Colruyt Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

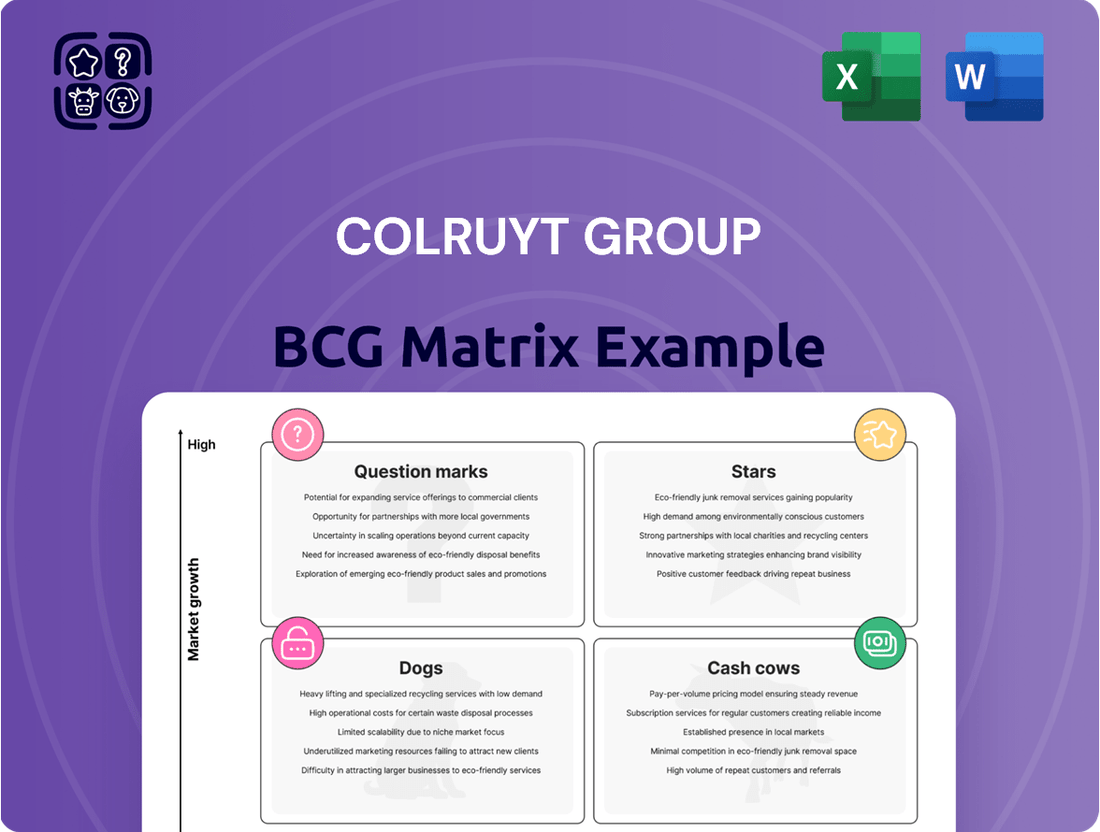

Unlock the strategic positioning of the Colruyt Group with our comprehensive BCG Matrix. Understand which of their brands are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or high-potential but unproven ventures (Question Marks).

This preview offers a glimpse into the Colruyt Group's product portfolio. Purchase the full BCG Matrix report to gain a detailed quadrant breakdown, data-driven insights, and actionable recommendations to optimize their market strategy and resource allocation.

Don't miss out on the complete picture! Secure the full Colruyt Group BCG Matrix to equip yourself with the strategic clarity needed to make informed investment decisions and drive future growth.

Stars

Colruyt Group is strategically elevating its Boni Selection private label, positioning it as a key competitor against established A-brands. This initiative is particularly evident in the expansion of sub-brands, such as Boni Plan't, targeting the rapidly growing plant-based food market.

This focus aims to capture a larger share of this lucrative segment, leveraging Boni Selection’s appeal to price-sensitive shoppers seeking value without compromising on quality. In 2023, private labels across European grocery retailers saw significant growth, with some markets reporting private label market share exceeding 40%, underscoring the strategic importance of brands like Boni Selection.

