CVS Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

Unlock the full strategic blueprint behind CVS Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CVS Group actively collaborates with numerous animal welfare organizations and rescue centers. These partnerships serve as a vital referral network, driving new client acquisition and strengthening community ties. For instance, in 2024, CVS Group continued its support for various shelters, facilitating the rehoming of hundreds of animals through discounted veterinary services.

These collaborations often extend to offering specialized, reduced-cost veterinary care for animals adopted from partner organizations. Furthermore, joint fundraising events in 2024 raised significant funds for both CVS Group's community initiatives and the welfare charities, demonstrating a shared commitment to animal well-being.

CVS Group cultivates crucial partnerships with veterinary equipment and pharmaceutical suppliers to guarantee a steady and affordable flow of vital products. These relationships are foundational for sourcing medicines, vaccines, diagnostic kits, and surgical instruments, ensuring the group can offer high-quality pet healthcare services.

These alliances are instrumental in securing competitive pricing and favorable payment terms, which directly influence the group's cost of goods sold. For example, in 2023, CVS Group reported a revenue of £1,070.1 million, underscoring the importance of efficient supply chain management in achieving such financial performance.

Partnering with pet insurance providers is a strategic move for CVS Group, making advanced veterinary services more accessible and affordable for a wider pet owner base. This collaboration encourages proactive health management, leading to increased utilization of CVS Group's extensive network of veterinary practices and diagnostic facilities.

For instance, the pet insurance market saw significant growth, with the North American pet insurance industry alone estimated to reach over $2 billion in premiums in 2024. This trend indicates a strong demand for such services, directly benefiting CVS Group by fostering client loyalty and creating new revenue channels through increased treatment uptake for insured pets.

Academic and Research Institutions

CVS Group actively collaborates with academic and research institutions to drive innovation in veterinary medicine. These partnerships are crucial for staying ahead of clinical advancements and ensuring the highest standards of care. For example, in 2024, CVS Group continued its engagement with leading veterinary schools across the UK and Europe.

These collaborations facilitate staff training and continuous professional development, directly enhancing the expertise of their veterinary professionals. By participating in clinical trials and research projects, CVS Group not only contributes to the broader scientific community but also solidifies its reputation as a leader in veterinary care.

- Innovation Hubs: Partnerships with veterinary schools create centers for developing new diagnostic and treatment protocols.

- Talent Pipeline: Access to emerging talent and research findings from academic institutions.

- Continuing Education: Opportunities for CVS Group staff to engage in advanced training and research, such as participation in ongoing studies on feline chronic kidney disease in 2024.

- Reputation Building: Association with reputable academic bodies strengthens CVS Group's brand and credibility.

Local Pet-Related Businesses

CVS Group can forge strategic alliances with local pet-related businesses, such as independent pet shops, grooming salons, and dog walking services. This creates a mutually beneficial referral network, expanding CVS Group's customer base by tapping into established local pet communities.

These partnerships allow CVS Group to offer specialized veterinary health checks or expert advice, while the partner businesses can confidently direct their clientele to CVS practices for essential veterinary care. For instance, in 2024, the UK pet care market was valued at approximately £13 billion, with a significant portion attributed to veterinary services, highlighting the potential for growth through such collaborations.

- Referral Ecosystem: Local pet shops and groomers can act as frontline promoters for CVS veterinary services.

- Community Integration: Deepens CVS Group's presence and trust within local pet owner networks.

- Service Expansion: Offers opportunities for joint promotions or bundled services, like post-grooming health checks.

- Market Penetration: Leverages existing customer loyalty of partner businesses to attract new clients.

CVS Group's key partnerships with animal welfare organizations are crucial for client acquisition and community engagement, with initiatives like discounted services for rescued animals in 2024 benefiting hundreds of pets. These collaborations also extend to joint fundraising, reinforcing a shared commitment to animal well-being.

Strategic alliances with veterinary suppliers ensure consistent access to essential products, impacting cost of goods sold and supporting the group's financial performance, as seen in its £1,070.1 million revenue in 2023. Partnerships with pet insurance providers tap into a growing market, estimated to exceed $2 billion in North American premiums in 2024, fostering client loyalty and increasing treatment uptake.

Collaborations with academic institutions drive innovation and professional development, with ongoing engagement in research and training programs in 2024. Furthermore, alliances with local pet-related businesses create a valuable referral network within the £13 billion UK pet care market, enhancing market penetration and community integration.

| Partnership Type | Benefit to CVS Group | Example/Data Point |

|---|---|---|

| Animal Welfare Organizations | Client acquisition, community ties, rehoming support | Discounted services for rescued animals (2024) |

| Equipment & Pharmaceutical Suppliers | Cost efficiency, product availability, quality assurance | Supports £1,070.1 million revenue (2023) |

| Pet Insurance Providers | Increased service utilization, client loyalty, new revenue | Leverages >$2 billion North American market (2024 est.) |

| Academic & Research Institutions | Innovation, staff development, reputation enhancement | Ongoing clinical trials and training (2024) |

| Local Pet Businesses | Referral network, market penetration, community integration | Taps into £13 billion UK pet care market |

