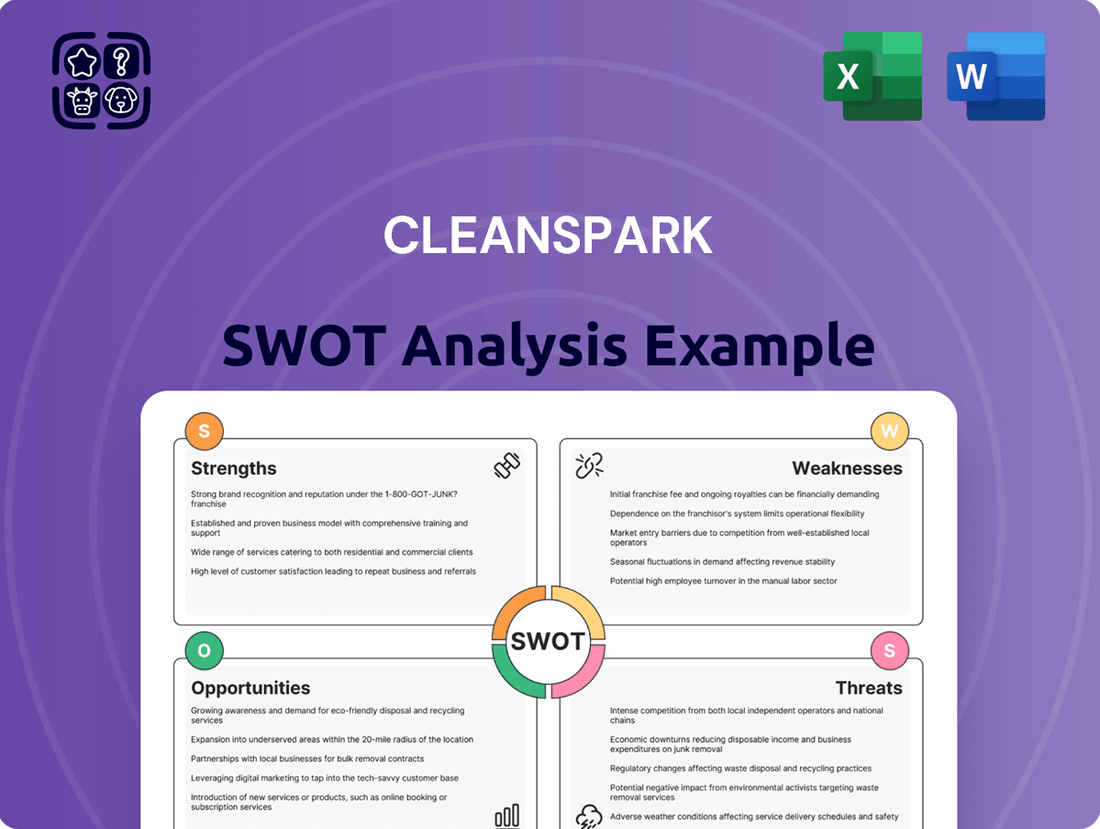

CleanSpark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

CleanSpark's strengths lie in its established Bitcoin mining operations and strategic energy management, but what are the hidden threats and untapped opportunities? Our full SWOT analysis dives deep into these critical areas, providing a comprehensive view of their market position.

Want the full story behind CleanSpark's potential for growth and the risks it faces in the volatile crypto market? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions.

Strengths

CleanSpark's commitment to operational excellence is evident in its impressive hashrate growth and enhanced fleet efficiency. The company surpassed its 2024 goal, achieving an operational hashrate of 37.5 EH/s with an efficiency rating of 17.7 J/Th.

This strong performance positions CleanSpark well for its ambitious target of 50 EH/s by mid-2025. Such efficiency gains are vital for maintaining profitability and a competitive edge in the dynamic Bitcoin mining sector, allowing for more Bitcoin to be mined with reduced energy consumption.

CleanSpark boasts a remarkably strong financial position and robust liquidity, crucial for its ambitious growth trajectory. The company achieved record-breaking financial results for fiscal year 2024, showcasing a substantial 125% surge in revenues to $378.9 million. This impressive top-line growth was complemented by an Adjusted EBITDA of $245.8 million, highlighting operational efficiency.

