CVS Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

CVS Group navigates a complex retail pharmacy landscape. Understanding the intense rivalry among existing competitors and the significant bargaining power of both suppliers and buyers is crucial for their strategic positioning. The threat of new entrants, while present, is somewhat mitigated by high capital requirements.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CVS Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The veterinary profession in the UK experiences substantial bargaining power due to a critical shortage of qualified veterinary surgeons and nurses. This scarcity, intensified by post-Brexit immigration policies, drives up demand for skilled professionals.

For CVS Group, this situation translates directly into escalating wage inflation and consequently, higher people costs. This pressure on labor expenses significantly impacts their adjusted EBITDA margins, a trend reflected in their financial statements.

Suppliers of veterinary pharmaceuticals and specialized equipment hold significant sway in the animal health sector. While the market features several large distributors and drug manufacturers, the presence of proprietary or exclusively distributed products grants these suppliers considerable bargaining power, impacting CVS Group's operational costs and product availability.

CVS Group, like its competitors, depends on a steady influx of these critical veterinary supplies to maintain its service standards. This reliance means that any disruption or price increase from these key suppliers can directly affect the group's ability to offer comprehensive care and manage its profitability, underscoring the importance of strong supplier relationships.

The bargaining power of suppliers is a significant factor for CVS Group, especially concerning specialized pharmaceutical products and unique diagnostic equipment. When a few manufacturers dominate the supply of critical, advanced veterinary treatments or cutting-edge diagnostic tools, their leverage increases. This concentration means CVS Group may find it challenging to negotiate favorable pricing or terms due to their reliance on these specific suppliers.

Supplier Power 4

The bargaining power of specialized referral services, particularly those provided by veterinary specialists, is a significant factor for CVS Group. These experts possess unique skills and knowledge for complex cases, making their services highly valuable and difficult to substitute. In 2024, the demand for advanced veterinary diagnostics and treatments continued to rise, increasing the leverage of these specialized providers.

CVS Group's reliance on these specialists, whether in-house or through external referrals, means these suppliers can command higher prices due to the scarcity of their expertise. This dynamic is particularly pronounced in areas like advanced surgical procedures or complex internal medicine cases where only a few specialists may be available within a given region.

- High Demand for Specialized Skills: The increasing complexity of animal health issues drives demand for veterinary specialists.

- Limited Availability of Experts: The number of highly skilled veterinary specialists remains relatively low compared to general practitioners.

- Indispensability for Complex Cases: These specialists are crucial for treating conditions beyond the scope of general veterinary care.

- Pricing Power: Scarcity and high demand allow specialists to negotiate favorable terms and pricing for their services.

Supplier Power 5

The regulatory landscape significantly influences supplier power within the veterinary sector, directly impacting CVS Group. For instance, the need for specific certifications and adherence to stringent health and safety standards for veterinary products, including licensed medications, narrows the supplier base. This regulatory compliance acts as a barrier to entry, giving certified suppliers leverage and potentially increasing sourcing costs for CVS Group.

In 2024, the veterinary pharmaceutical market, a key area for CVS Group, saw continued growth driven by increased pet ownership and spending on pet healthcare. Suppliers holding exclusive distribution rights for critical medications or specialized equipment can command higher prices. For example, the market for companion animal pharmaceuticals in the US alone was estimated to be over $10 billion in 2024, underscoring the value of compliant and specialized suppliers.

- Regulatory Hurdles: Compliance with veterinary drug regulations and licensing requirements limits the number of qualified suppliers.

- Specialized Product Needs: Sourcing specific, high-demand veterinary pharmaceuticals or advanced diagnostic equipment can give suppliers pricing power.

- Certification Advantage: Suppliers possessing necessary accreditations for product safety and efficacy are in a stronger negotiating position.

The bargaining power of suppliers for CVS Group is substantial, particularly concerning specialized veterinary pharmaceuticals and advanced diagnostic equipment. Limited competition among manufacturers of proprietary drugs or unique technologies grants these suppliers significant leverage, directly impacting CVS Group's procurement costs and operational efficiency.

