Colruyt Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Unlock the strategic blueprint behind Colruyt Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage cost leadership, efficient operations, and strong customer relationships to dominate the retail sector. Discover their key partners, value propositions, and revenue streams.

Ready to gain a competitive edge? Download the full Colruyt Group Business Model Canvas for an in-depth understanding of their operational excellence and market strategy. It’s the perfect tool for entrepreneurs and strategists seeking to emulate proven success.

Partnerships

Colruyt Group cultivates enduring ties with its suppliers, particularly for its private label offerings. This strategic approach guarantees unwavering product quality, advantageous pricing, and a robust supply chain. For instance, in 2023, private labels constituted a significant portion of their sales, demonstrating the importance of these supplier relationships.

These alliances often go beyond mere transactions, encompassing collaborative efforts in sustainable sourcing. Colruyt Group actively partners with farmers and producers on environmental initiatives, such as reducing greenhouse gas emissions in dairy farming, aligning with their 2024 sustainability goals.

Colruyt Group actively collaborates with a network of independent retailers and franchisees, a strategy that significantly broadens its market presence. This includes partnerships with well-known names like Spar, Alvo, and Mini Market stores across Belgium, as well as Coccinelle, Coccimarket, and Panier Sympa in France. These collaborations leverage Colruyt's robust wholesale and distribution infrastructure, extending its reach into diverse local markets without the complexities of direct ownership of every single outlet.

Colruyt Group relies heavily on logistics and technology providers to ensure efficient operations. Collaborations with specialized logistics partners are fundamental for managing its extensive distribution network, ensuring timely delivery of fresh and frozen goods across its various store formats. For instance, in 2024, Colruyt continued to invest in optimizing its supply chain, leveraging advanced route planning software from technology partners to reduce transit times and fuel consumption.

Technology partnerships are also vital for Colruyt's digital transformation strategy. These collaborations enable the development and enhancement of its e-commerce platforms, such as Collect & Go, and facilitate crucial data exchange initiatives. A prime example is the ongoing transition to GS1 standards for product data, a move that streamlines information flow with suppliers and improves inventory management, a process actively supported by technology solution providers throughout 2024.

Renewable Energy Partners

Colruyt Group actively collaborates with key players in the renewable energy domain, notably through its joint venture, Virya Energy. This partnership is instrumental in developing and managing a portfolio of wind and solar energy projects. For instance, by the end of fiscal year 2023-2024, Virya Energy had a significant renewable energy capacity, contributing to Colruyt Group's overarching strategy of reducing its carbon footprint.

This strategic alliance allows Colruyt Group to leverage specialized expertise in renewable energy development, ensuring efficient project execution and optimal asset management. The focus is on expanding their renewable energy generation capabilities, directly supporting their commitment to environmental sustainability and operational efficiency.

- Virya Energy's Role: Virya Energy, a joint venture with Korys Investments, spearheads the development and operation of wind and solar farms.

- Capacity Growth: By early 2024, Virya Energy's operational renewable energy capacity was substantial, with ongoing projects aimed at further expansion.

- Sustainability Impact: These partnerships directly contribute to Colruyt Group's ambitious targets for carbon emission reduction, reinforcing its position as a sustainable retailer.

Community and Sustainability Initiatives

Colruyt Group actively collaborates with numerous organizations to drive community engagement and sustainability. A prime example is their participation in Green Deals with the Flemish government, focusing on critical areas like shared mobility, circular procurement, and enhancing biodiversity.

These partnerships extend to ensuring ethical practices within their supply chains. Colruyt Group engages in collaborations for social audits, a crucial step in verifying fair labor conditions and responsible sourcing.

- Green Deals: Collaborations with the Flemish government on shared mobility, circular procurement, and biodiversity initiatives.

- Social Audits: Partnerships focused on conducting thorough social audits within their supply chains to ensure ethical standards.

- Community Engagement: Broader partnerships aimed at strengthening local communities and promoting sustainable development.

Colruyt Group's key partnerships are multifaceted, extending from deep supplier relationships for private labels to strategic alliances in renewable energy and retail expansion. These collaborations are crucial for maintaining product quality, driving sustainability, and broadening market reach.

The group actively works with technology and logistics providers to optimize its supply chain and digital platforms. Furthermore, partnerships with government entities and community organizations underscore its commitment to social responsibility and sustainable development.

| Partner Type | Examples | Impact |

|---|---|---|

| Suppliers | Private label producers, farmers | Product quality, pricing, supply chain robustness |

| Retailers/Franchisees | Spar, Alvo, Mini Market, Coccinelle | Market presence expansion, leveraging distribution |

| Energy Providers | Virya Energy (joint venture) | Renewable energy capacity, carbon footprint reduction |

| Technology Providers | GS1 standards, route planning software | Digital transformation, supply chain efficiency |

| Government/Community | Flemish Government (Green Deals) | Sustainability initiatives, community engagement |

What is included in the product

Colruyt Group's Business Model Canvas focuses on delivering value through efficient operations and customer-centricity, targeting price-conscious families and individuals with a broad range of private label products and a strong emphasis on cost leadership.

This model is ideal for understanding Colruyt's competitive advantage in the retail sector, highlighting its integrated supply chain and commitment to offering quality at affordable prices.

The Colruyt Group Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their value proposition, customer segments, and cost structure, simplifying complex operations for easier understanding and strategic adjustment.

Activities

Retail Operations Management for Colruyt Group encompasses the daily oversight of diverse store formats, including Colruyt Lowest Prices, Okay, and Bio-Planet, alongside convenience and specialized non-food outlets. This critical activity prioritizes streamlined store operations, effective inventory management, and exceptional customer engagement across all brands.

In 2023, Colruyt Group reported a turnover of €10.5 billion, underscoring the scale of their retail operations. The group's commitment to efficient management is evident in their continuous efforts to optimize stock levels and enhance the shopping experience, ensuring product availability and customer satisfaction.

