CK Infrastructure SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

CK Infrastructure's strengths lie in its diversified portfolio and extensive global reach, but understanding its vulnerabilities and the competitive landscape is crucial for strategic advantage. Our full SWOT analysis provides a deep dive into these critical areas, offering actionable insights for your business planning.

Want to fully grasp CK Infrastructure's market position, including its growth opportunities and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic decision-making and competitive analysis.

Strengths

CK Infrastructure Holdings Limited (CKI) possesses a robustly diversified global infrastructure portfolio, encompassing vital sectors like energy, transportation, water, and waste management. This broad reach extends across key markets including Hong Kong, Mainland China, the UK, Continental Europe, Australia, New Zealand, Canada, and the United States.

This extensive geographical and sectoral spread acts as a powerful risk mitigator. By not being overly reliant on any single market or industry, CKI is better positioned to weather economic fluctuations or adverse regulatory shifts, thereby ensuring more consistent and stable operating performance.

CKI's strength lies in its stable and predictable cash flows, largely derived from regulated utilities and long-term contracts. This structure ensures consistent revenue generation, underpinning its investment approach and dividend growth. For instance, in 2024, operating businesses contributed to a robust 10% year-on-year profit increase, highlighting the reliability of these assets.

CKI boasts a robust financial standing, underscored by a substantial cash reserve and a conservative net debt to net total capital ratio of 7.8% as of December 31, 2024. This financial strength, coupled with disciplined treasury management, equips the company with considerable flexibility to fund new ventures and manage existing debt effectively.

Consistent Dividend Growth and Shareholder Returns

CK Infrastructure (CKI) boasts an impressive history of consistent dividend growth, a significant strength for investors. The company has achieved its 28th consecutive year of dividend increases since its 1996 listing, demonstrating a strong commitment to shareholder returns. For the fiscal year ending December 31, 2024, CKI declared a total dividend of HK$2.58 per share, reinforcing its appeal to income-focused investors.

This sustained dividend growth is a key indicator of CKI's financial stability and its ability to generate reliable cash flows from its diverse infrastructure portfolio. Such a consistent track record not only rewards existing shareholders but also attracts new investors seeking dependable income streams. The company's performance highlights its operational efficiency and strategic management in delivering value.

- Consistent Dividend Growth: 28 consecutive years of increases since 1996.

- Shareholder Returns: Total dividend of HK$2.58 per share for the year ended December 31, 2024.

- Investor Appeal: Attracts income-focused investors due to reliable payouts.

- Financial Stability: Demonstrates operational efficiency and robust cash flow generation.

Strategic Acquisitions and Growth Momentum

CKI's strategic acquisition approach is a key strength, consistently bolstering its revenue streams and expanding its infrastructure portfolio. The company has a proven track record of identifying and integrating assets that immediately add value, even amidst economic headwinds.

This proactive growth strategy was evident in 2024 with significant acquisitions such as Phoenix Energy, a gas distribution network in Northern Ireland, and UK Renewables Energy, a substantial portfolio of onshore wind farms in the United Kingdom. These moves underscore CKI's capability to execute impactful deals that enhance its market position and financial performance.

- Strategic Acquisitions: CKI actively pursues acquisitions that immediately boost revenue and strengthen its diverse infrastructure portfolio.

- 2024 Deal Highlights: Key acquisitions in 2024 included Phoenix Energy (Northern Ireland gas network) and UK Renewables Energy (UK onshore wind farms).

- Value Creation: These acquisitions demonstrate CKI's ability to identify and successfully integrate value-accretive assets, even in challenging market conditions.

CKI's diversified global infrastructure portfolio across energy, transportation, and utilities provides significant risk mitigation. Its stable and predictable cash flows, bolstered by regulated assets and long-term contracts, ensure consistent revenue generation. The company's strong financial position, evidenced by a low net debt to net total capital ratio of 7.8% as of December 31, 2024, offers substantial flexibility for growth and debt management.

| Strength | Description | Supporting Data (as of Dec 31, 2024) |

| Diversified Portfolio | Global presence in energy, transportation, water, and waste management. | Operations across Hong Kong, Mainland China, UK, Europe, Australia, NZ, Canada, US. |

| Stable Cash Flows | Revenue from regulated utilities and long-term contracts. | 10% year-on-year profit increase from operating businesses in 2024. |

| Financial Strength | Substantial cash reserves and conservative leverage. | Net debt to net total capital ratio of 7.8%. |

| Consistent Dividends | Long history of increasing shareholder payouts. | 28 consecutive years of dividend increases; HK$2.58 per share dividend declared for FY2024. |

| Strategic Acquisitions | Proven ability to identify and integrate value-adding assets. | 2024 acquisitions include Phoenix Energy and UK Renewables Energy. |

