Comstock Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

Curious about Comstock Resources' strategic positioning? Our preview offers a glimpse into their product portfolio's potential, hinting at where they might be investing and where they're reaping rewards.

But to truly understand their competitive edge and future growth drivers, you need the full picture. Purchase the complete BCG Matrix report to unlock detailed quadrant analysis, identifying their Stars, Cash Cows, Dogs, and Question Marks with actionable insights.

Don't just guess where Comstock Resources is headed; know it. Get the full BCG Matrix today and gain the strategic clarity to make informed decisions about your own investments and market strategies.

Stars

Comstock Resources is making a significant push into its Western Haynesville operations, boasting an impressive 525,000 net acres. This expansion underscores the company's commitment to a high-growth sector within the natural gas market. The strategic focus on this acreage is a cornerstone of Comstock's long-term growth strategy.

Comstock Resources' Western Haynesville operations are demonstrating exceptional performance. In the second quarter of 2025, newly drilled wells in this region achieved average initial production rates of approximately 36 million cubic feet per day (MMcf/d). This figure highlights a significant uplift in productivity compared to the company's Legacy Haynesville wells.

These elevated production rates from the Western Haynesville are a key indicator of Comstock's potential to capture a larger share of the expanding natural gas market. The superior output suggests more efficient resource extraction and a stronger competitive position for the company.

Comstock Resources is significantly boosting its drilling and completion efforts in the Western Haynesville. The company's 2025 plan includes drilling 19 net wells and bringing 13 net wells online in this prime location. This intensified activity highlights Comstock's strategic focus on maximizing production from its extensive acreage in this high-potential shale play.

Favorable Natural Gas Market Outlook

The outlook for natural gas is decidedly positive, with expectations of climbing prices and robust demand growth. A key driver for this surge is the anticipated commissioning of new Liquefied Natural Gas (LNG) export facilities, with several slated to begin operations by late 2025 and continuing thereafter. This expansion in export capacity is poised to create a high-growth market environment.

This favorable market dynamic directly benefits Comstock Resources, given its strategic focus on natural gas production. The company's operations, particularly its rapidly expanding presence in the Western Haynesville region, are well-positioned to capitalize on this projected demand increase. In 2024, Comstock reported significant production volumes, with its Haynesville assets contributing substantially to its overall output, underscoring its alignment with the burgeoning gas market.

- Projected Price Increases: Analysts forecast rising natural gas prices through 2025 and beyond, driven by increased global demand.

- LNG Export Growth: New LNG export terminals coming online by late 2025 are expected to absorb significant volumes of U.S. natural gas.

- Comstock's Advantage: Comstock Resources, with its substantial natural gas reserves and production, is poised to benefit from these market trends.

- Western Haynesville Focus: The company's increasing production from the Western Haynesville area directly aligns with the projected demand growth.

Strategic Collaboration for Power Generation Assets

Comstock Resources is strategically positioning itself in the energy sector by collaborating with NextEra Energy to explore the development of power generation assets. This initiative is focused on areas near Comstock's Western Haynesville operations, aiming to serve high-demand sectors such as data centers.

This collaboration represents a significant growth opportunity, capitalizing on Comstock's established natural gas supply to tap into an expanding market with considerable future potential.

- Strategic Partnership: Comstock Resources is working with NextEra Energy to develop power generation assets.

- Target Market: The focus is on serving high-demand customers, including data centers, near the Western Haynesville area.

- Growth Potential: This venture leverages Comstock's natural gas resources for entry into a rapidly expanding energy market.