Colruyt Group's wholesale and foodservice segment, primarily operated through Solucious and Culinoa, is a significant pillar of their business. These divisions cater to professional clients, including the hospitality sector and healthcare facilities, providing a diverse range of food products and related services. In the first half of fiscal year 2024-2025, the foodservice segment showed robust growth, contributing to the group's overall performance.

Solucious, in particular, focuses on delivering tailored solutions to professional customers, encompassing everything from fresh produce to ready-to-eat meals. This B2B approach allows Colruyt Group to leverage its sourcing and logistics expertise beyond its retail footprint. The group's commitment to quality and efficiency in this segment is evident in its expanding customer base and consistent revenue generation.

Colruyt Group's private label development and production is a core activity, focusing on in-house creation of products under brands like Colruyt Group Fine Food. This approach allows for tight control over quality and costs, directly responding to customer preferences.

In 2023, private label products represented a substantial portion of Colruyt Group's sales, with the company continuously investing in expanding its private label offerings to enhance value for shoppers. This strategy is key to their competitive pricing and differentiation in the market.

Supply Chain and Logistics Optimization

Colruyt Group's supply chain and logistics optimization is central to its operational efficiency. This involves the meticulous management of warehouses and transportation networks to ensure a smooth flow of products from suppliers right to the shelves and directly to customers. The group consistently invests in expanding its logistics capacity to meet growing demand and improve delivery times.

Key activities in this area include:

- Warehouse Management: Operating and optimizing a network of distribution centers to store and manage inventory efficiently.

- Transportation Optimization: Planning and executing the movement of goods, utilizing various transport modes to minimize costs and delivery times.

- Inventory Control: Implementing systems to maintain optimal stock levels, reducing waste and ensuring product availability.

- Technology Integration: Employing advanced logistics software and automation to enhance visibility and streamline operations.

For instance, in the fiscal year 2023-2024, Colruyt Group continued its focus on enhancing its distribution network. While specific figures for logistics investment are often part of broader capital expenditure, the group’s commitment to efficiency is evident in its ongoing efforts to reduce lead times and improve the sustainability of its transportation, aiming for more fuel-efficient fleets and optimized routing.

Digital Transformation and Innovation

Colruyt Group actively drives digital transformation, focusing on robust e-commerce expansion and the integration of advanced technologies. This commitment aims to elevate operational efficiency and enrich the customer journey.

Significant investments are channeled into enhancing their digital platforms, exemplified by the continuous improvement of their online shopping experience. For instance, in the fiscal year 2023-2024, Colruyt Group reported a notable increase in online sales, reflecting the success of these digital initiatives.

- E-commerce Enhancement: Ongoing upgrades to their online stores and delivery services to meet growing digital demand.

- Technological Adoption: Implementation of smart AI cameras at checkouts, as seen in pilot programs, to streamline the payment process and reduce wait times.

- Data-Driven Insights: Utilizing digital tools to gather customer data and personalize shopping experiences, leading to increased customer loyalty.

- Operational Efficiency: Digital solutions are deployed across logistics and store management to optimize resource allocation and reduce costs.

Colruyt Group's key activities in digital transformation involve enhancing their e-commerce capabilities and integrating new technologies to improve customer experience and operational efficiency. This includes ongoing upgrades to their online platforms and the adoption of innovative solutions like AI cameras for faster checkout processes. The group leverages data analytics to personalize offerings and drive customer loyalty, ensuring a competitive edge in the evolving retail landscape.

Preview Before You Purchase

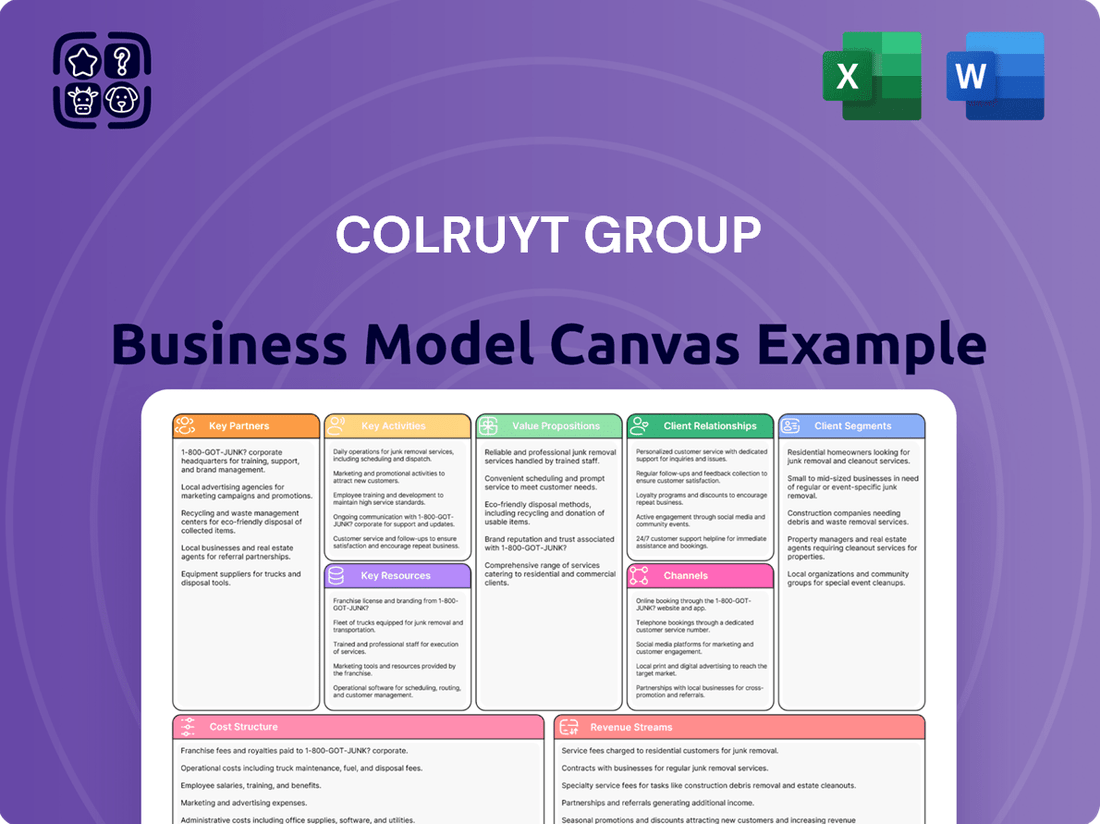

Business Model Canvas

The Colruyt Group Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. Once your order is complete, you'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Colruyt Group's extensive retail store network is a cornerstone of its business model. This network includes over 240 Colruyt stores, 130 OKay convenience stores, and 50 Spar outlets in Belgium alone, alongside a significant presence in France and Luxembourg. This widespread physical footprint ensures high customer accessibility and convenience.

