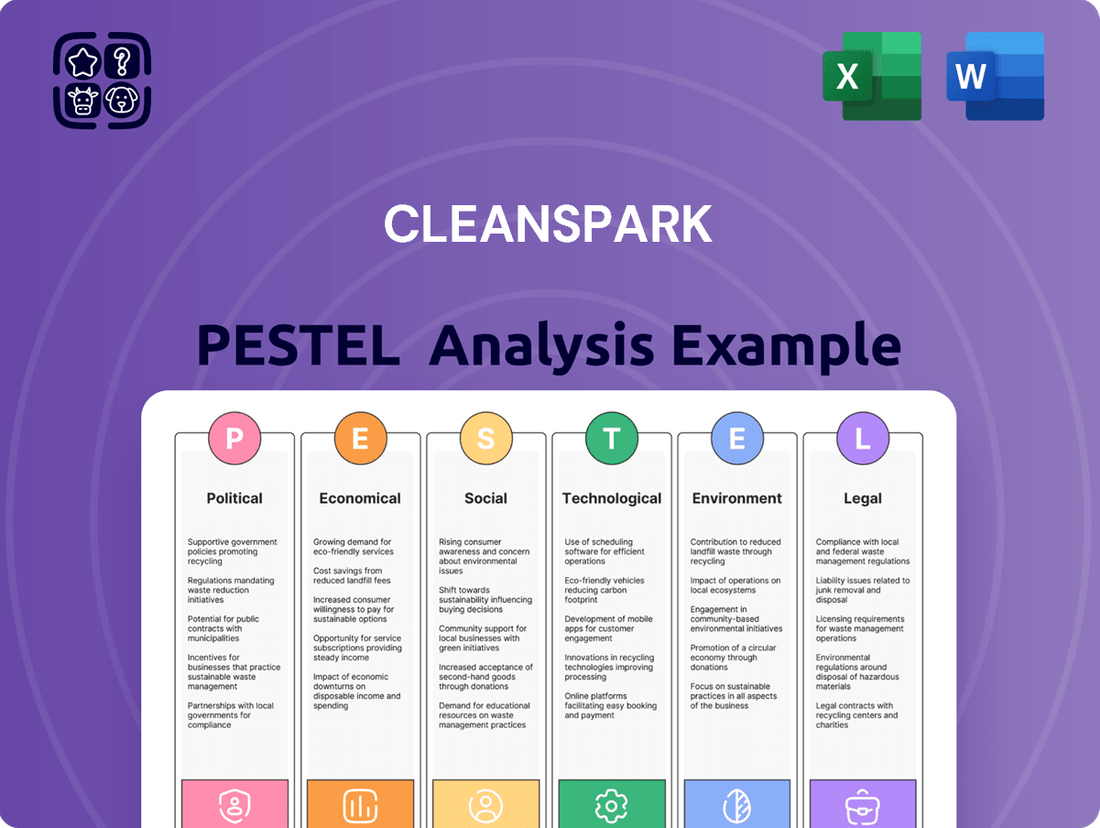

CleanSpark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

Unlock the hidden forces shaping CleanSpark's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Gain a critical edge by downloading the full report and arming yourself with actionable intelligence for smarter strategic decisions.

Political factors

The U.S. government, including the White House and various agencies, is intensifying its focus on cryptocurrency regulation. Initiatives like the GENIUS Act aim to create clearer guidelines for digital assets, which could translate into more rigorous rules for Bitcoin mining operations like CleanSpark. This increased oversight may affect compliance costs and operational flexibility.

While initial regulatory attention has been on stablecoins, broader discussions about cryptocurrency oversight are ongoing. For instance, the Treasury Department has been actively engaging with the industry to understand the implications of digital assets, potentially shaping future compliance frameworks that mining companies must adhere to.

Government policies focused on energy stability significantly influence Bitcoin mining operations. For instance, in 2024, Texas, a major hub for crypto mining, has been actively discussing the strain these operations can place on its power grid, leading to potential new regulations or incentives for miners to participate in demand response programs. CleanSpark, with its substantial U.S. presence, is directly exposed to these evolving state-level energy policies and the financial implications of grid stability initiatives.

While CleanSpark's operations are largely U.S.-based, international regulatory trends in cryptocurrency significantly impact investor sentiment and future global expansion prospects. For instance, the European Union's Markets in Crypto-Assets (MiCA) regulation, fully implemented in 2024, provides a comprehensive framework for crypto-assets, potentially influencing how other nations approach similar legislation and creating a more standardized global market.

