CommScope Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

Explore the intricate workings of CommScope's business with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic framework that powers their industry leadership and gain actionable insights for your own ventures.

Partnerships

CommScope actively partners with technology and software firms to bolster its product suite and offer comprehensive solutions. A prime example is their collaboration with DvSum, which led to the ServAssure NXT AI platform. This partnership integrates DvSum's advanced AI analytics, significantly enhancing network monitoring and optimization capabilities specifically for service providers.

Telecommunications operators and service providers are vital partners for CommScope, as they are the primary customers who deploy and utilize the company's extensive infrastructure solutions. CommScope provides these global operators with essential products like fiber optic and copper cabling, advanced network equipment, and critical connectivity components that form the backbone of today's communication networks.

These collaborations are fundamental to CommScope's business, enabling the widespread adoption of their technologies. For instance, in 2024, the demand for high-speed broadband and 5G deployment continued to drive significant infrastructure investments by telecom companies worldwide, directly benefiting CommScope's sales of cabling and connectivity solutions.

CommScope's strategic alliances with data center and hyperscale cloud providers are crucial for its business model. These partnerships allow CommScope to supply essential high-bandwidth infrastructure, including fiber optic cabling and connectivity solutions, enabling these massive digital hubs to function efficiently.

The robust demand from the data center sector, especially from hyperscale and cloud operators, has been a primary engine for growth within CommScope's Connectivity and Cable Solutions (CCS) segment. For instance, in 2024, CommScope reported continued strong performance in its CCS segment, with a significant portion of its revenue directly attributable to the expanding needs of cloud infrastructure build-outs and upgrades.

Channel Partners and Distributors

CommScope leverages a robust network of channel partners and distributors to effectively reach its global customer base. These alliances are crucial for extending market reach and ensuring efficient product delivery. In 2024, CommScope continued to emphasize its partner ecosystem to drive sales and provide localized support for its networking infrastructure solutions.

These partnerships are instrumental in CommScope's go-to-market strategy, enabling them to serve a wide array of industries, from telecommunications to enterprise and data centers. The company's commitment to its partners is reflected in ongoing programs designed to enhance their capabilities and profitability.

- Sales and Distribution Network: Channel partners and distributors act as an extension of CommScope's sales force, reaching customers in diverse geographic markets.

- Local Market Expertise: Partners provide invaluable local market knowledge, understanding regional customer needs and regulatory landscapes.

- Customer Support: These partners are key to delivering pre- and post-sales support, including installation and technical assistance, ensuring customer satisfaction.

- Market Expansion: By collaborating with established distributors, CommScope can more rapidly enter new markets and expand its customer footprint.

Government and Regulatory Bodies

CommScope actively partners with government and regulatory bodies to ensure compliance and leverage opportunities in national broadband initiatives. This engagement is crucial for aligning its manufacturing and product development with governmental objectives, particularly concerning domestic sourcing requirements.

A key aspect of this partnership involves adhering to regulations like the Build America Buy America (BABA) Act. For instance, CommScope is expanding its U.S. manufacturing capacity for fiber connectivity products, a move directly supported by funding from programs such as the Broadband Equity, Access, and Deployment (BEAD) program. This strategic alignment ensures that CommScope's offerings meet the criteria for projects receiving federal investment, fostering domestic job creation and supply chain resilience.

The company's commitment to these partnerships is demonstrated through its investments in U.S.-based production. By bolstering its domestic manufacturing for fiber optic cable and connectivity solutions, CommScope is positioning itself to be a primary supplier for the extensive fiber network buildouts anticipated across the United States. This proactive approach not only supports national broadband goals but also solidifies CommScope's market position in a rapidly evolving landscape.

- BABA Compliance: CommScope ensures its products meet domestic content requirements mandated by the Build America Buy America Act.

- BEAD Program Support: The company is increasing U.S. manufacturing of fiber connectivity products to qualify for funding from programs like BEAD.

- National Broadband Goals: Partnerships facilitate alignment with federal objectives for expanding broadband access nationwide.

- Domestic Manufacturing Expansion: CommScope is investing in U.S. facilities to boost production of critical fiber optic components.

CommScope's key partnerships extend to technology and software innovators, enhancing their product offerings with advanced capabilities. A notable collaboration with DvSum resulted in the ServAssure NXT AI platform, boosting network monitoring for service providers through integrated AI analytics.

Critical alliances with telecommunications operators and service providers are foundational, as they are the primary deployers of CommScope's infrastructure. These global entities rely on CommScope for essential fiber optic and copper cabling, along with advanced network equipment, to build robust communication networks.

The company also fosters strategic partnerships with data center and hyperscale cloud providers, supplying them with vital high-bandwidth fiber optic cabling and connectivity solutions. This ensures the efficient operation of these massive digital infrastructure hubs.

CommScope further relies on a broad network of channel partners and distributors to effectively reach its global customer base, extending market reach and ensuring efficient product delivery. In 2024, these partners were instrumental in driving sales and providing localized support for CommScope's networking infrastructure solutions.

What is included in the product

A detailed breakdown of CommScope's operations, outlining its customer segments, value propositions, and key resources to deliver connectivity solutions.

This model provides a strategic overview of CommScope's revenue streams and cost structure, crucial for understanding its market position and growth potential.

CommScope's Business Model Canvas offers a structured approach to identify and address complex market challenges, providing a clear framework for developing innovative solutions.

It simplifies the process of understanding and communicating CommScope's strategic approach, enabling faster adaptation to evolving industry needs.

