CleanSpark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

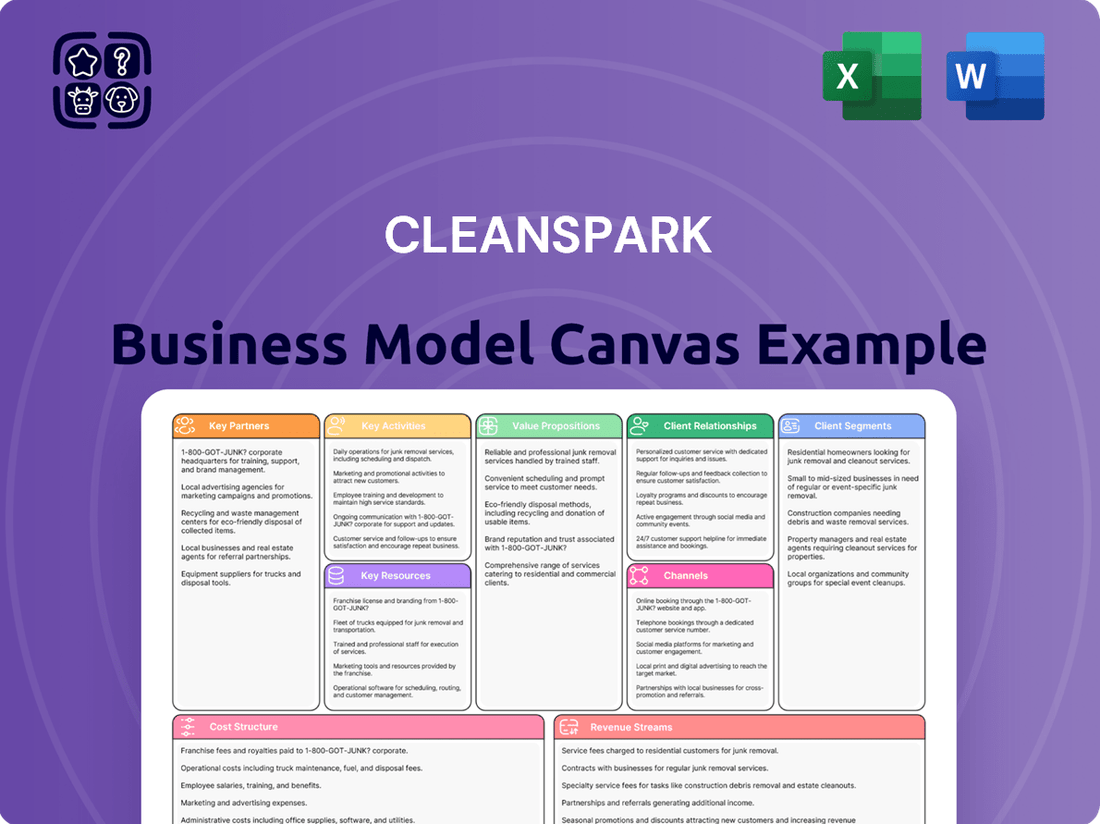

Discover the core components of CleanSpark's innovative approach with our Business Model Canvas. This snapshot reveals how they connect with customers and generate revenue in the dynamic energy sector. Unlock the complete, detailed analysis to understand their strategic advantages.

Partnerships

CleanSpark’s strategic alliances with energy providers, like the Tennessee Valley Authority (TVA), are fundamental to its business model. These collaborations ensure access to competitively priced, often renewable, electricity essential for its energy-intensive bitcoin mining operations.

These energy partnerships are vital for optimizing operational costs and enabling participation in demand response programs, contributing to grid stability and sustainability. By May 2025, CleanSpark had secured a significant contracted power capacity of 987 MW, underscoring the strength of its energy infrastructure pipeline.

CleanSpark collaborates with premier ASIC manufacturers, including Canaan, to secure cutting-edge, high-efficiency Bitcoin mining hardware. These partnerships are crucial for CleanSpark’s strategy to maintain and improve its operational capacity.

A prime example is CleanSpark's follow-on order for Canaan's Avalon A1566I immersion-cooling miners. This strategic procurement directly supports the company's commitment to fleet efficiency and technological advancement in a competitive market.

By investing in these advanced ASICs, CleanSpark aims to mitigate the impact of declining Bitcoin block rewards and uphold rigorous operational standards. This proactive approach ensures their mining operations remain competitive and cost-effective.

CleanSpark actively cultivates relationships with financial institutions to bolster its operational and growth capabilities. A prime example is the company's $200 million revolving credit facility, expanded with Coinbase in 2024, which provides significant financial flexibility.

These financial partnerships are instrumental in securing the necessary liquidity for strategic initiatives, enabling CleanSpark to pursue expansion without resorting to equity dilution. This approach is vital for maintaining shareholder value while executing its long-term growth plans.

Furthermore, CleanSpark’s robust balance sheet, notably its substantial Bitcoin treasury, underpins its financial strategy. Holding a significant digital asset reserve strengthens its financial position and provides an additional layer of capital resilience.

Technology and Infrastructure Partners

CleanSpark’s commitment to an infrastructure-first approach highlights its reliance on key technology and infrastructure partners. These collaborations are vital for building and operating advanced data centers, ensuring efficiency and scalability in their Bitcoin mining operations.

These partnerships are crucial for implementing cutting-edge solutions like immersion cooling, which significantly enhances operational performance. For instance, in early 2024, CleanSpark announced an expansion of its operations in Georgia, leveraging advanced infrastructure to boost its hashrate. This expansion underscores the practical application of these strategic alliances.

- Immersion Cooling Solutions: Partners providing advanced cooling technologies to optimize data center performance and energy efficiency.

- Infrastructure Development: Collaborations with providers specializing in the construction and maintenance of high-capacity data centers.

- Hardware and Network Providers: Securing reliable access to state-of-the-art mining hardware and robust network infrastructure.

