Comstock Resources Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comstock Resources Bundle

Unlock the strategic blueprint of Comstock Resources's business model. This comprehensive Business Model Canvas details their customer relationships, revenue streams, and key resources, offering a clear view of their operational framework. Discover the core elements that drive their success and gain actionable insights for your own ventures.

Partnerships

Comstock Resources heavily depends on specialized drilling and completion contractors to efficiently and safely execute its well development plans. These vital partnerships provide access to cutting-edge equipment and seasoned crews, which are absolutely crucial for successful operations in challenging shale formations, such as the Haynesville. For instance, in 2024, Comstock continued to leverage these relationships to optimize its drilling cycle times and maintain high operational standards.

Comstock Resources heavily relies on partnerships with specialized oil and gas service providers. These include companies offering seismic imaging for geological assessment, well logging for reservoir characterization, and hydraulic fracturing services to enhance production. Environmental service providers are also key for ensuring regulatory adherence and responsible operations.

These collaborations are vital for Comstock's operational success. For instance, in 2024, the company continued to leverage advanced fracturing techniques from service partners to maximize hydrocarbon recovery from its Eagle Ford Shale assets. These partnerships bring essential technical expertise and specialized equipment, directly impacting operational efficiency and the overall economic viability of their projects.

Comstock Resources relies heavily on partnerships with midstream companies and pipeline operators. These collaborations are essential for the crucial tasks of gathering, processing, and transporting Comstock's oil and natural gas to market.

These midstream relationships are not just about logistics; they are fundamental to Comstock's ability to get its product to customers reliably and affordably. Without this infrastructure, production growth can be significantly hampered, acting as a bottleneck.

For instance, in 2024, the demand for efficient midstream solutions remains high. Companies like Comstock understand that secure and cost-effective transportation is a direct driver of their revenue and operational efficiency, impacting their overall profitability.

Landowners and Mineral Rights Owners

Comstock Resources' core operations hinge on strong alliances with landowners and mineral rights owners. These partnerships are crucial for acquiring the land and leases needed for their exploration and production ventures. By fostering positive relationships and negotiating mutually beneficial lease terms, Comstock can effectively expand its operational footprint and gain access to promising new drilling sites, directly building its asset base.

These agreements are the bedrock of Comstock's ability to operate. For instance, in 2024, the company continued to focus on securing acreage in key basins, demonstrating the ongoing importance of these landowner relationships. The terms negotiated often involve upfront payments, royalties on extracted resources, and specific operational commitments, all of which are vital for the company's financial planning and project viability.

- Securing Acreage: Essential for obtaining the rights to explore and drill on valuable land.

- Lease Negotiations: Favorable terms are critical for profitability and operational flexibility.

- Asset Base Foundation: These agreements directly contribute to the company's proven reserves and future production potential.

- Ongoing Relationships: Maintaining good standing with landowners is key for continued access and future expansion.

Joint Venture Partners

Comstock Resources actively pursues joint ventures with other energy companies to co-develop significant projects. These collaborations are crucial for sharing the substantial risks and capital expenditures inherent in large-scale oil and gas development.

These strategic alliances offer Comstock access to complementary technical expertise and broader acreage positions, which can significantly accelerate development timelines and enhance the efficiency of resource extraction. For instance, in 2024, Comstock continued to evaluate opportunities for joint ventures to optimize its development plans in key operating areas.

- Access to Capital: Joint ventures allow Comstock to pool financial resources, enabling the undertaking of projects that might be too capital-intensive for a single entity.

- Risk Mitigation: By sharing ownership and operational responsibilities, the financial and operational risks associated with exploration and production are distributed among partners.

- Enhanced Expertise: Partners often bring specialized knowledge and technology, leading to more efficient and effective project execution and resource recovery.

- Accelerated Growth: These alliances can expedite the pace of development and production, allowing Comstock to capitalize on market opportunities more rapidly.

Comstock Resources' key partnerships extend to financial institutions and capital providers, crucial for funding its extensive drilling and development programs. These relationships ensure access to the necessary capital, whether through credit facilities or equity offerings, to execute its strategic growth plans.

In 2024, Comstock continued to manage its financial obligations and secure funding to support its operational objectives. These partnerships are fundamental to maintaining liquidity and enabling the company to pursue new acreage acquisitions and technological advancements in its pursuit of maximizing shareholder value.

Comstock Resources also partners with technology and equipment suppliers, integrating advanced drilling and completion technologies to enhance efficiency and production. These collaborations provide access to specialized tools and innovations that are vital for optimizing well performance and reducing operational costs.

For example, in 2024, Comstock focused on leveraging new technologies from its equipment partners to improve its drilling efficiency and well productivity in the Haynesville Shale. These partnerships are key to staying competitive and achieving superior operational outcomes.

| Partner Type | Role | 2024 Focus/Impact |

|---|---|---|

| Drilling & Completion Contractors | Execute well development plans | Optimizing drilling cycle times, maintaining high standards |

| Oil & Gas Service Providers | Geological assessment, reservoir characterization, production enhancement | Maximizing hydrocarbon recovery with advanced fracturing techniques |

| Midstream Companies | Gathering, processing, and transporting hydrocarbons | Ensuring reliable and cost-effective market access |

| Landowners/Mineral Rights Owners | Acquiring land and leases for exploration | Securing acreage in key basins, building asset base |

| Energy Companies | Co-development of projects, sharing risks and capital | Accelerating development, enhancing resource extraction efficiency |

| Financial Institutions | Providing capital for drilling and development | Funding strategic growth plans, maintaining liquidity |

| Technology/Equipment Suppliers | Providing advanced drilling and completion technologies | Improving well performance, reducing operational costs |

What is included in the product

A detailed Comstock Resources Business Model Canvas outlining their strategy as an independent oil and natural gas company focused on developing and acquiring reserves in the Eagle Ford Shale, highlighting key customer segments and value propositions.

