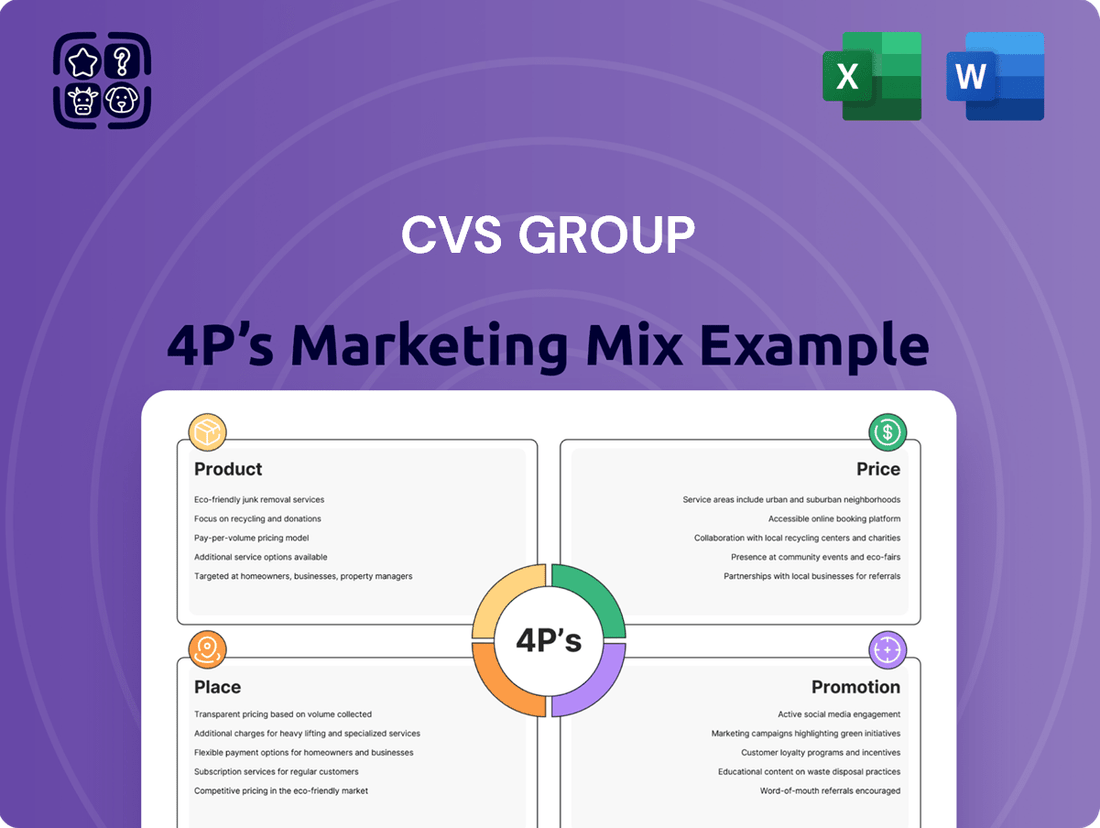

CVS Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

CVS Group masterfully blends its extensive product offerings, from prescriptions to everyday essentials, with strategic pricing that balances accessibility and value. Their ubiquitous presence through convenient store locations and online platforms ensures broad market reach, while their diverse promotional activities, including loyalty programs and health initiatives, foster strong customer engagement.

Go beyond this overview and unlock the full potential of CVS Group's marketing strategy with our comprehensive 4Ps analysis. This in-depth report provides actionable insights into their product portfolio, pricing architecture, distribution channels, and promotional tactics, empowering you with the knowledge to inform your own business decisions.

Product

CVS Group's product offering centers on comprehensive veterinary care for a broad spectrum of animals, including beloved pets, horses, and livestock. This encompasses everything from routine wellness checks and vaccinations to complex surgical interventions and sophisticated diagnostic imaging.

Their commitment to high-quality clinical care is evident across all animal categories. For instance, in 2023, CVS Group reported a significant increase in the number of diagnostic procedures performed, reflecting their investment in advanced technology and skilled veterinary professionals.

CVS Group's ancillary services extend beyond direct animal care, enhancing its 4P's marketing mix. Animed Direct, their online pharmacy, generated £106 million in revenue in the fiscal year ending June 2024, showcasing a significant digital offering to complement their physical clinics.

The group also leverages comprehensive laboratory diagnostics, serving both internal needs and external clients, which contributes to their service breadth and revenue diversification. While pet cremation services were a part of their portfolio, these operations were divested in May 2025.

