Colruyt Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

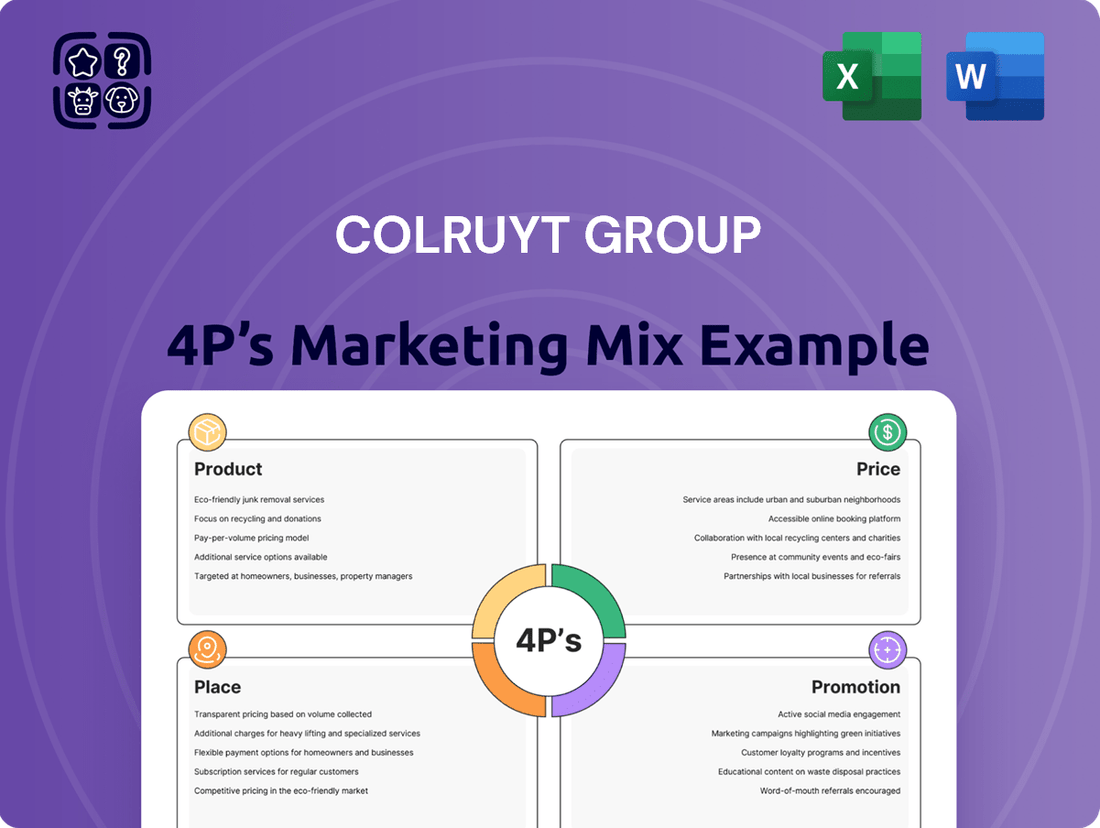

Colruyt Group masterfully leverages its product assortment, competitive pricing, extensive store network, and targeted promotions to solidify its market leadership. This 4Ps analysis delves into how these elements create a powerful customer proposition.

Discover the strategic brilliance behind Colruyt Group's product innovation, value-driven pricing, efficient distribution, and impactful promotional campaigns. Unlock the secrets to their enduring success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Colruyt Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Colruyt Group's diverse retail formats are a cornerstone of its market strategy, designed to meet a broad spectrum of consumer demands. This multi-format approach includes their flagship Colruyt Lowest Prices supermarkets, the more accessible Okay convenience stores, and specialized formats like Bio-Planet for organic products and Cru for gourmet food experiences. The recent acquisition of Delitraiteur in late 2023 further bolstered their presence in the premium convenience and urban food market, demonstrating a commitment to expanding their reach and catering to evolving shopping habits.

