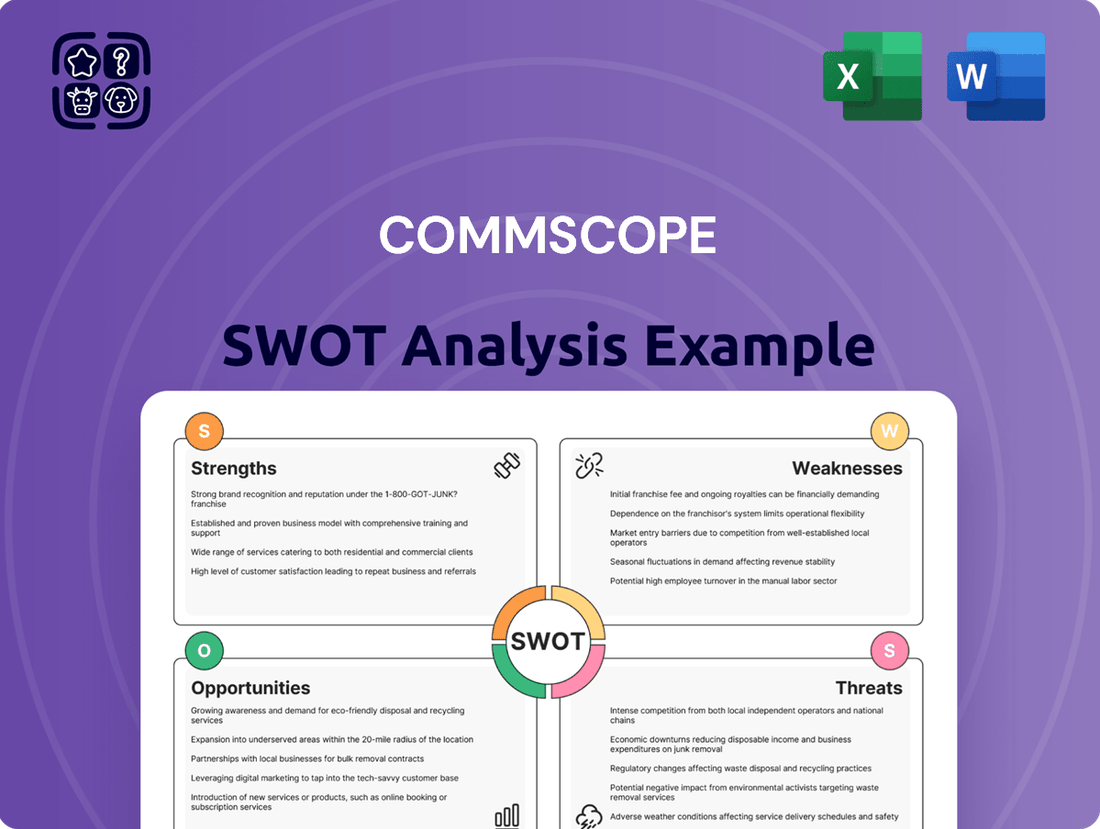

CommScope SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

CommScope's strengths lie in its established brand and diverse product portfolio, but it faces challenges from intense competition and evolving market demands.

Want the full story behind CommScope's opportunities for innovation and potential threats from technological shifts? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning.

Strengths

CommScope stands as a global leader in communication network infrastructure, boasting a strong market presence and a highly regarded brand. Their extensive product portfolio encompasses everything from fiber optic and copper cabling to antennas and essential network equipment, making them a go-to provider for modern communication needs.

This comprehensive range allows CommScope to effectively serve a wide array of customers across broadband, enterprise, and wireless sectors. For instance, in 2023, CommScope reported net sales of $2.25 billion in its Connectivity and Cable Solutions segment, highlighting the breadth of its offerings and market reach.

CommScope's dedication to technological advancement is a significant strength, evidenced by its substantial investment in research and development. In 2024, the company allocated $316.2 million to R&D, underscoring its commitment to staying at the forefront of the telecommunications industry.

