Comstock Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

Navigate the complex external forces shaping Comstock Resources's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain the strategic foresight needed to make informed decisions and secure your competitive advantage. Download the full analysis now for actionable intelligence.

Political factors

Government policies on oil and natural gas drilling permits, leasing, and development directly shape Comstock Resources' expansion capabilities. For instance, in 2024, the Bureau of Land Management continued to manage federal oil and gas leasing, with leasing activity fluctuating based on market conditions and regulatory reviews. Changes in federal or state energy strategies, such as potential incentives for domestic production or shifts towards renewable energy, can significantly alter Comstock's operational scope and investment outlook.

Comstock Resources' operations are heavily influenced by state-specific regulations in North Louisiana and East Texas. These rules cover everything from obtaining permits for new wells to ensuring environmental protection standards are met. For instance, Texas's Railroad Commission and Louisiana's Department of Natural Resources set the operational framework.

Changes in political priorities at the state level can lead to new rules or modifications of existing ones. These shifts might impose additional costs or operational constraints. For example, a heightened focus on water usage for hydraulic fracturing could introduce stricter reporting or recycling mandates.

Successfully navigating these localized political landscapes is crucial. Comstock Resources must remain agile, adapting to evolving regulatory requirements to maintain efficient operations and compliance. This includes staying informed about legislative proposals and potential policy changes that could impact their business model.

While Comstock Resources primarily operates within the United States, global geopolitical events and international energy policies remain critical influencers on crude oil and natural gas prices. These external forces directly impact Comstock's revenue and profitability by affecting the commodity prices it receives. For instance, in early 2024, ongoing tensions in the Middle East contributed to elevated oil prices, a trend that benefits producers like Comstock.

Trade disputes, conflicts in major energy-producing regions, or the implementation of international climate agreements can introduce significant volatility into global commodity markets. For example, the European Union's ongoing efforts to diversify energy sources away from Russia, as seen in their 2023-2024 energy strategies, can shift global supply and demand dynamics, impacting prices worldwide. This inherent external volatility underscores the necessity for Comstock Resources to maintain a robust and adaptable risk management strategy.

Taxation and Fiscal Policies

Changes in federal and state tax policies, including severance taxes on natural gas production and corporate income tax rates, directly influence Comstock Resources' profitability. For instance, fluctuations in the corporate income tax rate, which stood at 21% in the US for 2024, can significantly alter the company's net earnings. Depletion allowances also play a crucial role, affecting the taxable income from oil and gas extraction.

Favorable fiscal policies can enhance the economic feasibility of new drilling projects and boost overall profitability. Conversely, unfavorable changes, such as increased severance taxes in key producing states like Texas or Oklahoma, could reduce margins. The company's financial forecasts are therefore heavily reliant on anticipating these tax policy shifts.

- Impact of Corporate Tax Rates: A 1% change in the US federal corporate tax rate can impact Comstock's net income by millions of dollars.

- Severance Tax Sensitivity: Texas, a primary operating state, has a variable severance tax rate on natural gas, directly affecting production costs.

- Depletion Allowance Effects: The availability and structure of depletion allowances for oil and gas producers are critical for managing tax liabilities.

- Fiscal Policy Forecasting: Comstock's financial planning must incorporate projections of potential changes in state and federal tax legislation.

Energy Security and Domestic Production Initiatives

Government emphasis on domestic energy security in 2024 and 2025 is translating into policies that bolster U.S. oil and natural gas production. For instance, the Inflation Reduction Act of 2022 continues to influence the energy landscape, with potential for further regulatory adjustments supporting domestic output. This focus on energy independence can lead to streamlined permitting and targeted production incentives, creating a more predictable operating environment for companies like Comstock Resources.

The political discourse surrounding energy independence is crucial, directly impacting public perception and regulatory support for the oil and gas sector. As of late 2024, the debate often centers on balancing energy needs with environmental considerations, which can influence the stability of supportive policies. Comstock Resources, as a significant domestic producer, benefits from political narratives that champion national energy self-sufficiency.

- Policy Support: Continued government focus on energy security in 2024-2025 may result in favorable regulatory frameworks for domestic oil and gas producers.

- Incentives: Potential for production incentives or tax credits, influenced by energy independence initiatives, could directly benefit Comstock Resources' operational costs and profitability.

- Public Opinion: The political framing of energy security can shape public and regulatory attitudes, influencing the overall acceptance and support for companies like Comstock.

- Permitting: Streamlined permitting processes, a common outcome of energy security drives, can accelerate project development and reduce operational delays for Comstock.

Government policies directly influence Comstock Resources' operational landscape, from drilling permits to environmental regulations. In 2024, federal and state agencies continued to oversee leasing and development, with regulatory reviews impacting activity. Shifts in energy strategies, such as incentives for domestic production or a move towards renewables, can significantly alter Comstock's investment outlook and operational scope.