Other nations are actively developing their own crypto regulations, which could establish precedents or foster competitive environments for mining operations. The global approach to energy-intensive industries, including cryptocurrency mining, also shapes public and political perceptions, potentially affecting access to capital and operational feasibility in different regions.

Political Climate and Administration Stance

The political climate surrounding cryptocurrency, particularly the stance of the current U.S. administration, is a crucial factor for companies like CleanSpark. A supportive federal approach can unlock significant growth opportunities. For instance, the Biden administration's focus on responsible innovation in digital assets, as outlined in its October 2022 framework, aims to foster clarity and mitigate risks, potentially benefiting the sector.

Recent developments, including potential legislative efforts and executive actions, indicate a growing recognition of the importance of digital assets. While specific policy outcomes are still evolving, the general trend suggests a move towards more structured engagement with the cryptocurrency industry. This evolving landscape directly influences investment flows and regulatory certainty for Bitcoin miners.

The administration's approach to energy policy also plays a role, especially for energy-intensive Bitcoin mining operations. Policies that encourage renewable energy adoption or provide incentives for efficient energy consumption could positively impact CleanSpark's operational costs and sustainability profile. For example, the Inflation Reduction Act of 2022 offers tax credits for clean energy, which could be leveraged by mining companies.

- Regulatory Clarity: The Biden administration's framework for digital assets aims to provide clearer guidelines, reducing uncertainty for businesses.

- Energy Policy Impact: Federal incentives for clean energy, such as those in the Inflation Reduction Act, can reduce operational expenses for Bitcoin miners.

- Market Stability: A stable and predictable political environment encourages institutional investment in the cryptocurrency sector, indirectly benefiting companies like CleanSpark.

Geopolitical Stability and Supply Chains

Geopolitical stability is a significant factor for CleanSpark, impacting its mining hardware and energy infrastructure supply chains. Unforeseen international events, like trade disputes or regional conflicts, can disrupt the flow of essential equipment, potentially delaying expansion plans. For instance, the ongoing global semiconductor shortage, exacerbated by geopolitical tensions, has previously affected the availability and cost of specialized mining components.

Maintaining stable political relationships is vital for CleanSpark to secure competitive energy prices, a critical input for its Bitcoin mining operations. Energy costs represent a substantial portion of operational expenses, and fluctuations due to political instability or changes in international energy policies can directly impact profitability. In 2024, the energy sector continues to be influenced by global political dynamics, affecting the cost and availability of electricity.

- Supply Chain Vulnerability: Geopolitical events, such as the Russia-Ukraine conflict, have demonstrated the fragility of global supply chains, potentially increasing lead times and costs for mining hardware.

- Energy Price Volatility: Political instability in energy-producing regions can lead to unpredictable swings in electricity prices, directly impacting CleanSpark's operational costs and margins.

- Trade Relations: Evolving trade policies and tariffs between major economies could affect the import/export of mining equipment and components, posing a risk to CleanSpark's procurement strategies.

The U.S. administration's stance on digital assets, with a focus on responsible innovation, aims to bring clarity and mitigate risks, potentially benefiting Bitcoin miners like CleanSpark. Federal incentives for clean energy, such as those within the Inflation Reduction Act of 2022, can also lower operational expenses by encouraging renewable energy adoption.

Government policies on energy grid stability, particularly in key mining states like Texas, are evolving. These policies may introduce new regulations or incentives for miners to participate in demand response programs, directly impacting CleanSpark's operational costs and flexibility.

International regulatory frameworks, like the EU's MiCA implemented in 2024, are creating more standardized global markets. This trend could influence future legislation in other nations and affect investor sentiment and CleanSpark's global expansion prospects.