Comstock Resources' Western Haynesville assets are the company's clear Stars in the BCG Matrix. These operations exhibit high growth potential, driven by increasing natural gas demand and favorable market conditions, including the expansion of LNG exports. Their strong production performance, with new wells averaging 36 MMcf/d in Q2 2025, and strategic investments in drilling and completion solidify their position as high-performing, high-growth assets.

| Metric | Western Haynesville | Legacy Haynesville |

|---|---|---|

| Net Acres | 525,000 | Substantial |

| Q2 2025 Avg. Initial Production (MMcf/d) | 36 | Lower than Western Haynesville |

| 2025 Drilling Plan (Net Wells) | 19 | Ongoing |

| Growth Potential | High | Moderate |

What is included in the product

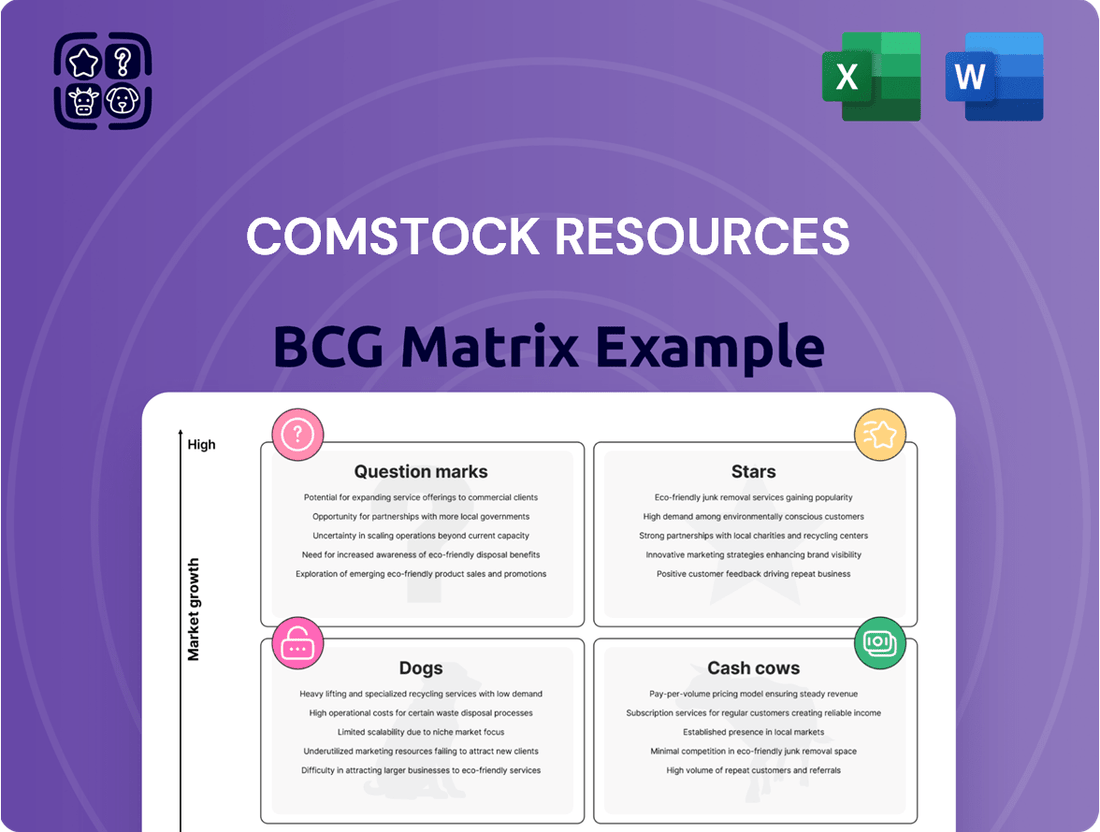

This BCG Matrix overview analyzes Comstock Resources' oil and gas assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations for investment, divestment, or holding based on market growth and relative market share.

Comstock Resources' BCG Matrix offers a clear, actionable view of its portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Comstock Resources holds a dominant position as an independent natural gas producer in the Legacy Haynesville Shale. This core operation boasts a high market share within a mature basin, offering a stable and consistent production base. In 2024, Comstock's Haynesville production averaged approximately 2.3 billion cubic feet equivalent per day (Bcfe/d), underscoring its significant footprint.

Comstock Resources demonstrates strong performance in its Cash Cows, consistently producing substantial operating cash flow. For instance, the company reported $239 million in Q1 2025 and $210 million in Q2 2025, highlighting its reliable cash-generating capabilities from established assets.