In 2024, the continued reliance on these specialized inputs, coupled with stringent regulatory requirements for veterinary medicines, further solidified supplier influence. This dynamic means CVS Group faces challenges in negotiating favorable terms, as the scarcity and specialized nature of these products limit alternative sourcing options.

The veterinary pharmaceutical market, a critical component for CVS Group, saw significant activity in 2024. Suppliers with exclusive distribution rights for high-demand medications or advanced diagnostic tools were well-positioned to command premium pricing. For instance, the global veterinary drug market was projected to reach approximately $68 billion in 2024, highlighting the value chain where specialized suppliers hold considerable sway.

| Supplier Category | Key Drivers of Bargaining Power | Impact on CVS Group |

|---|---|---|

| Veterinary Pharmaceuticals | Proprietary products, exclusive distribution rights, regulatory compliance | Increased cost of goods sold, potential for supply chain disruptions |

| Specialized Equipment | Unique technology, limited manufacturers, high R&D investment | Higher capital expenditure, reliance on specific service providers |

| Specialized Veterinary Services | Scarcity of expertise, high demand for complex procedures | Elevated professional fees, potential need for in-house specialist development |

What is included in the product

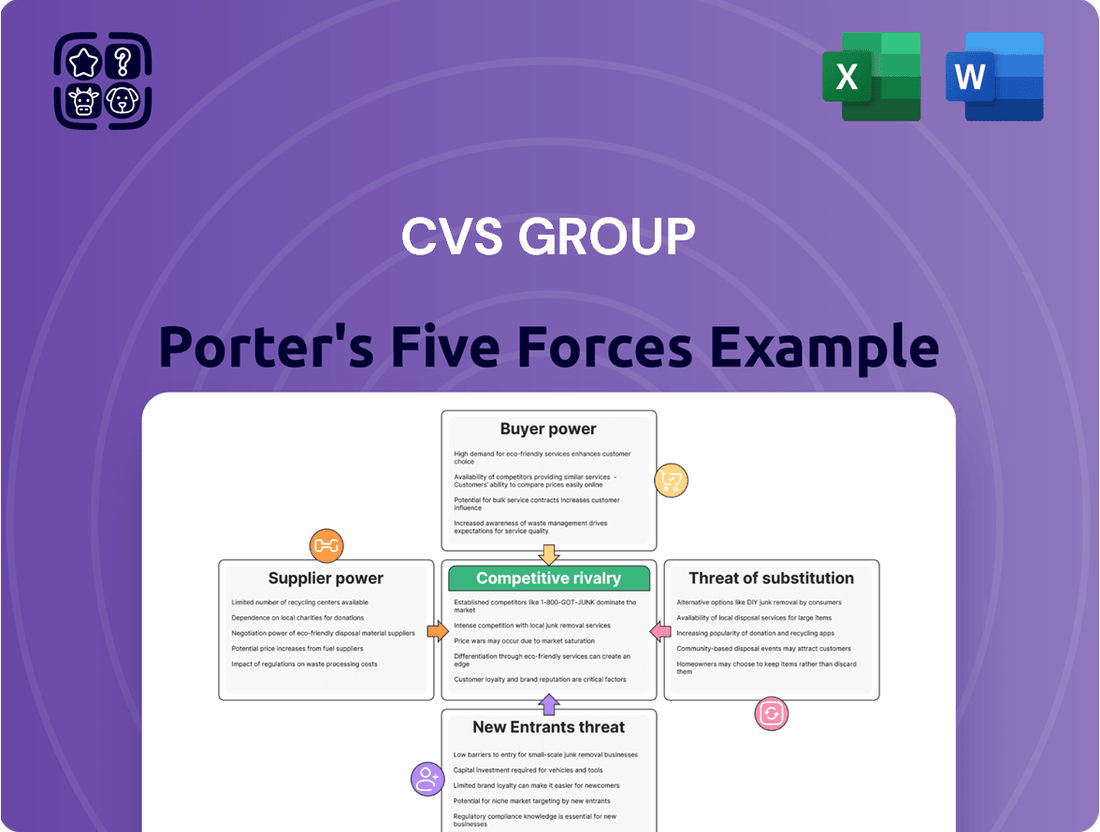

This analysis delves into the competitive forces shaping CVS Group's industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the impact of substitute products.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for CVS Group.

