Comstock Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

Comstock Resources faces moderate bargaining power from buyers, as oil and gas prices are largely dictated by global markets, but intense competition from rivals can shift leverage. The threat of new entrants is somewhat limited by high capital requirements and regulatory hurdles in the oil and gas sector.

The full Porter's Five Forces Analysis reveals the real forces shaping Comstock Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and natural gas sector, where Comstock Resources operates, heavily depends on specialized equipment and services. Think of things like drilling rigs, hydraulic fracturing, and pipeline construction. If only a handful of companies provide these essential services, they gain considerable leverage.

This concentrated supplier base means Comstock Resources might face higher prices and less flexible contract terms. For instance, in 2023, the cost of a hydraulic fracturing spread could range from $20,000 to $30,000 per day, a figure heavily influenced by the availability and demand for these specialized services from a limited number of providers.

Comstock Resources faces significant bargaining power from suppliers due to high switching costs in the oil and gas sector. Transitioning to new oilfield service providers or equipment vendors involves considerable expense and operational disruption. This includes the financial outlay for re-tooling facilities, retraining specialized staff, and managing potential project delays.

For instance, in 2024, the oilfield services sector experienced increased demand, which can amplify supplier leverage. The specialized nature of many oil and gas services means that Comstock may find it difficult and time-consuming to find and onboard alternative suppliers without impacting production schedules. This reliance on established relationships and specialized equipment makes it harder for Comstock to negotiate favorable terms when suppliers have high switching costs embedded in their contracts and services.

The bargaining power of suppliers for Comstock Resources is significantly influenced by the uniqueness of the services or inputs they provide. When a supplier offers specialized technologies, proprietary equipment, or highly specialized expertise that Comstock cannot easily find elsewhere, this creates a distinct advantage for that supplier.

For example, advanced drilling technologies or sophisticated seismic imaging services might be available from only a select few companies. This limited availability means Comstock has fewer alternatives, thereby increasing the supplier's leverage. In 2024, the demand for specialized oil and gas extraction technology remained robust, with reports indicating that companies possessing cutting-edge directional drilling capabilities commanded premium pricing, reflecting their unique value proposition.

Supplier's Ability to Forward Integrate

Suppliers' ability to forward integrate presents a significant threat to Comstock Resources. If a supplier can enter the exploration and production (E&P) market, it directly challenges Comstock's core business. This integration could mean a service provider acquiring or developing their own oil and gas leases.

This scenario would reduce the supplier's dependence on E&P companies. Consequently, their bargaining power for providing services to remaining players like Comstock could increase. For instance, a well-servicing company with substantial capital might decide to become an operator, directly competing for acreage.

- Threat of Forward Integration: Suppliers entering the E&P market weakens Comstock's position.

- Reduced Supplier Reliance: Integrated suppliers become less dependent on E&P companies.

- Increased Bargaining Power: Suppliers can demand higher prices for services to remaining E&P firms.

- Competitive Landscape Shift: New operator entrants can intensify competition for resources and talent.

Impact of Input Costs on Supplier Profitability

The bargaining power of suppliers for Comstock Resources is influenced by their own escalating input costs. When suppliers face higher expenses for labor, raw materials like steel, or energy, they are more likely to pass these increases onto Comstock. This is particularly true if the suppliers operate with thin profit margins, effectively strengthening their leverage.

- Rising Energy Prices: For instance, if the cost of natural gas, a key input for many energy service providers, surges, these suppliers may demand higher prices for their services from Comstock.

- Material Cost Volatility: Fluctuations in the price of steel, essential for drilling and pipeline construction, directly impact the cost of equipment and services, giving steel producers and equipment manufacturers more pricing power.

- Labor Shortages: In sectors experiencing labor scarcity, suppliers might need to offer higher wages, which can then be reflected in increased service costs passed on to Comstock.

Comstock Resources faces considerable supplier bargaining power due to the specialized nature of oil and gas services and equipment. High switching costs, unique technologies, and the threat of supplier forward integration all contribute to this leverage. For example, in 2024, the demand for advanced directional drilling capabilities meant providers of this technology could command premium pricing, impacting Comstock's operational costs.

