Comstock Resources Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

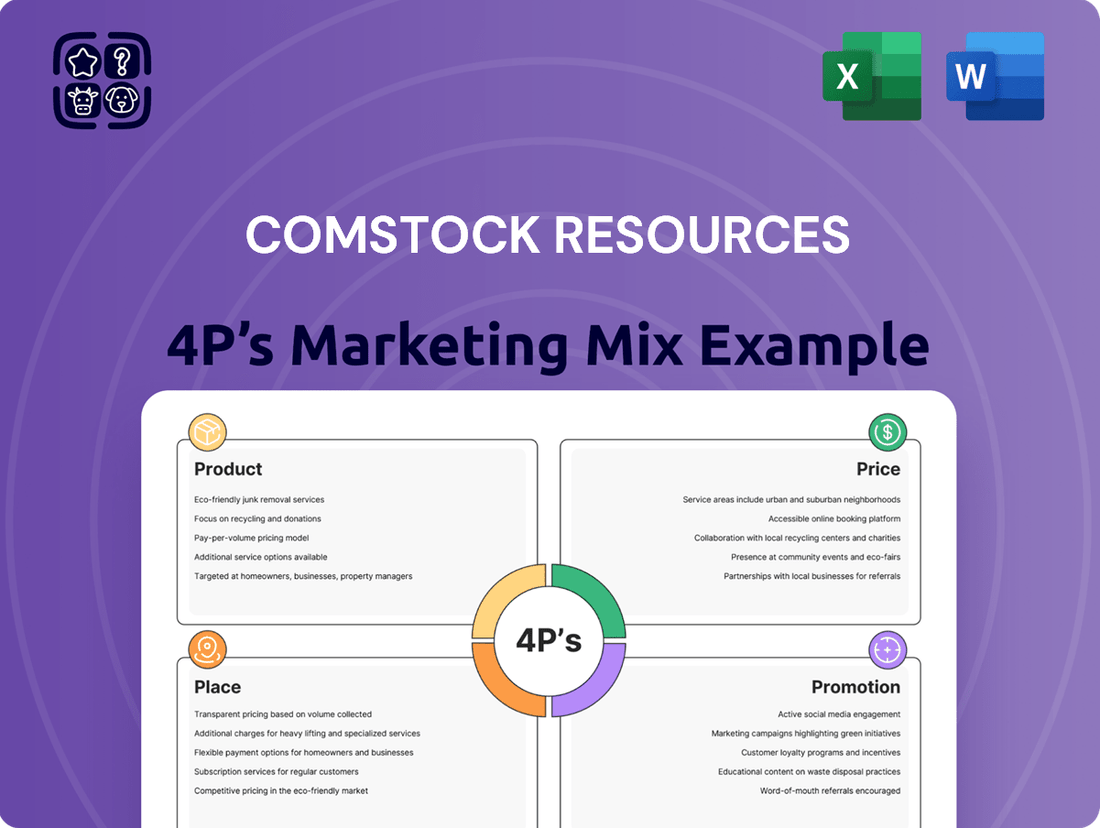

Comstock Resources' marketing strategy is a carefully orchestrated symphony of product, price, place, and promotion. Understanding how these elements interact reveals their competitive edge in the energy sector.

Dive deeper into Comstock Resources' product offerings, their strategic pricing models, their distribution channels, and their promotional activities. This comprehensive analysis will equip you with actionable insights.

Unlock the full potential of this analysis to benchmark, strategize, or simply gain a clearer understanding of Comstock Resources' market approach. Get the complete, editable report today.

Product

Comstock Resources' product offering centers on crude oil and natural gas, primarily sourced from its key operational regions in the Haynesville shale, spanning North Louisiana and East Texas. This strategic focus allows the company to leverage its extensive acreage for enhanced production and reserve growth.

The company's reserve profile as of December 31, 2024, highlights a significant concentration in natural gas, with 73% of its proved reserves being developed and 98% operated by Comstock. This positions Comstock to capitalize on the ongoing demand for natural gas, particularly in the developing Western Haynesville play.

Comstock Resources' product strategy is laser-focused on the prolific Haynesville and Bossier shale plays. This concentration allows them to maximize efficiency and expertise in these high-potential natural gas regions.