What is included in the product

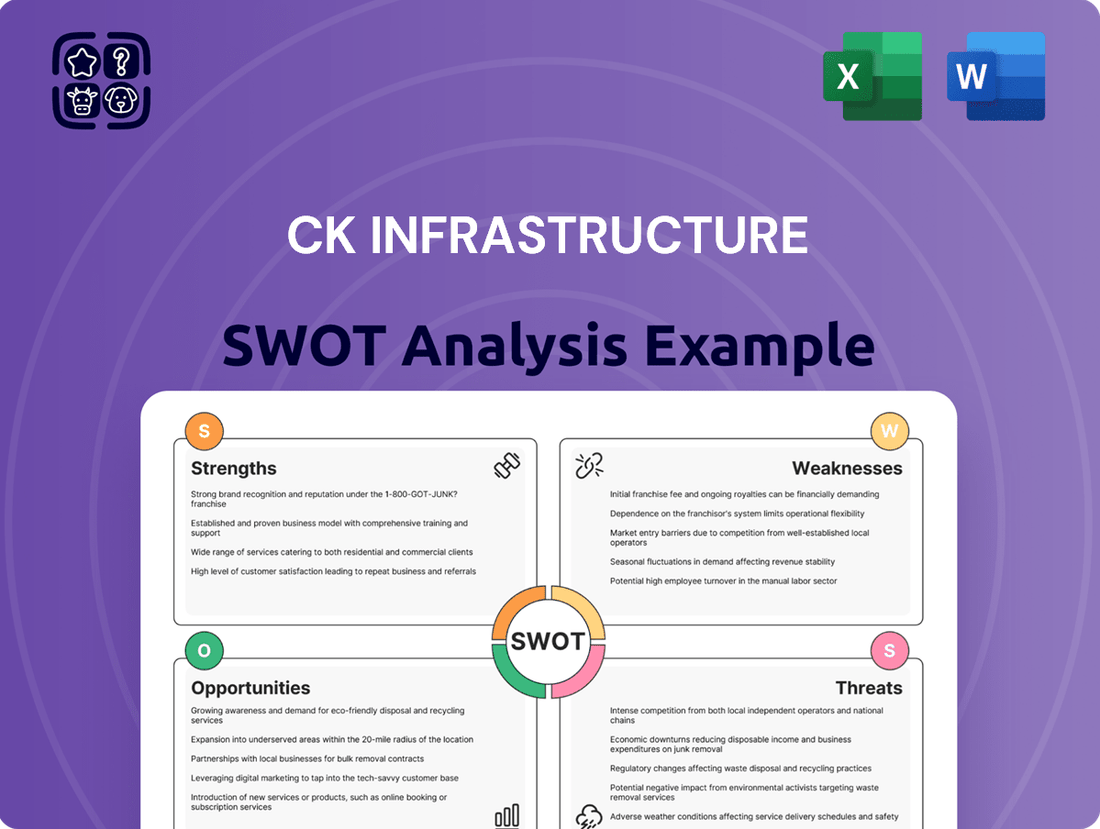

Analyzes CK Infrastructure’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address potential weaknesses and threats, thereby mitigating risks and enhancing strategic resilience.

Weaknesses

CK Infrastructure Holdings (CKI) faces significant headwinds due to its heavy reliance on regulated assets, which form a substantial part of its revenue streams. This exposure means CKI is highly sensitive to shifts in regulatory policies and political landscapes across the diverse global markets it serves. For instance, reductions in allowed returns on its UK and Australian regulated infrastructure assets, observed since 2018, have directly curtailed earnings growth and dampened investment returns.

Furthermore, these regulatory environments can present considerable obstacles, not just to existing operations but also to strategic growth initiatives. Navigating complex regulatory approval processes can significantly slow down or even halt potential acquisition activities, limiting CKI's ability to expand its portfolio and capitalize on new investment opportunities. The ongoing uncertainty surrounding future regulatory decisions poses a persistent risk to CKI's financial performance and strategic flexibility.

CK Infrastructure's (CKI) extensive global footprint means it's exposed to currency exchange rate volatility, which can directly impact its reported financial results. For instance, fluctuations in major currencies against the Hong Kong dollar can either boost or diminish the value of its overseas earnings when translated back.

