Colruyt Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

The Colruyt Group faces intense rivalry from established grocery players and the growing threat of online retailers, significantly impacting its market share. Bargaining power of buyers is high due to price sensitivity and abundant choices, while supplier power is moderate, influenced by private label strength. The threat of substitutes, though present, is less pronounced in the immediate grocery sector.

The complete report reveals the real forces shaping Colruyt Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Colruyt Group's robust private label strategy is a key factor in diminishing supplier bargaining power. This approach, which saw private label sales reach 33.7% of total sales in the fiscal year 2023-2024, allows Colruyt to exert more influence over sourcing and product development, thereby reducing reliance on external brand suppliers.

Colruyt Group’s immense purchasing power, driven by its scale as a major retail entity, significantly reduces supplier bargaining power. In 2024, its extensive network of stores across Belgium and France means it can negotiate preferential pricing and terms due to the sheer volume of goods it procures.

This leverage allows Colruyt to secure lower costs and more favorable delivery arrangements, directly impacting its profitability and competitive pricing strategy. For instance, its ability to place large, consistent orders provides suppliers with predictable revenue, further strengthening Colruyt’s negotiating position.

Colruyt Group's diverse business model, spanning food retail, non-food, foodservice, and renewable energy, means it engages with a vast and varied supplier base. This broad sourcing strategy inherently dilutes the bargaining power of any individual supplier or industry group, as Colruyt can readily switch to alternative providers. For instance, in its core food segment, the company's extensive network of food producers and distributors allows for significant negotiation leverage.

Supplier Power 4

Colruyt Group's strong emphasis on efficient distribution networks and its strategic exploration of vertical integration, including in-house production facilities and renewable energy generation, significantly curtails supplier power. By controlling more of its value chain, Colruyt reduces its reliance on external suppliers, thereby strengthening its negotiating position. For instance, their investment in energy production through wind turbines and solar parks lessens dependence on external energy suppliers, a key cost for retail operations.

This vertical integration strategy means Colruyt can potentially produce certain goods internally or secure raw materials more directly. This reduces the bargaining leverage of suppliers who might otherwise hold sway due to unique or essential inputs. The group's scale also allows for bulk purchasing, further enhancing its ability to negotiate favorable terms with its suppliers.

- Reduced Reliance: Colruyt's vertical integration, such as its own meat processing facilities, directly lessens dependence on external meat suppliers.

- Cost Control: In-house renewable energy generation, like their wind farm projects, mitigates the impact of fluctuating energy market prices, reducing supplier power in this critical area.

- Negotiating Strength: The group's substantial purchasing volume across its various brands provides significant leverage when negotiating prices and terms with suppliers.

- Supply Chain Efficiency: Colruyt's highly efficient logistics and distribution model, including its own transport fleet, gives it greater control over the supply chain, diminishing supplier influence.

Supplier Power 5

Supplier power within Colruyt Group's operations is generally moderate, largely due to the group's significant purchasing volume and focus on private label brands which reduces reliance on external suppliers for a substantial portion of their offerings. However, this dynamic shifts for certain specialized or highly demanded branded products where suppliers can leverage their unique market position.

Suppliers of distinctive or essential items that are specifically sought after by consumers can retain a degree of bargaining power. This leverage stems from the product's exclusivity or its strong brand recognition, making it difficult for Colruyt to substitute.

- Moderate Supplier Power: Colruyt's scale and private label strategy generally limit supplier leverage.

- Brand Leverage: Suppliers of popular, branded goods can exert more influence.

- Specialty Items: Unique or essential products with high consumer demand can command better terms.

- Strategic Sourcing: Colruyt actively manages supplier relationships to mitigate power imbalances.