Customers Bargaining Power

Pet owners, the core customers for CVS Group, are wielding more influence. This is largely due to the surge in pet ownership and a noticeable increase in how much people are willing to spend on their animal companions. For instance, in 2023, the American Pet Products Association reported that 66% of U.S. households owned a pet, a figure that has been steadily climbing.

The trend of pet 'humanization' is a major driver here. Owners are increasingly seeking premium, sophisticated veterinary care, which includes everything from advanced preventative treatments to highly specialized medical interventions. This growing demand for top-tier services, supported by substantial annual spending on veterinary services, naturally empowers customers to expect more and have a greater say in the quality and scope of care they receive.

The bargaining power of customers within the UK veterinary sector is currently being shaped by regulatory scrutiny. A Competition and Markets Authority (CMA) investigation has identified a significant lack of pricing transparency, with over 80% of veterinary practices not displaying their prices online. This makes it difficult for pet owners to compare costs and services effectively.

However, the CMA's efforts to mandate greater price transparency are poised to shift this dynamic. By making pricing information more readily available, consumers will be better equipped to shop around and negotiate, thereby increasing their collective bargaining power against providers like CVS Group.

The bargaining power of customers is a significant factor for CVS Group, particularly in its pet-related services. The increasing availability of alternative channels, like online pharmacies for pet medications, directly empowers consumers. For instance, pet owners can often find prescribed medicines at lower prices through these online platforms, which puts pressure on the pricing strategies of veterinary practices, including those within CVS Group's network.

CVS Group's ownership of Animed Direct, an online pharmacy, serves as a strategic move to counter this customer bargaining power. By offering an in-house online alternative, CVS Group can retain a portion of this market and compete more effectively on price for certain pet pharmaceutical needs. This integration allows them to offer competitive pricing and potentially capture customers who might otherwise seek cheaper options elsewhere.

Buyer Power 4

The bargaining power of customers within the veterinary services sector, particularly for a company like CVS Group, is growing. The increasing availability and adoption of telemedicine and digital health platforms are key drivers here. These platforms offer pet owners more convenient and accessible ways to get veterinary advice, expanding their choices beyond traditional brick-and-mortar clinics.

This technological shift directly empowers pet owners. They can now more easily compare services and pricing across different providers, including those offering remote consultations. This ability to shop around, even for initial advice, can reduce their dependence on any single physical veterinary practice, thereby increasing their leverage.

Furthermore, customer expectations are evolving. There's a clear trend towards wanting seamless digital engagement from all service providers, including veterinary care. This means clinics need to offer user-friendly online booking, digital communication channels, and potentially telehealth options to meet these rising demands and maintain customer loyalty.

For instance, a significant portion of veterinary practices are investing in digital tools. In 2023, reports indicated that over 60% of veterinary clinics were either using or planning to implement telehealth services to enhance client convenience and accessibility, directly impacting customer expectations and their bargaining power.

- Increased Accessibility: Telemedicine platforms provide easier access to veterinary advice, broadening customer options.

- Price and Service Comparison: Digital tools enable pet owners to compare veterinary services and fees more effectively.

- Evolving Customer Expectations: Demand for seamless digital interaction is rising among pet owners.

- Growing Telehealth Adoption: Over 60% of veterinary clinics were adopting or considering telehealth in 2023, reflecting this shift.

Buyer Power 5

The bargaining power of customers within the veterinary sector, and by extension for CVS Group, is generally moderate to high. Pet owners face relatively low financial barriers when switching veterinary practices, meaning they can easily move to a competitor if they are unhappy with the price, quality of service, or the transparency of billing. This ease of switching is amplified by increased regulatory scrutiny, such as that from the UK's Competition and Markets Authority (CMA), which is focused on promoting competition and protecting consumers in the veterinary market.