Global geopolitical events and international energy policies, such as the EU's 2023-2024 energy diversification strategies, continue to impact crude oil and natural gas prices. These external forces directly affect Comstock's revenue by influencing commodity prices. For example, Middle Eastern tensions in early 2024 contributed to elevated oil prices, benefiting producers like Comstock.

Changes in federal and state tax policies, including the 21% US federal corporate tax rate in 2024, directly impact Comstock's profitability. Severance taxes on natural gas production and depletion allowances are critical factors in managing tax liabilities and forecasting financial performance.

The government's emphasis on domestic energy security in 2024-2025 is translating into policies that may bolster U.S. oil and natural gas production, potentially leading to streamlined permitting and production incentives for companies like Comstock Resources.

What is included in the product

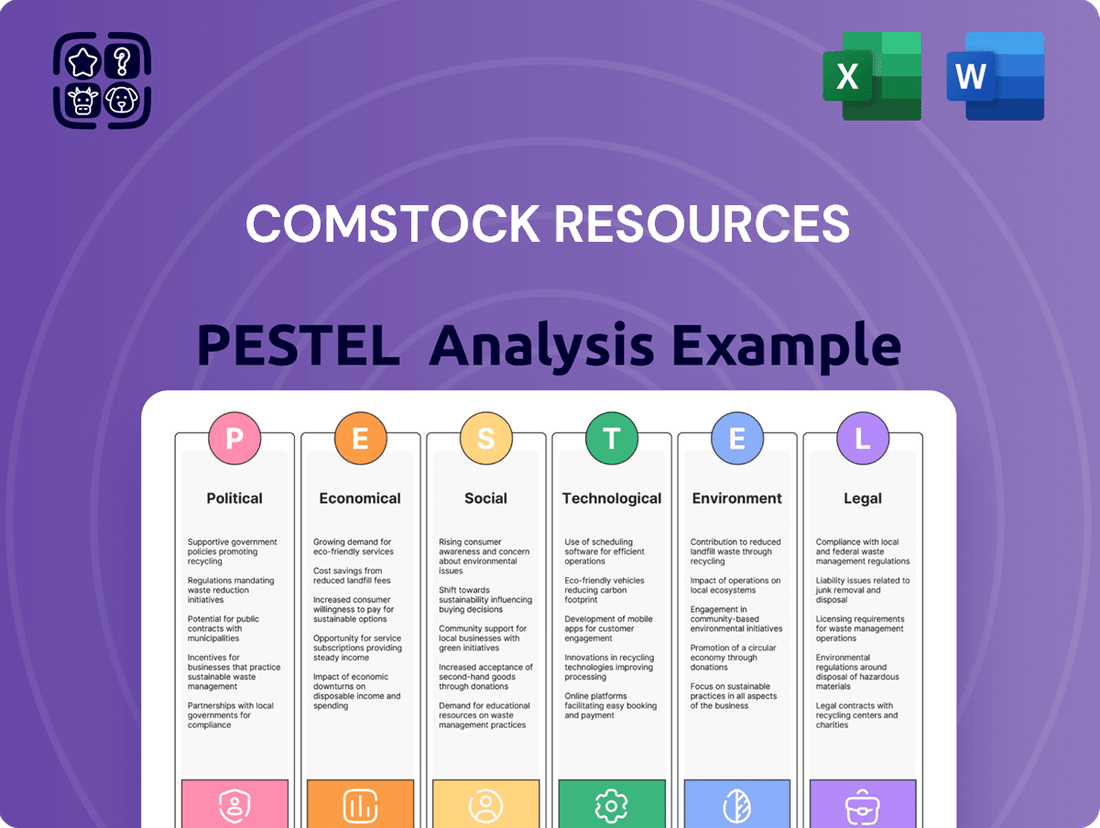

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Comstock Resources, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights into how these global and regional trends present both challenges and strategic opportunities for the company.

A PESTLE analysis for Comstock Resources offers a clear, summarized version of external factors, alleviating the pain point of wading through complex data during meetings and presentations.

Economic factors

Comstock Resources' financial performance is intrinsically linked to the volatile prices of natural gas and oil. For instance, in the first quarter of 2024, the average realized price for natural gas was $2.05 per Mcf, a significant decrease from $2.65 per Mcf in the same period of 2023, directly impacting revenue.

Global supply and demand, geopolitical tensions, and broader economic trends are major drivers of this price volatility. For example, disruptions in major oil-producing regions can send prices soaring, while increased production from new sources can lead to sharp declines, creating substantial revenue swings for Comstock.

To manage this risk, Comstock utilizes hedging strategies. However, prolonged periods of low commodity prices, such as those experienced in late 2023 and early 2024, can still compress profit margins and limit the company's ability to fund new drilling projects and capital expenditures.