Colruyt Group's proprietary brands and private labels are a cornerstone of its business model, offering a distinct advantage. These brands, often developed through its Colruyt Group Fine Food division, allow for greater control over quality and sourcing, directly impacting customer perception and loyalty.

The group's private label strategy is a powerful tool for differentiation in a competitive retail landscape. By offering a wide range of own-brand products, Colruyt can ensure a unique value proposition, combining quality with attractive price points. For example, in fiscal year 2023-2024, private labels continued to be a significant driver of sales growth for the group.

Colruyt Group's investment in a robust supply chain and logistics infrastructure, encompassing strategically located distribution centers, efficient warehouses, and a dedicated transport fleet, is a cornerstone of its business model. This integrated network ensures the timely and cost-effective movement of products from suppliers to their diverse retail formats.

In 2024, Colruyt Group continued to optimize its logistics operations, a vital component in maintaining its low-price strategy. For instance, their extensive network of distribution centers, such as the one in Willingelo, Belgium, handles a vast volume of goods, enabling economies of scale and reducing per-unit transportation costs.

The efficiency of this infrastructure directly supports Colruyt's ability to offer competitive pricing. By minimizing handling and transit times, and leveraging advanced inventory management systems, they reduce waste and operational overhead, passing these savings onto the consumer.

Skilled Workforce and Management Expertise

Colruyt Group’s extensive workforce, exceeding 33,000 individuals as of 2024, forms the bedrock of its operational success. This human capital is not just a number; it represents a deep pool of talent essential for maintaining high standards across the group's diverse operations.

The expertise within this workforce is particularly vital for the group's strategic execution and day-to-day excellence. Experienced retail managers ensure efficient store operations, while specialized logistics professionals keep the complex supply chain running smoothly. Furthermore, the group’s IT professionals are critical for driving innovation and maintaining its technological infrastructure.

- Human Capital: Over 33,000 employees contribute to operational excellence.

- Key Expertise: Retail management, logistics specialization, and IT proficiency are paramount.

- Strategic Importance: This skilled workforce is crucial for executing the group's business strategy.

- Operational Efficiency: Their collective knowledge directly impacts the group's ability to deliver value.

Technology and Data Infrastructure

Colruyt Group heavily invests in its technology and data infrastructure to drive efficiency and customer engagement. In the fiscal year 2023-2024, the company continued to enhance its IT systems, focusing on cloud migration and data integration. This strategic investment underpins their ability to offer personalized experiences and make data-driven decisions across all business units.

The group's commitment to digital transformation is evident in its robust e-commerce platforms and the ongoing development of digital tools. These advancements are crucial for meeting evolving consumer demands and maintaining a competitive edge. For instance, their digital loyalty programs and personalized offers leverage sophisticated data analytics.

- IT System Investments: Continued upgrades to core IT systems and cloud infrastructure for scalability and resilience.

- Data Analytics Capabilities: Enhanced use of data to understand customer behavior, optimize inventory, and personalize marketing efforts.

- E-commerce Platforms: Ongoing development and expansion of online shopping capabilities, including click-and-collect and home delivery services.

- Digital Tools: Implementation of new digital tools for employees to improve operational efficiency and customer service.

Colruyt Group's intellectual property, particularly its proprietary brands and sophisticated data analytics capabilities, represents a significant key resource. These elements allow for product differentiation, cost control, and a deeper understanding of customer preferences, directly contributing to their competitive advantage and market position.

The group's technological infrastructure, including advanced IT systems and e-commerce platforms, is another crucial asset. This investment enables operational efficiency, personalized customer engagement, and the agility needed to adapt to changing market demands. In fiscal year 2023-2024, continued investment in these areas underscored their strategic importance.

Colruyt Group's financial strength and access to capital are vital resources, supporting its extensive store network, supply chain investments, and ongoing technological development. This financial stability allows for strategic acquisitions, market expansion, and resilience during economic fluctuations.

The group's established brand reputation and customer loyalty, built over years of consistent value delivery, are intangible yet invaluable resources. This trust factor influences purchasing decisions and provides a stable customer base, underpinning long-term revenue generation.

| Key Resource | Description | Fiscal Year 2023-2024 Data/Relevance |

| Proprietary Brands & Private Labels | Own-brand products offering quality and value differentiation. | Continued driver of sales growth; control over sourcing and quality. |

| Technology & Data Infrastructure | Advanced IT systems, data analytics, and e-commerce platforms. | Continued enhancement of IT systems, focus on cloud migration and data integration. |

| Supply Chain & Logistics Network | Efficient distribution centers, warehouses, and transport fleet. | Optimization of operations to maintain low-price strategy; e.g., Willingelo distribution center. |

| Extensive Workforce | Over 33,000 employees with specialized expertise. | Crucial for operational excellence in retail management, logistics, and IT. |

| Retail Store Network | Widespread physical presence across Belgium, France, and Luxembourg. | Ensures high customer accessibility with over 240 Colruyt stores, 130 OKay, and 50 Spar outlets in Belgium. |

Value Propositions

Colruyt Lowest Prices is built around a core value proposition of offering the lowest prices, a strategy that has proven highly effective in attracting and retaining customers. This commitment ensures that shoppers can access quality products without overspending, a crucial benefit in today's economic climate.

