CleanSpark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

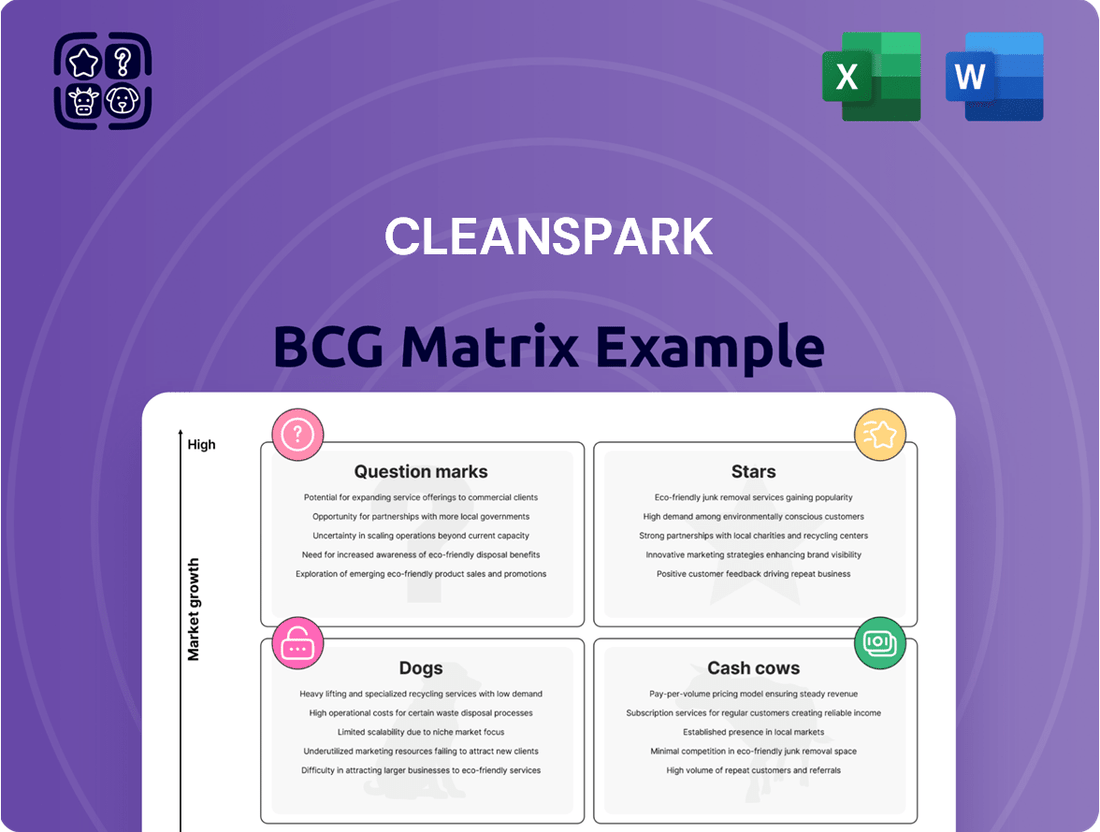

Uncover CleanSpark's strategic positioning with our comprehensive BCG Matrix analysis. See which of their ventures are market leaders and which require careful consideration. Purchase the full report for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights to guide your investment decisions.

Stars

CleanSpark is aggressively expanding its Bitcoin mining hashrate, surpassing its 2024 year-end projections. The company is now targeting an impressive 50 EH/s by the first half of 2025, a significant acceleration of its growth plans. This expansion is fully funded and aims to push beyond 60 EH/s into fiscal year 2026, solidifying its position in the rapidly growing digital asset sector.

CleanSpark has solidified its position as a leading Bitcoin producer, consistently demonstrating impressive monthly output. For instance, the company mined 685 BTC in June 2025, a substantial increase compared to the previous year. This robust production underscores CleanSpark's operational efficiency and its growing influence in the global Bitcoin mining landscape.

CleanSpark's strategic acquisitions, such as the October 2024 deal for GRIID Infrastructure, are a prime example of its Stars strategy. These moves significantly expand its operational capacity and market reach. This aggressive expansion is key to accelerating growth and establishing a broader footprint across the United States.

Technological Advancements in Mining

CleanSpark is heavily investing in cutting-edge technology for its Bitcoin mining operations. Their deployment of advanced immersion-cooled data centers, such as those in Wyoming and Norcross, Georgia, highlights a commitment to efficiency and innovation.