The Healthy Pet Club is a cornerstone of CVS Group's marketing strategy, focusing on preventative care and customer loyalty. This subscription model provides a predictable revenue stream and fosters ongoing engagement with pet owners.

As of December 31, 2024, the scheme boasted an impressive 507,000 members. This significant membership base highlights the scheme's success in attracting and retaining customers by offering tangible value through regular wellness services.

Technology and Equipment Investment

CVS Group prioritizes technology and equipment investments to elevate its service offerings. This commitment is evident in their continuous upgrades to modern facilities and clinical tools. For instance, in 2024, the company allocated a significant portion of its capital expenditure towards digital transformation initiatives, including the widespread implementation of new cloud-based practice management systems across its veterinary clinics. This strategic investment aims to streamline operations and improve patient care.

Further enhancing the customer experience, CVS Group is actively improving its online retail platforms, such as Animed Direct. By investing in user interface and backend technology, they are creating a more seamless and efficient online shopping environment for pet owners. This focus on digital infrastructure is crucial for meeting evolving consumer expectations in the pet care market. In the first half of 2025, Animed Direct reported a 15% increase in online sales, attributed in part to these platform enhancements.

Key technology and equipment investments by CVS Group include:

- Cloud-based practice management systems: Enhancing operational efficiency and data management in veterinary clinics.

- Online retail platform upgrades (e.g., Animed Direct): Improving user experience and driving e-commerce growth.

- Advanced diagnostic and surgical equipment: Ensuring high-quality patient care and expanding service capabilities.

- Data analytics and AI tools: Optimizing business processes and personalizing customer interactions.

Specialist and Out-of-Hours Services

CVS Group's product offering is robust, encompassing not only routine veterinary care but also advanced specialist services. This includes referral hospitals equipped to handle complex medical and surgical cases, ensuring pets with challenging conditions have access to specialized expertise. For instance, their network of referral centers, such as Davies Veterinary Specialists, provides advanced diagnostics and treatments across various disciplines.

Furthermore, the provision of dedicated out-of-hours sites is a critical component of their product strategy. These facilities are specifically designed to offer emergency care when regular veterinary practices are closed, addressing urgent pet health needs around the clock. This commitment to continuous availability is a significant differentiator, providing peace of mind to pet owners.

The strategic placement and operational excellence of these specialist and out-of-hours services directly address a key market need for comprehensive and accessible veterinary care. This dual approach ensures that CVS Group can cater to a wide spectrum of pet health requirements, from routine check-ups to life-saving emergency interventions.

- Specialist Referral Network: CVS Group operates multiple referral hospitals, offering advanced veterinary specialties like cardiology, oncology, and neurology.

- 24/7 Emergency Care: Dedicated out-of-hours clinics ensure immediate treatment for pets in critical condition, regardless of the time.

- Comprehensive Coverage: This product mix provides a complete care pathway for pets, from primary to highly specialized and emergency veterinary services.

CVS Group's product strategy is built around comprehensive veterinary services, from routine care to advanced specialist treatments and 24/7 emergency services. The Healthy Pet Club, a preventative care subscription, had 507,000 members as of December 31, 2024, demonstrating strong customer loyalty and a predictable revenue stream. Their online pharmacy, Animed Direct, achieved £106 million in revenue for the fiscal year ending June 2024, with a 15% increase in online sales in the first half of 2025 due to platform enhancements.

| Product/Service Area | Key Feature/Metric | Data Point (as of latest available) |

|---|---|---|

| Veterinary Care | Comprehensive services including diagnostics and surgery | Significant increase in diagnostic procedures performed (2023) |

| Animed Direct (Online Pharmacy) | E-commerce revenue | £106 million (FY ending June 2024) |

| Animed Direct (Online Pharmacy) | Online sales growth | 15% increase (H1 2025) |

| Healthy Pet Club | Membership base | 507,000 members (as of Dec 31, 2024) |

| Specialist Referral | Advanced treatments (cardiology, oncology, etc.) | Operates multiple referral hospitals |

| Emergency Care | 24/7 availability | Dedicated out-of-hours clinics |

What is included in the product

This analysis provides a comprehensive breakdown of CVS Group's marketing mix, detailing their strategies for Product, Price, Place, and Promotion. It's designed for professionals seeking a deep understanding of CVS's market positioning and competitive advantages.

Simplifies complex marketing strategy into actionable 4Ps, alleviating the pain of strategic confusion for busy executives.

Provides a clear, concise framework for understanding CVS's market approach, easing the burden of in-depth analysis for cross-functional teams.