Activities

CommScope's commitment to Research and Development is a cornerstone of its strategy, driving the creation of advanced wired and wireless solutions. In 2024, the company continued to pour resources into areas like Wi-Fi 7, fiber optics, and the latest DOCSIS 4.0 broadband technologies, ensuring they remain at the forefront of connectivity advancements.

This focus on innovation isn't just about hardware; CommScope is actively integrating AI-driven analytics into its platforms. This allows for smarter network management and enhanced performance, a critical differentiator in today's rapidly evolving technological landscape.

CommScope’s key activity in manufacturing and production involves the design and creation of a wide array of network infrastructure solutions. This includes essential components like fiber optic and copper cabling, antennas, and various network equipment vital for modern connectivity.

In 2024, CommScope has been actively investing in and expanding its U.S. manufacturing footprint, particularly for fiber-optic connectivity products. This strategic move is driven by the increasing demand for products that meet Buy America, Buy American (BABA) regulations, ensuring domestic sourcing for critical infrastructure projects.

CommScope's key activities center on actively promoting and selling its vast array of networking and connectivity solutions worldwide. This involves cultivating strong relationships with major telecommunications companies, data center operators, and enterprise clients, ensuring their products meet evolving demands.

The company strategically utilizes a network of channel partners, including distributors and resellers, to extend its market reach and effectively serve a diverse customer base. This multi-faceted approach is crucial for driving sales and maintaining a competitive edge in the global market.

In 2023, CommScope reported net sales of $5.2 billion, demonstrating the scale of their sales and distribution efforts. Their focus on building and maintaining these critical customer and partner relationships underpins their ability to generate revenue and grow market share.

Supply Chain Management and Logistics

CommScope's key activity involves the intricate management of its global supply chain. This encompasses sourcing raw materials, procuring essential components, and orchestrating the movement of finished products across diverse geographical locations. The efficiency of these operations directly impacts CommScope's ability to meet customer demand and maintain competitive pricing.

The company's logistics strategy is designed to ensure timely delivery and cost optimization, which is especially vital given the dynamic nature of global markets. This includes managing inventory levels, transportation networks, and warehousing to mitigate risks and enhance responsiveness.

- Global Sourcing: Procuring a wide array of materials and components from international suppliers.

- Inventory Management: Optimizing stock levels to balance availability with carrying costs.

- Logistics and Distribution: Managing transportation, warehousing, and last-mile delivery of products worldwide.

- Supplier Relationship Management: Cultivating strong partnerships to ensure reliable supply and quality.

Customer Support and Services

CommScope's key activities heavily involve delivering robust customer support and professional services. This ensures clients can effectively deploy and manage their intricate network infrastructure. For instance, in 2024, the company focused on enhancing its technical assistance channels, aiming to reduce average resolution times for customer inquiries.

The company's commitment extends to providing comprehensive support, including troubleshooting and ongoing maintenance, which is crucial for the success of its complex solutions. This proactive approach helps in fostering strong customer relationships and driving repeat business.

CommScope also emphasizes professional services designed to optimize network performance and user experience. Initiatives in 2024 included expanding their remote diagnostic capabilities to address issues more efficiently.

- Technical Assistance: Providing expert help for network setup and troubleshooting.

- Professional Services: Offering specialized services for network design, implementation, and optimization.

- Customer Experience: Implementing solutions to improve customer satisfaction and reduce support response times.

- Training and Education: Equipping customers with the knowledge to manage their CommScope solutions effectively.

CommScope's key activities revolve around innovation and product development, focusing on next-generation connectivity solutions. In 2024, significant investment was directed towards advancements in Wi-Fi 7, fiber optics, and DOCSIS 4.0, alongside the integration of AI for smarter network management.

Manufacturing and production are central, encompassing the design and creation of a broad spectrum of network infrastructure, from fiber and copper cabling to antennas and network equipment. The company also expanded its U.S. manufacturing for fiber-optic products in 2024 to meet Buy America requirements.

Sales and distribution are critical, driven by direct engagement with telecommunications companies, data centers, and enterprises, as well as leveraging a robust network of channel partners. In 2023, CommScope's net sales reached $5.2 billion, highlighting the scale of these efforts.

Supply chain management is a core activity, involving global sourcing, inventory optimization, and efficient logistics to ensure timely delivery and cost competitiveness. Supplier relationships are actively managed to guarantee reliable supply and quality.

Customer support and professional services are paramount, ensuring clients can effectively deploy and manage their network infrastructure. In 2024, CommScope enhanced technical assistance channels and expanded remote diagnostic capabilities to improve customer experience and reduce resolution times.

| Key Activity | Focus Areas | 2024 Initiatives/Data |

|---|---|---|

| Innovation & Development | Wired & Wireless Solutions | Wi-Fi 7, Fiber Optics, DOCSIS 4.0, AI Integration |

| Manufacturing & Production | Network Infrastructure Components | U.S. Fiber Manufacturing Expansion, BABA Compliance |

| Sales & Distribution | Global Market Reach | Customer & Partner Relationships, $5.2B Net Sales (2023) |

| Supply Chain Management | Global Operations Efficiency | Sourcing, Logistics, Inventory Optimization |

| Customer Support & Services | Network Deployment & Management | Enhanced Tech Support, Remote Diagnostics |