Colruyt Group places a significant emphasis on its private label brands, including Boni Selection and Everyday. These labels are fundamental to their market positioning, aiming to deliver high quality at accessible price points. The company consistently invests in rigorous taste and usage testing to ensure these private labels can effectively compete with, and often outperform, national brand offerings.

Colruyt Group's product strategy transcends basic groceries, encompassing a wide array of non-food items and a growing services sector. This diversification is evident in their expansion into health and well-being, notably through the online pharmacy Newpharma and their Jims fitness clubs.

Furthermore, Colruyt Group is actively involved in renewable energy via DATS 24, showcasing a commitment to a broader consumer ecosystem. This integrated approach aims to capture a larger share of consumer spending by offering a one-stop shop for diverse needs, from daily essentials to lifestyle and energy solutions.

Focus on Fresh and Sustainable s

Colruyt Group's commitment to fresh and sustainable products is a cornerstone of their strategy, particularly evident in their specialized formats. Bio-Planet, for instance, champions organic and locally sourced goods, aligning with growing consumer demand for healthier and more environmentally friendly options. Cru, another of their ventures, further emphasizes premium quality and provenance.

This focus on sustainability permeates various aspects of their operations. Colruyt Group actively works to minimize food waste, a significant issue in the retail sector. They are also dedicated to optimizing packaging solutions, aiming for reduced environmental impact. Furthermore, their support for local agriculture strengthens regional economies and ensures fresher produce for consumers.

- Bio-Planet and Cru: Dedicated formats offering a wide range of organic, local, and high-quality products.

- Food Loss Reduction: Initiatives implemented across the group to combat food waste, contributing to a more sustainable supply chain.

- Packaging Optimization: Efforts to reduce, reuse, or recycle packaging materials, minimizing environmental footprint.

- Support for Local Agriculture: Partnerships with local farmers and producers to ensure freshness, support communities, and reduce transportation emissions.

Innovation in Offerings and Customer Experience

Colruyt Group is actively enhancing its product range and the overall shopping journey. This includes a significant push into ready-to-eat and ready-to-heat meal solutions, catering to evolving consumer demands for convenience. Their acquisition of Delitraiteur further strengthens their position in the convenience segment, offering a more curated and accessible experience for shoppers seeking quick, high-quality meal options.

Technology plays a crucial role in Colruyt's innovation strategy, driving both in-store efficiency and supply chain advancements. For instance, the implementation of smart cooling systems within their Collect&Go service optimizes temperature management, ensuring product freshness and operational effectiveness. This focus on technological integration streamlines processes and elevates the customer experience by guaranteeing the quality of goods, especially for their online order and pickup service.

- Ready-to-Eat Expansion: Colruyt Group's commitment to convenience is evident in its growing selection of ready-to-eat and heat meals.

- Delitraiteur Acquisition: The integration of Delitraiteur broadens their convenience store footprint and product offerings.

- Smart Cooling for Collect&Go: Advanced cooling technology is being deployed to enhance the efficiency and quality assurance of their online grocery service.

- In-Store Production Efficiency: Investments in technology aim to optimize production processes within physical store locations.

Colruyt Group's product strategy emphasizes a broad and diversified offering, from everyday essentials under private labels like Boni Selection to specialized organic and gourmet ranges through Bio-Planet and Cru. Their commitment to quality is underscored by rigorous testing, ensuring private labels compete effectively with national brands. The group also extends its product reach into non-food categories and services, including online pharmacy Newpharma and fitness clubs, aiming to capture a larger share of consumer spending across various needs.

What is included in the product

This analysis provides a comprehensive breakdown of Colruyt Group's marketing mix, detailing their product offerings, competitive pricing strategies, extensive distribution channels, and targeted promotional activities.

Simplifies Colruyt Group's marketing strategy by clearly outlining their 4Ps, alleviating the complexity of understanding their customer-centric approach.

Provides a concise, actionable overview of Colruyt Group's 4Ps, removing the pain of deciphering extensive market research for quick strategic decisions.

