Colruyt Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colruyt Group Bundle

Navigate the complex external landscape impacting Colruyt Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and social trends are directly influencing their operations and strategic direction. Gain a competitive advantage by leveraging these critical insights.

Ready to make informed decisions about Colruyt Group? Our PESTLE analysis delves into the technological advancements, environmental considerations, and legal frameworks shaping their future success. Download the full version now to unlock actionable intelligence and stay ahead of the curve.

Political factors

Government policies on retail operations, including pricing controls, promotional rules, and Sunday opening hours, significantly shape Colruyt Group's competitive strategies and operational flexibility. For instance, in Belgium, while Sunday trading is generally restricted, specific exceptions can apply. Adapting to these varying regulations across Belgium, France, and Luxembourg demands agile business models.

Compliance with these diverse legal frameworks is paramount for Colruyt Group to avoid potential penalties and secure continued market access. For example, in France, regulations around end-of-day sales and promotional activities are strictly enforced, impacting how Colruyt can offer discounts or clear inventory.

Colruyt Group operates under stringent food safety and labeling regulations, dictated by both Belgian and broader European Union authorities. These rules, constantly evolving, directly influence how Colruyt sources its ingredients, manages its quality assurance processes, and designs its product packaging. For instance, the EU's General Food Law (Regulation (EC) No 178/2002) sets out foundational principles for food safety, requiring traceability throughout the supply chain.

Adherence to these strict standards is paramount for maintaining consumer confidence, particularly for Colruyt's extensive private label offerings, which often represent a significant portion of their sales. In 2023, private labels accounted for approximately 30% of sales for many major European retailers, a trend Colruyt actively participates in. Failure to comply with these regulations, such as incorrect allergen labeling or unaddressed contamination risks, could result in severe reputational damage and substantial financial penalties, impacting profitability and brand loyalty.

Colruyt Group operates under stringent national and European competition laws that scrutinize market dominance, mergers, and anti-competitive practices within the grocery retail landscape. These regulations are crucial for fostering a fair market and preventing monopolistic tendencies.

Navigating these rules directly impacts Colruyt's strategic decisions regarding market expansion and potential acquisitions, ensuring compliance while pursuing growth opportunities. For example, the European Commission's ongoing focus on digital markets and potential abuses of dominant positions by large retailers could influence future M&A activity.

Trade Policies and Import Tariffs

Colruyt Group's reliance on international sourcing means that trade policies and import tariffs significantly influence its operational costs and product availability. For instance, changes in EU trade agreements or tariffs on specific agricultural imports, such as those from non-EU countries, can directly increase the cost of goods for Colruyt, potentially impacting their competitive pricing strategies. The group actively monitors these global trade dynamics to adapt its procurement and supply chain management. For example, in 2024, ongoing discussions around agricultural trade between the EU and Mercosur countries could introduce new tariff structures impacting imported produce, a key category for Colruyt.

The group's ability to manage these political factors is crucial for maintaining profitability and offering a diverse product range to its customers. Fluctuations in tariffs can affect the landed cost of specialty items or produce sourced from regions outside of established trade blocs. Colruyt's strategic approach involves diversifying its supplier base and exploring local sourcing options where feasible to mitigate the risks associated with protectionist trade measures implemented by various governments.

Key considerations for Colruyt Group regarding trade policies include:

- Impact of EU Common Agricultural Policy (CAP) reforms: Changes in CAP subsidies or import quotas can influence the competitiveness of imported versus domestically produced goods.

- Brexit-related trade adjustments: While the initial shock has passed, ongoing adjustments to UK-EU trade relations continue to affect supply chains for certain goods.

- Geopolitical instability and trade sanctions: Emerging geopolitical tensions can lead to unexpected trade disruptions or sanctions, requiring agile responses in sourcing.

- Negotiations on new Free Trade Agreements (FTAs): The outcomes of FTAs, such as those involving the EU and other major economies, can create new opportunities or challenges for imported product costs.

Political Stability and Economic Policy

The political stability in Belgium, France, and Luxembourg is a key driver for Colruyt Group. A stable political landscape translates to more predictable economic conditions, which directly impacts consumer confidence and their willingness to spend. For instance, Belgium experienced a period of political transition in 2024, which, while not causing major economic disruption, highlights the importance of consistent governance for business planning.

Government economic policies, including fiscal and monetary strategies, significantly shape Colruyt's operating environment. Changes in taxation, subsidies, or interest rates can alter operational costs and influence consumer purchasing power. As of early 2025, the European Central Bank's monetary policy continues to be closely watched for its impact on inflation and consumer spending across the Eurozone, including the markets where Colruyt operates.

- Political Stability: Belgium, France, and Luxembourg maintain generally stable political environments, crucial for predictable business operations.