The oilfield services sector in 2024 saw increased demand, amplifying the power of suppliers who offer specialized expertise or proprietary equipment. This limited availability of alternatives makes it challenging for Comstock to negotiate favorable terms, especially when suppliers face their own escalating input costs for labor and materials like steel.

Suppliers' ability to forward integrate, by becoming operators themselves, directly threatens Comstock's position. This reduces their reliance on E&P companies, potentially leading to increased prices for services offered to remaining players. The competitive landscape can shift as new operators emerge, intensifying competition for resources and talent.

| Factor | Impact on Comstock Resources | 2024 Data/Trend |

|---|---|---|

| Specialized Services & Equipment | Limited alternatives increase supplier leverage. | High demand for directional drilling technology led to premium pricing. |

| Switching Costs | High costs to change providers make negotiation difficult. | Onboarding new, specialized vendors can cause project delays and financial outlays. |

| Supplier Forward Integration | Suppliers becoming operators reduces their dependence and increases their power. | Well-servicing companies with capital may enter the E&P market, intensifying competition. |

| Supplier Input Costs | Rising costs for labor, materials (steel), and energy are passed on. | Increased natural gas prices can lead to higher service costs for providers. |

What is included in the product

This analysis delves into Comstock Resources' competitive environment, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Instantly identify and address competitive threats with a dynamic Porter's Five Forces analysis, providing Comstock Resources with a clear roadmap to navigate industry pressures.

Customers Bargaining Power

Comstock Resources serves a wide array of customers, including pipelines, marketers, and direct end-users of natural gas. This broad customer base is a key factor in its operational landscape.

The diversity within Comstock's customer pool significantly dilutes the bargaining power of any individual buyer. Since no single customer represents a substantial percentage of overall sales, the company faces less pressure from any one entity regarding pricing or contract terms.

In 2023, Comstock's average realized price for natural gas was $2.49 per Mcf, a figure that reflects the market dynamics influenced by this fragmented customer structure. This allows for greater pricing flexibility and negotiation leverage for Comstock.

Natural gas, being a commodity, means buyers often make decisions primarily based on price. When natural gas prices are low, or when buyers have numerous alternative suppliers to choose from, their sensitivity to price increases significantly, thereby amplifying their bargaining power against producers like Comstock Resources.

Comstock Resources' financial performance is directly tied to the fluctuating prices of natural gas. For instance, in 2024, natural gas prices experienced considerable volatility, with Henry Hub spot prices averaging around $2.00 per MMBtu for much of the year, impacting revenue streams for companies like Comstock.

Customers possess significant bargaining power due to the wide array of energy alternatives available. These substitutes include traditional fossil fuels like coal and oil, as well as rapidly growing renewable energy sources such as solar and wind power.

The accelerating integration of renewables, particularly in the electricity generation sector, is a key factor. For instance, by the end of 2023, renewable energy sources accounted for approximately 23% of the total U.S. electricity generation, a figure projected to climb. This shift directly impacts the demand for natural gas, Comstock Resources' primary product, by offering viable alternatives.

As these alternatives become more prevalent and cost-competitive, customers gain leverage. They can more easily switch to different energy sources if natural gas prices rise or if supply becomes unreliable, thereby increasing their bargaining power against natural gas producers like Comstock Resources.

Customer's Ability to Backward Integrate

The bargaining power of customers can increase if they have the ability to backward integrate, meaning they could potentially produce the product or service themselves. For a company like Comstock Resources, this applies to large industrial end-users or utility companies that might consider investing in their own natural gas production facilities.

If these customers can produce their own natural gas, it significantly reduces their dependence on suppliers like Comstock. This capability grants them greater leverage in price negotiations and contract terms. For instance, a major industrial consumer might evaluate the cost-benefit of building a small-scale production unit versus continuing to purchase gas, especially during periods of high commodity prices.

- Customer Backward Integration Threat: Large industrial users or utilities could invest in their own natural gas production.