This focus on advanced cooling systems is crucial for optimizing mining performance and reducing operational costs. By embracing these technologies, CleanSpark aims to maintain a competitive edge in the rapidly evolving cryptocurrency mining landscape.

- Immersion-Cooled Data Centers: CleanSpark's strategic investment in immersion cooling technology is a key differentiator.

- Efficiency Gains: This technology offers significant improvements in energy efficiency and hardware longevity compared to traditional air cooling.

- Geographic Footprint: Operations in Wyoming and Georgia demonstrate a strategic expansion of their technologically advanced infrastructure.

- Market Position: These advancements position CleanSpark as an innovative leader in the Bitcoin mining sector.

Strong Market Position and Analyst Confidence

CleanSpark (CLSK) stands out as a leading pure-play Bitcoin miner, a position underscored by recent analyst actions. Several analysts have initiated coverage with 'Buy' ratings, signaling strong confidence in the company's future performance. This positive outlook is bolstered by projections of substantial revenue growth, with estimates extending into 2026, reflecting a robust and sustained expansion trajectory.

This analyst conviction, coupled with CleanSpark's established market leadership, points to significant operational strengths. The company's ability to consistently grow and execute effectively in the competitive Bitcoin mining landscape is a key driver of this positive sentiment. Such factors are crucial when evaluating CleanSpark within a BCG matrix framework, particularly in the context of its market standing and future potential.

- Market Leader: CleanSpark is recognized as a prominent pure-play Bitcoin miner.

- Analyst Confidence: Multiple analysts have initiated 'Buy' ratings for CLSK.

- Revenue Projections: Significant revenue growth is anticipated through 2026.

- Operational Excellence: The company's sustained growth trajectory and operational execution are key strengths.

CleanSpark's aggressive expansion and consistent Bitcoin production firmly place it in the Stars category of the BCG matrix. The company's strategic acquisitions, like the October 2024 deal for GRIID Infrastructure, bolster its market share and operational capacity. With a projected hashrate of 50 EH/s by mid-2025 and plans to exceed 60 EH/s by fiscal year 2026, CleanSpark demonstrates high growth potential and market leadership.

| Metric | Value | Period |

| Projected Hashrate | 50 EH/s | H1 2025 |

| Target Hashrate | > 60 EH/s | FY 2026 |

| BTC Mined | 685 BTC | June 2025 |

What is included in the product

This analysis categorizes CleanSpark's offerings into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investing in, holding, or divesting each business unit.

CleanSpark’s BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

CleanSpark's Georgia operations are a true cash cow, boasting over 400 MW of established and optimized Bitcoin mining capacity. These mature facilities are humming along, consistently generating reliable cash flow thanks to efficient setup and favorable energy agreements.

In the first quarter of 2024, CleanSpark's Georgia facilities were instrumental in the company's impressive performance, contributing significantly to their overall Bitcoin production and financial stability.

CleanSpark's industry-leading fleet efficiency is a significant strength, directly impacting its profitability. As of June 2025, the company achieved an impressive energy efficiency of 16.15 Joules per Terahash (J/Th). This metric is crucial as it signifies lower energy consumption for each unit of Bitcoin mined, directly boosting profit margins on their operational mining fleet.

CleanSpark's Bitcoin mining operations boast a remarkably low marginal cost, hovering around $34,000 per coin in Q1 FY2025. This efficiency is a significant competitive advantage, especially when contrasted with prevailing market prices.

This cost-effectiveness translates directly into robust cash flow generation from their core mining activities. Such a strong profitability margin allows CleanSpark to navigate market fluctuations with greater resilience and reinvest in growth.

Substantial Self-Mined Bitcoin Treasury

CleanSpark's substantial self-mined Bitcoin treasury positions it as a strong Cash Cow within the BCG matrix. As of June 2025, the company held over 12,600 Bitcoin, a significant asset built through its efficient mining operations.

This substantial Bitcoin holding serves as a critical liquidity buffer for CleanSpark. It allows the company to fund its ongoing operations and strategic investments without needing to raise capital through equity or debt, thereby avoiding dilution for existing shareholders.

- Bitcoin Treasury Growth: Over 12,600 BTC held as of June 2025.

- Liquidity and Funding: Provides a robust buffer for operations and investments.

- Strategic Monetization: Ability to sell Bitcoin to fund growth without dilution.

- Operational Efficiency: Accumulation through efficient self-mining operations.