This model provides a clear view of Comstock's operational framework, revenue streams, and cost structure, designed for strategic planning and stakeholder communication.

Comstock Resources' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for better understanding and decision-making.

Activities

Comstock Resources dedicates significant effort to geological and geophysical studies, focusing on identifying and assessing promising new drilling sites within its extensive acreage, especially in the prolific Haynesville shale. This process involves acquiring and meticulously interpreting seismic data to gain a deep understanding of subsurface rock formations and pinpoint the most advantageous locations for drilling.

In 2024, Comstock's strategic focus on exploration and appraisal within the Haynesville shale is crucial for its long-term production trajectory. The company’s ability to successfully identify and delineate new reserves directly fuels its future output and revenue streams, ensuring a robust pipeline of development projects.

Comstock Resources' primary focus lies in the drilling of horizontal wells, followed by hydraulic fracturing and completion. These operations are concentrated in the prolific Haynesville and Bossier shale formations, which are key to their production strategy.

The company's ability to execute these complex, capital-intensive activities efficiently and at a competitive cost directly impacts its capacity to bring new production online and optimize the extraction of valuable hydrocarbons from its reserves.

In 2024, Comstock Resources reported significant activity, completing approximately 20 net wells, a testament to their ongoing operational execution in these key shale plays.

Comstock Resources focuses on maximizing output from its existing oil and natural gas wells. This involves continuous monitoring of well performance to identify any issues or opportunities for improvement. For instance, in 2024, the company continued to invest in artificial lift technologies to enhance recovery from its Haynesville shale assets.

To extend the productive life of its reservoirs, Comstock employs strategies like artificial lift systems, which help bring more oil and gas to the surface. They also perform workovers, essentially maintenance or repair operations on wells, to address declining production. This proactive approach is crucial for maintaining consistent cash flow from their operations.

Marketing and Sales of Hydrocarbons

Comstock Resources actively markets and sells its produced natural gas and crude oil to a varied clientele, which includes pipelines, energy marketers, and industrial consumers. This core activity necessitates skillful negotiation of sales agreements, meticulous management of transportation and delivery networks, and a keen awareness of volatile market price shifts. By optimizing these processes, the company aims to maximize the value realized from its production volumes.

In 2024, Comstock Resources continued its focus on securing favorable pricing and reliable offtake for its substantial natural gas and oil production. The company's marketing strategy is designed to capture the best available market prices, often through a combination of short-term and longer-term contracts. This ensures consistent revenue streams and helps mitigate the impact of price volatility.

- Sales Channels: Direct sales to interstate pipelines, intrastate pipelines, and third-party marketers.

- Logistics Management: Coordination of gathering systems, processing facilities, and transportation via pipelines and trucking.

- Pricing Strategies: Utilization of fixed-price contracts, market-based indices (e.g., Henry Hub for natural gas), and basis differentials.

- Customer Diversification: Maintaining relationships with a broad base of purchasers to reduce counterparty risk and enhance market access.

Reservoir Management and Reserve Development

Comstock Resources actively manages its hydrocarbon reserves, prioritizing growth through strategic development drilling and targeted acquisitions. This proactive approach ensures a sustainable and valuable asset base for the company.

The company employs sophisticated geological modeling, production forecasting, and economic analysis to optimize reserve recovery and maximize long-term value creation. Reserve growth is a critical indicator of success for exploration and production (E&P) companies.

- Reserve Evaluation: Continuously assessing and updating proven and probable hydrocarbon reserves.

- Development Drilling: Executing drilling programs to convert potential reserves into producing assets.

- Acquisition Strategy: Pursuing strategic acquisitions to expand the company's reserve base.

- Economic Analysis: Utilizing financial modeling to ensure development and acquisition projects are profitable.

Comstock Resources' key activities revolve around the exploration, development, and production of oil and natural gas, primarily in the Haynesville and Bossier shales. This includes extensive geological and geophysical analysis to identify prime drilling locations, followed by the drilling and completion of horizontal wells. The company also focuses on optimizing production from existing wells through technologies like artificial lift and workovers. Finally, Comstock actively markets and sells its hydrocarbons, managing logistics and pricing to maximize revenue.

| Activity | Description | 2024 Focus/Data |

|---|---|---|

| Exploration & Appraisal | Identifying and assessing new drilling sites using seismic data. | Continued focus on Haynesville shale for long-term production. |

| Drilling & Completion | Drilling horizontal wells and hydraulic fracturing. | Completed approximately 20 net wells in 2024. |

| Production Optimization | Maximizing output from existing wells. | Investment in artificial lift technologies in Haynesville assets. |

| Marketing & Sales | Selling produced oil and natural gas. | Securing favorable pricing and reliable offtake through contracts. |

