CleanSpark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

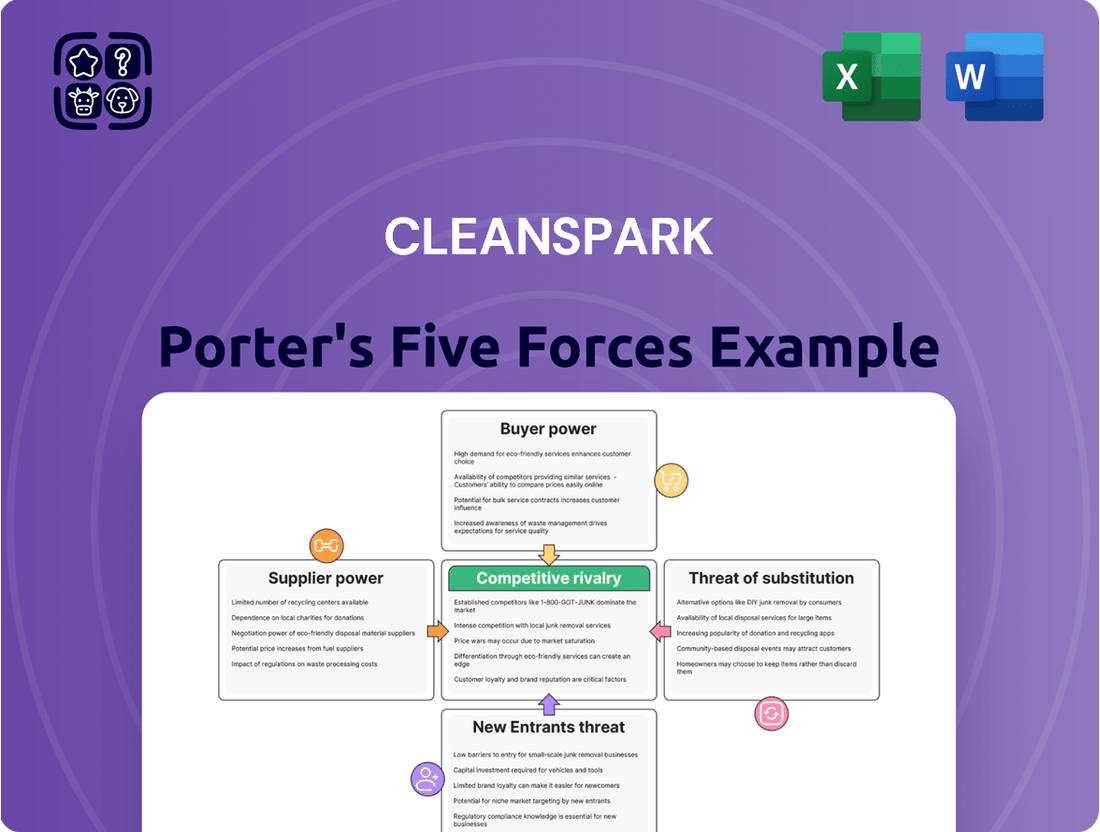

Understanding the competitive landscape is crucial for CleanSpark's success. Our Porter's Five Forces analysis reveals the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes impacting the company.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CleanSpark’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of ASIC manufacturers significantly impacts the bargaining power of suppliers in the Bitcoin mining industry. Companies like Bitmain, MicroBT, and Canaan dominate the market for high-efficiency mining hardware, meaning they can exert considerable influence over their customers. This limited supply of specialized equipment gives these manufacturers leverage when negotiating prices and terms with mining operations such as CleanSpark.

CleanSpark’s reliance on these major players, evidenced by its orders with Canaan, underscores this dynamic. When a company needs the latest, most efficient ASICs to remain competitive, and only a handful of suppliers can provide them, those suppliers hold substantial power. This can translate into higher costs for mining companies, affecting their profitability and operational planning.

Suppliers in the mining hardware sector are constantly pushing the envelope with innovations in ASICs, focusing on greater energy efficiency and processing power. This relentless innovation cycle quickly renders older hardware outdated, forcing companies like CleanSpark to continually upgrade.

