CommScope PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

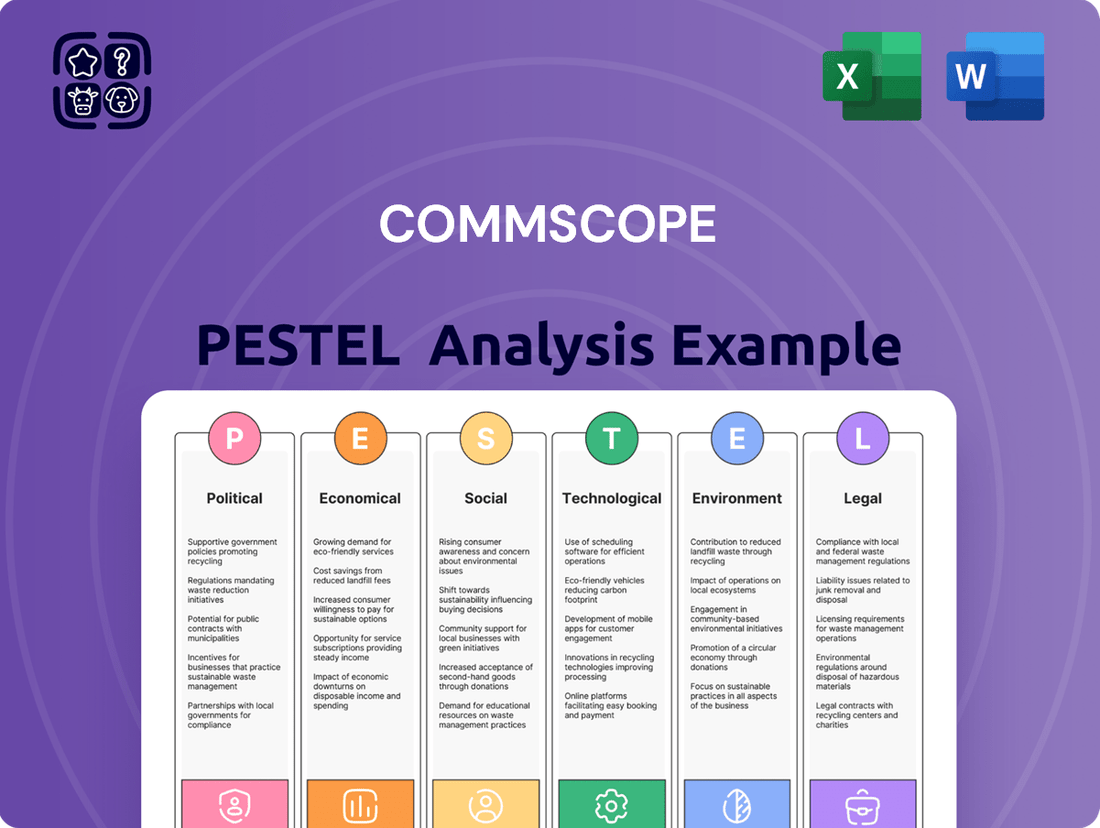

Uncover the critical political, economic, social, technological, environmental, and legal factors influencing CommScope's trajectory. Our meticulously researched PESTLE analysis offers a strategic roadmap to navigate these external forces, empowering you to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive competitive advantage.

Political factors

Government investment in broadband infrastructure, like the US Broadband Equity, Access, and Deployment (BEAD) program, is a major driver for CommScope. This program, with its substantial funding, is designed to bring high-speed internet to areas that currently lack it. This directly translates into increased demand for CommScope's essential products, including fiber optic cables and network equipment.

The BEAD program alone is allocating $42.45 billion to states and territories, creating a significant market opportunity for companies like CommScope that provide the physical infrastructure for broadband expansion. The success and pace of these government-backed projects directly influence CommScope's revenue streams and its ability to plan for future growth and technology development in these expanding markets.

Changes in telecommunications regulations, particularly potential deregulation, significantly impact CommScope's market opportunities and strategic planning. For instance, proposed shifts towards deregulation in the US for 2025 could intensify competition among internet service providers, directly influencing demand for CommScope's network infrastructure solutions.

While deregulation might spur greater competition, it could also encourage industry consolidation, potentially altering the landscape of CommScope's customer base. The company needs to remain agile, adapting its business model and product portfolio to align with evolving regulatory frameworks, such as those addressing broadband affordability and the pace of network build-outs.