This investment fuels CommScope's focus on key growth areas. They are actively developing solutions for fiber optic connectivity essential for Fiber to the x (FTTx) deployments and the burgeoning data center market. Furthermore, their innovation extends to next-generation wireless technologies like Wi-Fi 7 and the 6GHz spectrum, alongside advancements in DOCSIS 4.0 and critical components for 5G infrastructure.

The company's commitment to product evolution is clearly visible in its SYSTIMAX 2.0 portfolio. This includes innovative offerings such as FiberREACH and CableGuide 360, demonstrating a continuous effort to enhance their product suite and meet evolving market demands.

CommScope strategically positions itself within burgeoning markets, directly benefiting from the global push for enhanced connectivity. The company is poised to capture significant share in the deployment of 5G networks, the expansion of fiber-to-the-home (FTTH) services, and the rapidly growing demand from hyperscale and cloud data centers, which are increasingly vital for supporting generative AI workloads.

This advantageous market placement is reflected in their financial performance. For instance, CommScope's Connectivity and Cable Solutions (CCS) segment has demonstrated resilience and growth, fueled by these very infrastructure demands. In the first quarter of 2024, the CCS segment reported net sales of $1.1 billion, a slight increase year-over-year, underscoring the ongoing strength of these high-growth sectors.

Improved Financial Performance and Debt Management

CommScope has demonstrated a positive shift in its financial health, evidenced by increased revenues and net income in the first quarter of 2025. This improved performance is a key strength, indicating effective operational management and market responsiveness.

The company has made significant strides in managing its debt. By proactively refinancing substantial debt maturities due in 2025 and 2026, and through strategic asset sales, CommScope is actively working to bolster its capital structure. These efforts are projected to lead to a notable reduction in its debt-to-EBITDA ratio by the close of 2026, enhancing financial flexibility.

- Improved Revenue Streams: Q1 2025 saw an uptick in overall revenues.

- Enhanced Profitability: Net income also experienced growth in Q1 2025.

- Proactive Debt Refinancing: Key debt maturities for 2025 and 2026 have been addressed.

- Strengthened Capital Structure: Anticipated reduction in debt-to-EBITDA ratio by end of 2026.

Commitment to Sustainability and Ethical Practices

CommScope's dedication to sustainability and ethical operations is a significant strength. The company has consistently earned a Gold Sustainability Rating Medal from EcoVadis for eight consecutive years, underscoring its robust environmental, social, and governance (ESG) performance. This commitment is further evidenced by their substantial reductions in Scope 1, 2, and 3 greenhouse gas emissions, demonstrating tangible progress in environmental stewardship.

Furthermore, CommScope actively promotes ethical business practices throughout its value chain. This includes comprehensive employee training programs focused on integrity and compliance, as well as rigorous supplier assessments to ensure adherence to ethical standards. Such initiatives build trust with stakeholders and mitigate reputational risks.

- Consistent EcoVadis Gold Rating: Achieved for eight consecutive years, highlighting a sustained high level of ESG performance.

- Significant GHG Emission Reductions: Demonstrates a proactive approach to climate change mitigation across Scope 1, 2, and 3 emissions.

- Ethical Business Framework: Robust employee training and supplier assessments reinforce a culture of integrity and responsible conduct.

CommScope's strengths lie in its comprehensive product portfolio and its strategic positioning in high-growth markets. The company's commitment to innovation, backed by significant R&D investment, ensures it remains at the forefront of telecommunications advancements. Furthermore, CommScope is demonstrating improved financial health and a proactive approach to debt management, enhancing its overall stability and flexibility.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Product Portfolio & Market Reach | Extensive range of communication infrastructure solutions | Net sales of $2.25 billion in Connectivity and Cable Solutions (CCS) segment in 2023 |

| Innovation & R&D | Commitment to technological advancement | $316.2 million allocated to R&D in 2024; focus on FTTx, data centers, Wi-Fi 7, 6GHz, DOCSIS 4.0, 5G |

| Market Positioning | Strategic presence in burgeoning connectivity markets | Q1 2024 CCS segment sales of $1.1 billion, reflecting demand for 5G, FTTH, and data center infrastructure |

| Financial Health & Debt Management | Improved revenue and net income, proactive debt refinancing | Increased revenues and net income in Q1 2025; refinancing of 2025/2026 debt maturities |

| Sustainability & ESG | Consistent high ESG performance and emission reductions | Eight consecutive EcoVadis Gold Sustainability Rating Medals; significant GHG emission reductions |