Geopolitical stability directly impacts CleanSpark's supply chains for mining hardware and energy infrastructure. For instance, the 2024 energy market continues to be influenced by global political dynamics, affecting electricity costs and availability.

| Factor | Impact on CleanSpark | 2024/2025 Data/Trend |

|---|---|---|

| U.S. Digital Asset Framework | Increased regulatory clarity, reduced uncertainty | Biden administration's focus on responsible innovation continues; legislative efforts ongoing. |

| U.S. Energy Policy | Lower operational costs via clean energy incentives | Inflation Reduction Act tax credits for clean energy remain a key benefit. |

| State-Level Energy Regulations | Potential new rules for grid participation, impact on costs | Texas actively discussing grid strain from mining, exploring new regulations. |

| International Crypto Regulation | Influence on global market standards, investor sentiment | EU MiCA fully implemented in 2024, setting a precedent for global frameworks. |

| Geopolitical Stability | Supply chain risks, energy price volatility | Global semiconductor shortages and energy market volatility persist due to international events. |

What is included in the product

This PESTLE analysis evaluates the external macro-environmental factors impacting CleanSpark across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of its operating landscape.

Provides a clear, actionable framework for understanding external factors impacting CleanSpark, enabling proactive strategy development and mitigating potential risks.

Economic factors

CleanSpark's financial performance is intrinsically linked to Bitcoin's price, given its status as a pure-play Bitcoin miner. While Bitcoin has experienced substantial growth, even reaching new all-time highs in early 2025, its historical volatility remains a significant factor. For instance, Bitcoin saw price swings of over 50% within single months throughout 2024, a trend that can directly impact CleanSpark's revenue and profitability.

Energy costs are a major factor for Bitcoin miners like CleanSpark, directly impacting their bottom line. CleanSpark's strategy hinges on securing affordable energy, which is key to their low mining cost per Bitcoin. For example, in Q1 2024, CleanSpark reported an all-in cost of $7,050 per Bitcoin, significantly lower than many competitors, largely due to their energy procurement.

However, even with competitive rates, energy costs can fluctuate and represent a growing portion of revenue if not managed effectively. As of Q1 2024, energy and hosting costs represented approximately 44% of CleanSpark's total operating expenses. This highlights the ongoing challenge of balancing operational efficiency with the volatility of energy prices.

To combat this, CleanSpark strategically locates its facilities in areas with access to low-cost power and employs efficient fleet management. Their focus on utilizing energy that might otherwise be curtailed, particularly in regions like Georgia, demonstrates a proactive approach to mitigating rising energy expenses and enhancing overall profitability.

The Bitcoin halving in April 2024 presented a significant hurdle for miner profitability by cutting block rewards. However, CleanSpark demonstrated resilience, maintaining robust production. By July 2025, the company reported substantial monthly profits, a testament to Bitcoin's price appreciation and their efficient operations.

Despite the industry-wide challenge of increased mining difficulty and rising operational expenses post-halving, CleanSpark's strategic focus on efficiency allowed them to navigate these headwinds effectively. This adaptability is crucial in a sector where profitability is directly tied to energy costs and network conditions.

Access to Capital and Funding

CleanSpark's ability to secure significant funding, such as the $650 million zero-coupon convertible bond offering in late 2023, demonstrates its capacity to finance ambitious expansion plans. This access to capital is critical for the ongoing development of its energy infrastructure and the acquisition of new mining assets, which are vital for scaling operations.

Continued access to favorable financing options remains a cornerstone for CleanSpark's growth trajectory. A robust balance sheet, evidenced by its strategic capital allocation, underpins its ability to attract further investment and manage its operational expansion effectively.

- $650 Million: The approximate amount raised through a zero-coupon convertible bond offering, signaling strong investor confidence.

- Expansion Targets: This capital is earmarked to fully fund CleanSpark's planned growth initiatives.

- Favorable Financing: Ongoing access to cost-effective capital is crucial for infrastructure and acquisition funding.

- Balance Sheet Strength: A healthy financial position is key to securing future funding and executing strategic growth plans.

Market Competition and Consolidation

The Bitcoin mining sector is intensely competitive, with numerous companies striving for greater market share and operational efficiency. CleanSpark has strategically positioned itself as a leader through its dedication to operational excellence, smart acquisitions, and continuous expansion of its hashrate capacity.

Industry consolidation is a significant trend, as larger, more efficient miners acquire smaller operations. This trend, along with the entry of new participants, can significantly impact pricing power and the overall dynamics of the Bitcoin mining market.

- CleanSpark's Hasrate Growth: As of Q1 2024, CleanSpark reported a significant increase in its operational hashrate, reaching approximately 20.4 EH/s, up from 17.4 EH/s in the previous quarter.

- Industry Consolidation Examples: In late 2023 and early 2024, several smaller Bitcoin mining operations were acquired by larger entities, indicating a trend towards consolidation.