Preview Before You Purchase

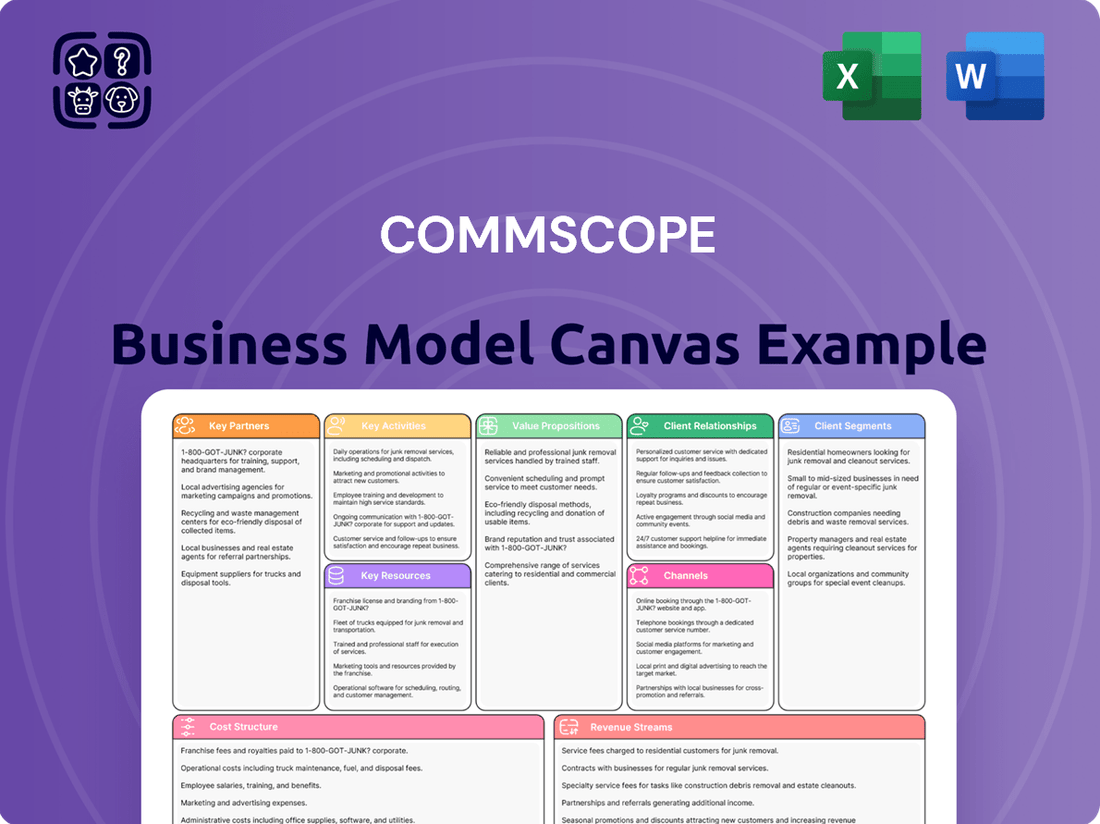

Business Model Canvas

The CommScope Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the complete, professionally formatted canvas, ready for immediate use. No alterations or sample sections are presented; what you see is precisely what you'll download, ensuring full transparency and a seamless transition from preview to ownership.

Resources

CommScope holds a substantial intellectual property portfolio, featuring thousands of patents covering wired and wireless communication technologies. This extensive patent library, a key resource, is crucial for their competitive edge in developing advanced network solutions.

These proprietary technologies, including innovations in fiber optics, broadband, and antenna design, are fundamental to CommScope's product development pipeline. For instance, their advancements in 5G infrastructure rely heavily on patented antenna beamforming and signal processing techniques.

The company actively manages and leverages its intellectual property to protect its market position and drive future innovation. In 2023, CommScope continued to invest in R&D, further expanding its patent count to reinforce its leadership in connectivity solutions.

CommScope's global network of manufacturing facilities represents a cornerstone of its business model, enabling the production of diverse communication infrastructure solutions. These physical assets are vital for delivering everything from fiber-optic cables to network antennas.

In 2024, CommScope continued its strategic investment in expanding its U.S.-based manufacturing capabilities. This expansion is specifically aimed at bolstering production capacity for critical fiber-optic connectivity products, a key growth area for the company and the broader telecommunications industry.

CommScope relies heavily on its highly skilled workforce, encompassing engineers, researchers, and technical experts. This talent pool is critical for the design, development, and ongoing support of their advanced network solutions, directly fueling innovation and product excellence.

In 2024, the demand for specialized network engineering talent remains exceptionally high, with companies like CommScope actively seeking individuals with expertise in areas like 5G, fiber optics, and Wi-Fi 7. The company's commitment to research and development, a key driver of its business model, necessitates continuous investment in attracting and retaining top R&D talent.

Global Distribution Network

CommScope's global distribution network is a critical asset, enabling efficient product delivery to over 100 countries. This extensive infrastructure includes strategically located warehouses and robust logistics operations, ensuring timely access to their solutions for a diverse customer base worldwide.

The company leverages a vast network of channel partners, forming a crucial link in its supply chain. These partners are instrumental in reaching end-users and providing localized support, further solidifying CommScope's market presence.

- Worldwide Reach: Serves customers in over 100 countries.

- Infrastructure: Operates warehouses and manages complex logistics globally.

- Partnerships: Utilizes a broad base of channel partners for market penetration.

Brand Reputation and Customer Relationships

CommScope's brand reputation as a global leader in network infrastructure is a cornerstone of its business model. This long-standing recognition, built over decades, instills confidence in customers regarding product quality and reliability. For instance, in 2023, CommScope continued to be a preferred supplier for major telecommunications carriers and enterprise clients worldwide, underscoring the strength of its brand equity.

The company cultivates deeply entrenched relationships with its key customers, fostering loyalty and ensuring recurring revenue streams. These partnerships are not merely transactional; they often involve collaborative development and a shared understanding of future network needs. This customer intimacy is a significant competitive advantage, leading to a high rate of repeat business and reduced customer acquisition costs.