Colruyt Group's bargaining power with suppliers is significantly bolstered by its substantial purchasing volume and its strategic emphasis on private labels. This allows the group to negotiate favorable terms and pricing, thereby limiting supplier leverage. For instance, in fiscal year 2023-2024, private label products constituted 33.7% of total sales, illustrating Colruyt's ability to control a significant portion of its product assortment.

| Factor | Colruyt's Position | Impact on Supplier Bargaining Power |

| Purchasing Volume | High due to extensive store network | Reduces supplier power through bulk negotiation |

| Private Label Strategy | Significant share of sales (33.7% in FY23-24) | Diminishes reliance on branded suppliers, increasing Colruyt's control |

| Vertical Integration | In-house production and energy generation | Further reduces dependence on external suppliers |

| Supplier Concentration | Diverse supplier base across segments | Dilutes power of individual suppliers |

What is included in the product

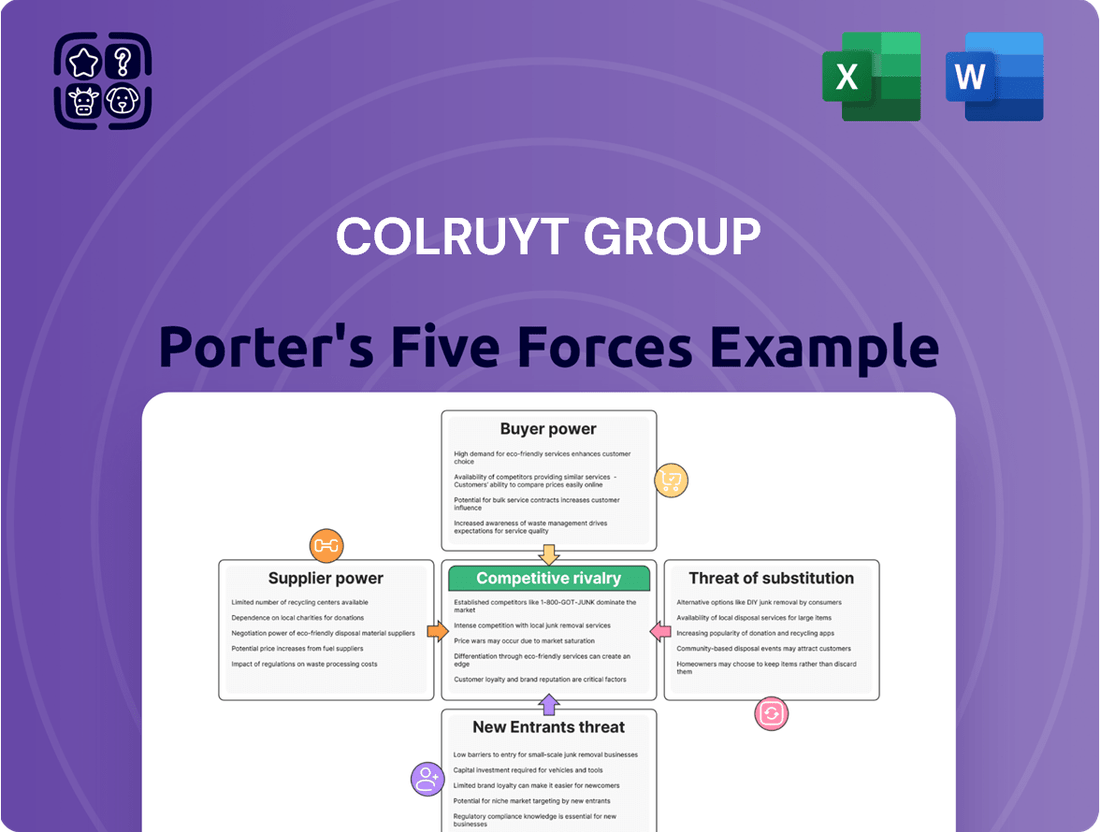

Tailored exclusively for Colruyt Group, analyzing its position within its competitive landscape by examining supplier and buyer power, threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic dashboard.

Customers Bargaining Power

Customers in the retail sector, including those served by Colruyt Group, wield significant bargaining power. This is largely due to the sheer volume of choices available to them, from traditional supermarkets to specialized stores and burgeoning online platforms. In 2023, the European grocery market alone saw continued growth in online sales, indicating a consumer willingness to explore and switch between channels based on price, convenience, and product offering.