Global trade policies, such as tariffs and import/export controls, directly influence CommScope's operational costs and pricing. For instance, the U.S. imposed tariffs on goods from China, impacting the cost of components for many technology companies, including those in the telecommunications infrastructure sector. Navigating these evolving trade agreements is crucial for maintaining competitive pricing and ensuring a stable supply chain for essential materials.

Geopolitical Stability and Conflicts

Geopolitical stability is a critical factor for CommScope, a global provider of network infrastructure solutions. Conflicts and political instability in regions where CommScope operates or sources materials can significantly disrupt its supply chains and affect market demand. For instance, ongoing geopolitical tensions in Eastern Europe and the Middle East in 2024 continue to pose risks to global trade routes and economic predictability, potentially impacting CommScope's logistics and the financial health of its customers in those areas.

These disruptions can manifest in several ways:

- Supply Chain Volatility: Wars and regional conflicts can interrupt the flow of essential components and raw materials, leading to production delays and increased costs for CommScope.

- Market Demand Fluctuations: Economic instability stemming from geopolitical events can reduce capital expenditure by telecommunications companies and enterprises, thereby dampening demand for CommScope's products.

- Operational Risks: Direct impacts on facilities or personnel in conflict zones, though less common for infrastructure providers, remain a potential risk that could affect service delivery and financial performance.

Cybersecurity and Data Privacy Regulations

Governments globally are enacting stricter cybersecurity and data privacy regulations, directly impacting how companies like CommScope design and secure their network equipment. These evolving laws, such as the EU's GDPR and various national data protection acts, necessitate robust security features and transparent data handling practices in CommScope's solutions, including those under the RUCKUS brand. Failure to comply can lead to significant fines and reputational damage, making adherence a critical operational and product development imperative.

The increasing focus on data protection means CommScope must ensure its offerings, particularly in areas like Wi-Fi and network infrastructure, meet stringent compliance standards worldwide. This regulatory landscape directly influences investment in secure product design and ongoing operational adjustments to safeguard customer data. For example, the global cybersecurity market was projected to reach over $300 billion in 2024, underscoring the significant financial and strategic importance of compliance.

- Increased compliance costs for product development and ongoing operations.

- Enhanced customer trust through demonstrable adherence to data privacy standards.

- Potential market access restrictions for non-compliant network solutions.

- Opportunities for differentiation by offering demonstrably secure and privacy-compliant products.

Government initiatives like the US Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, are creating substantial demand for CommScope's infrastructure solutions. Regulatory shifts, such as potential deregulation in telecommunications for 2025, could intensify competition and influence the demand for network equipment. Global trade policies, including tariffs, directly impact CommScope's operational costs and supply chain stability, requiring careful navigation of evolving international agreements.

What is included in the product

The CommScope PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of its external operating landscape.

This analysis is crucial for identifying strategic opportunities and mitigating potential risks by offering forward-looking insights into market and regulatory dynamics relevant to CommScope's industry.

A clear, concise summary of CommScope's PESTLE analysis that highlights key external factors, acting as a pain point reliver by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic conditions significantly shape CommScope's operating environment. As of mid-2024, many developed economies are experiencing moderating inflation, though it remains above central bank targets in some regions. For instance, U.S. inflation was around 3.4% in April 2024, a decrease from earlier peaks but still a concern.

Interest rate fluctuations directly impact CommScope's cost of capital and investment decisions. The U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, creating a higher borrowing cost environment compared to the low-rate era. This can constrain CommScope's ability to finance new projects or acquisitions.

Inflationary pressures continue to affect CommScope's input costs. Rising prices for raw materials like copper and aluminum, as well as increased labor expenses, can squeeze profit margins. For example, the Producer Price Index (PPI) for manufactured goods saw an increase in early 2024, indicating persistent cost pressures for companies like CommScope.

The telecommunications sector is characterized by significant investment cycles, largely dictated by the rollout of new technologies like 5G and the ongoing expansion of broadband networks. CommScope's financial health is intrinsically linked to these upgrade cycles, with recent trends indicating a resurgence in customer spending on network improvements.

For instance, in the first quarter of 2024, CommScope reported a net sales increase of 2.1% year-over-year, reaching $1.21 billion, partly fueled by this renewed investment in fiber and broadband infrastructure. This uptick directly benefited their Access Network Solutions and Connectivity and Cable Solutions segments, demonstrating the direct correlation between industry investment and CommScope's revenue generation.