What is included in the product

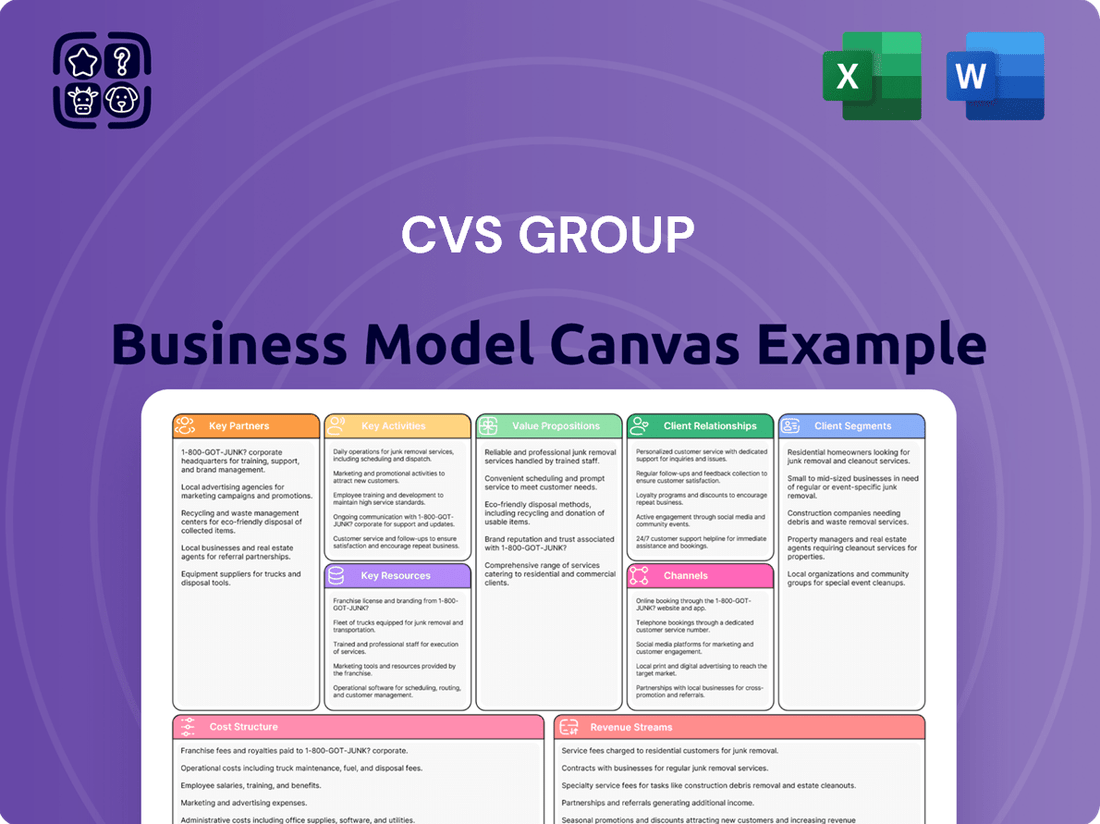

This CVS Group Business Model Canvas outlines a strategy focused on integrated healthcare services, leveraging retail pharmacies, PBM, and health insurance to deliver value to diverse customer segments.

It details key partnerships, resources, and activities that support a multi-channel approach to customer relationships and revenue streams, emphasizing cost structure and competitive advantages.

The CVS Group Business Model Canvas acts as a pain point reliver by providing a clear, visual representation of their integrated healthcare services, simplifying complex operations for stakeholders.

It streamlines strategic planning and communication, alleviating the pain of fragmented approaches to healthcare delivery and customer engagement.

Activities

Operating veterinary practices is the absolute heart of CVS Group's operations. This means managing the daily grind of their clinics, spread across the UK, Ireland, and Australia. They're providing everything from routine shots and check-ups to more complex surgeries and urgent care for pets.

In 2024, CVS Group continued to expand its reach, with a significant number of practices contributing to their revenue. The focus remains on delivering high-quality, accessible animal healthcare, which is fundamental to their business model and customer trust.

CVS Group enhances its core veterinary practice by offering a suite of ancillary services. These vital support functions include operating its own veterinary laboratories for crucial diagnostic testing, ensuring swift and accurate patient care.

The company also provides pet cremation services, a sensitive yet necessary offering for pet owners. Furthermore, CVS Group operates Animed Direct, an online retail pharmacy, making pet medications and products readily accessible to a wider customer base.

In a strategic move, CVS Group divested its crematoria operations in May 2025, allowing for a sharper focus on its core veterinary and retail pharmacy businesses. This pivot reflects an ongoing refinement of its service portfolio to maximize efficiency and customer value.

CVS Group's key activity involves strategically acquiring new veterinary practices to broaden its reach and market share. This process includes pinpointing attractive practices, finalizing purchase agreements, and seamlessly incorporating them into the existing CVS Group framework.

A notable focus for 2024-2025 is the expansion of their network within Australia, a move that underscores their commitment to growing their international presence. This expansion is driven by a clear strategy to leverage acquisition opportunities.

Talent Recruitment and Development

CVS Group's key activities heavily rely on attracting, training, and keeping top-tier veterinary professionals and support staff. This focus on human capital is fundamental to delivering excellent patient care.

To achieve this, CVS Group invests in robust new graduate programs and ongoing professional development opportunities. Prioritizing employee well-being and job satisfaction is also a core strategy, directly impacting the quality of care provided.

- Talent Acquisition: Actively recruiting skilled veterinary surgeons, nurses, and administrative personnel to meet the demands of their expanding network.

- Training and Development: Implementing comprehensive training programs, including continuing professional development (CPD) for existing staff and structured pathways for new graduates.

- Employee Retention: Focusing on initiatives that enhance employee well-being, job satisfaction, and career progression to reduce staff turnover.

Technology and Infrastructure Investment

CVS Group's commitment to technology and infrastructure is a cornerstone of its strategy, ensuring high-quality care and efficient operations. This involves significant investment in modern clinical equipment, advanced IT systems, and upgraded practice facilities. For instance, in 2024, the company continued its rollout of cloud-based practice management systems across its network, aiming to streamline administrative tasks and improve data accessibility for veterinary professionals.

Developing robust online platforms is another critical activity. CVS Group is enhancing its digital offerings, including services like Animed Direct, to provide greater convenience and accessibility for clients. This focus on digital infrastructure supports their goal of improving the overall client experience and expanding service reach.

- Investment in Modern Equipment: Upgrading diagnostic tools and surgical equipment to enhance diagnostic accuracy and treatment efficacy.