Customer power at Colruyt Group is notably high, largely driven by intense price sensitivity within the food retail sector. In 2024, consumers have access to a wealth of information, readily comparing prices across various retailers through apps and online platforms, which puts direct pressure on pricing strategies.

This heightened awareness means customers can easily switch to competitors offering better deals, forcing Colruyt to maintain competitive pricing. For instance, during promotional periods, customers actively seek out and leverage discounts, further amplifying their influence on the group's revenue and profit margins.

Customer bargaining power is a significant force for retailers like Colruyt Group, especially given the low switching costs for consumers. In 2024, the competitive grocery landscape means shoppers can easily move between supermarkets based on price, promotions, or product availability. This ease of transition empowers customers to demand better value.

The ability for customers to readily compare prices and offerings across numerous retailers, including discount chains and online platforms, directly impacts Colruyt's pricing strategies and operational efficiency. For instance, if a competitor offers a similar product at a lower price, customers are likely to shift their spending, forcing Colruyt to remain highly competitive.

Customer Power 4

Customers of Colruyt Group wield significant bargaining power, largely driven by the widespread availability of information. Online platforms, price comparison sites, and social media provide unparalleled transparency, enabling consumers to easily compare offerings, read reviews, and make well-informed purchasing decisions. This heightened awareness directly influences their choices and expectations.

This informational advantage allows customers to readily identify the best prices and quality across various retailers. For instance, a 2024 report indicated that over 70% of European consumers use online resources to research products before making a purchase, a trend that strongly impacts grocery retailers like Colruyt Group.

- Increased Price Sensitivity: Customers can easily compare prices, forcing retailers to remain competitive.

- Demand for Quality and Service: Informed customers expect high standards of both product quality and customer service.

- Switching Costs: For many grocery items, the cost for customers to switch to a competitor is minimal, further enhancing their power.

- Influence of Online Reviews: Negative or positive reviews shared online can significantly sway purchasing decisions for a large segment of the customer base.

Customer Power 5

Colruyt Group actively works to reduce customer power by concentrating on its own private label brands and robust loyalty programs. These strategies aim to build strong customer relationships and offer unique value, making it less appealing for customers to switch to competitors. For instance, in the 2023-2024 fiscal year, Colruyt Group reported a sales increase, partly driven by the appeal of their private labels.

Despite these efforts, the retail landscape inherently allows for easy customer switching. This means Colruyt must consistently innovate and enhance the benefits offered through their loyalty schemes and private label products to maintain customer retention. The competitive nature of grocery retail necessitates continuous investment in customer experience and value proposition.

- Private Label Strength: Colruyt's private labels often provide a price advantage and perceived quality, directly countering customer price sensitivity.

- Loyalty Program Engagement: Programs like Xtra aim to increase purchase frequency and basket size by offering personalized discounts and rewards.

- Competitive Pricing: The group's commitment to affordability, even on national brands, limits customers' ability to leverage price as a primary switching factor.

- Market Share Resilience: While facing intense competition, Colruyt maintained a significant market share in Belgium, indicating some success in mitigating customer power.

The bargaining power of customers remains a significant force for Colruyt Group, amplified by the digital age’s transparency. In 2024, consumers have readily accessible price comparison tools and extensive online reviews, making it simple to identify the best value. This empowers shoppers to switch retailers based on even minor price differences or perceived improvements in quality and service.

| Metric | Value (2023/2024 Data) | Impact on Colruyt |

|---|---|---|

| Online Grocery Penetration (Europe) | Continued growth, exceeding 15% in many markets | Increases customer options and price comparison ease |

| Customer Price Sensitivity | High, especially for staple goods | Pressures Colruyt’s margins and necessitates competitive pricing |

| Loyalty Program Participation (Colruyt Xtra) | High engagement, with millions of active users | Aims to mitigate switching by offering personalized value |

| Private Label Share of Sales | Significant and growing for Colruyt | Offers a price advantage and differentiation, reducing reliance on national brands |

Preview the Actual Deliverable

Colruyt Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of the Colruyt Group through Porter's Five Forces, providing a comprehensive overview of industry rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. This analysis is fully formatted and ready for your strategic decision-making.