Preview Before You Purchase

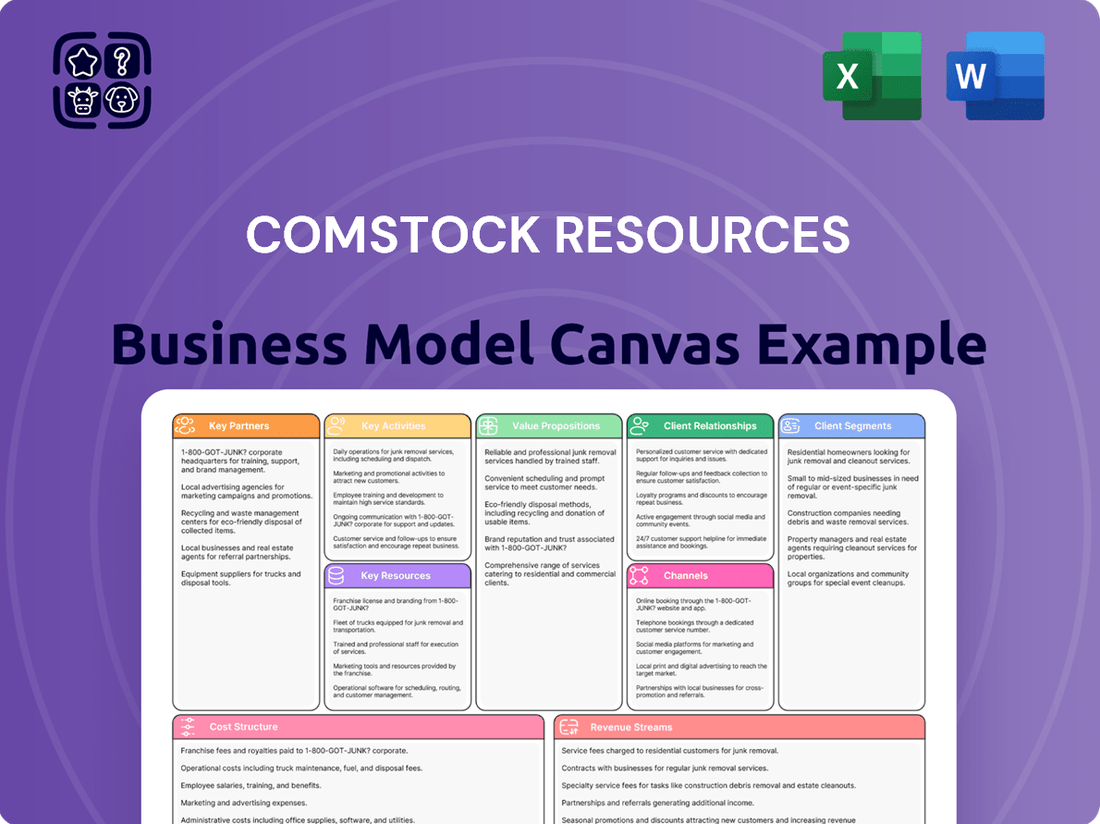

Business Model Canvas

The Comstock Resources Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting of the deliverable, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and analysis.

Resources

Comstock Resources' most critical asset is its vast landholdings in the Haynesville and Bossier shale formations, spanning Louisiana and East Texas. This extensive acreage serves as the bedrock for its future drilling plans and sustained production increases.

The sheer size and quality of these reserves are fundamental to Comstock's market valuation. As of early 2024, Comstock held approximately 1.1 million net acres in these premier unconventional resource plays, representing a significant competitive advantage.

Comstock Resources holds substantial proven oil and natural gas reserves, estimated at 6.3 trillion cubic feet equivalent (Tcfe) as of December 31, 2023. These reserves are the bedrock of the company's operations, directly translating into future production and revenue streams.

The company's proven reserves are crucial for investors, offering a quantifiable measure of its long-term value and production potential. This asset base directly supports Comstock's ability to generate cash flow and sustain its exploration and development activities.

Comstock Resources relies heavily on its specialized drilling and production equipment, including advanced drilling rigs and completion tools like frac fleets. This physical infrastructure is absolutely vital for their field operations, allowing them to efficiently extract oil and natural gas.

The company's ability to deploy and maintain this sophisticated machinery directly impacts operational efficiency and the ultimate recovery rates from their wells. For instance, in 2024, Comstock continued to invest in upgrading its drilling fleet to enhance performance and reduce downtime, a key factor in managing their production costs.

Skilled Human Capital and Technical Expertise

Comstock Resources relies heavily on its skilled human capital and technical expertise. This includes geologists, engineers, landmen, financial professionals, and operational staff whose collective knowledge is crucial for success in the oil and gas sector.

Their deep understanding of exploration, drilling techniques, reservoir management, and navigating complex regulatory environments allows Comstock to optimize its operations and make sound strategic choices. This human element is a direct driver of innovation and operational efficiency within the company.

- Geological and Engineering Prowess: Expertise in identifying and extracting hydrocarbon reserves.

- Operational Efficiency: Skilled teams to manage drilling, production, and maintenance.

- Financial Acumen: Professionals to manage capital, hedging, and investor relations.

- Regulatory Navigation: Landmen and legal teams to ensure compliance.

Financial Capital and Access to Funding

Comstock Resources relies heavily on substantial financial capital to fund its extensive exploration activities, development drilling programs, and the necessary infrastructure build-out in the oil and gas sector. This operational intensity demands significant upfront investment.

Access to diverse funding channels is vital for Comstock's continued operations and expansion. These include tapping into equity markets for capital raises, securing debt financing through loans and bonds, and leveraging internally generated cash flow from existing production. For instance, in 2024, Comstock actively managed its debt profile and explored various financing options to support its capital expenditure plans.

The company's strategic success hinges on astute capital allocation decisions. These decisions dictate where resources are deployed to maximize returns, whether in acquiring new reserves, enhancing production from existing wells, or investing in new exploration ventures. Comstock's 2024 capital budget, totaling approximately $700 million, reflects a focused approach on drilling and completion activities in its core operating areas.

- Capital Requirements: Significant investment is needed for exploration, development, and infrastructure.

- Funding Sources: Equity, debt, and operating cash flow are critical for sustained operations and growth.

- Capital Allocation: Strategic deployment of funds is paramount for maximizing shareholder value and achieving growth objectives.

Comstock Resources' key resources are its vast landholdings in the Haynesville and Bossier shale, its substantial proven reserves, advanced drilling and production equipment, and its skilled workforce. These assets are fundamental to its ability to explore, develop, and produce oil and natural gas efficiently. The company's financial capital, accessed through various funding channels, is also a critical resource enabling its capital-intensive operations and strategic growth initiatives.