CommScope's financial health is closely tied to the spending habits of its key customer segments: broadband, enterprise, and wireless. When these sectors invest more, CommScope sees a direct boost in its revenue.

After experiencing some choppiness in 2023 and early 2024 due to fluctuating customer inventory levels, there's a noticeable trend towards normalization. This means demand is now better aligned with how quickly CommScope can deploy its products, suggesting a more predictable sales environment.

This improved alignment between demand and deployment is a positive indicator for CommScope, pointing towards more stable and consistent order patterns for its various product lines moving forward.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic risk for CommScope, a global technology provider. Fluctuations in foreign exchange rates can directly impact the reported value of international sales and expenses, thereby affecting the company's profitability and financial statements. For instance, a stronger US dollar relative to other currencies can reduce the translated value of overseas earnings.

The impact of currency fluctuations is not merely theoretical. In 2023, for example, many multinational corporations reported impacts on their earnings due to adverse currency movements. CommScope's exposure means that a substantial depreciation of currencies in key markets where it operates could lead to lower reported revenue when converted back to US dollars, even if local sales volumes remain stable.

- Impact on Revenue: A strengthening USD can decrease the USD value of sales made in weaker foreign currencies.

- Impact on Costs: Conversely, a weakening USD can increase the USD cost of goods or services purchased in stronger foreign currencies.

- Hedging Strategies: CommScope likely employs hedging strategies, such as forward contracts, to mitigate some of this risk, though these strategies are not always perfect and can incur costs.

- Competitive Landscape: Currency advantages or disadvantages can also affect the pricing competitiveness of CommScope's products against local competitors in various international markets.

Mergers and Acquisitions in the Telecom Sector

Mergers and acquisitions (M&A) are reshaping the telecom landscape, creating both potential growth avenues and competitive pressures for CommScope. The ongoing industry consolidation, driven by the need for scale and the rollout of new technologies like 5G and fiber, means CommScope may encounter fewer, but larger, customers. For instance, in 2023, the telecom sector saw significant M&A activity globally, with deal values reaching hundreds of billions of dollars, indicating a strong trend towards integration.

These larger entities often have more sophisticated infrastructure requirements, potentially increasing the demand for CommScope's advanced network solutions. However, this consolidation can also lead to a more concentrated customer base, potentially reducing CommScope's bargaining power or forcing shifts in supplier relationships if acquiring companies have existing preferred vendors. CommScope itself has actively managed its portfolio through divestitures, such as the planned sale of its CommScope Connectivity Solutions (CCS) business, to focus on core growth areas and enhance its financial flexibility.

- Industry Consolidation: Telecom M&A activity globally exceeded $200 billion in 2023, signaling a trend toward larger, integrated players.

- Customer Dynamics: Larger, consolidated customers may present increased infrastructure demand but also concentrated purchasing power.

- Competitive Shifts: Mergers can alter preferred supplier lists, requiring CommScope to adapt its sales and partnership strategies.

- CommScope's Strategy: Divestitures, like the planned CCS segment sale, aim to streamline operations and improve financial positioning in response to market shifts.

Global economic conditions continue to influence CommScope's performance, with moderating inflation in developed economies being a key trend in mid-2024. While interest rates remained elevated through early 2024, impacting borrowing costs, persistent inflationary pressures on raw materials and labor continue to affect input costs.

The telecommunications sector's investment cycles, driven by 5G and broadband expansion, directly correlate with CommScope's revenue. CommScope saw a 2.1% net sales increase in Q1 2024, reaching $1.21 billion, underscoring the impact of renewed infrastructure spending.

Currency exchange rate volatility poses a risk, as demonstrated by global corporations reporting earnings impacts in 2023. A stronger USD can reduce the value of overseas earnings, while hedging strategies are employed to mitigate these fluctuations.

Industry consolidation through mergers and acquisitions, with over $200 billion in telecom M&A in 2023, is creating larger customers. CommScope is adapting by divesting non-core assets, such as the planned CCS business sale, to focus on growth areas.

Same Document Delivered

CommScope PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CommScope PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

The persistent digital divide, where significant portions of the population still lack reliable high-speed internet access, fuels ongoing demand for CommScope's essential infrastructure. As of early 2024, reports indicated that over 1.5 billion people globally remained offline, highlighting the scale of this challenge and the need for expanded connectivity.