Rivalry Among Competitors

Colruyt Group faces significant competitive rivalry in the Belgian, French, and Luxembourg retail landscapes. The market is crowded with established domestic giants and aggressive international discounters, all vying for customer loyalty and market share. For instance, in Belgium, competitors like Carrefour and Delhaize (now part of the Ahold Delhaize group) maintain substantial market presence, while Lidl and Aldi exert considerable pressure through their low-price strategies.

This intense competition means that Colruyt must constantly innovate and optimize its operations to maintain its edge. The group's commitment to offering competitive prices, as seen with its €1.6 billion investment in price competitiveness in 2023, is a direct response to this rivalry. Such investments are crucial for retaining customers in a price-sensitive market where promotional activities are frequent and impactful.

Competitive rivalry within the Belgian grocery sector, where Colruyt Group primarily operates, is indeed intense. This is fueled by aggressive pricing, frequent promotions, and robust loyalty programs as retailers vie for market share. For instance, in 2023, the Belgian retail market saw significant price adjustments, with inflation impacting consumer spending and prompting retailers to engage in price-sensitive strategies to maintain customer loyalty.

These price wars directly squeeze profit margins for all players, including Colruyt. The constant need to offer competitive prices, often through discounts and special offers, forces companies to operate on thinner margins, making operational efficiency and cost control paramount for survival and profitability in this dynamic environment.

Competitive rivalry within the grocery sector is intense, with companies like Colruyt Group constantly seeking differentiation. Key battlegrounds include the strength of private labels, commitment to sustainability, offering convenience, and superior customer service. Colruyt Group effectively utilizes its strong private label offerings, such as Boni Selection, and its highly efficient distribution network to carve out a distinct position in this highly competitive landscape.

Competitive Rivalry 4

The retail markets in Belgium and France, where Colruyt Group primarily operates, are quite mature and saturated. This means there's not a lot of new space for growth, so companies are really fighting for every customer. In 2023, the Belgian food retail market saw a slight volume decrease, indicating this intense competition where gains often come at the expense of others.

This maturity often translates into a zero-sum game, where one retailer's gain is another's loss. Competitors are frequently engaged in aggressive pricing strategies and promotional activities to capture market share. For example, in 2024, discounters continued to put pressure on traditional supermarkets through competitive pricing, forcing established players to react.

- Mature Markets: Belgium and France exhibit high levels of retail market saturation.

- Zero-Sum Environment: Limited organic growth opportunities drive intense competition for existing market share.

- Aggressive Tactics: Competitors frequently employ price wars and promotions to gain an edge.

- Discounters' Impact: Discount retailers continue to exert significant pressure on established players in 2024.

Competitive Rivalry 5

Competitive rivalry within the Belgian food retail sector is notably intense, driven by Colruyt Group's diverse store formats. The company operates large hypermarkets like those under the Carrefour banner, which are direct competitors, alongside smaller convenience stores and a growing online presence. This multi-format strategy means Colruyt is not only competing with similar large-scale retailers but also with smaller, localized shops and e-commerce platforms, each catering to distinct consumer preferences and shopping occasions.

Colruyt Group's strategic adaptation across these varied formats is crucial for maintaining market share. For instance, while its hypermarkets compete on price and product breadth, its smaller formats and online channels must differentiate through convenience and tailored assortments. This broad competitive landscape, encompassing everything from traditional supermarkets to discounters and online grocery services, forces continuous innovation and efficient operations to meet diverse customer demands.

- Diverse Retail Formats: Colruyt Group's operations span hypermarkets, convenience stores, and online platforms, creating a complex competitive environment.

- Adaptation Imperative: The need to cater to different consumer needs and shopping occasions across these formats necessitates constant strategic adjustments.

- Market Share Pressure: Intense competition from various retail types means Colruyt must remain agile and responsive to market dynamics to retain its customer base.

- Innovation Driver: The multi-faceted rivalry encourages Colruyt to innovate in pricing, product offerings, and customer experience across its entire retail ecosystem.