What is included in the product

Delivers a strategic overview of CommScope’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Helps identify and address CommScope's strategic vulnerabilities by providing a clear framework for analyzing internal weaknesses and external threats.

Weaknesses

CommScope has faced challenges with negative cash flow from operations, even with reported improvements in net income. This persistent cash burn can hinder the company's ability to fund its operations and growth initiatives organically.

The company's financial health is further strained by its substantial debt burden. As of March 31, 2025, CommScope's net leverage ratio stood at a high 7.8x. This elevated debt level significantly restricts its financial flexibility, making it more difficult to secure additional financing or invest in critical areas like research and development or strategic acquisitions.

CommScope has encountered considerable market volatility, with demand softening across its various business segments. This has directly translated into reduced sales figures, with the company reporting a decline in 2023 and continuing into early 2024.

A key factor contributing to this downturn has been customer inventory destocking, alongside a noticeable delay in anticipated network upgrade cycles. These trends have collectively put pressure on CommScope's revenue streams, despite expectations for a future recovery.

While the company anticipates a rebound, the precise timing of this demand recovery remains a significant point of uncertainty for CommScope's financial outlook. This unpredictability makes strategic planning and forecasting more challenging.

CommScope's reliance on a few large customers presents a significant weakness. For instance, in the first quarter of 2024, the company reported that its top three customers accounted for approximately 30% of its net sales, highlighting a concentrated revenue stream. A shift in purchasing behavior or strategic direction from even one of these major clients could disproportionately affect CommScope's financial results.

Impact of Tariffs and Supply Chain Challenges

CommScope anticipates continued headwinds from tariffs, projecting an additional cost burden of $10 million to $15 million for the second quarter of 2025. This ongoing tariff impact represents a significant financial vulnerability.

While the most severe supply chain disruptions have eased, the company remains susceptible to potential issues stemming from material scarcity and limitations in global manufacturing capacity. These factors could still disrupt production and increase costs.

- Tariff Costs: Projected $10-$15 million in additional costs for Q2 2025.

- Supply Chain Risks: Lingering concerns over material availability.

- Manufacturing Capacity: Potential constraints in global production.

- Cost Volatility: Exposure to fluctuating input prices and logistics.

Competition in a Dynamic Industry

CommScope faces intense competition in the rapidly evolving communication infrastructure sector. This dynamic landscape necessitates constant investment in research and development to stay ahead of technological shifts and emerging players. Failure to innovate quickly can lead to market share erosion.

The company must continually adapt its product portfolio to meet changing customer needs and industry standards. This includes staying competitive in areas like fiber optics, 5G deployment, and Wi-Fi solutions. For instance, in 2024, the global telecommunications infrastructure market was projected to reach over $200 billion, highlighting the sheer scale of competition CommScope navigates.

- Intense Rivalry: Competitors like Corning, TE Connectivity, and various regional players actively vie for market share.

- Innovation Pressure: The rapid pace of technological change, such as the rollout of Wi-Fi 7 and advancements in optical networking, demands continuous product development.

- Customer Retention: Maintaining existing customer relationships requires not only competitive pricing but also superior product performance and reliable support.

CommScope's high net leverage ratio of 7.8x as of March 31, 2025, significantly limits its financial flexibility, making it harder to fund growth or manage debt. The company also faces concentrated revenue risk, with its top three customers representing about 30% of net sales in Q1 2024, making it vulnerable to shifts in major client purchasing behavior.