- Economic Policy Impact: Shifts in fiscal and monetary policies directly affect Colruyt's costs and consumer demand.

- Consumer Confidence: Political stability underpins consumer confidence, a vital factor for retail sales performance.

- Regulatory Framework: Government regulations and trade agreements within these countries shape market access and operational compliance.

Colruyt Group navigates a complex web of political factors, with government policies on retail operations, such as pricing and opening hours, directly impacting its strategies. Compliance with diverse legal frameworks across Belgium, France, and Luxembourg is essential to avoid penalties and maintain market access. For example, strict enforcement of French regulations on promotional activities influences how Colruyt can offer discounts.

What is included in the product

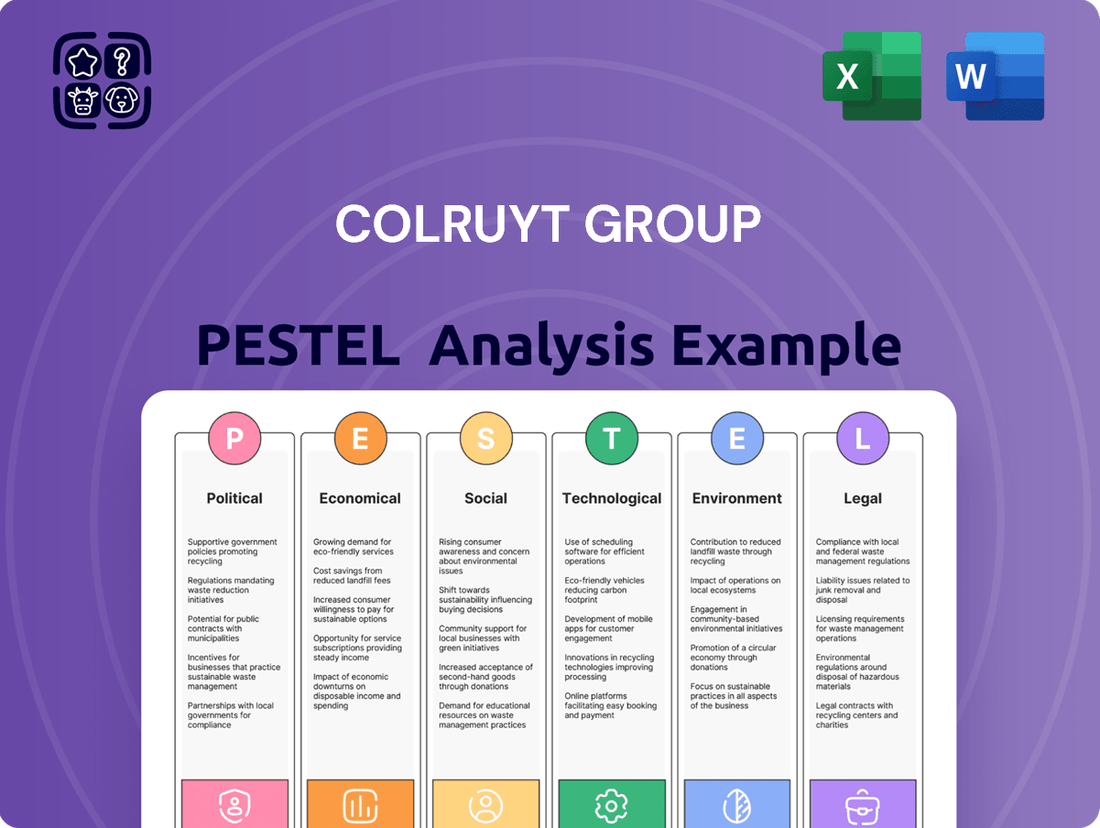

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Colruyt Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into how these forces shape the company's operational landscape and strategic decision-making.

A concise PESTLE analysis for Colruyt Group, highlighting key external factors impacting their operations, serves as a pain point reliever by providing a clear framework for strategic decision-making and risk mitigation.

This analysis, segmented by Political, Economic, Social, Technological, Environmental, and Legal factors, offers a quick and accessible overview for teams to identify potential challenges and opportunities, thereby easing the burden of complex market analysis.

Economic factors

Rising inflation in 2024 and 2025 directly impacts Colruyt's operational costs, especially for energy and logistics, and the raw materials used in their private label products. This economic pressure also reduces what consumers can afford to buy, forcing Colruyt to carefully balance pricing to keep sales volumes steady.

The group's focus on cost efficiency and strategic pricing becomes crucial to maintain affordability for customers, which in turn supports demand for their discount supermarket formats. For instance, in the first half of fiscal year 2024/25, Colruyt reported a 3.8% increase in sales, reflecting their ability to navigate these economic headwinds.