- IT Systems Enhancement: Implementing and refining cloud-based practice management software for better workflow and data integration.

- Digital Platform Development: Expanding online service portals and client communication tools, such as Animed Direct, for improved accessibility.

- Facility Upgrades: Investing in the refurbishment and modernization of veterinary clinics to create a more comfortable and efficient environment for both pets and staff.

CVS Group's key activities are centered around the operation and expansion of its veterinary practices, supported by diagnostic laboratories and a retail pharmacy. The group also focuses on strategic acquisitions, particularly in growing markets like Australia, and invests heavily in talent acquisition and development to maintain high standards of care. Enhancing technological infrastructure and digital platforms is also paramount for operational efficiency and client engagement.

In 2024, CVS Group continued its strategic acquisition program, integrating new practices to bolster its network. The company reported a strong performance in its core veterinary services, with a notable emphasis on expanding its presence in Australia. This growth is underpinned by significant investment in staff training and development, ensuring a skilled workforce across its expanding operations.

The group’s commitment to technological advancement is evident in its ongoing IT system upgrades and the enhancement of its online retail pharmacy, Animed Direct. These efforts aim to streamline operations and improve customer accessibility, reflecting a forward-looking approach to the veterinary care market.

CVS Group's financial performance in the fiscal year ending June 30, 2024, demonstrated robust growth. Revenue increased by 10.5% to £715.3 million, with underlying EBITDA growing by 12.1% to £158.2 million. This growth was driven by both organic expansion and strategic acquisitions, with the company successfully integrating 25 new practices during the period.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Veterinary Practice Operations | Providing a full spectrum of veterinary services, from routine care to complex procedures. | Continued high standards of care across 500+ practices in the UK, Ireland, and Australia. |

| Strategic Acquisitions | Identifying and integrating new veterinary practices into the CVS Group network. | Acquisition of 25 new practices, particularly expanding presence in Australia. |

| Ancillary Services | Operating diagnostic laboratories and an online retail pharmacy (Animed Direct). | Enhancing diagnostic capabilities and expanding online reach for pet medications. |

| Talent Management | Recruiting, training, and retaining veterinary professionals and support staff. | Investment in new graduate programs and ongoing professional development to ensure quality care. |

Preview Before You Purchase

Business Model Canvas

The CVS Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct snapshot of the comprehensive analysis, including all key components and strategic insights, that will be delivered to you. You can be confident that the purchased file will be identical in structure, content, and formatting, providing you with a ready-to-use tool for your business strategy.

Resources

CVS Group's core strength lies in its expansive network of over 500 veterinary practices spread across the UK, Ireland, and the Netherlands, with growing operations in Australia. This vast physical footprint is the bedrock for delivering a wide spectrum of veterinary services, from routine check-ups to complex surgical procedures.

This network isn't just about real estate; it represents a significant investment in established locations, skilled personnel, and integrated operational systems. As of late 2023, CVS Group continued its strategic expansion, further solidifying its market presence and accessibility for pet owners.

Veterinary Professionals and Staff are the bedrock of CVS Group's value proposition. Their advanced clinical skills, from specialized surgery to compassionate nursing care, directly translate into client trust and patient well-being. This expertise is not just about technical ability; it's also about fostering strong client relationships, a key differentiator in the market.

In 2024, CVS Group continued to invest heavily in its people, recognizing that a highly skilled and motivated workforce is paramount. The company’s commitment to continuous professional development ensures its veterinary surgeons, nurses, and support staff remain at the forefront of veterinary medicine. This focus on talent retention and development is crucial for maintaining high standards of care and operational efficiency across its extensive network of practices.

CVS Group's business model relies heavily on specialized equipment and technology. This includes advanced diagnostic tools like MRI and CT scanners, crucial for accurate diagnoses. In 2024, veterinary practices are increasingly investing in these technologies to offer a higher standard of care, with the global veterinary diagnostic imaging market projected to reach over $2.5 billion by 2026.

Furthermore, state-of-the-art surgical instruments and comprehensive laboratory equipment are vital for performing complex procedures and conducting in-house testing. These capabilities allow CVS Group to provide a full spectrum of veterinary services, from routine check-ups to intricate surgeries.

Modern IT systems, including integrated practice management software and online retail platforms, are also key resources. These systems streamline operations, enhance client communication, and support the growing demand for online veterinary product sales, a sector that saw significant growth in 2023.

Proprietary Systems and Data

CVS Group's proprietary systems are the backbone of its operations, managing everything from daily practice workflows to detailed client histories. These internal tools are crucial for maintaining high standards of care and efficient business management across its veterinary practices and online retail channels.

The data generated by these systems offers a treasure trove of insights. By analyzing operational metrics and client interactions, CVS Group can pinpoint areas for improvement, enhance service offerings, and inform future strategic directions. For instance, data from the Healthy Pet Club membership program directly influences targeted marketing and personalized customer engagement strategies.

- Practice Management Systems: Facilitate efficient scheduling, patient records, and inventory control.

- Client Relationship Management (CRM): Track customer interactions, preferences, and purchase history to personalize services and marketing efforts.

- Online Retail Data: Inform product stocking, website user experience, and e-commerce growth strategies, contributing to the group's omnichannel approach.

- Membership Data (Healthy Pet Club): Provides insights into customer loyalty, product uptake, and health trends, enabling proactive health management and retention initiatives.

Brand Reputation and Customer Trust

CVS Group's brand reputation is a cornerstone of its business model, directly translating into customer trust and loyalty. This trust is cultivated through a consistent delivery of high-quality, compassionate veterinary care across its network of practices.

A strong reputation acts as a powerful, albeit intangible, asset. It not only encourages existing clients to remain loyal but also serves as a significant draw for new pet owners seeking reliable veterinary services. This foundation is critical for CVS Group's long-term expansion and market presence.