Furthermore, CKI's business model, which often involves significant debt financing for infrastructure projects, makes it sensitive to interest rate movements. Rising interest costs, as experienced in 2024, can put pressure on net profit margins, especially if these higher borrowing costs are not fully passed on to customers or offset by increased revenue.

While CK Infrastructure actively pursues growth through acquisitions, the integration of these new assets, particularly large-scale ones, presents significant operational and cultural hurdles. Successfully merging diverse businesses across different regions demands exceptional management skill and can uncover unexpected complexities, potentially delaying the realization of expected synergies.

Potential for Slower Organic Growth

CK Infrastructure Holdings (CKI) faces a potential drag on its growth if it cannot secure significant new acquisitions. Without them, organic expansion from its current portfolio is projected to remain modest, likely in the low single digits. This underscores CKI's dependence on a robust acquisition pipeline to achieve more substantial earnings growth, a strategy inherently influenced by prevailing market conditions and the complexities of regulatory approvals.

The company's reliance on acquisitions for growth means that any slowdown in deal-making, perhaps due to elevated asset prices or increased competition, could directly impact its financial performance. For instance, if CKI's acquisition pace in 2024-2025 does not match previous years, its overall revenue and profit expansion could be constrained. This structural characteristic necessitates careful management of its M&A strategy to ensure continued upward momentum.

- Low Single-Digit Organic Growth: Without new major acquisitions, CKI's existing assets are expected to contribute only minimal growth.

- Acquisition Dependency: Significant earnings growth is heavily reliant on the company's ability to successfully execute new acquisitions.

- Market and Regulatory Risks: The success of CKI's growth strategy is subject to external factors like market conditions and regulatory hurdles, which can delay or prevent acquisitions.

Geopolitical Tensions and Economic Uncertainties

CK Infrastructure Holdings (CKI) faces significant headwinds from a volatile global economic climate. Lingering uncertainties due to weak economic growth in key regions and persistent inflationary pressures create a challenging operating environment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, highlighting ongoing economic fragility. This backdrop can directly impact CKI's project pipelines and the profitability of its existing infrastructure assets.

Geopolitical tensions further exacerbate these economic uncertainties. Ongoing conflicts and trade disputes can disrupt supply chains, increase operational costs, and deter new investment. The ongoing conflict in Eastern Europe, for example, has contributed to energy price volatility, a critical factor for infrastructure operations and development. These external risks can lead to project delays, cost overruns, and a general dampening of investor sentiment towards large-scale infrastructure projects.

- Economic Slowdown: Global economic growth forecasts for 2024 suggest continued, albeit moderate, expansion, with potential for regional downturns impacting demand for infrastructure services.

- Inflationary Pressures: Persistent inflation can increase the cost of materials, labor, and financing for CKI's projects, impacting margins and project viability.

- Geopolitical Instability: Regional conflicts and trade tensions can disrupt international trade, supply chains, and foreign direct investment, creating operational and strategic risks for CKI.

- Interest Rate Volatility: Rising or unpredictable interest rates can increase CKI's cost of capital, affecting the feasibility of new projects and the valuation of existing assets.

CK Infrastructure's (CKI) heavy reliance on regulated assets makes it vulnerable to adverse regulatory changes, as seen with reduced allowed returns in the UK and Australia impacting earnings. Complex approval processes can also hinder growth initiatives and acquisitions, limiting portfolio expansion. This regulatory sensitivity creates ongoing uncertainty for CKI's financial performance and strategic agility.

Preview Before You Purchase

CK Infrastructure SWOT Analysis

This is the actual CK Infrastructure SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing CK Infrastructure's strategic position.

This is a real excerpt from the complete CK Infrastructure SWOT analysis. Once purchased, you’ll receive the full, editable version ready for strategic planning.

Opportunities

CKI can capitalize on the growing global demand for decarbonization by expanding its investments in renewable energy and green infrastructure. The company's acquisition of UK Renewables Energy in 2024, a move that added significant wind power capacity, exemplifies this strategic direction. This expansion not only aligns with sustainability goals but also taps into a rapidly growing market with increasing governmental support and investor interest.

Despite economic headwinds, CK Infrastructure (CKI) is actively pursuing further acquisitions in stable, essential infrastructure. The company's robust M&A pipeline is bolstered by a strategic approach, capitalizing on stalled deals and the maturity of investment funds seeking exits. This positions CKI to potentially acquire quality assets at attractive valuations.

CKI's strong financial footing and a disciplined acquisition strategy, characterized by a 'not a must-win' mentality, enable it to target and secure valuable infrastructure assets. The focus remains on regulated utility sectors, which are known for their predictable revenue streams and stable, long-term returns, aligning with CKI's objective of consistent growth.