Comstock Resources, deeply involved in oil and gas exploration, requires substantial capital for its operations. Access to these funds, often through debt financing, is crucial for developing new wells and expanding production capacity.

Interest rates play a significant role in Comstock's financial health. For instance, if the Federal Reserve maintains its target range for the federal funds rate, as it has been doing in late 2024 and projected into 2025, borrowing costs for Comstock will be directly influenced. Higher rates mean increased expenses for servicing debt, potentially making new projects less profitable.

In a rising interest rate environment, the cost of capital can climb, impacting the economic feasibility of Comstock's drilling and development plans. This could lead to a reduction in capital expenditures or a shift towards more conservative investment strategies to manage increased debt service obligations.

Overall economic growth, both in the U.S. and globally, is a major driver of energy demand. When economies are expanding, businesses produce more and consumers spend more, leading to increased consumption of natural gas for power generation and industrial uses. For instance, the U.S. GDP grew by an estimated 2.5% in 2023, signaling a healthy economic environment that supports higher energy demand.

Comstock Resources, as a natural gas producer, benefits directly from this correlation. A strong economy means more factories are running, more homes are being heated or cooled, and more electricity is being generated, all of which boosts the demand for natural gas. This increased demand can translate into better pricing power for Comstock's output, positively impacting its revenue and profitability.

Conversely, any economic slowdown or recession can significantly dampen energy demand. A contracting economy leads to reduced industrial activity and lower consumer spending, directly impacting the need for natural gas. For example, if global GDP growth were to slow to below 1% in 2024 or 2025, Comstock would likely face suppressed demand and potentially lower natural gas prices, affecting its financial performance.

Inflationary Pressures on Operating Costs

Inflationary pressures directly impact Comstock Resources' operating costs, affecting everything from labor and equipment to essential services for drilling and completion. For instance, the Producer Price Index (PPI) for oil and gas extraction services saw a notable increase in late 2023 and early 2024, indicating rising input costs for energy producers. This surge in expenses can significantly squeeze profit margins, even if the company achieves favorable commodity prices.

Comstock Resources faces the challenge of managing these rising costs to maintain profitability. The company's ability to control its supply chain and enhance operational efficiencies becomes critical in mitigating the impact of inflation. For example, securing favorable contracts for drilling rigs and specialized equipment, and optimizing logistics for materials, are key strategies to counteract cost escalations.

- Increased Input Costs: Inflation drives up expenses for labor, fuel, chemicals, and specialized equipment crucial for exploration and production.

- Margin Erosion: Even with stable or rising oil and gas prices, higher operating costs can reduce net profit margins.

- Supply Chain Management: Effective management of suppliers and inventory is vital to secure resources at competitive prices amidst inflationary trends.

- Operational Efficiency: Streamlining drilling and completion processes can help offset rising costs and maintain project economics.

Competitive Landscape and Market Share

The Haynesville shale region, a key operational area for Comstock Resources, is characterized by intense competition. Numerous independent and major energy firms actively pursue prime acreage and production opportunities, directly impacting Comstock's economic standing. For instance, in the first quarter of 2024, the average rig count in the Haynesville hovered around 40-50 rigs, reflecting significant drilling activity by multiple operators.

Comstock's financial results are inherently tied to the strategic decisions of its rivals. Competitors' production levels, adoption of new drilling and completion technologies, and their success in marketing natural gas and natural gas liquids directly influence market dynamics and pricing. The ability of other companies to achieve lower lifting costs or secure favorable transportation contracts can create pricing pressure for Comstock.

To maintain its competitive advantage, Comstock Resources must consistently focus on operational efficiency and effective resource development. This includes optimizing drilling times, improving completion techniques to maximize well productivity, and managing costs diligently. For example, Comstock reported an average lateral length of over 10,000 feet for its new wells in 2023, a metric that signifies advancements in efficient resource extraction compared to earlier industry standards.

- Competitive Intensity: The Haynesville shale is a highly contested basin with many players.

- Competitor Influence: Competitors' production, technology, and marketing efforts shape market conditions.

- Efficiency Imperative: Maintaining a competitive edge relies on cost-effective operations and resource management.

- Industry Benchmarking: In Q1 2024, the Haynesville rig count averaged between 40-50, indicating robust, shared activity.

Economic factors significantly influence Comstock Resources, primarily through commodity prices and overall economic growth. For instance, the average realized price for natural gas in Q1 2024 was $2.05 per Mcf, down from $2.65 per Mcf in Q1 2023, directly impacting revenue. A strong U.S. GDP growth of 2.5% in 2023 supported higher energy demand, benefiting producers like Comstock.