Fluctuations in interest rates directly impact Colruyt Group's cost of borrowing for significant capital expenditures, including store modernizations, supply chain enhancements, and investments in sustainability. For instance, if the European Central Bank's key interest rates, which were around 4.50% in early 2024, were to rise, Colruyt's expenses for new loans or refinancing existing debt would increase. This could potentially temper the pace of their ambitious growth plans.

Access to affordable capital remains a cornerstone for Colruyt Group's ability to fund long-term strategic initiatives. When interest rates are low, as they were in previous years, borrowing becomes more attractive, facilitating investments in areas like expanding their organic product lines or developing new store formats. Conversely, a sustained period of higher interest rates, as anticipated by some forecasts for 2024 and 2025, could necessitate a more cautious approach to capital deployment.

Colruyt Group's performance is closely tied to the economic health of its primary operating regions: Belgium, France, and Luxembourg. In 2024, Belgium's GDP growth was projected to be around 1.4%, with France expecting a similar 1.3%. Luxembourg, known for its robust economy, anticipated a higher growth rate of approximately 2.2% for the same year. These figures directly influence consumer purchasing power for both essential food items and discretionary non-food products that Colruyt offers.

When these economies expand, consumers generally see their disposable incomes rise, which translates into higher sales volumes for retailers like Colruyt. For instance, a strong economic upturn in Belgium could lead to increased spending on Colruyt's private label brands and fresh produce. Conversely, a slowdown, such as the anticipated moderate growth in 2025, can dampen consumer confidence, leading to more cautious spending habits and potentially impacting Colruyt's revenue streams.

Unemployment Rates and Labor Costs

Unemployment rates in Colruyt Group's primary operating regions, particularly Belgium and France, directly affect the availability of staff and the pressure to increase wages. For instance, Belgium's unemployment rate hovered around 5.5% in early 2024, a figure that can strain recruitment efforts and necessitate higher compensation to attract and retain employees.

This dynamic directly impacts Colruyt's operational expenses, as labor is a significant cost component for retailers. When unemployment is low, as it has been in parts of Western Europe, companies like Colruyt face increased competition for workers, potentially driving up hourly wages and benefits.

To navigate these challenges and maintain profitability, Colruyt Group must focus on efficient workforce management, including optimized scheduling and training programs. Ensuring competitive compensation packages is crucial not only for attracting talent but also for retaining existing staff, thereby minimizing turnover costs and maintaining service quality.

- Belgium Unemployment Rate (Early 2024): Approximately 5.5%

- France Unemployment Rate (Early 2024): Approximately 7.3%

- Impact on Labor Costs: Low unemployment typically leads to increased wage pressure and recruitment expenses.

- Strategic Imperative: Efficient workforce management and competitive compensation are key to profitability.

Energy Prices and Supply Chain Costs

Volatile energy prices, especially for fuel and electricity, directly affect Colruyt Group's extensive logistics and store operations. As a significant energy consumer, particularly for its efficient distribution network, higher energy costs can compress profit margins. For instance, in the first half of fiscal year 2024-2025, energy costs represented a notable portion of operational expenses, though specific figures for the impact on Colruyt were not disclosed publicly.

The group's investment in its renewable energy division, which aims to generate a significant portion of its electricity needs, is a strategic move to partially offset this exposure. By 2025, Colruyt Group plans to have installed 500,000 solar panels across its sites, contributing to a more stable energy cost structure.

These fluctuations in energy prices also ripple through the supply chain, increasing the cost of goods for Colruyt and potentially impacting consumer prices.

- Rising fuel costs directly increase transportation expenses for Colruyt's distribution network.

- Electricity price volatility impacts the operational costs of all Colruyt stores and distribution centers.

- Colruyt's renewable energy initiatives aim to mitigate the financial impact of fluctuating energy markets.

- Supply chain costs are indirectly affected by energy prices, influencing the overall cost of merchandise.

Economic growth in Colruyt's key markets, Belgium and France, is projected to be moderate in 2024 and 2025, impacting consumer purchasing power. Belgium's GDP growth was around 1.4% in 2024, with France at 1.3%, influencing spending on both essentials and non-essentials. A slowdown, as anticipated for 2025, can dampen consumer confidence and affect Colruyt's revenue.

Rising inflation in 2024 and 2025 increases Colruyt's operational costs for energy, logistics, and raw materials, while also reducing consumer affordability. The group's focus on cost efficiency and strategic pricing is vital to maintain demand, as seen in their 3.8% sales increase in the first half of fiscal year 2024/25.