Jims, a prominent fitness chain within Belgium and Luxembourg under the Colruyt Group, is showing robust growth. In the first half of the 2024/25 fiscal year, Jims achieved a notable comparable revenue increase of 14.9%, highlighting its strong performance in the market.

The company is set to significantly expand its footprint in Belgium by acquiring NRG, a competitor that operates forty fitness clubs. This strategic move is designed to aggressively capture market share in an expanding industry, positioning Jims for leadership.

Newpharma, Colruyt Group's online pharmacy, is a clear star in their business portfolio. It saw a robust 20% comparable revenue growth in the first half of the 2024/25 fiscal year, demonstrating its strong market traction.

Operating across Belgium, France, Switzerland, the Netherlands, Germany, and Romania, Newpharma taps into the burgeoning global digital health market. Colruyt's ongoing commitment to enhancing its e-commerce capabilities, as highlighted in their 2024 strategic outlook, further solidifies Newpharma's position as a high-potential star.

Renewable Energy Initiatives (Virya Energy)

Colruyt Group's significant commitment to renewable energy, primarily through its subsidiary Virya Energy, firmly places this segment in the Star category of the BCG Matrix. The company is actively investing in solar and wind power, aiming to meet ambitious sustainability targets.

- Renewable Energy Target: Colruyt aims for at least 60% of its energy consumption to be sourced from renewables by 2030.

- Progress to Date: By the end of 2022, the group reported achieving 50% renewable energy usage, with a projected increase to 70% by 2024.

- Market Position: Virya Energy's investments in solar installations and wind farms, including participation in wind farm projects, tap into a high-growth market for sustainable energy solutions.

- Strategic Growth: This focus on self-production and expanding renewable energy capacity demonstrates a strategic move to capture increasing market share in the burgeoning green energy sector.

Okay City Concept

Colruyt Group's Okay City concept is a strategic move to capture the urban grocery market. The plan targets 100 locations within eight years, signaling aggressive expansion. These stores are envisioned as agile, urban-focused formats and testing grounds for new retail innovations.

The core of the Okay City strategy involves accelerating expansion and optimizing construction costs. This approach is designed to efficiently scale the concept and gain a stronger foothold in the convenience and urban grocery sectors. For instance, Colruyt Group has been actively investing in streamlining its supply chain and store operations, a trend likely to benefit the new Okay City format.

- Target: 100 Okay City locations within eight years.

- Purpose: Adapt to urban customer needs and test innovations.

- Strategy: Increase expansion speed and reduce building costs.

- Market Focus: Growing urban grocery and convenience segments.

Colruyt Group's renewable energy segment, primarily managed by Virya Energy, is a strong contender in the Star category. The company is making substantial investments in solar and wind power to meet its ambitious sustainability goals. By 2030, Colruyt aims for at least 60% of its energy consumption to be sourced from renewables.

The group reported achieving 50% renewable energy usage by the end of 2022, with a target to reach 70% by 2024. Virya Energy's involvement in solar installations and wind farm projects positions Colruyt within a rapidly expanding market for sustainable energy solutions, demonstrating a strategic drive to increase its market share in the green energy sector.

| Business Segment | BCG Category | Key Performance Indicators |

|---|---|---|

| Renewable Energy (Virya Energy) | Star | 50% renewable energy usage achieved by end of 2022; Target of 70% by 2024; Goal of 60% by 2030. |

| Newpharma | Star | 20% comparable revenue growth (H1 2024/25); Operates in 6 countries; Taps into global digital health market. |

| Jims Fitness | Star | 14.9% comparable revenue increase (H1 2024/25); Acquiring NRG to expand Belgian footprint (40 clubs). |

What is included in the product

Highlights which Colruyt Group units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizing Colruyt's portfolio offers strategic clarity, alleviating the pain of resource allocation dilemmas.

Cash Cows

Colruyt Lowest Prices, the cornerstone of Colruyt Group, continues to be a formidable cash cow, fulfilling its fifty-year-old promise of offering the lowest prices in Belgium. This flagship brand is instrumental in generating consistent profits and robust cash flow for the entire group.