Interest rates also play a critical role, with the Federal Reserve's target range for the federal funds rate influencing borrowing costs. Higher rates increase debt servicing expenses, potentially impacting the profitability of new drilling projects. Inflationary pressures, such as rising costs for oil and gas extraction services, further squeeze profit margins by increasing operating expenses.

| Economic Factor | Impact on Comstock Resources | Relevant Data (2023-2025 Projections) |

|---|---|---|

| Commodity Prices (Natural Gas) | Directly affects revenue and profitability. Lower prices compress margins. | Q1 2024 realized price: $2.05/Mcf (vs. $2.65 in Q1 2023) |

| Economic Growth (GDP) | Drives energy demand. Strong growth increases consumption. | U.S. GDP growth: 2.5% in 2023. Projections for 2024-2025 indicate continued, albeit potentially moderating, growth. |

| Interest Rates | Impacts cost of capital and debt servicing. Higher rates increase expenses. | Federal Reserve target range for federal funds rate maintained through late 2024 and projected into 2025. |

| Inflation | Increases operating costs (labor, equipment, services). | Producer Price Index (PPI) for oil and gas extraction services saw increases in late 2023/early 2024. |

Preview Before You Purchase

Comstock Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Comstock Resources PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights for strategic planning and risk assessment.

Sociological factors

Societal views on fossil fuels and the increasing focus on Environmental, Social, and Governance (ESG) criteria significantly shape investor sentiment and capital access for companies like Comstock Resources. Negative public perception can intensify pressure from advocacy groups and investors, pushing for more sustainable operations or a quicker shift away from fossil fuels.

Comstock must actively showcase its dedication to responsible practices to navigate this evolving landscape. For instance, in 2024, many energy companies are reporting increased ESG-related shareholder proposals, with some receiving substantial support, highlighting the growing investor demand for transparency and environmental stewardship.

Comstock Resources relies heavily on a skilled workforce, including petroleum engineers, geologists, and experienced field technicians, to effectively explore, develop, and produce oil and natural gas. The availability of these professionals directly impacts operational efficiency and the company's ability to capitalize on new opportunities. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in petroleum engineers between 2022 and 2032, indicating a competitive landscape for talent.

Demographic shifts, such as an aging workforce in the energy sector and competition for talent from other industries like technology, can constrain labor supply and drive up wage costs. This was evident in 2023, where many energy companies reported challenges in filling specialized roles due to a shortage of experienced personnel. Attracting and retaining this critical expertise is paramount for Comstock to maintain its operational continuity and foster innovation.

Comstock Resources' operations in North Louisiana and East Texas necessitate robust community relations to maintain its social license to operate. Local sentiment regarding land use, noise, traffic, and environmental impacts directly influences project permitting and public acceptance, as seen in the ongoing dialogue around infrastructure development in these regions.

Proactive engagement with local stakeholders is paramount. For instance, in 2024, Comstock reported continued investment in community outreach programs, aiming to address concerns and foster goodwill, which is critical for smooth operational continuity and future expansion plans in these resource-rich areas.

Shifting Consumer Preferences and Energy Transition

While Comstock Resources primarily supplies natural gas to pipelines and industrial clients, evolving societal attitudes towards sustainability are a significant consideration. Growing consumer demand for reduced carbon footprints and a broader societal push for renewable energy sources could indirectly affect the long-term market for natural gas. This ongoing energy transition, fueled by climate change awareness, presents a dynamic landscape that Comstock must actively monitor to inform its strategic planning.

The shift in consumer preferences is a powerful driver in the energy sector. For instance, by early 2024, surveys indicated that a majority of consumers in many developed nations supported increased investment in renewable energy, with a significant portion willing to pay a premium for cleaner energy options. This societal momentum towards decarbonization, even if Comstock's direct customer base isn't retail consumers, creates a ripple effect. As industries face pressure to lower their emissions, the demand for natural gas as a transitional fuel or a component in cleaner energy mixes will be shaped by these broader environmental goals.

Comstock's long-term strategy must therefore account for these evolving market dynamics. The company's ability to adapt to potential shifts in energy demand, perhaps by exploring opportunities related to natural gas as a bridge fuel or by integrating with emerging lower-carbon technologies, will be crucial. Staying attuned to these sociological factors ensures Comstock remains resilient and competitive in a rapidly changing global energy environment.

- Societal Support for Renewables: Public opinion polls in 2024 consistently showed over 60% of respondents in key markets favoring increased government and corporate investment in renewable energy sources.

- Corporate ESG Goals: A growing number of large industrial consumers, Comstock's indirect clientele, have publicly stated Environmental, Social, and Governance (ESG) targets that include reducing their greenhouse gas emissions, potentially impacting their long-term natural gas procurement strategies.

- Policy Influence: Government policies and international agreements aimed at climate change mitigation, increasingly influenced by public sentiment, can create regulatory environments that favor cleaner energy alternatives over fossil fuels.

Health and Safety Standards

Societal expectations for stringent health and safety standards within the oil and gas industry are paramount, especially given the inherent risks. Comstock Resources, like its peers, faces significant pressure to uphold these standards to maintain public trust and operational continuity.

