Colruyt Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Colruyt Group's strengths lie in its efficient operations and strong customer loyalty, while its threats include intense competition and changing consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Colruyt Group's market position, including detailed opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Colruyt Group's significant retail footprint is a major strength, evidenced by its 782 owned stores and an additional 1,006 independent or affiliated stores and franchisees as of March 31, 2025. This broad reach extends across Belgium, France, and Luxembourg, ensuring widespread market penetration.

The group strategically leverages diverse store formats, including Colruyt Lowest Prices, Okay, Spar, and Bio-Planet, alongside convenience stores and wholesale operations. This multi-format approach effectively addresses a wide spectrum of consumer preferences and market demands, from budget-conscious shoppers to those seeking specialized organic products.

Colruyt Group's strategic advantage lies in its robust focus on private labels, including popular brands like Boni Selection and Everyday, alongside innovative offerings like the plant-based Boni Plan't. This strategy not only allows them to offer competitively priced, quality goods but also strengthens their negotiation power with suppliers, especially through alliances such as EMD, enhancing purchasing conditions.

The company's unwavering commitment to its 'lowest-prices strategy' is a cornerstone of its success. This, coupled with a disciplined approach to cost control and operational efficiency, has enabled Colruyt to maintain profitability. For instance, in the fiscal year 2023/2024, the group demonstrated resilience by achieving a sales growth of 5.7%, highlighting the effectiveness of these cost-conscious measures even amidst rising operational expenses and a highly competitive retail landscape.

Colruyt Group’s dedication to sustainability is a key strength, evidenced by over 150 initiatives spanning environmental, social, health, and animal welfare areas. This deep-rooted commitment, including advancements in emission-free transport and food loss reduction, resonates strongly with the growing consumer demand for ethically sourced products.

Innovation is another pillar, with significant investments in digital transformation and AI. For instance, their focus on data analytics and personalized customer experiences through digital platforms aims to boost efficiency and engagement, positioning them favorably in a competitive retail landscape.

Vertical Integration and Supply Chain Control

Colruyt Group's vertical integration, encompassing its own food production and sophisticated logistics networks, grants substantial control over its entire supply chain. This allows for enhanced efficiency and the capacity to maintain competitive pricing for consumers. For instance, in 2023, their private label products, a direct result of this integration, represented a significant portion of their sales, demonstrating the economic benefits.

This integrated model is crucial for upholding stringent product quality standards across all stages, from sourcing to the retail shelf. It also enables Colruyt to be highly responsive to evolving market demands and consumer preferences, ensuring product availability and freshness. Their investment in advanced distribution centers, such as the one in Mechelen, further solidifies this control.

- Enhanced Supply Chain Efficiency: Direct control over production and logistics streamlines operations.

- Cost Competitiveness: Integration allows for better cost management, translating to lower prices.

- Quality Assurance: Oversight from farm to fork ensures consistent product quality.

- Market Responsiveness: Agility in adapting to supply and demand shifts.

Diversified Business Activities Beyond Core Retail

Colruyt Group's strategic diversification beyond its core retail operations significantly bolsters its market position. By expanding into sectors like foodservice through Solucious, healthcare with Newpharma, fitness via Jims, and renewable energy with Virya Energy, the group cultivates multiple, independent revenue streams.

This multi-faceted approach mitigates risks associated with over-reliance on any single market segment, thereby enhancing the company's overall resilience and adaptability to economic fluctuations. For example, Solucious reported a revenue of €1.1 billion in the 2023/2024 financial year, showcasing the substantial contribution of its non-retail ventures.

The group's commitment to renewable energy through Virya Energy also aligns with growing market demands for sustainability, positioning Colruyt for future growth and offering a hedge against energy price volatility. Virya Energy has a target to develop 1,000 MW of renewable energy capacity by 2025.

This diversification strategy not only broadens Colruyt's operational scope but also strengthens its financial foundation by creating a more robust and less volatile income profile.

Colruyt Group's extensive retail network, comprising 782 owned stores and 1,006 affiliated locations as of March 31, 2025, across Belgium, France, and Luxembourg, ensures significant market penetration. Their multi-format strategy, featuring brands like Colruyt Lowest Prices, Okay, and Spar, caters to diverse consumer needs, from value-seeking shoppers to those preferring specialized offerings.