Value Propositions

Comstock Resources offers a reliable and consistent supply of natural gas, a critical need for its customers. This dependability stems from its significant presence in the Haynesville shale, a key North American natural gas producing region.

This consistent flow is highly valued by pipelines, marketers, and industrial consumers who depend on stable energy to maintain their operations. For instance, in 2024, Comstock's production averaged approximately 2.4 billion cubic feet equivalent per day, showcasing their capacity to meet demand.

Customers benefit from this predictability, enabling them to better manage their supply chains and avoid disruptions. The company's focus on efficient production in the Haynesville ensures this steady output, making Comstock a trusted partner for essential energy needs.

Comstock Resources' strategic positioning in the Haynesville shale grants it prime access to major natural gas consumption centers and robust transportation networks. This geographical advantage is crucial for efficiently delivering gas to a variety of markets, making Comstock a desirable supplier for buyers needing reliable, well-connected sources.

This enhanced market access directly supports competitive pricing for Comstock's natural gas. For instance, in 2024, the Henry Hub, a key benchmark for North American natural gas prices, saw significant volatility but generally maintained strong demand due to industrial and export activity, a market Comstock is well-positioned to serve.

Comstock Resources focuses on cost-effective hydrocarbon production by employing advanced drilling and completion techniques within the prolific Haynesville Shale. This strategic approach allows them to achieve lower production costs per barrel of oil equivalent (BOE), contributing to their competitive edge in the natural gas market. For instance, in the first quarter of 2024, Comstock reported a production cost of $1.65 per Mcf, demonstrating their commitment to efficiency.

This operational efficiency translates directly into economic viability, enabling Comstock to offer competitive pricing to its customers and maintain stronger profit margins. The company's ability to produce natural gas at a lower cost point is a key value proposition that benefits both the company and its stakeholders by ensuring consistent returns and market competitiveness.

Development of High-Quality, Long-Life Reserves

Comstock Resources prioritizes the development of its extensive acreage to build a robust portfolio of high-quality, long-life oil and natural gas reserves. This strategic focus underpins a dependable, long-term supply for customers and establishes a stable foundation for investor confidence.

By concentrating on reserves with extended production lifespans, Comstock effectively mitigates the inherent risks associated with future exploration activities. This approach ensures a more predictable and sustainable revenue stream.

- Focus on Sustainable Development: Comstock's strategy centers on developing its substantial land holdings to generate reserves that will provide production for many years.

- Customer Supply Assurance: This commitment to long-life reserves guarantees a consistent and reliable supply of energy resources for Comstock's customer base.

- Investor Stability: A stable asset base built on long-life reserves offers investors a predictable and enduring investment opportunity, reducing exposure to short-term market volatility.

- Reduced Exploration Risk: By maximizing the value of existing proven reserves, the company minimizes the need for costly and uncertain new exploration ventures.

Commitment to Operational Excellence and Safety

Comstock Resources' commitment to operational excellence and safety is a cornerstone of its value proposition. This dedication translates into efficient exploration and production, benefiting partners and stakeholders through cost savings and reduced risk. For instance, in 2024, the company continued to focus on optimizing its drilling and completion techniques, aiming to improve well productivity and lower per-unit production costs, a key driver of profitability in the competitive oil and gas sector.

A strong safety record and streamlined operations directly contribute to lower overall costs and a reduced environmental footprint. This not only enhances financial performance but also builds trust with investors, regulators, and the communities in which Comstock operates. The company's emphasis on responsible practices is increasingly recognized as a critical factor for long-term sustainability and stakeholder confidence.

- Operational Efficiency: Focus on optimizing drilling and completion processes to maximize resource recovery and minimize downtime.

- Safety Culture: Prioritizing employee and environmental safety through rigorous protocols and continuous training.

- Cost Management: Implementing cost-control measures across all operational phases to enhance profitability.

- Stakeholder Trust: Building confidence through transparent communication and a proven track record of responsible operations.

Comstock Resources provides a dependable and consistent supply of natural gas, a vital commodity for its diverse customer base. This reliability is rooted in its substantial operations within the Haynesville shale, a premier natural gas producing basin in North America.

This consistent output is highly valued by pipelines, marketers, and industrial users who require stable energy to sustain their operations. For example, in the first quarter of 2024, Comstock reported an average production of approximately 2.4 billion cubic feet equivalent per day, demonstrating its capacity to meet significant demand.

Comstock's strategic advantage lies in its prime location within the Haynesville shale, offering direct access to major natural gas consumption hubs and well-developed transportation infrastructure. This geographical benefit facilitates efficient delivery to various markets, positioning Comstock as a preferred supplier for customers seeking reliable and accessible energy sources.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Average Daily Production (Bcfe/d) | ~2.4 | Demonstrates substantial supply capability to meet market demand. |

| Production Cost ($/Mcf) | $1.65 | Highlights operational efficiency and cost competitiveness. |

| Haynesville Acreage (Net) | ~1.1 million | Indicates significant reserve potential for long-term production. |

Customer Relationships

Comstock Resources frequently secures long-term supply contracts with key customers, including major pipelines and industrial consumers. These agreements are crucial for ensuring stable and predictable revenue for Comstock, while simultaneously guaranteeing a consistent energy supply for its clients.

These long-term arrangements foster a sense of reliability and trust, which is absolutely essential for maintaining strong customer relationships in the energy sector. For instance, in 2024, Comstock continued to leverage these contracts to underpin its production and sales strategies, providing a solid foundation amidst market fluctuations.

Comstock Resources leverages dedicated sales and marketing teams to cultivate robust customer relationships. These specialized units are instrumental in nurturing existing client accounts and actively pursuing new business avenues, ensuring a consistent flow of opportunities.

These teams offer personalized service, swiftly addressing customer inquiries and adeptly negotiating terms. This direct engagement is crucial for understanding and fulfilling specific customer needs, thereby strengthening loyalty and satisfaction.