In 2024, the company demonstrated this commitment by drilling 50 operated horizontal wells within the Haynesville/Bossier shale, boasting an impressive average lateral length of 10,759 feet. This aggressive development program underscores their belief in the long-term value of these formations.

This strategic emphasis directly contributed to Comstock's significant production output. In 2024, the company reported a total production of 527.8 billion cubic feet equivalent (Bcfe), a testament to the success of their Haynesville/Bossier shale focus.

Comstock Resources is strategically developing its product by expanding into the Western Haynesville, a promising new shale play. This expansion is a core part of their growth strategy, aiming to secure future production and replace existing reserves.

The company significantly bolstered its position in 2024, acquiring over 64,000 net acres in the Western Haynesville, bringing their total acreage to an impressive 518,000 net acres. This aggressive land acquisition demonstrates a strong commitment to this emerging resource.

Looking ahead to 2025, Comstock plans to deploy four drilling rigs exclusively in the Western Haynesville. This focused capital allocation underscores the play's importance and Comstock's expectation of substantial future output from this area.

Exploration and Development

Comstock Resources actively expands its product offering through continuous exploration, development, and strategic acquisitions. This commitment to growth ensures a dynamic and evolving portfolio for investors.

The company's significant investment in its future is highlighted by its planned capital expenditure of approximately $1.0 billion to $1.1 billion for 2025. These funds are earmarked for crucial development and exploration projects, aiming to bolster production capacity.

Comstock's proactive approach to expanding its reserves is evident in its operational achievements. In 2024, the company successfully brought 48 operated wells (42.9 net) online, directly contributing to its production output and future revenue streams.

- Exploration and Development Strategy: Comstock Resources prioritizes ongoing exploration, development, and acquisition to enhance its product offering.

- 2025 Capital Allocation: The company plans to invest between $1.0 billion and $1.1 billion in 2025 for development and exploration initiatives.

- Operational Success in 2024: Comstock turned 48 operated wells (42.9 net) to sales in 2024, demonstrating successful project execution.

- Future Production Growth: These investments are designed to ensure a consistent supply of new production, securing future operational output.

Midstream Infrastructure Investment

Comstock Resources is strategically investing in midstream infrastructure, particularly in the Western Haynesville region, to ensure efficient product delivery. This focus on infrastructure is a key element of their product strategy, directly supporting the reliable transportation of their natural gas output.

The company has earmarked a significant capital expenditure for this purpose, projecting spending between $130 million and $150 million on its Western Haynesville midstream system throughout 2025. This substantial investment underscores the critical role of these assets in Comstock's operations.

This midstream development is essential for several reasons:

- Efficient Gathering: The infrastructure facilitates the effective collection of natural gas from Comstock's wells.

- Market Access: It ensures the smooth and cost-effective transportation of produced natural gas to various markets.

- Operational Support: This investment directly bolsters the company's ability to deliver its core product, natural gas, to customers.

- 2025 Expenditure: The projected $130-$150 million investment highlights the priority placed on enhancing these vital systems.

Comstock Resources' product is primarily natural gas, with a strong focus on the Haynesville and Bossier shale plays. The company's 2024 proved reserves were heavily weighted towards natural gas, with 73% of reserves being developed. This strategic concentration allows for operational efficiencies and expertise in these high-yield formations.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Primary Product | Natural Gas & Crude Oil | Natural Gas & Crude Oil |

| Key Operational Regions | Haynesville Shale (North Louisiana & East Texas) | Haynesville Shale (North Louisiana & East Texas), Western Haynesville |

| 2024 Production (Bcfe) | 527.8 | N/A |

| 2024 Wells Turned Online | 48 operated (42.9 net) | N/A |

| 2025 Drilling Rigs | N/A | 4 in Western Haynesville |

What is included in the product

This analysis provides a comprehensive breakdown of Comstock Resources' marketing strategies across Product, Price, Place, and Promotion, offering insights into their operational positioning.

It serves as a valuable resource for understanding Comstock Resources' market approach, ideal for strategic planning and competitive benchmarking.

Simplifies Comstock Resources' marketing strategy by clearly outlining its 4Ps, alleviating the pain of complex market analysis for stakeholders.

