CommScope Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

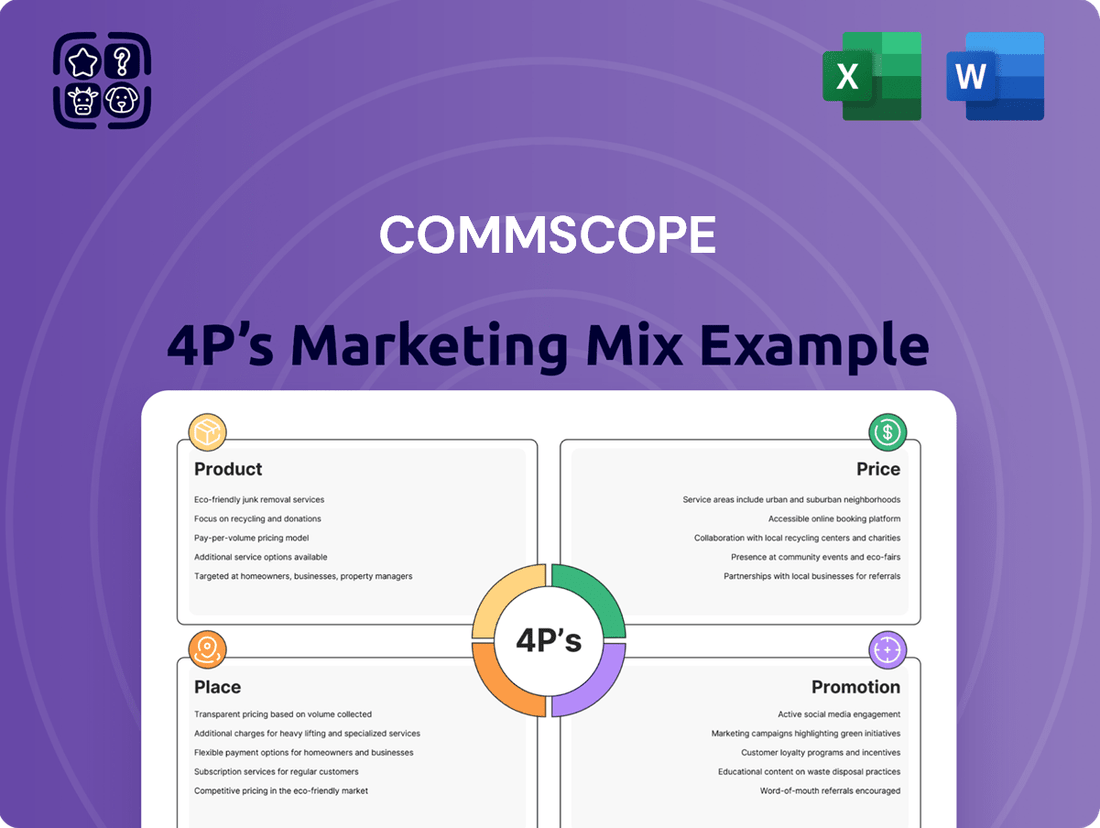

Discover how CommScope leverages its product innovation, strategic pricing, extensive distribution, and targeted promotions to maintain its market leadership. This analysis delves into the core of their marketing success, offering valuable insights for any business looking to optimize its own strategies.

Go beyond this snapshot and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for CommScope. Perfect for professionals and students seeking actionable data and strategic frameworks, this editable report will save you hours of research.

Product

CommScope's comprehensive infrastructure solutions encompass a wide array of wired and wireless products, including fiber optic and copper cabling, antennas, and essential network equipment. These offerings are fundamental to building and maintaining robust communication networks, supporting high-bandwidth demands across various industries.

The company's product suite is designed to be the physical backbone of modern communication systems, enabling critical connectivity for diverse customer segments. CommScope's emphasis lies in providing the foundational components necessary for the creation and ongoing support of physical network infrastructure, a market that saw significant investment in 2024 as global data traffic continued its upward trajectory.

CommScope's focus on broadband and access network systems is a cornerstone of its 4P strategy, particularly in Product. They are deeply invested in advanced solutions for both Hybrid Fiber-Coaxial (HFC) and Passive Optical Networks (PON). This commitment is evident in their product portfolio, which includes critical components like optical amplifiers, network gateways, and Optical Line Terminals (OLTs).

These offerings are meticulously engineered to address the escalating global demand for faster internet speeds, reduced latency, and greater network capacity. For instance, CommScope's recent advancements in DOCSIS 4.0 technology are enabling HFC networks to deliver symmetrical multi-gigabit speeds, a significant leap from previous generations. This directly supports the need for robust infrastructure to support the growing digital economy.