Despite a minor dip in the Belgian food market share for Colruyt Group's chains to 29.0% in fiscal year 2024/25, Colruyt Lowest Prices maintains a leading position in a well-established retail landscape. Its enduring brand recognition and operational efficiency translate into healthy profit margins and a reliable source of funding for the group's diverse ventures.

Colruyt Group's wholesale segment, including Retail Partners Colruyt Group in Belgium and Codifrance in France, is a strong cash cow. This segment saw impressive revenue growth of 19.3% in fiscal year 2023/24.

These wholesale operations supply a wide network of independent retailers like Spar and Alvo stores. This positions them with a substantial market share in supplying smaller, independent businesses.

Operating in a mature market, these wholesale activities provide a stable and consistent source of cash for the Colruyt Group. Their contribution to the group's overall revenue is significant and reliable.

Solucious, Colruyt Group's foodservice arm, is a prime example of a cash cow. Its sales surged by 19.4% in the first half of fiscal year 2024/25, a performance significantly enhanced by the strategic acquisition of Délidis.

Serving over 25,000 professional clients, including vital sectors like hospitals and the hospitality industry across Belgium, Solucious commands a strong market position. This established customer base and efficient distribution network, complemented by innovative pilot projects for broader reach, consistently generate substantial cash flow for the group.

Boni Selection (Excluding Plant-Based Sub-Brand)

Boni Selection, excluding its plant-based sub-brand, stands as a cornerstone cash cow for the Colruyt Group. Its deep roots in the mature Belgian retail market translate to substantial market penetration and widespread consumer trust.

The brand's enduring appeal lies in its commitment to offering affordable quality across a diverse product portfolio, which consistently drives sales and supports healthy profit margins. For instance, Colruyt Group reported a 6.9% increase in total sales for the first half of fiscal year 2024-2025, with private labels like Boni Selection playing a crucial role in this growth.

- High Market Penetration: Boni Selection enjoys significant consumer recognition and adoption within Belgium.

- Consistent Sales & Profitability: The brand's value proposition ensures steady revenue streams and strong profit margins.

- Mature Market Strength: Its established presence in a stable market makes it a reliable cash generator.

- Foundation for Growth: While newer ventures like Boni Plan't target growth, the core Boni Selection continues to provide essential cash flow.

DATS 24 Fuel Stations

DATS 24, a key component of Colruyt Group's operations, functions as a Cash Cow within the BCG Matrix. This segment benefits from its established network of filling stations, primarily in Belgium, where it holds a stable market share in a mature industry.

While specific recent growth rates for DATS 24 are not always front and center, its consistent cash generation is undeniable. Its integration with the broader Colruyt Group, including its stake in Virya Energy, reinforces its role as a reliable cash generator.

- Stable Market Presence: DATS 24 benefits from a mature market and a strong, established presence in Belgium, ensuring consistent customer flow.

- Cash Generation: As a mature business, it reliably generates significant cash flow, contributing to the overall financial health of Colruyt Group.

- Strategic Integration: Its role within Virya Energy and the group's broader energy strategy, including charging infrastructure, highlights its ongoing relevance and cash-generating potential.

Colruyt Lowest Prices, the group's flagship, continues its role as a steadfast cash cow, maintaining a leading position in the Belgian food retail market. Despite a slight market share dip to 29.0% in fiscal year 2024/25, its operational efficiency and strong brand recognition ensure consistent profit generation.

The wholesale segment, including Retail Partners Colruyt Group and Codifrance, is another significant cash cow, demonstrating robust revenue growth of 19.3% in fiscal year 2023/24. This segment reliably supplies independent retailers, contributing substantial and stable cash flow.

Solucious, the foodservice division, is performing exceptionally well as a cash cow, with sales increasing by 19.4% in the first half of fiscal year 2024/25, boosted by the Délidis acquisition. Serving over 25,000 professional clients, it generates substantial cash flow through its established network and efficient distribution.