This dependence on supplier R&D and production timelines significantly impacts CleanSpark's operational planning and capital expenditure. The industry saw a notable 24% year-over-year improvement in ASIC hardware efficiency by June 2024, highlighting the pace of these advancements.

Energy is a major cost for Bitcoin miners, often making up more than 80% of their operating expenses. CleanSpark strategically targets facilities with access to affordable energy, and they are also investing in their own energy infrastructure to gain more control.

Despite these efforts, CleanSpark's dependence on existing utility rate structures and government incentives means energy providers and grid operators still hold significant bargaining power. This is particularly true for large-scale mining operations that require substantial and consistent power supply.

Access to Sustainable Energy Sources

CleanSpark's dedication to utilizing sustainable energy sources like hydropower, wind, and nuclear power inherently narrows its energy supplier pool. This focus means suppliers capable of providing these specific, cleaner energy options hold significant bargaining power.

While the broader Bitcoin mining industry saw over 50% of its energy derived from sustainable sources in 2023, CleanSpark's stringent requirements for its operations amplify the leverage of those few suppliers who can meet these criteria. For instance, securing reliable, low-cost hydropower is a key differentiator.

- Limited Supplier Options: CleanSpark's commitment to renewables restricts its choices to energy providers offering specific sustainable sources.

- Supplier Leverage: Providers of hydropower, wind, and nuclear energy can command better terms due to their specialized offerings.

- Market Trend: The industry-wide shift towards sustainability, with over half of Bitcoin mining using renewables in 2023, increases demand for these specialized energy providers.

Financing for Hardware Acquisitions

Suppliers of advanced Bitcoin mining hardware, like Bitmain, often dictate terms that can impact a company's capital expenditure. These terms frequently involve substantial upfront payments or complex financing arrangements, directly influencing the accessibility and cost of acquiring new equipment. For CleanSpark, securing favorable financing for its large-scale miner acquisitions is a critical factor in its operational expansion and efficiency.

The bargaining power of these hardware suppliers is amplified by market demand for the latest, most efficient mining machines. CleanSpark's strategic decision to acquire 160,000 Bitmain S21 miners in early 2024 highlights the scale of these transactions and the importance of supplier relationships. This move underscores the need for CleanSpark to manage its financing effectively to meet supplier demands and secure its competitive edge.

- Supplier Financing Terms: Hardware suppliers can leverage their position by demanding significant upfront capital or structuring payment schedules that favor them, potentially limiting a buyer's flexibility.

- Market Demand for New Equipment: High demand for the latest ASIC miners increases supplier leverage, as they can command premium prices and stricter payment terms.

- CleanSpark's Acquisition Strategy: The acquisition of 160,000 Bitmain S21 miners in 2024 demonstrates CleanSpark's commitment to scaling, but also its reliance on suppliers meeting its hardware needs under potentially challenging financial conditions.

The bargaining power of suppliers for CleanSpark is significant, particularly concerning ASIC manufacturers and energy providers. Limited options in both specialized hardware and sustainable energy sources allow these suppliers to dictate terms and prices. This dynamic directly impacts CleanSpark's capital expenditure and operational costs, as seen in its substantial miner acquisitions and focus on specific energy sources.

| Supplier Type | Key Players | Impact on CleanSpark | Relevant Data/Trend |

|---|---|---|---|

| ASIC Manufacturers | Bitmain, MicroBT, Canaan | High prices, upfront payments, dependence on innovation cycles | 24% year-over-year improvement in ASIC hardware efficiency by June 2024 |

| Energy Providers (Sustainable) | Hydropower, wind, nuclear facilities | Limited supplier pool, potential for higher costs for specialized energy | Over 50% of Bitcoin mining used renewables in 2023; CleanSpark targets specific sources. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CleanSpark's position in the energy sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Gain immediate clarity on market pressures, enabling proactive strategies to navigate industry challenges.

Customers Bargaining Power

CleanSpark's primary "customers" are the Bitcoin network itself, which provides rewards in the form of newly minted Bitcoin and transaction fees. This decentralized structure means there's no single buyer dictating terms to CleanSpark, significantly reducing direct customer bargaining power. The value of the Bitcoin mined is ultimately set by the global market, not by any individual customer.