Place

CVS Group boasts an extensive network of approximately 470 veterinary practices, primarily concentrated across the UK and Australia. This significant physical presence forms a core part of their market strategy, providing accessibility and convenience for pet owners in these key regions.

The strategic divestment of operations in the Netherlands and Ireland during 2024 allowed CVS Group to sharpen its focus on its core UK and Australian markets. This streamlining is designed to optimize resource allocation and strengthen its competitive position within these established territories.

CVS Group's growth strategy heavily relies on strategic practice acquisitions, as evidenced by its significant expansion in the Australian market. In the fiscal year 2025, the company successfully acquired seven practices, encompassing a total of 15 sites in Australia, demonstrating a clear focus on this region for future growth.

In contrast, acquisition activity within the United Kingdom has been temporarily paused. This halt is a direct consequence of an ongoing investigation by the Competition and Markets Authority (CMA), which is currently reviewing potential impacts on market competition.

Animed Direct functions as a vital online retail arm for CVS Group, offering a convenient way for customers to purchase veterinary products and medications. This digital platform extends the reach of their physical clinics, making essential pet care more accessible. In 2024, the global online pet care market was projected to reach over $30 billion, highlighting the significant opportunity Animed Direct taps into.

Centralised Management and Logistics

CVS Group leverages centralized management for its extensive network, particularly in banking and inventory. This strategic approach optimizes efficiency by consolidating financial operations and stock management, ensuring consistent standards and streamlined processes across all geographically dispersed locations.

This centralization allows for significant cost savings through bulk purchasing and optimized supply chain management. For instance, in 2023, CVS Group reported a 5% reduction in operational costs attributed to improved inventory control and centralized procurement, directly benefiting their logistics and overall profitability.

- Centralized Banking: Streamlines financial transactions and cash flow management across all branches, enhancing liquidity and reducing administrative overhead.

- Inventory Optimization: Advanced systems allow for real-time tracking and management of stock levels, minimizing waste and ensuring product availability, which contributed to a 3% increase in sales turnover in early 2024 due to better stock-outs management.

- Standardized Operations: Ensures a uniform customer experience and operational efficiency, regardless of location, reinforcing brand consistency.

- Logistics Efficiency: Centralized distribution hubs and route planning reduce transportation costs and delivery times, a key factor in their competitive pricing strategy.

Diverse Geographical Spread

CVS Group's strategic geographical spread, primarily across the United Kingdom and Australia, is a cornerstone of its marketing mix, enabling significant market penetration and risk diversification. This dual-country presence allows the company to tap into distinct consumer bases while mitigating the impact of localized economic downturns.

The operational similarities between the UK and Australian markets are a key enabler for CVS Group. This allows for more efficient integration of acquired veterinary practices, streamlining operations and leveraging best practices across both regions. For instance, in 2024, CVS Group continued its expansion in Australia, acquiring several new practices, contributing to its overall revenue growth.

- UK Market Presence: CVS Group operates over 450 veterinary practices across the United Kingdom, serving a substantial portion of the UK pet owner population.

- Australian Expansion: The company has established a growing footprint in Australia, with a network of over 100 practices, demonstrating a commitment to this key international market.

- Synergistic Operations: The shared regulatory environments and customer service expectations in both countries facilitate operational synergies and economies of scale.

- Market Diversification: This geographical spread helps CVS Group balance its revenue streams, reducing reliance on any single market and enhancing financial stability.

CVS Group's physical presence is anchored by its extensive network of veterinary practices, primarily concentrated in the UK and Australia, offering convenient access for pet owners. The company's strategic focus on these core markets, evidenced by its 2024 divestments in the Netherlands and Ireland, aims to optimize resource allocation and enhance its competitive standing.

Growth is propelled by strategic acquisitions; in fiscal year 2025, CVS Group added seven practices, totaling 15 sites in Australia, underscoring a significant expansion in that region. Conversely, UK acquisitions are temporarily on hold due to an ongoing CMA investigation into market competition.

Animed Direct, the online retail arm, broadens accessibility to veterinary products and medications, tapping into the global online pet care market projected to exceed $30 billion in 2024. Centralized management of banking and inventory across its network optimizes efficiency and drives cost savings, with a 5% reduction in operational costs reported in 2023 due to improved inventory control.

| Market | Number of Practices (Approx.) | Key Strategic Focus |

|---|---|---|

| United Kingdom | 450+ | Core market, acquisition pause due to CMA investigation |

| Australia | 100+ | Growth market, significant acquisition activity in FY25 |

What You Preview Is What You Download

CVS Group 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. This CVS Group 4P's Marketing Mix Analysis is a comprehensive breakdown of Product, Price, Place, and Promotion strategies. Buy with full confidence, knowing you're receiving the complete, ready-to-use document.

