Comstock Resources SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

Comstock Resources exhibits notable strengths in its operational efficiency and strategic asset base, but also faces potential headwinds from fluctuating commodity prices and industry competition. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Comstock Resources' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Comstock Resources boasts a formidable presence in the Haynesville Shale, holding a substantial 826,741 net acres across North Louisiana and East Texas. This vast acreage, with an increasing focus on the Western Haynesville, translates into a deep inventory of prospective drilling sites, underpinning sustained production and reserve expansion for years to come.

As one of the leading producers in the Haynesville basin, Comstock leverages its scale to command a significant market share. This dominant position allows for optimized operational efficiencies and a strong voice in regional market dynamics, further solidifying its competitive edge.

Comstock Resources reported a notable upswing in its financial performance during the first half of 2025. Higher natural gas prices directly fueled a significant increase in both natural gas and oil sales, boosting the company's top line.

The company showcased strong operational efficiency, evidenced by robust operating cash flow and adjusted EBITDAX figures throughout Q1 and Q2 2025. This suggests effective cost management strategies were in place, contributing to improved profitability.

Comstock's unhedged operating margin stood at an impressive 77% in the first quarter of 2025, further strengthening to 73% in the second quarter. These figures highlight the company's ability to translate sales into substantial profits, underscoring its operational strengths.

Comstock Resources boasts a strong history of executing successful drilling and development projects, particularly within shale resource plays. Their operational performance in 2024 and the first half of 2025 demonstrates a consistent ability to bring new wells online with robust initial production rates.

The company's strategic focus on the Western Haynesville region has proven to be a significant growth catalyst, with impressive well results contributing to their development success. This consistent delivery of productive wells underscores their expertise in unlocking shale reserves.

Furthermore, Comstock's commitment to optimizing well design, including the implementation of longer lateral sections, directly translates into enhanced production efficiency and improved economic outcomes for each well drilled. This technical proficiency is a key strength in their development programs.

Strategic Hedging and Risk Management

Comstock Resources effectively employs derivative financial instruments to mitigate the inherent price volatility in the natural gas market. This strategic hedging has, in periods like the first half of 2024, resulted in substantial realized gains, significantly enhancing the company's financial resilience against adverse market movements.

While hedging strategies can sometimes lead to unrealized losses if commodity prices surge beyond contracted levels, they fundamentally serve to stabilize revenues and reduce earnings volatility. This predictable revenue stream is crucial for financial planning and maintaining operational stability, particularly in a sector prone to sharp price swings.

For instance, in Q1 2024, Comstock reported that its hedging program contributed positively to its financial performance, shielding it from some of the more extreme price dips experienced in the broader market. This proactive risk management is a key strength, providing a buffer against market uncertainties.

- Hedging Instruments: Comstock utilizes futures, options, and swaps to manage commodity price risk.

- Financial Impact: In the first half of 2024, hedging activities contributed to a more stable financial outlook for the company.

- Risk Mitigation: The strategy aims to reduce the impact of price volatility on revenues and cash flows.

- Revenue Predictability: Hedging provides a degree of certainty in revenue generation, aiding in financial forecasting.

Commitment to Environmental Stewardship

Comstock Resources shows a strong commitment to environmental stewardship, which is a key strength. They actively pursue cleaner energy solutions in their operations. For instance, Comstock prioritizes fueling drilling operations with natural gas, a cleaner alternative to diesel. This reduces their carbon footprint significantly.

Further demonstrating this commitment, Comstock employs advanced technologies to minimize emissions. They utilize dual-fuel and bi-fuel frac fleets, enhancing efficiency and reducing pollution. Additionally, instrument air supply is installed at new sites to eliminate methane emissions, a potent greenhouse gas.

Comstock's proactive approach to environmental management includes robust programs like Leak Detection and Repair (LDAR) and the adoption of 'green completion' practices. These initiatives are designed to minimize the environmental impact of their oil and gas extraction activities, aligning with growing industry and regulatory expectations for sustainability.

These environmental initiatives are not just about compliance; they represent a strategic advantage. By investing in cleaner technologies and practices, Comstock can potentially reduce operational costs associated with emissions control and improve its public image, attracting environmentally conscious investors and partners.

Comstock Resources possesses a vast and strategically positioned acreage in the Haynesville Shale, totaling over 826,000 net acres, primarily focused on the Western Haynesville. This extensive land position translates into a deep inventory of drilling locations, ensuring long-term production and reserve growth potential. The company's scale as a leading Haynesville producer allows for significant operational efficiencies and market influence.