The significant price swings in Bitcoin create a challenging environment for CleanSpark, directly influencing its earnings. When Bitcoin's market value drops, the revenue generated from mining rewards shrinks, forcing companies like CleanSpark to focus intensely on cost control and operational efficiency to remain profitable.

This volatility means that the effective price CleanSpark receives for mining a Bitcoin can fluctuate dramatically. For instance, with a marginal cost to mine around $34,000 per Bitcoin in Q1 FY2025, any substantial dip in Bitcoin's market price below this threshold would directly impact their ability to generate a profit on each mined unit.

The Bitcoin network's difficulty adjustment is a crucial factor influencing the bargaining power of its "customers," which in this context are the miners. This automatic adjustment ensures blocks are found roughly every ten minutes. As more miners join, the hashrate increases, leading to a higher difficulty. This means miners expend more computational power for the same Bitcoin reward, effectively reducing their individual profitability.

For instance, as of early 2024, Bitcoin's hashrate has seen significant growth, pushing mining difficulty to new all-time highs. This increased difficulty directly impacts the earnings of individual miners; a higher difficulty means less Bitcoin earned per terahash per second (TH/s). This dynamic inherently limits the profitability of mining operations, acting as a pressure point akin to customer bargaining power, as miners must constantly seek efficiency to remain viable.

Competition Among Miners for Block Rewards

CleanSpark operates in a highly competitive Bitcoin mining landscape. Miners worldwide vie for block rewards, a fixed incentive for validating transactions. This dynamic significantly impacts the bargaining power of customers, or rather, the overall profitability of mining itself. As more miners join the network, the difficulty of mining increases, meaning more computational power is required to earn the same reward. This effectively lowers the return on investment for individual miners.

The intense competition among miners for block rewards directly influences the profitability of companies like CleanSpark. The Bitcoin block reward, which was 6.25 BTC prior to the April 2024 halving, is now 3.125 BTC. This fixed reward, shared among all successful miners, means that increased competition dilutes individual gains. For instance, as of early 2024, the global Bitcoin hashrate was consistently above 500 EH/s, indicating a massive amount of computing power competing for each block.

- Intense Global Competition: CleanSpark faces a vast number of global competitors, all aiming to mine Bitcoin.

- Fixed Block Reward: The Bitcoin block reward is a set amount, meaning more miners sharing it leads to lower individual payouts.

- Increasing Mining Difficulty: As more hash power enters the network, the difficulty adjusts upwards, making it harder and more expensive to mine a single Bitcoin.

- Impact on Profitability: This competitive pressure limits a miner's ability to dictate terms or achieve higher returns per unit of energy consumed.

Limited Differentiation in Mined Product

The bargaining power of customers is significantly influenced by the lack of differentiation in the mined product. Bitcoin itself is a fungible asset, meaning there's no inherent qualitative difference between Bitcoin mined by CleanSpark and that mined by any competitor. This fungibility prevents CleanSpark from charging a premium based on its mining process or operational efficiency.

This lack of product differentiation directly translates into limited pricing power for CleanSpark. Customers, in this case, are essentially buyers of Bitcoin. Because any Bitcoin is the same as any other, buyers are not incentivized to pay more for Bitcoin sourced from a specific miner.

- Fungible Asset: Bitcoin’s nature as a fungible commodity means all units are interchangeable, regardless of the miner.

- No Premium Pricing: CleanSpark cannot leverage its operational efficiency or mining technology to command higher prices for its mined Bitcoin.

- Price Takers: In essence, CleanSpark acts as a price taker in the Bitcoin market, accepting the prevailing market rate for its output.

The bargaining power of customers in the Bitcoin mining sector, as it pertains to CleanSpark, is notably low due to the fungible nature of Bitcoin. This means that any Bitcoin mined by CleanSpark is identical to Bitcoin mined by any other entity, preventing any differentiation that could lead to premium pricing. Consequently, CleanSpark, like other miners, is a price taker in the global Bitcoin market.

