CVS Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Group Bundle

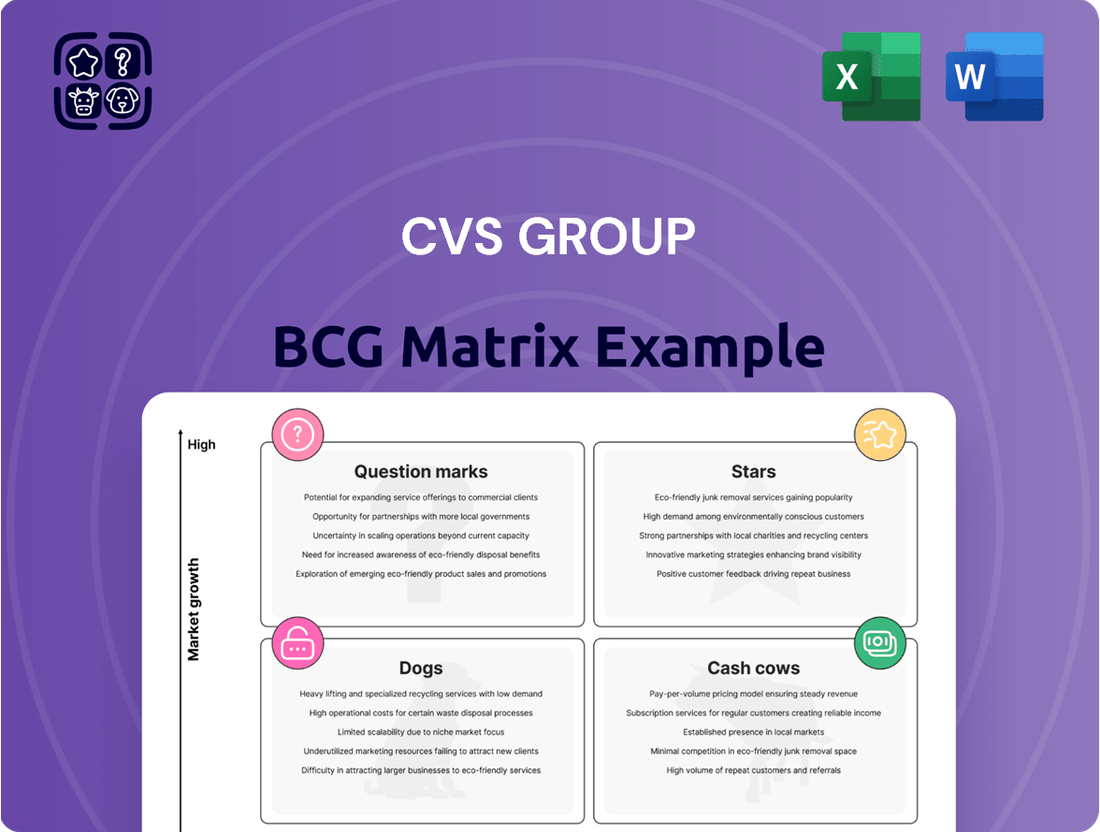

Curious about the CVS Group's strategic product positioning? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance. Unlock the full potential of this data by purchasing the complete report for actionable insights and a clear path forward.

Stars

CVS Group is aggressively expanding in Australia, acquiring multiple veterinary practices. This move targets a booming international market, classifying these new additions as stars with significant growth potential.

The company reported in its 2024 interim results that these Australian acquisitions are exceeding expectations. This strong performance is attributed to effective integration and the realization of buying synergies, a key driver for their star status.

CVS Group's specialist-led referral hospitals represent a significant component of their business, fitting into the Stars category of the BCG Matrix. These facilities offer advanced veterinary care for complex cases, tapping into a high-value market segment. The demand for such specialized services is on the rise, driven by the increasing trend of pet humanization and ongoing improvements in veterinary medicine.

CVS Group's laboratory division provides advanced diagnostic services, a critical component for sophisticated veterinary care. This segment is witnessing a significant upswing in demand as pet parents increasingly prioritize detailed health information and proactive wellness for their animals.

The investment in and broadening of these cutting-edge diagnostic tools represent a substantial growth avenue for the group. These services not only bolster the capabilities of CVS's own veterinary practices but also extend to supporting external clinics, highlighting a healthy and expanding market reach.