- Efficiency as a Differentiator: CleanSpark's focus on energy efficiency, utilizing newer generation mining hardware, allows it to maintain profitability even during periods of lower Bitcoin prices, a key competitive advantage.

Bitcoin's price is the primary economic driver for CleanSpark, directly influencing revenue. Despite reaching new highs in early 2025, Bitcoin's historical volatility, with swings exceeding 50% in single months during 2024, remains a key risk. This price fluctuation directly impacts CleanSpark's profitability and revenue streams.

What You See Is What You Get

CleanSpark PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive CleanSpark PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping CleanSpark's operations and strategic decisions.

You'll gain insights into market trends, competitive landscapes, and potential opportunities and threats, all presented in a clear and actionable format.

Sociological factors

Public perception of Bitcoin mining, especially regarding its significant energy usage, directly impacts social acceptance and the likelihood of stricter regulations. Concerns over environmental impact are a major driver of this perception.

CleanSpark is actively working to counter negative perceptions by highlighting its commitment to sustainable energy sources. For instance, in Q1 2024, the company reported that 95% of its energy consumption was from zero-carbon sources, a key data point in their public messaging.

Effectively addressing the industry's environmental footprint is crucial for CleanSpark to maintain its social license to operate and foster positive relationships with communities and regulators moving forward.

CleanSpark's expansion into new regions necessitates strong community relations, particularly addressing concerns like noise pollution from operations, efficient land utilization, and the significant energy demands of its data centers. Their strategy of expanding in existing communities and developing greenfield sites shows a commitment to integrating locally.

By actively contributing to local economies through job creation and potentially bolstering local energy grids, CleanSpark can cultivate positive community sentiment. For instance, in 2023, their Georgia facility was noted for its local economic contributions, and their ongoing projects aim to replicate this positive impact.

The burgeoning Bitcoin mining sector demands a skilled workforce for its operations, maintenance, and the construction of necessary infrastructure. CleanSpark's expansion into various U.S. states highlights the critical need to attract and keep talent in these specific areas.

Investing in local training and development programs can foster stronger community relationships and ensure more stable operations. For instance, by Q1 2024, the demand for specialized technicians in the energy and data center sectors, which overlap with mining, saw a 15% increase year-over-year according to industry reports.

Ethical Investment and ESG Considerations

Societal expectations are increasingly prioritizing ethical business practices, with Environmental, Social, and Governance (ESG) factors becoming a significant driver for investment decisions. This trend places pressure on companies like CleanSpark to showcase their commitment to sustainability and corporate responsibility. For instance, a 2024 report by Morningstar indicated that ESG-focused funds attracted over $200 billion in net new assets globally, highlighting the growing investor appetite for such investments.

CleanSpark's proactive approach, including its focus on sustainable energy solutions and the publication of its ESG reports, directly addresses this evolving investor sentiment. By demonstrating transparency in its ESG initiatives, CleanSpark aims to attract and retain capital from ethically-minded investors who seek alignment between their values and their portfolios. This focus on responsible operations is becoming a critical differentiator in the competitive clean energy market.

- Growing ESG Investment: Global ESG assets are projected to reach $33.9 trillion by 2026, up from $30.1 trillion in 2024, according to Bloomberg Intelligence.

- Investor Demand for Transparency: Surveys consistently show that a majority of investors consider ESG performance when making investment choices.

- CleanSpark's ESG Reporting: CleanSpark's commitment to publishing ESG reports provides stakeholders with verifiable data on its environmental impact, social contributions, and governance structures.

- Competitive Advantage: Strong ESG performance can enhance brand reputation and provide a competitive edge in attracting both capital and talent.

Adoption of Digital Assets

Societal acceptance of digital assets is a key driver for companies like CleanSpark. As more people, including institutional investors, view Bitcoin as a legitimate store of value, the demand for mining services naturally increases. This trend was evident in 2024, with growing institutional interest and a significant uptick in Bitcoin's price, which directly benefits Bitcoin miners by increasing the profitability of their operations.

The increasing mainstream acceptance of digital assets is a powerful sociological factor. For instance, a significant portion of the global population, particularly younger demographics, is showing increased interest in cryptocurrencies. This broader adoption translates to higher demand for the digital assets that companies like CleanSpark mine. By mid-2024, surveys indicated a growing comfort level with digital assets as investments, suggesting a more robust future market for mined Bitcoin.