The primary "customers" for CleanSpark are the buyers of Bitcoin on the open market. Since Bitcoin is a fungible asset, these buyers have no incentive to pay more for Bitcoin produced by CleanSpark compared to Bitcoin from any other miner. This lack of product differentiation significantly limits CleanSpark's ability to negotiate terms or influence pricing.

Furthermore, the decentralized nature of the Bitcoin network means there isn't a single, large customer dictating terms. Instead, CleanSpark sells its mined Bitcoin on a global, open market where prices are determined by supply and demand, further diminishing any individual customer's bargaining leverage.

The intense global competition among miners also plays a role. With a fixed block reward, which was 3.125 BTC after the April 2024 halving, more miners mean a smaller share for each. This dynamic, coupled with increasing mining difficulty, forces miners like CleanSpark to focus on efficiency rather than leveraging any customer relationship for better terms.

| Factor | Description | Impact on CleanSpark |

|---|---|---|

| Fungibility of Bitcoin | All Bitcoin units are identical and interchangeable. | Prevents CleanSpark from commanding premium prices based on its mining operations. |

| Decentralized Network | No single entity controls Bitcoin demand or sets prices. | Eliminates direct customer negotiation power over CleanSpark. |

| Open Market Sales | CleanSpark sells mined Bitcoin on global exchanges. | CleanSpark must accept prevailing market prices, acting as a price taker. |

| Global Competition | Many miners worldwide compete for block rewards. | Dilutes individual miner profitability, reducing leverage. |

Preview the Actual Deliverable

CleanSpark Porter's Five Forces Analysis

This preview showcases the complete CleanSpark Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the Bitcoin mining industry. You're looking at the actual, professionally formatted document, which means the exact file you see here will be available for your instant download and use immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

The Bitcoin mining sector is crowded with numerous publicly traded and private entities, fostering a fiercely competitive environment. Major players such as Marathon Digital Holdings, Hut 8 Mining Corp., and Iris Energy operate alongside CleanSpark, intensifying rivalry for market share and mining rewards.

Miners are locked in a relentless competition, constantly striving to boost their hashrate, which is the measure of their computational power. This race is crucial for securing a larger slice of Bitcoin rewards, particularly in the wake of halving events that reduce the block subsidy. Simultaneously, improving fleet efficiency, often measured in joules per terahash, directly impacts profitability by lowering energy costs.

CleanSpark, for instance, has demonstrated a strong commitment to this competitive dynamic by aggressively expanding its hashrate. The company has set an ambitious target of reaching 50 exahashes per second (EH/s) by the first half of 2025, showcasing its dedication to staying ahead in this critical aspect of Bitcoin mining.

Access to low-cost and stable energy is a significant competitive edge in the Bitcoin mining industry, as electricity costs represent the largest portion of operational expenses. CleanSpark's strategic approach centers on owning and operating facilities that benefit from globally competitive energy prices, with a particular emphasis on sustainable energy solutions.

As of the first quarter of 2024, CleanSpark reported an average energy cost of $0.04 per kilowatt-hour, a figure that remains exceptionally low compared to many industry peers. This cost advantage directly translates to improved profitability and a stronger competitive stance, especially during periods of fluctuating Bitcoin prices.

Capital Investment and Scale

The cryptocurrency mining industry demands substantial capital for cutting-edge hardware and robust energy infrastructure. This high barrier to entry favors established players with significant financial backing.

CleanSpark, for instance, benefits from its strong financial position. As of December 31, 2024, the company reported $1.2 billion in working capital. This financial strength allows CleanSpark to invest in advanced mining equipment and secure favorable energy contracts, giving it a competitive edge over smaller or less capitalized rivals.

This capital intensity also enables larger companies to capitalize on market downturns by acquiring distressed assets at lower costs. Such strategic acquisitions further enhance their scale and operational efficiency, solidifying their market position.

- Significant Capital Outlay: The need for advanced mining hardware and energy infrastructure creates a high capital investment requirement.

- Financially Strong Players: Companies like CleanSpark, with substantial working capital, are better positioned to scale and acquire assets.