- Brand Equity: CommScope’s established reputation as a reliable provider of high-performance network solutions.

- Customer Loyalty: Strong, long-term relationships with major telecommunication companies and enterprise clients.

- Repeat Business: The trust built through consistent performance drives ongoing sales and reduces churn.

- Partnership Value: Collaborative engagements with customers on future technology and infrastructure development.

CommScope's robust intellectual property portfolio, encompassing thousands of patents, is a vital resource for its innovation in wired and wireless communication technologies. This IP underpins their competitive advantage in areas like 5G infrastructure, leveraging patented antenna beamforming and signal processing.

Value Propositions

CommScope's core value proposition lies in its ability to empower high-bandwidth applications across various sectors. Their extensive portfolio of network infrastructure solutions is engineered to meet the escalating global demand for faster, more robust connectivity.

For broadband providers, this translates to delivering superior internet speeds and reliable service to homes and businesses. In the enterprise space, CommScope's offerings facilitate seamless operation of data-intensive applications, cloud computing, and advanced collaboration tools.

The wireless sector benefits from CommScope's solutions by enabling denser network deployments and supporting the growing capacity needs of mobile devices and emerging technologies like 5G. This focus on high-bandwidth enablement is crucial as data consumption continues its exponential rise, with global internet traffic projected to reach over 200 zettabytes per month by 2025.

CommScope provides a complete suite of wired and wireless solutions, covering everything from fiber optic and copper cabling to antennas and network equipment. This end-to-end approach ensures customers receive integrated, holistic solutions for their communication infrastructure needs.

In 2024, the demand for robust network infrastructure remained high, driven by 5G deployment and increasing data consumption. CommScope's comprehensive offerings directly address this market need, positioning them as a key provider for businesses and service providers looking to build and upgrade their networks.

CommScope's commitment to reliability and performance is a cornerstone of their value proposition. They deliver robust infrastructure solutions that are critical for the seamless operation of today's communication networks. For instance, in 2023, CommScope reported a net sales increase of 1.7% to $2.3 billion in the third quarter, underscoring the demand for their dependable solutions.

This focus on high-performance infrastructure ensures network stability, which is paramount for businesses relying on uninterrupted connectivity. Their products are designed to handle demanding applications, providing the foundation for efficient and optimal operation. This dedication to quality directly translates into reduced downtime and enhanced user experience for their clients.

Innovation and Future-Proofing

CommScope's commitment to innovation and future-proofing is a core value proposition, ensuring customers are equipped for evolving technological landscapes. The company consistently invests in developing and introducing new products and advanced technologies. For instance, CommScope is at the forefront of advancements like Wi-Fi 7 and DOCSIS 4.0, enabling their clients to maintain a competitive edge and prepare their networks for escalating future demands.

This focus translates into tangible benefits for customers. By adopting CommScope's cutting-edge solutions, businesses can avoid costly network overhauls and ensure their infrastructure remains relevant and performant. This proactive approach helps mitigate the risk of technological obsolescence, a critical concern in the rapidly changing telecommunications sector.

- Investment in R&D: CommScope allocates significant resources to research and development, driving the creation of next-generation networking technologies.

- Early Adoption of Standards: The company actively participates in industry standards bodies, positioning its products to be among the first to support emerging technologies like Wi-Fi 7 and DOCSIS 4.0.

- Customer Network Readiness: CommScope's solutions are designed to future-proof customer networks, ensuring they can handle increased bandwidth, lower latency, and new service demands.

Operational Efficiency and Cost Savings

CommScope's focus on operational efficiency and cost savings directly benefits service providers. Solutions like the ServAssure NXT AI platform are designed to significantly enhance network monitoring and analytics. This advanced capability allows for proactive identification and resolution of network issues, thereby reducing the need for costly emergency repairs and minimizing downtime.

By leveraging AI for fault management, CommScope helps service providers achieve faster issue resolution times. This not only cuts down on labor costs associated with troubleshooting but also improves the overall customer experience. In 2024, many telecommunications companies are investing heavily in network automation to combat rising operational expenditures, making these solutions particularly valuable.

- Improved Network Uptime: AI-driven monitoring reduces service interruptions, directly impacting customer satisfaction and reducing support costs.

- Reduced Truck Rolls: Proactive fault detection and remote resolution minimize the need for costly on-site technician visits.

- Optimized Resource Allocation: Better network visibility allows for more efficient deployment of maintenance and upgrade resources.

- Enhanced Customer Experience: Faster resolution of network problems leads to higher customer retention and loyalty.

CommScope's value proposition centers on delivering high-performance, reliable network infrastructure that supports the escalating demand for bandwidth and advanced connectivity. They offer end-to-end solutions, from cabling to wireless components, ensuring customers can build and upgrade their networks efficiently.

In 2024, the company's focus on future-proofing networks with technologies like Wi-Fi 7 and DOCSIS 4.0 provides a distinct advantage, helping clients avoid obsolescence and maintain a competitive edge in a rapidly evolving market.