Interest rate fluctuations affect Colruyt's borrowing costs for capital expenditures. For instance, if European Central Bank rates, around 4.50% in early 2024, rise, it could slow down growth plans. Conversely, lower rates in previous years facilitated investments in new store formats and organic product lines.

Unemployment rates, around 5.5% in Belgium and 7.3% in France in early 2024, can strain recruitment and increase wage pressures, impacting Colruyt's labor costs. Efficient workforce management and competitive compensation are crucial for retaining staff and maintaining service quality.

Preview the Actual Deliverable

Colruyt Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Colruyt Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Gain immediate access to this in-depth strategic overview upon completion of your purchase.

Sociological factors

Consumers are increasingly prioritizing health, sustainability, and ethical sourcing, alongside a strong demand for convenience. This shift is evident in the growing popularity of organic and plant-based options. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating a significant trend Colruyt Group needs to address.

Colruyt Group must proactively adapt its product offerings, especially its private label brands, to align with these evolving consumer preferences. Expanding the availability of organic, locally sourced, and plant-based items is crucial for maintaining market relevance and appealing to a broader, more conscious customer base.

Demographic shifts are reshaping consumer needs across Europe, with an aging population in many Western European markets, including Belgium where Colruyt is headquartered. For instance, in 2024, the proportion of individuals aged 65 and over in Belgium was projected to be around 21.5%, a figure expected to climb. This trend impacts demand for certain product categories and necessitates adaptable store formats.

Urbanization continues to be a significant driver, with more people moving to cities. By 2023, over 60% of the world's population lived in urban areas, a figure projected to reach nearly 70% by 2050 according to UN data. This growth in urban centers influences Colruyt's strategy, pushing for a mix of large supermarkets and smaller, more convenient formats like Spar Express to serve diverse urban living situations and commuting patterns.

Colruyt's multi-format approach, encompassing hypermarkets like Colruyt, supermarkets like Okay, and convenience stores like Spar Express, directly addresses these evolving demographic and urbanization trends. This flexibility allows the group to optimize its retail footprint, ensuring accessibility and relevance whether customers are in densely populated urban areas or suburban settings, catering to varying household sizes and lifestyle needs.

Colruyt Group must navigate the significant shift towards online shopping, with e-commerce sales in the grocery sector projected to reach €15.7 billion in Belgium by 2025. Consumers increasingly expect seamless omnichannel experiences, demanding that online and offline channels are well-integrated. This evolution necessitates substantial investment in Colruyt's digital infrastructure to maintain customer engagement and market position.

The enduring consumer focus on value and discount formats, a core strength of Colruyt, remains crucial. However, the integration of these value propositions across digital platforms is paramount. By adapting to these evolving shopping habits, Colruyt can enhance customer loyalty and secure its market share in an increasingly competitive retail landscape.

Ethical Consumerism and Social Responsibility

Ethical consumerism is a significant force shaping retail, with shoppers increasingly scrutinizing a company's social and environmental footprint. This trend directly impacts Colruyt Group by demanding greater transparency in its supply chain and operational practices. For instance, in 2024, a significant portion of Belgian consumers indicated they would switch brands if a company was found to have unethical sourcing practices.

Colruyt's established commitment to sustainability, fair labor standards, and active community involvement directly addresses this growing consumer consciousness. This focus not only bolsters its brand reputation but also attracts a growing segment of socially aware customers. The group's efforts in areas like reducing food waste and promoting local sourcing resonate strongly with these consumers.

- Consumer Demand: Reports from 2024 suggest over 60% of European consumers consider sustainability when making purchasing decisions.

- Brand Loyalty: Companies with strong ethical credentials often see higher customer retention rates.

- Operational Influence: Ethical considerations are driving changes in Colruyt's procurement policies, favoring suppliers with demonstrable social responsibility.

- Community Impact: Colruyt's investments in local communities through initiatives like food banks and sponsorships enhance its social license to operate.

Health and Wellness Trends

Colruyt Group is navigating a significant shift towards health and wellness, with consumers increasingly prioritizing fresh, minimally processed foods and specialized dietary options. This trend directly influences product development and marketing strategies, requiring Colruyt to offer clear nutritional information and an extensive range of healthy choices to meet evolving customer demands.

This focus on well-being is reflected in market data. For instance, the European market for organic food, a key segment within health-conscious consumption, was valued at approximately €52 billion in 2023, with projections indicating continued growth. Colruyt's commitment to healthy offerings, such as its Bio-Planet banner and extensive private label healthy product lines, positions it to capitalize on this expanding market.

- Consumer Demand for Healthy Options: A growing percentage of European consumers, estimated at over 60% in recent surveys, actively seek out healthier food alternatives.

- Dietary Specialization: The demand for gluten-free, vegan, and low-sugar products continues to rise, creating opportunities for retailers to diversify their stock.