- Competitive Advantage: Access to capital allows for investment in efficiency and strategic acquisitions, widening the gap with competitors.

Strategic Acquistions and Consolidation

The Bitcoin halving events, which reduce miner rewards, can create significant market pressure, often leading to consolidation. During these periods, more efficient and financially robust companies like CleanSpark are better positioned to acquire struggling competitors or their assets. This trend was evident in 2024 as the industry anticipated and reacted to the halving, prompting strategic moves to secure market share and operational efficiency.

CleanSpark has been a proactive participant in this consolidation trend. In 2024, the company continued its strategy of expanding its mining capacity through acquisitions. A notable example is their acquisition of facilities in Tennessee, which significantly boosted their hashrate and operational footprint. These moves are designed to leverage economies of scale and improve cost-efficiency, particularly in the face of reduced block rewards.

These strategic acquisitions not only enhance CleanSpark's competitive standing but also contribute to industry-wide consolidation. By integrating acquired assets, CleanSpark aims to optimize its energy consumption and operational management, solidifying its position as a leading, highly efficient Bitcoin miner.

- Industry Consolidation: Bitcoin halving events in 2024 intensified pressure on smaller miners, driving consolidation as stronger players acquired less efficient operations.

- CleanSpark's Acquisitions: CleanSpark strategically acquired new data center facilities, such as those in Tennessee, to expand its hashrate and operational scale.

- Efficiency Gains: These acquisitions are aimed at improving cost-efficiency and leveraging economies of scale, crucial for profitability in a post-halving environment.

- Market Position: CleanSpark's proactive acquisition strategy strengthens its competitive position within the increasingly consolidated Bitcoin mining sector.

The Bitcoin mining industry is characterized by intense rivalry, with numerous companies competing for hashrate and Bitcoin rewards. CleanSpark is actively participating in this dynamic, aiming to expand its operational capacity and efficiency. This competition is further fueled by the need for significant capital investment in hardware and energy infrastructure.

| Metric | CleanSpark (Q1 2024) | Industry Average (Estimate) | Significance |

|---|---|---|---|

| Average Energy Cost ($/kWh) | $0.04 | $0.06 - $0.08 | Lower costs enhance profitability and competitiveness. |

| Target Hashrate (EH/s) | 50 (by H1 2025) | Varies significantly by competitor | Higher hashrate increases Bitcoin mining rewards. |

| Working Capital ($ Billion) | $1.2 (as of Dec 31, 2024) | Varies by competitor | Enables investment in growth and acquisitions. |

SSubstitutes Threaten

While CleanSpark's primary focus is Bitcoin, the threat of substitutes exists in the form of other mineable cryptocurrencies. These altcoins, often utilizing similar proof-of-work mechanisms, could theoretically attract mining resources if Bitcoin's profitability declines significantly. For instance, in early 2024, cryptocurrencies like Litecoin and Dogecoin, which use the Scrypt algorithm, could be mined with modified hardware, presenting a potential, albeit often less efficient, alternative.

Cloud mining services present a significant threat of substitution for companies like CleanSpark. These services allow individuals to rent computing power for Bitcoin mining, bypassing the need for substantial upfront investment in hardware and infrastructure, which is a core offering of traditional mining operations.

This accessibility lowers the barrier to entry for cryptocurrency mining, attracting a broader audience who might otherwise invest in or contribute to the hash rate managed by dedicated mining firms. For instance, the global cloud mining market was valued at approximately $2.3 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative for crypto participation.

The increasing adoption of Proof-of-Stake (PoS) cryptocurrencies, such as Ethereum, poses a significant threat. In PoS systems, users stake their existing holdings to validate transactions and earn rewards, a far less energy-intensive process than Proof-of-Work (PoW) mining. This shift could divert capital and attention away from PoW miners like CleanSpark. For instance, by late 2023, Ethereum’s transition to PoS had already dramatically reduced its energy consumption, making it a more appealing alternative for environmentally conscious investors.

Buying Bitcoin Directly

For investors wanting exposure to Bitcoin, buying it directly on exchanges or through avenues like Bitcoin ETFs presents a clear substitute for investing in mining operations. This direct route sidesteps the operational hurdles and inherent risks of mining, such as significant upfront hardware expenses and the volatility of energy prices.