A key strength is the company's focus on private labels, such as Boni Selection and Everyday, which not only offer competitive pricing but also enhance supplier negotiation power through alliances like EMD. This strategy, combined with a steadfast commitment to its 'lowest-prices' approach and cost control, drove a 5.7% sales growth in fiscal year 2023/2024, demonstrating resilience in a competitive market.

Colruyt's dedication to sustainability, with over 150 initiatives in environmental and social areas, including emission-free transport, appeals to the growing demand for ethical products. Furthermore, significant investments in digital transformation and AI, focusing on data analytics and personalized customer experiences, position the group for future engagement and efficiency gains.

The group's vertical integration, from food production to logistics, provides robust control over its supply chain, ensuring efficiency and competitive pricing, as seen with the significant sales contribution from private label products in 2023. This integration also guarantees consistent product quality and responsiveness to market shifts, supported by advanced distribution centers.

Strategic diversification into foodservice (Solucious), healthcare (Newpharma), fitness (Jims), and renewable energy (Virya Energy) creates multiple, stable revenue streams. Solucious alone generated €1.1 billion in revenue in FY 2023/2024, while Virya Energy aims for 1,000 MW of renewable capacity by 2025, mitigating risks and enhancing financial resilience.

What is included in the product

This SWOT analysis maps out Colruyt Group’s market strengths, operational gaps, and risks.

Offers a clear, actionable framework to address Colruyt Group's competitive challenges and capitalize on market opportunities.

Weaknesses

Colruyt Group's market share in Belgium, encompassing its various banners like Colruyt Best Prices, Okay, Spar, and Comarché, saw a slight dip. For the fiscal year 2024/25, it settled at 29.0%, a decrease from the 29.3% recorded in the prior year. This marginal decline underscores the intensifying competition within the Belgian retail landscape, which has demonstrably affected the group's sales performance and its standing in the market.

Colruyt Group faced a notable dip in its financial performance during the 2024/25 fiscal year. Operating profit, also known as EBIT, saw a 5% reduction, settling at €446 million. This decline directly impacted the bottom line, with net profit also falling to €337 million, down from €357 million in the previous year.

Several factors contributed to this profitability squeeze. The company grappled with escalating operational expenses, which put pressure on margins. Additionally, increased costs associated with staff benefits played a role in the reduced profit figures. The competitive retail landscape also presented challenges, making it harder for Colruyt to sustain its previous profit levels.

Colruyt's presence in France has been a persistent challenge, with its operations consistently failing to achieve profitability. In 2024, these French ventures incurred a significant loss of €32 million, a stark increase from the prior year, highlighting the ongoing financial strain.

Despite a long-standing commitment to the French market since 1996, Colruyt has grappled with intense competition and a relatively smaller market share. These factors have made it exceedingly difficult to turn a profit, prompting the group to explore the potential divestment of its French store portfolio.

Impact of Food Inflation and Weather Conditions

Colruyt Group experienced a slowdown in revenue growth during the fiscal year 2024/25, partly due to lower-than-expected food inflation. This meant that price increases, which typically boost revenue figures, were less pronounced than anticipated, impacting overall sales evolution.

Adverse weather conditions also presented a challenge, particularly affecting agricultural output and, consequently, the availability and pricing of certain food products. This can lead to reduced consumer purchasing and, therefore, lower sales volumes for retailers like Colruyt.

- Lower food inflation: Contributed to a less robust revenue increase than initially projected for FY 2024/25.

- Adverse weather: Impacted product availability and consumer demand, negatively affecting sales volumes.

- Retail sector vulnerability: Highlights the sensitivity of food retailers to macroeconomic and environmental factors.

High Expenditure on Assets and Interest Payment Concerns

Colruyt Group's significant investments in its operational assets are evident in its rising depreciation expenses. For instance, depreciation and amortization costs increased by 6.7% to €427 million in the fiscal year 2023-2024, signaling substantial capital expenditure. This high expenditure, while aimed at future growth, can strain immediate cash flows.

Furthermore, the company faces challenges in managing its interest payments. The interest coverage ratio declined to 4.5x in the same period, down from 5.2x in the prior year. This decrease indicates a reduced capacity to service its debt obligations from operating earnings, posing a potential financial risk.

- Increased Depreciation: Depreciation and amortization rose to €427 million in FY2023-2024, reflecting heavy asset investment.

