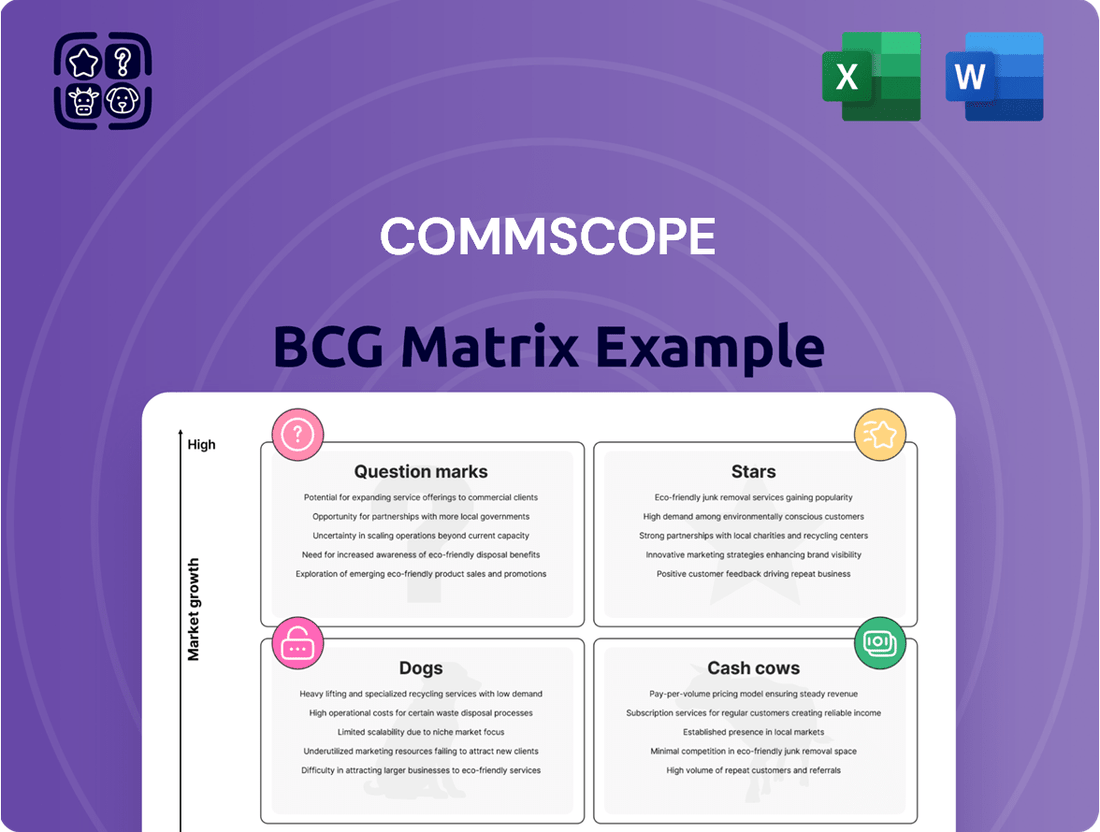

CommScope Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

This preview offers a glimpse into CommScope's strategic positioning, highlighting their market share and growth potential. To truly unlock the power of this analysis and make informed decisions, you need the full BCG Matrix.

Gain a comprehensive understanding of CommScope's product portfolio, identifying which segments are Stars, Cash Cows, Dogs, or Question Marks. Purchase the complete report for actionable insights and a clear roadmap to optimize your investment and product strategies.

Stars

CommScope's data center connectivity solutions are a star performer, fueled by the massive surge in AI and advanced networking infrastructure investments. This robust demand was a key driver for the Connectivity and Cable Solutions (CCS) segment's impressive performance in Q2 2025, demonstrating the critical role these offerings play in the modern digital economy.

The company is strategically investing in increasing its production capacity and rolling out innovative products, such as the SYSTIMAX 2.0 structured cabling system. These efforts are designed to capture the significant growth opportunities present in this high-demand market segment.