Competitive rivalry in Colruyt Group's core markets, particularly Belgium and France, is exceptionally fierce. This is due to market saturation and the presence of strong, established players alongside aggressive discounters. For example, in 2023, the Belgian food retail market experienced a slight volume contraction, intensifying the fight for every customer, with discounters like Lidl and Aldi continuing to exert significant price pressure in 2024.

Colruyt's response involves substantial investment in price competitiveness, with €1.6 billion allocated in 2023, highlighting the direct impact of rivalry on profit margins. This necessitates a constant focus on operational efficiency and cost control to maintain profitability in a market characterized by frequent promotions and price wars.

The group differentiates itself through strong private labels, such as Boni Selection, and an efficient distribution network. However, competitors also leverage similar strategies, including loyalty programs and promotional activities, to capture market share, making differentiation a continuous challenge.

| Competitor | Primary Market Presence | Key Competitive Strategy |

|---|---|---|

| Carrefour | Belgium, France | Broad product range, hypermarket format, price promotions |

| Delhaize (Ahold Delhaize) | Belgium | Strong local presence, convenience formats, loyalty programs |

| Lidl | Belgium, France | Aggressive low-price strategy, private label focus |

| Aldi | Belgium, France | Discount pricing, efficient operations, limited assortment |

SSubstitutes Threaten

The threat of substitutes for traditional brick-and-mortar grocery retail is substantial, primarily driven by the burgeoning online grocery delivery sector. These digital platforms provide consumers with unparalleled convenience, often coupled with a broader product assortment than a single physical store can offer. For Colruyt Group, this means customers have readily accessible alternatives to visiting their physical supermarkets.

In 2024, the online grocery market continued its upward trajectory, with reports indicating significant growth in penetration rates across Europe. For instance, in key markets where Colruyt operates, online grocery sales are projected to capture an increasing share of the total grocery market, potentially reaching double-digit percentages by the end of the year. This shift in consumer behavior directly challenges the traditional retail model by offering a compelling substitute for the in-store shopping experience.

Specialty food stores, local markets, and farm-to-table initiatives present a growing threat of substitutes for Colruyt Group. These alternatives cater to consumers seeking unique, artisanal, or locally sourced products, which traditional supermarkets may not fully address. For instance, the organic food market in Belgium, a key market for Colruyt, saw continued growth in 2023, with an increasing number of consumers willing to pay a premium for such products.

Meal kit delivery services are emerging as a significant substitute threat to Colruyt Group. These services, which provide pre-portioned ingredients and recipes, directly cater to the consumer's need for convenient meal solutions. This directly challenges Colruyt's core grocery business by offering an alternative to traditional shopping for dinner preparation.

4

The threat of substitutes for Colruyt Group is significant, primarily stemming from the foodservice sector. Restaurants, cafes, and ready-to-eat meal providers offer alternatives to traditional grocery shopping and home cooking. Consumers choosing to dine out or purchase prepared meals directly reduce their need for raw ingredients from retailers like Colruyt.

This trend is particularly relevant given evolving consumer lifestyles and convenience demands. In 2024, the global food delivery market is projected to continue its robust growth, indicating a sustained shift towards convenient meal solutions. For instance, the European food delivery market alone saw substantial expansion in recent years, with many consumers prioritizing time-saving options over in-store grocery shopping.

The availability and increasing variety of convenient food options directly impact grocery retailers. Colruyt must acknowledge that:

- Consumers are increasingly opting for prepared meals and dining out, diverting spending from grocery stores.

- The convenience factor of foodservice alternatives reduces the necessity for customers to purchase and prepare their own food.

- Innovations in ready-to-eat meals and meal kits further strengthen the substitute threat.

- Economic conditions can influence consumer choices between cooking at home and dining out.

5

For Colruyt Group's non-food offerings, the threat of substitutes is significant, particularly from direct-to-consumer (DTC) brands and specialized online retailers. These channels frequently provide niche products or distinctive shopping experiences that can draw consumer spending away from broader retailers.