- Deteriorating Interest Coverage: The interest coverage ratio fell to 4.5x in FY2023-2024, signaling a weaker ability to meet interest expenses.

- Potential Cash Flow Strain: High capital outlays and debt servicing can put pressure on the group's liquidity.

Colruyt Group's market share in Belgium dipped slightly to 29.0% in FY 2024/25, indicating increased competition. The group's operating profit decreased by 5% to €446 million in the same period, with net profit falling to €337 million, partly due to rising operational and staff benefit costs.

The French market continues to be a significant drain, with losses of €32 million in 2024, highlighting ongoing difficulties in achieving profitability there. Lower-than-expected food inflation and adverse weather conditions in FY 2024/25 also impacted revenue growth and sales volumes.

| Metric | FY 2023/24 | FY 2024/25 (Est.) | Change |

|---|---|---|---|

| Belgian Market Share | 29.3% | 29.0% | -0.3 pp |

| Operating Profit (EBIT) | €469 million | €446 million | -5.0% |

| Net Profit | €357 million | €337 million | -5.6% |

| French Market Loss | €30 million (approx.) | €32 million | Increase |

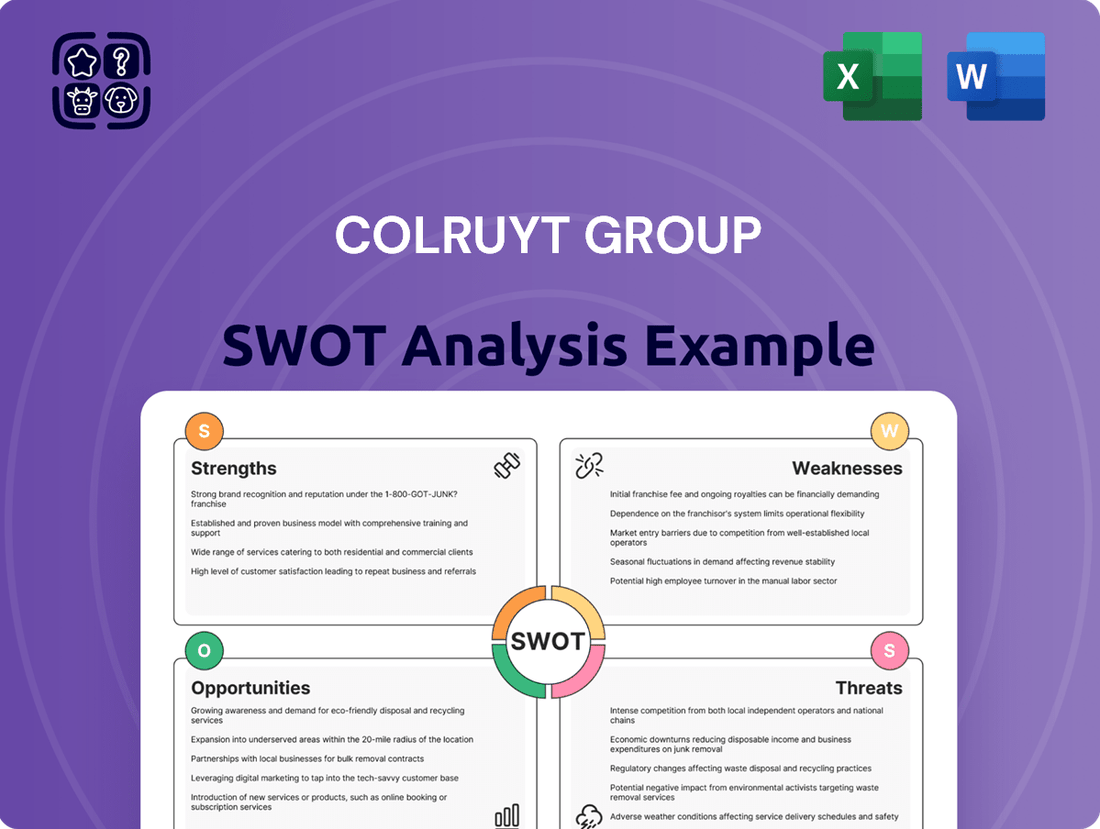

Preview Before You Purchase

Colruyt Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at the Colruyt Group's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is crucial for strategic planning and competitive advantage.