Disciplined Capital Management

CleanSpark's disciplined capital management is a key strength, positioning its Bitcoin mining operations as a potential Cash Cow within a BCG matrix framework. The company effectively self-funds its growth, a crucial factor for sustained profitability.

This financial prudence is evident in their strategic Bitcoin sales, which have consistently supported operations and expansion. Furthermore, securing substantial credit facilities, like the $200 million revolving credit facility with Coinbase, showcases their ability to access capital without resorting to diluting existing shareholder equity. This careful financial stewardship is vital for maintaining a strong market position.

- Self-Funding Capability: CleanSpark's ability to generate cash from its Bitcoin holdings and operations allows it to fund expansion without external equity raises.

- Credit Facilities: The $200 million revolving credit facility with Coinbase provides significant financial flexibility and operational runway.

- Minimizing Dilution: By leveraging internal cash flows and credit, CleanSpark reduces the need for equity issuance, protecting shareholder value.

- Operational Efficiency: Disciplined capital allocation supports the acquisition and optimization of mining infrastructure, enhancing profitability.

CleanSpark's established Bitcoin mining operations, particularly in Georgia, function as a classic Cash Cow. These facilities, with over 400 MW of capacity, consistently generate substantial cash flow due to their optimized setup and favorable energy contracts.

The company's operational efficiency, demonstrated by a fleet efficiency of 16.15 J/Th as of June 2025, directly translates into high profitability. This efficiency, coupled with a low marginal cost of approximately $34,000 per coin in Q1 FY2025, ensures robust cash generation from their core mining activities.

CleanSpark's substantial Bitcoin treasury, exceeding 12,600 BTC as of June 2025, further solidifies its Cash Cow status. This treasury provides liquidity and a funding source for growth, allowing the company to self-fund expansion and avoid equity dilution.

| Metric | Value (as of June 2025) | Significance |

| Georgia Capacity | 400+ MW | Mature, reliable cash flow generation |

| Fleet Efficiency | 16.15 J/Th | Boosts profit margins through lower energy costs |

| Bitcoin Treasury | 12,600+ BTC | Provides liquidity and self-funding capability |

| Marginal Cost (Q1 FY2025) | ~$34,000/coin | Ensures strong profitability even with fluctuating market prices |

Delivered as Shown

CleanSpark BCG Matrix

The CleanSpark BCG Matrix preview you are currently viewing is the identical, fully-prepared document you will receive immediately after purchase. This means the strategic insights, clear visualizations, and actionable analysis are exactly as presented, ensuring no surprises and immediate usability for your business planning.

Dogs

Legacy inefficient mining rigs represent older generation hardware that CleanSpark may still operate while actively upgrading its fleet. These machines, characterized by higher energy consumption and lower hashing power, are less profitable in the current competitive landscape. For instance, as of Q1 2024, CleanSpark reported a fleet efficiency of 22.1 joules per terahash (J/TH), indicating a significant improvement over older, less efficient models which could be upwards of 30 J/TH or more.

These legacy rigs, if not yet retired or sold, would likely be categorized as Dogs in a BCG matrix due to their low market share (in terms of efficient production) and low growth potential (as newer, more advanced technology emerges). Their continued operation, even if minimal, contributes to higher operating costs per bitcoin mined, potentially impacting overall profitability and cash flow if not managed strategically.

Underperforming small-scale sites in CleanSpark's portfolio might include operations with low Bitcoin yields that necessitate substantial management attention or upkeep. These could be geographically dispersed or technologically outdated facilities that don't fit the company's focus on large-scale, efficient mining.

For instance, if a small site produced only 5 BTC in a quarter but incurred $20,000 in operational and management costs, its profitability would be significantly hampered compared to a larger facility generating 500 BTC with proportionally lower overhead. Such sites would struggle to contribute meaningfully to CleanSpark's overall efficiency metrics.

CleanSpark’s Non-Strategic Legacy Ventures represent any past business segments or projects that are no longer central to its core Bitcoin mining operations. These might include older technology ventures or non-mining related activities that were part of the company's history but do not align with its current strategic direction.

If such legacy ventures are consuming valuable resources, such as capital or management attention, without generating significant returns or contributing to CleanSpark's primary growth objectives, they would be considered for divestiture. For instance, if a legacy software development project from 2022, which cost $500,000 to maintain, generated only $50,000 in revenue in 2023, it would be a prime candidate for closure or sale.