For instance, the rise of online marketplaces and specialized e-commerce sites means consumers can easily find alternatives to Colruyt's non-food categories, such as electronics, home goods, or apparel. In 2024, the global e-commerce market continued its robust growth, with online sales accounting for a substantial portion of retail revenue, underscoring the competitive pressure from digital channels.

- DTC Brands: Companies focusing on specific product categories, often with strong online presences, can bypass traditional retail models.

- Specialized Online Retailers: Niche online stores offer curated selections and often a more personalized customer journey, appealing to specific consumer needs.

- Marketplace Growth: Platforms like Amazon and Bol.com continue to expand their non-food product ranges, presenting a direct alternative for many purchases.

- Consumer Preferences: A growing segment of consumers prioritizes convenience, unique product offerings, and brand storytelling, which DTC and specialized online retailers are adept at delivering.

The threat of substitutes for Colruyt Group is multifaceted, encompassing both traditional and evolving retail channels. Online grocery platforms and specialized food retailers offer convenience and unique product selections, directly challenging the conventional supermarket model. Furthermore, the growing foodservice sector, including restaurants and meal kit services, presents a significant alternative for consumers seeking convenient meal solutions, diverting spending from traditional grocery purchases.

In 2024, the online grocery market in Europe continued its expansion, with penetration rates increasing across key markets. This growth directly impacts retailers like Colruyt, as consumers increasingly turn to digital channels for their food needs. For example, projections indicated that online grocery sales could capture a significant portion of the total grocery market in several European countries by year-end.

| Substitute Category | Key Characteristics | Impact on Colruyt | 2024 Trend Example |

|---|---|---|---|

| Online Grocery Platforms | Convenience, wider assortment, home delivery | Direct competition for traditional grocery shopping | Continued growth in online grocery sales penetration in Europe |

| Specialty Food Stores | Niche products, artisanal quality, local sourcing | Appeals to specific consumer segments seeking premium or unique items | Growth in the organic and local food market segments in Belgium |

| Foodservice (Restaurants, Meal Kits) | Convenience, ready-to-eat meals, simplified meal preparation | Reduces demand for raw ingredients and home cooking | Robust growth in the global and European food delivery market |

| DTC Brands & Specialized Online Retailers (Non-Food) | Niche products, curated selections, brand storytelling | Challenges Colruyt's non-food offerings through specialized e-commerce | Continued expansion of global e-commerce market share in retail revenue |

Entrants Threaten

The threat of new entrants into the physical retail space, particularly for a player like Colruyt Group, is generally considered moderate. This is primarily due to the substantial capital investment required to establish a viable retail presence. Building a network of physical stores, along with the necessary warehousing and sophisticated logistics infrastructure, demands significant upfront financial outlay, creating a considerable barrier for potential newcomers.

The threat of new entrants for Colruyt Group is relatively low, primarily due to the significant capital investment required to establish a comparable retail presence. Existing players like Colruyt benefit from considerable economies of scale in purchasing, distribution, and marketing, making it challenging for newcomers to achieve similar cost efficiencies. For instance, in the 2023-2024 fiscal year, Colruyt Group reported a turnover of €11.5 billion, demonstrating the scale of operations that new entrants would need to replicate.

New entrants would struggle to match these established cost efficiencies, making it difficult to compete on price from the outset. The grocery retail sector is highly competitive, with established players having strong brand loyalty and optimized supply chains. Building a comparable network of stores and distribution centers would necessitate substantial upfront investment, acting as a significant barrier to entry.

The threat of new entrants for Colruyt Group is moderate, primarily due to strong brand loyalty and established customer bases held by incumbents. Colruyt has cultivated significant trust and recognition over many years, making it difficult for newcomers to quickly attract and retain customers. For instance, in 2023, Colruyt Group's market share in Belgium remained robust, demonstrating the stickiness of its customer relationships.

4

The threat of new entrants for Colruyt Group is moderate, largely due to significant regulatory hurdles and capital requirements in the grocery retail sector. Establishing large-scale retail operations demands navigating a complex web of permits, licenses, and compliance with various food safety and environmental standards. For instance, in Belgium, obtaining the necessary building permits and adhering to strict zoning regulations can be a lengthy and costly process, often taking years and substantial investment before a new store can even open its doors.