- Energy Management Technology: Partnerships focused on integrating smart grid technologies and energy optimization solutions for sustainable operations.

Acquisition and Expansion Targets

CleanSpark actively pursues strategic acquisitions to bolster its mining operations and expand its reach. A prime example is the acquisition of GRIID Infrastructure Inc., which significantly boosted CleanSpark's mining capacity and geographic presence. This move was crucial for rapidly increasing its hashrate and securing vital power capacity in strategic locations like Tennessee and Wyoming.

- Acquisition of GRIID: This partnership was key to expanding CleanSpark's mining capacity and geographic footprint.

- Hasrate Increase: The acquisition allowed for a rapid increase in the company's hashrate.

- Power Capacity: Secured additional power capacity in key regions such as Tennessee and Wyoming.

- Growth Strategy: This complements organic growth efforts through existing site expansions and new developments.

CleanSpark's key partnerships are multifaceted, spanning energy providers, hardware manufacturers, financial institutions, and infrastructure developers. These collaborations are critical for securing competitive energy rates, acquiring efficient mining hardware, and ensuring financial flexibility for growth. The company also strategically acquires other entities to enhance its operational scale and market position.

| Partner Type | Key Collaborators | Impact on CleanSpark | Example Data/Event |

|---|---|---|---|

| Energy Providers | Tennessee Valley Authority (TVA) | Access to competitively priced, often renewable electricity; participation in demand response programs. | Secured 987 MW contracted power capacity by May 2025. |

| Hardware Manufacturers | Canaan | Access to cutting-edge, high-efficiency Bitcoin mining hardware (ASICs). | Follow-on order for Canaan's Avalon A1566I immersion-cooling miners in 2024. |

| Financial Institutions | Coinbase | Financial flexibility for strategic initiatives and growth without equity dilution. | $200 million revolving credit facility expanded with Coinbase in 2024. |

| Acquisitions | GRIID Infrastructure Inc. | Significant boost in mining capacity, geographic presence, and power capacity. | Acquisition completed in 2024, expanding operations into Tennessee and Wyoming. |

What is included in the product

A structured overview of CleanSpark's strategy, detailing its customer segments, value propositions, and revenue streams within the context of sustainable energy solutions.

This model highlights CleanSpark's operational strengths and market positioning, providing a clear framework for understanding its growth and investment potential.

Cleanspark's Business Model Canvas provides a clear, structured framework that simplifies complex operational strategies, acting as a relief for the pain of disorganized planning.

It offers a visual, actionable roadmap, alleviating the burden of piecing together disparate business elements into a cohesive whole.

Activities

CleanSpark's primary activity is the ongoing purchase and setup of efficient Bitcoin mining machines to boost its hashrate and production. This ensures they can process more transactions and earn more Bitcoin.

The company actively invests in the latest ASIC technology, like the Bitmain S21 and Canaan Avalon A1566I. These advanced models are crucial for improving their overall mining efficiency and staying ahead of the competition.

This continuous cycle of upgrading their mining hardware is vital for maintaining profitability, particularly in the face of events like the Bitcoin halving, which reduces mining rewards. For instance, by April 2024, CleanSpark had already deployed a significant portion of its new S21 fleet, aiming for a substantial increase in its operational hashrate.

CleanSpark's core activity involves the hands-on operation and continuous optimization of its Bitcoin mining facilities, strategically located across several U.S. states. This meticulous approach focuses on maximizing efficiency and minimizing costs.

Key to this is the diligent management of energy consumption, a significant operational expense in Bitcoin mining. The company aims for exceptionally high uptime, ensuring their mining hardware is consistently productive.

Furthermore, CleanSpark actively works on improving its fleet efficiency, measured in Joules per Terahash (J/Th). As of the first quarter of 2024, CleanSpark reported a fleet efficiency of 23.7 J/Th, a notable improvement that directly translates to a lower cost per Bitcoin mined.

CleanSpark is actively developing energy infrastructure, which includes constructing and expanding data centers. This is crucial for their bitcoin mining operations. They are also focused on securing contracted power capacity to ensure a stable energy supply.

The company's infrastructure development spans various locations, with projects in Georgia, Wyoming, Tennessee, and Mississippi. These efforts involve both new greenfield developments and enhancements to existing facilities, demonstrating a commitment to expanding their operational footprint.

By building out this robust energy infrastructure, CleanSpark is directly supporting its growth in mining operations. This strategic focus is essential for them to meet their hashrate targets and maintain a competitive edge in the evolving digital asset landscape.

Bitcoin Treasury Management

CleanSpark actively manages its Bitcoin treasury by accumulating self-mined BTC and strategically selling portions to fund operations and maintain liquidity. This approach, overseen by their Digital Asset Management group, treats Bitcoin as both a revenue-generating asset and a key component of their financial stability.

- Accumulation Strategy: CleanSpark focuses on growing its Bitcoin holdings through its mining operations.

- Strategic Sales: The company conducts planned sales to secure capital for operational expenses and growth initiatives.

- Balance Sheet Strength: Bitcoin is utilized to enhance the company's overall financial position and provide a hedge.

- Shareholder Value: The treasury management aims to optimize returns and mitigate risks, ultimately benefiting shareholders.

As of Q1 2024, CleanSpark reported holding approximately 1,779 BTC, demonstrating a consistent commitment to its Bitcoin treasury strategy. This positions the company to leverage its digital assets effectively in the current market environment.

Strategic Growth and Geographic Expansion

CleanSpark is pursuing a methodical approach to growth by expanding its operations regionally. They aim to replicate the successful strategies honed in Georgia by developing new data centers and enhancing existing ones within communities where they have established a presence. This focus on disciplined, scalable expansion is key to their long-term vision.

The company has set ambitious hashrate targets, aiming for 50 EH/s by the middle of 2025. This growth will be fueled by a dual strategy of internal development and opportunistic mergers and acquisitions, ensuring they can scale efficiently to meet market demands.