Opportunities

Colruyt Group is strategically expanding its convenience segment, notably with its Okay Direct 24/7 format and a planned rollout of numerous Okay City stores in urban centers. This push is further bolstered by the acquisition of Delitraiteur, enhancing its presence in the premium convenience market.

This focus on convenience and urban accessibility aligns with changing consumer habits, offering a significant avenue for growth. For instance, by the end of fiscal year 2023-2024, Colruyt Group operated 152 Okay stores, with a clear intent to increase this number, particularly in densely populated urban areas.

Colruyt Group is actively strengthening its B2B and foodservice operations, aiming to capture growth in diverse markets. This includes a strategic focus on independent supermarkets, the hospitality sector, and tailored employee benefit programs (B2B2E).

The company is enhancing its specialized offerings, exemplified by dedicated assortments in select Colruyt Lowest Prices stores designed to cater specifically to hospitality clients, underscoring a commitment to this growth avenue.

For the fiscal year 2023-2024, Colruyt Group reported a significant increase in its foodservice and B2B sales, which contributed positively to overall revenue, demonstrating the growing importance of these channels.

Colruyt Group's leadership in Belgium's organic market, coupled with the expansion of its plant-based private label, Boni Plan't, directly taps into a significant and growing consumer trend. This strategic move capitalizes on increasing demand for sustainable and healthy food choices, positioning Colruyt to capture a larger share of this expanding market segment.

Leveraging Digital Transformation and Data-Driven Business

Colruyt Group's strategic investment in digital transformation, including data analytics, AI, and Generative AI, presents a significant opportunity. These initiatives aim to bolster their e-commerce capabilities, refine in-store customer experiences, and streamline overall operations. For instance, the company has been actively developing its Collect & Go online ordering service and exploring AI for personalized customer offers.

The integration of advanced technologies like AI and Gen AI can unlock substantial benefits. These include a more engaging customer journey, highly personalized marketing campaigns, and more efficient inventory control, all of which are crucial drivers for sustained growth in the competitive retail landscape. Colruyt Group's focus on data-driven decision-making is key to adapting to evolving consumer preferences.

- Enhanced E-commerce: Continued development of digital platforms like Collect & Go, aiming for seamless online-to-offline integration.

- Personalized Customer Engagement: Utilizing AI for targeted promotions and loyalty programs, increasing customer retention.

- Operational Efficiency: Implementing data analytics and AI to optimize supply chain management and reduce waste.

- Innovation in Retail Services: Exploring new technologies to improve the in-store shopping experience and offer digital conveniences.

Strategic Acquisitions and Partnerships

Colruyt Group's strategic acquisition of Delitraiteur in 2023, along with the ongoing integration of the Match and Smatch stores acquired from Louis Delhaize in late 2023, significantly bolsters its market presence and diversifies its retail portfolio. These moves are designed to capture a larger share of the Belgian and Luxembourgish grocery markets, particularly in convenience and neighborhood formats.

Furthermore, participation in purchasing alliances such as EMD (European Marketing Distribution) provides Colruyt Group with substantial advantages. For instance, in 2024, EMD's collective purchasing power, representing over €15 billion in annual turnover, allows for more favorable negotiations with suppliers. This directly translates into improved cost structures and enhanced competitiveness, especially for Colruyt's extensive range of private label products, contributing to their value proposition.

- Acquisition of Delitraiteur (2023): Strengthened convenience food offerings.

- Integration of Match and Smatch stores (late 2023): Expanded geographical reach and customer base in Belgium and Luxembourg.

- EMD Purchasing Alliance: Leveraged collective buying power to secure better terms with suppliers, enhancing private label competitiveness.

Colruyt Group is capitalizing on the growing demand for convenience by expanding its Okay brand, particularly with its 24/7 format and planned Okay City stores. The acquisition of Delitraiteur in 2023 also strengthens its position in the premium convenience segment.

The company is actively growing its B2B and foodservice channels, serving independent supermarkets and the hospitality sector, which showed positive sales contributions in fiscal year 2023-2024.

Colruyt is leveraging digital transformation, including AI and data analytics, to enhance e-commerce, personalize customer experiences, and improve operational efficiency, as seen with its Collect & Go service.