Technology and Digital Health Initiatives

CVS Group is actively enhancing its technology and digital health capabilities. This includes significant investment in new cloud-based practice management systems (PMS) and other IT infrastructure. These upgrades are in lockstep with the growing trend of digitalization across the veterinary sector, which notably encompasses the expansion of telemedicine services.

These digital initiatives are designed to streamline operations and elevate the client experience. For instance, the adoption of advanced PMS can automate administrative tasks, freeing up veterinary staff to focus more on patient care. This strategic move is vital for CVS Group to maintain a competitive edge in a market that is increasingly shaped by technological advancements and client expectations for convenient, digitally-enabled services.

The financial implications of these investments are considerable, with companies in the veterinary IT sector seeing substantial growth. For example, the global veterinary software market was valued at approximately USD 1.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 10% through 2030, indicating a strong demand for such solutions. CVS Group's commitment to these technologies positions it to capitalize on this expanding market.

- Investment in Cloud-Based PMS: CVS Group is upgrading its IT infrastructure with modern, cloud-based practice management systems.

- Digitalization Trend: This aligns with the broader industry shift towards digitalization in veterinary care, including telemedicine.

- Efficiency and Client Experience: Digital advancements aim to boost operational efficiency and improve client satisfaction.

- Market Share Capture: These investments are crucial for capturing market share in a technologically evolving landscape, with the global veterinary software market expected to reach significant valuations by 2030.

High-Quality Clinical Care Focus

CVS Group's strategic emphasis on delivering high-quality clinical care is a cornerstone of its success, acting as a powerful magnet for pet owners in an increasingly competitive veterinary landscape.

This dedication to excellence, evidenced by ongoing investments in state-of-the-art facilities and advanced medical equipment, enables CVS Group to solidify its market leadership and foster robust organic growth. For instance, in 2023, CVS Group reported a revenue of £1.8 billion, with a significant portion attributed to their premium service offerings.

In an era where pet well-being is paramount, this unwavering commitment to superior care serves as a critical differentiator, directly fueling their expansion and market penetration.

- Client Attraction and Retention: High-quality clinical care directly translates into loyal clientele, a crucial factor in the recurring revenue model of veterinary services.

- Market Differentiation: In a crowded market, superior clinical standards set CVS Group apart, attracting clients willing to pay for perceived higher value and expertise.

- Organic Growth Driver: Investments in advanced medical technology and skilled personnel enhance service capabilities, leading to increased patient throughput and service utilization.

CVS Group's Australian acquisitions are performing exceptionally well, demonstrating strong growth potential and solidifying their position as Stars in the BCG matrix. The company's interim 2024 results highlight these acquisitions exceeding expectations due to effective integration and synergy realization.

Specialist-led referral hospitals and advanced laboratory diagnostics also fall into the Star category, driven by increasing demand for high-value, complex veterinary care and detailed health information for pets. These segments are crucial for CVS Group's expansion and market penetration.

Investments in technology, particularly cloud-based practice management systems and digital health initiatives, are key drivers for their Star classification. This strategic focus on digitalization and enhanced client experience aligns with market trends and positions CVS Group for continued growth in the evolving veterinary sector.

CVS Group's commitment to high-quality clinical care, supported by investments in advanced facilities and equipment, is a significant factor in attracting and retaining clients. This focus on premium service offerings, which contributed to their £1.8 billion revenue in 2023, reinforces their market leadership and organic growth trajectory.

What is included in the product

This CVS Group BCG Matrix analysis provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within their portfolio.

Simplifies complex portfolios by visually categorizing CVS Group's business units, easing strategic decision-making.

Cash Cows

The extensive network of established UK first opinion veterinary practices represents a significant cash cow for CVS Group. These practices benefit from a large, loyal client base in a mature market characterized by high pet ownership and consistent demand for routine veterinary services.

In the fiscal year ending September 2023, CVS Group reported that its UK first opinion division continued to be a strong performer, contributing substantially to the group's overall profitability. While specific segment data for 2024 is still emerging, the underlying trend of consistent demand for essential pet care suggests this segment will remain a reliable cash generator.

The Healthy Pet Club, a key preventative healthcare scheme for CVS Group, is a prime example of a cash cow. Its subscription-based model generates a consistent and predictable revenue stream from a growing customer base dedicated to their pets' well-being.