In 2024, Colruyt Group continued to emphasize this value, reporting a strong performance driven by its price leadership. For instance, their strategy allows them to maintain competitive pricing even when facing inflationary pressures, directly benefiting consumers managing household expenses.

This focus on value for money isn't just about low prices; it's about providing a comprehensive offering where customers feel they are getting the most for their budget. This approach has historically translated into significant market share gains, particularly during periods of economic uncertainty.

Colruyt Group's broad product assortment ensures customers find virtually everything they need, from fresh produce to household essentials. This extensive selection caters to diverse needs and preferences, simplifying the shopping experience.

The group's commitment to high-quality private label products is a significant value proposition. These own-brand items, such as the Boni Selection range, provide customers with reliable quality at competitive prices, often outperforming national brands in taste tests and customer satisfaction surveys, as evidenced by their consistent popularity and sales growth.

For example, in fiscal year 2023-2024, Colruyt Group reported a continued strong performance for its private label products, contributing significantly to overall sales figures and customer loyalty by offering a compelling alternative to national brands without compromising on quality.

Colruyt Group champions convenience through a multi-channel approach. Their diverse store formats, from large hypermarkets to smaller neighborhood shops, alongside a robust online presence and the popular Collect&Go service for pre-ordered pick-ups, ensure customers can shop how and when they prefer.

This commitment to accessibility is reflected in their operational reach. As of the first half of the 2024 financial year, Colruyt Group operated 613 own-brand stores across Belgium and France, demonstrating a significant physical footprint designed to be close to their customer base.

Commitment to Sustainability and Local Products

Colruyt Group demonstrates a strong commitment to sustainability, actively promoting responsible business practices across its operations. This dedication is reflected in its offering of a growing range of more sustainable products, catering to an increasingly eco-aware customer base.

A key aspect of their strategy involves robust support for local Belgian agriculture. By prioritizing local sourcing, Colruyt Group not only reduces its carbon footprint but also strengthens regional economies. In 2023, for instance, the group highlighted its partnerships with numerous local farmers, emphasizing the freshness and reduced transport miles of its produce.

Furthermore, Colruyt Group is actively working towards emission-free transport solutions. This includes investing in electric vehicles and exploring alternative fuels for its logistics fleet, aiming to significantly reduce its environmental impact. By 2024, the group plans to expand its fleet of electric delivery vans, contributing to cleaner urban environments.

- Sustainable Product Range: Offering a growing selection of products with improved environmental or social credentials.

- Local Sourcing: Prioritizing Belgian suppliers to support local economies and reduce transportation emissions.

- Emission-Free Transport: Investing in and deploying electric vehicles and other low-emission logistics solutions.

- Consumer Appeal: Attracting environmentally conscious consumers through transparent and responsible business practices.

Integrated Health and Well-being Offerings

Colruyt Group extends its value proposition beyond grocery retail by integrating health and well-being offerings. This diversification is evident through its dedicated brands, aiming to support customers in adopting healthier lifestyles.

Brands like Newpharma, an online pharmacy, and Jims, a fitness club chain, are key components of this strategy. Newpharma offers a wide range of health products and pharmaceutical services, making healthcare more accessible. Jims provides accessible fitness solutions, encouraging physical activity.

These integrated offerings allow Colruyt Group to cater to a broader spectrum of customer needs, fostering loyalty by providing holistic solutions for well-being. For instance, in 2023, the Belgian online pharmacy market saw significant growth, with Newpharma actively participating in this expanding sector.

- Newpharma: Online pharmacy offering prescription and over-the-counter medications, health supplements, and personal care products.

- Jims: A network of fitness centers providing affordable and accessible gym memberships and fitness classes.

- Synergy: Potential for cross-promotion and bundled offerings between food retail and health/wellness services.

- Customer Focus: Addressing the growing consumer demand for convenient access to health and well-being solutions.

Colruyt Group's core value proposition is built on offering the lowest prices, a strategy that resonates strongly with consumers. This commitment ensures affordability without compromising on product quality. In 2024, this price leadership remained a key driver of their performance, helping customers manage household budgets effectively amidst economic fluctuations.

The group also emphasizes a broad and high-quality product assortment, particularly its private label brands like Boni Selection. These brands offer excellent value, often rivaling national brands in customer satisfaction and sales growth. Fiscal year 2023-2024 saw continued strong performance from these private labels, reinforcing customer loyalty.

Convenience is another significant value, delivered through a multi-channel approach including diverse store formats and the Collect&Go click-and-collect service. By the first half of FY2024, Colruyt operated 613 own-brand stores, ensuring accessibility for a wide customer base.

Colruyt Group is also dedicated to sustainability, offering more eco-friendly products and prioritizing local sourcing, such as partnerships with Belgian farmers in 2023. Their investment in emission-free transport, including expanding their electric delivery van fleet by 2024, further appeals to environmentally conscious consumers.

Beyond groceries, Colruyt Group integrates health and well-being through offerings like the online pharmacy Newpharma and fitness clubs Jims. This diversification caters to growing consumer demand for holistic health solutions, with Newpharma actively participating in the expanding online pharmacy market in 2023.

Customer Relationships

Colruyt Group cultivates customer loyalty through a steadfast commitment to offering the lowest prices, a core element of their strategy. This price-focused approach, reinforced by their well-known price promise, builds significant trust and allows shoppers to consistently save money, driving repeat business.

Colruyt Group enhances customer relationships through personalized digital engagement, notably via its Xtra app. This platform delivers tailored offers and a streamlined shopping journey, boosting convenience. In 2024, the Xtra app continued to be a cornerstone of this strategy, with millions of active users regularly accessing personalized promotions and loyalty benefits.

Colruyt Group actively engages with local communities through various initiatives, strengthening its bond with customers. For instance, in 2023, the group supported over 1,000 local sports clubs and cultural events across Belgium and Luxembourg, demonstrating a commitment that extends beyond retail operations.