The company demonstrated strong financial performance in the first half of 2025, driven by higher natural gas prices that boosted sales. This was supported by robust operating cash flow and adjusted EBITDAX, indicating effective cost management. Comstock's unhedged operating margins remained exceptionally strong, reaching 77% in Q1 2025 and 73% in Q2 2025, showcasing its ability to convert sales into substantial profits.

Comstock has a proven track record of successful drilling and development, consistently achieving strong initial production rates from new wells, particularly in the Western Haynesville. Their technical expertise in optimizing well design, including longer laterals, enhances production efficiency and economic returns. Furthermore, Comstock effectively uses derivative financial instruments to hedge against natural gas price volatility, providing revenue stability and financial resilience, as seen in positive contributions from its hedging program in Q1 2024.

What is included in the product

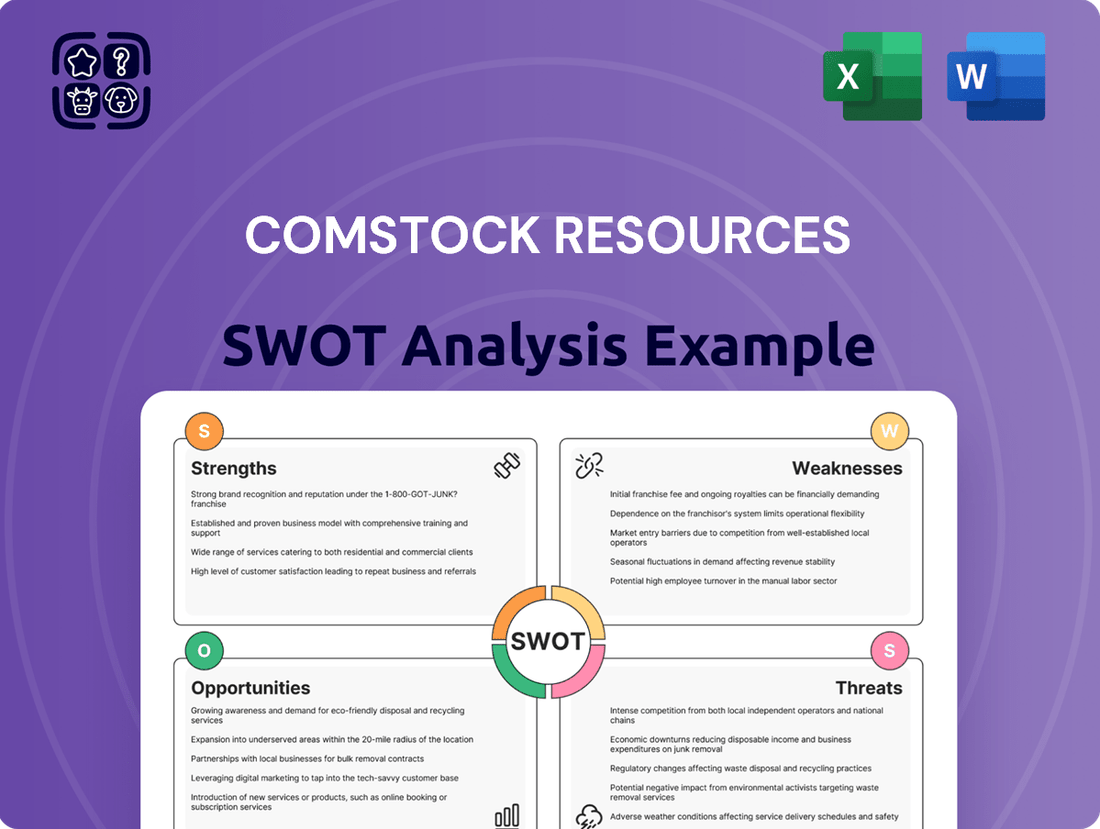

Comstock Resources' SWOT analysis highlights its strong position in the Haynesville Shale, leveraging operational efficiencies and a favorable cost structure, while also acknowledging the risks associated with commodity price volatility and potential regulatory changes.

Comstock Resources' SWOT analysis provides a clear roadmap to address operational challenges and capitalize on market opportunities, relieving the pain of uncertainty.

Weaknesses

Comstock Resources carries a substantial amount of long-term debt, which stood at approximately $3.05 billion as of March 31, 2025. This significant debt burden directly translates into considerable interest expenses, impacting the company's profitability. The high level of financial leverage limits Comstock's flexibility in pursuing new opportunities and can be a drag on its net income.

Comstock Resources' heavy reliance on natural gas production exposes it directly to the volatility of natural gas prices and market demand. This dependence means that any significant downturn in natural gas prices, like those experienced in prior years, could severely impact the company's earnings and its ability to generate cash.