As of the first half of fiscal year 2024, CVS Group reported that the Healthy Pet Club saw a 7.1% increase in membership, reaching over 500,000 members. This sustained growth underscores the scheme's strong market appeal and its ability to secure recurring income, contributing significantly to the company's financial stability.

CVS Group's laboratory diagnostics for third parties acts as a cash cow. This segment offers diagnostic services to external veterinary practices, diversifying revenue streams beyond CVS's internal needs. This strategy effectively utilizes existing laboratory infrastructure, generating consistent, high-margin income with minimal incremental investment.

Animed Direct (Online Retail Pharmacy)

Animed Direct, as CVS Group's online retail pharmacy, leverages convenience and a broad product selection, encompassing both prescription and over-the-counter medications. While the online retail pharmacy market has seen some moderation, Animed Direct continues to be a reliable revenue generator for CVS Group.

This segment benefits from a stable customer base, leading to consistent cash flow derived from repeat business and its extensive reach. In 2024, online pharmacies, including those like Animed Direct, continued to capture a significant share of the healthcare market, with projections indicating steady growth in the digital health sector.

- Established Revenue Stream: Animed Direct contributes a predictable income to CVS Group.

- Customer Loyalty: Repeat purchases from a broad customer base ensure consistent cash flow.

- Market Presence: The online channel remains a vital component of CVS Group's overall strategy.

- Industry Growth: The digital health sector, supporting online pharmacies, is expected to see continued expansion.

Farm Animal and Equine Services

While CVS Group is well-known for its companion animal services, it also offers essential healthcare for farm animals and equines. These specialized services cultivate deep, often generational, client relationships within established agricultural and equestrian sectors. This segment, though not experiencing the rapid expansion of companion animal care, delivers a reliable and predictable income, functioning as a stable cash generator for the group.

The farm animal and equine services within CVS Group's portfolio are characteristic of a Cash Cow in the BCG Matrix. These services benefit from mature markets with predictable demand.

- Consistent Revenue: These services provide a steady flow of income, contributing to the group's financial stability.

- Established Client Base: Long-standing relationships in agricultural and equestrian communities ensure recurring business.

- Lower Growth, High Share: While market growth may be modest, CVS Group holds a significant share, making them efficient cash generators.

- Support for Other Ventures: The profits generated can be reinvested into higher-growth areas of the business.

CVS Group's UK first opinion veterinary practices are a prime example of cash cows. These established businesses benefit from high pet ownership and consistent demand for routine services, ensuring a steady revenue stream.

The Healthy Pet Club, with over 500,000 members as of early 2024, demonstrates a strong subscription model generating predictable income. This recurring revenue is a hallmark of a cash cow, providing financial stability.

Animed Direct, the online pharmacy, continues to be a reliable revenue generator. Its broad product selection and convenience foster customer loyalty, leading to consistent cash flow from repeat business.

Specialized services for farm animals and equines also function as cash cows. These segments cater to mature markets with predictable demand and benefit from deep, established client relationships, contributing consistent income.

| Segment | BCG Classification | Key Characteristics | 2023/2024 Data Points |

|---|---|---|---|

| UK First Opinion Practices | Cash Cow | Established, loyal client base, consistent demand for routine services. | Strong contributor to overall profitability in FY23. Consistent demand trend expected to continue. |

| The Healthy Pet Club | Cash Cow | Subscription-based, predictable revenue, growing membership. | 7.1% membership increase in H1 FY24, exceeding 500,000 members. |

| Animed Direct (Online Pharmacy) | Cash Cow | Convenience, broad product selection, repeat business, digital health sector growth. | Continued reliable revenue generation; digital health sector shows steady growth. |

| Farm Animal & Equine Services | Cash Cow | Mature markets, predictable demand, generational client relationships. | Delivers reliable and predictable income; stable cash generator. |

Delivered as Shown

CVS Group BCG Matrix

The CVS Group BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the same in-depth insights and clear presentation that will empower your business planning and competitive strategy.

Dogs

CVS Group's divestment of its Netherlands and Republic of Ireland operations in 2024 aligns with a strategic move to shed underperforming assets. These businesses were characterized as 'loss-making' and 'sub-scale,' indicating a weak competitive position and insufficient revenue generation to cover costs.

The decision to sell these operations suggests they were viewed as cash traps within the BCG Matrix framework. They likely possessed low relative market share in their respective markets and operated in mature or declining sectors, offering limited growth potential.