- Disciplined Regional Expansion: Replicating successful Georgia model in new states.

- Site Development: Expanding existing facilities and building new data centers in established communities.

- Growth Targets: Aiming for 50 EH/s by mid-2025.

- Growth Drivers: Combination of organic development and strategic M&A.

CleanSpark's key activities revolve around the acquisition and deployment of advanced Bitcoin mining hardware, ensuring operational efficiency and hashrate expansion. They also focus on developing and managing energy infrastructure to support their mining operations and optimize energy costs.

Furthermore, the company actively manages its Bitcoin treasury, balancing accumulation with strategic sales to fund growth and maintain financial stability. This multifaceted approach drives their expansion and aims to maximize shareholder value.

| Activity Area | Key Actions | Data/Metric (as of Q1 2024 or latest available) |

|---|---|---|

| Hardware Acquisition & Deployment | Purchasing and setting up efficient mining machines (e.g., Bitmain S21) | Fleet efficiency: 23.7 J/Th |

| Infrastructure Development | Building and expanding data centers, securing contracted power capacity | Projects in Georgia, Wyoming, Tennessee, Mississippi |

| Bitcoin Treasury Management | Accumulating self-mined BTC, strategic sales for operations and liquidity | Holding approximately 1,779 BTC |

| Operational Efficiency | Optimizing energy consumption, maximizing uptime | Aiming for high operational uptime |

| Growth Strategy | Regional expansion, site development, M&A | Targeting 50 EH/s by mid-2025 |

Delivered as Displayed

Business Model Canvas

The CleanSpark Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot of the comprehensive analysis that will be yours to utilize. Upon completing your order, you will gain full access to this identical, professionally structured Business Model Canvas.

Resources

CleanSpark's primary physical asset is its advanced fleet of high-efficiency Bitcoin mining machines, primarily ASICs. This fleet is the engine driving their Bitcoin production, constantly being upgraded and expanded to maintain a competitive edge.

The company's strategic procurement of these machines is a cornerstone of its industry-leading fleet efficiency. For instance, in Q1 2024, CleanSpark reported operating 100,000 ASIC miners, with an average energy efficiency of 23.7 joules per terahash (J/TH).

CleanSpark's owned and operated data centers are a cornerstone of its business model, providing the essential infrastructure for its Bitcoin mining operations. The company boasts a substantial portfolio of these facilities strategically located across the United States, with key sites in Georgia, Wyoming, Tennessee, Mississippi, and New York.

These data centers are purpose-built to offer the controlled environments and robust power necessary for efficient, large-scale Bitcoin mining. By directly owning and managing these critical assets, CleanSpark gains significant operational control, enabling them to optimize energy usage and mining performance, which is crucial for profitability in the competitive cryptocurrency mining landscape.

CleanSpark's access to significant contracted power capacity is a cornerstone of its operations. This capacity, often sourced from low-cost and sustainable energy, directly fuels its bitcoin mining activities. As of May 2025, the company has secured an impressive 987 MW of power, a testament to its energy procurement capabilities.

This substantial energy resource is not just about volume; it's about strategic advantage. The ability to manage and leverage these megawatts of power directly influences CleanSpark's mining efficiency and, consequently, its profitability. This expertise in securing and optimizing energy is a key differentiator in the competitive cryptocurrency mining landscape.

Bitcoin Treasury Holdings

CleanSpark's significant treasury of self-mined Bitcoin acts as a core financial asset, bolstering its balance sheet. This strategic holding allows the company to capitalize on potential Bitcoin price appreciation while also providing crucial liquidity for future business development. As of May 2025, CleanSpark's Bitcoin reserves surpassed 12,500 BTC, underscoring its commitment to this digital asset.

The company's Bitcoin treasury offers several key advantages:

- Financial Strength: A substantial Bitcoin reserve enhances CleanSpark's overall financial stability and creditworthiness.

- Liquidity and Flexibility: Holding Bitcoin provides readily available funds for strategic acquisitions, operational expansion, or debt management.

- Potential for Appreciation: The company benefits directly from any increase in Bitcoin's market value, contributing to shareholder returns.

- Operational Hedge: Bitcoin holdings can act as a partial hedge against traditional financial system volatility.

Skilled Operational and Technical Teams

CleanSpark's operational and technical teams are the backbone of its Bitcoin mining success. These seasoned professionals possess deep expertise in Bitcoin mining operations, energy management, and the intricate details of data center infrastructure. This specialized knowledge is vital for ensuring maximum uptime, which directly impacts profitability.

Their proficiency is key to optimizing the performance of CleanSpark's mining fleet, making sure every piece of hardware is working at its peak efficiency. Furthermore, these teams are instrumental in successfully executing the company's ambitious expansion plans, navigating the complexities of scaling operations. For instance, in Q1 2024, CleanSpark reported a significant increase in its hashrate, a direct testament to the effective management by these skilled teams.

- Expertise in Bitcoin Mining: Deep understanding of mining hardware and software protocols.

- Energy Management Specialists: Optimizing power consumption for cost efficiency and sustainability.

- Data Center Infrastructure Proficiency: Ensuring reliable and secure operational environments.

- Fleet Performance Optimization: Maximizing mining output and minimizing downtime.

CleanSpark's key resources include its state-of-the-art ASIC mining fleet, which is crucial for its Bitcoin production capabilities. The company also owns and operates data centers strategically located across the United States, providing the necessary infrastructure for efficient mining. Furthermore, CleanSpark has secured substantial contracted power capacity, totaling 987 MW as of May 2025, enabling cost-effective operations. Finally, its treasury of over 12,500 BTC as of May 2025 provides financial strength and liquidity.

| Key Resource | Description | Data/Metric (as of May 2025) |

|---|---|---|

| ASIC Mining Fleet | High-efficiency Bitcoin mining machines | 100,000+ miners (Q1 2024), 23.7 J/TH efficiency |

| Data Centers | Owned and operated mining infrastructure | Multiple U.S. locations (GA, WY, TN, MS, NY) |

| Power Capacity | Contracted energy for mining operations | 987 MW |

| Bitcoin Treasury | Self-mined Bitcoin reserves | 12,500+ BTC |

Value Propositions

CleanSpark's value proposition centers on its efficient and scalable Bitcoin production. This is achieved through a high-efficiency mining fleet and meticulously optimized operations, ensuring maximum output from every unit of energy consumed.