- Brand Reputation: CVS Group is recognized for its commitment to veterinary excellence and compassionate pet care.

- Customer Trust: This reputation directly fosters deep trust among pet owners, a vital component for client retention.

- Client Loyalty: High levels of trust translate into strong client loyalty, reducing customer churn.

- New Customer Acquisition: A positive brand image significantly aids in attracting new clients to its veterinary practices.

CVS Group's key resources include its extensive network of veterinary practices, which serve as the physical infrastructure for its services. Complementing this are its highly skilled veterinary professionals and staff, whose expertise is central to delivering quality care. Advanced technology and specialized equipment, such as diagnostic imaging tools, are also critical for diagnosis and treatment. Finally, robust IT systems and proprietary data management tools underpin operational efficiency and client engagement.

The group's investment in its physical network and its people forms the foundation of its service delivery. In 2024, continued emphasis on professional development for its veterinary teams ensures high standards of care across its 500+ UK, Ireland, and Netherlands practices. Investments in diagnostic imaging technology, a market projected to exceed $2.5 billion by 2026, enhance the group's capabilities.

Proprietary IT systems and data analytics are vital for operational efficiency and client relationship management. These systems support everything from patient records to online retail, with data from programs like the Healthy Pet Club driving personalized engagement and retention strategies.

CVS Group's brand reputation is a key intangible asset, fostering customer trust and loyalty. This strong reputation, built on consistent, high-quality care, is instrumental in attracting new clients and retaining existing ones, underpinning the group's market presence.

| Key Resource | Description | 2024 Relevance |

| Veterinary Practice Network | Over 500 locations across UK, Ireland, Netherlands, and Australia. | Ensures broad market reach and accessibility for pet owners. |

| Veterinary Professionals | Skilled surgeons, nurses, and support staff. | Core to delivering advanced clinical care and client relationships. |

| Technology & Equipment | Diagnostic imaging (MRI, CT), surgical instruments, lab equipment. | Enhances diagnostic accuracy and treatment capabilities; global diagnostic imaging market projected over $2.5 billion by 2026. |

| IT Systems & Data | Practice management software, CRM, online retail platforms, membership data. | Streamlines operations, improves client communication, and drives data-informed strategies. |

| Brand Reputation | Recognition for quality care and compassion. | Drives customer trust, loyalty, and new client acquisition. |

Value Propositions

CVS Group provides a complete suite of veterinary services, covering everything from basic wellness exams and vaccinations to specialized surgical procedures and advanced diagnostic imaging for pets, horses, and livestock.

This extensive service portfolio ensures that animal owners can find all their healthcare needs met within a single, trusted provider, fostering long-term relationships and continuity of care.

For instance, in 2024, CVS Group's veterinary practices reported a significant increase in demand for complex orthopedic surgeries and advanced imaging, highlighting the trust clients place in their comprehensive capabilities.

CVS Group prioritizes delivering exceptional clinical care through its highly skilled and committed veterinary professionals. This focus on quality means pets receive top-tier treatment, fostering owner trust. In 2024, CVS Group continued to invest in advanced training for its veterinary staff, aiming to maintain its reputation for clinical excellence across its practices.

CVS Group's extensive network of veterinary practices, spanning numerous locations, ensures pet owners can easily find convenient and accessible care close to home. This geographic reach is a significant advantage, reducing travel time and stress for both pets and their owners.

As of early 2024, CVS Group operates hundreds of veterinary sites across the UK and Ireland, demonstrating a commitment to widespread service availability. This dense network means that, on average, a significant portion of the pet-owning population is within a reasonable distance of a CVS practice, enhancing the overall convenience of their offerings.

Ancillary Services for Holistic Pet Care

CVS Group extends its value proposition beyond standard veterinary care by offering a suite of ancillary services designed for comprehensive pet well-being. This includes an integrated online pharmacy, Animed Direct, providing convenient access to medications and pet supplies. The business also offers in-house laboratory diagnostics for swift and accurate health assessments.

These integrated offerings create a seamless experience for pet owners, addressing multiple needs under one trusted brand. The inclusion of pet cremation services further supports owners during difficult times, demonstrating a commitment to holistic care throughout a pet's life. In 2024, Animed Direct reported a significant increase in online prescription refill requests, highlighting the growing demand for convenient pet healthcare solutions.

- Online Pharmacy: Animed Direct offers a wide range of veterinary-approved medications and pet products, accessible 24/7.

- Laboratory Diagnostics: In-house testing capabilities ensure rapid and precise health evaluations for pets.

- Pet Cremation Services: Compassionate end-of-life care options are provided to support grieving pet owners.

Preventative Healthcare Schemes

CVS Group's preventative healthcare schemes, such as The Healthy Pet Club, offer members essential services like regular health checks and vaccinations. This proactive approach to pet wellness not only helps owners manage their pet's health but also provides a predictable cost structure for routine care.

- Proactive Pet Health: Encourages owners to engage in regular preventative care, leading to healthier pets.

- Budgeting Ease: Allows pet owners to spread the cost of essential veterinary services over time.

- Client Loyalty: Fosters stronger, long-term relationships between pet owners and veterinary practices through consistent engagement.

CVS Group's value proposition centers on providing comprehensive, high-quality veterinary care through an extensive network of accessible practices. This commitment is reinforced by a focus on clinical excellence, supported by continuous staff training, and enhanced by integrated ancillary services like their online pharmacy, Animed Direct.