While the higher natural gas prices seen in early 2025 provided a revenue boost, this vulnerability remains a key weakness. A sharp decline in prices, which is a recurring feature of the natural gas market, would directly translate to reduced profitability and potentially strain cash flow for Comstock.

While Comstock Resources has seen impressive production from its newer wells, especially in the Western Haynesville, the company faced a dip in overall natural gas output during the first half of 2025. This decline, evident in the year-over-year comparison for Q1 and Q2 2025, highlights the persistent difficulty in sustaining production levels across its older fields. This trend could potentially dampen revenue growth if not effectively counterbalanced by the success of ongoing development projects.

Unrealized Losses from Hedging Contracts

While Comstock Resources utilizes hedging to manage price volatility, a significant weakness arises from substantial unrealized losses on these contracts when natural gas prices surge unexpectedly. This can create a disconnect between the company's operational performance and its reported financial results.

For instance, in the first quarter of 2025, Comstock reported a pre-tax unrealized loss of $322.4 million stemming from its hedging activities. This substantial figure directly impacted the company's net income, contributing significantly to a quarterly net loss.

- Unrealized Losses: Significant unrealized losses on hedging contracts have materialized when future natural gas prices have risen sharply.

- Q1 2025 Impact: A pre-tax unrealized loss of $322.4 million from hedging contracts in Q1 2025 notably contributed to the company's net loss for that period.

- Financial Distortion: These unrealized losses can distort the perception of the company's underlying operational profitability in periods of rising commodity prices.

Capital Intensive Operations

Comstock Resources operates in a sector demanding substantial upfront investment. The process of acquiring leases, exploring for reserves, developing wells, and ultimately producing oil and natural gas requires significant capital outlay. This inherent capital intensity is a notable weakness for the company.

The company's commitment to developing its Western Haynesville assets and expanding its midstream infrastructure contributes to ongoing capital expenditures. For instance, in 2023, Comstock reported capital expenditures of approximately $1.4 billion, which led to a free cash flow deficit. This necessitates continuous investment to maintain and grow its operational capacity, potentially straining financial resources.

- High Capital Requirements: The core business of oil and gas extraction demands substantial financial resources for exploration, drilling, and production infrastructure.

- Free Cash Flow Deficits: Significant capital expenditures, particularly for asset development and midstream build-out, can result in periods of negative free cash flow, as seen with Comstock's 2023 performance.

- Sustained Investment Needs: To sustain and grow its operations, Comstock must consistently reinvest capital, creating a dependency on financing or retained earnings.

Comstock Resources' significant debt load, exceeding $3 billion as of early 2025, creates substantial interest expenses that can erode profitability and limit financial flexibility. The company's heavy reliance on natural gas production also makes it highly susceptible to price volatility, with any significant downturn directly impacting earnings and cash flow generation. Furthermore, recent production declines in older fields, despite success in newer areas, highlight ongoing challenges in maintaining output levels, potentially hindering revenue growth.

| Metric | Value (as of Q1 2025) | Impact |

|---|---|---|

| Long-term Debt | ~$3.05 billion | High interest expenses, reduced financial flexibility |

| Natural Gas Price Volatility | High sensitivity | Risk of reduced earnings and cash flow |

| Production Trends | Mixed (declines in older fields) | Potential revenue growth impediment |

| Hedging (Unrealized Losses) | -$322.4 million (pre-tax Q1 2025) | Distorted financial results, impact on net income |

Full Version Awaits

Comstock Resources SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Comstock Resources SWOT analysis, offering a clear understanding of its strengths, weaknesses, opportunities, and threats. The full, detailed report is unlocked upon purchase.

Opportunities

Comstock Resources sees significant opportunity in its Western Haynesville shale acreage, identifying it as a primary engine for future growth due to its substantial undeveloped potential.

Recent drilling results from step-out wells in this region have been very encouraging, effectively expanding the company's proven reserves and production capabilities, which is a crucial development for increasing overall output.

To capitalize on this, Comstock plans to boost its drilling rig count in the Western Haynesville throughout 2025, signaling a strong commitment to unlocking the full value of this strategic asset.

The global energy landscape is increasingly prioritizing cleaner alternatives, and this presents a significant opportunity for natural gas to serve as a crucial transition fuel. Comstock Resources, with its dedicated focus on natural gas production, is well-positioned to capitalize on this evolving demand. Natural gas burns cleaner than coal and oil, making it an attractive option for countries seeking to reduce emissions while still meeting energy needs. This positioning suggests a potentially sustained demand for Comstock's core product in the coming years.