Place

Colruyt Group boasts an extensive physical store network, a cornerstone of its marketing strategy. As of late 2024, this network comprises over 700 owned stores and more than 1,000 affiliated stores and franchisees. This substantial footprint spans Belgium, France, and Luxembourg, ensuring high customer accessibility and strong brand presence in key markets.

Colruyt Group's commitment to strategic distribution is evident in its substantial investments in modern logistics infrastructure. The opening of Ollignies 2, a highly automated distribution center specifically designed for non-food items, exemplifies this focus, aiming for enhanced productivity and energy efficiency. This facility is key to maintaining optimal stock levels and streamlining the flow of goods across the supply chain.

Colruyt Group masterfully blends its physical and digital presence, offering customers unparalleled convenience through its omnichannel strategy. Services like Collect&Go allow shoppers to order groceries online and pick them up at designated points, streamlining the shopping experience. This integration is crucial as online grocery sales in Belgium saw significant growth, with Colruyt Group's own digital sales channels performing strongly throughout 2024.

The group is also proactively adapting to changing consumer lifestyles and urban market demands. The expansion of compact urban store formats, such as Okay City and the innovative 24/7 Okay Direct stores, demonstrates a forward-thinking approach. These concepts cater to the need for quick, accessible shopping in densely populated areas, a trend that gained further momentum in 2024 as urban populations continued to grow.

Wholesale and Foodservice Channels

Colruyt Group extends its reach beyond its own retail stores through significant wholesale operations. In Belgium, they supply independent retailers such as Spar, Alvo, and Mini Market, fostering a network of diverse food outlets. This wholesale segment is crucial for market penetration and brand visibility, ensuring Colruyt's products are available even where they don't operate direct-to-consumer stores.

Their presence in France is bolstered by Codifrance and Degrenne Distribution, further solidifying their wholesale capabilities in a key European market. These activities demonstrate a strategic approach to market coverage, leveraging their purchasing power and logistical expertise to serve a broader customer base.

Colruyt's foodservice division, encompassing Solucious and Culinoa, is a vital component of their multi-channel strategy. This arm of the business specifically targets professional clients, including hospitals, schools, and the hospitality sector. For instance, Solucious reported a significant increase in sales in their 2023-2024 financial year, driven by strong demand from the foodservice sector, highlighting the division's growth and importance to the group's overall performance.

The foodservice channel allows Colruyt Group to tap into a different, yet complementary, market segment. By providing tailored solutions and bulk supplies to professional kitchens, they diversify revenue streams and build relationships with institutional buyers. This strategic diversification is key to resilience and continued growth in the evolving food industry.

- Wholesale Network: Colruyt Group supplies independent retailers like Spar, Alvo, and Mini Market in Belgium, and Codifrance and Degrenne Distribution in France.

- Foodservice Focus: The Solucious and Culinoa divisions cater to professional clients in sectors like healthcare and hospitality.

- Financial Performance: Solucious experienced notable sales growth in the 2023-2024 financial year, underscoring the strength of the foodservice segment.

- Strategic Diversification: These channels allow Colruyt to broaden market reach and diversify revenue beyond direct retail operations.

Strategic Acquisitions for Market Penetration

Colruyt Group actively pursues strategic acquisitions to bolster its market penetration and diversify its retail footprint. This approach allows them to enter new market segments and strengthen their competitive position. For instance, their acquisition of Delitraiteur, a chain of gourmet food stores, in 2021, aimed at capturing a more affluent customer base. This was followed by the significant acquisition of Match and Smatch stores in Belgium, completed in 2023, which substantially increased their store count and market share, particularly in urban areas.

These acquisitions are key components of Colruyt's strategy to adapt to evolving consumer preferences for convenience and localized shopping experiences. The integration of these acquired businesses into the Colruyt Group network allows for synergies in purchasing, logistics, and marketing. By expanding their reach through these strategic moves, Colruyt Group aims to capture a larger share of the Belgian and Luxembourgish food retail market, which saw total retail sales exceeding €60 billion in 2024.