Furthermore, CommScope's commitment to operational efficiency, exemplified by AI-driven network management tools, directly translates into cost savings and improved customer experiences for service providers.

| Value Proposition Pillar | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| High-Bandwidth Enablement | Comprehensive portfolio of wired and wireless solutions for demanding applications. | Faster speeds, robust connectivity for broadband, enterprise, and wireless. | Global internet traffic projected to exceed 200 zettabytes/month by 2025, driving demand. |

| Reliability and Performance | Robust infrastructure solutions for seamless network operation. | Reduced downtime, enhanced user experience, network stability. | Q3 2023 net sales increased 1.7% to $2.3 billion, reflecting strong demand for dependable solutions. |

| Future-Proofing and Innovation | Investment in R&D for next-gen technologies (Wi-Fi 7, DOCSIS 4.0). | Avoids costly overhauls, maintains network relevance, competitive edge. | Early adoption of standards ensures clients are ready for escalating future demands. |

| Operational Efficiency | AI-driven network monitoring and analytics (e.g., ServAssure NXT). | Proactive issue resolution, reduced costs, improved customer experience. | Telecommunication companies heavily investing in network automation in 2024 to combat rising OpEx. |

Customer Relationships

CommScope's dedicated account management teams are crucial for building strong ties with major telecommunications companies, data centers, and large enterprise clients. This personalized approach ensures they deeply understand each client's unique requirements.

These dedicated teams focus on fostering long-term partnerships, providing tailored support and proactive solutions. For instance, in 2024, CommScope continued to emphasize this strategy, aiming to enhance customer retention and identify new growth opportunities within its key accounts.

CommScope offers comprehensive technical support and professional services to ensure customers successfully deploy and leverage its advanced network solutions. This includes expert troubleshooting, seamless system integration, and ongoing optimization services, all designed to help clients maximize the return on their investment in CommScope's technology.

In 2024, CommScope’s commitment to customer success is underscored by its dedicated support teams. These professionals provide critical assistance for complex network rollouts, ensuring that clients can achieve peak performance and reliability from their infrastructure. This focus on post-sale support is vital for maintaining customer satisfaction and fostering long-term partnerships.

CommScope actively engages its key customers in the co-creation of new products and solutions. This collaborative process ensures that offerings are precisely aligned with evolving market needs and customer requirements, leading to more effective and relevant technological advancements.

For instance, in 2024, CommScope reported significant success in its customer collaboration initiatives, with a notable portion of its new product pipeline directly influenced by feedback from its top-tier clients. This strategy has demonstrably boosted customer satisfaction scores and accelerated product adoption rates in competitive segments.

Online Resources and Self-Service Portals

CommScope's online resources and self-service portals are designed to put information directly into customers' hands. These platforms offer extensive documentation, detailed knowledge bases, and intuitive self-service tools, allowing users to find answers and solve common problems on their own. This approach significantly boosts efficiency and ensures information is always accessible.

In 2024, CommScope continued to enhance its digital customer support. By providing readily available online information, the company aimed to reduce reliance on direct support channels for routine inquiries. This strategy is crucial for managing customer interactions effectively and scaling support operations.

- Extensive Online Documentation: Access to manuals, guides, and technical specifications.

- Knowledge Base: A searchable repository of articles, FAQs, and troubleshooting tips.

- Self-Service Portals: Tools for account management, order tracking, and support ticket submission.

- Improved Customer Efficiency: Enabling customers to resolve issues independently, saving time and resources.

Industry Events and Thought Leadership

CommScope actively participates in key industry events like Mobile World Congress and Cable-Tec Expo. These platforms are crucial for showcasing their latest innovations in fiber optics and wireless infrastructure to a wide audience. In 2023, CommScope reported significant engagement at these events, highlighting their commitment to driving the future of connectivity.

Publishing thought leadership content, including white papers and webinars, further solidifies CommScope's position as an industry expert. This strategy allows them to share insights on emerging trends such as 5G deployment and network virtualization, fostering deeper connections with customers and partners. Their content often garners thousands of downloads, demonstrating strong interest from the market.

- Industry Conferences: CommScope leverages events like CES and GITEX to connect with customers and showcase new products.

- Trade Shows: Participation in shows focused on broadband and enterprise networking allows for direct customer interaction and feedback.

- Thought Leadership: Publishing research on network evolution and sustainability helps build brand authority and customer trust.

- Community Building: Engaging in forums and hosting webinars fosters a sense of community around CommScope's technological advancements.

CommScope cultivates strong customer relationships through dedicated account management, ensuring deep understanding of client needs and fostering long-term partnerships. This personalized approach is complemented by comprehensive technical support and professional services, aimed at maximizing client ROI. Furthermore, CommScope actively involves key customers in co-creation, aligning product development with evolving market demands, a strategy that proved successful in 2024 with a notable portion of its new product pipeline influenced by client feedback.

Channels

CommScope's direct sales force is crucial for engaging major enterprise clients, telecom operators, and government bodies. This approach enables personalized solutions and fosters robust client relationships through direct negotiation.

In 2024, CommScope reported that its direct sales channel was instrumental in securing significant contracts within the telecommunications sector, contributing to their overall revenue growth.

CommScope leverages a vast global distributor network, comprising authorized distributors and resellers, to effectively reach a broad customer base. This extensive network is crucial for serving smaller businesses and regional service providers, significantly expanding market reach and establishing a vital local presence.

In 2024, CommScope continued to emphasize this channel strategy. For instance, their robust partner programs are designed to equip these distributors with the necessary training and support to effectively market and sell CommScope’s comprehensive portfolio of connectivity solutions, ranging from fiber optic cables to wireless infrastructure components.

CommScope actively utilizes its corporate website, a central hub for product specifications, investor relations, and company updates, alongside a strategic presence on platforms like LinkedIn and Twitter. These digital channels are crucial for disseminating information and fostering engagement with a global audience of customers, partners, and potential employees. In 2024, the company continued to invest in digital marketing, focusing on content tailored to specific industry needs to drive lead generation and enhance brand visibility within the telecommunications and enterprise networking sectors.