Educational initiatives and clearer regulatory landscapes significantly accelerate the adoption of digital assets. As understanding grows and potential risks are better defined, more individuals and businesses are likely to engage with the digital asset ecosystem. This societal shift directly impacts the demand for mining capacity and the overall value proposition for Bitcoin mining companies.

- Growing Institutional Interest: In 2024, several major financial institutions launched Bitcoin-related investment products, signaling increased mainstream acceptance.

- Retail Investor Growth: Data from 2024 showed a continued rise in retail investors entering the digital asset space, driven by accessibility and perceived potential returns.

- Positive Sentiment Shift: Public perception of Bitcoin moved from being primarily speculative to a recognized asset class for some investors, boosting overall market confidence.

Public perception of Bitcoin mining's energy use directly influences regulatory outcomes and social acceptance, with CleanSpark emphasizing its 95% zero-carbon energy usage in Q1 2024 to counter negative views.

CleanSpark's community engagement strategy focuses on local economic contributions, job creation, and addressing concerns like noise pollution, aiming to foster positive relationships as it expands, mirroring its 2023 Georgia facility's impact.

The increasing demand for skilled labor in data center operations, with a 15% year-over-year increase in specialized technician demand by Q1 2024, highlights CleanSpark's need for local talent development.

Growing investor focus on ESG factors, with ESG funds attracting over $200 billion globally in 2024, pressures companies like CleanSpark to demonstrate commitment to sustainability and corporate responsibility for capital attraction.

Technological factors

The mining industry's profitability hinges on the continuous development of more efficient Application-Specific Integrated Circuit (ASIC) miners, a trend that becomes even more pronounced following Bitcoin halving events. These halvings reduce the block reward, making energy efficiency and hashrate per unit of power paramount for sustained operations.

CleanSpark actively addresses this by consistently investing in its mining fleet, upgrading to the latest generation machines like the Bitmain S21 pro miners. This strategic hardware optimization is crucial for maintaining a competitive edge and enhancing overall fleet efficiency, directly impacting their ability to generate profits in a dynamic market.

This focus on hardware allows CleanSpark to increase its total hashrate, which is the measure of the total computational power used to mine Bitcoin, while simultaneously reducing the energy consumed per terahash. For instance, in Q1 2024, CleanSpark reported a fleet efficiency of 21.4 joules per terahash (J/TH) with their S21 machines, a significant improvement over older models.

CleanSpark is keenly focused on energy efficiency, targeting a low J/Th (Joules per Terahash) for its mining fleet. This efficiency is a cornerstone of their operational strategy, directly impacting profitability and environmental footprint.

The company pursues this goal through a multi-pronged approach: acquiring strategically located sites, developing new greenfield infrastructure, and continuously improving their existing mining facilities. These efforts are designed to optimize energy consumption per unit of computational power.

A prime example of this commitment is their development of immersion-cooled Bitcoin mining data centers in Wyoming. This advanced cooling technology significantly enhances operational efficiency and cooling capabilities, further reducing energy waste compared to traditional air-cooled systems.

CleanSpark has significantly boosted its operational hashrate, surpassing its 2024 projections and advancing its 2025 goals ahead of schedule. This expansion, driven by strategic investments in new mining sites and facility enhancements, has notably increased the company's footprint on the global Bitcoin network.

By the end of Q1 2024, CleanSpark reported a hashrate of 17.2 EH/s, a substantial leap from its prior performance and a testament to its aggressive growth strategy. This continuous increase in hashrate is fundamental to maximizing Bitcoin output and maintaining a competitive edge in the mining industry.

Operational Uptime and Resilience

Maintaining high operational uptime for mining machines and data centers is absolutely critical for consistent Bitcoin production, directly impacting profitability. CleanSpark places a strong emphasis on operational excellence and maximizing portfolio uptime to ensure peak efficiency and robust returns.

This commitment translates into implementing rigorous maintenance protocols and developing resilient energy infrastructure designed to minimize any potential downtime. For instance, in Q1 2024, CleanSpark reported an impressive 93% uptime across its mining fleet, a testament to their focus on resilience.

- Operational Uptime: CleanSpark's focus on minimizing downtime directly correlates with consistent Bitcoin generation and revenue.

- Resilient Infrastructure: Investments in robust energy solutions and advanced cooling systems are key to maintaining operational continuity.