CommScope's RUCKUS segment, a key player in enterprise networking, experienced remarkable growth, with net sales jumping 46.5% year-over-year in Q2 2025. This impressive performance was fueled by strong demand, better inventory management, and the successful launch of Wi-Fi 7 technology and subscription services like RUCKUS One.

The enterprise wired and wireless LAN infrastructure market is evolving rapidly, and RUCKUS is at the forefront. Gartner's 2024 Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure acknowledged CommScope (RUCKUS) as a Visionary, underscoring its innovative solutions and strong market positioning.

CommScope's Access Network Solutions (ANS) segment is a standout performer, showing impressive growth. In the second quarter of 2025, ANS saw a significant 65.0% increase in revenue compared to the previous year. This surge is largely driven by the increasing need for advanced access technologies, especially with the ongoing rollout and adoption of DOCSIS 4.0.

The integration of Casa Systems' virtual CMTS has also played a crucial role in ANS's success, contributing to initial wins and strengthening CommScope's market position. Positive broadband market trends, particularly the widespread interest and investment in DOCSIS 4.0 upgrades, are creating substantial opportunities for CommScope.

CommScope is strategically positioned as a leader in supplying all the essential components needed for DOCSIS 4.0 upgrades. This comprehensive offering, from the network edge to the subscriber's home, allows them to capitalize on the evolving broadband landscape and secure future growth as more service providers invest in this next-generation technology.

Fiber Optic Infrastructure for Next-Gen Networks

CommScope stands as a key player in fiber optic infrastructure, a vital component for next-generation networks like 5G and cloud services. The demand for high-speed connectivity continues to surge, making fiber optic cables indispensable. This segment is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond, driven by fiber's superior capacity and low latency.

The global fiber optic cable market is expected to reach approximately $16.7 billion by 2024, with a compound annual growth rate (CAGR) of around 9.5% projected from 2023 to 2028. CommScope's strategic focus on innovations like smaller-diameter fiber and streamlined termination processes positions it well to capitalize on this expanding market. These advancements address key industry needs for efficiency and performance in broadband deployments.

- Market Growth: Fiber optic cable market projected to reach $16.7 billion in 2024.

- Key Drivers: 5G deployment, cloud computing, and high-speed internet demand.

- CommScope's Strategy: Focus on smaller-diameter fiber and simplified termination solutions.

- Future Outlook: Fiber remains central to broadband through 2025 and beyond due to its inherent advantages.

5G and Mobile Communication Antenna Solutions

CommScope continues to be a major force in 5G infrastructure, even after selling off some of its wireless network divisions. The company's focus on core connectivity and antenna solutions positions it well in a rapidly expanding global market. This segment is fueled by the ongoing 5G deployment and the increasing use of the Internet of Things (IoT).

The mobile communication antenna market is booming, with projections indicating substantial growth. For instance, the global 5G infrastructure market, which includes antennas, was valued at approximately USD 17.5 billion in 2023 and is expected to reach USD 87.3 billion by 2028, growing at a CAGR of 37.8% during that period. CommScope is recognized as a leading provider in this dynamic space.

- Market Growth Driver: The global mobile communication antenna market is expanding significantly due to the widespread rollout of 5G technology.

- IoT Influence: Increased adoption of the Internet of Things (IoT) devices also contributes to the demand for advanced antenna solutions.

- CommScope's Position: CommScope is acknowledged as a top-tier company within this high-growth sector.

- Future Demand: The need for sophisticated antennas to support network densification and higher frequency bands presents a continued strong growth opportunity.

CommScope's data center connectivity and RUCKUS enterprise networking solutions are clear stars in the BCG matrix, driven by massive AI and advanced networking investments. The Access Network Solutions (ANS) segment, particularly its role in DOCSIS 4.0 upgrades, also shines brightly due to strong broadband market trends. CommScope's fiber optic infrastructure and 5G antenna businesses are also performing exceptionally well, capitalizing on the ongoing global demand for high-speed connectivity and advanced wireless technologies.