- Reduced Reliance: This capability diminishes their need to purchase from companies like Comstock.

- Increased Negotiation Leverage: Customers gain more power in pricing and contract discussions.

- Market Dynamics: The potential for backward integration is a factor influencing Comstock's pricing power.

Volume of Purchases by Customers

Customers who purchase in large volumes, such as major pipeline operators or significant industrial consumers, wield considerable bargaining power. Their substantial orders allow them to negotiate more favorable pricing and contract terms with Comstock Resources.

For instance, if a large customer represents a significant portion of Comstock's total sales volume, they can leverage this to secure discounts or more advantageous delivery schedules. This is particularly relevant in the oil and gas sector where contracts are often long-term and involve substantial quantities.

- Large-volume buyers can demand price concessions due to economies of scale in their own operations.

- Pipeline operators, as key intermediaries, often have the leverage to dictate terms based on their own capacity and market reach.

- Industrial consumers with high energy needs can switch suppliers if terms are not met, increasing their negotiating strength.

Comstock Resources faces moderate customer bargaining power, primarily due to the commodity nature of natural gas and the availability of substitutes. While individual customer concentration is low, large-volume buyers and potential backward integration by major consumers can exert significant influence on pricing and contract terms.

The market dynamics for natural gas in 2024 illustrate this. Henry Hub spot prices, a key benchmark, averaged around $2.00 per MMBtu for much of the year, creating a price-sensitive environment for buyers. This price volatility directly impacts Comstock's ability to negotiate favorable terms, as customers can more readily seek alternative suppliers or energy sources if prices rise. For example, the increasing share of renewables in U.S. electricity generation, reaching approximately 23% by the end of 2023, offers a growing alternative that amplifies customer leverage.

| Factor | Impact on Comstock Resources | 2024 Data/Context |

|---|---|---|

| Customer Concentration | Low | No single customer represents a significant portion of sales, reducing individual buyer power. |

| Product Nature | Commodity | Natural gas is primarily sold based on price, increasing customer sensitivity to fluctuations. |

| Availability of Substitutes | Moderate to High | Renewables (solar, wind) and other fossil fuels offer alternatives, increasing customer switching ability. |

| Potential for Backward Integration | Low to Moderate | Large industrial users or utilities could theoretically produce their own gas, increasing leverage. |

| Volume of Purchase | High for some buyers | Large pipeline operators and industrial consumers can negotiate better terms due to scale. |