- Transparency in Nutrition: Consumers expect clear and accessible nutritional labeling, influencing packaging design and product information provided by retailers like Colruyt.

- Impact on Private Labels: Colruyt's own brands are increasingly incorporating healthier formulations and transparent sourcing to align with these wellness trends, driving sales in these categories.

Sociological factors significantly influence Colruyt Group's operations, driven by evolving consumer values and demographics. There's a pronounced shift towards health-conscious eating and sustainability, with over 60% of European consumers in 2024 considering sustainability in their purchases. This necessitates Colruyt's adaptation of product ranges and supply chains to meet demands for organic, ethically sourced, and plant-based options, a trend supported by the global plant-based food market's projected growth to $162 billion by 2030.

Demographic changes, particularly an aging population in key markets like Belgium, where individuals aged 65+ represented approximately 21.5% in 2024, impact product demand and store formats. Simultaneously, increasing urbanization, with over 60% of the global population living in urban areas by 2023, drives the need for diverse retail formats, from hypermarkets to convenient local stores like Spar Express, to cater to varied urban lifestyles.

| Sociological Factor | Trend Description | Impact on Colruyt Group | Supporting Data (2023-2025) |

|---|---|---|---|

| Health & Wellness | Growing consumer preference for healthy, minimally processed foods. | Expansion of organic, plant-based, and low-sugar product lines; clear nutritional labeling. | European organic food market valued at ~€52 billion (2023). |

| Sustainability & Ethics | Increased demand for eco-friendly products and ethical sourcing. | Focus on supply chain transparency, reduced food waste, and community initiatives. | >60% of European consumers consider sustainability in purchasing (2024). |

| Demographics | Aging population in Western Europe; rise of smaller households. | Adaptation of store formats and product assortments to cater to diverse age groups and household needs. | Belgium's 65+ population ~21.5% (2024 projection). |

| Urbanization | Migration towards urban centers. | Development of convenient, smaller-format stores (e.g., Spar Express) alongside larger supermarkets. | >60% of global population urbanized (2023). |

| Digital Adoption | Shift towards online grocery shopping and omnichannel experiences. | Investment in e-commerce infrastructure and integrated online/offline services. | Belgian online grocery sales projected to reach €15.7 billion by 2025. |

Technological factors

The accelerating growth of e-commerce and the demand for integrated omnichannel experiences are reshaping retail. Colruyt Group needs to consistently invest in its digital backbone to support online sales, efficient delivery networks, and convenient click-and-collect services. This technological evolution is crucial for broadening their customer base and offering greater accessibility.

In 2023, Colruyt Group reported a 14.5% increase in online sales for its Belgian food retail segment, highlighting the significant shift in consumer behavior. To stay competitive, the group must continue to refine its digital platforms and logistics, ensuring a smooth transition between online and in-store shopping journeys.

Colruyt Group's commitment to supply chain automation is a key technological driver. In 2024, the group continued to invest in robotics and automated systems within its distribution centers, aiming to boost operational efficiency. For instance, their distribution center in Wilrijk utilizes advanced sorting technologies to handle a higher volume of goods with greater accuracy.

The integration of AI-driven routing and predictive analytics is central to optimizing logistics. These technologies help Colruyt reduce delivery times and fuel consumption, contributing to cost savings and environmental sustainability. By leveraging data, they can better forecast demand, leading to more efficient inventory management and a significant reduction in waste, a crucial element for their business model.

Colruyt Group is increasingly leveraging big data and AI to gain deeper customer insights. This allows for highly personalized marketing campaigns, which can significantly boost engagement and sales. For instance, by analyzing purchasing patterns, they can tailor promotions to individual shopper preferences, making marketing spend more efficient.

The application of AI in demand forecasting is a game-changer for Colruyt's inventory management. Accurate predictions minimize both overstocking and stockouts, directly impacting profitability and customer satisfaction. In 2024, retailers globally saw improved efficiency by up to 15% through AI-driven supply chain optimization, a trend Colruyt is likely pursuing.

These data-driven strategies are fundamental to understanding and meeting the diverse needs of Colruyt's customer base. By processing vast amounts of data, the group can identify emerging trends and adapt its offerings, ensuring it remains competitive in a rapidly evolving retail landscape.

Renewable Energy Technologies Integration

Colruyt Group actively integrates renewable energy, notably through solar panel installations across its sites. For instance, by the end of the 2023-2024 financial year, the group had installed solar panels with a total capacity of 78 MWp, generating a significant portion of its electricity needs. This commitment not only lowers energy expenses but also reinforces their dedication to environmental stewardship and reducing their carbon footprint.