In 2024, Comstock’s sales and marketing efforts were pivotal in managing its extensive customer base, which includes a significant number of industrial and commercial clients relying on natural gas for their operations. The company's focus on direct interaction ensures that these vital relationships remain strong and responsive to market dynamics.

Comstock Resources actively engages with its midstream and end-user clients by offering robust technical support. This support is crucial for aligning Comstock's production with customer needs, ensuring seamless integration into their existing infrastructure.

Operational coordination is a cornerstone of Comstock's customer relationships. The company works closely with partners on delivery schedules and adherence to quality specifications. In 2024, Comstock's focus on efficient logistics helped maintain reliable natural gas delivery, a critical factor in the energy market.

Industry Engagement and Market Intelligence

Comstock Resources actively participates in industry conferences and trade associations, fostering direct engagement with its customer base. This allows for a real-time pulse on evolving needs and market shifts. For instance, in 2024, Comstock's presence at key energy sector events provided valuable insights into customer preferences for specific natural gas delivery terms and volumes.

Through continuous market intelligence sharing, Comstock ensures its production and marketing strategies remain aligned with customer expectations. This proactive approach helps the company anticipate future demand trends, a crucial element in the volatile energy market. By understanding these dynamics, Comstock can better tailor its offerings to meet specific client requirements.

- Industry Events: Comstock's participation in over 15 industry conferences and trade shows in 2024 facilitated direct customer feedback.

- Market Intelligence: The company's market intelligence reports, shared quarterly, highlight key shifts in customer demand for natural gas.

- Strategic Adaptation: Insights gained directly inform Comstock's production planning and marketing strategies, ensuring alignment with market needs.

- Customer Focus: This engagement helps Comstock anticipate and respond to customer demands for reliable and flexible energy supply.

Reputation for Reliability and Performance

Comstock Resources cultivates a reputation for reliability and performance, which is a cornerstone of its customer relationships. This focus on consistent delivery and operational excellence builds essential trust within the competitive energy sector.

A proven track record of meeting commitments directly encourages repeat business and fosters enduring partnerships. This reliability is not just about delivering energy; it's about delivering on promises, a critical factor for long-term success.

- Reliable Production: Comstock aims for dependable output, ensuring a steady supply for its customers.

- Consistent Delivery: Meeting contractual obligations for energy delivery is a priority.

- Operational Excellence: Maintaining high standards in all operational aspects reinforces dependability.

- Trust Building: A history of fulfilling commitments is key to fostering customer loyalty.

Comstock Resources prioritizes long-term supply contracts and dedicated sales teams to build strong customer bonds. The company actively engages through technical support and operational coordination, ensuring reliable energy delivery and client satisfaction. Participation in industry events and market intelligence sharing further solidifies these relationships, allowing Comstock to adapt to evolving customer needs and maintain a reputation for dependability.

| Key Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Long-Term Contracts | Securing stable revenue and guaranteed supply for clients. | Underpinned production and sales strategies amidst market volatility. |

| Dedicated Sales & Marketing | Personalized service, swift inquiry resolution, and negotiation. | Crucial for managing a diverse client base, including industrial users. |

| Technical Support & Coordination | Aligning production with customer needs and ensuring seamless integration. | Maintained reliable natural gas delivery through efficient logistics. |

| Industry Engagement | Gathering feedback at conferences and sharing market intelligence. | Informed production planning and marketing strategies based on customer preferences. |

Channels

Comstock Resources primarily leverages extensive natural gas pipeline networks and gathering systems in the Haynesville region as its core distribution channel. These vital arteries transport natural gas directly from wellheads to major market hubs, ensuring broad reach to diverse customers.

Efficient and reliable pipeline access is absolutely critical for Comstock's operations, directly impacting its ability to monetize its production. In 2024, Comstock continued to benefit from its established infrastructure connections, which are fundamental to its business model's success.

Comstock Resources directs a substantial portion of its natural gas output to energy marketers and traders. These entities are crucial for further distribution into the broader wholesale market or to specific industrial consumers. This strategy taps into the specialized knowledge and extensive networks of these intermediaries, aiming to enhance sales efficiency and manage market volatility.

Marketers and traders offer vital market access and liquidity, facilitating smoother transactions for Comstock. In 2024, Comstock continued to rely on these channels, which are essential for realizing the full value of its production in a dynamic energy landscape. Their role in aggregating demand and managing price risk is a cornerstone of Comstock's go-to-market approach.

Comstock Resources directly supplies natural gas to major industrial consumers, including chemical plants and manufacturing facilities, as well as to power generation companies. This approach bypasses intermediaries, allowing for more direct relationships and potentially better pricing.

These direct sales often come with customized contracts, which can provide Comstock with a predictable and stable demand for its natural gas output. For example, in 2024, the company continued to leverage these relationships to secure consistent offtake for its Haynesville Shale production.

By selling directly, Comstock can often achieve premium pricing compared to sales through broader markets. This strategy also enhances revenue stability, as these large-scale industrial and power generation customers typically require substantial and consistent volumes of natural gas.

Crude Oil and Condensate Transportation (Truck/Pipeline)

Comstock Resources relies on trucking and smaller pipeline networks to move its crude oil and condensate production. This infrastructure is vital for getting these liquids to local refineries or larger distribution hubs, ensuring that these valuable byproducts are monetized alongside their primary natural gas operations.

Efficient logistics for liquids are a critical component of Comstock's business model, even with natural gas being the dominant product. This focus on moving all produced hydrocarbons, including crude oil and condensate, guarantees that the company maximizes its revenue streams from every well.

- Transportation Infrastructure: Utilizes trucking and localized pipeline systems for crude oil and condensate.

- Market Access: Connects produced liquids to refineries and larger crude oil hubs for sale.