The company's commitment to growth is evident in its consistently increasing hashrate. CleanSpark has set an ambitious target of reaching 50 EH/s by mid-2025, a significant expansion that directly translates into a substantial increase in Bitcoin mining capacity and output.

This substantial scale provides CleanSpark with considerable operational leverage. It allows the company to maintain competitive cost structures, which is crucial for profitability in the dynamic cryptocurrency mining landscape.

CleanSpark's core value proposition centers on its dedication to powering its Bitcoin mining operations with sustainable energy. This commitment not only reduces its environmental footprint but also aligns with growing investor demand for ESG-compliant businesses.

By actively participating in demand response programs, CleanSpark further solidifies its 'green Bitcoin miner' image. For instance, in 2023, the company reported that approximately 90% of its energy consumption was derived from renewable sources, showcasing a tangible impact of this strategy.

This focus on sustainability is a significant differentiator in the competitive cryptocurrency mining landscape. It appeals to a broad range of stakeholders, from environmentally conscious individual investors to institutional funds prioritizing ESG metrics in their portfolios.

CleanSpark prioritizes disciplined capital management, focusing on non-dilutive financing to preserve shareholder value. This approach is bolstered by a strong balance sheet, which as of the first quarter of 2024, included approximately 4,054 BTC, valued at over $290 million at the time, and significant credit facilities.

This robust financial foundation offers resilience against market fluctuations and fuels long-term growth initiatives without the need for excessive equity issuance. The company's strategy aims to optimize shareholder returns through careful financial stewardship and strategic asset allocation.

Pure-Play Bitcoin Mining Focus

CleanSpark's commitment to a pure-play Bitcoin mining strategy sets it apart. While others explore AI or high-performance computing, CleanSpark dedicates its efforts solely to Bitcoin production. This focused strategy allows for deep specialization and resource optimization within the Bitcoin mining landscape.

This specialization is particularly attractive to investors looking for direct and concentrated exposure to the Bitcoin mining industry. By concentrating on its core competency, CleanSpark aims to maximize efficiency and output in Bitcoin mining operations.

- Dedicated Bitcoin Mining: CleanSpark exclusively focuses on Bitcoin mining, avoiding diversification into areas like AI or HPC.

- Optimized Expertise: This pure-play approach enables the company to concentrate its resources and expertise on enhancing Bitcoin production.

- Investor Appeal: The specialization caters to investors seeking direct and unadulterated exposure to the Bitcoin mining sector.

Operational Excellence and High Fleet Efficiency

CleanSpark's commitment to operational excellence is evident in its remarkably efficient mining fleet. This translates to a low energy consumption per Bitcoin mined, often measured in Joules per Terahash (J/Th). For instance, in Q1 2024, CleanSpark reported an average fleet efficiency of 27.7 J/Th, a significant improvement that directly impacts their cost structure.

This high fleet efficiency is a cornerstone of their competitive advantage, particularly in the wake of Bitcoin halving events which reduce mining rewards. By minimizing energy costs per Bitcoin, CleanSpark can maintain profitability even when market conditions become more challenging. Their optimized site management further contributes to this efficiency, ensuring smooth and cost-effective operations.

- Fleet Efficiency: CleanSpark achieved an average fleet efficiency of 27.7 J/Th in Q1 2024.

- Cost Advantage: Low J/Th directly lowers the cost per Bitcoin mined, enhancing profitability.

- Post-Halving Resilience: Operational efficiency is critical for sustained profitability after Bitcoin reward reductions.

- Continuous Improvement: The company actively seeks to further optimize its operations and fleet performance.

CleanSpark's value proposition is built on efficient, scalable Bitcoin production driven by a high-efficiency mining fleet and optimized operations, maximizing Bitcoin output per unit of energy. The company's ambitious growth target of 50 EH/s by mid-2025 signifies a substantial increase in mining capacity, providing considerable operational leverage and maintaining competitive cost structures.

A key differentiator is CleanSpark's commitment to powering operations with sustainable energy, aiming to reduce its environmental footprint and appeal to ESG-conscious investors. This focus is demonstrated by approximately 90% of its energy consumption being from renewable sources in 2023, enhancing its image as a 'green Bitcoin miner'.

The company also emphasizes disciplined capital management, prioritizing non-dilutive financing and maintaining a strong balance sheet. As of Q1 2024, this included over 4,054 BTC, valued at more than $290 million, and significant credit facilities, ensuring resilience and enabling growth without excessive equity dilution.

CleanSpark's pure-play Bitcoin mining strategy allows for deep specialization and resource optimization, attracting investors seeking direct exposure to the sector. This focused approach aims to maximize efficiency and output in Bitcoin mining operations.

Operational excellence is showcased through its efficient mining fleet, with an average efficiency of 27.7 J/Th reported in Q1 2024. This low energy consumption per Bitcoin mined is crucial for maintaining profitability, especially after Bitcoin halving events.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Average Fleet Efficiency | 27.7 J/Th | Lowers cost per Bitcoin, enhances profitability |

| Bitcoin Holdings | ~4,054 BTC | Over $290 million in value, provides financial resilience |

| Target Hashrate | 50 EH/s by mid-2025 | Significant expansion of mining capacity |

| Renewable Energy Usage | ~90% (2023) | Supports ESG appeal and reduces environmental impact |

Customer Relationships

CleanSpark prioritizes open communication with its investors, offering regular updates on its bitcoin mining activities, financial health, and future plans. This commitment to transparency is demonstrated through quarterly earnings calls, timely press releases, and readily available SEC filings.