Failure to meet these expectations can result in substantial reputational damage, leading to decreased investor confidence and potential boycotts. For instance, in 2024, several energy companies faced intense scrutiny and financial penalties following safety lapses, underscoring the high stakes involved.

Comstock Resources’ commitment to a robust safety culture is crucial for several reasons:

- Employee Well-being: Protecting its workforce from accidents and injuries is a fundamental responsibility.

- Community Relations: Ensuring safe operations safeguards the health and environment of the communities where it operates.

- Regulatory Compliance: Adhering to strict safety regulations, such as those enforced by OSHA and the EPA, avoids costly fines and operational shutdowns.

- Financial Performance: Maintaining high safety standards can reduce insurance premiums and litigation costs, positively impacting the bottom line.

Societal views increasingly favor renewable energy, with over 60% of respondents in key markets in 2024 supporting greater investment in these sources. This public sentiment influences corporate ESG goals, as many industrial clients are setting targets to reduce their greenhouse gas emissions, potentially altering long-term natural gas demand for companies like Comstock Resources.

The energy sector faces a critical need for skilled labor, with the U.S. Bureau of Labor Statistics projecting a 5% growth in petroleum engineers between 2022 and 2032. However, demographic shifts and competition from other industries present challenges in attracting and retaining experienced personnel, a trend noted by many energy firms in 2023.

| Sociological Factor | Impact on Comstock Resources | 2024/2025 Data/Trend |

|---|---|---|

| Public Opinion on Energy Sources | Influences investor sentiment and capital access; pressure for sustainable operations. | Over 60% public support for renewables in key markets (2024). |

| Workforce Availability & Skills | Affects operational efficiency and ability to capitalize on opportunities. | Projected 5% growth in petroleum engineers (2022-2032), but talent competition exists. |

| Community Relations | Crucial for social license to operate, impacting permitting and public acceptance. | Comstock reported continued investment in community outreach programs (2024). |

Technological factors

Continuous innovation in horizontal drilling and hydraulic fracturing technologies directly impacts Comstock Resources' ability to efficiently extract oil and natural gas from the Haynesville shale. These advancements are crucial for maintaining competitive production levels.

Improved techniques, such as longer laterals and enhanced proppant designs, can significantly increase recovery rates. For instance, in 2023, Comstock reported that their average lateral length in the Haynesville increased, contributing to higher production per well.

Furthermore, advancements like multi-well pad drilling reduce surface disturbance and operational costs. This efficiency allows Comstock to lower per-unit production costs, making their operations more economically viable, especially in fluctuating commodity price environments.

Comstock Resources is leveraging advanced data analytics, AI, and machine learning to interpret seismic, well log, and production data. This allows for a deeper understanding of its reservoirs, crucial for optimizing operations.

These technologies are instrumental in refining well placement strategies and predicting production decline rates. For instance, by analyzing historical production data from similar wells, Comstock can more accurately forecast future output, enabling better capital allocation. In 2023, the company reported a significant increase in production efficiency, partly attributed to these analytical tools.

The application of AI in identifying enhanced oil and gas recovery opportunities is a key technological driver. By processing vast datasets, Comstock can pinpoint areas within existing fields that may yield additional resources through advanced techniques, thereby maximizing the value of its asset base and boosting overall output.

As environmental regulations intensify, Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly relevant for natural gas producers like Comstock Resources. The growing emphasis on decarbonization means that the long-term marketability of natural gas, often touted as a cleaner alternative to coal, could be influenced by the success and widespread adoption of CCUS. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion in 2022 for CCUS projects, signaling significant government support that could shape the energy landscape.

While Comstock is not currently a direct operator of CCUS facilities, the evolving technological landscape presents potential strategic considerations. The scalability and cost-effectiveness of CCUS solutions will play a crucial role in determining the future demand for natural gas. Companies are increasingly evaluating how to align their operations with climate goals, and Comstock might explore future opportunities to participate in or support CCUS initiatives, potentially through partnerships or investments, to maintain its competitive edge in a decarbonizing economy.

Pipeline Infrastructure and Midstream Technologies

The efficiency and capacity of natural gas midstream infrastructure are paramount for Comstock Resources to successfully deliver its production to market. Technological progress in pipeline integrity, such as advanced sensor technology for leak detection, and more efficient compression units directly impact operational costs and reliability. For instance, advancements in materials science for pipeline construction can enhance durability and reduce maintenance needs, a crucial factor in the vast network Comstock relies upon.

Improvements in midstream technologies, including enhanced gas processing capabilities and more cost-effective liquefaction for Liquefied Natural Gas (LNG) exports, can significantly broaden market access and lower transportation expenses. As of early 2024, the demand for natural gas, particularly for export markets, continues to drive investment in these areas. The development of smaller-scale, modular liquefaction plants, for example, offers greater flexibility for producers.