The disposal of these entities frees up capital and management focus that can be redirected towards more promising segments of CVS Group's portfolio. This strategic pruning is essential for optimizing resource allocation and improving overall financial health.

CVS Group completed the divestment of its crematoria operations in April 2025. This strategic move signals that this segment was no longer considered a core part of the company's growth strategy or offered limited future potential. The sale generated significant cash, indicating a departure from a business unit likely characterized by low growth prospects and not a priority for further investment.

Within the CVS Group's strategic framework, acquired practices that falter in integration or fail to meet performance benchmarks are categorized as Dogs. These underperforming units demand significant capital and management attention, yet offer minimal returns, acting as a drag on the company's overall financial health.

For instance, if a newly acquired veterinary clinic, despite initial projections of capturing 15% of the local market in its first year, only achieves 5% by mid-2024 and shows no signs of improvement, it would likely be classified as a Dog. Such a scenario necessitates a critical review of the acquisition's strategic fit and operational execution.

Certain Niche or Outdated Veterinary Services

Certain niche or outdated veterinary services within CVS Group's portfolio could be classified as dogs in the BCG matrix. These might include specialized treatments that have been largely replaced by more advanced or cost-effective alternatives, or services catering to breeds or conditions with significantly diminished prevalence.

These offerings typically exhibit low market share and minimal growth potential, often requiring significant investment for maintenance without substantial returns. For instance, if CVS Group still offers services for a rare genetic condition in a specific dog breed that is now critically endangered, this would likely fall into the dog category.

Consider the financial implications: in 2024, if a particular service line, like a specialized surgical procedure for a now-uncommon ailment, generated less than 5% of the total revenue for a specific clinic and showed a year-over-year decline in patient numbers, it would strongly indicate a dog status. Such services can divert valuable resources, including specialized equipment and trained personnel, from more profitable or growing areas of the business.

- Outdated Treatment Modalities: Veterinary services relying on older, less effective treatment protocols that have been surpassed by modern advancements.

- Niche Services with Declining Demand: Specialized care for rare conditions or specific pet breeds that are no longer popular or have seen significant population decline.

- Low Profitability and High Overhead: Services that require specialized equipment or highly trained staff but generate minimal revenue, leading to a net loss.

- Resource Drain: Continued investment in maintaining facilities or training for services that are rarely utilized, impacting overall operational efficiency.

Legacy IT Systems

Legacy IT systems, prior to CVS Group's aggressive cloud migration, would have been categorized as a 'dog' in the BCG matrix. These outdated infrastructures demanded substantial resources for maintenance, often exceeding their diminishing operational value.

These systems would have significantly hampered efficiency, slowing down crucial processes and limiting the company's ability to adapt to market changes. In 2023, companies investing in IT modernization saw an average of 20% improvement in operational efficiency.

The lack of competitive advantage offered by such legacy systems made them a drain on resources, justifying the substantial investment in upgrading to a modern, cloud-based practice management system. This strategic shift is essential for future growth and agility.

- Resource Drain: Older systems often require costly upkeep and specialized personnel.

- Efficiency Bottleneck: Outdated technology impedes faster, more streamlined operations.

- Competitive Disadvantage: Lack of modern features hinders innovation and market responsiveness.

In the context of CVS Group's strategic portfolio management, 'Dogs' represent business units or services that possess a low market share and operate within a low-growth industry. These segments typically consume more resources than they generate in returns, acting as a drag on overall profitability.

For example, a specific veterinary service that has seen declining demand, such as treatments for a rare breed now facing population decline, would be classified as a Dog. In 2024, such a service might account for less than 5% of a clinic's revenue and show a negative year-over-year growth trend.

The divestment of underperforming assets, like the Netherlands and Republic of Ireland operations in 2024, reflects a strategy to eliminate these 'Dog' categories. This allows for capital reallocation to higher-potential areas, optimizing the group's overall performance and resource allocation.

Legacy IT systems, prior to CVS Group's 2024/2025 modernization efforts, also fit the 'Dog' profile. These systems required substantial maintenance costs while offering diminishing operational value and hindering efficiency, unlike the 20% average efficiency gains seen by companies investing in IT upgrades in 2023.

Question Marks

New Australian acquisitions for CVS Group, while entering a high-growth market, are initially classified as question marks. These businesses offer significant potential for future market share gains, but they demand considerable investment and strategic integration to realize this promise.