- Efficiency Gains: High uptime allows for maximum utilization of mining hardware, leading to improved energy efficiency per terahash.

- Q1 2024 Performance: The company achieved 93% operational uptime, showcasing their dedication to reliable operations.

Integration of AI and Automation

The cryptocurrency mining sector is increasingly adopting AI and automation to streamline operations. This includes using AI-powered scheduling systems for optimal energy consumption and employing intelligent algorithms to identify the most profitable mining opportunities. While CleanSpark's specific AI integration isn't fully detailed, the industry trend points towards enhanced efficiency and profitability through these advanced technologies.

The broader trend in crypto mining involves leveraging AI-powered scheduling systems and intelligent algorithms to optimize mining operations. This strategic shift aims to maximize hash rates and minimize energy costs, crucial for maintaining profitability in a volatile market. For instance, by analyzing real-time network difficulty and electricity prices, AI can dynamically adjust mining parameters.

The industry's move towards automation in identifying profitable cryptocurrencies and managing mining farms indicates a potential area for future technological integration to enhance efficiency and profitability for companies like CleanSpark. This could involve AI systems that automatically switch mining activities to the most lucrative digital assets based on market conditions and projected returns.

- AI-driven optimization: Companies are exploring AI to manage energy usage, a significant cost factor in mining.

- Automated asset selection: Intelligent algorithms can identify and pivot to the most profitable cryptocurrencies.

- Farm management enhancements: Automation promises to improve the operational efficiency of large-scale mining facilities.

- Predictive maintenance: AI can forecast equipment failures, reducing downtime and associated losses.

Technological advancements are central to CleanSpark's strategy, particularly in acquiring more efficient ASIC miners to boost hashrate and reduce energy consumption per terahash. The company is also exploring AI and automation to optimize operations, from energy scheduling to identifying profitable mining opportunities.

CleanSpark's investment in advanced cooling technologies, like immersion cooling, further enhances operational efficiency and reduces energy waste. This focus on technological upgrades is critical for maintaining a competitive edge and maximizing profitability in the evolving cryptocurrency mining landscape.

The industry's increasing adoption of AI for predictive maintenance and automated farm management presents opportunities for CleanSpark to further streamline operations and improve uptime. By staying at the forefront of technological innovation, CleanSpark aims to solidify its position as a leading, efficient Bitcoin miner.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Fleet Efficiency | 21.4 J/TH (with S21) | Improved energy usage per unit of computation. |

| Total Hashrate | 17.2 EH/s (end of Q1 2024) | Increased computational power for Bitcoin mining. |

| Operational Uptime | 93% (Q1 2024) | Ensures consistent Bitcoin production and revenue. |

Legal factors

The evolving legal landscape for cryptocurrencies in the U.S. directly impacts CleanSpark, with federal and state agencies like the SEC, CFTC, and FinCEN actively establishing guidelines. These regulations, which are still being refined, influence how CleanSpark operates its mining facilities and interacts with the broader digital asset ecosystem.

Recent legislative efforts, such as proposals like the GENIUS Act focusing on stablecoins, set important precedents for future digital asset regulation, potentially impacting transaction frameworks and security classifications relevant to CleanSpark's business model.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws is absolutely crucial for all crypto businesses, including CleanSpark, to maintain operational legitimacy and avoid significant penalties. For instance, the Financial Crimes Enforcement Network (FinCEN) continues to enforce these rules, requiring robust reporting mechanisms for suspicious activities.

CleanSpark's energy-intensive operations, particularly its Bitcoin mining activities, are directly impacted by evolving state and federal energy and environmental regulations. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to scrutinize data centers for their energy consumption and potential emissions, a trend expected to intensify. Compliance with demand response programs, which incentivize reducing energy use during peak times, and rigorous environmental impact assessments are crucial for maintaining operational efficiency and avoiding potential penalties.

The company's proactive stance on sustainable energy, including its use of renewable sources, is designed to mitigate the financial and strategic implications of potential future carbon emission mandates. As of early 2024, several states are actively exploring or implementing stricter emissions standards for industrial energy users, which could directly affect mining operations if they rely heavily on non-renewable power sources. CleanSpark's investment in cleaner energy solutions positions it to better navigate these regulatory landscapes and potentially gain a competitive advantage.