This proactive approach builds essential trust, equipping financially-literate individuals with the crucial data needed to make sound investment choices. For instance, in Q1 2024, CleanSpark reported a significant increase in its bitcoin holdings, reaching 4,097 BTC, showcasing operational growth.

CleanSpark cultivates enduring partnerships with critical entities like hardware suppliers, energy providers, and financial institutions. These collaborations are built on shared advantages and cooperative efforts, allowing CleanSpark to secure vital resources and advance its expansion plans. For instance, in 2024, CleanSpark continued to solidify its supply chain by entering into agreements that ensured timely delivery of mining hardware, a crucial element for its operational capacity.

This strategic approach to partner engagement guarantees a consistent and dependable supply chain, which is fundamental for maintaining operational efficiency and meeting production targets. Furthermore, it provides essential access to capital, enabling the company to fund its ambitious growth initiatives and invest in new technologies, thereby supporting its overall business model.

CleanSpark actively participates in demand response programs with utilities, demonstrating a commitment to grid stability. For instance, in 2023, their participation in such programs helped manage energy load during peak demand periods, contributing to a more reliable energy infrastructure in the communities where they operate.

The company prioritizes alignment with local energy grids and environmental considerations, ensuring their mining operations integrate responsibly. This proactive approach to regulatory engagement and community outreach is crucial for maintaining their social license to operate and fostering sustainable growth, especially as the energy sector evolves.

Financial Market Engagement

CleanSpark actively cultivates relationships within the financial ecosystem, engaging with financial analysts, institutional investors, and individual retail investors. This proactive approach ensures clear communication and understanding of the company's progress and strategy.

The company prioritizes participation in key industry conferences and delivers investor presentations to disseminate information and foster dialogue. For instance, CleanSpark's participation in events like the Roth Capital Partners 10th Annual Investor Conference in March 2024 provided a platform to share their latest developments and future outlook with a targeted audience.

Responding promptly to market queries and providing transparent updates is crucial for building trust and attracting capital. This consistent engagement helps to shape positive market perception, which is vital for securing the necessary funding for CleanSpark's continued expansion and operational growth in the Bitcoin mining sector.

- Financial Analyst Relations: Providing timely and accurate data to analysts to facilitate informed coverage.

- Institutional Investor Outreach: Presenting the company's growth strategy and financial performance at investor days and roadshows.

- Retail Investor Communication: Utilizing digital platforms and press releases to keep individual investors informed.

- Market Feedback Integration: Actively listening to and addressing investor concerns to refine business strategies.

Internal Digital Asset Management

CleanSpark's internal digital asset management capabilities are a cornerstone of its customer relationships, particularly in how it optimizes its Bitcoin treasury. This sophisticated approach ensures efficient management of its primary product, directly impacting its ability to serve stakeholders and potentially generate new revenue.

This strategic control over its digital assets allows for greater financial flexibility. For instance, by actively managing its Bitcoin holdings, CleanSpark can better navigate market volatility. As of early 2024, the company continued to expand its Bitcoin mining capacity, underscoring the importance of robust internal management for its core asset.

- Optimized Bitcoin Treasury: Internal systems are in place to manage and maximize the value of the company's Bitcoin holdings.

- Strategic Flexibility: This capability allows CleanSpark to adapt to market conditions and pursue growth opportunities.

- Potential Revenue Streams: Advanced management of digital assets can open doors to revenue generation through financial instruments and derivatives.

- Commitment to Core Operations: Demonstrates a dedication to enhancing the value derived from its primary business activity.

CleanSpark fosters strong relationships with its investor base through transparent communication and active engagement. This includes regular updates on operational progress and financial performance, ensuring stakeholders are well-informed. For example, in Q1 2024, CleanSpark reported mining 1,429 BTC, demonstrating consistent operational output and providing tangible data for investors.

The company also cultivates strategic partnerships with key suppliers and energy providers, crucial for its growth. These collaborations ensure access to necessary hardware and reliable energy, underpinning its expansion. In 2024, CleanSpark continued to secure favorable energy rates, a vital component for cost-efficient mining operations.

Furthermore, CleanSpark actively engages with the financial community, participating in industry events and investor conferences. Their presence at events like the H.C. Wainwright 26th Annual Global Investment Conference in March 2024 highlights their commitment to dialogue and information dissemination with potential and existing investors.

| Relationship Type | Engagement Method | Key 2024 Focus/Data Point |

|---|---|---|

| Investor Relations | Quarterly Earnings Calls, Press Releases | Q1 2024: 1,429 BTC Mined |

| Strategic Partnerships | Supply Agreements, Energy Contracts | Secured favorable energy rates for expanded operations |

| Financial Community | Investor Conferences, Presentations | Participation in H.C. Wainwright Conference (March 2024) |

Channels

CleanSpark's core channel involves its owned and operated Bitcoin mining facilities. This direct control over infrastructure, located across states like Georgia and Mississippi, allows for optimized operational efficiency and performance.

The company's growth hinges on expanding its capacity within these company-managed sites. As of early 2024, CleanSpark reported a significant increase in its hashrate, demonstrating the effectiveness of this channel strategy.

CleanSpark leverages its dedicated investor relations website, press releases, and SEC filings to keep stakeholders informed. These channels are vital for disseminating transparent and timely financial and operational updates, ensuring current and potential shareholders have access to critical information.

CleanSpark’s growth is heavily driven by strategic acquisitions and partnerships. This approach allows them to quickly increase their mining capacity, or hashrate, and spread their operations across different locations. For instance, their acquisition of GRIID Infrastructure Inc. significantly boosted their operational scale.

Procurement agreements with major miner manufacturers are another vital channel. These deals ensure access to the latest, most efficient mining hardware, which is crucial for maintaining competitiveness. These partnerships are key to securing the necessary equipment for expansion.