CommScope's Enterprise Network Solutions, encompassing SYSTIMAX, NETCONNECT, and RUCKUS, are designed to equip businesses with robust, high-performance networking. These solutions are crucial for demanding applications that require significant bandwidth and reliability.

The company is actively pushing advancements like Wi-Fi 7 and AI-driven infrastructure, directly addressing the evolving needs of enterprises. This focus ensures businesses can handle mission-critical operations and future growth, with CommScope reporting strong demand for its advanced networking technologies in 2024.

Innovation in Fiber Connectivity

CommScope is driving advancements in fiber connectivity, offering solutions designed to streamline network build-outs. For instance, their innovative 36-fiber flat cable is specifically engineered to simplify and accelerate Fiber-to-the-X (FTTx) deployments in rural areas, a critical segment for expanding broadband access. This focus on ease of installation directly addresses the challenges of reaching underserved communities.

In the data center space, CommScope's Propel XFrame exemplifies this commitment to innovation. This solution is built to support the increasing demands for higher speeds and greater density within these critical facilities. By reducing complexity and improving efficiency, these products are crucial for enabling the next generation of digital infrastructure.

These innovations directly translate into tangible benefits:

- Reduced Deployment Costs: Simplified installation processes, like those enabled by the 36-fiber flat cable, can lower labor expenses and speed up project timelines.

- Enhanced Network Performance: Solutions like the Propel XFrame are designed to accommodate higher bandwidth requirements and greater port densities, future-proofing network infrastructure.

- Broader Broadband Access: Innovations targeting FTTx deployments are key to bridging the digital divide, particularly in rural regions where connectivity is often limited.

Evolving Portfolio for Emerging Technologies

CommScope’s product evolution is keenly focused on emerging technologies, ensuring their portfolio stays ahead of market demands. This includes supporting advancements like AI-driven data centers and the rollout of Wi-Fi 7, anticipating the infrastructure needs for these next-generation applications. For instance, the global AI market is projected to reach over $1.5 trillion by 2030, highlighting the critical need for robust data center connectivity that CommScope aims to provide.

Recent product launches underscore this forward-looking strategy. FiberREACH and CableGuide 360 are designed to improve network power, connectivity, and streamline cable management, particularly at the network edge where new technologies are often deployed first. This focus on edge computing infrastructure is vital as the number of connected IoT devices is expected to exceed 29 billion by 2030, requiring efficient and reliable network solutions.

- AI Data Center Infrastructure: CommScope's solutions support the high-density, high-speed requirements of AI workloads.

- Wi-Fi 7 Readiness: Products are being developed to enable the faster speeds and lower latency promised by Wi-Fi 7.

- Edge Connectivity Solutions: FiberREACH and CableGuide 360 enhance performance and manageability at the network edge.

- Future-Proofing Networks: CommScope's R&D investment in new technologies aims to provide customers with scalable and adaptable network infrastructure.

CommScope's product strategy centers on providing the foundational infrastructure for modern connectivity, spanning broadband, enterprise networks, and data centers. Their portfolio includes advanced HFC and PON solutions, enterprise networking gear like RUCKUS, and specialized data center infrastructure.

Key product innovations focus on enabling higher speeds and greater network capacity, such as DOCSIS 4.0 for HFC and Wi-Fi 7 support for enterprises. CommScope's commitment to simplifying deployments, like their 36-fiber flat cable for FTTx, directly addresses market needs for cost reduction and faster rollout.

The company is actively investing in solutions for emerging technologies, including AI data centers and edge computing, anticipating future bandwidth demands. This forward-looking approach ensures their products are relevant for the rapidly evolving digital landscape, with a strong emphasis on future-proofing customer networks.

| Product Category | Key Technologies/Solutions | Market Focus | 2024/2025 Relevance |

|---|---|---|---|

| Broadband Access | DOCSIS 4.0, PON, Optical Amplifiers, OLTs | Cable Operators, Telcos | Enabling multi-gigabit speeds on HFC, expanding fiber reach. |

| Enterprise Networks | Wi-Fi 7, RUCKUS Wi-Fi, SYSTIMAX Cabling | Businesses, Campuses, Hospitality | Supporting increased device density and performance demands. |

| Data Center Solutions | Propel XFrame, High-Density Cabling | Cloud Providers, Enterprises | Facilitating AI workloads and hyperscale growth. |

| Edge Connectivity | FiberREACH, CableGuide 360 | Telcos, Enterprises | Streamlining deployments at the network edge for IoT and 5G. |

What is included in the product

This analysis provides a comprehensive overview of CommScope's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning.

