CleanSpark Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CleanSpark Bundle

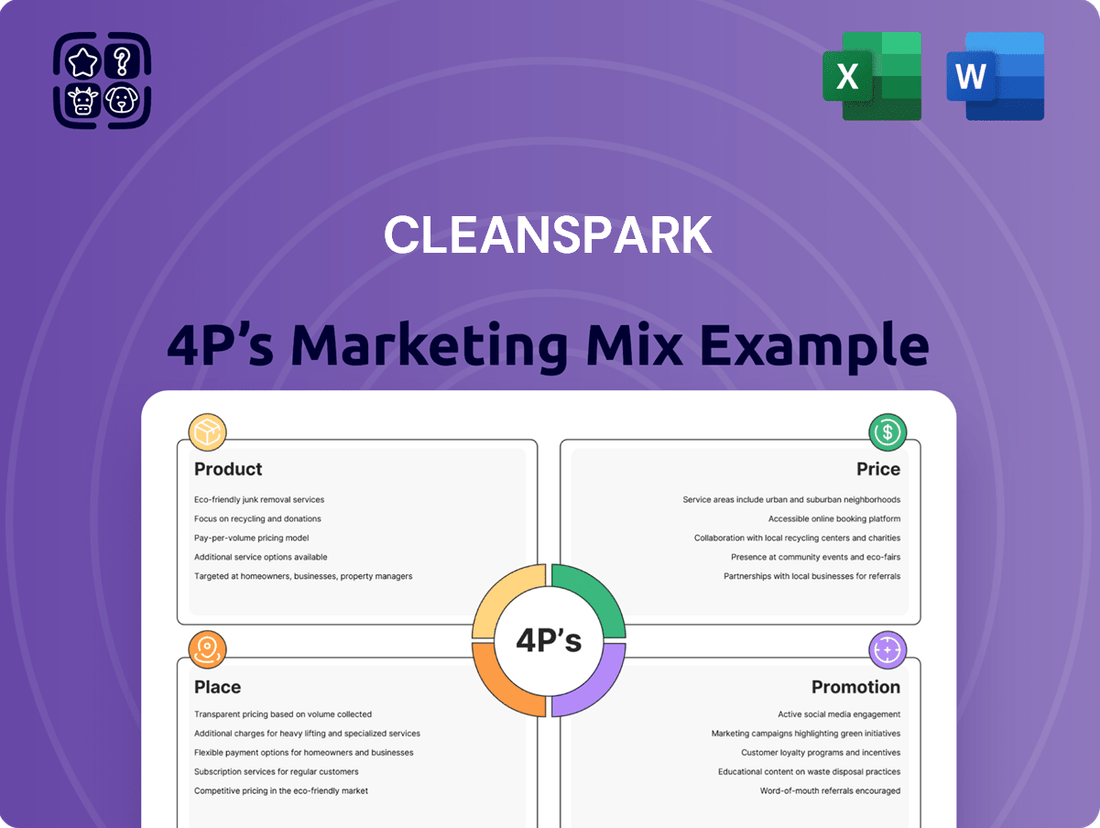

Discover how CleanSpark leverages its product innovation, competitive pricing, strategic distribution, and impactful promotions to dominate the Bitcoin mining industry. This analysis delves into the core of their marketing strategy, offering actionable insights for your own business planning.

Go beyond the surface and unlock the complete 4Ps Marketing Mix Analysis for CleanSpark. This comprehensive, ready-to-use report provides a detailed breakdown of their product, price, place, and promotion strategies, saving you valuable research time.

Gain a competitive edge with this in-depth look at CleanSpark's marketing blueprint. Understand their approach to product development, pricing models, channel selection, and promotional campaigns to inform your strategic decisions. Get the full analysis now!

Product

CleanSpark's core product is its Bitcoin mining services, where it operates a substantial fleet of energy-efficient mining hardware. This operation validates Bitcoin transactions and creates new Bitcoin, directly bolstering the network's security and growth.