This robust cash generation is a critical advantage, enabling Comstock to self-fund its growth strategies and manage its debt obligations effectively. It provides the financial stability needed for ongoing operations without excessive reliance on external funding sources.

Comstock Resources stands out with a remarkably low production cost structure. In the first half of 2025, their production costs averaged an impressive $0.80-$0.83 per Mcfe.

This cost efficiency is a hallmark of a strong cash cow. It enables Comstock to maintain healthy profit margins, even when natural gas prices experience volatility, a common trait in the energy sector.

Large Proved Natural Gas Reserves

Comstock Resources' significant proved natural gas reserves, reaching 7 TCFE by the end of 2024, position its Haynesville assets as a prime Cash Cow. This 6% growth in reserves underscores the company's strong resource base.

These substantial reserves are a key driver of sustained production and reliable cash flow from its established Haynesville operations. This long-term supply security is a hallmark of a Cash Cow, providing a stable foundation for the company's financial performance.

- 7 TCFE: Proved natural gas reserves at year-end 2024.

- 6% growth: Year-over-year increase in proved reserves.

- Haynesville assets: Primary focus for mature, cash-generating operations.

- Long-term supply: Underpins sustained production and cash flow.

Stabilized Production in Legacy Areas

Comstock Resources is maintaining production in its Legacy Haynesville area by operating four rigs. This focus on stabilization, rather than aggressive expansion, is characteristic of a cash cow business. The goal is to ensure consistent cash flow from this mature asset.

This approach is expected to support production levels through 2026. By keeping operations steady, Comstock can reliably generate revenue from its established Haynesville assets. This strategy allows for capital to be redirected towards higher-growth areas.

- Stabilized Production: Four rigs are active in the Legacy Haynesville area.

- 2026 Outlook: Production is being managed to remain stable through 2026.

- Cash Cow Strategy: Maintaining output in a mature area generates consistent cash flow.

- Capital Allocation: Funds from this segment can support growth initiatives elsewhere.

Comstock Resources' Haynesville operations are firmly positioned as Cash Cows within the BCG framework. These assets benefit from a high market share in a mature basin, delivering consistent and substantial operating cash flow. The company's proved reserves in this area reached 7 TCFE by year-end 2024, a 6% increase, ensuring long-term production stability.

| Asset | BCG Category | Key Metrics (2024/H1 2025) | Strategic Implication |

|---|---|---|---|

| Legacy Haynesville | Cash Cow | 2.3 Bcfe/d production (2024 avg.) 7 TCFE proved reserves (YE 2024) $0.80-$0.83/Mcfe production cost (H1 2025) |

Generates stable cash flow to fund growth and debt reduction. |

What You See Is What You Get

Comstock Resources BCG Matrix

The Comstock Resources BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you'll get the complete analysis, free of any watermarks or demo content, ready for your strategic planning.

Dogs

Comstock Resources' oil segment represents a minor part of its overall operations, a characteristic of a 'Dog' in the BCG matrix. In the first quarter of 2025, oil sales accounted for a mere $702,000 of the company's substantial $512.85 million in total revenue. This minimal contribution highlights its low market share in a sector that is not a strategic priority for Comstock.

Further solidifying its 'Dog' status, Comstock's oil production volumes have also experienced a downward trend. This decline, coupled with its already small revenue contribution, suggests a product line with limited growth potential and a weak competitive position within the oil market. The company's focus remains firmly on natural gas, leaving its oil ventures with minimal investment and development.

Given Comstock Resources' strategic focus on natural gas in the Haynesville shale, its oil assets are classified as non-core. These assets don't directly support the company's primary growth objectives and could potentially dilute management's attention and capital allocation.

Comstock Resources is planning to divest non-core properties in 2025, a move aimed at speeding up the reduction of its debt. This strategy signals a readiness to let go of assets that aren't performing well or don't fit the company's main objectives.

While these divestitures aren't solely focused on oil, it's highly probable that their oil assets, which currently contribute very little to the company's overall performance, will be among those sold off.