Boni Selection, excluding its plant-based line, remains a core cash cow, benefiting from deep market penetration and consumer trust in Belgium. Its consistent sales and profitability, contributing to a 6.9% overall sales increase in H1 FY2024-2025, solidify its role as a reliable cash generator.

DATS 24, with its established filling station network in Belgium, functions as a cash cow in a mature market. Its consistent cash generation, bolstered by its integration with Virya Energy, ensures its ongoing contribution to the group's financial stability.

| Business Unit | BCG Category | Key Performance Indicator | Recent Performance Data |

| Colruyt Lowest Prices | Cash Cow | Market Share & Profitability | 29.0% Belgian market share (FY24/25); consistent profit margins |

| Wholesale (Retail Partners, Codifrance) | Cash Cow | Revenue Growth | 19.3% revenue growth (FY23/24) |

| Solucious | Cash Cow | Sales Growth | 19.4% sales growth (H1 FY24/25) |

| Boni Selection (core) | Cash Cow | Sales Contribution | Key driver of 6.9% total sales increase (H1 FY24/25) |

| DATS 24 | Cash Cow | Market Stability & Cash Generation | Stable presence in mature energy market; reliable cash flow |

Delivered as Shown

Colruyt Group BCG Matrix

The Colruyt Group BCG Matrix preview you're seeing is the definitive report you will receive immediately after purchase, offering a complete strategic overview without any watermarks or demo content. This document has been meticulously prepared to provide actionable insights into Colruyt's business units, categorized by market share and growth rate, ensuring you get a fully formatted and ready-to-use analysis. You can confidently expect the same professional design and in-depth market-backed analysis in the final file that will be sent directly to you, allowing for immediate application in your strategic planning. This BCG Matrix report is precisely what you'll download, enabling you to unlock its full potential for editing, printing, or presenting to stakeholders, all without any hidden revisions or surprises.

Dogs

Colruyt's integrated retail activities in France, encompassing Colruyt Prix Qualité stores and DATS 24 petrol stations, have been categorized as question marks or potentially dogs within the BCG matrix. These operations have consistently reported losses, struggling against the fierce competition and challenging economic climate prevalent in the French food retail sector. Despite efforts to revitalize the business, including specific investment programs, the desired turnaround has not materialized, prompting the group to consider strategic alternatives such as a recovery plan or outright divestment.

The recent sale of 81 French supermarkets and 44 DATS 24 stations to Groupement Mousquetaires solidifies their position as a low-growth, low-market-share segment. This divestment, announced in early 2024, underscores the drain these French operations have represented on Colruyt Group's resources, indicating a strategic move to exit a segment that has failed to deliver profitability and is unlikely to generate significant future growth.

Colruyt Group's fashion segment, The Fashion Society, which includes Zeb, PointCarré, and The Fashion Store, experienced stable to slightly increasing comparable revenue in the first half of fiscal year 2024/25. However, the overall sales figures faced pressure within this competitive retail landscape.

The fashion retail sector is characterized by maturity and intense competition, presenting a significant hurdle for these brands to achieve substantial market share expansion. While profitability isn't explicitly stated as a concern, their constrained growth and difficulty in gaining meaningful traction in a saturated market suggest a potential classification as Dogs in a BCG matrix analysis.

This positioning implies that The Fashion Society brands may require careful strategic management to prevent them from becoming a drain on resources. Their performance indicates a need for strategic evaluation to either revitalize their market position or consider divestment, especially given the challenging market dynamics they face.

Bike Republic, a bicycle retail chain within the Colruyt Group, faced a significant sales decline of 8.9% in the first half of the 2024/25 fiscal year. This downturn occurred within a bicycle market characterized as being under considerable pressure.

The observed sales drop and the challenging market environment strongly suggest that Bike Republic currently operates in a low-growth or declining market. Coupled with its sales performance, this positions Bike Republic as a potential 'Dog' within the BCG Matrix framework.

As a 'Dog,' Bike Republic's strategic future requires careful consideration. The company must evaluate its long-term viability, exploring options for a turnaround or potentially divesting from this segment of the business.