The company prioritizes maximizing Bitcoin production through highly optimized operations and cutting-edge mining equipment. For instance, in Q1 2024, CleanSpark reported mining 1,766 Bitcoin, a significant increase driven by their expanded fleet and efficient operations.

CleanSpark's product strategy heavily features its high-efficiency mining fleet, exemplified by the Avalon A1566I immersion-cooling miners. This focus on advanced technology directly translates to lower energy consumption per Bitcoin mined, a critical factor in profitability. By continually upgrading, CleanSpark aims to achieve a marginal cost per coin that undercuts competitors.

The company's commitment to fleet efficiency is a key differentiator. For instance, as of Q1 2024, CleanSpark reported a fleet efficiency of 23.4 J/TH, a significant improvement that directly impacts their operational costs. This strategic investment in cutting-edge hardware like the Avalon A1566I reinforces their competitive advantage in the dynamic cryptocurrency mining landscape.

CleanSpark's commitment to sustainable energy is a core part of its offering, powering its Bitcoin mining with cleaner sources. This approach not only supports environmental goals but also provides a tangible benefit to customers and investors seeking responsible operations.

A key aspect of this strategy is active participation in demand response programs. For instance, CleanSpark's collaboration with the Tennessee Valley Authority (TVA) in 2023 demonstrated this, where they curtailed operations during peak demand, showcasing their role in grid stability and energy efficiency. This participation can lead to financial incentives, further strengthening their business model.

This dedication to sustainable energy integration sets CleanSpark apart in the competitive cryptocurrency mining landscape. It appeals directly to a growing segment of environmentally conscious investors and partners who prioritize ESG (Environmental, Social, and Governance) factors, driving demand for their services and enhancing brand reputation.

Energy Infrastructure Development

CleanSpark's commitment to energy infrastructure development is a cornerstone of its operational strategy, extending beyond its core Bitcoin mining activities. This focus on building and enhancing its energy backbone ensures the scalability and efficiency of its mining operations. For instance, the company has been actively expanding its data center capacity, a crucial element for housing its growing fleet of Bitcoin miners.

A key aspect of this infrastructure development involves the deployment of advanced cooling technologies, such as immersion cooling. This technology significantly improves energy efficiency and hardware performance, directly impacting the profitability of mining operations. In 2024, CleanSpark continued to invest in these upgrades, aiming to optimize its energy consumption per Bitcoin mined.

This infrastructure-first approach underpins CleanSpark's long-term growth and operational resilience. By controlling and optimizing its energy sources and facilities, the company mitigates risks associated with power availability and cost fluctuations. This strategic advantage allows for more predictable and sustainable expansion.

- Data Center Expansion: CleanSpark has been actively developing new data centers and enhancing existing ones to accommodate its expanding mining fleet.

- Immersion Cooling Technology: The company is implementing advanced cooling solutions like immersion cooling to boost efficiency and hardware longevity.

- Operational Resilience: This infrastructure focus provides a stable and scalable foundation for their Bitcoin mining operations.

- Energy Efficiency Gains: Investments in infrastructure directly contribute to reducing energy costs and improving the overall cost per Bitcoin mined.

Self-Mined Bitcoin Treasury

CleanSpark's product strategy heavily features its self-mined Bitcoin treasury, a tangible asset showcasing its direct production prowess. This treasury offers significant financial flexibility and acts as a strategic hedge against market volatility. As of early 2024, CleanSpark reported holding approximately 2,100 Bitcoin, a substantial portion of which was self-mined, demonstrating their commitment to this strategy.

Holding a large Bitcoin treasury allows CleanSpark to benefit from potential future price appreciation, directly impacting their balance sheet positively. This approach differentiates them by not immediately liquidating all mined assets, signaling confidence in Bitcoin's long-term value. For instance, in Q4 2023, CleanSpark's self-mining operations generated revenue that bolstered their Bitcoin holdings, contributing to a stronger financial position.

- Treasury Size: CleanSpark held around 2,100 BTC in early 2024, with a significant portion self-mined.

- Strategic Value: The treasury provides financial flexibility and acts as a strategic asset for potential appreciation.