Further bolstering its financial strength, CleanSpark closed a significant $650 million zero-coupon convertible bond offering in December 2024. This strategic move not only strengthens its balance sheet but also fully capitalizes its expansion plans, enabling the company to reach a target of 50 EH/s.

CleanSpark's strategic geographic diversification is a significant strength, with operations spanning Georgia, Mississippi, Tennessee, Wyoming, and New York as of early 2024. This broad U.S. footprint, bolstered by key acquisitions like the 2023 purchase of five Bitcoin mining facilities in Mississippi, allows the company to capitalize on varied energy costs and regulatory environments. This expansion not only diversifies operational risk but also enhances CleanSpark's ability to secure favorable energy pricing, a critical factor in the profitability of Bitcoin mining.

Low-Cost Energy Focus and Sustainable Practices

CleanSpark’s strategic focus on low-cost energy is a significant advantage, allowing them to operate their high-efficiency Bitcoin miners using sustainable sources. This commitment is underscored by their access to globally competitive energy prices, with wholesale power costs as low as 1.3 cents per kilowatt-hour at their wholly-owned sites. This cost efficiency directly impacts their profitability and operational resilience in the competitive Bitcoin mining landscape.

Furthermore, CleanSpark actively participates in demand response programs. This not only reinforces their dedication to energy efficiency but also contributes positively to grid sustainability. By aligning their operations with grid needs, they can potentially generate additional revenue streams and further reduce their overall energy expenditure, a critical factor for long-term success in the energy-intensive mining sector.

- Low Energy Costs: Access to wholesale power as low as 1.3 cents per kWh at owned sites.

- Sustainable Operations: Prioritizes using sustainable energy for Bitcoin mining.

- Demand Response Participation: Engages in programs that promote energy efficiency and grid stability.

Significant Bitcoin Holdings

CleanSpark's strategic accumulation of Bitcoin is a significant strength. As of the end of 2024, the company held 9,952 BTC, positioning it as the fifth-largest corporate Bitcoin holder.

This substantial treasury offers considerable financial flexibility and a direct avenue to capitalize on potential Bitcoin price increases.

- Substantial Bitcoin Treasury: CleanSpark held 9,952 BTC by the end of 2024.

- Fifth-Largest Corporate Holder: This places CleanSpark among the top corporate Bitcoin owners.

- Financial Flexibility: The Bitcoin holdings provide the company with significant financial maneuverability.

- Benefit from Price Appreciation: The asset base allows CleanSpark to directly profit from rising Bitcoin values.

CleanSpark's operational efficiency is a key strength, demonstrated by its impressive hashrate growth and energy efficiency. The company achieved an operational hashrate of 37.5 EH/s by the end of 2024, with an efficiency of 17.7 J/Th, surpassing its earlier goals and positioning it for its mid-2025 target of 50 EH/s.

The company's financial health is robust, marked by record revenues of $378.9 million in fiscal year 2024 and an Adjusted EBITDA of $245.8 million. This strong performance was further enhanced by a $650 million convertible bond offering in December 2024, securing capital for expansion.

CleanSpark's strategic geographic diversification across multiple U.S. states, including acquisitions in Mississippi, mitigates operational risks and allows access to favorable energy costs. Their commitment to low-cost energy, with rates as low as 1.3 cents per kWh at owned sites, and participation in demand response programs, underpins their competitive advantage and sustainability efforts.

Furthermore, CleanSpark's substantial Bitcoin treasury, holding 9,952 BTC by the end of 2024, ranks it as the fifth-largest corporate Bitcoin holder, providing significant financial flexibility and the potential to benefit from price appreciation.

| Metric | Value (End of 2024) | Target (Mid-2025) |

|---|---|---|

| Operational Hashrate | 37.5 EH/s | 50 EH/s |

| Energy Efficiency | 17.7 J/Th | |

| FY 2024 Revenue | $378.9 million | |

| FY 2024 Adjusted EBITDA | $245.8 million | |

| Bitcoin Holdings | 9,952 BTC |

What is included in the product

Analyzes CleanSpark’s competitive position through key internal and external factors, highlighting its strengths in efficient mining operations and opportunities in expanding its Bitcoin holdings, while acknowledging weaknesses in its debt levels and threats from market volatility.