It's designed for professionals seeking a deep dive into CommScope's actual marketing practices and competitive context, offering actionable insights for strategic planning.

Provides a clear, actionable framework to identify and address market challenges, transforming potential pain points into strategic advantages.

Place

CommScope's global distribution network is a cornerstone of its market strategy, ensuring broad product accessibility. This extensive infrastructure, featuring over 100 warehouses strategically positioned across North America, Europe, and Asia, facilitates efficient delivery of its copper, fiber, and wireless solutions. This robust network underpins CommScope's ability to serve a diverse international customer base promptly.

CommScope leverages strategic partnerships and a robust network of independent distributors, such as Anixter, to extend its market reach and offer specialized expertise. These collaborations are vital for accessing a broad spectrum of customers, from major telecommunications carriers to enterprise data centers.

In 2024, CommScope's distribution strategy continues to be a cornerstone of its go-to-market approach. For instance, Anixter, a key partner, reported strong sales growth in the networking and infrastructure sectors, reflecting the demand for CommScope's solutions within these segments.

CommScope actively pursues direct sales channels, engaging with major clients like wireless and wireline network operators, original equipment manufacturers (OEMs), and system integrators. This strategy allows for the development of highly customized solutions that precisely meet the complex needs of these key customers.

For instance, CommScope's direct engagement with large telecommunications companies in 2024 and early 2025 has been crucial in deploying advanced fiber optic infrastructure for 5G rollouts. This direct sales model fosters deeper, more collaborative relationships, leading to a better understanding of evolving market demands and enabling CommScope to proactively innovate.

Online Partner Locator and Portals

CommScope enhances its channel partner relationships through robust digital platforms, including the PartnerPRO Portal and a comprehensive Partner Locator. These online tools are central to their 'Place' strategy, ensuring partners have the resources they need to succeed.

The PartnerPRO Portal offers a suite of benefits designed to streamline operations and boost sales effectiveness for CommScope's partners. It provides access to valuable co-marketing materials, enabling partners to promote CommScope solutions effectively to their customer base. Furthermore, the portal facilitates automated account management, simplifying administrative tasks and freeing up partner resources. Crucially, it serves as a hub for essential training programs, ensuring partners are up-to-date on the latest product offerings and sales techniques.

- PartnerPRO Portal: Offers co-marketing tools, automated account management, and training resources.

- Partner Locator: Facilitates customer discovery of authorized CommScope partners.

- Streamlined Sales: Digital tools are designed to simplify and accelerate the sales cycle for partners.

- Enhanced Support: Provides partners with immediate access to critical information and assistance.

Regional and International Presence

CommScope boasts a significant global footprint, with operations spanning the United States, Europe, the Middle East, Africa, Asia Pacific, and Latin America. This extensive reach allows them to cater to diverse market demands and provide localized support for their infrastructure solutions. For instance, in 2023, their international segments contributed substantially to their overall revenue, highlighting the importance of their global presence.

Their international operations are crucial for accessing growth opportunities in emerging markets and maintaining strong relationships in established ones. CommScope's commitment to a worldwide presence ensures their advanced connectivity solutions are accessible to a broad customer base, facilitating digital transformation across various geographies.

- United States: Core market with significant R&D and manufacturing presence.

- Europe, Middle East, Africa (EMEA): Expanding market for broadband and enterprise solutions.

- Asia Pacific (APAC): High growth potential, particularly in emerging economies for network upgrades.

- Latin America: Growing demand for connectivity infrastructure in telecommunications and enterprise sectors.

CommScope's distribution strategy emphasizes a multi-channel approach, combining direct sales with a robust network of distributors and strategic partners. This ensures their extensive portfolio of network infrastructure solutions reaches a broad customer base efficiently. Their global warehousing and logistics network, with over 100 facilities, is key to timely delivery across all regions.

In 2024, CommScope continued to strengthen its partner ecosystem, recognizing the critical role these relationships play in market penetration. For example, their direct engagement with major telecommunications providers in early 2025 was instrumental in supporting 5G infrastructure deployments, highlighting the effectiveness of this channel for complex projects.