The company's investment in renewable energy is a strategic move towards greater energy independence and cost control. By harnessing solar power, Colruyt Group mitigates the volatility of traditional energy markets, contributing to more stable operational costs. This focus on sustainable energy aligns with broader European Union targets for renewable energy adoption and emissions reduction, positioning Colruyt as a leader in responsible business practices.

Continued advancements in renewable energy technologies, such as more efficient solar panels and potential future integration of other sources like wind, will further bolster Colruyt Group's long-term energy strategy. These technological factors are crucial for maintaining a competitive edge and achieving ambitious sustainability objectives in the evolving energy landscape.

In-Store Technology and Customer Experience

Colruyt Group is actively integrating advanced in-store technologies to elevate the customer journey and streamline operations. The adoption of self-checkout kiosks, digital displays, and mobile payment solutions is a key focus. For example, by the end of fiscal year 2023-2024, Colruyt Group reported a continued rollout of self-scanning options across its stores, aiming to improve checkout speed for customers.

These technological advancements are designed to boost convenience and offer dynamic pricing strategies. Electronic shelf labels, for instance, allow for real-time price adjustments and targeted promotions, enhancing responsiveness to market demands. This agility is crucial in the fast-paced retail environment.

Staying at the forefront of retail technology is paramount for maintaining competitive advantage. Colruyt Group's investment in these areas reflects a commitment to innovation, ensuring a seamless and engaging shopping experience. This includes exploring technologies that personalize offers and improve inventory management.

Key technological integrations include:

- Self-checkout and Self-Scanning: Increasing customer throughput and reducing wait times.

- Digital Signage and Electronic Shelf Labels: Enabling dynamic pricing, personalized promotions, and efficient product information display.

- Mobile Payment and Loyalty Integration: Offering faster, more convenient transactions and enhancing customer engagement through loyalty programs.

- Data Analytics for Personalization: Leveraging in-store technology to gather insights and tailor offers to individual customer preferences.

Colruyt Group's technological advancements are central to its operational efficiency and customer engagement. Investments in e-commerce platforms and logistics automation, such as robotics in distribution centers, are key priorities. The group is also leveraging AI for demand forecasting and personalized marketing, aiming to enhance inventory management and customer insights.

The group's commitment to renewable energy, exemplified by its 78 MWp solar panel capacity by the end of fiscal year 2023-2024, showcases a strategic focus on energy independence and cost control. This aligns with broader sustainability goals, positioning Colruyt as a leader in responsible energy practices within the retail sector.

In-store technologies like self-checkout, digital signage, and mobile payment solutions are being integrated to improve customer experience and operational agility. These innovations, including the continued rollout of self-scanning options, are designed to streamline transactions and enable dynamic pricing strategies.

| Technology Focus | Key Initiatives | Fiscal Year 2023-2024 Impact/Data |

|---|---|---|

| E-commerce & Omnichannel | Digital platform enhancement, logistics optimization | 14.5% increase in online sales (Belgian food retail) |

| Automation & AI | Robotics in distribution, AI for demand forecasting | Investment in advanced sorting technologies (Wilrijk DC) |

| Renewable Energy | Solar panel installation | 78 MWp total solar capacity |

| In-Store Technology | Self-checkout, digital labels, mobile payment | Continued rollout of self-scanning options |

Legal factors

Colruyt Group navigates a complex web of labor laws across Belgium, France, and Luxembourg, impacting everything from minimum wages and working hours to employee benefits and collective bargaining agreements. For instance, Belgium's federal minimum wage for adults was €2,029.83 gross per month in 2024, a figure Colruyt must adhere to while managing its extensive workforce.

Strict adherence to these regulations, including those concerning employee representation and consultation, is paramount to prevent costly legal challenges and ensure a harmonious industrial relations environment. Failure to comply can lead to significant fines and reputational damage, as seen in past labor disputes within the retail sector.

Anticipating and adapting to evolving labor legislation, such as potential shifts in employment protection or new mandates on work-life balance, is crucial for Colruyt's operational efficiency and its human resource planning. For example, ongoing discussions around the four-day work week in some European countries could necessitate strategic adjustments to staffing models and payroll.

Colruyt Group operates under a robust framework of consumer protection laws that dictate product quality, safety, advertising standards, and fair trading. These regulations are crucial for maintaining consumer trust, especially concerning Colruyt's extensive private label offerings. For instance, in Belgium, the General Food Law (Regulation (EC) No 178/2002) sets out general principles and requirements related to food safety, which Colruyt must rigorously follow.

Data privacy regulations, such as the GDPR, significantly shape Colruyt Group's operations. These laws mandate stringent protocols for handling customer and employee data, impacting everything from loyalty programs to online platforms. Failure to comply can result in substantial fines, as seen with other companies facing penalties for data breaches, underscoring the need for robust security and transparent privacy policies to safeguard customer trust and avoid financial repercussions.