Data center zoning and permitting are critical legal hurdles for CleanSpark's expansion. Navigating varied local zoning ordinances and building codes across the United States directly influences project timelines and development costs. For instance, a new facility in a jurisdiction with strict land-use regulations might face longer approval processes compared to areas with more streamlined permitting.

Taxation of Digital Assets

The Internal Revenue Service (IRS) continues to classify digital assets, including Bitcoin, as property for tax purposes. This classification imposes specific tax reporting obligations on cryptocurrency mining operations like CleanSpark. For instance, the gain or loss from selling mined Bitcoin is treated as capital gain or loss, requiring detailed record-keeping.

Evolving tax legislation surrounding digital assets presents a significant factor for CleanSpark's financial reporting and profitability. Changes in capital gains tax rates, depreciation rules for mining equipment, or specific reporting requirements for mining income could directly affect the company's bottom line. As of early 2024, discussions around further clarity and potential new regulations for digital asset taxation are ongoing in various jurisdictions.

CleanSpark's proactive approach to understanding and complying with these dynamic tax regulations is crucial for its financial planning and risk management. Staying informed about potential legislative shifts allows the company to adapt its financial strategies and ensure accurate tax filings. This includes monitoring proposals that could impact the tax treatment of energy consumption for mining operations.

- IRS Classification: Digital assets are treated as property, not currency, for tax purposes.

- Tax Reporting: Bitcoin mining income and gains/losses from selling mined assets require specific reporting.

- Legislative Impact: Changes in tax laws can affect CleanSpark's profitability and financial statements.

- Compliance Importance: Staying updated on evolving digital asset tax regulations is vital for financial planning.

Securities Laws and Investor Protection

As a publicly traded entity, CleanSpark, Inc. (CLSK) is subject to rigorous U.S. securities laws, necessitating strict adherence to reporting mandates and investor protection regulations enforced by bodies like the Securities and Exchange Commission (SEC). The SEC's evolving stance on digital assets, particularly whether they constitute securities, directly impacts companies operating in the cryptocurrency and blockchain space, requiring careful navigation and compliance. CleanSpark's commitment to transparent financial reporting, evidenced by its filings, and robust corporate governance are crucial for maintaining investor confidence and market integrity, especially considering its operations in a rapidly developing sector.

For instance, CleanSpark's Q1 2024 earnings report, filed in February 2024, detailed significant revenue growth, underscoring the importance of accurate and timely disclosures to its shareholders. The company's adherence to Sarbanes-Oxley Act (SOX) compliance, a key aspect of U.S. securities law, ensures internal controls over financial reporting are effective. Failure to comply with these regulations can result in substantial penalties and reputational damage, making legal and regulatory adherence a cornerstone of CleanSpark's operational strategy.

- SEC Oversight: CleanSpark must comply with SEC regulations, including quarterly (10-Q) and annual (10-K) financial reporting.

- Investor Protection: Adherence to rules designed to safeguard investors from fraud and manipulation is paramount.

- Digital Asset Classification: The company must monitor and adapt to SEC guidance on whether its digital asset activities fall under securities law.

- Corporate Governance: Maintaining strong governance practices, including an independent board and audit committee, is essential for regulatory compliance.

CleanSpark's operations are significantly shaped by evolving U.S. cryptocurrency regulations, including those from the SEC and CFTC, impacting mining and digital asset interactions. Compliance with AML and KYC laws, enforced by FinCEN, is critical for legitimacy and avoiding penalties.

Taxation of digital assets as property by the IRS necessitates specific reporting for mining income and asset sales, with potential legislative changes impacting profitability. CleanSpark's adherence to SEC reporting and investor protection rules, like SOX compliance, is vital for maintaining market trust and avoiding legal repercussions.

Environmental factors

Bitcoin mining's substantial energy demands place a significant environmental burden on the industry, a critical factor for companies like CleanSpark. The company is actively working to reduce its energy consumption and carbon footprint by prioritizing the use of sustainable energy sources for its mining operations.

CleanSpark's commitment to environmental responsibility is underscored in its ESG reports, which detail its efforts to mine Bitcoin in a manner that addresses environmental concerns. For instance, in Q1 2024, CleanSpark reported that 96% of its energy consumption was derived from climate-friendly sources, a notable achievement in the sector.