Digital tools like the PartnerPRO Portal streamline partner operations, offering co-marketing materials and training to enhance sales effectiveness. The Partner Locator feature further supports customers in finding authorized CommScope partners, simplifying the procurement process.

| Region | Key Activities/Focus | 2023 Contribution (Illustrative) |

|---|---|---|

| United States | Core market, R&D, manufacturing | ~40% of revenue |

| Europe, Middle East, Africa (EMEA) | Broadband and enterprise solutions expansion | ~30% of revenue |

| Asia Pacific (APAC) | High growth, network upgrades | ~20% of revenue |

| Latin America | Growing demand for connectivity | ~10% of revenue |

Same Document Delivered

CommScope 4P's Marketing Mix Analysis

The preview you see here is the exact CommScope 4P's Marketing Mix Analysis you'll receive upon purchase. This comprehensive document is fully prepared and ready for immediate use, ensuring no surprises. You're viewing the final, complete version that will be instantly available to you after checkout.

Promotion

CommScope prioritizes investor relations and financial communications to clearly articulate its vision and strategy. This includes detailed annual reports and timely financial results press releases, ensuring transparency for stakeholders.

Through investor conference calls and presentations, CommScope shares its market position and strategic outlook, fostering trust and attracting capital. For example, in Q1 2024, CommScope reported net sales of $1.8 billion, demonstrating its ongoing operational performance.

This commitment to open communication is crucial for building confidence and facilitating informed investment decisions by a diverse financial audience.

CommScope actively participates in and sponsors significant industry events and tradeshows, like the Fiber to the Home (FTTH) Conference and BICSI Fall. These gatherings are crucial for demonstrating their latest innovations, connecting with prospective clients and collaborators, and understanding emerging market dynamics. For instance, in 2024, the FTTH Conference saw over 1,500 attendees, a key audience for CommScope's fiber optic solutions.

CommScope actively leverages its digital platforms, including its website and blog, to disseminate valuable content. This content focuses on emerging technologies, crucial industry trends, and insightful strategic frameworks, positioning the company as a key thought leader in network connectivity.

By consistently publishing informative articles and analyses, CommScope aims to educate and actively engage its diverse target audience, which includes investors, financial professionals, and business strategists. This approach directly supports their marketing objectives by building brand authority and fostering deeper customer relationships.

Strategic Partner Alliance Agreements

CommScope actively cultivates strategic partner alliances to broaden its market presence and enrich its product and service portfolio. A prime example is the recent collaboration with DvSum, a move designed to leverage shared expertise and customer bases for mutual growth.

These alliances are instrumental in driving joint marketing initiatives, which in turn expand reach and tap into new customer segments. For instance, in 2024, CommScope's partnerships have been a key driver in introducing integrated solutions that address evolving industry demands.

- Enhanced Market Reach: Alliances like the one with DvSum in 2024 allow CommScope to access new geographical markets and customer demographics.

- Expanded Solution Offerings: Collaborations enable the integration of complementary technologies, creating more comprehensive solutions for customers.

- Joint Marketing Efforts: Partners often engage in co-branded campaigns and lead-sharing, amplifying marketing impact and reducing customer acquisition costs.

- Increased Innovation: Strategic partnerships foster an environment for shared research and development, accelerating the pace of innovation.

Targeted Advertising and Marketing Campaigns

CommScope leverages targeted advertising to highlight its strengths in video delivery and enterprise solutions, emphasizing how its products enhance personalized viewing and ad revenue for operators. For instance, their focus on solutions for optimized ad insertion directly addresses a key pain point for cable and broadband providers looking to maximize monetization.

The company's marketing efforts often showcase how their technology enables seamless, high-quality video experiences, a critical factor for customer retention in the competitive telecommunications landscape. This targeted approach ensures their message resonates with specific industry needs.

Key areas of focus for CommScope's targeted campaigns include:

- Personalized Video Experiences: Promoting solutions that allow operators to deliver customized content and interfaces to end-users.

- Optimized Ad Insertion: Highlighting technologies that enable more effective and targeted advertising within video streams, boosting operator revenue.

- Enterprise Network Solutions: Showcasing advancements in Wi-Fi and network infrastructure designed for businesses seeking reliable and high-performance connectivity.

- Fiber Optic Technology: Communicating the benefits of their advanced fiber solutions for enabling higher bandwidth and future-proofing networks.

CommScope's promotional activities are multifaceted, encompassing direct investor relations, active industry event participation, robust digital content strategies, strategic partnerships, and targeted advertising. These efforts aim to clearly communicate their value proposition, foster industry leadership, and drive business growth by engaging a diverse audience of stakeholders.

Price

CommScope's value-based pricing strategy for its infrastructure solutions directly reflects the critical role these products play in enabling high-bandwidth communication. For instance, their fiber optic cabling and connectivity solutions are foundational for 5G deployment and the increasing demand for faster internet speeds, allowing them to price based on the significant operational and revenue-generating advantages they provide to network operators and enterprises.