Comstock Resources can significantly boost its operational efficiency and profitability by adopting the latest advancements in drilling and extraction technologies. Innovations like enhanced hydraulic fracturing techniques and improved directional drilling are crucial for maximizing hydrocarbon recovery from its extensive Haynesville acreage.

By investing in these technologies, Comstock can lower its per-barrel production costs, which is vital in a fluctuating commodity price environment. For instance, advancements in real-time data analytics for well performance monitoring can lead to quicker adjustments and optimized production, directly impacting the bottom line. This strategic embrace of innovation is key to maintaining a competitive edge.

Strategic Partnerships for Power Generation

Comstock Resources is actively pursuing strategic partnerships to develop power generation assets, notably collaborating with NextEra Energy Resources near its Western Haynesville operations. This venture is designed to offer dependable energy solutions for prospective data center clients, simultaneously opening up new revenue streams and fostering strategic diversification for Comstock within the broader energy market.

These collaborations represent a significant opportunity for Comstock to leverage its existing infrastructure and operational expertise. By integrating power generation capabilities, the company can create a more robust and attractive offering for energy-intensive industries. For example, as of early 2024, the demand for reliable, low-cost power for data centers is escalating, driven by advancements in AI and cloud computing, making this a timely strategic move.

- Strategic Alliance: Partnership with NextEra Energy Resources to develop power generation.

- Customer Focus: Providing reliable energy for potential data center customers.

- Revenue Diversification: Creating new income streams beyond traditional oil and gas.

- Market Advantage: Capitalizing on the growing demand for localized, stable power solutions.

Improved Natural Gas Price Outlook

The outlook for natural gas prices is showing signs of improvement, with forecasts for 2025 and beyond suggesting higher average prices than the lows seen in 2024. For instance, some market analyses project Henry Hub spot prices to average around $2.50-$3.00 per million British thermal units (MMBtu) in 2025, a notable increase from the sub-$2.00 levels experienced earlier in 2024. This anticipated rebound, fueled by factors such as increased LNG export demand and a more balanced supply picture, presents a significant opportunity for Comstock Resources.

This potential uptick in commodity prices directly translates to enhanced revenue streams and improved profitability for Comstock, given its substantial natural gas production. If these price forecasts materialize, the company's top-line growth could accelerate, and its margins are likely to expand.

- Improved Price Environment: Projections indicate a rise in natural gas prices for 2025, potentially reaching average levels above $2.50/MMBtu.

- Demand Drivers: Increased global demand for Liquefied Natural Gas (LNG) exports is a key factor supporting higher prices.

- Supply Management: A more disciplined approach to production by key players could also contribute to price stabilization and growth.

- Revenue Boost: Higher natural gas prices directly benefit Comstock Resources by increasing its revenue and profitability.

Comstock Resources' strategic focus on the Western Haynesville shale offers substantial growth potential, with significant undeveloped acreage. Encouraging recent drilling results have expanded reserves, and the company plans to increase its rig count there in 2025 to maximize this asset's value.

The company is also poised to benefit from natural gas's role as a transition fuel, as global demand for cleaner energy sources grows. By integrating advanced drilling technologies, Comstock can enhance production efficiency and lower costs, improving profitability in a dynamic market.

Furthermore, partnerships like the one with NextEra Energy Resources for power generation, targeting data centers, create new revenue streams and diversify Comstock's business model, capitalizing on the increasing demand for reliable, localized power solutions.

Market forecasts for 2025 suggest an improvement in natural gas prices, with projections indicating averages above $2.50 per MMBtu, driven by factors like increased LNG exports. This anticipated price recovery directly benefits Comstock's revenue and profitability.

| Opportunity Area | Key Driver | Comstock's Action/Positioning | Potential Impact |

|---|---|---|---|

| Western Haynesville Acreage | Undeveloped potential, strong drilling results | Increased rig count in 2025 | Reserve and production growth |

| Natural Gas as Transition Fuel | Global demand for cleaner energy | Focus on natural gas production | Sustained demand, market share |

| Technological Advancements | Improved drilling/extraction techniques | Investment in new technologies | Lower production costs, higher efficiency |

| Power Generation Partnerships | Demand for data center power | Collaboration with NextEra Energy Resources | New revenue streams, diversification |

| Natural Gas Price Recovery | Increased LNG exports, balanced supply | Positioned for higher commodity prices | Enhanced revenue and profitability |

Threats

Natural gas prices, despite recent upticks, continue to exhibit significant volatility. Factors like supply levels, consumer demand, unpredictable weather, and global geopolitical shifts can cause rapid price swings. For instance, the Henry Hub spot price, a key benchmark, saw fluctuations throughout 2023 and into early 2024, highlighting this inherent instability.