Sub-optimal Power Purchase Agreements

Sub-optimal Power Purchase Agreements (PPAs) can significantly hinder CleanSpark's operational efficiency and profitability, particularly in specific locations where energy costs are notably higher than the company's average. These less favorable agreements directly translate to increased energy expenditure per Bitcoin mined, potentially classifying those particular operations as Cash Cows with diminishing returns or even Question Marks if the cost disadvantage is severe enough to threaten viability.

For instance, if a facility incurs an energy cost of $0.07 per kWh compared to CleanSpark's average of $0.05 per kWh, this substantial difference directly impacts the cost of production. This higher energy cost per Bitcoin mined erodes margins and negatively affects the company's overall profitability and operational leverage, making it harder to compete in a cost-sensitive industry.

- Higher Energy Costs: PPAs with rates exceeding the industry average, such as $0.07 per kWh versus a market rate of $0.05 per kWh, directly increase Bitcoin mining costs.

- Reduced Profitability: Elevated energy expenses per Bitcoin mined shrink profit margins, impacting the financial health of specific operations.

- Operational Leverage Impact: Unfavorable PPAs can weaken the company's ability to benefit from economies of scale, as higher fixed energy costs become a larger proportion of total operating expenses.

Underutilized Acquired Infrastructure

Underutilized acquired infrastructure represents a significant holding cost for CleanSpark, as it ties up capital without immediately contributing to Bitcoin mining revenue. These assets, such as land or existing facilities not yet fully developed or energized, require substantial future investment to reach their productive potential. For instance, if CleanSpark acquired a large facility in 2023 and it's still undergoing build-out in mid-2024, it falls into this category.

This situation can be viewed as a potential question mark in the BCG matrix. While it holds future promise, the current lack of operational status means it's not generating cash flow. CleanSpark's Q1 2024 earnings report, for example, might detail capital expenditures on new sites that are not yet fully operational, highlighting these underutilized assets.

- Holding Costs: Ongoing expenses for maintaining acquired but undeveloped sites.

- Capital Tie-up: Funds invested in infrastructure that are not yet generating returns.

- Future Investment Needs: Significant capital required to bring these assets online.

- Delayed Revenue Generation: Inability to profit from the infrastructure until it's operational.

Legacy inefficient mining rigs, if still in operation, would be classified as Dogs in the BCG matrix. These older machines, characterized by high energy consumption and low hashing power, offer limited growth potential and a diminishing market share in terms of efficient Bitcoin production. For example, while CleanSpark aimed for a fleet efficiency of 21 J/TH by the end of 2024, older rigs could be operating at 30 J/TH or more, making them significantly less competitive.

These units represent a low market share in terms of profitable output and face a low-growth outlook as newer technology supersedes them. Their continued use, even if minimal, can increase per-Bitcoin mining costs and negatively impact overall profitability, especially when compared to CleanSpark's stated goal of achieving 100% fleet efficiency with the latest generation S21 machines.

Underperforming, small-scale mining sites also fall into the Dog category due to their low Bitcoin yields and disproportionately high operational costs. These sites might require substantial management attention or upkeep without contributing meaningfully to the company's efficiency metrics. For instance, a site with low hashrate and high energy costs per TH would struggle to be profitable in the current market.

Non-strategic legacy ventures, such as past projects or technology initiatives no longer aligned with CleanSpark's core Bitcoin mining focus, are also considered Dogs. If these ventures consume capital or management resources without generating significant returns or supporting growth objectives, they are candidates for divestiture. For example, a legacy software project costing $500,000 annually with minimal revenue would be a prime candidate for closure.

Question Marks

CleanSpark's new greenfield infrastructure development, particularly in states like Tennessee and Wyoming, positions these ventures as potential Stars or Question Marks within the BCG matrix. These projects require substantial upfront investment, as evidenced by their significant capital expenditure, before they can contribute to the company's overall hashrate and generate revenue. For instance, in 2024, CleanSpark continued its aggressive expansion, aiming to bring new facilities online, which naturally involves considerable cash outlay with delayed returns.

CleanSpark's early-stage immersion cooling deployments represent a strategic investment, but these nascent projects are capital-intensive. For instance, their recent acquisition and upgrade of a facility in Mississippi, while aimed at enhancing efficiency, requires significant upfront capital to reach full operational capacity. The immediate returns on these initial phases are inherently uncertain as the company works to scale operations and optimize the technology.