Public Relations and Media Outreach

CleanSpark actively engages in public relations and media outreach to share its progress, strategic vision, and dedication to responsible Bitcoin mining. This approach is crucial for influencing public opinion, drawing in potential investors, and solidifying its reputation as a frontrunner in the Bitcoin mining industry.

Key activities include disseminating press releases detailing operational milestones and participating in significant industry conferences. For instance, in 2024, CleanSpark announced several expansion projects, which were widely covered by financial news outlets, contributing to increased investor interest.

- Enhanced Brand Visibility: Media coverage of CleanSpark's achievements, such as its significant increase in hashrate capacity throughout 2024, directly boosts its public profile.

- Investor Relations: Effective PR helps translate operational success into investor confidence, as seen in the positive market reactions to their 2024 growth announcements.

- Industry Leadership: By communicating its commitment to sustainable practices and technological innovation, CleanSpark positions itself as a thought leader in the evolving digital asset landscape.

- Market Positioning: Consistent media presence reinforces CleanSpark's narrative as a reliable and growing entity within the competitive Bitcoin mining sector.

Corporate Website and Social Media

CleanSpark's corporate website and social media platforms are crucial for direct communication with its audience. These channels allow the company to share updates on its Bitcoin mining operations, financial performance, and sustainability initiatives, fostering transparency. For instance, as of Q1 2024, CleanSpark reported a significant increase in its Bitcoin holdings and operational capacity, details readily available on their official site.

- Corporate Website: Serves as the primary hub for official announcements, investor relations, and detailed operational reports.

- Social Media Channels (e.g., X, LinkedIn): Used for real-time engagement, community building, and sharing accessible updates on mining progress and company milestones.

- Information Dissemination: Directly communicates CleanSpark's mission, operational achievements, and commitment to sustainable energy practices.

- Brand Building & Stakeholder Engagement: Crucial for cultivating brand loyalty and maintaining open lines of communication with investors, customers, and the broader public.

CleanSpark's channels extend to partnerships with hardware manufacturers, securing the latest ASIC miners essential for efficient Bitcoin extraction. These strategic alliances are critical for maintaining a competitive edge and facilitating expansion. Additionally, the company utilizes its investor relations portal and SEC filings to provide transparent and timely updates to shareholders, reinforcing trust and accessibility.

The company's direct engagement through its corporate website and social media platforms allows for real-time dissemination of operational progress and financial performance. This direct communication strategy is key to building brand loyalty and informing stakeholders about achievements like their increased Bitcoin holdings reported in early 2024.

| Channel Type | Description | 2024 Impact/Data Point |

|---|---|---|

| Owned Facilities | Direct control over mining infrastructure | Significant hashrate increase reported by early 2024 |

| Investor Relations & Filings | Transparent communication with stakeholders | Vital for disseminating financial and operational updates |

| Acquisitions & Partnerships | Rapid capacity expansion and geographic spread | GRIID Infrastructure Inc. acquisition significantly boosted scale |

| Hardware Procurement Agreements | Access to latest, efficient mining hardware | Crucial for maintaining competitiveness and expansion |

| Public Relations & Media Outreach | Influencing public opinion and investor confidence | Covered expansion projects widely in 2024 financial news |

| Corporate Website & Social Media | Direct engagement and information dissemination | Shared Q1 2024 updates on Bitcoin holdings and capacity |

Customer Segments

CleanSpark strategically targets both individual and institutional investors who are looking to gain exposure to the dynamic Bitcoin mining industry. This segment is keenly interested in companies that demonstrate strong operational efficiency, a clear growth path, and sound capital management practices. For instance, as of Q1 2024, CleanSpark reported a significant increase in its Bitcoin holdings, reflecting its expansion efforts and commitment to shareholder value.

The company understands that these investors prioritize transparency and clear communication regarding financial performance and operational updates. CleanSpark's investor relations efforts are therefore focused on providing detailed reports and accessible information, ensuring this sophisticated audience can make well-informed decisions. Their strategy emphasizes showcasing a robust balance sheet and a clear roadmap for future development, which resonates well with those managing substantial portfolios.

Bitcoin enthusiasts and cryptocurrency market participants form a key customer segment for CleanSpark. This group values CleanSpark's dedication to the Bitcoin ecosystem, particularly its role in network security through mining. Their interest is amplified by CleanSpark's identity as a pure-play Bitcoin miner, a distinction that appeals directly to those deeply invested in the digital asset's success and infrastructure.

Energy sector stakeholders and utilities find a valuable partner in CleanSpark, particularly given its involvement in developing energy infrastructure and participating in demand response programs. These organizations are focused on grid stability and monetizing low-cost energy, areas where CleanSpark's expertise directly contributes. For instance, CleanSpark's operations in areas with abundant, low-cost energy, like those powered by renewable sources, directly benefit utilities seeking to optimize their energy portfolios.

These partners are keenly interested in advancing sustainable energy practices and enhancing the efficiency of energy consumption across their networks. CleanSpark's ability to integrate and manage distributed energy resources, such as its Bitcoin mining operations that can be curtailed during peak demand, aligns perfectly with utility goals for grid balancing and reducing strain on infrastructure. In 2023, the company highlighted its strategy to leverage its significant energy purchasing power for grid services, aiming to provide value to utilities and their customers.

Hardware and Technology Suppliers

CleanSpark acts as a substantial customer for hardware and technology suppliers, particularly those specializing in mining rigs and data center infrastructure. In 2024, the company continued its aggressive expansion, placing significant orders for advanced ASIC miners. This consistent demand directly fuels innovation and production scaling within the hardware manufacturing sector.

The company's large-scale mining operations, such as its facilities in Georgia, necessitate substantial capital expenditures on cutting-edge technology. For instance, CleanSpark reported acquiring thousands of new-generation mining units throughout 2023 and into 2024, directly benefiting suppliers like MicroBT and Bitmain. These purchases are crucial for maintaining operational efficiency and competitiveness.