Environmental Protection Legislation

Colruyt Group navigates a complex web of environmental protection legislation. These laws cover crucial areas like waste management, packaging materials, operational emissions, and overall energy consumption. For instance, in 2024, the EU's updated Packaging and Packaging Waste Regulation continues to push for higher recycling rates and reduced packaging, directly impacting Colruyt's supply chain and product offerings.

Adherence to these environmental statutes is paramount, especially given Colruyt's substantial logistics network and its growing investments in renewable energy. Failure to comply can lead to significant fines and reputational damage. The group's commitment to sustainability, as highlighted in its 2024 sustainability report which noted a 5% reduction in Scope 1 and 2 emissions compared to 2023, demonstrates proactive engagement with these regulatory demands.

The dynamic nature of environmental regulations means Colruyt must remain agile. Anticipated changes in carbon pricing mechanisms and stricter emissions standards for transport fleets, potentially introduced in late 2024 or early 2025, could necessitate substantial capital expenditures in upgrading infrastructure and adopting greener technologies.

- Waste Management: Adherence to EU directives on waste reduction and recycling, with targets for increased material recovery rates.

- Packaging Regulations: Compliance with evolving rules on single-use plastics and the promotion of recyclable and reusable packaging solutions.

- Emissions Standards: Meeting increasingly stringent limits on greenhouse gas and other pollutant emissions from logistics and retail operations.

- Energy Consumption: Implementing energy efficiency measures and increasing the share of renewable energy sources in line with national and EU targets.

Contract Law and Supplier Agreements

Colruyt Group's operations are heavily reliant on contract law for its vast network of suppliers and partners. Robust supplier agreements are crucial for ensuring the consistent availability of goods, a cornerstone of their retail and wholesale businesses. For instance, in 2023, Colruyt Group reported a total procurement spend of over €9.5 billion, highlighting the sheer volume of contractual relationships managed. Failure to maintain legally sound contracts can lead to supply chain disruptions and significant financial penalties.

The effectiveness of Colruyt's legal framework around commercial contracts directly impacts its ability to manage risk and maintain operational stability. Disputes arising from supplier agreements, such as breaches of contract or disagreements over terms, can result in costly litigation and damage to business relationships. These legal entanglements can divert resources and attention from core business activities, potentially impacting profitability. For example, a single major supplier dispute could lead to millions in legal fees and lost revenue.

- Supplier Contract Compliance: Ensuring all supplier agreements adhere to Belgian and international contract law is paramount.

- Risk Mitigation: Well-drafted contracts minimize exposure to supply disruptions and price volatility.

- Dispute Resolution: Clear dispute resolution clauses within agreements help manage potential conflicts efficiently.

- Regulatory Adherence: Staying abreast of evolving contract law ensures ongoing compliance and avoids legal challenges.

Colruyt Group must navigate a complex landscape of competition laws designed to ensure fair market practices and prevent monopolies. These regulations impact pricing strategies, promotional activities, and potential mergers or acquisitions, requiring careful legal review. For instance, the European Commission's ongoing scrutiny of retail sector practices in 2024 highlights the need for vigilance in adhering to antitrust regulations.

Compliance with intellectual property laws is also critical, protecting Colruyt's brands, private labels, and any proprietary technologies. Safeguarding these assets from infringement is vital for maintaining brand value and competitive advantage. The group's extensive private label portfolio, a key differentiator, relies heavily on robust IP protection.

Furthermore, Colruyt operates under specific retail sector regulations that may govern store opening hours, Sunday trading, and relationships with suppliers, such as rules against unfair trading practices. Adherence to these sector-specific laws, which can vary significantly by region, is essential for smooth operations and avoiding penalties.

Environmental factors

Colruyt Group is actively addressing climate change by focusing on reducing its carbon footprint. This includes significant investments in renewable energy sources and optimizing logistics to lower emissions. For example, in 2023, the group continued to expand its solar panel installations, aiming to generate a substantial portion of its energy needs renewably.

The company is also enhancing energy efficiency across its retail stores and distribution centers. Initiatives like upgrading refrigeration systems and improving building insulation are key components of their strategy. These efforts are vital for meeting sustainability goals and complying with evolving environmental regulations, particularly as the EU pushes for more aggressive climate action leading into 2025.

Colruyt Group faces increasing pressure from consumers and regulators to ensure its products are sourced sustainably and that its supply chains are transparent. This means verifying that everything from farming practices to labor conditions and production methods for their own-brand products are ethical and environmentally sound.