- Acquisition of Delitraiteur: Strengthened presence in the premium food segment.

- Acquisition of Match/Smatch stores: Significantly expanded market share and store network in Belgium.

- Market Share Impact: The Match/Smatch acquisition alone was expected to add approximately €1.5 billion in annual revenue, boosting Colruyt's overall market share in Belgium.

- Diversification of Channels: Enhanced capability to serve diverse customer needs, from large supermarkets to smaller convenience formats.

Colruyt Group's physical presence is a cornerstone, with over 700 owned stores and more than 1,000 affiliated and franchised locations across Belgium, France, and Luxembourg as of late 2024. This extensive network ensures broad customer accessibility and reinforces brand visibility in key European markets. The group's strategic distribution is further enhanced by investments in automated logistics, such as the Ollignies 2 distribution center, which boosts efficiency and ensures optimal stock management. This robust infrastructure supports both their direct retail operations and their significant wholesale and foodservice activities.

Colruyt Group's place strategy is characterized by a diverse and expansive physical footprint, complemented by a strong digital presence and strategic acquisitions. Their network of over 700 owned stores and 1,000 affiliated locations in Belgium, France, and Luxembourg provides extensive customer access. This physical presence is augmented by a sophisticated logistics network, including automated distribution centers like Ollignies 2, ensuring efficient product flow. Furthermore, strategic acquisitions, such as Match and Smatch stores in 2023, have significantly broadened their market share and reach, allowing them to cater to a wider spectrum of consumer needs and preferences across various store formats.

What You See Is What You Get

Colruyt Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Colruyt Group's 4Ps Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to the full, ready-to-use report upon completing your order.

Promotion

Colruyt's promotional strategy is anchored in its unwavering 'Lowest Price Promise,' a core tenet that has defined the brand for years. This commitment is consistently highlighted across all touchpoints, fostering deep trust and loyalty with Belgian shoppers, a sentiment echoed in their recognition as the Best Retail FMCG Brand in 2024.

Colruyt Group's promotional campaigns, like 'zo maken we 't verschil', focus on educating customers about their commitment to the lowest price. This includes detailing their efficient supply chain and cost-saving measures, which are crucial for maintaining this promise.

These efforts directly support their value proposition by demonstrating the work that goes into offering competitive prices. For instance, in the first half of fiscal year 2024-2025, Colruyt Group reported a sales increase of 5.6%, indicating the effectiveness of their communication around value.

Colruyt Group actively highlights its dedication to sustainability, a key element in their product strategy. They communicate initiatives like reducing food waste, aiming for a 30% reduction in food loss by 2025, and utilizing eco-friendly packaging, with a goal of 100% recyclable or reusable packaging by 2028. This transparent communication strategy directly appeals to the growing segment of consumers prioritizing environmental responsibility in their purchasing decisions.

Digital Engagement and Omnichannel Content

Colruyt Group actively uses digital tools to enhance its marketing and communication efforts. They've developed an omnichannel content hub, a central platform designed to maintain a consistent brand image and boost efficiency in content creation across their many brands.

This strategy is crucial for delivering unified messages whether customers interact online or in physical stores. For instance, in fiscal year 2023-2024, Colruyt Group reported a 5.5% increase in digital sales for their Belgian food retail segment, underscoring the growing importance of their digital engagement.

The omnichannel approach helps manage content creation more effectively, ensuring that marketing messages are coherent and impactful across all touchpoints. This focus on digital engagement is a key part of their strategy to connect with customers in today's multi-channel retail environment.

- Digital Integration: Leveraging technology for marketing and communication.

- Omnichannel Content Hub: Centralizing content for brand consistency and productivity.

- Streamlined Messaging: Ensuring coherent communication across online and offline channels.

- Sales Impact: Digital sales growth, like the 5.5% increase in Belgian food retail in FY 2023-2024, validates this strategy.