By prioritizing sustainable sourcing and reducing its environmental footprint, Colruyt Group builds trust through shared values. Their ongoing efforts to increase the percentage of sustainably sourced private label products, aiming for 100% by 2030, resonate with an increasingly eco-conscious customer base.

Efficient Customer Service and Support

Colruyt Group prioritizes responsive customer service across all touchpoints. In-store staff are trained to assist shoppers, while digital channels like their websites and apps offer quick access to information and support. This commitment aims to resolve queries efficiently, fostering a positive shopping experience and building lasting customer satisfaction.

In 2023, Colruyt Group reported a significant increase in customer engagement through their digital platforms, with app downloads growing by 15%. This highlights the importance of their multichannel support strategy in addressing customer needs effectively.

- In-store assistance: Trained staff available to answer questions and provide product information.

- Digital support: Websites and apps offering FAQs, contact forms, and order tracking.

- Issue resolution: Dedicated teams to handle customer complaints and feedback promptly.

- Customer satisfaction metrics: Regularly monitored to ensure service quality and identify areas for improvement.

Educational and Health-Focused Initiatives

Colruyt Group actively cultivates relationships with health-conscious consumers through dedicated platforms like the Colruyt Group Academy, Bio-Planet, Jims fitness centers, and Yoboo. These initiatives provide valuable guidance and resources focused on conscious consumption and healthier lifestyles, thereby strengthening customer loyalty.

- Colruyt Group Academy: Offers workshops and online content promoting sustainable and healthy living choices.

- Bio-Planet: A specialized organic supermarket providing a curated selection of healthy products and expert advice.

- Jims: Fitness centers that encourage active lifestyles, complementing the group's health-focused offerings.

- Yoboo: A digital platform delivering personalized health and nutrition tips, further engaging customers in their wellness journey.

Colruyt Group fosters strong customer ties through a multi-faceted approach, blending competitive pricing with personalized digital experiences and community engagement. Their commitment to value, exemplified by the Xtra app's tailored offers, drives repeat business and builds trust. By actively supporting local communities and championing sustainability, they align with customer values, further solidifying relationships.

| Initiative | Focus | Customer Impact | 2024 Data/Activity |

|---|---|---|---|

| Xtra App | Personalized offers, loyalty program | Increased convenience, tailored savings | Millions of active users, driving significant engagement with promotions. |

| Community Support | Local sponsorships, events | Strengthened local ties, brand goodwill | Continued support for numerous local sports clubs and cultural initiatives. |

| Sustainability | Eco-friendly sourcing, reduced footprint | Alignment with conscious consumer values | Progress towards 100% sustainable private label sourcing by 2030. |

| Health & Wellness Platforms | Colruyt Group Academy, Bio-Planet, Jims, Yoboo | Guidance on healthy lifestyles, conscious consumption | Providing resources and platforms for customers seeking wellness solutions. |

Channels

The physical supermarket network, including Colruyt Lowest Prices, Okay, and Bio-Planet, forms the bedrock of Colruyt Group's customer reach. This extensive physical presence ensures accessibility and a tangible shopping experience for a broad customer base across Belgium and Luxembourg.

In the fiscal year 2023-2024, Colruyt Group reported a consolidated turnover of €11.5 billion, with its Belgian food retail segment, encompassing these physical stores, being the primary revenue driver. The group operates over 600 physical stores, highlighting the significant role of brick-and-mortar retail in its overall strategy and customer engagement.

Collect&Go Pick-up Points represent a key online-to-offline channel for Colruyt Group, enabling customers to conveniently order groceries via their website or app and collect them at numerous designated locations. This strategy directly addresses the growing demand for efficiency among busy consumers, streamlining the shopping experience.

In 2024, Colruyt Group continued to expand its Collect&Go network, with a significant number of pick-up points strategically located across Belgium. This channel saw robust growth, reflecting its popularity and the company's commitment to providing accessible and time-saving grocery solutions.

Colruyt Group leverages a robust online presence through various webshops catering to both food and non-food categories. This digital strategy is exemplified by Newpharma, their dedicated platform for health and well-being products, offering customers convenient online purchasing and home delivery options.

Wholesale Distribution Networks

Colruyt Group leverages its robust wholesale distribution networks, such as Retail Partners Colruyt Group and Codifrance, to serve a diverse B2B customer base. These networks are crucial for supplying independent retailers and professional clients with a wide array of products, ensuring efficient reach across various market segments.

The group's wholesale operations are a significant contributor to its overall business strategy, facilitating market penetration and brand presence beyond its own retail outlets. This dual approach allows Colruyt Group to capture a broader market share by catering to both end consumers and business partners.

- Retail Partners Colruyt Group: Serves over 550 independent Belgian and Luxembourgish retailers, providing them with access to Colruyt Group's extensive product range and logistical expertise.

- Codifrance: A key player in the French wholesale market, supplying a broad spectrum of food and non-food products to professional clients, including restaurants and small businesses.

- Growth in Wholesale Segment: In the first half of fiscal year 2023-2024, Colruyt Group reported a 15.6% increase in sales for its wholesale activities, highlighting the segment's strong performance and expansion.

Foodservice

Colruyt Group's foodservice channels, primarily through Solucious and Culinoa, cater to the professional market, offering specialized food products and services. These channels focus on sectors like hospitality, healthcare, and education, providing customized solutions to meet the unique demands of each. This B2B approach allows Colruyt Group to leverage its sourcing and logistics expertise beyond traditional retail.

In 2023, the foodservice sector represented a significant growth area for Colruyt Group. Solucious, for instance, reported a strong performance, driven by increased demand for convenient and high-quality food solutions in professional settings. The company's commitment to sustainability and tailored offerings resonated well with its business clients.

- Target Sectors: Hospitality, healthcare, and education institutions are key clients for Colruyt Group's foodservice operations.