Reliable midstream infrastructure is not just about capacity; it's about consistency in sales. Downtime in gathering or processing facilities, or limitations in transmission lines, can directly affect Comstock's revenue streams. The company's ability to secure firm transportation agreements and leverage efficient processing capacity is directly tied to the technological sophistication and maintenance of the midstream sector it utilizes.

Automation and Remote Operations

Increased automation in field operations and the capability to remotely monitor and control wells are transforming the energy sector. For Comstock Resources, these advancements offer significant potential to boost safety, slash operational expenses, and expedite responses to various situations.

These technologies enable more strategic deployment of personnel, thereby reducing the need for direct human presence in potentially hazardous environments. For instance, in 2024, companies like Comstock are investing in digital oilfield solutions that leverage AI and IoT for predictive maintenance, aiming to cut downtime by an estimated 15-20%.

- Enhanced Safety: Remote monitoring minimizes personnel exposure to dangerous conditions.

- Cost Reduction: Automation and remote management lead to lower labor and operational costs.

- Improved Efficiency: Faster response times and optimized operations through digital solutions.

- Operational Resilience: Greater ability to manage operations effectively, even in challenging circumstances.

Technological advancements in drilling and completion techniques are central to Comstock Resources' operational efficiency and cost-effectiveness in the Haynesville shale. Innovations like extended-reach horizontal drilling and advanced hydraulic fracturing designs directly influence well productivity and economic viability.

The company's adoption of digital oilfield technologies, including AI and machine learning for reservoir analysis and production optimization, is a key driver for improved performance. For example, in 2023, Comstock reported increased production efficiency, partly attributed to these analytical tools, allowing for more precise well placement and better forecasting of output.

The evolving landscape of Carbon Capture, Utilization, and Storage (CCUS) technologies presents both challenges and opportunities for natural gas producers. As environmental regulations tighten, the integration of CCUS could become critical for the long-term marketability of natural gas, with significant government investment, such as the $12 billion allocated by the U.S. Department of Energy in 2022, signaling its growing importance.

Midstream infrastructure technology, including pipeline integrity monitoring and efficient gas processing, directly impacts Comstock's ability to deliver its production to market reliably and cost-effectively. Advances in materials science and modular liquefaction plants, supported by continued demand for exports as of early 2024, enhance market access and reduce transportation expenses.

Legal factors

Comstock Resources operates under a stringent environmental regulatory framework, encompassing federal, state, and local laws. These regulations dictate standards for air emissions, water discharge, waste disposal, and site cleanup, all critical for sustainable operations.

Key compliance areas for Comstock include managing methane emissions, handling produced water responsibly, and preventing and remediating spills. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine methane regulations, impacting oil and gas operations. In 2024, the EPA proposed new rules aimed at reducing methane emissions from existing oil and natural gas infrastructure, which could require significant investments in leak detection and repair technologies for companies like Comstock.

Failure to adhere to these environmental mandates can lead to severe consequences. These include substantial financial penalties, with fines potentially reaching tens of thousands of dollars per day per violation, operational disruptions such as temporary shutdowns, and considerable damage to the company's public image. To mitigate these risks, Comstock must maintain and continuously improve its environmental management systems, ensuring proactive compliance and a commitment to environmental stewardship.

Comstock Resources' operations in North Louisiana and East Texas are heavily influenced by land use and mineral rights laws. Navigating these complex regulations, including zoning and ownership structures, is crucial for securing and maintaining drilling leases. For instance, in 2024, the Bureau of Land Management (BLM) continued to manage federal oil and gas leases, with lease sales in states like Louisiana and Texas reflecting ongoing demand and regulatory oversight.

Legal challenges related to land access or mineral rights ownership can significantly impact Comstock's project timelines and financial performance. These disputes can lead to costly delays and require substantial legal resources to resolve. The ability to manage surface owner relationships effectively is also a key legal and operational consideration.

Comstock Resources must strictly adhere to Occupational Safety and Health Administration (OSHA) regulations, which are legally binding. These rules encompass equipment upkeep, hazard communication, worker training, and emergency preparedness, ensuring a safe working environment. For instance, OSHA's Process Safety Management standard (29 CFR 1910.119) mandates rigorous safety protocols for facilities handling highly hazardous chemicals, directly impacting oil and gas operations.

Contractual Obligations and Commercial Law

Comstock Resources operates under a complex web of commercial contracts, essential for its day-to-day business. These include agreements for selling natural gas and oil, securing transportation through pipeline contracts, and engaging drilling service providers. Upholding these contractual obligations and adhering to broader commercial law is fundamental to maintaining consistent operations and predictable revenue streams.

Failure to meet these contractual commitments can trigger significant financial penalties and legal disputes, impacting Comstock's operational efficiency and profitability. For instance, a breach in a long-term gas sales agreement could lead to lost revenue and potential market share erosion. In 2024, the energy sector continued to see litigation over contract performance, highlighting the critical nature of these agreements.