Preview the Actual Deliverable

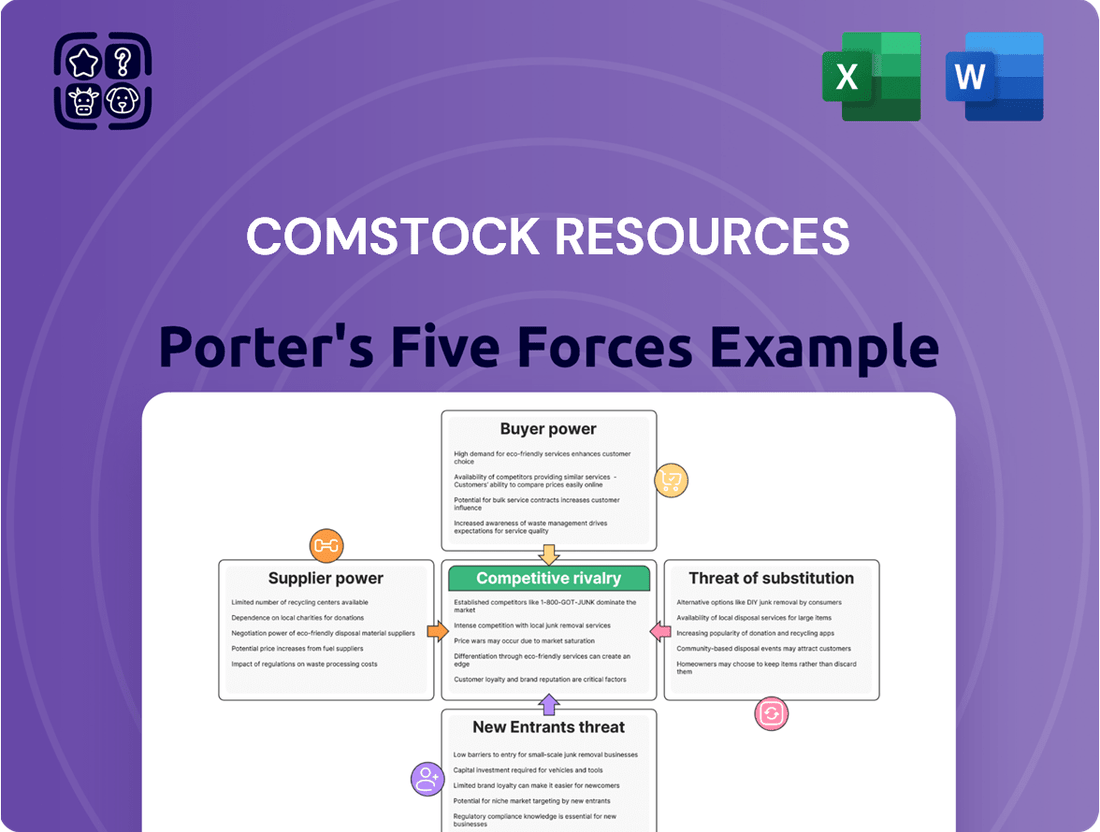

Comstock Resources Porter's Five Forces Analysis

This preview showcases the comprehensive Comstock Resources Porter's Five Forces analysis, detailing the competitive landscape of the oil and gas industry. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the threat of substitutes. This is not a sample; it's the complete analysis ready for your strategic planning.

Rivalry Among Competitors

The Haynesville shale, Comstock Resources' main operational turf, is a major natural gas hub with many companies actively drilling. This means Comstock faces competition from a variety of other independent energy firms and even larger, more integrated energy corporations.

The sheer number of these active players, many of whom are well-funded, significantly cranks up the competitive pressure within the Haynesville basin. For instance, in 2023, the Haynesville region saw approximately 150 active drilling rigs, highlighting the intense activity and competition for acreage and resources.

The natural gas industry, especially in the Haynesville shale, has experienced fluctuating growth. While global natural gas demand is projected to increase structurally through 2025, the Haynesville specifically faced production declines in 2024, largely driven by depressed price environments.

A robust industry growth rate can sometimes temper competitive rivalry, as firms prioritize expansion over aggressive competition for existing market share. However, the recent production dip in the Haynesville suggests that even with potential overall demand increases, localized factors like pricing can intensify competition for available resources and market positions.

Natural gas, the core product for companies like Comstock Resources, is largely a commodity. This means there's very little inherent difference in the product itself from one producer to another. Because of this, the battle for market share often boils down to who can offer the lowest price.

This commodity nature forces producers to compete intensely on efficiency and cost control. For Comstock, this translates into a critical need for operational excellence. Think about it: if your gas is the same as everyone else's, customers will naturally gravitate towards the cheapest option.

In 2024, the focus on cost leadership is paramount. Companies that can extract and deliver natural gas at a lower cost per unit are better positioned to weather price fluctuations and gain market share. This drive for efficiency is what truly separates successful players in this market.

Exit Barriers

Comstock Resources faces high exit barriers in the oil and gas sector. Significant sunk costs are tied up in drilling rigs, pipelines, and other specialized infrastructure. These substantial investments, once made, are difficult to recover if a company decides to leave the market.

Long-term contractual obligations, such as supply agreements or lease commitments, also contribute to these exit barriers. Companies are often locked into these arrangements, preventing them from easily ceasing operations even when market conditions are unfavorable. For instance, in 2024, the oil and gas industry continued to grapple with the challenge of stranded assets, where the value of existing infrastructure diminished due to market shifts, highlighting the difficulty of exiting such capital-intensive ventures.