Community Engagement and Social Programs

Colruyt Group actively participates in community engagement through social programs that resonate with their customer base. A prime example is the 'Aan tafel in 1, 2, 3 euro' initiative. This program specifically targets vulnerable families, offering them practical support in preparing healthy and affordable meals. This commitment goes beyond mere transactions, fostering a sense of social responsibility and enhancing their local brand perception.

These community-focused efforts serve as a powerful element of their marketing mix, directly impacting the 'Promotion' aspect. By investing in societal well-being, Colruyt Group builds trust and loyalty. For instance, their support for food banks and initiatives aimed at reducing food waste further solidifies their image as a responsible corporate citizen, which is increasingly valued by consumers in the 2024-2025 period.

- Community Investment: Colruyt Group's social programs demonstrate a tangible commitment to local communities.

- Brand Image Enhancement: Initiatives like 'Aan tafel in 1, 2, 3 euro' strengthen their reputation as a socially conscious retailer.

- Targeted Support: The focus on vulnerable families highlights a strategic approach to addressing specific societal needs.

- Customer Loyalty: Such programs foster goodwill and can translate into increased customer loyalty and positive word-of-mouth.

Colruyt Group's promotional strategy is built on its 'Lowest Price Promise,' consistently communicated across all channels to build trust, as evidenced by their 2024 Best Retail FMCG Brand award. Their campaigns actively explain their cost-saving operations, reinforcing their value proposition and contributing to a 5.6% sales increase in the first half of fiscal year 2024-2025.

They also leverage digital platforms, with a 5.5% rise in Belgian food retail digital sales in FY 2023-2024, supported by an omnichannel content hub for consistent brand messaging. Furthermore, community engagement through programs like 'Aan tafel in 1, 2, 3 euro' enhances their social responsibility image and fosters customer loyalty.

| Promotional Tactic | Key Message | Impact/Metric |

|---|---|---|

| Lowest Price Promise | Unwavering commitment to competitive pricing | Brand trust, customer loyalty, 5.6% sales increase (H1 FY24-25) |

| Educational Campaigns (e.g., 'zo maken we 't verschil') | Transparency on supply chain efficiency and cost savings | Reinforces value proposition, customer understanding |

| Digital Marketing & Omnichannel Hub | Consistent brand image, efficient content delivery | 5.5% digital sales growth (Belgian food retail, FY23-24) |

| Community Engagement (e.g., 'Aan tafel in 1, 2, 3 euro') | Social responsibility, support for vulnerable families | Enhanced brand perception, increased goodwill |

Price

Colruyt Group's 'lowest price guarantee' is a cornerstone of their marketing strategy, aiming to provide customers with the most competitive prices available. This commitment necessitates constant vigilance over competitor pricing to ensure they remain the most affordable option.

To uphold this promise, Colruyt actively monitors market prices and makes swift adjustments, a strategy that has proven effective in maintaining customer loyalty. For instance, in the first half of fiscal year 2024-2025, Colruyt Group reported a turnover of €5.4 billion, demonstrating the ongoing success of their price-focused approach.

Colruyt Group's pricing strategy is remarkably dynamic, often adjusting prices multiple times a week to maintain its "lowest price" commitment. This agility allows them to react swiftly to competitor pricing and market fluctuations, a crucial advantage in the fast-paced grocery sector.

This frequent price adjustment is a core element of their competitive strategy. For instance, during 2024, Colruyt's proactive pricing allowed them to remain competitive even as inflation impacted consumer spending, with many product prices being updated to reflect immediate market conditions.

Colruyt Group's commitment to its lowest price strategy is deeply rooted in relentless cost efficiency and operational optimization. This focus is crucial for maintaining profitability while offering competitive pricing. For instance, the group's ongoing investments in automation and digital transformation are designed to streamline processes and reduce overheads.

The company actively optimizes its supply chain through investments in advanced distribution centers, ensuring that goods move efficiently from supplier to shelf. This operational excellence directly translates into lower costs, which are then passed on to consumers, reinforcing Colruyt's value proposition. In the fiscal year 2023/2024, Colruyt Group reported a capital expenditure of €574 million, a significant portion of which is allocated to these efficiency-enhancing initiatives, including the expansion of their automated distribution centers.