- Service Offering: Tailored food solutions, including ready-to-eat meals, fresh ingredients, and specialized dietary options, are provided.

- Business Model: Focuses on business-to-business (B2B) sales, leveraging Colruyt's extensive supply chain and product range.

- Growth Driver: Increasing demand for convenience and specialized catering services in professional environments fuels expansion.

Colruyt Group's channels are a multi-faceted approach to reaching diverse customer segments. The physical supermarket network, including brands like Colruyt Lowest Prices and Okay, remains the core, complemented by the growing Collect&Go click-and-collect service. This blend of brick-and-mortar and convenient online ordering caters to a broad spectrum of consumer needs.

Beyond direct-to-consumer retail, Colruyt Group effectively utilizes wholesale channels like Retail Partners Colruyt Group and Codifrance, serving over 550 independent retailers and numerous professional clients. Furthermore, their foodservice operations, spearheaded by Solucious, target the hospitality, healthcare, and education sectors with specialized food solutions.

| Channel Type | Key Brands/Operations | Target Audience | 2023-2024 Performance Highlight |

|---|---|---|---|

| Physical Retail | Colruyt Lowest Prices, Okay, Bio-Planet | General Consumers | Over 600 stores, significant revenue driver |

| Online/Omnichannel | Collect&Go, Webshops (e.g., Newpharma) | Convenience-seeking Consumers | Expansion of Collect&Go network |

| Wholesale | Retail Partners Colruyt Group, Codifrance | Independent Retailers, Businesses | 15.6% sales increase in H1 2023-2024 |

| Foodservice | Solucious, Culinoa | Hospitality, Healthcare, Education | Strong performance driven by demand for convenience |

Customer Segments

Price-sensitive consumers form a significant portion of Colruyt Group's customer base. This segment is driven by a strong desire for value, actively seeking out the lowest possible prices on their regular grocery purchases and essential household items. Their purchasing decisions are heavily influenced by price comparisons, making them highly responsive to promotions and discount strategies.

Colruyt's core strategy, "Colruyt Lowest Prices," directly appeals to this segment by guaranteeing competitive pricing. For instance, in the 2023-2024 fiscal year, Colruyt Group reported a sales increase, partly attributed to their ability to attract and retain these value-conscious shoppers by consistently offering affordable options. Their focus on efficiency and cost control allows them to pass savings onto these customers.

Convenience-oriented shoppers are a key segment for Colruyt Group, prioritizing speed and ease in their grocery shopping experience. This group actively utilizes services like Collect&Go, their online ordering and in-store pickup option, which saw significant uptake. In the fiscal year 2023-2024, Colruyt Group reported that its e-commerce sales, largely driven by such convenient solutions, continued to grow, reflecting the strong demand for time-saving alternatives.

Health and Sustainability Conscious Consumers are a key segment for Colruyt Group. They actively seek out organic products, with Bio-Planet, Colruyt's dedicated organic supermarket, serving as a prime example of catering to this demand. This group values transparency in sourcing and is increasingly interested in brands and initiatives that support a healthy lifestyle, including those promoting plant-based diets.

Colruyt Group's commitment to sustainability resonates strongly with this demographic. For instance, in 2023, the group reported a significant increase in sales of private label organic products, demonstrating a growing consumer preference for healthier and more environmentally friendly options. Their efforts to reduce food waste and promote local sourcing further align with the values of these consumers.

Independent Retailers and Small Businesses

Colruyt Group actively supports independent retailers and small businesses by providing them with access to their extensive wholesale and distribution network. This segment includes a variety of entrepreneurs, from local supermarket owners to operators of convenience stores.

For these businesses, Colruyt Group acts as a crucial supply chain partner, offering competitive pricing and a wide product assortment. In 2023, the group's wholesale division, including activities serving these independent players, contributed significantly to its overall revenue, demonstrating the importance of this customer segment.

The benefits for independent retailers extend beyond just product sourcing:

- Access to a broad product range: Independent businesses can offer a wider selection to their customers by leveraging Colruyt's purchasing power.

- Competitive pricing: The group's efficient operations translate into cost savings for its wholesale clients.

- Logistical support: Reliable delivery and distribution services ensure stock availability for these smaller enterprises.

- Brand association: Partnering with a reputable name like Colruyt can enhance the credibility of independent stores.

Professional and Institutional Clients

Colruyt Group serves professional and institutional clients, including businesses in the hospitality sector, healthcare facilities, and educational institutions. These clients have significant needs for bulk food supplies and require tailored foodservice solutions to meet their operational demands. For example, in 2023, the food service sector in Belgium, a key market for Colruyt, saw continued recovery, with restaurants and hotels increasingly placing large orders for ingredients and prepared items.

These segments rely on Colruyt for consistent quality and efficient delivery, often requiring specialized product ranges and packaging. The group's extensive distribution network and focus on sourcing enable them to cater to these bulk requirements effectively. For instance, institutional clients often benefit from contract pricing and dedicated account management, ensuring their supply chain is robust and cost-effective.

- Hospitality: Restaurants, hotels, and catering services requiring large volumes of fresh produce, meats, dairy, and pantry staples.

- Healthcare: Hospitals and care homes needing specialized dietary options, bulk purchasing for patient meals, and adherence to strict food safety standards.

- Education: Schools and universities procuring food for canteens and events, often with budget constraints and a need for nutritious, kid-friendly options.

Colruyt Group caters to a diverse customer base, with price-sensitive consumers being a cornerstone. This segment prioritizes value and actively seeks out the lowest prices, making them highly responsive to promotions. The group's "Lowest Prices" strategy directly addresses this need, as evidenced by their consistent sales growth, partly driven by attracting these shoppers.

Convenience-seekers represent another vital segment, valuing speed and ease in their shopping. Colruyt's Collect&Go service, an online ordering and in-store pickup option, has seen significant adoption. In fiscal year 2023-2024, the growth in e-commerce sales, largely fueled by such convenient solutions, underscores the demand for time-saving alternatives.