These high exit barriers can force companies like Comstock to continue production even during periods of low profitability. This can lead to an oversupply of oil and gas, intensifying competitive rivalry as firms strive to cover their fixed costs through continued output. In 2023, despite price volatility, many exploration and production companies maintained or even increased production levels, a common strategy when exit is costly.

- High Capital Investment: Significant upfront costs in exploration, drilling, and infrastructure create a substantial barrier to exiting the industry.

- Specialized Assets: Much of the infrastructure, like pipelines and processing facilities, has limited alternative uses, making resale difficult and value retention low upon exit.

- Contractual Commitments: Long-term contracts for drilling services, transportation, and sales agreements can obligate companies to continue operations, even in a downturn.

- Regulatory and Environmental Obligations: Companies may face ongoing responsibilities for well plugging and site reclamation, even after ceasing active production, adding to exit costs.

Cost Structure of Competitors

Comstock Resources' competitive rivalry is significantly influenced by the cost structures of its peers in the natural gas sector. Companies that achieve lower production costs or operate more efficiently are better positioned to navigate periods of depressed natural gas prices and potentially capture greater market share. This cost advantage is a critical determinant of competitive strength.

Comstock Resources itself is strategically focused on leveraging its substantial acreage in the Haynesville shale. This strategy centers on expanding production and reserves, with a core objective of enhancing cost efficiency across its operations. By optimizing its development plans and operational processes, Comstock aims to reduce its per-unit production costs.

- Cost Efficiency Advantage: Competitors with lower lifting costs per barrel of oil equivalent (BOE) can maintain profitability even when commodity prices decline, allowing them to outlast less efficient rivals.

- Haynesville Focus: Comstock's concentrated development in the Haynesville shale aims to capitalize on the region's prolific reserves and potentially achieve economies of scale, driving down production expenses.

- Operational Optimization: Continuous improvements in drilling, completion, and production techniques are key for all players to reduce the cost structure and enhance competitiveness in the natural gas market.

- 2024 Market Dynamics: In 2024, the natural gas market experienced volatility, with average Henry Hub spot prices fluctuating. Companies with robust cost management, like those focusing on efficient shale plays, were better equipped to manage these price swings.

The Haynesville shale, Comstock Resources' primary operational area, is a highly competitive natural gas hub. Numerous companies, ranging from independent producers to larger integrated energy firms, are actively drilling, intensifying the rivalry for acreage and resources.

The commodity nature of natural gas means that competition largely centers on price, making cost efficiency and operational excellence critical for success. In 2024, companies focused on cost leadership were better positioned to manage price fluctuations and gain market share.

High exit barriers, including substantial sunk costs in infrastructure and long-term contractual obligations, can compel companies to continue production even during periods of low profitability, potentially leading to oversupply and heightened competition.

Comstock's strategy of leveraging its Haynesville acreage aims to enhance cost efficiency through economies of scale and optimized operations, a crucial factor for competitiveness in the volatile natural gas market of 2024.

| Metric | Comstock Resources (Approx.) | Haynesville Average (Approx.) | Significance |

|---|---|---|---|

| Production Cost per Mcf | $2.00 - $2.50 (2024 Estimate) | $2.20 - $2.70 (2024 Estimate) | Lower costs provide a competitive edge. |

| Active Rigs in Haynesville | N/A (Comstock specific) | 150 (2023) | Indicates high industry activity and competition. |

| Natural Gas Price (Henry Hub Spot) | Fluctuating (e.g., ~$2.00/MMBtu in early 2024) | Fluctuating (e.g., ~$2.00/MMBtu in early 2024) | Price volatility directly impacts profitability and competitive positioning. |

SSubstitutes Threaten

The primary substitutes for natural gas, such as crude oil, coal, and renewables like solar and wind, present a significant competitive force. The availability and cost of these alternatives directly impact demand for natural gas. For example, a substantial rise in renewable electricity generation in Europe during 2024 contributed to a notable decrease in gas-fired power production, underscoring the substitutability in the energy market.