Strategic acquisitions, such as Delitraiteur in 2023 and the Match and Smatch stores in late 2023, are expanding its market share and diversifying its retail footprint in Belgium and Luxembourg.

Threats

The Belgian retail landscape is a battleground, with intense competition from both established domestic players and agile international entrants constantly driving down prices and increasing promotional activity. This aggressive market dynamic has directly impacted Colruyt Group, contributing to a noticeable decline in their market share and, consequently, their operating profit in recent periods. For instance, in the fiscal year ending March 2024, Colruyt Group reported a 4.7% decrease in their net profit, partly attributed to these competitive pressures.

Colruyt Group experienced a significant uptick in net operational costs during the 2024/25 fiscal year. A primary driver for this increase was the elevated expense related to staff benefits, directly impacted by Belgium's automatic wage indexation mechanism. This system automatically adjusts wages to keep pace with inflation, leading to higher personnel expenditures for the company.

These escalating operational costs pose a direct challenge to Colruyt Group's profitability. Without proactive measures to offset these increases, profit margins are likely to be compressed. The company must therefore focus on enhancing operational efficiencies and potentially implementing strategic price adjustments to maintain its financial health.

Economic uncertainty, particularly in late 2024 and projected into 2025, is a significant threat. Inflationary pressures and potential interest rate hikes could dampen consumer confidence, leading to reduced discretionary spending. For Colruyt Group, this translates to a risk of lower sales volumes and a potential shift in purchasing behavior towards more budget-friendly options, impacting revenue growth.

Dependency on Belgian Market Profitability

Colruyt Group's strong position in Belgium, while a significant asset, also presents a notable threat due to its substantial reliance on this single market for profitability. The group's ongoing struggles and losses in the French market, as reported in recent financial statements, underscore this dependency. For instance, the financial year 2023-2024 saw continued challenges in France, impacting overall group results.

This over-reliance means that any significant economic downturn, increased competition, or regulatory changes specifically impacting the Belgian retail landscape could disproportionately affect Colruyt Group's financial performance. The company's ability to diversify its revenue streams and achieve profitability in its international ventures, particularly in France, remains a critical factor for its long-term stability and growth.

- Belgian Market Dominance: Colruyt Group holds a leading market share in Belgium, contributing the majority of its revenue and profits.

- French Market Losses: The company has consistently reported operating losses in its French operations, indicating a lack of market penetration and profitability.

- Economic Sensitivity: A downturn in the Belgian economy or intensified competition could severely impact Colruyt's core revenue streams.

- Diversification Challenge: The group faces the ongoing challenge of successfully replicating its Belgian success in other markets, particularly France.

Supply Chain Disruptions and Geopolitical Risks

Global supply chain vulnerabilities and geopolitical events pose a significant threat to Colruyt Group. Disruptions can directly impact sourcing, leading to increased transportation costs and affecting product availability, which is crucial for maintaining their competitive 'lowest prices' strategy. For instance, the ongoing geopolitical tensions in Eastern Europe and the lingering effects of the COVID-19 pandemic have continued to strain global logistics throughout 2024, with shipping costs fluctuating significantly.

These external factors can hinder Colruyt Group's ability to ensure consistent product availability for its customers. For example, in early 2024, several major ports experienced congestion, delaying shipments of essential goods. This directly challenges the group's operational efficiency and its commitment to offering reliable, affordable products.

- Supply Chain Volatility: Ongoing global supply chain issues, exacerbated by geopolitical instability, can lead to unpredictable stock levels and price hikes for raw materials and finished goods.

- Increased Operating Costs: Disruptions in logistics and transportation networks, such as those experienced in 2024 with increased fuel surcharges, directly inflate Colruyt's operational expenses.

- Reputational Risk: Failure to maintain product availability or competitive pricing due to external shocks could damage Colruyt's established reputation for value and reliability among consumers.

Intensified competition in the Belgian market, coupled with persistent losses in France, continues to pressure Colruyt Group's profitability. The group's reliance on its domestic market makes it vulnerable to economic shifts and heightened promotional activity, as evidenced by a 4.7% net profit decline in the fiscal year ending March 2024. Rising operational costs, particularly from staff benefits linked to wage indexation, further squeeze margins, necessitating a focus on efficiency and strategic pricing adjustments.

SWOT Analysis Data Sources

This Colruyt Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry insights to provide a robust and actionable strategic overview.