In 2024, the accessibility of Bitcoin ETFs has significantly broadened the direct investment landscape. For instance, the approval and subsequent trading of several spot Bitcoin ETFs in the US in early 2024 saw substantial inflows, demonstrating a strong investor preference for direct, regulated exposure over indirect methods like mining. This trend highlights a significant threat, as it offers a simpler, less capital-intensive path to Bitcoin ownership.

- Direct Purchase Accessibility: Bitcoin ETFs and direct exchange purchases offer immediate access without the need for specialized hardware or energy contracts.

- Reduced Operational Risk: Investors bypass the complexities of managing mining equipment, electricity costs, and potential regulatory changes affecting mining operations.

- Lower Capital Outlay: Entry barriers are significantly lower for direct purchase compared to the substantial investment required for setting up or participating in Bitcoin mining.

Non-Mining Bitcoin Acquisition Strategies

The threat of substitutes for Bitcoin mining operations is significant. Bitcoin can be acquired through various channels beyond direct mining. These include over-the-counter (OTC) desks, peer-to-peer exchanges, and by accepting Bitcoin as payment for goods and services. These alternative acquisition methods directly compete with the supply of newly minted Bitcoin that mining companies like CleanSpark provide to the market.

These substitutes offer a readily available alternative for obtaining Bitcoin, potentially reducing the demand for Bitcoin produced through mining. For instance, in 2024, the growth of decentralized finance (DeFi) platforms and increased adoption of Bitcoin as a payment method by businesses further solidified these non-mining acquisition avenues. This diversification in Bitcoin acquisition means that the market is not solely reliant on the output of mining companies.

- Over-the-Counter (OTC) Desks: Facilitate large Bitcoin transactions directly between parties, bypassing public exchanges.

- Peer-to-Peer (P2P) Platforms: Enable direct trading of Bitcoin between individuals.

- Acceptance as Payment: Businesses accepting Bitcoin for goods and services effectively introduce new supply into circulation from the perspective of those acquiring it.

The threat of substitutes for Bitcoin mining is multifaceted, encompassing alternative cryptocurrencies, cloud mining services, and direct acquisition methods. These alternatives offer varying levels of accessibility, risk, and capital requirements, directly impacting the demand for mined Bitcoin and the profitability of mining operations like CleanSpark.

| Substitute Category | Description | 2023/2024 Relevance |

|---|---|---|

| Alternative Cryptocurrencies | Other mineable coins (e.g., Litecoin, Dogecoin) | Potential diversion of mining resources if Bitcoin profitability dips. |

| Cloud Mining Services | Renting computing power for mining | Global market valued at ~$2.3 billion in 2023, lowering entry barriers. |

| Proof-of-Stake (PoS) Cryptocurrencies | Energy-efficient alternatives (e.g., Ethereum) | Ethereum's transition to PoS by late 2023 reduced its energy footprint significantly. |

| Direct Bitcoin Acquisition | Bitcoin ETFs, direct exchange purchases, OTC desks, P2P platforms | Spot Bitcoin ETFs saw substantial inflows in early 2024, indicating strong investor preference for direct exposure. |

Entrants Threaten

The Bitcoin mining industry, particularly at a significant scale, demands a substantial initial outlay for essential infrastructure. This includes acquiring suitable land, constructing robust data centers capable of housing specialized equipment, and procuring state-of-the-art, energy-efficient mining hardware. For instance, CleanSpark’s strategic move to acquire 160,000 Bitmain S21 miners, a significant capital expenditure, underscores the high barrier to entry for new players aiming for substantial operations.

New companies looking to enter the Bitcoin mining industry, like CleanSpark, often find it difficult to secure access to low-cost energy and suitable operational sites. This is a significant hurdle because electricity is the primary cost driver in mining. Without competitive energy rates, a new entrant's profitability can be severely hampered from the outset.