Initiatives aimed at closing this gap, especially in rural and underserved areas, necessitate substantial investments in broadband network expansion. This directly translates into increased opportunities for CommScope, as they supply critical fiber optic and copper cabling, alongside other vital connectivity solutions required for these network build-outs.

The widespread adoption of remote work and online education, accelerated by events in 2020 and continuing through 2024, has fundamentally reshaped how people connect and learn. This seismic shift has directly fueled an insatiable demand for dependable, high-speed internet infrastructure. For instance, by early 2025, it's estimated that over 30% of the global workforce will be engaged in hybrid or fully remote roles, a significant jump from pre-pandemic levels.

This sustained demand translates into a critical need for continuous network upgrades and expansions. CommScope, with its comprehensive portfolio of solutions for broadband, enterprise, and wireless networks, is strategically positioned to capitalize on this trend. The company's investments in fiber optic technology and advanced wireless infrastructure are directly aligned with enabling these evolving communication needs, ensuring consistent connectivity for millions.

Global urbanization continues at a rapid pace, with the United Nations estimating that 68% of the world's population will live in urban areas by 2050. This trend fuels the demand for smart city development, requiring robust communication networks to manage everything from traffic flow to energy consumption. CommScope's expertise in fiber optic and wireless solutions is critical for building the underlying infrastructure that makes these interconnected urban environments function.

The growth of the smart city market is substantial. Projections indicate the global smart city market could reach over $2.5 trillion by 2026, highlighting the massive investment in technologies that rely on advanced connectivity. CommScope's portfolio, including its high-density fiber solutions and intelligent building connectivity, directly supports the deployment of IoT sensors, 5G networks, and the data management systems essential for smart city operations.

Consumer Expectations for Connectivity

Consumers now demand instant, high-speed internet for everything, from binge-watching shows to managing smart homes. This expectation means service providers constantly need to improve their infrastructure, which directly fuels the need for CommScope's advanced networking gear, fiber optics, and wireless technology.

This trend is evident in the growing adoption of 5G and fiber-to-the-home (FTTH) services. For instance, global mobile data traffic is projected to reach 292 exabytes per month by 2027, up from 77 exabytes per month in 2022, according to Statista. This surge highlights the increasing consumer reliance on robust connectivity.

- Growing Demand for Bandwidth: Consumers expect uninterrupted access to high-bandwidth applications like 4K streaming and cloud gaming.

- Smart Home Integration: The proliferation of connected devices in homes necessitates reliable and extensive network coverage.

- Mobile Data Growth: Mobile data traffic is expected to grow significantly, driving demand for advanced wireless infrastructure.

Labor Shortages in Network Deployment

The telecommunications industry, including network deployment, faces significant challenges due to labor shortages, especially for skilled technicians needed for fiber optic installations. This scarcity directly affects the speed at which new infrastructure can be rolled out, impacting service providers' ability to meet growing demand.

CommScope is actively working to mitigate these issues. Their strategy involves creating products that are easier and faster to install, thereby reducing the reliance on highly specialized labor. For instance, their fiber optic connectivity solutions are designed for simplicity and efficiency.

This approach aims to lessen the burden on service providers dealing with a shrinking pool of qualified workers. By simplifying deployment, CommScope helps its customers overcome the practical hurdles presented by labor constraints, potentially accelerating network build-outs even with fewer technicians.

- Skilled Labor Gap: Reports in late 2024 and early 2025 continue to highlight a persistent shortage of skilled technicians for fiber optic splicing and installation across North America and Europe.

- Product Innovation: CommScope's focus on 'smaller, simpler, and more sustainable products' directly addresses deployment efficiency, aiming to reduce installation time per connection by an estimated 15-20% in pilot programs.

- Deployment Pace: Industry analysts project that labor shortages could slow the pace of fiber network expansion by up to 10% in key markets if not addressed through technological solutions and workforce development initiatives.

The ongoing digital divide, with over a billion people still offline as of early 2024, creates a continuous need for CommScope's infrastructure solutions. These connectivity gaps, particularly in underserved regions, necessitate significant investment in broadband expansion, directly benefiting CommScope through demand for their cabling and network components.

The shift to remote work and online learning, a trend that solidified through 2024, has amplified the demand for reliable, high-speed internet. With over 30% of the global workforce expected to be in hybrid or remote roles by early 2025, this sustained demand drives the need for network upgrades, positioning CommScope to supply essential fiber optic and wireless technologies.