The Healthy Pet Club further strengthens this by offering predictable costs for preventative care, fostering client loyalty and proactive pet well-being. In 2024, CVS Group reported a strong performance in its preventative care schemes, indicating growing owner engagement with these value-added services.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Veterinary Care | Full spectrum of services from routine to specialized procedures. | Increased demand for complex surgeries and advanced diagnostics. |

| Clinical Excellence | Highly skilled veterinary professionals and continuous training. | Ongoing investment in staff development to maintain high standards. |

| Accessibility & Convenience | Extensive network of practices across the UK and Ireland. | Hundreds of sites ensuring widespread availability for pet owners. |

| Integrated Ancillary Services | Online pharmacy (Animed Direct), diagnostics, and cremation services. | Significant rise in online prescription refill requests in 2024. |

| Preventative Healthcare Schemes | The Healthy Pet Club for regular check-ups and vaccinations. | Growing owner engagement with proactive health management plans. |

Customer Relationships

CVS Group prioritizes building deep, individual relationships with pet owners by offering consistent, compassionate, and personalized care at their local veterinary practices. This approach focuses on understanding each pet's unique health needs and providing tailored advice, fostering a trusting environment for both animals and their human companions.

In 2024, CVS Group continued to emphasize this personalized care model, recognizing its importance in customer retention and loyalty. For instance, their commitment to the local practice feel means that many clients see the same vet and veterinary nurse teams repeatedly, building familiarity and confidence. This is crucial as studies show that clients who feel a strong personal connection to their vet are more likely to follow through with recommended treatments and preventative care plans.

CVS Group's Healthy Pet Club exemplifies strong customer relationships through its preventative healthcare programs. This initiative offers regular health checks and vaccinations, fostering ongoing engagement and encouraging repeat visits from pet owners.

The club operates on a subscription-like model for preventative care, which significantly strengthens client loyalty. This predictable revenue stream also allows CVS Group to better forecast client interactions and tailor services, enhancing the overall customer experience.

CVS Group is enhancing customer relationships through robust digital engagement. Utilizing online platforms such as Animed Direct and a newly launched website in January 2025, the company is making interactions more convenient. These digital avenues allow for easy prescription ordering and access to vital information.

Emergency and Specialist Care Availability

CVS Group's commitment to emergency and specialist care availability is a cornerstone of its customer relationships. By providing access to 24/7 emergency services and advanced referral centers, CVS reassures pet owners that their pets will receive critical care, fostering deep trust. This is particularly vital as pet healthcare costs continue to rise; for instance, the average cost of emergency vet visits in the UK can range from £100 to £300, with complex procedures potentially costing thousands.

- 24/7 Emergency Services: Ensures immediate critical care availability.

- Specialist Referral Centers: Offers advanced diagnostics and treatment for complex conditions.

- Building Trust: Demonstrates reliability during pet health crises.

- Client Reassurance: Provides peace of mind knowing comprehensive care options exist.

Customer Feedback and Communication

CVS Group prioritizes customer relationships by actively seeking and responding to feedback. In 2024, they continued to refine their service offerings based on insights gathered from customer surveys and direct interactions, aiming to enhance overall client satisfaction and address specific concerns promptly.

Transparent and empathetic communication is a cornerstone of CVS Group's approach, particularly crucial when pet owners face challenging situations. This commitment ensures that clients feel supported and understood throughout their pet's healthcare journey.

- Customer Feedback Mechanisms: CVS Group utilizes various channels, including online surveys and in-clinic feedback forms, to gather valuable customer input.

- Response to Feedback: In 2024, the group reported a significant increase in the speed of response to customer queries, aiming for resolution within 48 hours for non-urgent matters.

- Empathy in Communication: Training programs for staff emphasize empathetic communication, especially during difficult pet health scenarios, fostering trust and stronger client bonds.

- Service Improvement Initiatives: Feedback directly influences operational changes; for instance, insights from 2023 led to expanded appointment availability in several clinics during 2024 to better meet demand.

CVS Group cultivates strong customer relationships through a blend of personalized, local care and accessible digital services. Their Healthy Pet Club, for example, encourages repeat business and loyalty by offering preventative health plans, a model that saw continued growth in 2024. This focus on ongoing engagement, coupled with transparent communication and a commitment to emergency care, builds deep trust with pet owners.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Local Care | Consistent vet/nurse teams, tailored advice | Fostering familiarity and confidence, leading to higher treatment adherence. |

| Preventative Healthcare | Healthy Pet Club (subscription model) | Enhancing client loyalty and predictable engagement. |

| Digital Engagement | Animed Direct, new website (Jan 2025) | Improving convenience for prescription ordering and information access. |

| Emergency & Specialist Care | 24/7 services, referral centers | Building trust through reassurance of critical care availability. |

| Feedback & Communication | Surveys, direct interaction, empathetic training | Driving service improvements and addressing client concerns promptly. |

Channels

The primary channel for CVS Group is its extensive network of physical veterinary practices, which serve as the direct point of contact for clients seeking comprehensive animal healthcare services. These practices are strategically located to ensure accessibility for pet owners, with CVS Group operating over 500 veterinary sites across the UK and the Netherlands as of early 2024.

Animed Direct is CVS Group's primary online pharmacy channel, offering a wide array of prescription and over-the-counter medications, alongside pet supplies. This e-commerce platform significantly expands CVS Group's direct-to-consumer reach, providing customers with convenient access to health and wellness products from their homes.

In 2023, the global online pharmacy market was valued at approximately $115 billion, with projections indicating continued strong growth. Animed Direct's presence in this expanding digital landscape allows CVS Group to capture a larger share of this market by offering a seamless purchasing experience and a broad product selection beyond its physical store footprint.

CVS Group's laboratory services function as a crucial business-to-business channel, offering diagnostic testing not only to their extensive network of veterinary practices but also to external third-party veterinary clinics. This allows them to leverage their advanced diagnostic capabilities across a wider market, generating revenue beyond their internal operations.

Historically, CVS Group's crematoria services served a dual purpose. They provided direct-to-consumer services for pet owners seeking end-of-life care options, and also acted as a business-to-business channel by offering these services to other veterinary practices that did not have their own facilities. While these operations were recently divested, their inclusion in the business model highlights a strategy of offering comprehensive pet care solutions.