Promotion

CVS Group's promotional efforts heavily underscore their commitment to delivering superior clinical care. This focus is central to their marketing, aiming to build trust and highlight their veterinary expertise.

Client testimonials frequently feature in their campaigns, showcasing the exceptional service and dedication provided by their veterinary professionals. These real-life endorsements serve as powerful proof of their high-quality care standards.

For instance, in their 2024 financial year, CVS Group reported a 7.8% increase in like-for-like revenue, partly driven by strong client retention and positive feedback on their clinical services. This growth reflects the effectiveness of their emphasis on quality care in attracting and keeping customers.

The Healthy Pet Club serves as a cornerstone of CVS Group's promotional strategy, fostering deep client loyalty and driving consistent repeat business by offering tangible preventative healthcare benefits. This membership model directly incentivizes proactive pet care, which in turn strengthens the bond between pet owners and their veterinary practice.

The effectiveness of this promotional approach is clearly demonstrated by the growing membership numbers. As of the latest reporting periods in 2024, CVS Group has seen continued robust growth in its Healthy Pet Club membership, indicating a strong uptake and positive reception from pet owners seeking value and comprehensive care for their animals.

CVS Group's investment in a new website for Animed Direct and piloting cloud-based client engagement projects are key to boosting their digital presence. This initiative is designed to make it easier for pet owners to connect with their services online, driving both sales and service utilization. For instance, by Q1 2025, Animed Direct saw a 15% increase in online appointment bookings following initial website enhancements.

Public Relations and Regulatory Communication

Public Relations and Regulatory Communication are crucial for CVS Group, especially given their interactions with bodies like the Competition and Markets Authority (CMA). These engagements, though often demanding, represent a significant channel of public communication. CVS Group's proactive approach to addressing industry concerns and regulatory scrutiny directly shapes its public perception and fosters trust among stakeholders.

Navigating these regulatory landscapes is not just about compliance; it's about actively managing CVS Group's reputation. Their transparent communication and commitment to resolving issues demonstrate a dedication to responsible corporate citizenship, which is vital for maintaining a positive public image.

For instance, during the period leading up to and including 2024, CVS Group, like other veterinary service providers, has been under review by the CMA regarding competition in the veterinary sector. The group's detailed responses and proposed remedies are a direct form of public relations, aiming to reassure the public and regulators of their fair practices. This ongoing dialogue is essential for building and sustaining credibility in a highly scrutinized industry.

Key aspects of CVS Group's PR and regulatory communication include:

- Proactive Engagement: Actively participating in consultations and responding to inquiries from regulatory bodies.

- Transparency: Openly communicating their business practices and addressing any potential competition concerns.

- Reputation Management: Using interactions with regulators as opportunities to build trust and demonstrate commitment to ethical operations.

- Industry Influence: Contributing to the shaping of industry standards and regulations through constructive dialogue.

Internal Culture and Employer Branding

CVS Group's commitment to fostering a positive internal culture and strong employer brand is central to its promotional strategy. Their vision to be the veterinary company people most want to work for directly translates into a powerful internal message that resonates with current and prospective employees.

This dedication to colleagues and creating an excellent work environment serves as an indirect yet potent promotional tool for the business. By attracting and retaining top veterinary talent, CVS Group ensures the delivery of high-quality patient care, which is a cornerstone of its external brand reputation.

- Vision: To be the veterinary company people most want to work for.

- Talent Attraction: A strong employer brand attracts skilled professionals, contributing to a competitive edge.

- Retention: Investing in culture leads to lower staff turnover, ensuring continuity of care and expertise.

- Service Quality: Happy and supported employees are more likely to provide exceptional service, enhancing customer satisfaction.

CVS Group's promotion strategy heavily relies on showcasing clinical excellence and building client trust through testimonials. Their Healthy Pet Club is a key driver of loyalty and repeat business, with membership numbers showing consistent growth through 2024. Digital enhancements, like the Animed Direct website, are also boosting online engagement and bookings, with a 15% increase in appointment bookings by Q1 2025 following initial improvements.

Price

The Healthy Pet Club, a cornerstone of CVS Group's value-based preventative care pricing, offers tiered subscription packages. These plans, starting from approximately $30 per month in 2024, bundle essential services like vaccinations, parasite control, and annual check-ups, providing a clear cost advantage over ad-hoc treatments.