CK Infrastructure's secondary listing on the London Stock Exchange in August 2024 significantly bolsters its profile as a key player in the global infrastructure arena. This move not only provides a platform to raise capital more effectively but also diversifies its investor base. The enhanced access to international capital markets is crucial for funding its ambitious growth strategies.

This strategic listing is anticipated to unlock new avenues for financing major infrastructure projects and potential acquisitions, thereby reinforcing CKI's worldwide operational footprint. The London Stock Exchange's robust regulatory environment and deep liquidity pool are expected to attract a broader range of institutional investors, potentially lowering the cost of capital for future endeavors.

Technological Advancements and Digitalization in Operations

CK Infrastructure (CKI) can significantly boost its operational effectiveness by adopting cutting-edge technologies and embracing digitalization. This strategic move allows for better asset management and service provision across its vast infrastructure network. For instance, CKI's investment in smart grid technologies in its electricity distribution businesses can lead to more efficient energy management and reduced downtime.

The company's commitment to innovation offers a pathway to substantial cost savings and enhanced operational resilience. By integrating advanced data analytics and automation, CKI can streamline maintenance schedules and predict potential equipment failures, thereby minimizing costly disruptions. This proactive approach not only cuts expenses but also strengthens the reliability of its services.

Furthermore, technological advancements open doors for CKI to explore and develop novel service offerings. This could include expanding into areas like smart city solutions or advanced digital infrastructure services, leveraging its existing expertise and infrastructure.

- Enhanced Efficiency: Digitalization can streamline processes, leading to faster project completion and improved resource allocation.

- Cost Reduction: Automation and data-driven insights can lower operational and maintenance expenses.

- Improved Asset Management: Real-time monitoring and predictive analytics optimize the performance and lifespan of infrastructure assets.

- New Service Development: Embracing technology enables CKI to offer innovative solutions in areas like smart infrastructure and digital services.

Emerging Markets Infrastructure Development

CK Infrastructure Holdings (CKI) can explore strategic expansion into emerging markets that require substantial infrastructure upgrades. This presents a significant growth opportunity, especially as many developing economies are prioritizing infrastructure investment to fuel economic expansion. For instance, the Asian Development Bank projected that developing Asia would need $1.7 trillion annually in infrastructure investment through 2030, a figure that underscores the potential scale of these opportunities.

Such ventures, if meticulously evaluated for their risk-reward profiles, could unlock new avenues for diversification and revenue generation for CKI. The company's established expertise in managing large-scale infrastructure projects positions it well to capitalize on these burgeoning markets.

- Emerging Market Growth: Many emerging economies are experiencing rapid population growth and urbanization, driving a critical need for new and upgraded infrastructure, from transportation networks to utilities.

- Government Support: Several governments in these regions are actively seeking private sector partners to finance and develop major infrastructure projects, often offering incentives and long-term concessions.

- Diversification Potential: Expanding into emerging markets can reduce CKI's reliance on its existing developed markets, offering a broader base for earnings and mitigating country-specific economic risks.

- Project Scale: The sheer scale of infrastructure needs in emerging markets, such as the estimated $3.4 trillion required for infrastructure in Southeast Asia by 2030 according to ADB, offers substantial project opportunities.

CKI's strategic focus on decarbonization presents a significant opportunity, especially with its 2024 acquisition of UK Renewables Energy, which expanded its wind power capacity. This aligns with global sustainability trends and taps into a market with strong governmental and investor backing.

The company is well-positioned to acquire quality infrastructure assets at attractive valuations due to its robust M&A pipeline and the current market environment, which sees investment funds seeking exits. CKI's disciplined approach targets stable, essential infrastructure, particularly in regulated utilities known for predictable revenue.

CKI's secondary listing on the London Stock Exchange in August 2024 enhances its global profile and access to capital, crucial for funding growth and acquisitions. This move is expected to attract a broader investor base, potentially lowering the cost of capital for future projects.

Embracing digitalization and advanced technologies, such as smart grid solutions, can significantly boost CKI's operational efficiency and reduce costs. This innovation also opens doors for new service offerings like smart city solutions.

Emerging markets offer substantial growth potential for CKI, with developing Asia alone needing an estimated $1.7 trillion annually for infrastructure through 2030. CKI's expertise in managing large projects positions it to capitalize on these burgeoning markets and diversify its revenue streams.

Threats

CK Infrastructure Holdings (CKI) faces significant headwinds from escalating regulatory scrutiny, particularly concerning national security implications. This intensified oversight could directly impede CKI's ability to pursue new investment opportunities and complete potential acquisitions, as seen in past instances where regulatory bodies blocked proposed deals.