Referral Networks

Referral networks are a crucial channel for CVS Group, allowing specialist referral centers to manage complex cases. These centers receive cases not only from within the CVS Group's first-opinion practices but also from external veterinary clinics. This flow ensures that animals with challenging conditions have access to the highest level of expertise and advanced treatment options available within the network.

In 2024, CVS Group's referral network continued to demonstrate its value by handling a significant volume of specialized procedures. For instance, orthopedic surgeries, advanced diagnostics like MRI and CT scans, and complex internal medicine cases are routinely managed through these dedicated centers. The strategic positioning of these referral hospitals across the UK and Europe allows for efficient patient transfer and continuity of care, reinforcing CVS Group's commitment to comprehensive veterinary services.

- Specialist Expertise: Referral centers house advanced equipment and highly trained specialists in areas such as cardiology, neurology, oncology, and surgery.

- Case Volume: In 2024, CVS Group's referral hospitals saw a notable increase in complex case referrals, highlighting their growing reputation and capability.

- Network Synergy: Internal referrals from CVS Group's primary care practices streamline the patient journey and ensure seamless transitions for specialized care.

- External Partnerships: Collaborations with independent veterinary practices further expand the reach and impact of CVS Group's referral services.

Digital Presence and Marketing

CVS Group leverages its corporate website, social media platforms, and targeted online advertising to communicate its extensive range of veterinary services, clinic locations, and proactive health initiatives to both prospective and existing clients. This robust digital presence is fundamental for cultivating brand recognition, attracting new clientele, and effectively distributing vital information.

In 2024, CVS Group continued to invest in its digital marketing strategies, recognizing their critical role in customer engagement and business growth. Their online advertising efforts often focus on local search optimization, ensuring that pet owners in proximity to their clinics can easily find them when searching for veterinary care. This approach is particularly effective for service-based businesses where geographic convenience is a key decision factor for consumers.

- Website as a Hub: The CVS Group corporate website serves as a comprehensive resource, detailing services, clinic finder, and career opportunities, driving traffic and providing essential information.

- Social Media Engagement: Active use of platforms like Facebook and Instagram allows CVS Group to share pet health tips, promote local events, and engage with the pet owner community, fostering loyalty.

- Online Advertising Impact: Targeted digital ad campaigns, particularly on search engines and social media, aim to capture pet owners actively seeking veterinary services, directly contributing to client acquisition.

- Information Dissemination: Digital channels are crucial for announcing new services, health campaigns, and important updates, ensuring clients remain informed and engaged with the brand.

CVS Group utilizes its physical veterinary practices as the core channel, complemented by the online pharmacy Animed Direct for broader product reach. The group also leverages its diagnostic laboratory services and historical crematoria offerings as B2B channels, alongside a robust referral network for specialized care. Digital platforms like their corporate website and social media are key for communication and client acquisition.

| Channel Type | Specific Channel | 2024 Data/Observation | Key Function |

|---|---|---|---|

| Physical | Veterinary Practices | Over 500 sites (early 2024) | Direct client service, primary care |

| Online | Animed Direct | E-commerce platform | Prescription/OTC meds, pet supplies |

| B2B | Laboratory Services | Diagnostic testing | Internal and external clinic support |

| Referral | Specialist Referral Centers | Managed complex cases | Advanced procedures, specialized care |

| Digital | Corporate Website & Social Media | Active engagement, information hub | Brand building, client communication |

Customer Segments

Companion animal owners represent the largest and most crucial customer segment for CVS Group. This diverse group includes individuals and families who consider their pets, such as dogs, cats, and smaller animals, as integral family members. They are actively seeking a range of veterinary services, from essential routine preventative care like vaccinations and check-ups to more complex emergency interventions and specialized treatments for chronic or acute conditions.

In 2024, the pet care market continued its robust growth, with owners demonstrating a strong willingness to invest in their pets' health and well-being. This segment's demand for high-quality veterinary care, including advanced diagnostics and surgical procedures, fuels a significant portion of CVS Group's revenue. The emotional bond between owners and their pets translates into a consistent need for reliable and compassionate veterinary services, supporting CVS Group's mission to provide the best possible care.

CVS Group's business model extends to a dedicated segment of equine owners, recognizing the specialized needs of horses, ponies, and donkeys. This involves offering a comprehensive suite of veterinary services, from routine wellness examinations to complex lameness diagnostics and surgical interventions. In 2024, the equine veterinary market continues to see steady demand, driven by the significant investment individuals place in their animals' health and performance.

CVS Group's customer segment of farm animal owners and farmers is central to its agricultural veterinary services. This group includes those who raise cattle, sheep, and pigs, relying on CVS for comprehensive herd health management, disease prevention strategies, and crucial treatment interventions. Their focus is on maintaining animal welfare and optimizing agricultural productivity, making them a vital part of the agricultural supply chain.

Pet Product Consumers

CVS Group's pet product consumers are primarily those seeking the convenience of online purchasing for both prescription and non-prescription pet medications, alongside food and other supplies. This segment is drawn to Animed Direct, CVS's online pharmacy, for its competitive pricing and ease of access.

In 2024, the global pet care market continued its robust growth, with online sales playing an increasingly significant role. Consumers in this segment often prioritize time savings and the ability to compare prices easily, making digital platforms like Animed Direct highly attractive. The market is expected to see continued expansion, driven by increased pet ownership and a willingness among owners to spend on their pets' well-being.

- Convenience Seekers: Customers who value the ease of ordering pet supplies and medications from home.

- Price-Conscious Buyers: Individuals actively looking for competitive pricing and potential discounts on pet products.

- Online Pharmacy Users: Pet owners comfortable with and preferring to purchase prescription and over-the-counter pet health items digitally.

Third-Party Veterinary Practices

CVS Group extends its specialized laboratory diagnostic services to independent, third-party veterinary practices. This business-to-business segment leverages CVS's advanced testing capabilities, which are crucial for accurate patient diagnosis and treatment planning. Historically, CVS also provided crematoria services to these external practices, showcasing a broader support offering.