Health and sustainability-conscious consumers are also a key demographic. They seek organic products, with Bio-Planet being a testament to this focus. This group values sourcing transparency and supports brands promoting healthy lifestyles, including plant-based options. The increase in private label organic product sales in 2023 highlights this growing preference.

Independent retailers and small businesses form a significant customer segment, benefiting from Colruyt's wholesale and distribution network. These businesses, from local grocers to convenience stores, rely on Colruyt for competitive pricing and a broad product assortment. The wholesale division's contribution to revenue in 2023 demonstrates the importance of this partnership.

Professional and institutional clients, such as those in hospitality, healthcare, and education, constitute another important segment. They require bulk food supplies and tailored foodservice solutions. The recovery in the food service sector in 2023, with increased large orders for ingredients, shows the demand Colruyt meets.

| Customer Segment | Key Characteristics | Colruyt Group's Offering | Fiscal Year 2023-2024 Data Point | Fiscal Year 2023 Data Point |

|---|---|---|---|---|

| Price-Sensitive Consumers | Value-driven, seek lowest prices, responsive to promotions. | "Lowest Prices" strategy, efficient operations. | Sales increase attributed to attracting value-conscious shoppers. | |

| Convenience-Oriented Shoppers | Prioritize speed and ease, utilize online ordering and pickup. | Collect&Go service, e-commerce solutions. | Continued growth in e-commerce sales. | |

| Health & Sustainability Conscious Consumers | Seek organic and sustainable products, value transparency. | Bio-Planet, private label organic products, food waste reduction. | Significant increase in private label organic product sales. | |

| Independent Retailers & Small Businesses | Need access to broad product range, competitive pricing, logistical support. | Wholesale and distribution network, efficient supply chain. | Wholesale division contributed significantly to overall revenue. | |

| Professional & Institutional Clients | Require bulk food supplies, tailored foodservice solutions, consistent quality. | Extensive distribution network, focus on sourcing, contract pricing. | Increased large orders from the recovering food service sector. |

Cost Structure

Colruyt Group's cost structure heavily relies on procurement and inventory management, with a substantial amount allocated to purchasing a wide array of food and non-food items. This focus on efficient sourcing is crucial for their strategy of offering the lowest prices to customers.

In the fiscal year 2023-2024, Colruyt Group's cost of sales was €9.7 billion, reflecting the significant expenditure in acquiring their product assortment. Maintaining a diverse product range and managing the associated inventory levels are key components of their operational expenses, directly impacting their ability to compete on price.

Colruyt Group's personnel and labor costs are a significant component of its expense structure. In the fiscal year 2023-2024, employee benefit expenses, encompassing wages, salaries, and social contributions for its workforce of over 33,000 individuals, constituted a substantial portion of the group's operational spending. These costs are distributed across its diverse operations, including retail store staff, logistics personnel, and various support functions.

Colruyt Group's logistics and distribution costs are substantial, reflecting the expenses tied to managing an extensive supply chain. These include the significant outlays for transporting goods across numerous locations, maintaining sophisticated warehousing facilities, and keeping their modern fleet of vehicles operational.

For instance, in the fiscal year 2023-2024, Colruyt Group reported that their cost of sales, which encompasses logistics, amounted to €9.6 billion. This highlights the sheer scale of investment required to ensure products reach their stores and customers efficiently.

Store Operations and Real Estate Costs

Colruyt Group's cost structure heavily features expenses related to its extensive physical retail footprint. This includes the ongoing costs of maintaining and operating a large network of supermarkets and convenience stores, alongside their associated pick-up points.

These operational expenses encompass a significant portion of their budget, covering essential elements like rent for prime retail locations, utilities to power these large spaces, and regular maintenance to ensure facilities are in good working order. For 2024, it's estimated that real estate and store operations represent a substantial percentage of their overall expenditure, reflecting the capital-intensive nature of brick-and-mortar retail.

Furthermore, Colruyt Group allocates considerable funds towards strategic investments in its store portfolio. This involves not only the modernization and renovation of existing outlets to enhance customer experience and operational efficiency but also capital for opening new stores in promising markets and expanding their pick-up point network to meet evolving consumer preferences for omnichannel shopping.

- Rent and Property Leases: Significant fixed costs associated with securing and maintaining a wide array of retail locations across Belgium and France.

- Utilities and Energy Consumption: High variable costs for electricity, water, and heating required to operate large supermarket formats and cold storage facilities.

- Store Maintenance and Upkeep: Ongoing expenses for repairs, cleaning, and general upkeep to ensure store presentation and functionality.

- Investments in Modernization and Expansion: Capital expenditure for store renovations, new store openings, and upgrades to infrastructure and technology.

Marketing, Sales, and Digital Investment

Colruyt Group dedicates significant resources to its Marketing, Sales, and Digital Investment cost structure. This includes substantial expenditures on advertising campaigns across various media to maintain brand visibility and attract customers. Promotional activities, such as loyalty programs and special offers, are also a key component, driving sales volume and customer engagement.

Ongoing investment in digital platforms and e-commerce is crucial for Colruyt Group's future growth. This encompasses developing and enhancing their online shopping experience, optimizing their digital marketing strategies, and investing in the underlying technology to support these efforts. For instance, in the fiscal year 2023-2024, the group continued to focus on expanding its digital capabilities, with a notable emphasis on improving the user experience and delivery services for its online platforms.

- Advertising and Brand Presence: Funds allocated to traditional and digital advertising to reinforce brand image and reach a broad customer base.

- Promotional Activities: Costs associated with sales promotions, discounts, and loyalty programs designed to boost immediate sales and customer retention.

- Digital Platform Development: Investments in e-commerce infrastructure, website enhancements, and mobile application improvements to support online sales channels.

- Technological Innovation: Spending on new technologies that can improve customer experience, operational efficiency, or create new digital revenue streams.