Strategic Partnerships and Alliances

CommScope leverages strategic partnerships and alliances as crucial indirect channels, integrating its solutions into broader technology ecosystems. These collaborations, particularly with system integrators, allow CommScope's products to be embedded within larger projects and solutions, effectively extending its market reach. For instance, in 2024, the company continued to foster relationships with key players in the cloud and data center industries, enabling its connectivity solutions to be part of comprehensive infrastructure deployments.

These alliances are vital for accessing new customer segments and geographies that might be difficult to penetrate directly. By working with partners who have established relationships and expertise in specific verticals, CommScope can more effectively deliver its value proposition. The company’s focus in 2024 included strengthening ties with telecommunications providers and enterprise IT solution providers, thereby gaining access to a wider array of end-users and project opportunities.

- Technology Partnerships: Collaborations with chipset manufacturers and software providers ensure CommScope’s hardware integrates seamlessly with leading-edge technologies, enhancing solution offerings.

- System Integrator Alliances: Partnering with system integrators allows CommScope to be a component within larger, complex network deployments, reaching diverse enterprise and service provider markets.

- Market Expansion: These channels are instrumental in penetrating new vertical markets, such as smart cities and advanced manufacturing, by leveraging partners' existing customer bases and domain expertise.

- Solution Bundling: Strategic alliances enable the bundling of CommScope’s connectivity products with complementary technologies, creating more attractive and comprehensive solutions for customers.

Industry Events and Trade Shows

CommScope actively participates in key industry events like Mobile World Congress (MWC) and Cable-Tec Expo. These exhibitions are crucial for demonstrating their latest innovations in network infrastructure, from 5G solutions to fiber optics. In 2024, companies across the telecommunications sector, including CommScope's competitors, invested significantly in booth presence and speaking opportunities to capture market attention and generate leads.

These trade shows offer unparalleled opportunities for direct engagement. CommScope can showcase new product capabilities, gather immediate feedback from potential clients, and foster stronger connections with existing partners. For instance, at MWC 2024, CommScope highlighted advancements in their passive optical network (PON) technology, a key area for network operators looking to upgrade their infrastructure.

- Product Showcase: Demonstrating new technologies like advanced fiber solutions and 5G small cell components.

- Networking: Connecting with potential customers, partners, and industry influencers.

- Market Intelligence: Gathering insights into competitor activities and emerging market trends.

- Brand Visibility: Reinforcing CommScope's position as a leader in connectivity solutions.

CommScope utilizes a multi-channel strategy to reach its diverse customer base. Direct sales are key for large enterprise and government contracts, while a broad distributor network serves smaller businesses. Digital channels and strategic partnerships extend market reach and integrate solutions into larger projects. Industry events provide crucial platforms for product showcases and direct engagement.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Engaging major enterprise clients, telecom operators, and government bodies for personalized solutions. | Instrumental in securing significant telecom contracts, contributing to revenue growth. |

| Distributor Network | Global network of authorized distributors and resellers reaching a broad customer base, including smaller businesses. | Emphasis on partner programs to equip distributors with training and support for CommScope's portfolio. |

| Digital Channels (Website, Social Media) | Disseminating product info, investor relations, and company updates; fostering global engagement. | Continued investment in digital marketing with industry-specific content to drive lead generation and brand visibility. |

| Strategic Partnerships/Alliances | Integrating solutions into broader technology ecosystems, particularly with system integrators. | Fostering relationships with cloud and data center industries for comprehensive infrastructure deployments. |

| Industry Events | Participating in key exhibitions like MWC for product demonstrations and direct client engagement. | Showcasing advancements in PON technology at MWC 2024, highlighting innovation in network upgrades. |

Customer Segments

Telecommunications operators, both global giants and regional players, represent a core customer segment for CommScope. These companies depend on robust infrastructure to deliver broadband, cellular, and fiber optic services to their subscribers.

In 2024, the demand for 5G network expansion continues to drive significant investment from these operators. For instance, major carriers are investing billions in upgrading their infrastructure, creating a substantial market for CommScope's connectivity solutions.

CommScope's offerings are crucial for these operators to build out their high-speed data networks. This includes everything from fiber optic cables that form the backbone of modern communication to the small cells and antennas necessary for expanding mobile coverage.

Local and national internet service providers, including cable operators, are a crucial customer segment for CommScope. These companies depend on CommScope for essential network equipment, such as DOCSIS 4.0 solutions, and advanced fiber optic connectivity. This enables them to offer the high-speed internet services their subscribers demand.

In 2024, the demand for faster internet speeds continues to drive significant investment in network upgrades by these providers. For instance, the ongoing rollout of DOCSIS 4.0 technology, where CommScope is a key player, is designed to deliver symmetrical multi-gigabit speeds, crucial for supporting bandwidth-intensive applications and the growing number of connected devices.

Enterprise customers, spanning all industries and sizes, rely on dependable and secure communication networks to drive their daily operations. CommScope addresses this fundamental need by providing essential wired and wireless solutions tailored for corporate campuses, high-demand data centers, and diverse enterprise settings.

In 2024, the global enterprise network infrastructure market was valued at approximately $130 billion, with a projected compound annual growth rate of over 7% through 2029, highlighting the significant demand for CommScope's offerings.

Data Center and Cloud Providers

Data center and cloud providers are a critical customer segment, demanding cutting-edge connectivity solutions. These entities, including hyperscalers and major cloud service operators, require robust fiber optic and copper cabling to manage their vast and growing infrastructure. The increasing adoption of AI and the resulting surge in data traffic directly fuels their need for high-density, high-performance networking components.