- Significant Purchaser: CleanSpark's substantial orders for ASICs and data center components make it a key client for technology manufacturers.

- Driving Innovation: The company's demand for the latest, most efficient hardware encourages suppliers to invest in research and development.

- Scale and Volume: CleanSpark's ongoing build-outs create consistent, large-volume orders, providing predictability for its hardware partners.

- Mutual Benefit: These supplier relationships are vital, supporting the growth and technological advancement of the entire Bitcoin mining hardware ecosystem.

Local Communities and Government Bodies

Local communities and government bodies are vital indirect stakeholders for CleanSpark, particularly as the company pursues its regional expansion. For instance, in 2024, CleanSpark's operations in Georgia, a key state for its mining activities, necessitate close attention to state and local energy policies and environmental regulations.

CleanSpark's commitment to adhering to local regulations and actively engaging with communities is paramount for sustained growth and operational stability. In 2024, this includes navigating varying permitting processes and contributing to local economies through job creation and potential tax revenues.

- Regulatory Compliance: Ensuring all mining and energy operations meet state and local environmental and safety standards.

- Community Engagement: Building positive relationships through local hiring initiatives and support for community development.

- Economic Impact: Contributing to local economies via job creation, estimated to be hundreds of jobs in expansion areas by late 2024, and local procurement.

- Infrastructure Development: Collaborating with local entities on energy infrastructure upgrades that benefit both the company and the community.

CleanSpark's customer segments are diverse, encompassing individual and institutional investors drawn to the Bitcoin mining sector's growth potential. These investors value operational efficiency and transparent financial reporting, as evidenced by CleanSpark's Q1 2024 increase in Bitcoin holdings.

The company also targets Bitcoin enthusiasts who appreciate its role in securing the network and its identity as a pure-play miner. Furthermore, energy sector stakeholders and utilities are key partners, benefiting from CleanSpark's expertise in grid stability and demand response programs, as highlighted by its 2023 strategy to leverage energy purchasing power.

CleanSpark serves as a significant customer for hardware and technology suppliers, consistently placing large orders for advanced mining rigs, such as its thousands of new-generation units acquired in 2023-2024, directly benefiting manufacturers like MicroBT and Bitmain.

Local communities and government bodies are also crucial stakeholders, with CleanSpark focusing on regulatory compliance and community engagement, aiming for significant job creation by late 2024.

Cost Structure

Energy expenses are a major operational cost for CleanSpark due to the high electricity demands of Bitcoin mining. The company prioritizes securing affordable energy and utilizes its energy management knowledge to keep these costs down. For instance, in the second quarter of fiscal year 2025, energy costs represented about 46.0% of CleanSpark's Bitcoin mining revenue.

CleanSpark's cost structure heavily features capital expenditures for high-efficiency Bitcoin mining hardware and data center infrastructure. For instance, in Q1 2024, the company reported capital expenditures of $59.7 million, primarily for acquiring new mining units and expanding its facilities.

These substantial investments, including strategic procurement of advanced mining rigs and greenfield data center development, are fundamental to boosting CleanSpark's hashrate and sustaining its competitive position in the market.

Ongoing operational and maintenance expenses are critical for CleanSpark, encompassing data center cooling, routine repairs, and staff salaries. The company's strategic emphasis on operational excellence is designed to drive down these costs on a per-unit of hashrate basis, a key metric in the competitive Bitcoin mining landscape.

CleanSpark's commitment to efficiency extends to its investment in chip-level repair capabilities. This allows them to address hardware issues internally, potentially reducing downtime and the need for costly replacements. In Q1 2024, CleanSpark reported a significant increase in its hashrate, reaching 20.4 EH/s, demonstrating their expanding operational capacity while managing these essential expenses.

Debt Servicing and Financing Costs

CleanSpark's cost structure includes significant expenses related to debt servicing and financing. These are the costs incurred from borrowing money to fuel operations and expansion. For instance, interest payments on outstanding convertible bonds and credit lines fall under this category.

In 2024, CleanSpark has actively used debt financing to support its ambitious growth plans. A notable example is the company's $650 million convertible bond offering, which provides capital but also necessitates regular interest payments. Additionally, a $200 million credit line from Coinbase represents another significant source of financing, with associated financing costs.

- Interest Payments: A primary cost is the interest paid on its $650 million convertible bond offering.

- Credit Line Expenses: Costs associated with the $200 million Coinbase credit line, including interest and potential fees.

- Financial Management: Effective management of these debt servicing costs is crucial for maintaining CleanSpark's overall financial health and profitability.

Research and Development for Efficiency

CleanSpark incurs significant, though often implicit, costs in its pursuit of enhanced operational efficiency. These investments are crucial for maintaining a competitive edge in the rapidly evolving cryptocurrency mining landscape. The company actively allocates resources towards research and development focused on improving its mining fleet and optimizing its operational infrastructure.

A core area of R&D investment is in next-generation ASIC (Application-Specific Integrated Circuit) technology. By staying at the forefront of ASIC development, CleanSpark aims to boost its hashrate and energy efficiency, directly impacting its cost per Bitcoin mined. For instance, in 2023, CleanSpark reported acquiring 10,000 new S21 miners, a significant upgrade in efficiency compared to older models, highlighting this commitment.

Furthermore, CleanSpark invests in innovative cooling solutions. Efficient cooling is paramount for maintaining optimal performance of mining hardware and reducing energy consumption. These advancements are not just about hardware upgrades but also about the sophisticated systems that keep the hardware running smoothly and cost-effectively, a critical factor given rising energy prices.

- R&D Investment: Costs associated with developing and acquiring advanced ASIC mining hardware.

- Fleet Optimization: Expenses related to improving the efficiency and performance of existing mining infrastructure.

- Cooling Innovations: Investment in advanced cooling technologies to reduce energy usage and hardware degradation.