In 2024, the veterinary market continued to see discussions around pricing and service accessibility. While a specific statistic for customer switching rates in the UK veterinary market isn't readily available, the general trend in consumer services suggests that dissatisfaction with cost or service leads to customer churn. For CVS Group, this means maintaining competitive pricing and high service standards is crucial to retaining its client base. The emotional bond owners have with their pets can sometimes mitigate immediate switching, but persistent issues can override this sentiment.

- Low Financial Switching Costs: Pet owners can switch veterinary providers without incurring significant financial penalties, enhancing their bargaining power.

- Increased Regulatory Scrutiny: Bodies like the CMA are actively monitoring competition, which encourages providers to be more competitive on price and service, further empowering customers.

- Price Sensitivity: While pet care is often a necessity, owners are increasingly price-aware, especially with rising costs, making them more likely to seek alternatives if pricing is perceived as unreasonable.

- Information Availability: Online reviews and comparison platforms allow pet owners to easily research and compare different veterinary practices, increasing transparency and their ability to make informed decisions.

The bargaining power of customers for CVS Group, particularly within the veterinary sector, is significant and growing. This stems from increased price transparency efforts, the rise of digital alternatives like online pharmacies and telemedicine, and generally low switching costs for pet owners. For example, the UK's CMA's investigation into pricing transparency highlighted that over 80% of practices didn't display prices online, a situation that is changing to empower consumers.

The availability of online pharmacies, including CVS Group's own Animed Direct, allows customers to compare medication prices, putting pressure on traditional veterinary service fees. Furthermore, the adoption of telehealth, with over 60% of clinics exploring these services by 2023, gives pet owners more options for consultations and advice, enhancing their ability to shop around.

| Factor | Impact on Customer Bargaining Power | Relevance to CVS Group |

|---|---|---|

| Price Transparency Initiatives (e.g., CMA investigation) | Increases ability to compare costs, strengthening power. | Pressures CVS Group's pricing strategies. |

| Online Pharmacies (e.g., Animed Direct) | Offers alternative, often lower-cost, medication sources. | CVS Group leverages its own online presence to compete. |

| Telemedicine & Digital Health Platforms | Expands access to advice and services, facilitating comparison. | Requires CVS Group to enhance digital offerings to meet expectations. |

| Low Switching Costs | Pet owners can easily move to competitors if dissatisfied. | Demands competitive pricing and high service quality from CVS Group. |

Preview Before You Purchase

CVS Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the CVS Group, detailing the competitive landscape and strategic implications for the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

Competitive rivalry within the UK veterinary market is notably intense, with significant consolidation driving a landscape where large corporate groups, such as CVS Group, hold considerable sway. This trend has intensified competition as these dominant players strategically acquire smaller practices to expand their reach and market share.

Competitive rivalry within the veterinary services sector, where CVS Group operates, is quite intense. Key players like Pets at Home Group PLC, Medivet Group Limited, Independent Vetcare Group, Linnaeus Group, and IVC Evidensia UK are all vying for market share.

These companies directly compete by offering a full spectrum of veterinary services, from routine check-ups and vaccinations to advanced diagnostics and complex surgeries. This broad offering means they are constantly battling for both customer loyalty and skilled veterinary professionals.

For instance, in 2024, the UK veterinary market saw continued consolidation, with larger groups like IVC Evidensia and CVS Group actively acquiring smaller practices, further intensifying the competitive landscape. This consolidation often leads to increased price competition and a greater emphasis on service differentiation to attract and retain clients.

The competitive landscape for CVS Group in the UK veterinary market is significantly influenced by the ongoing Competition and Markets Authority (CMA) investigation. This scrutiny focuses on competition, pricing, and transparency within the sector, creating an environment of uncertainty for all players. The provisional CMA decision is anticipated around May-June 2025, with the final report due by late 2025 or May 2026, potentially triggering substantial regulatory changes.