This segment is characterized by its continuous investment in network upgrades and expansion to accommodate escalating workloads. For instance, global data center construction spending was projected to reach hundreds of billions of dollars in 2024, underscoring the immense scale of infrastructure development. CommScope's solutions are vital for these providers to achieve the necessary bandwidth and reliability.

- Hyperscale Data Centers: These massive facilities, operated by companies like Amazon Web Services, Microsoft Azure, and Google Cloud, are the backbone of the internet and require the highest density and performance cabling.

- Cloud Service Providers: Beyond hyperscalers, a broad range of cloud providers rely on advanced cabling to deliver scalable and reliable services to their end-users.

- AI Workload Demands: The exponential growth of AI training and inference necessitates cabling that can handle extreme data throughput and low latency.

- Infrastructure Expansion: Ongoing global expansion of data center capacity, driven by digital transformation and cloud adoption, presents a consistent demand for advanced connectivity.

Government and Public Sector

Government agencies and public sector entities rely heavily on robust and secure communication networks to deliver essential services, from public safety to smart city infrastructure. CommScope’s solutions are designed to meet these stringent demands, ensuring reliable connectivity for critical operations.

CommScope's commitment to Buy America, Build America (BABA) compliance is particularly relevant for government clients. This ensures that products used in federally funded projects meet specific domestic sourcing requirements, a key consideration for public sector procurement. For instance, in 2024, federal spending on infrastructure projects, many of which involve communication technology upgrades, continued to be a significant driver for government technology adoption.

- Critical Infrastructure Support: Providing secure and reliable networks for public safety, utilities, and transportation.

- Smart City Enablement: Facilitating the deployment of IoT devices and data management for urban development.

- BABA Compliance: Offering products that meet domestic sourcing requirements for federally funded initiatives.

- Long-Term Reliability: Delivering solutions designed for durability and performance in demanding public sector environments.

CommScope serves a diverse customer base, with telecommunications operators being a primary focus. These companies, from global leaders to regional providers, are actively investing in 5G expansion and fiber optic upgrades in 2024, creating substantial demand for CommScope's advanced connectivity solutions. The company's offerings are essential for building out high-speed data networks, supporting everything from cellular coverage to broadband delivery.

Cost Structure

CommScope's commitment to innovation means a substantial portion of its expenses goes into Research and Development. This is crucial for staying ahead in the rapidly evolving telecommunications and networking industry, where new technologies emerge constantly.

These R&D costs encompass a wide range of expenditures, from the salaries of highly skilled engineers and scientists to the upkeep of advanced laboratories and the creation of prototypes for new product designs. In 2023, CommScope reported R&D expenses of $394.9 million, highlighting the significant financial commitment to developing next-generation solutions.

CommScope's manufacturing and production costs are a significant component of its business model. These expenses encompass the procurement of essential raw materials like fiber optic cable and copper, which are fundamental to their product lines. In 2023, the company reported that its cost of sales, which includes these direct manufacturing expenses, was approximately $5.4 billion.

Labor costs for the skilled workforce involved in assembly and production, along with the operational expenses of running manufacturing facilities, also represent substantial outlays. Furthermore, the ongoing maintenance and upgrades of specialized equipment are critical to ensuring product quality and production efficiency, adding to the overall cost structure.

The strategic expansion of CommScope's manufacturing capabilities within the United States, aimed at strengthening domestic supply chains and meeting growing demand, has also contributed to these capital and operational expenditures. This investment in U.S.-based production is a key factor influencing their manufacturing cost base.

CommScope's Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, encompassing salaries for its sales, marketing, and administrative personnel, as well as corporate overhead and essential legal and financial services. In 2023, CommScope reported SG&A expenses of $1.5 billion, reflecting the substantial investment in its go-to-market strategy and operational infrastructure.

The company actively seeks to enhance operational efficiency, with a key focus on optimizing SG&A costs. For instance, initiatives aimed at streamlining administrative processes and leveraging technology for sales support are ongoing strategies to manage these expenditures effectively and improve profitability.

Supply Chain and Logistics Costs

CommScope’s supply chain and logistics costs are a significant component of its operating expenses. These costs encompass the movement of raw materials and finished goods globally, including freight charges, warehousing, and inventory holding. For instance, in 2023, the company reported that fluctuations in transportation costs and supply chain disruptions directly impacted its profitability. The complexity of managing a worldwide network means that customs duties and tariffs also contribute to these expenses.

Managing these global operations involves substantial investment in infrastructure and technology to ensure efficiency and mitigate risks. Supply chain instability, as seen with global shipping challenges in recent years, can lead to unexpected cost increases for CommScope. For example, the average cost to ship a 40-foot container from Asia to the US saw significant volatility throughout 2023, impacting companies like CommScope that rely on international sourcing.

- Transportation: Costs associated with shipping raw materials and finished products via air, sea, and land.

- Warehousing: Expenses for storing inventory in strategically located facilities worldwide.

- Inventory Management: Costs related to holding and managing stock levels to meet demand efficiently.

- Customs and Duties: Fees and taxes incurred when importing or exporting goods across international borders.

Debt Servicing Costs

CommScope's cost structure is heavily influenced by debt servicing costs due to its significant financial leverage. In 2023, the company reported interest expenses of approximately $740 million, a substantial outflow directly tied to its outstanding debt obligations.

To manage these considerable interest payments, CommScope has actively engaged in refinancing activities. These efforts aim to optimize the terms of its existing debt, potentially lowering interest rates and extending maturity dates, thereby easing the burden on its cash flow.