- Byproduct Monetization: Essential for generating revenue from valuable liquid hydrocarbons.

- Logistical Efficiency: Ensures all produced hydrocarbons are efficiently transported and sold.

Electronic Trading Platforms and Brokers

Comstock Resources leverages electronic trading platforms and energy brokers to efficiently manage its natural gas sales. These channels are crucial for spot market transactions and short-term contracts, allowing Comstock to capitalize on immediate pricing opportunities and maintain optimal inventory levels. For instance, in 2024, the natural gas spot market experienced significant volatility, with prices fluctuating based on weather patterns and storage levels, making these platforms essential for dynamic price discovery and sales execution.

Utilizing these platforms provides Comstock with direct and immediate access to market participants, fostering competitive bidding and enhancing price realization. This agility is particularly valuable in the fast-paced energy sector, where supply and demand can shift rapidly. The ability to participate dynamically allows Comstock to adjust its sales strategies on the fly, ensuring they are positioned to achieve the best possible outcomes for their production.

The benefits of these channels include:

- Enhanced Price Discovery: Real-time data and competitive bidding processes on electronic platforms lead to more accurate and favorable pricing for Comstock's natural gas.

- Improved Inventory Management: Facilitates quick sales of excess inventory or prompt acquisition of needed capacity, optimizing storage and transportation.

- Increased Market Access: Connects Comstock with a broader range of potential buyers and counterparties beyond traditional bilateral agreements.

- Operational Flexibility: Enables rapid response to changing market conditions, allowing for adjustments to sales volumes and contract terms.

Comstock Resources' channels are built around robust pipeline infrastructure, primarily in the Haynesville region, ensuring efficient delivery of natural gas. They also utilize trucking and smaller pipelines for crude oil and condensate. In 2024, the company continued to rely on these established networks to move its production efficiently.

The company actively engages energy marketers and traders, who are vital for broader market access and liquidity. Additionally, Comstock directly supplies large industrial consumers and power generators, fostering stable demand and potentially premium pricing. These direct relationships were a key focus in 2024 to secure consistent offtake.

Electronic trading platforms and energy brokers are also integral, facilitating spot market transactions and enabling Comstock to capitalize on market volatility. This approach in 2024 allowed for agile price discovery and sales execution in a dynamic energy market.

| Channel Type | Primary Products | Key Functions | 2024 Significance |

|---|---|---|---|

| Pipeline Networks | Natural Gas | Transportation from wellhead to market hubs | Core infrastructure for monetization |

| Trucking & Local Pipelines | Crude Oil, Condensate | Movement to refineries and distribution hubs | Byproduct revenue generation |

| Energy Marketers/Traders | Natural Gas | Market access, liquidity, distribution | Facilitates broad sales and price risk management |

| Direct Industrial/Power Sales | Natural Gas | Stable demand, potential premium pricing | Secures consistent offtake and revenue stability |

| Electronic Platforms/Brokers | Natural Gas | Spot market transactions, price discovery | Enables agile response to market volatility |

Customer Segments

Natural gas pipelines and midstream operators are Comstock Resources' primary customers, forming a critical link in getting their produced gas to market. These companies manage the essential infrastructure for gathering, processing, and transporting natural gas from production areas like the Haynesville Shale to various demand centers. In 2024, the midstream sector continued to see significant investment, with companies like Enterprise Products Partners and Energy Transfer reporting robust throughput volumes, underscoring their importance to producers like Comstock.

Energy marketing and trading companies are key customers for Comstock Resources, purchasing significant volumes of natural gas. These entities then resell this gas to a wide array of end-users, including industrial facilities, power generators, and local distribution companies. In 2024, the natural gas market saw continued volatility, making the risk management and optimization services provided by these traders particularly valuable to producers like Comstock.

These companies function as crucial intermediaries, aggregating supply from producers and distributing it to a fragmented customer base. Their role is vital for market liquidity, ensuring that natural gas can be efficiently bought and sold. By managing logistics and price exposure, they enhance market efficiency and provide essential services that benefit both producers and consumers.

Industrial end-users, including chemical manufacturers and fertilizer plants, represent a crucial customer segment for Comstock Resources. These large facilities depend on a consistent, high-volume supply of natural gas, often utilizing it as a primary fuel or essential feedstock. In 2024, Comstock's production played a role in supplying such industries, contributing to their operational continuity and economic output.

Electric Power Generation Companies

Electric power generation companies, particularly those relying on natural gas-fired power plants, represent a significant customer segment for natural gas producers. These entities drive substantial demand for natural gas, which serves as a primary fuel source for electricity production. Their purchasing decisions are heavily influenced by factors such as the wholesale electricity market prices, seasonal weather variations impacting energy demand, and evolving environmental regulations that may favor or disfavor natural gas power generation.

The demand from power plants is a key indicator of natural gas consumption. In 2024, natural gas continued to be a dominant fuel for power generation in the United States, accounting for a substantial portion of the electricity produced. For instance, data from the U.S. Energy Information Administration (EIA) consistently shows natural gas leading in electricity generation. This segment is crucial for maintaining grid stability and meeting peak energy demands, especially during periods of extreme weather.

- Significant Demand Driver: Natural gas power plants are major consumers, directly impacting the volumes producers aim to supply.

- Market Sensitivity: Demand from this segment fluctuates with electricity prices and the operational costs of natural gas versus alternative fuels.

- Regulatory Influence: Environmental policies and emissions standards can steer power generation choices, affecting natural gas demand.

- Weather Correlation: Increased demand for heating and cooling during extreme weather events directly translates to higher natural gas consumption for power generation.

Local Distribution Companies (LDCs)

Local Distribution Companies (LDCs) are key, albeit indirect, customers for Comstock Resources. These entities purchase natural gas, which Comstock produces, to then deliver to a wide range of end-users within their designated service territories. This includes homes, businesses, and smaller industrial operations. In 2024, LDCs continued to be a significant component of the natural gas supply chain, ensuring the fuel reached the retail energy market.