The success of these Australian ventures, moving them from question marks to stars in the BCG matrix, hinges on effective post-acquisition management and ongoing capital allocation. CVS Group's 2024 strategy likely involves careful assessment and resource deployment to nurture these new assets.

CVS Group's advanced digital health platforms, including new cloud-based practice management systems, represent a significant investment in modernizing operations and enhancing client experience. These initiatives are designed to streamline workflows and improve service delivery, but their long-term success and market impact are still unfolding.

While these digital health platforms hold substantial promise, their market adoption and the realization of their full return on investment are currently uncertain, placing them squarely in the question mark category of the BCG matrix. CVS Group is channeling considerable resources into developing and refining these tools, aiming to solidify their position in a rapidly evolving digital healthcare landscape.

Specialist pet rehabilitation and wellness centers represent a 'question mark' for CVS Group within the BCG matrix. These facilities, offering services beyond routine veterinary care like physical therapy and advanced diagnostics, tap into a burgeoning market driven by increased pet humanization and a desire for premium pet health solutions.

The potential for significant growth in this niche is evident, with the global pet care market projected to reach $270 billion by 2025, according to some industry estimates. However, establishing these centers requires substantial capital for specialized equipment and trained personnel, alongside a robust marketing strategy to educate pet owners and build trust, making their market share uncertain.

Expansion into Untapped European Veterinary Markets

Following its strategic divestments from the Netherlands and Ireland, CVS Group's potential expansion into untapped European veterinary markets would categorize these new ventures as question marks within the BCG matrix. These markets represent significant growth opportunities, potentially driven by increasing pet ownership rates and unmet specialist veterinary needs, but currently hold no market share for CVS.

Such expansion requires substantial investment and carries inherent risks, mirroring the characteristics of question mark products or services. For example, countries like Poland and Hungary have seen a notable increase in pet expenditure, with Poland's pet care market projected to grow by approximately 7% annually leading up to 2025, presenting a fertile ground for exploration.

- High Growth Potential: Emerging European markets often exhibit faster growth in pet ownership and veterinary service demand compared to more mature markets.

- Zero Market Share: CVS Group would be entering these markets as a new player, necessitating brand building and market penetration strategies.

- Significant Investment Required: Establishing a presence, acquiring clinics, and building operational capacity in new territories demands considerable capital outlay.

- High Risk: Regulatory hurdles, competitive landscapes, and cultural differences present significant risks that need careful management.

Development of Proprietary Veterinary Products/Brands (MiPet, EqueVet-Pro)

CVS Group's development of proprietary veterinary products, such as MiPet and EqueVet-Pro, positions them as potential question marks within a BCG Matrix analysis. These brands, aimed at managing specific conditions and enhancing animal well-being, are likely in a growth phase but may face strong competition from established pharmaceutical players, thus holding a relatively low market share currently. Continued strategic investment in research and development, alongside robust marketing and distribution efforts, will be essential for these products to ascend to star status.

- Product Focus: MiPet and EqueVet-Pro are proprietary brands developed by CVS Group for veterinary use.

- Market Position: While designed to improve pet health, their market share may be limited compared to established competitors.

- Growth Strategy: Significant investment in R&D, marketing, and distribution is critical for increasing market penetration.

- Future Potential: Successful development could see these products transition from question marks to stars in the BCG matrix.

Question marks in CVS Group's BCG matrix represent ventures with high growth potential but currently low market share, demanding significant investment. These could include new acquisitions in emerging markets or the development of innovative digital health solutions. Their success hinges on strategic resource allocation and effective market penetration to transition into stars.

The Australian acquisitions, for example, offer access to a growing pet care market, but require substantial capital for integration. Similarly, proprietary veterinary products like MiPet and EqueVet-Pro are in a growth phase but face established competition, necessitating continued R&D and marketing investment. Emerging European markets also present question mark opportunities, requiring significant outlay for market entry and brand building.

| Venture Type | Market Growth | Market Share | Investment Need | Risk Level |

|---|---|---|---|---|

| Australian Acquisitions | High | Low | High | High |

| Digital Health Platforms | High | Low | High | High |

| Specialist Pet Wellness Centers | High | Low | High | High |

| Proprietary Veterinary Products | High | Low | High | High |

| Untapped European Markets | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from CVS Health's financial reports, market share analysis, and industry growth projections to accurately position each business unit.