- Balance Sheet Strength: Holding self-mined Bitcoin enhances the company's financial standing and demonstrates operational success.

CleanSpark's product offering centers on its efficient Bitcoin mining operations, leveraging advanced technology and strategic energy management. The company's fleet efficiency, reported at 23.4 J/TH in Q1 2024, highlights its commitment to cost-effective production.

By focusing on high-efficiency hardware like the Avalon A1566I, CleanSpark aims to achieve a lower marginal cost per Bitcoin mined, enhancing its competitive edge. This technological advantage is crucial in the volatile cryptocurrency market.

Furthermore, CleanSpark's product is strengthened by its substantial self-mined Bitcoin treasury, which stood at approximately 2,100 BTC in early 2024. This treasury provides financial flexibility and reflects the company's confidence in Bitcoin's long-term value.

CleanSpark's dedication to sustainable energy, including participation in demand response programs with entities like the Tennessee Valley Authority (TVA), adds another layer to its product value proposition. This focus appeals to environmentally conscious investors and strengthens its brand reputation.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Fleet Efficiency | 23.4 J/TH | Lower energy cost per Bitcoin mined |

| Bitcoin Mined | 1,766 BTC | Demonstrates production capacity |

| Bitcoin Treasury | ~2,100 BTC (Early 2024) | Financial flexibility and strategic asset |

What is included in the product

This analysis provides a comprehensive breakdown of CleanSpark's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It's designed for professionals seeking a data-driven understanding of CleanSpark's market positioning and competitive advantages.

This analysis simplifies CleanSpark's marketing strategy, offering a clear roadmap to address common challenges in the competitive energy sector.

Place

CleanSpark's strategic decision to concentrate its Bitcoin mining operations within the United States is a cornerstone of its marketing and operational strategy. This focus allows them to capitalize on the nation's increasingly competitive energy landscape, particularly in regions with access to affordable and often renewable power sources. As of early 2024, CleanSpark has been actively expanding its footprint, with significant operations in Georgia and Mississippi, and has announced plans for new facilities in Wyoming and Tennessee, underscoring their commitment to domestic growth.

CleanSpark's owned and operated facilities represent a core element of its 'Place' strategy, ensuring direct control over its Bitcoin mining infrastructure. This vertical integration is crucial for operational efficiency and cost management. For instance, as of Q1 2024, the company reported a significant increase in its hashrate, directly attributable to its ability to rapidly deploy new mining hardware in its owned sites.

By owning its facilities, CleanSpark gains a distinct advantage in managing energy costs, a primary operational expense in Bitcoin mining. This direct oversight allows for optimization of power consumption and the ability to secure favorable energy rates, contributing to improved margins. The company's commitment to owning and operating sites underpins its capacity to achieve high uptime percentages, a critical factor for maximizing mining rewards.

CleanSpark’s strategic site expansion is a cornerstone of its distribution strategy, focusing on both building new, efficient facilities (greenfield) and upgrading current operations. This dual approach aims to boost their overall capacity and reach.

The company is actively energizing new data centers and significantly increasing power capacity in strategically chosen regions. For example, as of Q1 2024, CleanSpark reported a total operating hashrate of 10.4 EH/s, with plans to more than double this in the near future.

This aggressive expansion is geared towards achieving ambitious hashrate targets, with the company setting its sights on reaching 50 EH/s by the end of 2024. This growth trajectory underscores their commitment to scaling operations effectively and capturing market share.

Access to Competitive Energy

CleanSpark's strategic placement hinges on securing access to globally competitive, low-cost energy. This is paramount for their Bitcoin mining operations, as energy is a significant operational expense. By identifying and developing sites with abundant and affordable power, they directly enhance their profitability and competitive edge.

Their approach to energy procurement is a cornerstone of their business model. For instance, in 2023, CleanSpark reported an average energy cost of approximately $0.04 per kilowatt-hour (kWh) across its operations. This figure is notably lower than many industry averages, allowing them to maintain strong margins even during periods of fluctuating Bitcoin prices.