Customer preference for alternatives poses a significant threat to Comstock Resources. Growing environmental concerns and government policies actively promoting cleaner energy sources are increasingly shifting consumer and industrial demand away from fossil fuels, including natural gas. This societal and regulatory push, amplified by rapid advancements in renewable energy technologies, heightens the long-term risk of substitution.

Technological advancements are making substitutes for natural gas increasingly competitive. Innovations in renewable energy, like solar and wind power, coupled with improved battery storage, are directly impacting the demand for natural gas in electricity generation. For instance, the cost of solar photovoltaic (PV) systems has seen a dramatic decrease, with global weighted-average levelized cost of electricity (LCOE) for utility-scale solar PV falling by approximately 89% between 2010 and 2022, making it a more attractive alternative.

Switching Costs for Customers to Alternatives

Switching from natural gas to alternatives like renewables can involve significant upfront investment for customers, such as installing solar panels or converting industrial processes. For instance, the average cost of a residential solar panel system in 2024 can range from $15,000 to $25,000 before incentives. However, government incentives and the potential for long-term cost savings on energy bills can gradually reduce these perceived switching costs, making substitutes increasingly appealing.

The increasing efficiency and decreasing costs of renewable energy technologies are also playing a crucial role. By mid-2024, the levelized cost of energy (LCOE) for new utility-scale solar photovoltaic projects had fallen to approximately $25-$35 per megawatt-hour, and wind power to around $20-$30 per megawatt-hour, making them highly competitive with natural gas in many regions.

- High Upfront Investment: Customers face substantial initial costs when adopting renewable energy sources or other alternatives to natural gas.

- Government Incentives: Tax credits and rebates, such as the Investment Tax Credit (ITC) for solar in the US, which was extended and enhanced, significantly lower the net cost for consumers.

- Long-Term Savings: Despite initial outlays, customers can achieve considerable savings over the lifespan of alternative energy systems, improving their attractiveness.

- Technological Advancements: Improvements in renewable energy technology and storage solutions are steadily reducing the cost and increasing the viability of alternatives.

Regulatory and Policy Environment

The regulatory landscape poses a significant threat to Comstock Resources by influencing the competitiveness of natural gas against substitutes. Policies like carbon pricing, emissions targets, and renewable energy subsidies directly impact the cost-effectiveness of natural gas. For instance, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, incentivizes the adoption of solar and wind power, making them more attractive alternatives.

These governmental actions can effectively increase the cost of natural gas production and consumption, thereby diminishing its market share. By making alternatives more economically viable, regulations can erode demand for natural gas.

- Government policies such as carbon taxes and emissions regulations can increase the cost of natural gas.

- Subsidies for renewable energy sources like solar and wind make them more competitive.

- The US Inflation Reduction Act of 2022 offers significant incentives for clean energy adoption.

- These factors collectively reduce the relative attractiveness and market demand for natural gas.

The threat of substitutes for natural gas remains a potent force, driven by evolving customer preferences and technological progress. While upfront costs for alternatives like solar and wind power can be substantial, averaging $15,000-$25,000 for residential solar in 2024, government incentives and long-term savings are steadily eroding these barriers. For example, the US Inflation Reduction Act of 2022 provides significant tax credits, making clean energy adoption more financially appealing.

Renewable energy sources are becoming increasingly cost-competitive, directly impacting natural gas demand. By mid-2024, the levelized cost of energy for utility-scale solar PV was estimated between $25-$35 per megawatt-hour, and wind power between $20-$30 per megawatt-hour, rivaling natural gas prices in many markets. This trend is further amplified by policy support, such as carbon pricing and renewable energy subsidies, which can increase the cost of natural gas and bolster the appeal of cleaner alternatives.

| Substitute | Key Driver | 2024 Cost Indicator (Indicative) | Impact on Natural Gas |

|---|---|---|---|

| Solar PV | Technological Advancements & Incentives | $25-$35/MWh (Utility-scale LCOE) | Increasingly competitive in power generation |

| Wind Power | Technological Advancements & Incentives | $20-$30/MWh (Utility-scale LCOE) | Strong competitor in power generation |

| Coal | Environmental Regulations & Price Volatility | Varies by region; generally higher emissions costs | Declining demand in many regions due to environmental concerns |

| Crude Oil | Price Fluctuations & Geopolitics | Market-driven, subject to global supply/demand | Direct substitute in some industrial and transportation applications |