This regulatory uncertainty has directly impacted CVS Group's strategic options, leading to a suspension of merger and acquisition activities within the UK. The potential for new regulations or market interventions means that companies are likely adopting a more cautious approach to expansion and competitive positioning. This pause in M&A activity highlights the significant influence of the CMA's findings on the industry's competitive dynamics and future consolidation.

Competitive Rivalry 4

Competitive rivalry within the UK veterinary services sector remains a significant force for CVS Group. Despite the market's overall projected growth, which was anticipated to continue through 2024 and beyond, companies like CVS have faced pressure on like-for-like sales. This is largely due to intensified competition for consumer spending on pets, a trend potentially exacerbated by the economic climate and the cost-of-living crisis impacting discretionary spending.

The competitive landscape is characterized by a mix of independent practices and larger corporate groups, all vying for market share. This dynamic necessitates that players like CVS focus on differentiation and operational efficiency to maintain profitability and growth.

- Intensified Competition: The UK veterinary market sees numerous players, from small independent clinics to large corporate entities, all competing for pet owner loyalty and spending.

- Market Conditions: Softer market conditions and pressure on like-for-like sales have been observed for major players like CVS Group in recent periods, indicating heightened rivalry.

- Cost-of-Living Impact: Economic pressures can influence discretionary spending on pet care, intensifying the competition for every pound spent by pet owners.

- Differentiation Needs: To succeed, veterinary groups must clearly differentiate their services, whether through specialized care, pricing strategies, or customer experience, to stand out in a crowded market.

Competitive Rivalry 5

Competitive rivalry within the healthcare sector, particularly for companies like CVS Group, is intensifying due to a significant shift towards technological integration in service delivery. This evolution is marked by an increasing adoption of telemedicine, AI-driven diagnostic tools, and enhanced digital patient engagement platforms.

Companies are no longer solely competing on the quality of clinical care. Instead, convenience and innovation have become critical differentiators, compelling rivals to make substantial investments in these technological areas to either preserve or expand their market share. For instance, a notable trend in 2024 has been the surge in telehealth adoption; a report indicated that by the end of 2024, an estimated 40% of consumers had used virtual health services, up from 25% in 2023.

- Technological Advancements: The industry is rapidly adopting telemedicine, AI diagnostics, and digital patient portals.

- Focus on Convenience: Companies are competing on ease of access and user experience alongside clinical quality.

- Market Share Dynamics: Investment in innovation is crucial for maintaining or gaining competitive positioning.

- Increased Investment: Rivals are compelled to allocate significant capital towards digital transformation initiatives.

Competitive rivalry within the UK veterinary market remains fierce, with major players like CVS Group, IVC Evidensia, and Pets at Home Group PLC actively competing. This intense rivalry is further fueled by ongoing market consolidation, with larger entities acquiring smaller practices, a trend that continued through 2024.

The market is characterized by a constant push for differentiation, as companies vie for customer loyalty and skilled veterinary professionals. This competition extends to the adoption of new technologies, with telemedicine and AI-driven diagnostics becoming key battlegrounds for market share.

Economic pressures, such as the cost-of-living crisis, also intensify competition by impacting discretionary spending on pet care, forcing providers to compete more aggressively for consumer budgets.

The UK veterinary sector faced significant regulatory scrutiny in 2024, with the Competition and Markets Authority (CMA) investigating competition practices. Provisional findings were expected in mid-2025, with a final report due later that year or in early 2026, potentially leading to substantial market changes.

| Competitor | Key Services | Market Presence |

|---|---|---|

| CVS Group | Veterinary care, diagnostics, surgery, pet cremation | Extensive UK network, also in Netherlands and Ireland |

| IVC Evidensia UK | Veterinary care, specialist referrals, dental services | Largest veterinary group in Europe, significant UK presence |

| Pets at Home Group PLC | Veterinary care, grooming, pet supplies | Large retail footprint with integrated veterinary clinics |

| Medivet Group Limited | Veterinary care, out-of-hours services | Growing network of practices across the UK |

| Independent Vetcare Group | Veterinary care, diagnostics, surgery | Significant number of practices, focus on integration |

SSubstitutes Threaten

Online pharmacies and retailers present a substantial threat of substitution for veterinary clinics, especially for everyday medications and pet supplies. Pet owners can frequently find these items cheaper online, bypassing their local vet. For instance, the Competition and Markets Authority (CMA) in the UK has investigated pricing practices, noting that pet owners might be overpaying for medicines from vets and could save money by purchasing elsewhere online. This trend is amplified as more consumers become comfortable with e-commerce for their pet care needs.