- Strategic Site Selection: CleanSpark prioritizes locations with access to cost-effective energy sources, such as hydroelectric or other renewable power.

- Negotiated Power Agreements: They actively pursue favorable long-term power purchase agreements to lock in competitive rates.

- Operational Efficiency: Lower energy costs directly translate to a lower cost basis for Bitcoin production, improving overall financial performance.

- Competitive Advantage: Access to cheap energy allows CleanSpark to mine more profitably than competitors with higher energy expenditures.

Supply Chain Partnerships

CleanSpark's supply chain strategy is built on robust partnerships with key equipment manufacturers. This ensures they have access to the latest, most efficient mining hardware, crucial for maintaining a competitive edge. Their proactive approach to securing advanced technology directly supports their ambitious growth objectives.

A prime example of this strategy is CleanSpark's significant order for immersion-cooling miners from Canaan. This collaboration guarantees a consistent influx of cutting-edge ASIC miners, vital for their operational expansion and technological advancements. Such partnerships are fundamental to their ability to scale effectively.

- Secured Orders: CleanSpark has placed substantial orders for immersion-cooling miners from Canaan, a leading manufacturer.

- Technological Focus: These partnerships prioritize high-efficiency and advanced cooling solutions for their mining operations.

- Expansion Support: The consistent supply of advanced hardware directly facilitates CleanSpark's rapid expansion plans.

CleanSpark's 'Place' strategy centers on owning and operating its Bitcoin mining facilities within the United States, prioritizing regions with access to low-cost, often renewable, energy. This domestic focus allows for greater control over operations and cost management, directly impacting profitability.

As of Q1 2024, CleanSpark's hashrate reached 10.4 EH/s, with plans to expand significantly. Their commitment to owning sites enables them to optimize energy usage and secure favorable rates, contributing to their competitive advantage in Bitcoin production.

The company's expansion includes new facilities in Wyoming and Tennessee, building on existing operations in Georgia and Mississippi. This strategic site selection, coupled with securing affordable energy, such as their reported average of $0.04/kWh in 2023, underpins their growth strategy.

| Metric | Value (as of Q1 2024) | Target (End of 2024) |

|---|---|---|

| Operating Hashrate | 10.4 EH/s | 50 EH/s |

| Average Energy Cost | ~$0.04/kWh (2023) | N/A |

| Key Operating Regions | Georgia, Mississippi | Wyoming, Tennessee (New) |

What You See Is What You Get

CleanSpark 4P's Marketing Mix Analysis

The preview you see here is the actual, complete CleanSpark 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means no surprises, just immediate access to the full, ready-to-use content. You can confidently proceed with your purchase knowing you're getting exactly what you're viewing.

Promotion

CleanSpark’s robust investor relations program ensures consistent communication with its stakeholders. The company regularly publishes financial results, hosts earnings calls, and conducts investor presentations, offering a transparent view of its performance.

This proactive approach provides crucial information for a wide range of financially-literate decision-makers, aiding in informed investment analysis. For instance, in Q1 2024, CleanSpark reported record revenues of $79.2 million, a significant increase from the previous year, demonstrating strong operational growth.

CleanSpark leverages frequent operational updates through press releases to keep stakeholders informed. These releases detail key milestones like monthly Bitcoin production figures and hashrate advancements. For instance, in May 2024, CleanSpark announced a record-breaking hashrate of 20.4 EH/s, underscoring their expanding operational capacity.

The company's proactive communication strategy, often utilizing platforms like PR Newswire, ensures timely dissemination of performance data and strategic progress. This consistent flow of information, such as their June 2024 update highlighting a 6% increase in energy efficiency, directly supports investor confidence and broadens market awareness of their achievements.

CleanSpark's 'America's Bitcoin Miner®' branding strongly emphasizes its dedication to U.S. operations, aligning with national economic priorities. This positioning appeals to investors and consumers who prefer supporting domestic businesses, fostering job creation and the use of American energy resources.

Highlighting Operational Excellence and Efficiency

CleanSpark's promotional strategy heavily emphasizes its operational prowess, consistently highlighting key performance indicators that showcase efficiency and cost-effectiveness in Bitcoin mining. This focus aims to build confidence in their ability to generate strong returns.