Colruyt Group's cost structure is heavily influenced by its procurement and inventory management, with a significant portion of its €9.7 billion cost of sales in FY 2023-2024 dedicated to acquiring a wide product range. Personnel costs are also substantial, with employee benefits for over 33,000 staff representing a key operational expense. Furthermore, extensive logistics and distribution networks, alongside the upkeep of a large physical retail footprint including rent, utilities, and maintenance, contribute significantly to overall expenditure.

| Cost Category | FY 2023-2024 (Approximate) | Key Drivers |

|---|---|---|

| Cost of Sales (Procurement & Inventory) | €9.7 billion | Product sourcing, supplier agreements, inventory holding costs |

| Personnel Costs (Employee Benefits) | Significant portion of operating expenses | Wages, salaries, social contributions for ~33,000 employees |

| Logistics & Distribution | Included in Cost of Sales (€9.6 billion total) | Transportation, warehousing, fleet management |

| Store Operations (Rent, Utilities, Maintenance) | Substantial percentage of overall expenditure | Real estate leases, energy consumption, facility upkeep |

| Marketing, Sales & Digital Investment | Ongoing expenditure | Advertising, promotions, e-commerce development, technology upgrades |

Revenue Streams

Colruyt Group's main income comes from selling everyday essentials. This includes groceries, fresh fruits and vegetables, and their own brand products, as well as everyday non-food items. These sales happen across their different supermarket brands like Colruyt, OKay, and Spar, and also through their specialized formats.

In the fiscal year 2023-2024, Colruyt Group reported a total revenue of €10.5 billion. The retail sales segment is the backbone of this revenue, reflecting the strong customer loyalty and consistent demand for their offerings.

Colruyt Group generates revenue through wholesale and foodservice channels by supplying a diverse range of products to independent retailers and franchisees. This segment also caters to professional clients within the foodservice industry, offering tailored solutions.

In the fiscal year 2023-2024, Colruyt Group's wholesale and foodservice activities contributed significantly to its overall performance, reflecting a strategic focus on expanding its reach beyond its own retail banners.

Colruyt Group leverages e-commerce sales as a significant revenue stream, primarily through its Collect&Go service and specialized online shops like Newpharma. This channel directly addresses the increasing consumer preference for digital convenience and home delivery options. In the first half of fiscal year 2024-2025, Colruyt Group saw continued growth in its online sales, reflecting the ongoing shift in shopping habits.

Renewable Energy Generation and Services

Colruyt Group's renewable energy division, primarily focused on wind and solar projects, represents a significant and growing revenue stream, showcasing their strategic diversification beyond traditional retail operations. This segment actively contributes to the group's financial performance, underscoring a commitment to sustainable energy generation.

In 2024, Colruyt Group continued to invest in and expand its renewable energy capacity. For instance, their involvement in wind energy projects, such as those in Belgium, generated consistent income. Solar energy initiatives, including installations on their own retail store rooftops and dedicated solar farms, also added to this income. The group has a stated ambition to increase its renewable energy production, aiming to cover a larger portion of its own energy needs and sell surplus power to the grid.

- Wind Energy: Income derived from operational wind farms, contributing to electricity generation and sales.

- Solar Energy: Revenue from rooftop solar installations on stores and dedicated solar parks, feeding into the grid.

- Energy Services: Potential income from offering energy management or trading services related to their renewable assets.

Other Business Activities

Colruyt Group diversifies its revenue through various other business activities beyond its core retail operations. These ventures contribute to the group's overall financial health and stability. For instance, Symeta Hybrid offers printing and document management solutions, catering to businesses needing efficient document handling.

Furthermore, Colruyt Group operates Jims, a fitness chain. This segment taps into the growing health and wellness market, providing an additional revenue stream. In 2024, the performance of these diversified activities, while not always explicitly broken out in detail for each segment, collectively supports the group's broader financial objectives.

- Symeta Hybrid: Provides printing and document management services.

- Jims Fitness Chain: Operates fitness centers, capitalizing on the health and wellness trend.

- Diversified Contribution: These activities supplement core retail revenues, enhancing financial resilience.

Colruyt Group's primary revenue driver is its extensive retail network, encompassing supermarkets like Colruyt, OKay, and Spar, alongside specialized formats. This core segment generated the vast majority of the group's €10.5 billion revenue in fiscal year 2023-2024, demonstrating strong customer engagement with everyday essentials and own-brand products.

Beyond its own stores, Colruyt Group secures income through wholesale and foodservice operations, supplying independent retailers and professional clients. This channel is crucial for expanding market reach and catering to diverse business needs, contributing significantly to the group's overall financial performance.

The group is actively growing its e-commerce presence, with Collect&Go and Newpharma representing key digital revenue streams. This online growth reflects a strategic adaptation to evolving consumer shopping habits and a commitment to digital convenience.

Colruyt Group also generates revenue from its renewable energy initiatives, particularly wind and solar projects. In 2024, these ventures, including installations on store rooftops and dedicated solar farms, provided a growing income stream, aligning with their sustainability goals.

Further diversification comes from services like Symeta Hybrid (document management) and the Jims fitness chain. These ventures, while smaller in scale, contribute to financial resilience and tap into specialized market segments.

| Revenue Stream | Description | Fiscal Year 2023-2024 Contribution |

|---|---|---|

| Retail Sales | Groceries, fresh produce, own brands, non-food items across supermarket banners. | Majority of €10.5 billion total revenue. |

| Wholesale & Foodservice | Supplying independent retailers and foodservice professionals. | Significant contributor to overall performance. |

| E-commerce | Collect&Go, Newpharma, and other online sales channels. | Continued growth observed in H1 2024-2025. |

| Renewable Energy | Income from wind and solar energy projects. | Growing revenue stream, contributing to financial performance. |

| Other Diversified Activities | Symeta Hybrid (document management), Jims (fitness chain). | Supplement core retail revenues, enhancing financial resilience. |

Business Model Canvas Data Sources

The Colruyt Group Business Model Canvas is informed by a blend of internal financial data, extensive market research on consumer behavior and competitor strategies, and operational insights from across their diverse business units.