Telemedicine and virtual consultations are increasingly offering an alternative to traditional in-person veterinary visits, particularly for routine check-ups, minor health concerns, and behavioral consultations. This shift is fueled by a growing demand for convenient, accessible healthcare solutions, mirroring trends seen in human medicine.

The expansion of telehealth platforms, such as those offered by companies like Vetster or Pawp, provides a readily available substitute, potentially decreasing the need for physical clinic appointments. For instance, as of early 2024, many veterinary telehealth services report significant increases in user adoption, with some seeing year-over-year growth exceeding 30% for non-emergency consultations.

The threat of substitutes for CVS Group's veterinary services is growing, particularly from preventative care options. Products like premium pet foods, supplements, and even wearable health monitors are gaining traction. These allow pet owners to proactively manage their pets' health, potentially reducing the need for some traditional veterinary interventions.

The increasing trend of pet humanization fuels this shift. Owners are more inclined to spend on proactive health management, seeing pets as family members. This willingness to invest in preventative measures could indeed lessen the demand for certain reactive veterinary services offered by companies like CVS Group, impacting their service revenue streams.

4

The threat of substitutes for veterinary services is moderate, as informal advice can sometimes influence pet owners. Online forums and social media groups offer readily accessible, though often unverified, pet care advice. For instance, a 2024 survey indicated that 35% of pet owners sought advice from online communities for minor pet health concerns before consulting a veterinarian, potentially delaying professional care.

These substitutes, while not offering the diagnostic capabilities of a veterinarian, can fulfill a perceived need for quick, low-cost information. This can lead pet owners to attempt home remedies or delay seeking professional help for issues that might escalate. This trend is particularly noticeable for common ailments like mild skin irritations or digestive upset.

The availability of non-veterinary pet professionals, such as pet sitters or dog walkers who provide basic health observations, also presents a mild substitute. While their expertise is limited, they can influence a pet owner's perception of a pet's health status. For example, a pet sitter noting a slight change in a pet's behavior might prompt an owner to seek advice from a friend or online resource rather than immediately contacting a vet.

- Informal Online Advice: Platforms like Reddit's r/AskVet or Facebook pet groups offer peer-to-peer advice, impacting decisions on seeking professional veterinary care.

- Non-Veterinary Professionals: Pet sitters and dog walkers can offer observational insights that may influence owner decisions about veterinary visits.

- Cost Sensitivity: The lower cost associated with informal advice compared to professional consultations makes it an attractive substitute for some pet owners, especially for non-critical issues.

- Perceived Minor Issues: Substitutes are more likely to be considered for issues pet owners deem minor, such as slight changes in appetite or minor skin irritations.

5

The threat of substitutes for traditional veterinary clinics, a key consideration for CVS Group, is growing, particularly from in-home pet care and mobile veterinary services. These alternatives offer significant convenience for pet owners, allowing for routine check-ups, vaccinations, and even some minor procedures to be performed in the comfort of their own homes. This shift in delivery model presents a direct challenge to the established brick-and-mortar clinic network.

While these mobile services often still provide veterinary care, their convenience factor can attract a segment of the market, especially for less complex needs. For instance, the demand for at-home pet care services in the US saw substantial growth, with estimates suggesting the market could reach billions of dollars annually by 2025, indicating a clear preference for convenience among a growing number of pet owners. This trend directly impacts the accessibility and perceived necessity of traditional clinic visits for certain services.

- Mobile Vet Services: Offer convenience and reduced stress for pets by bringing veterinary care directly to the home.

- In-Home Pet Care: Includes services like grooming, dog walking, and pet sitting, which can sometimes overlap with or reduce the need for clinic visits.