Offers a clear, actionable framework to identify and address CleanSpark's strategic vulnerabilities and leverage its competitive advantages.

Weaknesses

As a company focused solely on Bitcoin mining, CleanSpark's financial health is intrinsically tied to Bitcoin's price swings. This means that even if they mine more Bitcoin, a drop in its market value can significantly hurt their earnings.

For instance, Bitcoin experienced considerable volatility throughout 2024. While prices saw a notable increase in early 2024, reaching new all-time highs, subsequent periods saw sharp corrections. This inherent price risk means CleanSpark's revenue can fluctuate dramatically, impacting profitability and investor confidence, regardless of their operational success in mining.

The April 2024 Bitcoin halving event significantly impacted mining revenue by cutting the block reward by half. This directly reduces the income CleanSpark earns for each new Bitcoin block mined.

While CleanSpark's focus on operational efficiency is a strength, this 50% reduction in block rewards creates ongoing pressure on profitability. Sustained profitability will likely depend on a substantial increase in Bitcoin's market price to offset the lower rewards.

Bitcoin mining demands significant upfront capital for specialized hardware, like the latest Antminer S21 models, and ongoing investment in robust energy infrastructure to ensure consistent operations. This capital intensity means CleanSpark must carefully manage its finances and consistently access funding to maintain its competitive edge.

Reliance on Tax Incentives and Regulatory Compliance

CleanSpark's profitability is significantly tied to government tax incentives, particularly those related to renewable energy. A shift in state policies or a failure to meet the stringent compliance requirements for these incentives could result in unforeseen tax liabilities and penalties, directly impacting the company's financial performance and cash flow generation.

The company's reliance on these incentives creates a vulnerability. For instance, if tax credits are reduced or eliminated, or if CleanSpark faces audit challenges regarding its compliance, its bottom line could be substantially affected. This dependency makes it crucial for investors to monitor legislative changes and the company's adherence to regulatory frameworks.

- Tax Incentive Dependence: CleanSpark's financial model is sensitive to changes in state-level tax incentives for solar and energy storage projects.

- Regulatory Compliance Risk: Failure to meet the specific conditions of tax incentives can lead to clawbacks or penalties.

- Impact on Profitability: Adverse changes in tax laws or compliance issues can increase operational costs and reduce net income.

- Cash Flow Vulnerability: Penalties or reduced incentives directly threaten the company's ability to generate and retain cash.

Increasing Network Difficulty

The Bitcoin network's increasing difficulty rate presents a significant hurdle. This means more processing power is needed to mine each Bitcoin, directly impacting operational costs for miners like CleanSpark. For instance, as of early 2024, the average difficulty adjustment has seen consistent upward trends, requiring miners to invest in newer, more energy-efficient hardware to remain competitive and maintain profitability.

This escalating difficulty necessitates continuous hardware upgrades and hashrate expansion. Such investments are crucial for maintaining mining efficiency, but they also represent substantial capital expenditures. If not managed with foresight, these rising operational costs could potentially squeeze profit margins, especially if Bitcoin prices don't keep pace with the increased mining expenditure.

- Rising Computational Demands: The Bitcoin network's difficulty adjusts roughly every two weeks to maintain a 10-minute block target. This constant upward pressure demands more computational power per Bitcoin mined.

- Hardware Obsolescence: Older, less efficient mining rigs become less profitable as difficulty increases, forcing continuous investment in newer Application-Specific Integrated Circuits (ASICs).

- Increased Energy Consumption: Higher difficulty often correlates with increased energy consumption per successful hash, directly impacting operational expenses for energy-intensive mining operations.

- Margin Squeeze Potential: Without corresponding increases in Bitcoin price or mining efficiency gains, the rising cost of mining due to difficulty can compress profit margins.

CleanSpark's reliance on Bitcoin's price volatility is a significant weakness, as even increased mining volume can be negated by price drops. The April 2024 halving event further reduced revenue per Bitcoin, creating sustained profitability pressure that requires a higher Bitcoin price to offset.

The company's capital-intensive nature, requiring constant investment in advanced hardware like the Antminer S21, and its dependence on tax incentives for renewable energy projects introduce financial risks. Adverse changes in tax policies or compliance failures could lead to penalties and reduced cash flow, impacting overall financial health.