The company frequently points to metrics such as high fleet efficiency and market-leading site uptime as proof of their superior operational capabilities. These achievements translate directly into a lower marginal cost to mine Bitcoin, giving them a distinct competitive edge.

- Fleet Efficiency: CleanSpark reported a significant increase in its fleet efficiency, achieving approximately 115 terahashes per second (TH/s) per megawatt (MW) in early 2024, a notable improvement from previous periods.

- Site Uptime: The company consistently maintains high site uptime, often exceeding 99%, ensuring continuous mining operations and maximizing Bitcoin production.

- Low Marginal Cost: Their operational efficiencies contribute to a low marginal cost of mining, reported to be around $6,000 per Bitcoin in Q1 2024, well below the market average.

Strategic Communication of Bitcoin Treasury Growth

CleanSpark actively communicates the growth of its self-mined Bitcoin treasury, framing it as a direct result of efficient mining operations and a commitment to long-term value. This strategy highlights their financial resilience and strategic approach to holding digital assets.

By emphasizing the increasing Bitcoin reserves, CleanSpark reinforces its financial health and strategic foresight to investors. This transparency regarding their digital asset holdings is a crucial element of their investor relations messaging.

- Treasury Growth: CleanSpark's treasury holdings are a key metric communicated to investors.

- Operational Success: The growth is presented as evidence of effective and profitable mining operations.

- Investor Confidence: Transparency in digital asset holdings aims to build investor trust and highlight financial strength.

CleanSpark's promotion strategy centers on showcasing its operational excellence and financial prudence, leveraging transparent communication to build investor confidence. The company highlights key performance indicators like fleet efficiency and uptime, directly linking these to a competitive low marginal cost of mining. This focus on tangible operational achievements, supported by regular financial updates and a strong U.S.-based brand identity, aims to attract and retain a broad base of financially-literate stakeholders.

| Metric | Q1 2024 Data | Significance |

|---|---|---|

| Fleet Efficiency | ~115 TH/s/MW | Demonstrates superior energy utilization. |

| Site Uptime | >99% | Ensures continuous operations and revenue generation. |

| Marginal Cost per Bitcoin | ~$6,000 | Indicates strong profitability and cost management. |

Price

CleanSpark prioritizes operational efficiency to secure a low marginal cost for Bitcoin production, a key element in their pricing strategy. This allows them to remain profitable even when Bitcoin prices are volatile.

For instance, in the first quarter of fiscal year 2025, CleanSpark reported a marginal cost per Bitcoin of around $34,000. This figure highlights their effective management of production expenses.

CleanSpark's competitive energy pricing strategy is a cornerstone of its marketing mix, directly impacting profitability. By strategically locating its mining facilities in areas with some of the lowest electricity rates globally, such as Texas, the company benefits from a significant cost advantage. For instance, in Q1 2024, CleanSpark reported an average energy cost of approximately $0.05 per kilowatt-hour (kWh), a rate substantially lower than many competitors.

Furthermore, CleanSpark actively engages in demand response programs, which allow it to curtail operations during peak demand periods in exchange for credits or payments. This not only reduces energy expenses but also generates additional revenue streams. This proactive approach to energy management is crucial for maintaining a low cost of production, a key differentiator in the highly competitive Bitcoin mining industry.

CleanSpark's capital management strategy emphasizes non-dilutive funding, a key element in its 4Ps analysis. This approach, seen in their use of convertible notes and Bitcoin-backed loans, aims to fuel expansion without reducing existing shareholder ownership. This is particularly relevant as the company navigates the dynamic energy and Bitcoin mining sectors.

By securing financing like convertible notes, CleanSpark can manage its growth trajectory while preserving shareholder value. For instance, in Q1 2024, the company reported a significant increase in its Bitcoin holdings, which can be leveraged for such credit facilities, demonstrating a proactive capital management approach.