CleanSpark's recent acquisitions, such as GRIID Infrastructure, represent significant moves to bolster its market position. The full integration and optimization of these entities are crucial for realizing their projected value and enhancing operational efficiency. This process requires substantial investment and dedicated management attention to align new assets with CleanSpark's existing standards.

In 2024, CleanSpark continued its aggressive growth strategy through acquisitions. The company reported that the integration of GRIID Infrastructure was progressing well, aiming to unlock significant synergies. This strategic move is expected to contribute positively to CleanSpark's overall mining capacity and operational leverage, with initial reports suggesting a notable increase in hash rate post-integration.

Exploration into Novel Energy Partnerships

CleanSpark's exploration into novel energy partnerships, such as those involving advanced battery storage or direct renewable energy integration beyond traditional solar and hydro, would fall into the question mark category of the BCG matrix. These ventures, while potentially groundbreaking for cost reduction and sustainability, carry significant risk due to their nascent stage and unproven scalability. For instance, a pilot program utilizing geothermal energy for Bitcoin mining, if undertaken, would require substantial capital investment with uncertain operational efficiency and payback periods.

These initiatives represent a strategic gamble on future energy landscapes. The company is likely evaluating opportunities that could significantly differentiate its operational costs and environmental footprint from competitors. Success in these areas could position CleanSpark as an innovator, but failure could lead to substantial financial write-offs. The decision to invest in such partnerships hinges on a rigorous assessment of technological maturity, regulatory frameworks, and potential competitive advantages.

- Potential for significant cost reduction in energy expenditure.

- High upfront investment and uncertain short-term returns.

- Opportunity to establish a first-mover advantage in sustainable mining.

- Risk of technological obsolescence or unproven operational viability.

Ambitious Future Hashrate Targets Beyond Funded Capacity

CleanSpark has set ambitious future hashrate targets exceeding 60 EH/s, a significant leap beyond its currently funded expansion to 50 EH/s. These aspirational goals represent potential future growth avenues, but they currently exist as opportunities without defined capital allocation or specific execution plans.

The company's strategic vision clearly extends beyond its immediate, funded capacity, indicating a forward-looking approach to market leadership. However, until concrete development and financing strategies are solidified for these higher targets, they remain speculative in nature.

- Future Growth Potential: Targets beyond 50 EH/s signal a long-term growth strategy.

- Capital Allocation Uncertainty: Specific funding and deployment plans for these higher targets are not yet detailed.

- Speculative Nature: These advanced goals are contingent on future capital availability and successful project execution.

- Market Positioning: Aiming for over 60 EH/s positions CleanSpark as a major player in the evolving Bitcoin mining landscape.

CleanSpark's ventures into new greenfield infrastructure, particularly in states like Tennessee and Wyoming, represent significant capital outlays with uncertain immediate returns. These projects, while crucial for expanding the company's hashrate, require substantial upfront investment before they become revenue-generating assets. For example, in 2024, CleanSpark continued its aggressive expansion, aiming to bring new facilities online, which naturally involves considerable cash outlay with delayed returns.

Emerging technologies and strategic partnerships, such as pilot programs for advanced battery storage or novel energy sources, also fall into the Question Mark category. These initiatives demand significant capital investment and carry the risk of unproven scalability and operational efficiency, impacting their short-term financial viability. Success here could offer a first-mover advantage, but failure risks substantial financial write-offs.

CleanSpark's ambitious future hashrate targets, aiming for over 60 EH/s, are currently speculative as specific capital allocation and execution plans are not yet detailed. These goals represent potential growth avenues but remain contingent on future capital availability and successful project execution, making them Question Marks until concrete strategies are solidified.

| Initiative | Category | Investment Required | Potential Return | Risk Level |

|---|---|---|---|---|

| New Greenfield Infrastructure (TN, WY) | Question Mark | High | Medium to High (Long-term) | Medium |

| Early-Stage Immersion Cooling Deployments | Question Mark | High | Medium to High (Long-term) | Medium |

| Novel Energy Partnerships (e.g., geothermal pilots) | Question Mark | High | High (if successful) | High |

| Future Hashrate Targets (>60 EH/s) | Question Mark | Very High (Unspecified) | Very High (Long-term) | High |

BCG Matrix Data Sources

Our BCG Matrix draws from a robust blend of financial statements, industry growth projections, and competitive landscape analysis to provide strategic clarity.