Urbanization continues to fuel smart city development, with 68% of the world's population projected to live in urban areas by 2050. This growth requires robust communication networks, a market where CommScope's fiber optic and wireless solutions are critical for enabling IoT and 5G deployments, supporting a market projected to exceed $2.5 trillion by 2026.

A persistent shortage of skilled technicians for fiber optic installations, a challenge highlighted in late 2024 and early 2025, impacts network rollout speed. CommScope addresses this through product innovation, aiming to reduce installation time by 15-20% and helping service providers overcome labor constraints.

Technological factors

The rapid expansion of 5G networks globally is a primary technological catalyst for CommScope. This rollout necessitates significant investment in network infrastructure, directly benefiting companies like CommScope that supply essential components such as antennas, fiber optic cables, and base station equipment. The market for 5G infrastructure is projected to reach hundreds of billions of dollars by the mid-2020s, with continued growth expected.

Looking ahead, the development and eventual deployment of 6G technology represent a future growth avenue. While still in its early research phases, 6G promises even higher speeds, lower latency, and expanded capabilities, which will undoubtedly drive further demand for advanced networking solutions. CommScope's commitment to innovation positions it to capitalize on these emerging technological shifts, requiring new generations of connectivity hardware.

CommScope's success hinges on its ability to innovate in both fiber optic and copper cabling. This means constantly pushing for higher bandwidth and better energy efficiency in their solutions, which is a key driver for network upgrades across various industries.

The company's investment in advanced fiber technologies, such as the Prodigy Connector Solution, directly addresses the escalating need for greater network capacity. Similarly, SYSTIMAX 2.0 structured cabling demonstrates their commitment to providing sustainable and high-performance network infrastructure, vital for future-proofing data centers and enterprise networks.

The increasing prevalence of Artificial Intelligence (AI) and edge computing is reshaping network infrastructure demands. CommScope is actively creating solutions to support AI advancements, including its AI-driven RUCKUS Wi-Fi 7 AP and RUCKUS Edge platforms. These innovations are designed to streamline network operations, boost data center efficiency, and proactively address the evolving needs of AI-powered applications.

Development of DOCSIS Technologies (e.g., DOCSIS 4.0)

The ongoing evolution of Data Over Cable Service Interface Specification (DOCSIS) technologies, specifically the advent of DOCSIS 4.0, is a significant technological factor for CommScope. This advancement allows for substantially increased broadband speeds over existing hybrid fiber-coaxial (HFC) infrastructure, which directly fuels the demand for CommScope's specialized network equipment.

DOCSIS 4.0 is designed to deliver symmetrical multi-gigabit speeds, with potential for up to 10 Gbps downstream and 6 Gbps upstream. This capability is crucial for service providers looking to compete with fiber-to-the-home (FTTH) deployments without a complete network overhaul, thereby bolstering the market for CommScope's nodes, amplifiers, and other HFC components. For instance, CommScope's own testing and deployments of DOCSIS 4.0 solutions have demonstrated these enhanced performance metrics, indicating strong market potential.

- DOCSIS 4.0 enables symmetrical multi-gigabit speeds, up to 10 Gbps downstream and 6 Gbps upstream.

- This technology allows cable operators to upgrade existing HFC networks to compete with fiber deployments.

- Demand for compatible network equipment, including nodes and amplifiers, is driven by DOCSIS 4.0 advancements.

- CommScope's investment in and development of DOCSIS 4.0-ready solutions positions them to capitalize on this technological shift.

Network Automation and Software-Defined Networking (SDN)

The growing adoption of network automation and Software-Defined Networking (SDN) is fundamentally changing how networks are managed and optimized. This shift allows for more dynamic and responsive network infrastructures. CommScope's strategic investments, like its alliance to develop the ServAssure NXT AI platform, directly address this trend by providing solutions that enhance automated operations and boost network performance. This offers telecommunication providers increased flexibility and operational efficiency in their network management.

CommScope's engagement in this area is crucial for staying competitive. For instance, the global network automation market was valued at approximately $25 billion in 2023 and is projected to reach over $60 billion by 2028, indicating a significant growth trajectory. This expansion is driven by the need for faster service deployment and reduced operational costs.

- Network Automation Market Growth: The network automation market is experiencing rapid expansion, with projections indicating a compound annual growth rate (CAGR) of around 19% from 2023 to 2028.