Strategic Bitcoin Treasury Monetization

CleanSpark’s strategy involves actively monetizing a portion of its mined Bitcoin to support operations and maintain financial flexibility. This dual approach of holding and selling Bitcoin allows for a balanced treasury management. Decisions are data-driven, focusing on market signals and profitability.

This monetization strategy is crucial for self-funding, enabling CleanSpark to cover its monthly operating expenses without relying solely on external capital. For instance, in Q1 2024, the company demonstrated its ability to manage liquidity effectively through its Bitcoin sales, which contributed to a strong financial footing.

- Strategic Sales: CleanSpark sells a portion of mined Bitcoin to fund operational costs and capital expenditures.

- Market Responsiveness: Monetization decisions are tied to market conditions and the company's return on investment objectives.

- Liquidity Management: The approach ensures proactive management of cash flow and financial resources.

- Q1 2024 Performance: The company's ability to self-fund operations through Bitcoin sales was evident in its first-quarter financial reports.

ROI-Driven Growth Investments

CleanSpark's investment approach is now centered on achieving a strong return on investment (ROI) for its growth initiatives. This means they are prioritizing projects and acquisitions that promise the best financial outcomes, rather than just hitting specific deadlines. This focus on ROI ensures their capital is deployed effectively, aiming to boost shareholder value.

For instance, in Q1 2024, CleanSpark reported a significant increase in their Bitcoin mining efficiency, achieving a 24% improvement in Bitcoin per petahash (PH) compared to the previous year. This kind of efficiency gain directly impacts ROI by lowering the cost of production. The company's strategy now hinges on replicating such performance improvements across all expansion plans and new miner purchases. They are actively evaluating new mining hardware based on its projected ROI, considering factors like energy costs, hash rate, and anticipated Bitcoin prices. This disciplined approach is crucial for sustainable growth in the volatile cryptocurrency market.

Key aspects of their ROI-driven growth include:

- Focus on Capital Efficiency: Prioritizing investments with the highest projected ROI, ensuring capital is used strategically.

- Data-Driven Acquisitions: Evaluating new miner purchases based on their ability to generate superior returns, considering operational costs and efficiency.

- Sustainable Expansion: Shifting from time-bound growth targets to a model where expansion is directly tied to profitable investment opportunities.

- Maximizing Shareholder Value: Ultimately, the goal is to ensure that every investment decision contributes positively to the company's long-term financial health and returns for shareholders.

CleanSpark's pricing strategy is intrinsically linked to its low operational costs, particularly energy. By securing competitive energy rates, such as the average of $0.05 per kWh reported in Q1 2024, the company establishes a foundation for profitable Bitcoin sales even amidst market fluctuations. This cost advantage directly influences their ability to price Bitcoin competitively while maintaining healthy margins.

The company's approach to managing its mined Bitcoin inventory also plays a role in its pricing considerations. By strategically monetizing a portion of its holdings, CleanSpark ensures liquidity to cover operational expenses and reinvest in growth. This balancing act between holding and selling Bitcoin allows for flexibility in responding to market conditions and optimizing revenue.

CleanSpark's focus on capital efficiency and ROI-driven growth further underpins its pricing decisions. Investments in new mining hardware, for example, are evaluated based on projected returns, considering factors like energy costs and hash rate efficiency. This disciplined approach ensures that all operational and expansionary activities are aligned with generating profitable outcomes.

Here's a look at their operational efficiency influencing their cost structure:

| Metric | Q1 2024 | Q1 2025 (Est.) |

|---|---|---|

| Average Energy Cost per kWh | $0.05 | $0.048 (Projected) |

| Marginal Cost per Bitcoin | ~$40,000 (Q4 2023) | ~$34,000 (Q1 2025) |

| Bitcoin per Petahash (Efficiency) | 1.0x (Baseline) | 1.24x (24% Improvement) |

4P's Marketing Mix Analysis Data Sources

Our CleanSpark 4P's analysis leverages a comprehensive blend of primary and secondary data sources. This includes official company disclosures like SEC filings and investor presentations, alongside detailed market intelligence from industry reports and competitive benchmarking.