These barriers are compounded by the substantial capital needed to acquire prime real estate, build modern distribution centers, and invest in sophisticated inventory management systems. The economies of scale enjoyed by established players like Colruyt, which allows for competitive pricing and efficient operations, also present a significant challenge for newcomers. Without achieving a similar scale quickly, new entrants struggle to match the cost-effectiveness that draws customers to established brands.

Furthermore, brand loyalty and established supply chain relationships are difficult to replicate. Colruyt's long-standing presence and trusted reputation in the Belgian market mean consumers are less likely to switch to an unknown entity without a compelling reason, such as significantly lower prices or a unique value proposition. Building these customer relationships and securing reliable, cost-effective supply chains requires considerable time and resources.

- Regulatory Compliance: Obtaining necessary permits and licenses for retail operations in Belgium involves adherence to strict food safety, environmental, and consumer protection laws.

- Capital Investment: Significant upfront capital is required for land acquisition, store construction, logistics infrastructure, and initial inventory, often running into tens of millions of euros per large-format store.

- Economies of Scale: Existing players benefit from bulk purchasing power and optimized logistics, making it difficult for new entrants to compete on price without achieving comparable scale.

- Brand Loyalty and Supply Chains: Established brands like Colruyt benefit from consumer trust and long-term supplier agreements, which are challenging and time-consuming for new entrants to build.

5

While establishing a physical presence in the grocery sector presents significant hurdles, the threat of new entrants for Colruyt Group is increasingly shifting towards the digital realm. Niche online grocery retailers or established international players leveraging their online platforms pose a considerable challenge. These digital entrants can circumvent some of the substantial capital investment required for physical store networks, potentially offering more agile market entry.

However, even digital newcomers must contend with building brand recognition and establishing robust logistics networks to compete effectively with established players like Colruyt. For instance, in 2023, the Belgian e-commerce market saw continued growth, with online grocery sales representing a growing, albeit still smaller, segment. New entrants need to invest heavily in technology and supply chain efficiency to gain traction against incumbents with established customer bases and operational expertise.

The threat is amplified by the potential for disruptive business models that focus on specific product categories or delivery methods. While direct comparisons are difficult, the broader European grocery market has seen new online-only players gain market share by focusing on convenience and specialized offerings. For Colruyt, this means staying competitive not just on price and product range, but also on digital customer experience and efficient last-mile delivery.

- Digital Disruption: The primary threat comes from online-native retailers and international players expanding digitally, bypassing some physical entry barriers.

- Brand and Logistics Challenges: New entrants still face significant hurdles in building brand loyalty and creating efficient, cost-effective logistics operations.

- E-commerce Growth: The expanding online grocery market in Belgium and Europe provides fertile ground for new digital entrants to challenge established players.

- Focus on Convenience: Disruptive models often succeed by prioritizing niche markets or offering superior convenience, requiring incumbents to adapt their digital strategies.

The threat of new entrants for Colruyt Group is generally moderate, primarily due to significant capital requirements for physical retail presence and established economies of scale. Newcomers face challenges in replicating Colruyt's purchasing power and optimized logistics, making price competition difficult from the start.

Brand loyalty and existing supply chain relationships also act as considerable barriers, as building consumer trust and securing reliable supplier networks takes substantial time and investment. While digital disruption presents a growing challenge, new online entrants still grapple with brand recognition and logistics efficiency.

| Barrier | Impact on New Entrants | Colruyt Group Advantage (2023-2024 Data) |

|---|---|---|

| Capital Investment | High (Store networks, logistics) | Turnover: €11.5 billion |

| Economies of Scale | Low cost efficiency | Bulk purchasing power |

| Brand Loyalty | Difficult to acquire customers | Established trust and recognition |

| Regulatory Hurdles | Complex and costly compliance | Navigated extensive permitting |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Colruyt Group is built upon a foundation of publicly available information, including Colruyt's annual reports, investor presentations, and press releases. We also incorporate insights from reputable retail industry analysis reports and market research databases to provide a comprehensive view.