Minimal Contribution to Overall Revenue

Comstock Resources' oil production contributes minimally to its overall revenue, especially when contrasted with its substantial natural gas sales. This disparity indicates that oil is not a primary financial driver for the company.

For instance, in the first quarter of 2024, Comstock reported total revenue of approximately $281 million, with natural gas accounting for the vast majority of this figure. Oil revenue, while present, represented a small fraction, underscoring its limited impact on the company's financial health.

- Oil revenue is dwarfed by natural gas sales.

- Oil production is not a key financial performance driver for Comstock.

- The minimal revenue suggests limited justification for further oil investment.

- In Q1 2024, natural gas dominated Comstock's revenue generation.

Potential Cash Traps if Maintained

Comstock Resources' minor oil production assets, characterized by low market share and low growth prospects, represent potential cash traps within its BCG Matrix. Maintaining these assets could tie up valuable capital and operational resources that would be more effectively utilized in its higher-growth natural gas ventures.

Consider the implications for capital allocation. In 2023, Comstock Resources reported oil production of approximately 3,000 barrels per day, a relatively small fraction of its overall energy output. This segment, while contributing to revenue, may not offer the same return on investment as its natural gas operations, which are central to its strategic focus.

- Capital Allocation Strain: Continued investment in low-growth oil assets diverts funds from potentially more lucrative natural gas development.

- Operational Complexity: Managing diverse asset types increases operational overhead and complexity.

- Divestiture Opportunity: Selling these minor oil assets would unlock capital for reinvestment in core natural gas projects.

- Strategic Focus Enhancement: Divestiture allows for a sharper focus on the company's primary growth drivers.

Comstock Resources' oil segment fits the 'Dog' category in the BCG Matrix due to its minimal market share and low growth prospects, as evidenced by its small revenue contribution. In the first quarter of 2025, oil sales represented only $702,000 of the company's total $512.85 million revenue, highlighting its non-strategic importance. This limited financial impact, coupled with declining production volumes, suggests that oil assets are not a priority for Comstock, which is strategically focused on natural gas in the Haynesville shale.

The company's intention to divest non-core properties in 2025 further supports the classification of its oil assets as 'Dogs.' These divestitures are aimed at debt reduction and streamlining operations, making it highly likely that underperforming oil assets will be among those sold. This strategic move allows Comstock to reallocate resources to its core natural gas business, enhancing overall efficiency and focus.

The minimal revenue generated by oil, as seen in the first quarter of 2024 where it was a small fraction of the approximately $281 million total revenue dominated by natural gas, indicates a lack of justification for continued investment. In 2023, Comstock's oil production averaged around 3,000 barrels per day, a modest figure compared to its natural gas output, underscoring the 'Dog' status of its oil operations.

| BCG Category | Comstock Resources' Oil Segment |

| Market Share | Low |

| Market Growth | Low |

| Q1 2025 Revenue Contribution | $702,000 (out of $512.85 million total) |

| Strategic Focus | Non-core; focus on Natural Gas |

| 2023 Production (Approx.) | 3,000 barrels per day |

Question Marks

Comstock Resources is venturing into power generation, a new frontier for the company, by partnering with NextEra Energy. This strategic move positions Comstock to tap into a high-growth market, though its current market share in this sector is minimal. The collaboration aims to leverage NextEra's expertise in the power industry.

Comstock Resources is exploring the potential of its power generation assets to meet the surging energy demands of data centers, a sector experiencing explosive growth. This positions the company to tap into a high-growth market, though its current involvement in providing energy services to this specific sector is minimal, reflecting a new venture.

The global data center market is projected to reach $677.7 billion by 2027, growing at a compound annual growth rate of 15.5%, according to Grand View Research. This substantial expansion underscores the significant opportunity for energy providers like Comstock to secure new revenue streams by catering to these energy-intensive facilities.