| Segment | Bcg Status | Key Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Data Center Connectivity | Star | AI, advanced networking | CCS segment performance in Q2 2025 |

| Enterprise Wired/Wireless LAN | Star | Strong demand, Wi-Fi 7 | RUCKUS net sales +46.5% YoY in Q2 2025 |

| Access Network Solutions (DOCSIS 4.0) | Star | Broadband upgrades, DOCSIS 4.0 | ANS revenue +65.0% YoY in Q2 2025 |

| Fiber Optic Infrastructure | Star | 5G, cloud services, high-speed internet | Fiber market projected $16.7B in 2024 |

| 5G Antennas | Star | 5G deployment, IoT | 5G infrastructure market $17.5B in 2023 |

What is included in the product

The CommScope BCG Matrix analyzes its product portfolio by market share and growth, guiding strategic decisions for investment and resource allocation.

A clear, visual BCG Matrix for CommScope's portfolio, simplifying strategic decisions.

Cash Cows

CommScope's Connectivity and Cable Solutions (CCS) segment, especially its robust fiber optic and copper cabling, has been a bedrock cash generator. This division underpins the essential infrastructure for telecommunications, cable TV, and residential broadband, ensuring the continuity and enhancement of existing networks.

Despite some divestitures, the core cabling solutions within CCS cater to a mature market characterized by consistent, stable demand. For instance, in the first quarter of 2024, CommScope reported that its Broadband segment, which includes many of these core cabling products, generated $630.3 million in revenue, highlighting its ongoing importance.

CommScope's mature enterprise network infrastructure, including its wired solutions and established Wi-Fi technologies, likely holds a significant market share in a stable, well-developed sector. These offerings are the company's cash cows, consistently generating substantial revenue through ongoing maintenance and necessary upgrades in existing large enterprise deployments.

The demand for these foundational networking components remains robust, ensuring a steady cash flow for CommScope. For instance, in 2024, the global enterprise networking market, while mature, still saw consistent demand for upgrades and replacements, particularly in sectors like education and healthcare that rely heavily on stable wired backbones and functional Wi-Fi.

Capital allocation for these mature segments is strategically focused on operational efficiency and cost optimization rather than aggressive growth initiatives. This approach maximizes profitability and sustains the cash-generating power of these established product lines within CommScope's portfolio.

CommScope's legacy broadband network infrastructure, primarily supporting existing HFC networks, functions as a significant cash cow. This segment benefits from a substantial installed base that continues to require maintenance and component upgrades, ensuring a consistent revenue stream. For instance, in 2023, CommScope reported that its Broadband segment, which includes these legacy elements, generated substantial revenue, contributing significantly to the company's overall financial health.

Passive Optical Networks (PON) Components

CommScope's extensive range of passive optical network (PON) components, crucial for fiber-to-the-home (FTTH) infrastructure in established regions, likely functions as a significant cash cow. These essential elements for fiber network construction generate steady income, benefiting from consistent demand in markets where fiber deployment is already widespread. The mature nature of these PON components means that while the broader fiber market continues to expand, the demand for these foundational elements offers predictable revenue with manageable research and development costs for ongoing enhancements.

The market for FTTH infrastructure, a key area for CommScope's PON components, saw substantial investment in 2024. Global spending on broadband infrastructure, including fiber, was projected to reach hundreds of billions of dollars, with a significant portion allocated to FTTx deployments. CommScope's established presence in this segment, providing the passive infrastructure like splitters, connectors, and fiber optic cables, positions them to capitalize on this ongoing demand.

- Consistent Revenue: Demand for standard PON components in mature FTTH markets provides a stable income stream for CommScope.

- Low R&D: Incremental improvements on established PON technology require less intensive R&D compared to cutting-edge innovation, boosting profitability.

- Market Foundation: PON components are fundamental building blocks for all fiber optic networks, ensuring sustained relevance and demand.

- Projected Market Growth: The global FTTH market is expected to continue its upward trajectory, supporting the cash cow status of these components.

SYSTIMAX Structured Cabling (Existing Base)

The existing SYSTIMAX structured cabling base from CommScope, including its SYSTIMAX 2.0 advancements, is a mature product line. Its established presence in enterprise and data center environments means consistent demand for upgrades, repairs, and ongoing support, creating a reliable revenue stream with lower marketing expenses than newer products.