- SDN Adoption: SDN adoption is accelerating as businesses seek more agile and programmable network infrastructures, enabling faster innovation and service delivery.

- CommScope's Strategic Alignment: CommScope's focus on AI-driven network management and automation solutions, such as its ServAssure NXT AI platform initiative, positions it to capitalize on these market trends.

- Benefits for Providers: These technological advancements offer telecommunication providers enhanced network flexibility, improved operational efficiency, and the ability to deliver services more rapidly and cost-effectively.

The ongoing evolution of Data Over Cable Service Interface Specification (DOCSIS) technologies, specifically the advent of DOCSIS 4.0, is a significant technological factor for CommScope. This advancement allows for substantially increased broadband speeds over existing hybrid fiber-coaxial (HFC) infrastructure, which directly fuels the demand for CommScope's specialized network equipment.

DOCSIS 4.0 is designed to deliver symmetrical multi-gigabit speeds, with potential for up to 10 Gbps downstream and 6 Gbps upstream. This capability is crucial for service providers looking to compete with fiber-to-the-home (FTTH) deployments without a complete network overhaul, thereby bolstering the market for CommScope's nodes, amplifiers, and other HFC components. For instance, CommScope's own testing and deployments of DOCSIS 4.0 solutions have demonstrated these enhanced performance metrics, indicating strong market potential.

The increasing prevalence of Artificial Intelligence (AI) and edge computing is reshaping network infrastructure demands. CommScope is actively creating solutions to support AI advancements, including its AI-driven RUCKUS Wi-Fi 7 AP and RUCKUS Edge platforms. These innovations are designed to streamline network operations, boost data center efficiency, and proactively address the evolving needs of AI-powered applications.

The rapid expansion of 5G networks globally is a primary technological catalyst for CommScope. This rollout necessitates significant investment in network infrastructure, directly benefiting companies like CommScope that supply essential components such as antennas, fiber optic cables, and base station equipment. The market for 5G infrastructure is projected to reach hundreds of billions of dollars by the mid-2020s, with continued growth expected.

| Technology | Impact on CommScope | Market Data/Projections (2024-2025) |

|---|---|---|

| 5G Network Expansion | Increased demand for antennas, fiber optics, base station equipment. | Global 5G infrastructure market expected to exceed $200 billion by 2025. |

| DOCSIS 4.0 | Drives demand for HFC network equipment (nodes, amplifiers). | Enables up to 10 Gbps downstream, 6 Gbps upstream speeds on existing HFC. |

| AI & Edge Computing | Need for advanced networking solutions to support AI applications. | CommScope offers AI-driven Wi-Fi 7 APs and Edge platforms. |

| Network Automation & SDN | Demand for solutions enhancing automated operations and network performance. | Network automation market projected to grow significantly, with CommScope investing in AI platforms like ServAssure NXT. |

Legal factors

CommScope navigates a complex regulatory landscape, adhering to diverse international and domestic laws. These cover product safety, manufacturing quality, and ethical business conduct across its global operations. For instance, in 2024, the company continued its focus on compliance with evolving data privacy regulations like GDPR and CCPA, which impact how customer data is handled.

Failure to comply can result in significant legal penalties, damage to brand reputation, and operational interruptions. In 2023, regulatory scrutiny on supply chain transparency and environmental standards, such as those concerning conflict minerals, intensified, requiring CommScope to maintain robust compliance frameworks.

CommScope places significant emphasis on safeguarding its intellectual property, particularly its extensive portfolio of patents covering wired and wireless network solutions. This protection is fundamental to maintaining its competitive edge in a rapidly evolving technology landscape. For instance, in 2023, the company continued to invest in R&D, a key driver for patent applications, though specific figures for new patent filings in that year are not publicly detailed, the ongoing trend indicates a robust commitment to innovation.

The active management and defense of these intellectual property rights are crucial for CommScope to deter infringement and preserve its market standing. Legal actions to protect patents are not uncommon in the telecommunications infrastructure sector, and CommScope's proactive approach ensures it can leverage its technological advancements without unauthorized competition, thereby safeguarding its revenue streams and market share.

CommScope places a strong emphasis on ethical conduct and robust governance, ensuring strict adherence to anti-corruption legislation across all its global operations. This commitment is reinforced through mandatory ethics and compliance training for all employees, fostering a culture of integrity.