- Telemedicine: Veterinary telehealth platforms allow for remote consultations, potentially substituting for initial in-person diagnostic visits.

- DIY Pet Care: Increased availability of pet health information and products online empowers owners to handle some basic care themselves.

The threat of substitutes for veterinary services is significant and multifaceted, impacting traditional brick-and-mortar clinics like those operated by CVS Group. Online pharmacies and retailers offer a cost-effective alternative for medications and supplies, while telemedicine platforms provide convenient remote consultations for routine issues. Furthermore, the rise of preventative care products and informal online advice empowers pet owners to manage their pets' health proactively, potentially reducing reliance on veterinary professionals for certain needs.

| Substitute Category | Examples | Impact on Veterinary Clinics | Key Trend/Data Point (2024) |

|---|---|---|---|

| Online Retailers & Pharmacies | Chewy, Amazon, Petco | Lower prices for medications and supplies, bypass vet for refills | Online pet medication sales projected to grow by 15% annually through 2025. |

| Telemedicine Platforms | Vetster, Pawp, Airvet | Convenient remote consultations for minor issues, reducing need for in-person visits | Veterinary telehealth usage increased by an estimated 30% in early 2024 for non-emergency cases. |

| Preventative Care & DIY | Supplements, health monitors, online advice | Empowers owners to manage health proactively, potentially delaying or avoiding vet visits | 35% of pet owners sought online advice for minor health concerns before consulting a vet in 2024. |

| Mobile & In-Home Services | Mobile vet units, pet sitters with observational skills | Offers convenience, reducing demand for traditional clinic appointments | The at-home pet care market in the US is expected to reach billions annually by 2025. |

Entrants Threaten

The threat of new entrants in the veterinary services market is generally considered moderate. Establishing a new veterinary practice demands significant upfront capital for facilities, state-of-the-art medical equipment, and robust IT infrastructure. For instance, equipping a modern veterinary clinic can easily cost upwards of $250,000 to $500,000, presenting a substantial financial hurdle for aspiring entrepreneurs.

These high fixed costs, coupled with the need for specialized veterinary personnel and regulatory compliance, create considerable barriers to entry. Newcomers often struggle to achieve profitability swiftly due to the initial investment and the time required to build a client base and reputation, especially when competing against established players like CVS Group, which benefits from brand recognition and economies of scale.

The threat of new entrants into the veterinary services market, particularly for established players like CVS Group, is somewhat mitigated by significant barriers. Regulatory hurdles are substantial; new practices must obtain necessary licenses and adhere to strict professional standards, a process that demands considerable time and resources.

Furthermore, the critical need for qualified veterinary professionals acts as a significant deterrent. The market faces a widespread shortage of vets, meaning new entrants struggle with recruiting and retaining a skilled workforce. For instance, in the UK, the Royal College of Veterinary Surgeons (RCVS) reported a growing demand for veterinary professionals, exacerbating staffing challenges for any new practice attempting to establish itself.

The UK veterinary market is highly consolidated, with major players like CVS Group operating a substantial number of practices. This oligopolistic structure acts as a significant barrier to entry for new independent veterinary clinics. For instance, as of early 2024, CVS Group reported owning over 500 veterinary practices across the UK, highlighting the dominance of established groups.

Established groups benefit from considerable economies of scale in areas like bulk purchasing of pharmaceuticals and equipment, which reduces their per-unit costs. This purchasing power, combined with strong brand recognition built over years, makes it challenging for new, smaller practices to compete on price or attract a significant client base from the outset.

4

The threat of new entrants in the veterinary services market, while seemingly moderate, is influenced by several factors. Despite a general shortage of veterinarians, the pipeline of new professionals is being bolstered. For instance, the number of accredited veterinary medicine programs in the United States has remained steady, with many institutions graduating qualified professionals annually. In 2023, the American Association of Veterinary Medical Colleges reported over 15,000 students enrolled in veterinary programs.