The company anticipates ongoing tariff costs, projecting an additional $10 million to $15 million burden in Q2 2025, impacting profitability. Lingering supply chain risks, including material scarcity and manufacturing capacity constraints, continue to pose a threat to production and cost management.

| Weakness | Description | Supporting Data |

|---|---|---|

| High Leverage | Restricts financial flexibility and investment capacity. | Net leverage ratio of 7.8x as of March 31, 2025. |

| Customer Concentration | Vulnerability to changes in purchasing by major clients. | Top 3 customers accounted for ~30% of net sales in Q1 2024. |

| Tariff Impact | Increased operational costs due to trade policies. | Projected $10-$15 million additional costs in Q2 2025. |

| Supply Chain Vulnerability | Potential disruptions from material shortages and capacity limits. | Ongoing concerns over material availability and global manufacturing capacity. |

What You See Is What You Get

CommScope SWOT Analysis

The preview you see is the actual CommScope SWOT analysis document you’ll receive upon purchase. This ensures transparency and that you get exactly what you expect—a professional, comprehensive report. Unlock the full, detailed analysis by completing your purchase.

Opportunities

The global 5G infrastructure market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond. CommScope's advanced antenna systems and comprehensive network solutions position it favorably to capitalize on this trend.

The ongoing build-out of fiber optic networks is crucial for supporting wireless backhaul, a key component of 5G deployment. CommScope’s expertise in fiber solutions directly addresses this demand, enabling faster and more reliable data transmission essential for next-generation networks.

Analysts anticipate the 5G infrastructure market to reach hundreds of billions of dollars by 2025, driven by increased adoption of 5G services by consumers and enterprises alike. CommScope's established presence and innovative product portfolio are well-aligned to secure a significant share of this expanding market.

The burgeoning demand for artificial intelligence is fueling massive investments in hyperscale and cloud data centers, creating a critical need for enhanced fiber optic connectivity. This surge directly benefits CommScope's Connectivity and Cable Solutions (CCS) segment, which is already experiencing robust growth driven by these infrastructure build-outs.

CommScope's CCS business is well-positioned to capitalize on this trend, with industry analysts projecting the global hyperscale data center market to reach over $300 billion by 2026, a significant portion of which is allocated to network infrastructure. This presents a substantial opportunity for CommScope to increase its revenue streams by supplying essential cabling and connectivity solutions to these expanding facilities.

Government initiatives like the U.S. Broadband Equity, Access, and Deployment (BEAD) program, allocating $42.45 billion, and the E.U.'s Gigabit Infrastructure Act are significantly boosting fiber optic network construction in underserved areas. CommScope is strategically positioning itself to capitalize on this by expanding its U.S. manufacturing capabilities to comply with 'Build America Buy America' (BABA) provisions.

This focus on domestic production allows CommScope to directly benefit from the substantial government subsidies aimed at enhancing broadband infrastructure nationwide. The company's investment in U.S.-based manufacturing is a direct response to these funding opportunities, ensuring it can supply the necessary components for these critical expansion projects.

Portfolio Optimization and Strategic Divestitures

CommScope's 'CommScope NEXT' initiative is a key driver for portfolio optimization, aiming to enhance profitability. This includes strategic divestitures, such as the sale of its Outdoor Wireless Networks (OWN) segment and Distributed Antenna Systems (DAS) business units. These moves are designed to streamline operations and sharpen the company's focus on its core, high-growth product areas, potentially improving financial performance and market position.

These strategic divestitures are crucial for portfolio optimization. For instance, the sale of the OWN segment and DAS business units allows CommScope to reallocate resources and attention towards areas with greater growth potential. This focus on core competencies is vital for navigating the evolving telecommunications landscape and maximizing shareholder value in the 2024-2025 period.

- Portfolio Optimization: 'CommScope NEXT' program targets profitable growth through strategic asset sales.

- Divestiture Strategy: Sale of Outdoor Wireless Networks (OWN) and Distributed Antenna Systems (DAS) business units.

- Focus on Core: Streamlining operations to concentrate on high-growth product segments.