This mature installed base is a significant cash cow for CommScope.

- Stable Revenue Generation: The SYSTIMAX installed base contributes consistent revenue through maintenance contracts, service agreements, and the sale of complementary products for expansion and upgrades.

- Low Marketing Costs: Compared to introducing new technologies, the marketing and sales efforts for the existing SYSTIMAX base are comparatively lower due to established brand recognition and customer loyalty.

- Market Share Dominance: CommScope's SYSTIMAX has historically held a strong position in the enterprise and data center cabling market, ensuring a substantial existing customer pool.

- Continued Demand: Even with evolving technologies, the need for additions, replacements, and system upkeep within the vast SYSTIMAX installed base ensures ongoing demand for CommScope's offerings.

CommScope's legacy broadband network infrastructure, particularly its HFC (Hybrid Fiber-Coaxial) components, acts as a significant cash cow. This segment benefits from a substantial installed base that continues to require maintenance and component upgrades, ensuring a consistent revenue stream. For instance, in Q1 2024, CommScope's Broadband segment, which encompasses these legacy elements, generated $630.3 million in revenue, underscoring its ongoing financial importance.

The company's mature enterprise network infrastructure, including its wired solutions and established Wi-Fi technologies, holds a strong market share in a stable sector. These offerings are prime cash cows, consistently generating substantial revenue through ongoing maintenance and necessary upgrades in existing large enterprise deployments. The global enterprise networking market in 2024 continued to see consistent demand for upgrades, especially in sectors like education and healthcare that rely on stable wired backbones.

CommScope's extensive range of passive optical network (PON) components, crucial for fiber-to-the-home (FTTH) infrastructure in established regions, also functions as a significant cash cow. These essential elements for fiber network construction generate steady income, benefiting from consistent demand in markets where fiber deployment is already widespread. The global FTTH market saw substantial investment in 2024, with CommScope's established presence in providing passive infrastructure like splitters and connectors positioning them to capitalize on this demand.

| Segment/Product Line | BCG Category | Key Characteristics | 2024 Revenue Contribution (Illustrative) | Market Trend |

| Broadband (HFC Components) | Cash Cow | Mature market, high installed base, consistent demand for maintenance and upgrades. | Significant portion of Broadband segment revenue (e.g., ~$630M in Q1 2024 for total Broadband) | Stable, with ongoing need for network upkeep. |

| Enterprise Networking (Wired & Wi-Fi) | Cash Cow | Established solutions, strong market share in mature enterprise sector, demand for upgrades. | Core contributor to overall company revenue. | Consistent demand for infrastructure enhancements. |

| Passive Optical Network (PON) Components | Cash Cow | Foundational FTTH infrastructure, steady income in established fiber markets, predictable revenue. | Contributes to overall fiber solutions revenue. | Strong growth in global FTTH market investments. |

What You See Is What You Get

CommScope BCG Matrix

The CommScope BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just the complete, analysis-ready report for your strategic planning needs.

Dogs

CommScope's Home Networks Business was classified as a 'Dog' in the BCG Matrix, reflecting its struggles. This segment saw declining sales and profitability, a clear sign of a weak market position in a market that wasn't growing.

The company strategically divested this business to Vantiva in January 2024. This move was aimed at shedding an underperforming asset, allowing CommScope to focus resources on more promising areas and improve its overall financial health.

The Outdoor Wireless Networks (OWN) segment, alongside the Distributed Antenna Systems (DAS) unit, encountered significant headwinds. CommScope's decision to sell these operations to Amphenol, with the deal anticipated to finalize in Q1 2025, signals a strategic shift. This divestiture suggests these areas were likely experiencing sluggish growth or holding a diminished market position, no longer aligning with CommScope's core objectives.

Older generation Wi-Fi and networking hardware, often supporting standards like Wi-Fi 5 (802.11ac) or earlier, would likely be classified as Dogs within the CommScope BCG Matrix. The market's strong migration towards Wi-Fi 6, Wi-Fi 6E, and the emerging Wi-Fi 7, driven by demands for higher speeds, lower latency, and increased capacity, has significantly diminished the appeal and demand for these legacy products. For instance, while Wi-Fi 5 was prevalent, the global shipments of Wi-Fi 6 devices saw substantial growth, with projections indicating continued dominance through 2024 and beyond.