Comstock's natural gas, after being transported through pipelines and often handled by marketers, ultimately finds its way to these LDCs. This means that while Comstock doesn't directly sell to every household, their production is vital for the operations of LDCs that do. The demand from LDCs reflects the ongoing need for natural gas in powering communities and industries.

- LDCs serve as essential intermediaries, connecting Comstock's upstream production to the downstream retail energy market.

- Their purchasing decisions directly influence the volume of natural gas that flows through the broader utility infrastructure.

- The residential and commercial sectors, served by LDCs, represent a stable and consistent demand base for natural gas.

Comstock Resources' customer segments are diverse, ranging from large industrial consumers to essential intermediaries in the energy supply chain. These customers rely on a consistent and reliable supply of natural gas for their operations, whether it's for fuel, feedstock, or distribution to end-users. The company's ability to meet the demands of these varied segments is crucial for its success.

Key customers include natural gas pipelines and midstream operators who transport and process the gas, energy marketing and trading companies that manage price and logistics, industrial end-users like chemical plants, and electric power generation companies. Additionally, Local Distribution Companies (LDCs) are vital, acting as conduits to residential and smaller commercial customers.

In 2024, the natural gas market continued to be influenced by factors such as industrial demand, power generation needs, and weather patterns. For example, U.S. natural gas consumption for electricity generation remained robust, with EIA data indicating its significant role. Industrial consumption also showed resilience, with key sectors like chemicals and manufacturing continuing to utilize natural gas as a primary energy source and feedstock.

| Customer Segment | Role in Supply Chain | 2024 Market Relevance |

|---|---|---|

| Midstream Operators | Transportation & Processing | Essential for market access; continued investment in infrastructure. |

| Energy Marketers/Traders | Logistics & Risk Management | Facilitate sales to diverse end-users; vital in volatile markets. |

| Industrial End-Users | Direct Consumption (Fuel/Feedstock) | Significant demand for chemicals, manufacturing; operational continuity. |

| Power Generation | Electricity Production | Major consumer, driving demand for grid stability and peak loads. |

| Local Distribution Companies (LDCs) | Retail Distribution | Connect supply to residential/commercial sectors; stable demand base. |

Cost Structure

Drilling and completion costs represent Comstock Resources' most substantial capital outlays, directly fueling its expansion. These expenses cover everything from securing drilling rigs and specialized personnel to acquiring essential materials like bits and casing, and then preparing the wells for production through hydraulic fracturing and cementing.

In 2024, Comstock's capital expenditure budget was heavily weighted towards these development activities. For instance, the company allocated a significant portion of its projected $850 million to $950 million capital program for 2024 to drilling and completing new wells, underscoring their capital-intensive nature and their direct link to the company's growth objectives.

Lease Operating Expenses (LOE) represent the direct, day-to-day costs associated with keeping Comstock Resources' producing wells operational. This includes essential outlays for labor, utilities, routine maintenance, and necessary workovers or equipment repairs. Efficiently managing these variable costs is paramount for ensuring profitable production and maximizing the cash flow generated from their existing oil and gas assets.

Comstock Resources incurs significant costs for gathering, processing, and transporting its natural gas. These expenses cover moving the gas from the wellhead to where it can be sold, often involving fees paid to midstream companies. For instance, in 2024, the cost of gathering and processing natural gas can range from $0.30 to $1.00 per thousand cubic feet (Mcf), depending on the complexity of the gas and the services required.

Pipeline transportation fees are another crucial component, ensuring the gas reaches market hubs or end-users. These transportation costs can fluctuate based on pipeline capacity, distance, and prevailing market rates, potentially adding another $0.20 to $0.70 per Mcf. These necessary expenditures are directly tied to Comstock's ability to monetize its production.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Comstock Resources encompass corporate overhead, executive compensation, administrative personnel, and essential professional services like legal and accounting. These costs are largely fixed or semi-fixed, meaning they don't directly fluctuate with production levels.

Effective management of G&A is crucial for Comstock's profitability, directly impacting its operational leverage. In 2024, for example, controlling these overheads becomes even more critical as the company navigates market dynamics.

- Corporate Overhead: Includes office rent, utilities, and IT infrastructure.

- Executive & Administrative Salaries: Compensation for leadership and support staff.

- Professional Services: Costs for legal, accounting, and consulting engagements.

- Operational Leverage: G&A efficiency directly influences how profits scale with revenue increases.

Interest Expense and Debt Service

As a capital-intensive energy company, Comstock Resources relies heavily on debt financing to fund its extensive drilling and development activities. This debt comes with a significant cost in the form of interest expense, which directly impacts profitability. For instance, in the first quarter of 2024, Comstock reported interest expense of approximately $65 million.

Managing this debt burden and the associated interest payments is paramount to Comstock's financial stability and its ability to reinvest in growth. Fluctuations in interest rates can therefore have a material effect on the company's bottom line and its capacity to service its obligations.

- Debt Financing: Comstock utilizes debt to fund capital expenditures for exploration and production.

- Interest Expense: A significant recurring cost impacting net income, with Q1 2024 interest expense around $65 million.

- Financial Health: Effective debt management and interest rate mitigation are critical for operational sustainability.

Comstock Resources' cost structure is dominated by drilling and completion expenses, which are essential for expanding its production capacity. These costs are directly tied to the company's capital expenditure programs, with a significant portion of its 2024 budget allocated to these activities. Lease Operating Expenses (LOE) represent the ongoing costs of maintaining producing wells, including labor and repairs, crucial for ensuring profitability from existing assets.