- Strategic Imperative: Continuous improvement in mining efficiency is a key strategy for profitability and market competitiveness.

Energy expenses remain a significant cost, making up approximately 46.0% of CleanSpark's Bitcoin mining revenue in Q2 FY2025. Capital expenditures for mining hardware and infrastructure, such as the $59.7 million reported in Q1 2024 for new units and facility expansion, are also substantial. Operational and maintenance costs, including cooling and repairs, are managed through an emphasis on efficiency, aiming to reduce per-unit hashrate expenses.

| Cost Category | Description | Examples/Data Points |

| Energy Expenses | Electricity costs for Bitcoin mining operations. | 46.0% of Bitcoin mining revenue (Q2 FY2025). |

| Capital Expenditures | Investment in mining hardware and data center infrastructure. | $59.7 million (Q1 2024) for new mining units and facility expansion. |

| Operational & Maintenance | Ongoing costs for running and maintaining facilities. | Data center cooling, repairs, staff salaries; focus on reducing per-unit hashrate costs. |

| Financing Costs | Interest payments and fees on debt. | Interest on $650 million convertible bond offering; costs related to $200 million Coinbase credit line. |

| Research & Development | Investment in improving mining efficiency and technology. | Acquisition of 10,000 new S21 miners (2023); investment in advanced cooling solutions. |

Revenue Streams

CleanSpark's main way of making money is by mining Bitcoin directly from its own operations. The more Bitcoin they can mine, the more revenue they bring in. This is directly tied to how much mining power they have and how efficient their equipment is.

In May 2025, CleanSpark was really busy, mining an average of 22.39 Bitcoin every single day. This consistent daily output is the core of their revenue generation strategy, directly reflecting their operational success.

CleanSpark strategically sells a portion of the Bitcoin it mines to generate revenue. This approach allows them to fund ongoing operations and maintain healthy liquidity. Their Digital Asset Management team handles these sales, aiming to execute them when market prices are most favorable for maximizing returns.

For instance, in the first quarter of 2024, CleanSpark sold approximately 2,466 BTC, generating $97.5 million in proceeds. This demonstrates their active management of mined assets to support their business model and operational needs.

The appreciation in the value of CleanSpark's Bitcoin treasury, while not a direct operational revenue stream, significantly bolsters its financial health and can be converted to cash through strategic sales.

CleanSpark maintains a considerable Bitcoin holding as a corporate asset, directly benefiting from fluctuations in Bitcoin's market price. As of May 2025, this treasury was valued at an impressive $1.13 billion, demonstrating the substantial impact of Bitcoin's performance on the company's balance sheet.

Potential for Derivatives and Treasury Optimization

CleanSpark is actively investigating the use of financial derivatives to enhance its Bitcoin treasury management. This strategic pivot aims to capitalize on Bitcoin's inherent price volatility, moving beyond a passive holding strategy.

The company is looking into hedging strategies and potentially yield-generating instruments tied to its significant Bitcoin reserves. For instance, as of Q1 2024, CleanSpark held approximately 5,100 BTC, valued at over $200 million at certain points, presenting a substantial asset base for such optimization.

- Treasury Optimization: Utilizing derivatives to manage and potentially grow the value of its Bitcoin holdings.

- Revenue Generation: Exploring opportunities to earn additional income from market fluctuations.

- Sophisticated Financial Management: Transitioning from basic Bitcoin holding to more active financial strategies.

- Risk Mitigation: Employing hedging instruments to protect against adverse price movements.

Operational Efficiency Leading to Lower Cost per Bitcoin

CleanSpark's commitment to operational efficiency significantly boosts its revenue streams by lowering the cost to mine Bitcoin. In Q2 FY2025, the company achieved a cost of approximately $42,667 per Bitcoin mined. This cost advantage directly translates to a higher profit margin on each Bitcoin, thereby increasing the overall revenue generated from its mining operations.

This focus on cost reduction is a key driver for CleanSpark's financial performance. A lower cost per coin means that even with fluctuating Bitcoin prices, the company can maintain profitability. This operational advantage allows for more predictable and robust revenue generation from its core business of Bitcoin mining.

- Lower Cost Per Bitcoin: Approximately $42,667 in Q2 FY2025.

- Enhanced Profitability: Larger margin on each Bitcoin mined.

- Increased Revenue: Direct correlation between cost efficiency and revenue from mining.

CleanSpark's primary revenue comes from mining Bitcoin, directly influenced by their hashrate and operational efficiency. They also strategically sell a portion of their mined Bitcoin to fund operations and maintain liquidity, as seen in Q1 2024 when they sold 2,466 BTC for $97.5 million.

The company's Bitcoin treasury, valued at $1.13 billion as of May 2025, represents a significant asset that can be converted to cash. CleanSpark is also exploring financial derivatives to optimize this treasury, aiming to generate additional income and mitigate risks associated with Bitcoin's price volatility.

Operational efficiency is crucial, with Q2 FY2025 costs averaging $42,667 per Bitcoin mined, enhancing profitability and revenue from their core mining activities.

| Revenue Stream | Description | Q1 2024 Data | May 2025 Data | Q2 FY2025 Data |

|---|---|---|---|---|

| Bitcoin Mining | Direct revenue from mining operations. | N/A | 22.39 BTC/day average | N/A |

| Bitcoin Sales | Strategic sale of mined Bitcoin. | 2,466 BTC sold ($97.5M) | N/A | N/A |

| Treasury Appreciation/Optimization | Value of Bitcoin holdings and potential derivative strategies. | ~5,100 BTC held | $1.13B treasury value | Cost to mine: $42,667/BTC |

Business Model Canvas Data Sources

The CleanSpark Business Model Canvas is informed by a blend of internal financial data, market research reports on the energy and Bitcoin mining sectors, and competitive analysis. These diverse sources ensure a comprehensive and data-driven approach to understanding CleanSpark's operations and strategic direction.