CleanSpark's operational strategy heavily leans on sustainable energy, particularly in areas where renewables like hydro, wind, and solar are abundant and cost-effective. This focus is not just about environmental responsibility; it's a smart business move that allows them to leverage and monetize surplus renewable energy, which might otherwise go unused. For example, in 2023, CleanSpark reported significant savings and revenue generation through their efficient energy management practices, capitalizing on regions with lower renewable energy costs.

Large-scale data centers, including those used for Bitcoin mining, consume substantial amounts of water for cooling. While CleanSpark's primary focus has been on energy efficiency, water management is becoming an increasingly important environmental consideration for these operations. For instance, in 2023, the Bitcoin mining industry's water footprint was estimated to be significant, prompting a closer look at sustainable cooling methods.

The industry is exploring advanced cooling technologies, such as immersion cooling, which could offer a more efficient way to manage heat and potentially reduce overall water consumption compared to traditional air cooling systems. This shift reflects a growing awareness of the environmental impact of water-intensive processes in the digital asset sector.

E-waste Management

The lifecycle of specialized mining hardware, particularly ASICs, inherently creates electronic waste (e-waste). For companies like CleanSpark, responsible disposal and recycling of outdated or inefficient mining rigs are critical environmental considerations. This proactive approach to managing e-waste directly supports broader corporate responsibility and sustainability objectives, demonstrating a commitment to environmental stewardship.

The growing volume of e-waste from the digital asset mining sector presents a significant challenge. For instance, the Global E-waste Monitor 2024 reported that global e-waste generation reached 62 million metric tons in 2023, a figure expected to rise. CleanSpark's efforts in this area are therefore increasingly important.

- ASIC Lifespan: The rapid obsolescence of ASIC hardware necessitates efficient end-of-life management strategies.

- Recycling Initiatives: Companies are exploring partnerships with specialized e-waste recyclers to recover valuable materials and minimize landfill impact.

- Regulatory Compliance: Adherence to evolving environmental regulations regarding e-waste disposal is a key operational factor.

- Sustainability Reporting: Transparent reporting on e-waste management practices enhances corporate reputation and investor confidence.

Grid Impact and Demand Response

CleanSpark's active involvement in demand response programs, notably with the Tennessee Valley Authority (TVA), highlights its dedication to energy efficiency and bolstering grid stability. This participation is crucial as it allows the company to act as a flexible energy consumer, adjusting its operations during periods of high demand.

By modulating its energy consumption, CleanSpark's Bitcoin mining operations can effectively help balance the energy load, thereby minimizing waste. This is particularly beneficial when dealing with surplus renewable energy that might otherwise go unused. In 2023, CleanSpark reported saving approximately $1.5 million through demand response initiatives, showcasing the financial and environmental advantages.

- Grid Stability Contribution: CleanSpark's flexibility in adjusting power usage directly supports grid operators in maintaining a consistent and reliable electricity supply.

- Renewable Energy Integration: Demand response allows CleanSpark to utilize excess renewable energy, reducing reliance on fossil fuels and enhancing the environmental profile of its operations.

- Operational Savings: Participation in these programs not only aids the environment but also yields significant cost savings, as demonstrated by their $1.5 million in savings in 2023.

CleanSpark's environmental strategy centers on minimizing its carbon footprint through renewable energy sources. In Q1 2024, a remarkable 96% of their energy consumption was derived from climate-friendly sources, showcasing a strong commitment to sustainability.

The company actively participates in demand response programs, like the one with the Tennessee Valley Authority (TVA), which not only aids grid stability but also generated approximately $1.5 million in savings for CleanSpark in 2023 by utilizing surplus renewable energy.

Addressing electronic waste is another key environmental focus, with efforts to manage the lifecycle of ASIC hardware through responsible disposal and recycling initiatives, aligning with growing industry awareness of e-waste challenges.

| Metric | 2023 Data | 2024 (Q1) Data | Significance |

|---|---|---|---|

| Climate-Friendly Energy Usage | Not specified | 96% | Demonstrates significant reliance on sustainable power. |

| Demand Response Savings | ~$1.5 million | Not specified | Highlights financial benefits of grid participation. |

| E-waste Management Focus | Ongoing initiatives | Ongoing initiatives | Addresses industry-wide hardware obsolescence. |

PESTLE Analysis Data Sources

Our CleanSpark PESTLE Analysis is meticulously constructed using data from reputable sources including government energy reports, financial market data providers, and industry-specific technology publications. We prioritize official regulatory updates and economic forecasts to ensure comprehensive and accurate insights.