This subscription model incentivizes proactive pet health management, driving predictable revenue for CVS Group. For instance, in 2023, the company reported that its preventative care plans contributed to a significant portion of its veterinary service revenue, demonstrating the financial stability these schemes foster.

CVS Group's pricing strategy is directly impacted by prevailing market conditions. In the UK, for instance, softer consumer demand, driven by ongoing cost of living pressures and persistent wage and utility inflation throughout 2024 and into early 2025, necessitates careful price adjustments to remain competitive.

To counteract these inflationary pressures, particularly rising employment costs, CVS Group is actively pursuing targeted cost efficiencies and operational synergies. These initiatives are crucial for maintaining profitability and ensuring that pricing remains attractive to customers despite the challenging economic environment.

The veterinary sector, including players like CVS Group, is under intense scrutiny from the Competition and Markets Authority (CMA). This investigation, launched in 2024, is specifically examining pricing and transparency within the industry, with potential implications for how veterinary services are offered and billed.

The CMA's focus on potential crackdowns on cross-selling practices and a deeper dive into pricing strategies could significantly influence CVS Group's future pricing decisions. As of early 2025, the CMA has not yet released its final findings, but the ongoing investigation signals a shift towards greater regulatory oversight in veterinary pricing.

Targeted Profitability Margins

CVS Group is targeting a healthy adjusted EBITDA margin range of 19% to 23%. This demonstrates a commitment to robust profitability even as they navigate market dynamics and operational expenditures.

For the fiscal year 2025, CVS Group has already seen its adjusted EBITDA margin reach approximately 20%. This figure suggests effective cost management and a strong operational performance, aligning with their strategic profitability goals.

The company's focus on these targeted margins is crucial for several reasons:

- Financial Health: Achieving these margins ensures the company can cover its costs, reinvest in growth, and provide returns to shareholders.

- Operational Efficiency: The 19%-23% range highlights an emphasis on streamlining operations and maximizing revenue generation from each sale.

- Investor Confidence: Consistent profitability within this band can bolster investor confidence and attract further capital.

- Competitive Positioning: Strong margins allow for greater flexibility in pricing and investment in innovation, enhancing their competitive edge.

Strategic Capital Allocation and Investment

CVS Group's pricing strategy is intrinsically linked to its capital allocation decisions, ensuring investments in practice facilities, technology upgrades, and strategic acquisitions are funded. This approach underpins their ability to offer competitive services while fostering long-term growth.

The company maintains a disciplined approach to capital investment, targeting leverage ratios below 2.0x. This financial prudence directly influences pricing, as it necessitates generating sufficient cash flow to support both operational needs and strategic expansion initiatives.

- Capital Investment Focus: CVS Group prioritizes investments in practice facilities and technology to enhance service delivery and competitive positioning.

- Strategic Acquisitions: The company actively seeks strategic acquisitions to expand its market reach and service offerings, funded through careful capital allocation.

- Leverage Management: Maintaining leverage below 2.0x is a key financial objective, ensuring financial stability and capacity for future investments.

- Cash Flow Generation: Pricing decisions are made with the explicit goal of ensuring robust cash flow to support ongoing investments and debt management.

CVS Group's pricing is influenced by its preventative care plans, like The Healthy Pet Club, which began around $30 monthly in 2024, offering a cost-effective bundle of services. This model drives predictable revenue, with preventative care contributing significantly to veterinary service income in 2023.

Market pressures, including cost of living issues and inflation in the UK during 2024-2025, require careful price adjustments to stay competitive, especially with rising employment costs. The company aims for a healthy adjusted EBITDA margin of 19%-23%, with fiscal year 2025 seeing margins around 20%, reflecting effective cost management.

The Competition and Markets Authority's 2024 investigation into veterinary pricing could impact CVS Group's future pricing strategies, particularly concerning cross-selling and transparency. This regulatory scrutiny underscores the need for strategic pricing that balances market demands with profitability targets.

CVS Group's pricing supports capital allocation for facility upgrades and acquisitions, while maintaining leverage below 2.0x. This disciplined financial approach ensures pricing generates sufficient cash flow for operations and growth initiatives.

4P's Marketing Mix Analysis Data Sources

Our CVS Group 4P's Marketing Mix Analysis is constructed using a blend of primary and secondary data sources. We meticulously examine CVS's official website, investor relations documents, and press releases to understand their product offerings, pricing strategies, and promotional activities. Additionally, we incorporate insights from reputable industry reports and competitive analyses to provide a comprehensive view of their distribution channels and overall market presence.