- Contractual Reliance: Comstock's revenue generation hinges on fulfilling sales contracts for its oil and gas output.

- Transportation Agreements: Securing pipeline capacity through contracts is vital for delivering products to market.

- Service Contracts: Agreements with drilling and completion companies are crucial for exploration and production activities.

- Legal Ramifications: Contract breaches can result in substantial financial liabilities and operational disruptions for Comstock.

Antitrust and Competition Laws

As a player in the energy sector, Comstock Resources navigates a landscape shaped by antitrust and competition laws. These regulations are in place to foster a level playing field, preventing any single entity from dominating the market and ensuring fair competition. This means Comstock must be mindful of how its business practices, especially those involving potential mergers or acquisitions, impact market concentration.

The company's pricing strategies and any information exchanges with rivals are also under scrutiny to ensure they don't lead to anti-competitive behavior. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on energy market consolidation, issuing reports and initiating investigations into potential monopolistic practices across various energy sub-sectors. Such regulatory oversight is critical for maintaining market integrity.

Failure to adhere to these laws can result in substantial financial penalties and intense regulatory examination. For example, past antitrust violations in the broader energy industry have led to fines in the hundreds of millions of dollars and mandated changes to business operations. Comstock must therefore maintain robust compliance programs to mitigate these risks.

- Mergers & Acquisitions Scrutiny: Comstock's growth strategies, particularly acquisitions, face review by agencies like the FTC and Department of Justice to assess their impact on market competition.

- Pricing Practices: Antitrust laws prohibit price-fixing and other collusive activities that could artificially inflate energy prices for consumers.

- Information Sharing: Regulations limit the sharing of sensitive competitive information with rivals to prevent coordinated market manipulation.

- Regulatory Enforcement: In 2024, energy sector antitrust enforcement remained a priority, with regulatory bodies actively investigating and penalizing anti-competitive conduct.

Comstock Resources operates within a dynamic legal framework that significantly influences its operations and strategic decisions. Key legal considerations include environmental compliance, land and mineral rights, occupational safety, contractual obligations, and antitrust laws.

In 2024, regulatory bodies like the EPA continued to refine methane emission standards, potentially increasing compliance costs for Comstock. Land use regulations, managed by entities such as the BLM, also impact lease acquisitions and operations. OSHA standards, particularly Process Safety Management, are paramount for worker safety.

Contractual adherence for sales, transportation, and services is vital, with breaches carrying financial penalties. Furthermore, antitrust laws, actively enforced by agencies like the FTC in 2024, scrutinize market concentration and pricing practices to ensure fair competition.

| Legal Area | Key Regulations/Considerations | 2024/2025 Impact Examples |

|---|---|---|

| Environmental | EPA methane regulations, Clean Air Act, Clean Water Act | Proposed stricter methane emission rules for existing infrastructure; potential compliance investments. |

| Land & Mineral Rights | State and federal leasing laws (e.g., BLM oversight) | Ongoing federal lease sales; potential disputes over surface owner rights. |

| Occupational Safety | OSHA standards (e.g., PSM) | Mandatory safety protocols for handling hazardous chemicals; worker training requirements. |

| Contractual | Sales, transportation, and service agreements | Litigation over contract performance in the energy sector; penalties for breaches. |

| Antitrust | FTC and DOJ oversight | Scrutiny of energy market consolidation; investigations into anti-competitive practices. |

Environmental factors

The intensifying global and national commitment to addressing climate change and achieving ambitious greenhouse gas emissions targets presents a significant long-term consideration for Comstock Resources, a company heavily invested in fossil fuels. Policies designed to curb carbon footprints, including measures like carbon pricing mechanisms or more stringent regulations on methane emissions, have the potential to raise operational expenses or demand substantial capital outlays for emissions abatement technologies.

Hydraulic fracturing, a core process for Comstock Resources, demands substantial water volumes, and managing the resulting wastewater presents a significant environmental challenge. In 2023, the Permian Basin, a key operational area for Comstock, experienced varying levels of drought, increasing scrutiny on water sourcing and disposal practices.

Comstock Resources is under observation for its water sourcing, efficiency in usage, and how it handles wastewater, especially in areas prone to water shortages. For instance, in certain Texas counties where Comstock operates, water availability can be a constraint, impacting operational costs and regulatory compliance.

Adopting robust water management strategies is crucial for Comstock to lessen its environmental footprint and maintain its ability to operate smoothly. This includes exploring recycled water usage and advanced treatment technologies, which are becoming increasingly important for long-term sustainability in the energy sector.

Oil and natural gas operations, like those undertaken by Comstock Resources, inherently carry risks to local ecosystems. Activities such as drilling, pipeline construction, and well pad development can lead to land disturbance and habitat fragmentation, impacting biodiversity. For instance, a 2024 report highlighted that energy development in the Permian Basin, a key operational area for Comstock, has shown correlations with reduced populations of certain ground-nesting bird species due to habitat alteration.