Strategic Sourcing and Purchasing Alliances

Colruyt Group leverages strategic sourcing and purchasing alliances to bolster its competitive edge, particularly for its private label offerings. By participating in major international purchasing alliances such as European Marketing Distribution (EMD) and AgeCore, Colruyt significantly amplifies its purchasing power. This collective bargaining strength enables the group to negotiate more favorable terms and conditions with suppliers, ultimately translating into cost savings that are passed on to consumers through affordable, high-quality private label products.

These alliances are crucial for maintaining Colruyt's commitment to value. For instance, EMD, one of the largest purchasing groups globally, provides its members with access to a vast network of suppliers and exclusive product ranges. In 2024, EMD reported a turnover of €15.9 billion, underscoring the substantial scale of purchasing power Colruyt taps into. This strategic collaboration allows Colruyt to secure competitive pricing and ensure a consistent supply of quality goods for its private label brands, reinforcing its 'affordable quality' promise.

- Enhanced Purchasing Power: Membership in alliances like EMD and AgeCore allows Colruyt to negotiate better terms with suppliers due to increased order volumes.

- Cost Savings for Private Labels: These alliances directly contribute to lower procurement costs for Colruyt's private label products, enabling competitive pricing.

- Access to Exclusive Products: Participation provides access to a wider range of products and potential exclusive deals not available to individual retailers.

- Supply Chain Stability: Collaborating with large alliances can improve supply chain resilience and ensure product availability.

Impact of Market Competition and Inflation

Colruyt Group's pricing is significantly shaped by the intense competition within the Belgian grocery sector and the unpredictable nature of food inflation. This environment demands a delicate balance to maintain market share and profitability.

To navigate these pressures, Colruyt Group focuses on maintaining competitive prices while implementing rigorous cost control strategies. This dual approach is key to their objective of keeping the operating result stable amidst market volatility.

- Competitive Pricing: Colruyt is known for its price leadership strategy, aiming to offer the lowest prices in the market.

- Inflation Impact: Rising food prices, a persistent trend in 2024 and projected into 2025, directly challenge this strategy, requiring careful margin management.

- Cost Control: The group's operational efficiency and supply chain management are critical for offsetting inflationary pressures and maintaining profitability.

- Operating Result Stability: Despite external economic headwinds, Colruyt Group aims for a stable operating result, demonstrating resilience through strategic pricing and cost discipline.

Colruyt Group's pricing strategy is built on a foundation of aggressive competitiveness, aiming to be the price leader in the Belgian market. This is supported by significant investments in operational efficiency and strategic purchasing alliances, allowing them to absorb some of the impact of inflation and maintain their value proposition for consumers.

The group's commitment to offering the lowest prices is evident in their dynamic price adjustments, often occurring multiple times a week. This agility, combined with a strong focus on cost control, is crucial for navigating the competitive landscape and inflationary pressures experienced throughout 2024 and into 2025.

Colruyt's financial performance, with a turnover of €5.4 billion in the first half of fiscal year 2024-2025, underscores the effectiveness of this price-centric approach. Their substantial capital expenditure of €574 million in fiscal year 2023/2024, directed towards automation and supply chain improvements, further reinforces their ability to deliver value.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Turnover | €5.4 billion | H1 FY 2024-2025 | Demonstrates sustained customer traffic and sales volume driven by price competitiveness. |

| Capital Expenditure | €574 million | FY 2023/2024 | Highlights investment in efficiency to support low-price strategy and cost management. |

| Purchasing Alliance Turnover (EMD) | €15.9 billion | 2024 | Indicates significant purchasing power leveraged through alliances to secure competitive sourcing. |

4P's Marketing Mix Analysis Data Sources

Our Colruyt Group 4P's Marketing Mix Analysis is built on a foundation of official company disclosures, including annual reports and investor presentations, complemented by insights from industry-specific market research and retail performance data.