CleanSpark has strategically addressed this by focusing on securing globally competitive energy prices and developing its own energy infrastructure. For instance, in 2023, CleanSpark reported an average energy cost of approximately $0.06 per kilowatt-hour (kWh), which is considerably lower than many industry averages. This focus on cost-effective energy is a crucial barrier to entry, making it challenging for less efficient or less strategically positioned newcomers to compete.

Operating and optimizing a large-scale Bitcoin mining fleet requires significant technical expertise in areas like hardware management, advanced cooling solutions such as immersion cooling, and sophisticated energy optimization strategies. Newcomers often face a steep learning curve, potentially struggling to match the operational efficiency that established players like CleanSpark have honed. For instance, in 2024, CleanSpark reported a significant increase in its hashrate, demonstrating its operational prowess and ability to manage a growing fleet effectively.

Regulatory and Environmental Scrutiny

The Bitcoin mining sector is under a microscope regarding its energy use, leading to heightened regulatory and environmental scrutiny. This presents a significant barrier for potential new entrants.

New companies entering the Bitcoin mining space in 2024 and beyond will likely face more rigorous permitting procedures and stricter environmental regulations. Communities are increasingly vocal about the energy demands of mining operations, especially if sustainability commitments are lacking.

- Increased Compliance Costs: New entrants must factor in the costs associated with meeting evolving environmental standards and obtaining necessary permits, which can be substantial.

- Community Relations: Building positive relationships with local communities is crucial, as opposition can delay or halt new projects.

- Sustainable Infrastructure Investment: Companies that cannot demonstrate a commitment to renewable energy sources or energy efficiency may struggle to gain regulatory approval and public acceptance.

Economies of Scale and Existing Hashrate

The threat of new entrants into the Bitcoin mining sector is significantly mitigated by the substantial economies of scale enjoyed by established players like CleanSpark. These larger operations can secure more favorable pricing on essential inputs such as specialized mining hardware and electricity, giving them a distinct cost advantage.

Newcomers would struggle to match the operational efficiency and sheer computing power, or hashrate, of existing large-scale miners. For instance, CleanSpark's hashrate reached an impressive 50 EH/s by mid-2025, a benchmark that smaller, nascent operations would find incredibly difficult and costly to attain quickly.

- Economies of Scale: Established miners benefit from bulk purchasing power for hardware and energy contracts.

- High Capital Requirements: Significant upfront investment is needed to acquire efficient mining rigs and secure affordable power.

- Existing Hashrate Dominance: New entrants face a steep climb to compete with the massive cumulative hashrate of established firms.

- Technological Expertise: Operating and maintaining advanced mining infrastructure requires specialized knowledge and experience.

The Bitcoin mining industry presents a formidable barrier to entry for new companies, largely due to the immense capital required for infrastructure and specialized hardware. CleanSpark's 2024 expansion, including the acquisition of advanced mining units, highlights this significant investment hurdle. Furthermore, securing access to low-cost electricity, a critical factor for profitability, remains a major challenge for newcomers, as demonstrated by CleanSpark's focus on achieving competitive energy rates around $0.06 per kWh.

New entrants also face a steep learning curve in operational efficiency and technological expertise, areas where established players like CleanSpark have cultivated significant advantages. The increasing regulatory and environmental scrutiny surrounding Bitcoin mining adds another layer of complexity, demanding substantial compliance costs and community engagement from any new participant. These factors collectively limit the threat of new entrants, as the initial investment and ongoing operational demands are substantial.

| Factor | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for land, data centers, and ASIC miners. | Significant barrier, requiring substantial upfront funding. |

| Energy Costs | Electricity is the primary operational expense. | New entrants struggle to secure low-cost, reliable power essential for profitability. |

| Operational Expertise | Requires specialized knowledge in hardware management and energy optimization. | Newcomers face a steep learning curve to match established efficiency levels. |

| Regulatory Environment | Increasing scrutiny on energy consumption and environmental impact. | Higher compliance costs and potential delays in permitting for new operations. |

| Economies of Scale | Established players benefit from bulk purchasing power. | New entrants cannot initially match the cost advantages of larger, existing miners. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CleanSpark leverages data from SEC filings, investor presentations, and industry-specific market research reports to assess competitive pressures.