Comstock Resources, operating in ecologically sensitive regions, must navigate stringent environmental regulations designed to mitigate these impacts. Adherence to best practices for land management and spill prevention is crucial. The company's 2024 sustainability report indicated investments in land reclamation projects, aiming to restore areas affected by its operations, though specific biodiversity metrics for these reclaimed sites are still under development.

Seismic Activity Concerns

While the direct link between hydraulic fracturing and seismic activity is complex, the disposal of produced water into deep injection wells has been increasingly associated with induced seismicity in certain regions. Comstock Resources, operating in areas with potential seismic concerns, must navigate evolving regulatory landscapes. For instance, the Oklahoma Corporation Commission, in response to heightened seismic events, has implemented measures to curb wastewater injection volumes in specific zones, impacting operators' disposal strategies and potentially increasing costs.

These concerns can translate into stricter regulations on drilling and wastewater disposal practices. Such regulations might necessitate modifications to Comstock's operational methods, potentially increasing compliance costs or requiring investment in alternative disposal technologies. For example, in 2023, the Railroad Commission of Texas continued to review and update its rules regarding wastewater injection wells in response to localized seismic events, a trend likely to persist and influence operational planning.

Monitoring and adapting to these environmental factors are crucial for Comstock's long-term operational viability and cost management. The company's ability to anticipate and respond to potential regulatory changes driven by seismic activity concerns will be a key factor in maintaining efficient and cost-effective production.

- Induced Seismicity Monitoring: Comstock must invest in and utilize advanced seismic monitoring technologies in its operating regions to proactively identify and assess any potential links between its operations and seismic events.

- Regulatory Compliance Costs: Anticipate potential increases in compliance costs due to stricter regulations on wastewater disposal, which could include fees for enhanced monitoring or investments in alternative disposal methods.

- Operational Adaptability: Maintain flexibility in operational plans to adapt to potential restrictions on injection well volumes or locations, as seen in other oil and gas producing states like Oklahoma.

Land Reclamation and Site Remediation

Comstock Resources, like all oil and gas operators, faces significant responsibilities regarding land reclamation and site remediation following drilling and production. This involves restoring well sites and associated infrastructure to their original or a suitable condition, a process governed by stringent environmental regulations. For instance, in 2024, the EPA continued to emphasize best practices for site closure and reclamation, with many states implementing their own specific requirements for post-production land management.

These obligations necessitate substantial planning and financial commitments from companies. Effective site remediation is not merely a regulatory hurdle but a core aspect of environmental stewardship. Comstock's 2023 ESG report highlighted ongoing investments in reclamation projects, aiming to minimize the long-term environmental footprint of its operations. The company's proactive approach to remediation is crucial for maintaining its social license to operate and ensuring compliance with evolving environmental standards.

Key aspects of Comstock's land reclamation and site remediation efforts include:

- Compliance with State and Federal Regulations: Adhering to requirements set by agencies like the Bureau of Land Management (BLM) and state environmental protection departments.

- Cost Management: Budgeting for and executing remediation activities, which can range from well plugging and abandonment to soil testing and revegetation.

- Environmental Impact Mitigation: Implementing strategies to prevent soil erosion, protect water resources, and restore native habitats at former operational sites.

Environmental regulations continue to shape the operational landscape for Comstock Resources, particularly concerning greenhouse gas emissions and water management. The company must navigate policies aimed at reducing carbon footprints, which could increase costs or necessitate investments in new technologies. In 2024, the focus on methane emission reduction, a key component of climate policy, remained a significant consideration for oil and gas operators like Comstock.

Water scarcity in key operating regions, such as the Permian Basin, directly impacts Comstock's hydraulic fracturing activities. The company's water sourcing, usage efficiency, and wastewater disposal practices are under increasing scrutiny, especially in areas experiencing drought conditions. By 2025, the trend of prioritizing recycled water and advanced treatment technologies is expected to intensify, influencing operational strategies and costs.

The potential for induced seismicity linked to wastewater injection, a concern in many oil-producing states, also affects Comstock. Evolving regulations in response to seismic events may require adjustments to disposal practices, potentially increasing compliance expenses. For instance, the Railroad Commission of Texas continued to review wastewater injection rules in 2023 and 2024, signaling a trend towards more stringent oversight.

Comstock's commitment to land reclamation and site remediation is crucial for its environmental stewardship and social license to operate. The company's 2023 ESG report detailed ongoing investments in restoring operational sites, aligning with evolving state and federal requirements for post-production land management. These efforts are vital for mitigating long-term environmental impacts and ensuring regulatory compliance.

PESTLE Analysis Data Sources

Our Comstock Resources PESTLE Analysis draws from official government publications, industry-specific regulatory updates, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, and legal landscape impacting the company.