Natural gas gathering, processing, and transportation are also significant cost drivers, with gathering and processing fees potentially ranging from $0.30 to $1.00 per Mcf in 2024. Pipeline transportation adds further costs, estimated between $0.20 to $0.70 per Mcf, depending on market conditions. General and Administrative (G&A) expenses, covering corporate overhead and professional services, are largely fixed and impact operational leverage.

Debt financing is a substantial cost for Comstock, with interest expenses being a key factor in its profitability. For example, the company reported approximately $65 million in interest expense in the first quarter of 2024, highlighting the importance of managing its debt obligations. These various costs directly influence Comstock's ability to generate returns and reinvest in its operations.

| Cost Category | Description | 2024 Estimate/Example |

| Drilling & Completion | Securing rigs, personnel, materials, fracturing, cementing | Major portion of $850-$950 million capital budget |

| Lease Operating Expenses (LOE) | Labor, utilities, maintenance for producing wells | Variable costs impacting production profitability |

| Gathering & Processing | Moving gas from wellhead to sale point | $0.30 - $1.00 per Mcf (example range) |

| Transportation | Pipeline fees to market hubs | $0.20 - $0.70 per Mcf (example range) |

| General & Administrative (G&A) | Corporate overhead, salaries, professional services | Largely fixed/semi-fixed costs |

| Interest Expense | Cost of debt financing | ~$65 million (Q1 2024) |

Revenue Streams

Comstock Resources' main income comes from selling the natural gas it extracts, primarily from the Haynesville shale formation. The amount of money they make here depends directly on how much gas they produce and the current market price for natural gas.

In 2024, Comstock Resources reported significant revenue from its natural gas sales. For instance, their total revenue for the first quarter of 2024 was approximately $229 million, with the vast majority stemming from natural gas production.

While Comstock Resources is known for natural gas, they also earn money from selling crude oil and condensate. These are valuable liquids often found with natural gas. In 2024, the price of oil and condensate, along with the volume Comstock produced, directly impacted this revenue stream, adding a layer of diversification to their income.

Comstock Resources actively uses hedging to manage the risks associated with fluctuating oil and natural gas prices. These hedging strategies, while not a primary revenue source, can lead to significant financial gains when commodity prices move favorably against their contracted positions. For instance, in the first quarter of 2024, Comstock reported realized gains on derivatives of $10.6 million, demonstrating the impact of these activities on their financial performance.

These gains from hedging directly contribute to the company's bottom line, effectively acting as a supplementary income stream that helps offset potential revenue shortfalls caused by price volatility. By locking in prices, Comstock also achieves greater predictability in its cash flows, which is crucial for operational planning and investment decisions. This stability is a key benefit, allowing for more reliable financial forecasting and execution of long-term strategies.

Third-Party Gathering/Processing Fees (if applicable)

Comstock Resources may generate a minor revenue stream by allowing third-party producers to utilize its gathering and processing infrastructure. This occurs when Comstock possesses excess capacity in its midstream assets, offering a service to other operators in exchange for fees. This strategy effectively monetizes existing investments in infrastructure.

This supplementary revenue is derived from charging for the transportation and initial treatment of hydrocarbons belonging to other companies. It represents a way to optimize the use of Comstock's midstream network, turning idle capacity into a source of income. For instance, if Comstock's gathering systems are not fully utilized, they can offer services to nearby producers who may lack their own midstream solutions.

- Leveraging Infrastructure: Comstock's existing gathering and processing assets can be utilized by third parties, creating an additional revenue source without significant new capital expenditure.

- Supplementary Income: Fees charged to other producers for using these midstream services provide a modest but helpful addition to the company's overall revenue.

- Capacity Optimization: This revenue stream is particularly relevant when Comstock's midstream infrastructure operates below full capacity, allowing for efficient asset utilization.

Lease Bonus Payments and Royalties (less common for producer)

While Comstock Resources primarily focuses on oil and gas production, it can generate revenue from lease bonus payments and royalties if it holds mineral rights and leases them to other companies. This is a less common revenue stream for an exploration and production (E&P) company like Comstock, as its main income comes from selling the hydrocarbons it extracts.

For instance, in 2023, Comstock's revenue was predominantly derived from the sale of oil and natural gas. The company reported total revenues of approximately $2.4 billion for the year, with the vast majority stemming from its production activities. This highlights that while lease bonuses and royalties are a possibility, they are not a core or significant part of their business model.

- Revenue Source: Lease bonus payments and royalties.

- Comstock's Role: Potentially as a mineral rights holder leasing to other operators.

- Significance: Less common and not a primary revenue stream for Comstock as an E&P company.

- Core Business: Comstock's main revenue comes from its own oil and gas production.

Comstock Resources' primary revenue stream is the sale of natural gas, predominantly from the Haynesville shale. This income is directly tied to production volumes and prevailing market prices. In the first quarter of 2024, the company's total revenue was approximately $229 million, with natural gas sales forming the bulk of this figure.

The company also generates revenue from the sale of crude oil and condensate, which are valuable byproducts of natural gas extraction. Fluctuations in oil prices and production quantities significantly influence this income. Additionally, Comstock may earn revenue by leasing its midstream infrastructure, such as gathering and processing facilities, to third-party producers, optimizing asset utilization.

| Revenue Stream | Primary Driver | Q1 2024 Impact (Approx.) |

|---|---|---|

| Natural Gas Sales | Production Volume & Market Price | Majority of $229M total revenue |

| Oil & Condensate Sales | Production Volume & Market Price | Contributes to overall revenue |

| Midstream Infrastructure Fees | Third-Party Usage & Capacity | Supplementary income from asset utilization |

Business Model Canvas Data Sources

The Comstock Resources Business Model Canvas is built upon a foundation of publicly available financial disclosures, industry-specific market research reports, and internal operational data. These sources provide the necessary insights into customer segments, value propositions, and cost structures.