However, the ability of these new entrants to establish a significant presence and compete effectively with established players like CVS Group is tempered by the substantial capital investment required for setting up a veterinary practice, including equipment, staffing, and regulatory compliance. Furthermore, building brand recognition and a loyal client base takes considerable time and effort, acting as a barrier for newcomers.

New entrants also face challenges in attracting and retaining experienced veterinary staff, especially in a market where skilled professionals are in high demand. This can hinder their operational capacity and growth potential. The regulatory landscape, which includes licensing and accreditation, also adds another layer of complexity for those looking to enter the market.

- Growing Supply of Veterinarians: An increasing number of veterinary schools and international graduates contribute to a steady supply of new professionals entering the market.

- Capital Investment Barriers: Establishing a new veterinary practice requires significant upfront investment in facilities, equipment, and technology, posing a hurdle for new entrants.

- Brand Recognition and Client Loyalty: New practices must overcome the established trust and client relationships held by existing providers like CVS Group, which takes time and resources to build.

- Staffing and Retention Challenges: Attracting and retaining qualified veterinary staff remains a critical challenge for new entrants, impacting their ability to scale and operate efficiently.

5

The veterinary sector's increasing sophistication presents a significant barrier to new entrants. Advanced diagnostics, specialized surgeries, and complex treatment protocols demand substantial ongoing investment in cutting-edge technology and continuous staff training. For instance, the global veterinary diagnostics market was valued at approximately USD 4.2 billion in 2023 and is projected to grow, indicating the capital required to stay current.

New competitors must meet these high clinical standards to compete effectively, thereby increasing the initial capital outlay and operational complexity. This high level of required investment and expertise deters many potential new players from entering the market.

- High Capital Investment: Advanced diagnostic equipment (e.g., MRI, CT scanners) and surgical suites require millions in upfront costs.

- Skilled Workforce Needs: Attracting and retaining highly trained veterinarians and technicians, especially specialists, is costly and competitive.

- Regulatory Compliance: Meeting stringent veterinary practice regulations and licensing requirements adds to the initial and ongoing operational burden.

- Brand Reputation and Trust: Established players benefit from years of building client trust, a factor new entrants must work hard to replicate.

The threat of new entrants for CVS Group in the veterinary services sector is moderate, primarily due to substantial barriers. High capital requirements for facilities and equipment, estimated at $250,000 to $500,000 for a modern clinic, alongside regulatory compliance and the need for specialized staff, deter many potential new players. The market's consolidation, with CVS Group alone operating over 500 UK practices by early 2024, further solidifies the position of established entities.

New entrants face challenges in building brand recognition and client loyalty against established players like CVS Group, which benefits from economies of scale in purchasing and a strong reputation. Furthermore, the ongoing shortage of qualified veterinary professionals, as highlighted by the RCVS, makes recruitment and retention a significant hurdle for newcomers, impacting their operational capacity and growth potential.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Investment | Cost of facilities, advanced equipment (MRI, CT scanners), and IT infrastructure. | High initial cost, limiting market entry. | Clinic setup: $250,000 - $500,000+; Diagnostics market: ~$4.2 billion globally. |

| Staffing & Expertise | Need for qualified veterinarians and technicians, especially specialists. | Recruitment and retention challenges due to high demand and shortages. | UK vet shortage reported by RCVS; US vet student enrollment steady (~15,000+). |

| Regulation & Compliance | Licensing, accreditation, and adherence to professional standards. | Time-consuming and resource-intensive process. | Strict operational standards required by veterinary governing bodies. |

| Market Consolidation | Dominance of large groups like CVS Group with extensive practice networks. | Difficult to compete on scale and market presence. | CVS Group operates over 500 UK practices (early 2024). |

| Brand & Client Loyalty | Established trust and relationships with existing client bases. | Requires significant time and marketing investment to build. | Long-standing customer relationships are a key competitive asset. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CVS Group is built upon a foundation of comprehensive data, including publicly available financial statements, investor reports, and industry-specific market research from firms like IBISWorld and Statista. We also incorporate insights from trade publications and news archives to capture current market dynamics and competitive actions.