear processes for handling requests related to data access, rectification, and erasure.

Employment Law and Professional Licensing

CVS Group, as a significant employer, navigates a complex web of employment laws across its international operations. These regulations govern everything from minimum wage and working hours to health and safety standards, ensuring fair treatment and a safe working environment for its diverse workforce. For instance, in the UK, the National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, a key consideration for CVS Group's payroll.

The veterinary sector is particularly sensitive to stringent professional licensing and conduct regulations. CVS Group must ensure that all its veterinary surgeons and nurses maintain current registrations with relevant professional bodies, such as the Royal College of Veterinary Surgeons (RCVS) in the UK. Adherence to these standards is crucial not only for legal compliance but also for maintaining the trust and reputation of the organization and its practitioners.

- Compliance with UK National Living Wage: Adherence to the £11.44 per hour rate (April 2024) impacts wage structures for many CVS Group employees.

- RCVS Registration: Ensuring all veterinary surgeons maintain up-to-date RCVS professional registration is a fundamental legal requirement.

- International Employment Standards: CVS Group must also comply with varying employment laws in countries like the Netherlands and Ireland, affecting working conditions and staff welfare.

- Professional Conduct: Upholding veterinary professional conduct codes is paramount to maintaining the integrity of services provided.

The CMA's ongoing review of the UK veterinary market, focusing on competition and pricing, could lead to remedies impacting CVS Group's acquisition strategies and market share. New EU and Irish regulations, effective 2022 and late 2024 respectively, mandate electronic prescribing to combat antimicrobial resistance, requiring significant investment in technology for CVS Group.

Compliance with stringent animal health and welfare laws, including new UK penalty notices for welfare offenses from early 2024, is critical. Data protection laws like GDPR impose strict rules on handling sensitive information, with potential fines up to 4% of global annual revenue, directly affecting CVS Group's operational integrity and customer trust.

Employment law compliance, including the UK National Living Wage increase to £11.44 per hour in April 2024, impacts CVS Group's payroll. Maintaining RCVS registration for all veterinary professionals is a fundamental legal requirement, alongside adherence to international employment standards and professional conduct codes.

| Legal Factor | Impact on CVS Group | Key Data/Regulation |

| Market Competition Review | Potential restrictions on acquisitions, market share adjustments | CMA investigation into UK veterinary services market |

| Veterinary Medicine Regulations | Mandatory adoption of e-prescribing, focus on antimicrobial resistance | EU regulations (2022), Irish regulations (late 2024) |

| Animal Welfare Legislation | Increased scrutiny, potential fines for non-compliance | New UK penalty notices for animal welfare offenses (early 2024) |

| Data Protection & Privacy | Strict data handling requirements, risk of substantial fines | GDPR fines up to 4% of global annual revenue |

| Employment Law | Wage compliance, health and safety standards | UK National Living Wage: £11.44/hour (April 2024) |

| Professional Licensing | Mandatory professional registration for veterinary staff | RCVS registration for UK veterinary surgeons and nurses |

Environmental factors

The veterinary sector, including operations like those of CVS Group, contributes to greenhouse gas emissions through energy use in clinics and the release of anesthetic gases. For instance, the use of volatile anesthetic agents like sevoflurane and isoflurane, common in veterinary procedures, has a significant global warming potential, with sevoflurane having a warming potential approximately 130 times that of carbon dioxide over 100 years.

CVS Group, as a major player in the veterinary market, faces mounting pressure from regulators, customers, and investors to demonstrably reduce its carbon footprint. This aligns with global environmental targets and growing stakeholder demand for corporate sustainability, pushing companies to adopt greener practices and report on their environmental impact.

Veterinary practices, including those within CVS Group, generate significant waste streams, encompassing medical disposables, chemical byproducts, and substantial amounts of single-use plastics. In the UK alone, the veterinary sector contributes to the national waste challenge, with a growing emphasis on reducing landfill contributions. CVS Group's commitment to sustainability necessitates advanced waste management protocols, focusing on segregation, sterilization of hazardous materials, and responsible disposal methods to meet stringent environmental regulations.