Place

Comstock Resources directly markets its oil and natural gas to a broad customer base, including pipelines, marketers, and industrial end-users. This direct sales strategy, as opposed to relying heavily on third-party marketers, gives Comstock greater influence over its sales channels and fosters stronger customer connections. For instance, in the first quarter of 2024, Comstock reported average daily production of 2.4 Bcfe/d, all of which was marketed directly to these diverse customer segments.

Comstock Resources' strategic geographic concentration in the prolific Haynesville shale, spanning North Louisiana and East Texas, is a cornerstone of its operational efficiency. This focused approach allows the company to maximize its use of existing infrastructure, a critical advantage in a mature yet productive natural gas basin.

This geographical focus also translates into significant logistical benefits. By operating in close proximity to the Gulf Coast, a major hub for natural gas consumption and export, Comstock minimizes transportation costs and enhances its ability to serve key markets. For example, the company's 2024 production targets are heavily weighted towards this region, reflecting its commitment to leveraging this strategic advantage.

Comstock Resources leverages a significant pipeline network, comprising 246 miles of high-pressure lines, to efficiently transport its natural gas. This infrastructure is crucial for connecting its production to market demand points.

The company also operates a gas treating plant at Bethel and has another under construction at Marquez, further enhancing its midstream capabilities. These facilities are key to preparing natural gas for sale and ensuring it meets market specifications.

Access to LNG and Industrial Markets

Comstock Resources is strategically positioning itself to capitalize on growing demand from Liquefied Natural Gas (LNG) and industrial markets. The company is actively exploring direct contracts with LNG shippers and power generators, aiming to secure favorable terms and consistent offtake for its natural gas production.

A significant portion of Comstock's operations, specifically 90% of its Western Haynesville acreage, remains undedicated. This provides substantial marketing flexibility, allowing Comstock to target and serve the expanding LNG export market and various industrial consumers who represent key growth sectors for natural gas demand.

- Market Reach: Comstock's undedicated acreage (90% in Western Haynesville) offers significant optionality for marketing natural gas to high-demand sectors.

- Strategic Partnerships: The company is actively pursuing direct contracts with LNG shippers and power generators to access lucrative markets.

- Growth Sectors: Focus on LNG and industrial users aligns with projected increases in natural gas consumption in these areas.

Logistical Advantage to Gulf Coast

Comstock Resources benefits immensely from its operational proximity to the Gulf Coast. This strategic placement allows for streamlined transportation of natural gas, a critical component of their product offering.

The company's location facilitates efficient delivery to major export terminals, tapping into global demand, and also serves key industrial hubs within the region. This accessibility directly translates to enhanced market reach and a stronger competitive position in the energy sector.

- Proximity to Gulf Coast Markets: Comstock's assets are strategically located near the extensive Gulf Coast pipeline network.

- Export Terminal Access: Facilitates efficient movement of natural gas to LNG export facilities, capitalizing on international price differentials.

- Industrial Demand Centers: Direct access to a dense concentration of industrial consumers, including petrochemical plants and manufacturers, ensures consistent demand.

- Reduced Transportation Costs: Shorter transit distances lower per-unit transportation expenses, improving profit margins.

Comstock Resources' marketing strategy heavily leverages its prime location within the Haynesville shale, offering direct access to the Gulf Coast's extensive infrastructure. This allows for efficient transportation of natural gas to major export terminals and industrial consumers, minimizing costs and maximizing market reach. The company's significant undedicated acreage, approximately 90% of its Western Haynesville holdings, provides crucial flexibility to pursue contracts with high-demand sectors like LNG and power generation, aligning with projected consumption growth.

| Metric | Value | Period |

|---|---|---|

| Average Daily Production | 2.4 Bcfe/d | Q1 2024 |

| Undedicated Acreage (Western Haynesville) | 90% | As of latest reporting |

| Pipeline Network | 246 miles | As of latest reporting |

Preview the Actual Deliverable

Comstock Resources 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Comstock Resources 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Comstock Resources prioritizes clear investor relations and financial reporting to showcase its operational and financial health. The company consistently provides quarterly and annual financial results, alongside detailed investor presentations and SEC filings, ensuring a high level of transparency.