The increasing difficulty of Bitcoin mining necessitates continuous hardware upgrades and higher energy consumption, directly increasing operational costs. This escalating demand for computational power, coupled with the potential for hardware obsolescence, can squeeze profit margins if Bitcoin prices do not rise in tandem.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Bitcoin Price Volatility | Revenue directly tied to Bitcoin's market price fluctuations. | Earnings can drop significantly even with increased mining output. | Bitcoin price experienced significant swings throughout 2024. |

| Halving Event Impact | Reduced block rewards by 50% in April 2024. | Directly lowers income per mined Bitcoin, pressuring profitability. | Block rewards halved from 6.25 BTC to 3.125 BTC. |

| Capital Intensity | High upfront and ongoing investment in mining hardware and energy infrastructure. | Requires consistent access to funding to maintain competitiveness. | Latest ASICs like Antminer S21 represent substantial capital outlay. |

| Tax Incentive Dependence | Financial model relies on state-level tax incentives for renewable energy. | Changes in policy or compliance failures can result in penalties and reduced net income. | Incentives are crucial for offsetting operational costs. |

| Rising Mining Difficulty | Increasing computational power required to mine each Bitcoin. | Drives up operational costs and necessitates continuous hardware upgrades. | Difficulty adjustments have shown consistent upward trends in 2024. |

Full Version Awaits

CleanSpark SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

CleanSpark has a well-defined plan to boost its Bitcoin mining hashrate to 50 EH/s by mid-2025, a substantial jump from its current operational levels. This expansion is fully funded, ensuring the company can execute its growth strategy effectively.

This aggressive expansion, coupled with continuous upgrades to their mining equipment for better energy efficiency, is designed to significantly increase their Bitcoin output. For instance, in Q1 2024, CleanSpark achieved an average fleet efficiency of 26.3 J/TH, a key metric in this industry.

By scaling its operations and optimizing efficiency, CleanSpark is positioning itself to become a more dominant player in Bitcoin production, aiming to secure a larger slice of the network's rewards.

The Bitcoin halving, a programmed reduction in block rewards, is poised to drive significant consolidation in the mining sector. Smaller, less efficient operations will likely face profitability challenges, creating a fertile ground for stronger players.

This industry shake-up presents a prime opportunity for well-capitalized firms like CleanSpark. They can strategically acquire struggling miners' assets, bolstering their own infrastructure and expanding their operational footprint. For instance, CleanSpark's aggressive acquisition strategy in 2023, acquiring facilities in Mississippi and Georgia, positions them well to capitalize on this trend.

The increasing global focus on environmental sustainability is creating a significant opportunity for Bitcoin mining operations that utilize renewable or low-carbon energy sources. This trend directly benefits companies like CleanSpark, whose core strategy centers on sustainable energy and infrastructure development.

CleanSpark's commitment to eco-friendly mining practices positions it favorably to attract environmentally conscious investors and potential partners. In 2023, CleanSpark reported that 95% of its energy consumption for Bitcoin mining came from renewable sources, a statistic that resonates strongly with the growing demand for green digital assets.

Energy Infrastructure Development and Diversification

CleanSpark's capabilities extend beyond Bitcoin mining, with significant opportunities in developing and diversifying energy infrastructure. Their expertise in modular microgrids and participation in demand response programs can create new revenue streams. This strategic shift allows them to offer energy solutions and grid services, lessening their dependence on the volatile Bitcoin market.

For instance, CleanSpark's involvement in demand response programs in 2023 contributed to their operational efficiency and provided additional revenue. They are actively exploring partnerships to deploy their microgrid technology, aiming to secure long-term contracts for energy management and grid stabilization services. This diversification is crucial for sustainable growth and mitigating risks associated with a single-industry focus.

- Energy Infrastructure Expertise: CleanSpark can leverage its knowledge in developing modular microgrids and participating in demand response programs.

- Revenue Diversification: Offering energy solutions and grid services can reduce reliance on Bitcoin mining revenue.

- Grid Services: Potential to generate income by providing grid stabilization and energy management services.

- Reduced Market Volatility: Diversifying revenue streams helps buffer against fluctuations in the cryptocurrency market.