The company's pricing aligns with the substantial value delivered, considering the long-term benefits of robust and reliable network infrastructure. This approach is particularly evident in their data center solutions, where performance and scalability are paramount, justifying premium pricing that captures the immense value these components contribute to business continuity and digital transformation initiatives. In 2024, the global data center market was valued at over $250 billion, highlighting the critical nature of the infrastructure CommScope provides.

CommScope strategically positions itself by balancing competitive pricing with its market leadership in network connectivity solutions. They actively monitor competitor pricing and market demand to ensure their offerings remain attractive. This approach allows them to reflect their established position in a dynamic market populated by diverse players offering similar or complementary technologies.

CommScope actively manages the impact of tariffs by utilizing its adaptable global manufacturing network and making necessary price adjustments. This strategy helps cushion the financial blow from duties, especially on items produced in areas facing import taxes, such as certain RUCKUS product lines.

Strategic Divestitures and Deleveraging

CommScope's recent strategic divestitures, including the sale of its Home Networks business in late 2023 for $400 million, are a clear move to strengthen its financial footing. This deleveraging effort allows the company to concentrate on core, higher-margin segments, potentially enabling more aggressive and competitive pricing strategies within those key areas.

The sale of its Optical Network Solutions (ONS) and Distributed Antenna Systems (DAS) businesses, part of a broader strategy to reduce debt, directly impacts its pricing power. By shedding less profitable or capital-intensive units, CommScope can reallocate resources and potentially offer more attractive pricing in its remaining, more robust product lines.

- Divestiture Impact: Sale of Home Networks for $400 million in late 2023.

- Strategic Goal: Improve capital structure and reduce debt.

- Pricing Influence: Enables focus on higher-margin segments for potentially competitive pricing.

- Resource Allocation: Freed-up capital can be directed towards core, profitable areas.

Long-Term Value and Total Cost of Ownership

CommScope highlights the enduring value and lower total cost of ownership (TCO) of its solutions, especially in fiber connectivity. This strategy aims to validate upfront expenses by showcasing customer benefits like improved efficiency, easier installation, and preparedness for future technological advancements.

For instance, CommScope's fiber solutions are designed for longevity, minimizing the need for frequent upgrades. This focus on TCO is crucial for large-scale deployments where initial capital outlay is significant, but operational savings over many years can be substantial. In 2024, the demand for high-speed, reliable fiber infrastructure continues to grow, making TCO a key purchasing driver.

- Long-Term Durability: CommScope's fiber products are engineered for extended lifespans, reducing replacement cycles.

- Operational Efficiency: Simplified deployment and management features contribute to lower labor and maintenance costs.

- Future-Proofing: Solutions are designed to accommodate evolving network demands, preventing costly retrofits.

- Total Cost of Ownership: By focusing on these aspects, CommScope demonstrates a clear advantage over competitors with higher upfront but less sustainable long-term costs.

CommScope's pricing strategy emphasizes value-based approaches, aligning costs with the critical performance and long-term benefits their infrastructure solutions offer, particularly in high-bandwidth communication like 5G. This is supported by the global data center market's valuation exceeding $250 billion in 2024, underscoring the importance of reliable infrastructure.

The company balances competitive market positioning with its leadership, actively monitoring rivals and demand. Strategic divestitures, such as the $400 million sale of its Home Networks business in late 2023, aim to strengthen its financial position and allow for more competitive pricing in core, higher-margin segments.

CommScope also highlights the lower total cost of ownership (TCO) of its fiber connectivity solutions, showcasing benefits like improved efficiency and longevity to justify upfront investments, a crucial factor in the growing demand for high-speed fiber infrastructure in 2024.

| Pricing Strategy Aspect | Description | Supporting Data/Context |

|---|---|---|

| Value-Based Pricing | Aligns price with operational and revenue benefits for customers. | Foundational for 5G deployment and high-speed internet demand. |

| Competitive Positioning | Balances market leadership with competitor pricing and demand. | Reflects established position in a dynamic market. |

| Impact of Divestitures | Strengthens financial footing, enabling focus on core segments. | Home Networks sale for $400 million (late 2023) to reduce debt. |

| Total Cost of Ownership (TCO) | Emphasizes longevity and efficiency to justify upfront costs. | Key purchasing driver in growing fiber infrastructure market (2024). |

4P's Marketing Mix Analysis Data Sources

Our CommScope 4P's Marketing Mix Analysis leverages a robust blend of official company disclosures, including SEC filings, investor presentations, and press releases, alongside comprehensive industry reports and competitive intelligence. This ensures a data-driven understanding of CommScope's product strategies, pricing structures, distribution networks, and promotional activities.