Entrants Threaten

The oil and natural gas exploration and production sector, particularly in prolific areas like the Haynesville shale, demands immense upfront capital. For instance, a single horizontal well in the Haynesville can cost upwards of $8-10 million to drill and complete. This necessity for significant financial resources to secure leases, drill wells, and build essential infrastructure presents a formidable barrier for potential new competitors.

New entrants to the natural gas market face significant hurdles in accessing essential distribution channels. Securing space on existing pipeline networks and establishing relationships with midstream operators is crucial for transporting and selling their product. For instance, in 2024, the continued high utilization rates of key natural gas pipelines in regions like the Permian Basin underscore the difficulty new players face in gaining capacity.

Building new infrastructure or negotiating favorable terms with existing providers is a complex, time-consuming, and capital-intensive endeavor. This lack of readily available access acts as a substantial barrier, deterring potential new entrants from effectively competing with established companies like Comstock Resources, which already possess these vital logistical advantages.

Comstock Resources benefits from its proprietary technology and deep expertise in shale plays like the Haynesville. This includes advanced drilling techniques such as horizontal drilling and hydraulic fracturing, honed over years of operation. Newcomers would face substantial challenges in replicating this specialized knowledge and accessing the crucial geological data that Comstock already possesses, making entry difficult.

Regulatory Hurdles and Permits

The oil and gas sector faces significant regulatory hurdles, demanding extensive permits and strict adherence to environmental and safety standards. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations concerning methane emissions from oil and gas facilities, requiring new entrants to invest heavily in compliance infrastructure. Navigating this intricate web of regulations, including those from state-level agencies like the Texas Railroad Commission, presents a substantial barrier for new companies. These new players often lack the established compliance departments and crucial relationships with regulatory bodies that existing firms possess, making market entry considerably more challenging.

- Permitting Complexity: Obtaining necessary drilling, operational, and environmental permits can be a lengthy and costly process.

- Environmental Compliance Costs: New entrants must immediately factor in significant expenses for pollution control, waste management, and emissions monitoring.

- Safety Standards: Adhering to rigorous safety protocols, including those mandated by OSHA for oil and gas operations, requires substantial upfront investment in training and equipment.

- Regulatory Relationships: Established companies benefit from existing relationships and familiarity with regulatory agencies, streamlining compliance processes.

Economies of Scale

Comstock Resources, like other established players in the oil and gas sector, leverages significant economies of scale. This advantage translates into lower per-unit costs for activities such as drilling, production, and securing essential services and equipment. For instance, in 2023, Comstock reported capital expenditures of approximately $1.1 billion, a scale that allows for bulk purchasing discounts and optimized operational efficiencies not readily available to smaller operators.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the existing infrastructure and operational volume, startups would likely incur higher per-unit expenses, making it challenging to compete on price and achieve early profitability in a market where cost management is paramount.

- Economies of Scale: Established firms benefit from lower per-unit costs in drilling, production, and procurement.

- Cost Disadvantage for New Entrants: Smaller-scale operations result in higher initial costs for new companies.

- Competitive Barrier: The cost advantage of scale acts as a significant barrier, deterring new, smaller competitors.

The threat of new entrants for Comstock Resources is generally low due to the substantial capital requirements and established infrastructure needed to compete in the oil and gas sector. Securing leases, drilling wells, and accessing pipeline networks demand millions of dollars. For example, drilling a single horizontal well in the Haynesville shale can cost $8-10 million. Furthermore, navigating complex regulations, such as EPA methane emission standards in 2024, adds significant compliance costs for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Comstock Resources leverages data from SEC filings, investor presentations, and industry-specific market research reports. This blend of public company disclosures and specialized industry intelligence provides a comprehensive view of competitive dynamics in the oil and gas sector.