Potential for Bitcoin Price Appreciation

The upcoming Bitcoin halving events, historically catalysts for price surges due to reduced supply, present a significant opportunity for CleanSpark. Following the April 2024 halving, Bitcoin's price has shown upward momentum, reaching over $65,000 by mid-May 2024. This appreciation directly benefits CleanSpark, given its substantial Bitcoin reserves and ongoing mining operations.

CleanSpark's strategic advantage lies in its ability to capitalize on these market trends. As of Q1 2024, the company reported holding approximately 3,000 BTC, a substantial asset that gains value with Bitcoin's price increases. Continued Bitcoin production, coupled with a rising market price, is projected to significantly enhance CleanSpark's revenue streams and overall financial health.

- Historical Precedent: Past Bitcoin halving events have consistently preceded bull markets, with Bitcoin prices often increasing by over 200% in the year following the event.

- CleanSpark's Holdings: The company's substantial Bitcoin treasury, exceeding 3,000 BTC as of early 2024, stands to benefit immensely from any sustained price appreciation.

- Production Growth: CleanSpark's aggressive expansion plans, aiming to increase its hashrate capacity by 200% by the end of 2024, will further amplify its gains in a rising Bitcoin market.

- Revenue Impact: A higher Bitcoin price directly translates to increased revenue for CleanSpark, improving profitability and strengthening its balance sheet.

CleanSpark's strategic expansion to 50 EH/s by mid-2025, fully funded, positions it to capitalize on industry consolidation following the Bitcoin halving. The company's acquisition of underperforming assets from struggling miners, exemplified by its 2023 facility purchases, is a key growth strategy. Furthermore, CleanSpark's commitment to renewable energy, with 95% of its 2023 energy consumption from green sources, aligns with growing investor demand for sustainable operations.

The company is also diversifying its revenue streams by leveraging its energy infrastructure expertise. By developing modular microgrids and participating in demand response programs, CleanSpark can generate income beyond Bitcoin mining, mitigating market volatility. This diversification is crucial for long-term stability and growth.

The Bitcoin halving events, particularly the one in April 2024, historically drive price appreciation. CleanSpark, holding over 3,000 BTC as of early 2024, is well-positioned to benefit from this trend, with its production growth amplifying potential gains. A rising Bitcoin price directly enhances CleanSpark's revenue and profitability.

| Opportunity | Description | Supporting Data |

|---|---|---|

| Industry Consolidation | Acquiring assets from less efficient miners post-halving. | CleanSpark's 2023 acquisitions in Mississippi and Georgia. |

| Renewable Energy Focus | Attracting eco-conscious investors and partners. | 95% renewable energy usage in 2023. |

| Revenue Diversification | Leveraging energy infrastructure and grid services. | Participation in demand response programs in 2023. |

| Bitcoin Price Appreciation | Benefiting from increased Bitcoin value post-halving. | Holding over 3,000 BTC (early 2024); Bitcoin price over $65,000 (mid-May 2024). |

Threats

Bitcoin's price continues to be a wild ride, and while that's been the norm, it's still a major concern. For CleanSpark, a big drop in Bitcoin's value, especially after the halving reduced block rewards in April 2024, could really hurt their earnings and the worth of the Bitcoin they hold.

The Bitcoin mining landscape is fiercely competitive, with established players like Marathon Digital Holdings and Riot Platforms consistently increasing their hashrate and operational efficiency. This escalating competition can drive up energy costs and hardware expenses, putting pressure on CleanSpark's profit margins and potentially hindering its ability to secure favorable locations for new mining sites or invest in the latest mining technology.

The cryptocurrency sector faces a constantly shifting regulatory environment, with rules differing significantly across various countries. For CleanSpark, new or intensified regulations concerning Bitcoin mining, its energy usage, or its environmental footprint could mean substantial compliance expenses, operational limitations, or even policy shifts detrimental to its core business strategy.

For instance, in 2024, the U.S. Securities and Exchange Commission (SEC) continued its scrutiny of digital assets, and while direct impacts on mining operations are still developing, the potential for stricter environmental disclosures or energy consumption standards remains a clear threat. CleanSpark's reliance on efficient energy sourcing and its public reporting on sustainability metrics are directly exposed to these evolving governmental stances.