Everyday Private Label

Colruyt Group is strategically shifting its private label focus. The budget-friendly 'Everyday' brand is being phased out, with 'Boni Selection' being promoted as the main private label. This move suggests 'Everyday' is considered a Dog within the BCG Matrix due to its limited growth potential and the company's decision to reduce its investment and presence.

While 'Everyday' has been a recognized name in Belgium, its future is uncertain as Colruyt prioritizes 'Boni Selection'. The company plans to assess which 'Everyday' products might continue, implying a contraction of the brand's overall portfolio. This strategic realignment aims to consolidate resources and marketing efforts behind a stronger, more promising private label.

- Brand Transition: Colruyt Group is moving away from its 'Everyday' private label to bolster 'Boni Selection'.

- Market Position: 'Everyday' is classified as a Dog due to its limited growth prospects and de-emphasis by the company.

- Product Evaluation: Colruyt will review 'Everyday' products to decide which, if any, will remain.

- Strategic Rationale: The shift aims to streamline private label offerings and concentrate on brands with higher growth potential.

Certain Acquired Match and Smatch Stores (pre-conversion)

The acquired Match and Smatch stores, prior to their conversion to the CoMarkt/CoMarché banner, initially provided a stabilizing effect on Colruyt Group's food retail sales. Without their contribution, the group's overall sales performance would have seen a decline. This situation indicates that, in their pre-conversion state, these stores occupied a position characterized by low market growth and a relatively small market share, likely operating with inefficiencies.

The strategic decision to convert these stores signifies an effort to reposition them from a potentially underperforming segment. The need for significant investment to integrate them into the Colruyt Group's operational framework further supports their initial classification as 'Dogs' within the BCG matrix. This implies they were in a low-growth market and held a low market share, requiring substantial capital to improve their standing.

- Initial Contribution: These stores provided stable food retail sales, preventing a decline in the overall segment.

- Market Position: Pre-conversion, they likely represented a low-growth, low-market-share segment.

- Operational Status: The need for conversion and integration suggests potential inefficiencies and underperformance.

- Strategic Intent: The conversion aims to move these assets out of the 'Dog' quadrant and improve their performance.

Colruyt Group's ventures in France, including its retail stores and petrol stations, have been a consistent drain, reporting losses and facing intense competition. The sale of 81 supermarkets and 44 DATS 24 stations in early 2024 to Groupement Mousquetaires confirms their status as low-growth, low-market-share assets, effectively exiting a segment that failed to deliver profitability.

The fashion segment, The Fashion Society, encompassing brands like Zeb and PointCarré, operates in a mature and highly competitive market. Despite stable comparable revenue in the first half of fiscal year 2024/25, overall sales faced pressure, suggesting limited growth potential and a struggle for market share expansion, positioning them as potential Dogs.

Bike Republic experienced a notable sales decline of 8.9% in the first half of fiscal year 2024/25. This downturn within a pressured bicycle market strongly indicates that Bike Republic is operating in a low-growth environment with a weak market position, classifying it as a Dog requiring strategic re-evaluation.

Colruyt's strategic shift away from the 'Everyday' private label, prioritizing 'Boni Selection', signals 'Everyday's' limited growth prospects and de-emphasis. This move, with a review of remaining 'Everyday' products, aims to consolidate resources behind more promising brands, confirming 'Everyday' as a Dog.

Question Marks

In the 2024/25 fiscal year, Colruyt Group's Okay, Bio-Planet, and Cru formats achieved a combined sales increase of 1.9%, demonstrating positive momentum despite broader market share challenges for the group's flagship brand. Bio-Planet, a leader in Belgium's expanding organic food sector, continues to benefit from this trend, solidifying its niche.

Okay is aggressively expanding with its urban-focused 'Okay City' concept, aiming for 100 stores, signaling a strong growth ambition. Cru, meanwhile, carves out its space by concentrating on fresh, artisanal products, tapping into a segment with notable growth potential.

While these formats are showing promising growth, they may still hold a smaller market share compared to the dominant Colruyt brand. Continued strategic investment is crucial for them to mature into Stars within the BCG matrix, further strengthening their market positions.