In the context of Comstock Resources' BCG Matrix, initial stages of new business development, such as exploration and potential development projects, would likely be categorized as Stars or Question Marks. These ventures represent new product or service offerings with unproven market share, demanding significant resource allocation for planning and infrastructure before yielding substantial returns.

For instance, Comstock's ongoing exploration activities in the Eagle Ford Shale, a key operating area, exemplify this phase. While the potential for high returns exists, the upfront investment in seismic surveys, drilling, and facility construction is substantial, characteristic of a Question Mark or a nascent Star depending on early exploration results.

Requires Significant Future Investment for Scale

To truly capitalize on its power generation assets and achieve a significant market presence, Comstock Resources would face the necessity of considerable future investment. This aligns with the characteristics of Question Marks in the BCG matrix, which often require substantial capital infusion to grow and potentially become Stars.

Comstock's power generation segment, while holding potential, currently demands heavy upfront capital for expansion and technological upgrades. For instance, developing new power generation facilities or enhancing existing ones to meet growing energy demands can involve billions of dollars in expenditure. This need for significant capital outlay is a defining trait for assets categorized as Question Marks.

- High Capital Expenditure: Developing new power generation capacity or upgrading existing infrastructure often requires substantial upfront investment, potentially running into hundreds of millions or even billions of dollars depending on the scale and technology.

- Market Share Growth: To move from a Question Mark to a Star, Comstock would need to aggressively invest to capture a larger share of the power generation market, which is often characterized by established players and high barriers to entry.

- Technological Advancement: Future investments may also be directed towards adopting newer, more efficient, or environmentally friendly power generation technologies to remain competitive and meet evolving regulatory standards.

- Operational Efficiency Improvements: Significant capital could also be allocated to improving the operational efficiency of existing assets, thereby reducing costs and increasing output, which is crucial for scaling up.

Uncertainty of Market Adoption and Success

While the data center sector is experiencing robust expansion, the actual market adoption and ultimate success of Comstock Resources' potential power generation services remain subjects of considerable uncertainty. This inherent risk, coupled with the high growth potential of the data center market, firmly places these services within the Question Mark category of the BCG Matrix.

Comstock's foray into providing power generation for data centers faces the challenge of establishing a significant market share in a competitive landscape. Despite the projected growth in data center energy demand, which is expected to rise significantly in the coming years, Comstock's ability to capture a meaningful portion of this market is not guaranteed. For instance, the U.S. energy market for data centers is projected to grow, with some estimates suggesting a substantial increase in electricity consumption by these facilities in the near future, potentially reaching tens of gigawatts. However, Comstock's specific market penetration remains an unknown variable.

- Uncertain Market Share: Comstock's power generation services for data centers are in a nascent stage, making it difficult to predict their future market share.

- High Growth Potential: The data center industry's increasing demand for reliable and efficient power presents a significant growth opportunity.

- Competitive Landscape: Existing energy providers and new entrants pose competition, impacting Comstock's ability to gain traction.

- Regulatory and Technological Hurdles: Navigating energy regulations and adopting new power generation technologies add layers of uncertainty to market success.

Comstock Resources' new venture into power generation for data centers is a classic example of a Question Mark in the BCG Matrix. This is due to its high growth potential in the booming data center market, which is projected to significantly increase its energy consumption, but also its current low market share and the substantial investment required to establish a foothold. The company needs to invest heavily to grow its market share in this competitive sector.

The uncertainty surrounding Comstock's ability to capture a significant portion of the data center power market, despite the sector's rapid expansion, solidifies its position as a Question Mark. Significant capital is needed to develop new facilities and adopt advanced technologies to compete effectively.

To transition from a Question Mark to a Star, Comstock must successfully navigate regulatory landscapes, invest in technological advancements, and improve operational efficiency, all while facing established energy providers.

The company's power generation segment, while promising, demands considerable capital for expansion and upgrades, a hallmark of Question Marks needing substantial investment to potentially become market leaders.

BCG Matrix Data Sources

Our Comstock Resources BCG Matrix is informed by comprehensive data, including financial reports, industry analyses, and market share data to accurately position business units.