- Financial Impact: Potential for improved profitability and resource allocation.

Advancements in Fiber Optic Technology

The ongoing shift towards smaller-diameter fiber optic cables, coupled with a growing demand for sustainable solutions, presents a significant opportunity. This trend is fueled by market desires for enhanced economic efficiency, accelerated deployment timelines, and a reduced environmental footprint. CommScope's established leadership in fiber innovation positions it to capitalize on this evolving market landscape.

CommScope's commitment to developing advanced fiber optic technologies, including those with smaller diameters and improved sustainability, directly addresses these market needs. For instance, the company’s HELIAX® fiber cable solutions are designed for easier handling and installation, contributing to faster network rollouts and potentially lower labor costs. This focus on practical, environmentally conscious innovation can translate into a distinct competitive edge.

The market for fiber optic infrastructure is projected for continued robust growth. Analysts predict the global fiber optic market to reach over $100 billion by 2028, with a compound annual growth rate (CAGR) of approximately 10% leading up to that period. This expansion is largely driven by the increasing demand for high-speed internet, 5G network deployments, and data center growth, all areas where CommScope's advanced fiber solutions are highly relevant.

CommScope's strategic investments in research and development for next-generation fiber technologies, such as those supporting higher bandwidth and increased data transmission efficiency, align perfectly with these market drivers. By continuing to innovate in areas like:

- Reduced cable diameter for increased density and lower material usage.

- Development of more energy-efficient manufacturing processes.

- Enhanced durability and recyclability of fiber optic components.

- Solutions enabling faster and more cost-effective network upgrades.

The company is well-positioned to capture market share in this expanding sector.

The global 5G infrastructure market is a significant growth area, with CommScope well-positioned to benefit from its advanced antenna systems and comprehensive network solutions. The ongoing expansion of fiber optic networks, critical for 5G backhaul, directly plays to CommScope's strengths in fiber solutions, facilitating faster and more reliable data transmission.

The increasing demand for hyperscale and cloud data centers, driven by AI, creates a substantial need for enhanced fiber optic connectivity. CommScope's Connectivity and Cable Solutions (CCS) segment is already seeing robust growth from these infrastructure build-outs, with the global hyperscale data center market projected to exceed $300 billion by 2026, a significant portion of which is for network infrastructure.

Government initiatives like the U.S. BEAD program, with $42.45 billion allocated, and the E.U.'s Gigabit Infrastructure Act are spurring fiber optic network construction. CommScope's strategic expansion of U.S. manufacturing to meet 'Build America Buy America' provisions directly aligns with these funding opportunities, allowing it to supply components for these vital projects.

CommScope's 'CommScope NEXT' initiative focuses on portfolio optimization through strategic divestitures, such as the sale of its Outdoor Wireless Networks (OWN) and Distributed Antenna Systems (DAS) business units. This streamlining aims to sharpen focus on core, high-growth product areas, potentially improving profitability and financial performance through better resource allocation.

The market's shift towards smaller-diameter fiber optic cables and sustainable solutions presents a key opportunity, driven by the need for economic efficiency and reduced environmental impact. CommScope's leadership in fiber innovation, including its HELIAX® fiber cable solutions designed for easier installation, positions it to capitalize on these evolving market demands.

Threats

Global economic uncertainty remains a significant headwind for CommScope, potentially dampening demand for its networking and communications infrastructure solutions. Analysts project that a slowdown in capital expenditures by telecommunications providers, a key customer segment, could impact CommScope's revenue streams. For instance, in Q1 2024, the broader telecom sector saw a notable pullback in spending, directly affecting companies reliant on network build-outs, a trend that could persist through 2025.

The communication infrastructure sector is a crowded arena, with many companies competing fiercely for a slice of the market. This constant battle for customers often forces price reductions, which can squeeze CommScope's profitability and necessitate ongoing investment in new technologies to stay ahead.