In 2023, Colruyt Group continued its commitment to sustainability, with 98% of its private label products already meeting specific sustainability criteria, a testament to their focus on responsible sourcing. This commitment directly addresses growing consumer demand for ethically produced goods, a trend that shows no signs of slowing down.

By prioritizing transparency and ethical practices, Colruyt not only mitigates potential reputational damage but also strengthens its appeal to a growing segment of environmentally and socially conscious shoppers. This proactive approach is crucial for maintaining brand loyalty and market share in the evolving retail landscape.

Colruyt Group faces increasing pressure to minimize waste, especially plastic packaging, which directly affects their retail operations. This means actively pursuing strategies to cut down on plastic, encouraging customers to use reusable bags and containers, and enhancing recycling programs across their stores and throughout their supply chain.

In 2023, Colruyt Group reported a 5% reduction in plastic packaging for their private label products compared to 2022, a step towards their 2025 goal of a 25% reduction. Effective waste management is not only crucial for meeting environmental regulations but also significantly influences public perception and brand loyalty.

Energy Consumption and Renewable Energy Adoption

Colruyt Group's extensive retail and logistics network means significant energy consumption, driving a need for ongoing investment in efficiency and renewables. In 2023, the group continued its focus on reducing its carbon footprint, with renewable energy playing a crucial role. This strategic direction is vital for achieving their ambitious sustainability targets and mitigating the impact of fluctuating energy prices.

Leveraging its dedicated renewable energy division, Colruyt is actively working to decrease its dependence on fossil fuels. This internal capability not only supports their environmental commitments but also offers a pathway to lower operational expenditures. For instance, by the end of fiscal year 2023-2024, Colruyt aimed to have 100% of its electricity consumption covered by its own renewable energy production, a significant step towards energy independence.

- Energy Efficiency Investments: Colruyt Group consistently invests in energy-saving technologies across its stores and distribution centers, including LED lighting and advanced refrigeration systems.

- Renewable Energy Generation: The group operates wind turbines and solar panels, contributing to a substantial portion of its electricity needs from renewable sources.

- Fossil Fuel Reduction: By prioritizing renewable energy, Colruyt aims to significantly reduce its reliance on fossil fuels, aligning with broader climate goals.

- Operational Cost Savings: The adoption of renewable energy and efficiency measures is projected to lead to considerable long-term savings on energy bills.

Water Usage and Conservation

While energy often takes center stage, water usage is an increasingly important environmental factor for retailers like Colruyt Group. This is particularly true in areas such as maintaining fresh produce displays and for general store cleaning. Colruyt's commitment to resource efficiency extends to managing its water footprint.

Implementing water-saving technologies and adopting responsible water management practices are key components of Colruyt's environmental stewardship. These efforts not only reduce operational costs but also highlight a dedication to sustainability beyond just energy consumption.

- Water Conservation Measures: Colruyt Group actively explores and implements technologies to reduce water consumption in its stores, particularly in departments requiring high hygiene standards and produce preservation.

- Operational Efficiency: Responsible water management contributes to overall operational efficiency, aligning with the group's broader goals of resource optimization and cost control.

- Environmental Stewardship: By focusing on water usage, Colruyt demonstrates a comprehensive approach to environmental responsibility, recognizing water as a critical natural resource.

Colruyt Group's environmental strategy is heavily focused on reducing its carbon footprint through significant investments in renewable energy and enhanced energy efficiency across its operations. By the end of fiscal year 2023-2024, the group aimed to cover 100% of its electricity needs with its own renewable energy production, a critical step towards sustainability and mitigating energy cost volatility.

Waste reduction, particularly concerning plastic packaging, is another key environmental focus. Colruyt reported a 5% reduction in plastic packaging for its private label products in 2023 compared to the previous year, working towards a 25% reduction target by 2025. This aligns with growing consumer and regulatory demands for more sustainable product sourcing and transparent supply chains.

Water conservation is also an integral part of Colruyt's environmental stewardship. The group is implementing water-saving technologies and responsible management practices to minimize its water footprint, contributing to both operational efficiency and its broader sustainability commitments.

| Environmental Focus | 2023 Progress/Target | Impact |

| Renewable Energy Coverage | Aiming for 100% of electricity from own production by end of FY 2023-2024 | Reduced reliance on fossil fuels, potential operational cost savings |

| Plastic Packaging Reduction | 5% reduction in private label products (vs. 2022) | Meeting consumer demand for sustainability, mitigating environmental impact |

| Water Management | Implementation of water-saving technologies | Reduced operational costs, enhanced environmental stewardship |

PESTLE Analysis Data Sources

Our Colruyt Group PESTLE analysis is built on a robust foundation of data from reputable sources including government publications, economic forecasts from institutions like the IMF and World Bank, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the group.