This commitment to open communication is designed to attract and inform a broad audience of financially-literate decision-makers and potential investors. For instance, in Q1 2024, Comstock reported adjusted EBITDA of $235 million, demonstrating tangible performance metrics for stakeholders.

Comstock Resources regularly issues news releases to keep investors informed about crucial operational milestones. These announcements often highlight successful drilling results and new wells coming online, directly impacting production figures and demonstrating growth potential.

The company's communication strategy emphasizes timely updates on reserve additions and strategic acreage acquisitions, particularly in key development areas like the Western Haynesville. For instance, in early 2024, Comstock reported significant progress in its Haynesville program, with several wells exceeding initial production expectations, contributing to a robust reserve base.

These operational updates serve as a vital component of Comstock's marketing mix, providing transparency and building confidence among stakeholders. The detailed information on production growth and strategic developments allows the market to assess the company's performance and future prospects effectively.

Comstock Resources actively engages with the financial community through quarterly earnings conference calls and webcasts. These sessions, which typically occur shortly after financial results are released, allow management to detail operational achievements and financial performance. For instance, in their Q1 2024 earnings call, the company highlighted a production increase and provided guidance for the remainder of the year.

Strategic Partnerships and Collaborations

Comstock Resources leverages strategic partnerships to enhance its market presence and explore new avenues for growth. A prime example is its collaboration with NextEra Energy Resources, focusing on power generation assets in the vicinity of the Western Haynesville shale play.

This alliance underscores Comstock's commitment to innovation and its anticipation of future market demands, particularly the burgeoning need for power to support data centers and other energy-intensive industries. Such collaborations are key to unlocking synergistic value and expanding operational capabilities.

- Strategic Alliance: Partnership with NextEra Energy Resources for power generation exploration.

- Geographic Focus: Western Haynesville region, a key operational area for Comstock.

- Market Opportunity: Targeting emerging markets like data centers requiring significant power infrastructure.

- Growth Potential: Demonstrates a forward-thinking approach to capitalize on future energy demands.

Digital Presence and Investor Resources

Comstock Resources leverages its digital presence to provide robust investor resources. The company's website features a dedicated investor relations section, offering immediate access to crucial documents like annual reports and SEC filings. This commitment to transparency facilitates informed decision-making for stakeholders.

This digital platform is a key component of Comstock's marketing mix, ensuring potential and current investors can easily conduct their due diligence. For instance, as of their latest filings in early 2024, the company provided readily available access to their Q4 2023 earnings presentations and related financial statements.

The availability of these resources directly supports the 'Promotion' aspect of their 4Ps. It allows for efficient dissemination of company performance and strategic updates, crucial for maintaining investor confidence and attracting new capital.

- Website Investor Relations: Comprehensive access to annual reports, SEC filings, and investor presentations.

- Accessibility: Ensures current and prospective investors can easily obtain detailed company information.

- Transparency: Facilitates due diligence and analysis for informed investment decisions.

- Digital Promotion: Supports investor engagement and capital attraction through readily available data.

Comstock Resources actively promotes its operational successes and financial stability through various communication channels. The company's investor relations efforts are geared towards transparency, providing stakeholders with timely updates on production, reserves, and financial performance. This proactive approach aims to build and maintain investor confidence.

In the first quarter of 2024, Comstock reported a significant increase in its proved reserves, reaching approximately 1.4 trillion cubic feet of natural gas equivalent (Tcfge). This growth, particularly in the Western Haynesville, is a key promotional point highlighting the company's asset quality and development success.

The company's strategic alliance with NextEra Energy Resources, focused on power generation, is also a significant promotional element. This partnership, announced in late 2023, positions Comstock to capitalize on the growing demand for power, especially from energy-intensive industries like data centers, demonstrating forward-thinking strategy.

| Metric | Q1 2024 | Key Highlight |

|---|---|---|

| Proved Reserves (Tcfge) | 1.4 | Significant growth, especially in Western Haynesville. |

| Adjusted EBITDA ($M) | 235 | Demonstrates strong operational cash flow. |

| Strategic Partnership | NextEra Energy Resources | Focus on power generation, targeting future energy demand. |

Price

Comstock Resources' pricing for oil and natural gas is intrinsically tied to the dynamic global commodity markets. The company's ability to secure favorable pricing is a key driver of its financial performance.