Rising Energy Costs and Grid Instability

While CleanSpark prioritizes access to low-cost energy for its Bitcoin mining operations, a significant threat emerges from potential surges in electricity prices. For instance, if wholesale electricity prices in regions like Georgia or Mississippi, where CleanSpark has significant operations, were to unexpectedly climb, it could directly impact profitability. The company's reliance on utility rate structures and agreements with third-party power providers for future expansion also presents a vulnerability. Any adverse changes in these agreements or unexpected grid instability could disrupt operations and escalate costs.

The energy sector in 2024 and 2025 continues to be influenced by geopolitical events and supply chain dynamics, which can lead to price volatility. For example, disruptions in natural gas supply, a key driver for electricity generation, could trigger higher energy costs across the board. CleanSpark's operational expenses are directly tied to these market forces, making it susceptible to fluctuations that are outside of its direct control.

- Rising electricity prices: Unforeseen increases in energy costs can directly impact CleanSpark's cost of mining Bitcoin.

- Grid instability: Disruptions to the power grid in its operating regions could halt or slow down mining operations.

- Dependency on third-party providers: Expansion plans relying on external power agreements are subject to the terms and reliability of these contracts.

- Market volatility: Geopolitical factors and supply chain issues can cause unpredictable swings in energy prices.

Technological Obsolescence and Hardware Costs

The relentless march of technological progress in Bitcoin mining hardware presents a significant threat. As newer, more efficient machines emerge, CleanSpark's existing fleet risks becoming outdated and less competitive. This rapid innovation cycle demands constant, substantial capital expenditure to upgrade mining rigs, creating a continuous financial strain and the ever-present risk of technological obsolescence.

For instance, the ASIC (Application-Specific Integrated Circuit) market is characterized by rapid generation shifts. Older models, while still functional, consume more electricity per terahash (TH/s) than the latest generation. By late 2024 and into 2025, the efficiency gap between the newest ASICs, often boasting efficiencies below 20 J/TH, and even slightly older models can become substantial enough to impact profitability, especially during periods of lower Bitcoin prices or increased network difficulty.

- Rapid Hardware Advancement: Newer ASIC miners consistently offer higher hash rates and improved energy efficiency, rendering older models less competitive.

- Capital Investment Strain: Maintaining a state-of-the-art mining fleet requires significant and ongoing capital outlays for hardware upgrades.

- Risk of Obsolescence: Failure to upgrade can lead to higher operating costs per Bitcoin mined, impacting profitability and market position.

- Efficiency Gap: The difference in energy consumption per terahash between generations can widen, making older hardware uneconomical.

The intensifying competition within the Bitcoin mining sector poses a significant threat to CleanSpark. As more participants enter the market and existing ones expand, the demand for energy and specialized hardware increases, driving up costs and potentially reducing profit margins. This also leads to a constant need for technological upgrades to remain competitive, which requires substantial capital investment.

The regulatory landscape for cryptocurrency mining remains a considerable threat, with evolving policies and potential new restrictions on energy consumption or environmental impact. For CleanSpark, navigating these diverse and often changing regulations across different jurisdictions could lead to increased compliance costs and operational limitations. For instance, in 2024, discussions around energy usage by data centers, including crypto miners, continued in various legislative bodies, signaling potential future oversight.

CleanSpark's profitability is intrinsically linked to the volatile price of Bitcoin. A sharp decline in Bitcoin's value, especially following the April 2024 halving which reduced block rewards, could severely impact the company's revenue and the value of its holdings. Market analysts in late 2024 and early 2025 continued to highlight Bitcoin's price volatility as a key risk factor for mining companies.

The constant need to upgrade mining hardware to maintain efficiency and competitiveness presents a financial challenge. As newer, more energy-efficient ASIC miners become available, older equipment risks becoming obsolete, necessitating significant capital expenditure. By late 2024, the efficiency gap between the latest generation of ASICs and those even a year older was becoming substantial, impacting operational costs.

SWOT Analysis Data Sources

This CleanSpark SWOT analysis is meticulously constructed from a blend of authoritative data sources, including the company's official financial filings, comprehensive market research reports, and expert industry analyses. These diverse inputs ensure a robust and well-rounded understanding of CleanSpark's strategic position.