- Interest Expenses: CommScope's annual interest expense represents a major fixed cost, directly impacting profitability.

- Debt Refinancing: The company's strategic moves to refinance debt are crucial for mitigating the impact of high-interest rates and managing its overall debt profile.

- Impact on Cash Flow: Significant debt servicing costs reduce the capital available for reinvestment, operational expansion, or shareholder returns.

CommScope's cost structure includes significant expenditures on research and development, manufacturing, and selling, general, and administrative (SG&A) activities. In 2023, R&D costs were $394.9 million, cost of sales (including manufacturing) was approximately $5.4 billion, and SG&A expenses were $1.5 billion. These figures underscore the substantial investment in innovation, production, and market presence.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Research & Development | 394.9 | Engineering salaries, lab upkeep, prototyping |

| Cost of Sales (Manufacturing) | ~5,400 | Raw materials, labor, facility operations |

| Selling, General & Administrative (SG&A) | 1,500 | Sales/marketing staff, corporate overhead, legal/financial services |

Revenue Streams

CommScope's main income source is selling physical network gear. Think fiber optic and copper cables, antennas, and other connectivity hardware. These products serve key areas like their Connectivity and Cable Solutions (CCS), RUCKUS networking, and Access Network Solutions (ANS) divisions.

In 2024, the company continued to see strong demand for its infrastructure solutions. For instance, their CCS segment, which includes cabling and connectivity, remained a significant contributor to overall revenue, driven by ongoing 5G deployments and data center expansion projects globally.

CommScope generates significant revenue through software and licensing fees, particularly for its RUCKUS One platform. This recurring income stream complements hardware sales, offering customers ongoing access to advanced network management and control capabilities.

The company also licenses its virtual CMTS (Cable Modem Termination System) solutions, providing a flexible and scalable option for broadband service providers. These software-based offerings are crucial for modernizing network infrastructure and are a key part of CommScope's strategy to capture recurring revenue.

CommScope generates significant revenue through post-sales services and support contracts. These offerings, which include installation, ongoing maintenance, and specialized technical support, are crucial for customer retention and recurring income. For instance, many customers opt for multi-year support agreements, providing a predictable revenue stream.

Professional consulting services also form a vital part of this revenue stream. CommScope's expertise in network design and deployment allows them to offer valuable advice and project management, further solidifying customer relationships and generating additional income beyond initial product sales. This focus on comprehensive solutions ensures long-term customer engagement.

Strategic Divestitures

Strategic divestitures represent a significant, albeit non-operational, revenue stream for CommScope. In recent periods, the company has realized substantial cash inflows from the sale of non-core assets. For instance, the divestiture of the Connectivity and Cable Solutions (CCS) segment, along with Outdoor Wireless Networks (OWN) and Distributed Antenna Systems (DAS) business units, generated considerable proceeds.

These strategic sales are crucial for optimizing the company's portfolio and improving financial flexibility. For example, in 2023, CommScope completed the sale of its Home Networks business to Axiata Digital Labs for $400 million, a move aimed at streamlining operations and focusing on core growth areas.

- Divestiture Proceeds: Significant cash generation from the sale of business units like CCS, OWN, and DAS.

- Portfolio Optimization: Strategic sales help CommScope focus on its core competencies and growth initiatives.

- Financial Flexibility: These inflows provide capital for debt reduction, reinvestment, or shareholder returns.

- Example Transaction: The 2023 sale of the Home Networks business for $400 million highlights this revenue stream.

Subscription-Based Services

CommScope is increasingly leaning on subscription-based services as a key revenue driver. This shift is exemplified by offerings like RUCKUS One, which provides customers with access to network management and analytics on a recurring basis.

This model fosters predictable income streams and cultivates deeper, ongoing engagement with clients. For instance, in the first quarter of 2024, CommScope reported that its Broadband Communities segment, which includes many of its service offerings, saw a notable increase in recurring revenue, contributing to overall financial stability.

- RUCKUS One Adoption: Growing uptake of RUCKUS One signifies a successful transition towards subscription models.

- Recurring Revenue Growth: Subscription services are a significant contributor to CommScope's predictable revenue.

- Customer Retention: The subscription model enhances customer loyalty and long-term relationships.

- Q1 2024 Performance: The Broadband Communities segment, bolstered by services, demonstrated positive revenue trends.

CommScope's revenue streams are diverse, encompassing hardware sales, software licensing, and recurring services. The company's Connectivity and Cable Solutions (CCS) segment, a major revenue generator, continues to benefit from robust demand in 2024, fueled by global 5G network build-outs and data center expansion. Furthermore, software and subscription-based services, such as those offered through the RUCKUS One platform, are increasingly vital, providing predictable recurring income and enhancing customer engagement.

| Revenue Stream | Description | Key Drivers / Examples | 2024 Relevance |

| Hardware Sales | Physical network infrastructure products | Fiber optic cables, antennas, connectivity hardware (CCS, ANS) | Continued strong demand from 5G and data centers |

| Software & Licensing | Fees for network management software and virtual solutions | RUCKUS One platform, virtual CMTS solutions | Recurring revenue growth, modernization of networks |

| Services & Support | Post-sales support, maintenance, and consulting | Installation, technical support, network design consulting | Customer retention, predictable income streams |

| Subscription Services | Recurring access to network management and analytics | RUCKUS One subscriptions | Fostering predictable income, Q1 2024 Broadband Communities segment growth |

Business Model Canvas Data Sources

The CommScope Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and competitive intelligence. This multi-faceted approach ensures a comprehensive understanding of our market position and strategic direction.