For instance, Comstock Resources reported an average realized natural gas price of $2.32 per Mcf before hedging in the fourth quarter of 2024. This figure rose to $2.70 per Mcf after accounting for hedging activities, clearly illustrating how market fluctuations and risk management strategies directly shape their revenue streams.

Comstock Resources actively manages commodity price volatility through a comprehensive hedging strategy. As of Q4 2024, the company had strategically hedged 50% of its projected production for both 2025 and 2026. This proactive approach utilizes financial instruments like swaps and collars to lock in favorable prices, thereby safeguarding cash flow stability and mitigating downside risk in an often unpredictable energy market.

Comstock Resources places a significant emphasis on cost control as a cornerstone of its operational strategy, directly impacting its ability to maintain robust operating margins. This focus on efficiency is crucial for supporting its overall pricing power.

In the fourth quarter of 2024, Comstock achieved an impressive production cost of just $0.72 per thousand cubic feet equivalent (Mcfe). This low cost structure enabled the company to report an unhedged operating margin of 69%, which improved to 73% after accounting for hedging activities.

Capital Expenditure and Investment Decisions

Comstock Resources' pricing strategy is intrinsically linked to its capital expenditure needs. The company's ability to fund substantial investments in exploration and development directly impacts its operational capacity and future growth. This financial requirement shapes how they approach pricing their products in the market.

The current market environment, particularly the improved natural gas prices, has a direct influence on Comstock's investment decisions. For 2025, Comstock Resources is projecting capital expenditures in the range of $1.0 billion to $1.1 billion. This significant outlay is earmarked for increasing the number of operating drilling rigs, a move directly enabled by favorable market conditions.

- 2025 Capital Expenditure: $1.0 billion to $1.1 billion.

- Investment Driver: Increased operating drilling rigs.

- Market Influence: Improved natural gas prices.

Debt Management and Financial Stability

Comstock Resources' pricing strategy is intrinsically linked to its financial stability, particularly its debt management. The company’s ability to generate sufficient cash flow is paramount for servicing its debt obligations and reducing interest expenses, which directly impacts profitability and investor confidence.

While Comstock has made strides in improving its financial footing, its debt levels and associated interest costs remain a significant consideration. This necessitates a pricing approach that prioritizes cash flow generation to facilitate debt reduction and bolster long-term financial health.

- Debt Reduction Focus: Pricing decisions are geared towards maximizing free cash flow to accelerate debt repayment.

- Interest Expense Management: Lowering debt directly translates to reduced interest expenses, improving net income.

- Financial Flexibility: A stronger balance sheet through debt reduction enhances the company's ability to invest in growth opportunities.

- Market Pricing Power: The company aims to leverage favorable market conditions to achieve pricing that supports its financial objectives.

Comstock Resources' pricing strategy is heavily influenced by its operational costs and the need to maintain healthy margins. The company's ability to produce natural gas and oil efficiently directly impacts its profitability and competitive pricing.

In the fourth quarter of 2024, Comstock reported a low production cost of $0.72 per Mcfe, which allowed for a strong unhedged operating margin of 69%. This cost efficiency is a critical factor in how they price their output to ensure profitability even with market fluctuations.

The company's pricing is also a lever for its ambitious capital expenditure plans. With projections of $1.0 billion to $1.1 billion in capital expenditures for 2025, driven by an increase in drilling rigs due to improved natural gas prices, Comstock needs pricing that supports these growth investments.

| Metric | Q4 2024 Value | Significance to Pricing |

|---|---|---|

| Average Realized Natural Gas Price (Unhedged) | $2.32/Mcf | Directly impacts revenue before hedging benefits. |

| Production Cost | $0.72/Mcfe | Low costs enable competitive pricing and healthy margins. |

| Unhedged Operating Margin | 69% | Demonstrates profitability at current pricing levels. |

4P's Marketing Mix Analysis Data Sources

Our Comstock Resources 4P's Marketing Mix Analysis is built upon a foundation of verified public company data, including SEC filings, investor presentations, and official press releases. We also incorporate insights from industry reports and competitive intelligence to ensure a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.