The company proactively mitigates risks tied to unethical business practices by conducting regular sustainability assessments and audits of its worldwide supplier network. This diligent approach helps maintain CommScope's reputation for corporate responsibility and minimizes potential legal and reputational damage.

Data Privacy and Security Laws

CommScope operates within a landscape increasingly shaped by stringent data privacy and security laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate how companies collect, process, and store personal data. For CommScope, this means ensuring its network infrastructure solutions and operational processes are designed with privacy by design principles, safeguarding sensitive customer information. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This regulatory environment underscores the critical need for robust data protection measures to maintain customer trust and operational integrity in the communications sector.

The company must actively manage compliance with these evolving legal frameworks. This involves not only technical safeguards but also clear policies and transparent practices regarding data handling. As of early 2024, data privacy remains a top concern for consumers and businesses alike, with ongoing discussions about strengthening these regulations globally. CommScope's commitment to data security directly impacts its brand reputation and its ability to secure contracts with entities that prioritize data protection. The communication industry, handling vast amounts of user data, is particularly scrutinized, making adherence to these laws a fundamental aspect of business strategy.

Key considerations for CommScope include:

- Data Minimization: Collecting only the data necessary for service provision.

- Consent Management: Ensuring clear and informed consent for data processing.

- Security Measures: Implementing technical and organizational safeguards to protect data.

- Breach Notification: Establishing protocols for timely reporting of data breaches.

Contractual Obligations and Litigation Risks

CommScope's operations are deeply intertwined with a vast network of contractual agreements, encompassing relationships with customers, suppliers, and strategic partners. These contracts form the backbone of its business, dictating terms of service, product delivery, and collaborative efforts.

The company navigates inherent litigation risks stemming from potential breaches or disputes within these contractual frameworks. Such legal challenges can lead to substantial financial outlays and negatively affect its financial standing, as seen in the ongoing legal landscape for telecommunications equipment providers.

Effective management of these legal and contractual obligations is paramount for CommScope's operational resilience and financial health. Proactive legal counsel and robust contract management are essential to mitigate potential disruptions and safeguard the company's stability.

- Contractual Dependencies: CommScope relies on numerous contracts for revenue generation and supply chain management.

- Litigation Exposure: The telecommunications sector often sees patent disputes and contract disagreements impacting companies like CommScope.

- Financial Impact: Litigation can result in significant legal fees, settlement costs, and potential damage awards, directly affecting profitability.

- Risk Mitigation: Strong legal teams and diligent contract administration are vital for minimizing exposure to costly legal battles.

CommScope's legal and regulatory environment demands stringent adherence to product safety and quality standards, particularly as global regulations evolve. For instance, in 2024, the company continues to navigate evolving environmental regulations impacting manufacturing processes and material sourcing, such as those related to electronic waste and conflict minerals.

The company's commitment to intellectual property protection is a cornerstone of its competitive strategy, safeguarding its innovations in network infrastructure. In 2023, CommScope's ongoing investment in research and development, a key driver for patent applications, underscores its dedication to maintaining a technological edge, even as specific patent filing numbers for that year remain proprietary.

CommScope's global operations necessitate strict compliance with anti-corruption laws and ethical business practices, reinforced by mandatory employee training. This focus on integrity is critical for maintaining its reputation and avoiding legal repercussions, with regular audits of its supply chain further mitigating risks associated with unethical conduct.

The company actively manages compliance with data privacy laws like GDPR and CCPA, essential for protecting customer data and maintaining trust. As of early 2024, these regulations remain a significant focus, with potential fines for non-compliance, such as up to 4% of global annual revenue under GDPR, highlighting the critical need for robust data protection measures.

Environmental factors

CommScope is making strides in reducing its environmental footprint, with a particular focus on greenhouse gas (GHG) emissions. The company has successfully lowered its Scope 1, 2, and 3 GHG emissions from a 2019 baseline, demonstrating a commitment to sustainability.

These reductions are part of a broader strategy to align with global climate change mitigation goals. CommScope continues to set ambitious targets for further emission cuts, reflecting an ongoing effort to operate more responsibly.

CommScope is actively integrating sustainability into its product development, focusing on solutions that reduce environmental impact across their entire lifespan. This commitment is evident in their pursuit of low-carbon footprint designs, the incorporation of recyclable and reusable materials, and the creation of energy-efficient products. For instance, their advanced fiber optic solutions offer a substantial energy efficiency advantage over traditional copper-based infrastructure.