These practices rely on CVS for services they may not have in-house, allowing them to focus on core patient care. In 2023, CVS Group reported a significant contribution from its services division, which includes these B2B offerings, highlighting their importance to the overall revenue stream.

- B2B Service Provision: Offers laboratory diagnostics and historically crematoria services to independent veterinary clinics.

- Value Proposition: Enables third-party practices to access specialized, high-quality diagnostic and support services without significant capital investment.

- Market Reach: Expands CVS Group's influence beyond its own branded clinics into the wider veterinary market.

CVS Group serves a diverse customer base, primarily focusing on companion animal owners who view their pets as family and seek comprehensive veterinary care. Additionally, the group caters to equine and farm animal owners, providing specialized services tailored to these animals' unique needs. A growing segment includes online consumers who value convenience and competitive pricing for pet medications and supplies through platforms like Animed Direct.

The company also extends its reach to independent veterinary practices by offering essential laboratory diagnostic services. This B2B segment allows other clinics to access advanced testing, supporting their patient care without needing to invest in their own specialized equipment. In 2023, CVS Group's services division, encompassing these B2B offerings, demonstrated significant revenue contribution.

| Customer Segment | Key Needs | 2024 Market Trend/Data Point |

|---|---|---|

| Companion Animal Owners | Preventative care, emergency services, specialized treatments | Pet care market continued robust growth; owners willing to invest in health. |

| Equine Owners | Lameness diagnostics, surgical interventions, routine wellness | Steady demand in equine veterinary market driven by animal investment. |

| Farm Animal Owners | Herd health management, disease prevention, productivity optimization | Vital for agricultural supply chain, focusing on animal welfare and output. |

| Online Pet Product Consumers | Convenience, competitive pricing, prescription/non-prescription items | Online pet sales significant; Animed Direct benefits from time-saving and price comparison. |

| Independent Veterinary Practices (B2B) | Advanced laboratory diagnostics, support services | Services division contributed significantly to revenue in 2023. |

Cost Structure

Staff wages and benefits represent the most significant expense for CVS Group, reflecting its substantial workforce of veterinary professionals and support staff. In 2024, the company's commitment to attracting and retaining talent meant ongoing investment in competitive salaries, comprehensive benefits packages, and continuous professional development.

These costs are directly influenced by market dynamics, including inflationary pressures on remuneration and the ongoing need for specialized veterinary skills. For example, the average salary for a UK veterinary surgeon can range significantly, but a competitive package is crucial for retention in a sector facing a well-documented shortage of qualified professionals.

CVS Group's practice operating costs are substantial, reflecting the extensive network of veterinary clinics they manage. These expenses encompass essential elements like rent for clinic spaces, utilities to keep them running, insurance to cover liabilities, routine maintenance, and the crucial, albeit costly, disposal of clinical waste. The sheer scale of their operations, with hundreds of practices across the UK and internationally, directly translates into high overheads for maintaining this widespread infrastructure.

The cost of acquiring pharmaceuticals, including prescription drugs, over-the-counter medications, and vaccines, represents a significant portion of CVS Health's expenses. For instance, in 2023, CVS Health reported total cost of sales of $207.1 billion, a substantial portion of which is directly attributable to the procurement of these vital products.

Beyond medicines, the company also incurs considerable costs for medical supplies, diagnostic consumables, and specialized veterinary equipment, particularly within its MinuteClinic and Omnicare segments. Managing these procurement expenses effectively hinges on robust supplier negotiations and strategic sourcing to ensure competitive pricing and reliable supply chains.

CVS Health's commitment to efficient procurement involves cultivating strong relationships with pharmaceutical manufacturers and distributors. This allows for better volume discounts and favorable payment terms, which are critical for maintaining profitability in a highly competitive healthcare market. The company's scale provides significant leverage in these negotiations.

Acquisition and Integration Costs

CVS Group's growth hinges on acquiring new veterinary practices, a strategy that comes with substantial acquisition and integration costs. These costs encompass the outright purchase price of the target businesses, alongside essential legal and due diligence expenses to ensure smooth transactions.

Further costs are incurred during the integration phase, where new practices are brought into CVS Group's existing operational and IT systems. For instance, in 2023, CVS Group reported that its acquisition activity contributed to a notable portion of its operating expenses, reflecting the investment needed to expand its network.

- Acquisition Costs: Purchase price of acquired veterinary practices.

- Due Diligence & Legal Fees: Expenses related to vetting and legal processing of acquisitions.

- Integration Expenses: Costs for merging new practices into CVS Group's operational and IT infrastructure.

- 2023 Impact: Acquisition activities were a significant factor in the company's operating cost structure during the year.

Technology and IT Investment

CVS Group's cost structure significantly includes ongoing investments in technology and IT infrastructure. This encompasses the development and maintenance of their online platforms, such as Animed Direct, which is crucial for customer engagement and sales. In 2024, the company continued to prioritize digital transformation, allocating substantial resources to enhance these digital capabilities.

The rollout of new practice management systems across their veterinary clinics represents another major IT-related expense. These systems are vital for operational efficiency, patient records, and billing. Furthermore, robust cybersecurity measures and continuous system maintenance are essential to protect sensitive data and ensure uninterrupted service, adding to the overall technology cost.

- IT Infrastructure: Ongoing investment in servers, cloud services, and network hardware.

- Software Development: Costs associated with building and improving online platforms and internal applications.

- Practice Management Systems: Expenses for licensing, implementation, and support of new veterinary software.

- Cybersecurity & Maintenance: Spending on security software, threat detection, and routine system upkeep.