In 2023, the global telecommunications infrastructure market was valued at approximately $285 billion, with projections indicating continued growth but also highlighting the competitive landscape. Companies like Corning, TE Connectivity, and Nokia are significant rivals, each investing heavily in R&D and expanding their product portfolios, thereby intensifying pricing pressures on CommScope.

The communication industry is experiencing a relentless surge in technological evolution, particularly in wireless and wired network infrastructure. This rapid advancement, exemplified by the ongoing rollout and refinement of 5G and the development of next-generation Wi-Fi standards, presents a significant threat of obsolescence for CommScope's existing product lines.

To counter this, CommScope faces the imperative to continuously invest in research and development, ensuring its portfolio remains cutting-edge and aligned with emerging customer needs and industry standards. Failure to adapt quickly could lead to a loss of market share as competitors introduce more advanced solutions.

For instance, the shift towards higher frequency bands in 5G and the increasing demand for higher bandwidth in enterprise networks necessitate constant innovation in antenna design and cabling technology. CommScope's ability to stay ahead of these trends is critical for its long-term viability.

Supply Chain Disruptions and Raw Material Costs

While global supply chain pressures have somewhat receded, CommScope remains vulnerable to renewed disruptions. Fluctuations in the cost and availability of essential raw materials, such as copper and aluminum, along with critical electronic components, pose a significant threat. These factors can directly inflate production expenses and hinder the company's capacity to fulfill customer orders, impacting revenue and market share.

The ongoing geopolitical landscape and potential trade policy shifts can further exacerbate supply chain vulnerabilities. For instance, a sudden increase in tariffs on imported components could significantly raise CommScope's cost of goods sold. Furthermore, a shortage of specialized semiconductors, a recurring issue in recent years, could directly impede the production of advanced networking equipment.

- Vulnerability to Geopolitical Events: Continued instability in key manufacturing regions could trigger new supply chain bottlenecks.

- Commodity Price Volatility: CommScope's reliance on metals like copper means that price swings directly affect profitability. In early 2024, copper prices continued to experience upward pressure, reaching multi-year highs, which would directly impact CommScope's material costs.

- Component Shortages: The persistent challenge of securing critical electronic components, particularly advanced microprocessors, remains a risk to production schedules.

High Indebtedness and Financial Leverage

CommScope's considerable debt load, even after recent refinancing, continues to pose a significant risk. As of the first quarter of 2024, the company reported total debt of approximately $8.7 billion. This substantial indebtedness, coupled with a net leverage ratio that remains elevated, restricts financial flexibility.

The high level of financial leverage limits CommScope's capacity to navigate market shifts, invest in new growth opportunities, or absorb the impact of economic slowdowns. For instance, a challenging economic environment could make it harder to service this debt, potentially impacting future investments and operational stability.

- Substantial Debt Burden: CommScope carried approximately $8.7 billion in total debt as of Q1 2024.

- Elevated Leverage: The company's net leverage ratio remains a concern, impacting its financial maneuverability.

- Limited Strategic Agility: High debt restricts the ability to fund growth initiatives or respond effectively to market changes.

- Vulnerability to Downturns: Increased financial leverage heightens the company's susceptibility to economic downturns and interest rate fluctuations.

The intense competition within the communications infrastructure sector, featuring strong players like Corning and TE Connectivity, continues to exert downward pressure on pricing, impacting CommScope's profit margins. Rapid technological advancements, such as the ongoing 5G rollout and evolving Wi-Fi standards, also pose a threat of product obsolescence, demanding continuous and significant R&D investment to maintain market relevance.

CommScope's substantial debt load, reported at approximately $8.7 billion in Q1 2024, coupled with elevated leverage, significantly curtails its financial flexibility for strategic investments or weathering economic downturns. Furthermore, the company remains susceptible to renewed supply chain disruptions, including volatility in raw material costs like copper, which saw multi-year highs in early 2024, and potential shortages of critical electronic components.

SWOT Analysis Data Sources

This CommScope SWOT analysis is built upon a robust foundation of verified financial reports, in-depth market intelligence, and expert industry commentary, ensuring a comprehensive and data-driven assessment.