Sustained periods of depressed natural gas prices pose a considerable threat to Comstock Resources. Such an environment directly impacts the company's revenue streams and overall profitability. Lower prices can also strain Comstock's capacity to finance its planned capital expenditures, potentially leading to financial pressures and a need to adjust operational strategies.

The oil and gas sector is under a microscope, facing heightened regulatory and environmental scrutiny. This includes potential new rules concerning emissions, drilling methods, and how land is utilized. For Comstock Resources, stricter environmental policies or higher compliance expenses could directly affect its operational efficiency and increase overall costs, potentially hindering future growth initiatives.

Comstock Resources operates in a fiercely competitive oil and gas sector, facing rivals ranging from independent producers to major energy corporations. This intense rivalry is particularly evident in sought-after regions like the Haynesville shale, where multiple companies vie for prime acreage.

The pressure to secure drilling services and access markets can significantly affect Comstock's strategic positioning. For instance, in 2024, the average daily rig count in the Haynesville fluctuated, impacting the cost and availability of essential drilling services, a direct consequence of this competitive landscape.

This competition directly influences Comstock's capacity to expand its reserve base and retain its market share. Furthermore, it puts pressure on achieving optimal pricing for its natural gas and oil products, as supply and demand dynamics are constantly shaped by the actions of numerous industry players.

Geological and Drilling Risks

Comstock Resources faces inherent geological and drilling risks in its exploration and production operations. Unexpected geological formations, equipment malfunctions, and potential blowouts can significantly disrupt operations. For instance, in 2023, the company reported capital expenditures of $1.2 billion, a substantial portion of which is allocated to drilling and completion activities, making these risks a direct threat to financial projections.

These risks can lead to substantial cost overruns and project delays, directly impacting Comstock's financial performance. Furthermore, mechanical failures or blowouts can necessitate costly remedial actions, diverting resources from planned production and potentially reducing output. The company's reliance on successful drilling campaigns means that even a few unforeseen issues can have a material negative effect on its bottom line and shareholder value.

- Geological Uncertainty: Encountering unforeseen rock formations can increase drilling time and costs.

- Mechanical Failures: Equipment breakdowns during drilling can lead to costly downtime and repairs.

- Blowout Potential: Uncontrolled release of oil or gas poses significant safety, environmental, and financial risks.

- Operational Disruptions: These risks can cause delays, reduce production volumes, and inflate capital expenditure budgets.

Access to Capital and Debt Servicing Challenges

Comstock Resources faces significant hurdles in accessing capital and managing its debt. With a substantial long-term debt burden, the company's ability to secure new funding or refinance existing obligations could be hampered by unfavorable market conditions, rising interest rates, or shifts in investor confidence.

These debt servicing challenges directly impact Comstock's financial flexibility. The company's ongoing obligations mean that any misstep in managing its debt could quickly escalate into financial distress, limiting its capacity for growth and operational stability.

- Debt-to-Equity Ratio: As of Q1 2024, Comstock's debt-to-equity ratio stood at approximately 2.6, indicating a significant reliance on debt financing.

- Interest Coverage Ratio: The company's interest coverage ratio for the trailing twelve months ending March 31, 2024, was around 1.5x, highlighting the pressure of its debt servicing obligations.

- Credit Facility: Comstock has a revolving credit facility with a borrowing base that is subject to periodic redeterminations, which can fluctuate based on commodity prices and reserve reports.

Comstock Resources operates in a highly competitive market, facing pressure from numerous rivals for prime acreage and optimal pricing. This intense competition, particularly in the Haynesville shale, can impact the availability and cost of essential drilling services, as evidenced by fluctuating rig counts in 2024.

The company's significant debt load presents a substantial threat, with a debt-to-equity ratio of approximately 2.6 as of Q1 2024 and an interest coverage ratio of around 1.5x for the trailing twelve months ending March 31, 2024. These figures underscore the financial strain of servicing its obligations and highlight the risk associated with its revolving credit facility, which is subject to redeterminations.

Geological and drilling risks are inherent to Comstock's operations, with potential for cost overruns and delays due to unforeseen formations or mechanical failures. The company's substantial capital expenditures, totaling $1.2 billion in 2023, are largely directed towards these activities, amplifying the financial impact of any operational disruptions.

Heightened regulatory and environmental scrutiny poses another significant threat, with potential for new rules impacting emissions and drilling methods. Stricter policies could increase compliance costs and affect operational efficiency, potentially hindering Comstock's growth initiatives.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including Comstock Resources' official financial filings, detailed industry market research, and expert analyses of the energy sector.