The company's dedication to eco-friendly solutions is underscored by its efforts to minimize waste and promote circular economy principles. In 2023, CommScope reported a significant increase in the use of recycled content in its manufacturing processes, contributing to a reduction in raw material consumption. Their ongoing innovation in areas like connectivity hardware aims to further enhance energy savings for end-users, aligning with global trends towards greener technology adoption.

CommScope is actively engaged in waste reduction, prioritizing recycling and the incorporation of reusable materials across its product lines and operational processes. This commitment aligns with broader circular economy principles, aiming to minimize environmental impact within the telecommunications infrastructure industry.

In 2023, CommScope reported a significant increase in its waste diversion rate, with 78% of its operational waste being recycled or reused, a notable improvement from 72% in 2022. The company has set a target to reach 85% diversion by the end of 2025, underscoring its dedication to minimizing landfill contributions and promoting resource efficiency.

Energy Consumption and Renewable Energy Adoption

CommScope views energy efficiency as a critical environmental consideration, impacting both its internal operations and the products it delivers to market. The company is actively developing solutions designed to help clients enhance energy optimization within their data centers and network infrastructures.

The telecommunications sector is increasingly prioritizing renewable energy adoption, with many industry players setting ambitious goals, aiming for 50% to 100% renewable energy usage. This trend directly influences demand for CommScope's energy-efficient technologies and sustainable product offerings.

Key environmental factors influencing CommScope include:

- Energy Efficiency Focus: CommScope's commitment to reducing energy consumption in its own facilities and through its product portfolio.

- Customer Solutions: Development of technologies that enable customers to optimize energy usage in data centers and networks.

- Renewable Energy Trends: The broader telecom industry's shift towards renewable energy sources, with many companies targeting 50-100% renewable energy adoption by 2025-2030.

Resource Scarcity and Supply Chain Sustainability

CommScope actively addresses resource scarcity by prioritizing fiber optic solutions over copper, a move that aligns with its sustainability goals and reduces reliance on more limited raw materials. This strategic shift is vital for long-term operational resilience and meeting growing customer demand for high-performance connectivity.

The company's commitment to supply chain sustainability involves rigorous screening of suppliers based on environmental and social criteria. For instance, in 2023, CommScope reported that 95% of its key suppliers had undergone sustainability assessments, demonstrating a proactive approach to responsible sourcing and ethical practices.

- Fiber Optic Adoption: CommScope's focus on fiber optic cable production directly addresses the depletion of copper resources, a critical environmental consideration.

- Supplier Screening: In 2023, 95% of CommScope's key suppliers were assessed for environmental and social compliance, reinforcing supply chain responsibility.

- Responsible Sourcing: Efforts to ensure responsible sourcing of materials are paramount for maintaining operational continuity and meeting evolving regulatory landscapes.

CommScope's environmental strategy emphasizes reducing greenhouse gas emissions, with Scope 1, 2, and 3 emissions lowered from a 2019 baseline. The company is also focused on developing sustainable products, like energy-efficient fiber optic solutions, and increasing the use of recycled content in manufacturing, reporting a significant rise in 2023.

Waste reduction and circular economy principles are key, with CommScope aiming for an 85% waste diversion rate by the end of 2025, up from 78% in 2023. This focus extends to supply chain sustainability, where 95% of key suppliers underwent environmental and social assessments in 2023.

The telecommunications sector's growing adoption of renewable energy, with many firms targeting 50-100% renewable usage, directly supports CommScope's energy-efficient technologies. Furthermore, the company's strategic shift towards fiber optics addresses resource scarcity concerns related to copper.

| Environmental Metric | 2023 Data | Target | Notes |

| Scope 1, 2, 3 GHG Emissions Reduction | Lowered from 2019 baseline | Ongoing | Demonstrates commitment to climate goals. |

| Waste Diversion Rate | 78% | 85% by end of 2025 | Increase from 72% in 2022. |

| Key Supplier Sustainability Assessments | 95% | Ongoing | Ensures responsible sourcing. |

| Recycled Content in Manufacturing | Significant increase | Ongoing | Supports circular economy principles. |

PESTLE Analysis Data Sources

Our CommScope PESTLE Analysis draws from a robust blend of data, including official government reports, leading industry publications, and reputable economic forecasting agencies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the telecommunications infrastructure sector.