Persistent high interest rates and inflationary pressures pose a significant threat to CK Infrastructure (CKI). For instance, the Bank of England maintained its base rate at 5.25% through early 2024, a level not seen in over a decade, impacting borrowing costs for infrastructure projects. This can directly increase CKI's financing expenses and potentially reduce its net profit margins.

While CKI's regulated utility businesses can often pass on some inflation-related cost increases to consumers, prolonged or unexpectedly high inflation can still erode profitability. For example, if the rate of inflation outpaces the allowed regulatory adjustments, CKI could face a squeeze on its earnings. This was a concern in 2023, with inflation in many developed economies hovering around 5-7% for extended periods.

The infrastructure sector is experiencing heightened competition, with a growing number of financial and strategic investors actively seeking quality assets. This trend is particularly evident in 2024 and projected to continue into 2025, as global infrastructure spending targets remain robust.

This intense competition can inflate acquisition prices, making it more difficult for companies like CK Infrastructure (CKI) to secure projects that align with their desired internal rates of return. For instance, in 2023, the average premium paid for infrastructure assets in developed markets saw an uptick, a factor CKI must navigate.

Geopolitical Instability and Economic Downturns

Geopolitical instability, such as ongoing conflicts and trade disputes, poses a significant threat to CK Infrastructure Holdings (CKI). These global tensions, coupled with weakening economic conditions in crucial markets for CKI, can directly impact its revenue streams and project pipeline.

For instance, a slowdown in global infrastructure spending, potentially exacerbated by rising inflation and interest rates throughout 2024 and into 2025, could reduce demand for CKI's core services. This economic uncertainty also heightens the risk of project delays or cancellations, impacting profitability.

- Reduced Demand: Economic downturns can lead to decreased government and private sector investment in infrastructure projects, directly affecting CKI's order book.

- Increased Operational Risks: Geopolitical friction can disrupt supply chains, increase the cost of materials, and create challenges in securing financing for new ventures.

- Project Viability: Uncertain economic forecasts and political instability can make it harder for CKI to secure new projects or secure favorable terms for existing ones.

Climate Change and Environmental Regulations

CK Infrastructure Holdings (CKI) faces significant threats from climate change and evolving environmental regulations. As a global operator of essential infrastructure, the company is exposed to physical risks like extreme weather events, which could disrupt operations and damage assets. For instance, the increasing frequency of typhoons in Asia, where CKI has substantial investments, poses a direct threat to its power generation and transportation networks.

Furthermore, the global push towards decarbonization and stricter environmental standards presents transitional risks. CKI's reliance on traditional energy sources and infrastructure assets could lead to increased compliance costs and potential obsolescence if it fails to adapt. By 2024, many jurisdictions are implementing more stringent carbon pricing mechanisms and renewable energy mandates, directly impacting the operational economics of CKI's portfolio. Failure to align with these sustainability benchmarks could result in penalties and diminished investor confidence.

- Physical Risks: Increased frequency and intensity of extreme weather events (e.g., floods, storms, heatwaves) impacting CKI's global infrastructure assets.

- Transitional Risks: Stricter environmental regulations, carbon pricing, and shifting market preferences towards sustainable energy sources affecting CKI's traditional asset base.

- Operational Disruptions: Potential for service interruptions and damage to infrastructure, leading to revenue loss and increased repair costs.

- Reputational Damage: Failure to meet evolving sustainability expectations could harm CKI's brand image and stakeholder relationships.

CK Infrastructure (CKI) faces intensified competition for quality infrastructure assets, driving up acquisition prices and challenging its ability to achieve target returns. This trend is expected to persist through 2024 and into 2025, as global infrastructure spending remains a priority. For example, the average premium paid for infrastructure assets in developed markets saw an increase in 2023, directly impacting CKI's procurement costs.

Geopolitical instability and economic slowdowns pose significant threats, potentially reducing demand for CKI's services and increasing project risks. Weakening economic conditions in key markets, coupled with ongoing global tensions, could disrupt supply chains and lead to project delays or cancellations, impacting CKI's revenue streams and profitability through 2024-2025.

CKI is also vulnerable to climate change impacts and evolving environmental regulations. Extreme weather events can disrupt operations and damage assets, while stricter decarbonization mandates and carbon pricing mechanisms, increasingly implemented by 2024, could increase compliance costs and affect the viability of its traditional infrastructure portfolio.

SWOT Analysis Data Sources

This CK Infrastructure SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a robust and actionable strategic overview.