Colruyt Group is strategically investing in its B2B2E (business-to-business-to-employee) ventures, notably Yoboo and the Colruyt Group Academy. These programs are designed to tap into the growing demand for corporate wellness and employee development solutions. For instance, Yoboo, a digital platform offering personalized health and well-being plans, aims to be a key player in the employee benefits market, which saw significant growth in 2024 as companies prioritized workforce health.

The Colruyt Group Academy, meanwhile, focuses on upskilling and reskilling employees, both within Colruyt and for external businesses. This initiative aligns with the broader trend of continuous learning in the professional landscape. While specific revenue figures for these newer ventures are still emerging, Colruyt's commitment signals a belief in their high-growth potential within the competitive corporate services sector.

Colruyt Group is aggressively pursuing leadership in online shopping, leveraging data to drive both insights and revenue, underscoring a strategic push to bolster its digital footprint. Collect&Go, their established online shopping platform, is actively investing in sustainable logistics, notably incorporating electric cargo bikes into its operations, a move that highlights innovation within the increasingly competitive and expanding e-commerce landscape.

While Colruyt Group's online sales have seen a positive trajectory, the fiercely competitive nature of the overall online grocery sector necessitates sustained investment for Collect&Go. This ongoing commitment is crucial for the service to achieve significant market share expansion and transition into a Star category within the BCG matrix.

Strategic Investments in Vertical Integration and Logistics Capacity

Colruyt Group is making substantial strategic investments, allocating EUR 479 million in 2024/25. This significant capital outlay is primarily directed towards enhancing production capacity and bolstering logistics infrastructure within Belgium. These moves are foundational for long-term operational efficiency and competitive positioning.

These investments in vertical integration and logistics capacity, while critical for future growth, may not immediately translate into a dramatic increase in market share. They represent the group's commitment to building a robust operational backbone.

- Strategic Capital Allocation: EUR 479 million invested in 2024/25.

- Focus Areas: Expanding production capacity and logistics capabilities in Belgium.

- Long-Term Vision: Initiatives designed to support future growth and market penetration.

- Investment Profile: These are capital-intensive projects aimed at securing future market leadership.

New Specialised Assortment for Hospitality Sector in Colruyt Lowest Prices Stores

Colruyt Group is testing a new strategy by bringing 200 specialized products from Solucious, their foodservice expert, into two of their Colruyt Lowest Prices stores. This initiative is designed to tap into the business-to-business (B2B) market more effectively by utilizing their current retail locations. This pilot project targets a high-growth segment, the B2B hospitality sector, where Colruyt is still establishing its presence.

This venture into the B2B hospitality market, specifically with a curated assortment of 200 products, positions it as a Question Mark within the BCG Matrix. While the B2B market offers significant growth potential, Colruyt's current market share for this specific offering is low, necessitating careful investment and strategic scaling to transition into a Star performer. The success of this pilot is crucial for future expansion in this lucrative sector.

- B2B Market Expansion: Colruyt Group is piloting a specialized assortment for the hospitality sector in two Colruyt Lowest Prices stores, leveraging Solucious's expertise.

- Question Mark Positioning: This initiative targets the high-growth B2B market but currently holds a low market share for this specific offering, characteristic of a Question Mark.

- Strategic Objective: The goal is to successfully scale this pilot to capture a larger share of the B2B hospitality market, aiming to transform it into a Star.

Colruyt Group's foray into the B2B hospitality market, utilizing Solucious's expertise within select Colruyt Lowest Prices stores, represents a strategic move into a high-growth sector. This initiative is currently classified as a Question Mark due to its nascent market share in this specific segment. The success of this pilot project, featuring approximately 200 specialized products, is critical for Colruyt's ambition to establish a stronger foothold and potentially elevate this venture into a Star performer within the BCG matrix.

BCG Matrix Data Sources

Our Colruyt Group BCG Matrix is built on comprehensive data, including internal sales figures, market share reports, and industry growth projections to accurately position each business unit.