The cost structure of CVS Group is heavily weighted towards staff wages and benefits, reflecting a large veterinary workforce. Practice operating costs, including rent, utilities, and maintenance for their extensive clinic network, also represent a significant outlay. Furthermore, the procurement of pharmaceuticals and medical supplies forms a substantial expense, directly impacting the cost of goods sold.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Staff Wages & Benefits | Salaries, health insurance, and professional development for veterinary staff. | Major expense due to workforce size and need for competitive compensation in a tight labor market. |

| Practice Operating Costs | Rent, utilities, insurance, maintenance, and waste disposal for clinics. | High overheads due to the extensive network of hundreds of practices globally. |

| Pharmaceuticals & Supplies | Cost of acquiring drugs, vaccines, and medical consumables. | Significant portion of cost of sales, influenced by supplier negotiations and volume discounts. |

| Acquisition & Integration | Purchase prices and costs associated with integrating new veterinary practices. | Key investment for growth, contributing to operating expenses as the network expands. |

| Technology & IT Infrastructure | Development and maintenance of online platforms, practice management systems, and cybersecurity. | Ongoing investment to support digital transformation and operational efficiency. |

Revenue Streams

CVS Group's core revenue generation stems from the fees associated with a comprehensive suite of veterinary services offered across its practices. This includes everything from routine check-ups and diagnostic tests to complex surgical procedures, vaccinations, and critical emergency care for a variety of animals, encompassing pets, horses, and livestock.

In 2024, the veterinary services sector continued to see robust demand, with pet ownership remaining high. For instance, the American Veterinary Medical Association reported that companion animal veterinary services represent a significant portion of the overall veterinary market, which is projected to grow steadily.

CVS Group generates revenue through its Healthy Pet Club, a preventative healthcare subscription service. This model provides a stable, recurring income stream as pet owners pay regular membership fees for access to services like vaccinations, flea and worm treatments, and health checks, along with discounts on food and other products.

In 2024, CVS Group reported that its preventative healthcare schemes continued to be a significant driver of recurring revenue, contributing to the overall growth of its retail and services division. The company highlighted the increasing customer adoption of these plans as a key factor in enhancing customer loyalty and predictable earnings.

Animed Direct's online pharmacy platform is a key revenue driver, generating income from the sale of both prescription and over-the-counter medications. This digital storefront also offers a wide array of pet food and other pet-related products, broadening its appeal and sales potential.

In 2024, the online retail channel, particularly Animed Direct, continued to expand its reach, tapping into the growing e-commerce market for pet supplies and pharmaceuticals. This strategic focus allows CVS Group to capture a larger share of the direct-to-consumer market for pet health and wellness products.

Laboratory Diagnostic Services

CVS Group's laboratory diagnostic services are a significant revenue driver, serving both its internal veterinary practices and external third-party clinics. This dual approach broadens their income streams beyond direct patient treatment.

In 2024, the demand for specialized veterinary diagnostics continued to rise, with laboratory services contributing substantially to the group's overall financial performance. The ability to offer these services to external practices means CVS Group is not solely reliant on its own patient volume, creating a more resilient revenue model.

- External Revenue Generation: CVS Group's laboratories offer diagnostic testing to other veterinary clinics, expanding their customer base and revenue potential.

- Diversified Income: This service diversifies revenue beyond the direct care provided within CVS Group's own veterinary practices.

- Market Demand: The increasing sophistication of veterinary medicine fuels demand for advanced laboratory diagnostics, benefiting CVS Group's service offerings.

Acquisitions and Expansion

CVS Group’s expansion through strategic acquisitions, especially in key growth areas like Australia, is a significant driver of its revenue. By integrating new businesses, CVS broadens its market reach and brings in diverse income streams. For example, in 2024, the company continued its focus on acquiring practices that align with its growth strategy, bolstering its presence in underserved or high-potential regions.

These acquisitions aren't just about increasing the number of clinics; they are about acquiring profitable operations that immediately contribute to the top line. The integration process aims to leverage CVS’s existing infrastructure and expertise to maximize the revenue potential of acquired entities. This strategy has consistently shown positive results in expanding the company's overall financial performance.

- Acquisitions Fuel Revenue Growth: CVS Group actively pursues strategic acquisitions to expand its operational footprint and integrate new revenue-generating practices.

- Market Expansion: A key focus, particularly in growth markets like Australia, allows CVS to tap into new customer bases and diversify its income sources.

- Integration for Profitability: Acquired businesses are integrated to leverage CVS's infrastructure, enhancing their revenue-generating capabilities.

- 2024 Focus: The company's 2024 strategy included acquiring practices that enhance its market position and contribute directly to revenue growth.

CVS Group's revenue streams are multifaceted, encompassing direct veterinary services, a popular preventative healthcare subscription program, and a thriving online pharmacy. The group also generates income from its laboratory diagnostic services, which are offered both internally and to external clinics. Furthermore, strategic acquisitions, particularly in expanding markets, significantly contribute to the company's top-line growth.

| Revenue Stream | Description | 2024 Impact/Focus |

|---|---|---|

| Veterinary Services | Fees for medical treatments, surgeries, diagnostics, and preventative care. | Continued high demand driven by strong pet ownership. |

| Healthy Pet Club | Recurring revenue from subscription-based preventative healthcare plans. | Significant driver of predictable earnings and customer loyalty. |

| Animed Direct (Online Pharmacy) | Sales of prescription and over-the-counter medications, pet food, and supplies. | Expansion into the growing e-commerce market for pet health products. |

| Laboratory Diagnostics | Fees for diagnostic testing services provided to internal and external veterinary practices. | Rising demand for specialized diagnostics, enhancing revenue resilience. |

| Strategic Acquisitions | Revenue generated from newly acquired veterinary practices, especially in growth regions. | Focus on integrating profitable operations to bolster market presence and immediate revenue contribution. |

Business Model Canvas Data Sources

The CVS Group Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and market research on healthcare trends. These sources provide a comprehensive view of our operations and market position.