Resource consumption is another critical environmental factor. The high demand for medical supplies, pharmaceuticals, and energy within veterinary clinics presents an opportunity for CVS Group to enhance its efficiency. For instance, exploring partnerships for bulk purchasing of eco-friendly consumables and investing in energy-efficient equipment can significantly reduce the group's carbon footprint. This aligns with broader industry trends, where companies are increasingly evaluated on their environmental stewardship and resourcefulness.

CVS Group's commitment to antimicrobial stewardship in veterinary practices is a significant environmental consideration. The responsible use of antibiotics helps curb the spread of antimicrobial resistance (AMR), a growing global threat to both human and animal health, with significant ecological implications.

In 2024, the World Health Organization (WHO) continued to emphasize the critical need for reducing antimicrobial use in livestock, a sector where veterinary medicine plays a vital role. CVS Group's adherence to stringent pharmaceutical stewardship programs and regulatory guidelines, such as those promoted by the European Medicines Agency (EMA) or equivalent bodies, directly impacts its environmental footprint by minimizing the discharge of active pharmaceutical ingredients into the environment.

Prudent antimicrobial use, a core tenet of environmental responsibility for veterinary service providers like CVS Group, involves prescribing antibiotics only when truly necessary and selecting the most targeted agents. This approach not only preserves the efficacy of these life-saving drugs for future use but also reduces the potential for resistant bacteria to emerge and spread through ecosystems.

Water and Energy Efficiency

Optimizing water and energy use in veterinary clinics is a key environmental focus for CVS Group. This involves adopting energy-efficient equipment and exploring renewable energy options to lessen their impact. For instance, many modern veterinary practices are installing LED lighting and high-efficiency HVAC systems, which can reduce energy consumption by up to 30% compared to older technologies.

CVS Group's commitment extends to encouraging sustainable commuting for its employees. This could involve promoting public transport, cycling, or electric vehicle use for staff travel to and from work. Such initiatives not only reduce carbon emissions but also align with growing consumer and regulatory expectations for corporate environmental responsibility.

- Energy Efficiency: Investing in energy-efficient equipment and lighting can significantly cut operational costs and environmental impact.

- Renewable Energy: Exploring solar or wind power for facilities can further reduce reliance on fossil fuels.

- Water Conservation: Implementing water-saving fixtures and practices in clinics minimizes water usage.

- Sustainable Transportation: Encouraging eco-friendly commuting options for staff reduces the company's overall carbon footprint.

Sustainability Reporting and Corporate Responsibility

CVS Group is increasingly scrutinized for its environmental impact, making robust sustainability reporting a critical factor. In 2023, the company highlighted progress in reducing greenhouse gas emissions, aiming for a 30% reduction by 2030 from a 2019 baseline, a move that resonates with environmentally conscious investors and consumers.

The company’s commitment is demonstrated through its annual sustainability reports, which detail efforts in areas like waste reduction and responsible sourcing. For instance, CVS Health reported diverting over 70% of its operational waste from landfills in 2023, a figure that appeals to stakeholders prioritizing circular economy principles.

- Reputation Management: Transparent sustainability reporting enhances CVS Group's brand image and builds trust with customers and investors.

- Stakeholder Engagement: Demonstrating environmental responsibility attracts and retains environmentally conscious employees, partners, and shareholders.

- Regulatory Compliance: Proactive reporting can anticipate and align with evolving environmental regulations, mitigating future risks.

Environmental factors significantly influence CVS Group's operations, from greenhouse gas emissions linked to anesthetic gases like sevoflurane to waste management challenges in veterinary practices. The company faces increasing pressure to reduce its carbon footprint, with a stated goal of a 30% reduction in greenhouse gas emissions by 2030 from a 2019 baseline, as reported in 2023.

CVS Group's approach to antimicrobial stewardship is a key environmental consideration, aiming to curb the spread of antimicrobial resistance. This aligns with global health initiatives and reduces the environmental impact of pharmaceutical discharge. Furthermore, optimizing water and energy use, including exploring renewable energy options and promoting sustainable commuting, are critical for minimizing the company's ecological footprint.

Transparent sustainability reporting is paramount for CVS Group, enhancing its reputation and stakeholder engagement. In 2023, CVS Health reported diverting over 70% of its operational waste from landfills, demonstrating a commitment to environmental responsibility that appeals to a growing segment of environmentally conscious investors and consumers.

PESTLE Analysis Data Sources

Our PESTLE analysis for CVS Group is built upon a robust foundation of data sourced from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the business.