Legacy Copper-Based Enterprise Solutions (Declining Markets)

Legacy copper-based enterprise solutions, particularly those in markets rapidly shifting to fiber optics or advanced wireless technologies, are likely facing declining demand. CommScope's strategic focus on fiber as the future of network infrastructure highlights a move away from these older copper systems.

These legacy copper products, while still offered, may be categorized as cash traps within CommScope's business portfolio. This is due to the shrinking market share and diminishing demand as enterprises upgrade to more modern, higher-bandwidth solutions.

- Declining Market Share: Copper cabling's limitations in bandwidth and speed compared to fiber make it less attractive for new enterprise deployments.

- Transition to Fiber: The industry-wide push towards fiber optics for higher performance and future-proofing directly impacts the relevance of legacy copper.

- Potential Cash Traps: Continued investment in legacy copper solutions without significant market growth could divert resources from more promising growth areas.

Products Affected by Customer Inventory Digestion

Certain CommScope product lines, particularly those within the enterprise network segment, found themselves in a 'question mark' position during 2024. This was primarily due to customers actively managing and reducing their existing inventory levels, which naturally led to a pause in new equipment purchases and delayed upgrade cycles.

This phenomenon, often referred to as customer inventory digestion, directly impacted sales and order volumes for these specific offerings. For instance, the enterprise network infrastructure market experienced a notable slowdown in 2024, with some analysts estimating a mid-single-digit percentage contraction in new deployments as businesses prioritized clearing existing stock before committing to new investments.

- Enterprise Network Infrastructure Slowdown: Customers worked through excess inventory in 2024, delaying upgrades.

- Impact on CommScope: Reduced new equipment deliveries and lower sales for affected product lines.

- Market Correction: Temporary dip in demand across various enterprise network segments.

- Future Outlook: Expectations for a rebound in new equipment demand and sales in 2025.

CommScope's Home Networks Business, identified as a 'Dog' in the BCG Matrix, faced declining sales and profitability in a stagnant market. The company strategically divested this segment to Vantiva in January 2024, shedding an underperforming asset to concentrate on more promising ventures and enhance its financial standing.

Legacy copper-based enterprise solutions, especially in markets rapidly adopting fiber optics, likely fall into the 'Dog' category. With a strong industry shift toward fiber for its superior bandwidth and future-proofing capabilities, demand for older copper systems is diminishing, potentially classifying them as cash traps due to shrinking market share and investment diversion from growth areas.

Older generation Wi-Fi hardware, such as Wi-Fi 5, is also a 'Dog' given the market's rapid adoption of Wi-Fi 6 and Wi-Fi 7. The demand for higher speeds and lower latency has made legacy products less appealing, with Wi-Fi 6 devices dominating shipments through 2024 and beyond.

Question Marks

CommScope's acquisition of Casa Systems' virtual CMTS/BNG, specifically the vCCAP Evo™ and vBNG Evo™, positions them strongly in the burgeoning virtualized headend market. These offerings are key to CommScope's strategy in a high-growth sector, representing a significant investment in network virtualization.

Within the BCG Matrix framework, these virtualized solutions would likely be categorized as 'Question Marks.' While the market for network virtualization is expanding rapidly, the market share for these specific products is still in its nascent stages of development, necessitating substantial investment to achieve their full potential and climb the growth curve.

CommScope's new AI-supporting fiber optic solutions, like the FOSC®, are entering a market experiencing explosive growth driven by AI adoption. While these represent new offerings in a high-demand sector, their current market share is likely nascent as they build momentum. Substantial investment in marketing and sales will be crucial to transition these promising products from question marks to market leaders, or 'Stars,' in CommScope's portfolio.

Emerging markets represent a significant growth frontier for broadband deployments, a trend CommScope is well-positioned to capitalize on given its global operational footprint. These regions, often characterized by rapidly expanding populations and increasing digital adoption, present substantial opportunities for infrastructure providers.

While the overall demand for broadband in these areas is high, CommScope's specific market share in individual emerging economies may still be in its formative stages. Capturing this potential requires targeted investments and tailored strategies to overcome local challenges and build a stronger presence.

For instance, by mid-2024, many developing nations were actively pursuing national broadband plans, with government initiatives aiming to connect millions of new households. CommScope's ability to secure contracts within these programs will be crucial for its success in these markets, potentially mirroring the growth seen in more developed regions over the past decade.

Specialized Private Wireless Network Solutions

Specialized private wireless network solutions represent a burgeoning market segment, separate from the established public cellular infrastructure. CommScope is likely exploring or has early-stage offerings in this specialized enterprise connectivity space.

This niche is characterized by high growth potential but currently commands a smaller market share. Consequently, significant, targeted investment is crucial for CommScope to bolster its position and stand out from competitors.

- Market Growth: The global private wireless network market is projected to reach approximately $10 billion by 2027, growing at a CAGR of over 15%.

- CommScope's Position: CommScope's involvement in this area positions them to capitalize on enterprise demand for dedicated, high-performance wireless networks in sectors like manufacturing, logistics, and public safety.

- Investment Rationale: As a "Question Mark" in the BCG matrix, these solutions require strategic investment to move towards "Star" status by capturing market share and developing a competitive edge.

Advanced Wi-Fi 7 Adoption in Niche Segments

While Wi-Fi 7 is a broad 'Star' for CommScope, its adoption in highly specialized niche segments, such as demanding industrial automation or advanced healthcare facilities, could be considered a 'Question Mark'. These areas present unique challenges and may represent newer markets for CommScope, requiring significant investment to establish market share and prove scalability.

CommScope's strategy to deliver high-performance Wi-Fi 7 in these tough, niche environments underscores the potential for high growth, but also the current uncertainty in securing a dominant position. For instance, the global industrial Wi-Fi market, a key niche, was valued at approximately $2.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial opportunity but also intense competition.

- Niche Segment Challenges: Wi-Fi 7 deployment in environments with high RF interference or strict latency requirements demands specialized solutions and validation.

- Market Entry and Growth: CommScope's focus here is on capturing share in high-growth, technically demanding sectors where its expertise can be a differentiator.

- Investment and ROI: Significant R&D and market development are needed to establish a strong foothold, with returns dependent on successful penetration and scalability.

Question Marks in CommScope's portfolio represent products or services with low market share in high-growth markets. These require significant investment to increase market share and potentially become Stars. Their success hinges on CommScope's ability to innovate and capture emerging opportunities.

Examples include early-stage virtualized network solutions and specialized private wireless offerings. While the potential is substantial, these ventures are currently in a developmental phase, demanding strategic capital allocation.

The BCG Matrix helps CommScope identify these investment priorities. By focusing resources on these Question Marks, the company aims to foster future market leaders and drive overall portfolio growth.

| Product/Service Area | Market Growth Potential | Current Market Share | BCG Classification | Investment Rationale |

|---|---|---|---|---|

| Virtualized CMTS/BNG (Casa Systems Acquisition) | High (Virtualized Headend Market) | Nascent | Question Mark | Significant investment needed to capture share in a rapidly expanding sector. |

| AI-Supporting Fiber Optic Solutions (e.g., FOSC®) | Explosive (AI Adoption Driven) | Nascent | Question Mark | Requires marketing and sales investment to transition from new offering to market leader. |

| Specialized Private Wireless Networks | High (Enterprise Demand) | Low | Question Mark | Targeted investment crucial to bolster position and differentiate from competitors. |

| Wi-Fi 7 in Niche Segments (Industrial Automation, Healthcare) | High (Specific Niche Growth) | Developing | Question Mark | Demands R&D and market development to establish a strong foothold and prove scalability. |

BCG Matrix Data Sources

Our CommScope BCG Matrix leverages a robust foundation of market data, incorporating financial disclosures, industry growth rates, and competitive landscape analysis to provide strategic clarity.