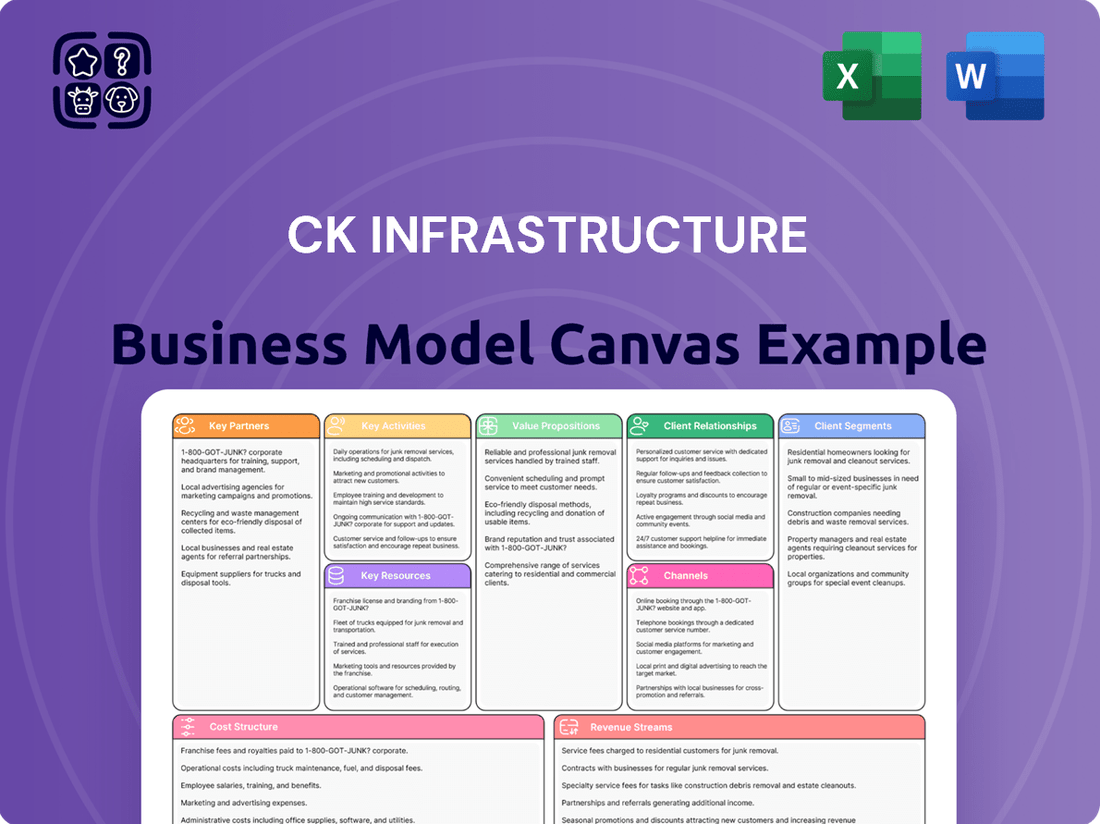

CK Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

Unlock the core components of CK Infrastructure's success with our Business Model Canvas. This snapshot reveals their key partners, value propositions, and revenue streams, offering a glimpse into their operational strategy.

Ready to dive deeper and understand the full strategic blueprint? Download the complete CK Infrastructure Business Model Canvas to gain actionable insights into their customer relationships, cost structure, and competitive advantages. Perfect for strategic planning and competitive analysis.

Partnerships

CK Infrastructure's key partnerships with government and regulatory bodies are fundamental to its global operations in highly regulated sectors like energy, transportation, and water. These relationships are vital for obtaining necessary licenses and permits, ensuring ongoing compliance with diverse legal frameworks, and proactively managing evolving policies across different countries. For instance, in 2024, the company continued to engage with authorities to secure approvals for significant infrastructure projects, such as expansions in its European energy networks.

CKI frequently engages in joint ventures, a strategy exemplified by its acquisition of Phoenix Energy alongside CK Asset and Power Assets. These collaborations are crucial for managing the substantial risks associated with large-scale infrastructure projects and global acquisitions, allowing CKI to pool resources and expertise.

These strategic partnerships provide CKI with invaluable access to local market knowledge and regulatory understanding, which is critical for navigating diverse international operating environments. By joining forces, CKI can leverage the complementary strengths of its partners, enhancing its ability to secure and successfully execute complex infrastructure deals.

CK Infrastructure Holdings actively collaborates with technology and service providers to enhance operational efficiency and modernize its diverse asset portfolio. These partnerships are crucial for integrating cutting-edge solutions, such as smart grid technologies for its energy networks and advanced systems for water treatment facilities. For instance, in 2024, the company continued to invest in digital transformation initiatives, aiming to leverage data analytics and automation across its infrastructure operations.

Financial Institutions and Lenders

CK Infrastructure Holdings Limited (CKI) relies heavily on its relationships with financial institutions and lenders to fuel its substantial capital expenditure and strategic acquisitions. These partnerships are fundamental to maintaining a robust financial foundation, enabling CKI to undertake and complete its large-scale, global infrastructure projects. For instance, in 2024, CKI continued to leverage its strong credit standing to secure diverse funding sources, supporting its ongoing development pipeline and opportunistic investments.

These collaborations are not merely transactional; they represent a strategic alignment that underpins CKI's ability to execute its growth strategy across various sectors. The consistent access to capital from these key partners allows CKI to maintain its competitive edge and pursue opportunities that require significant upfront investment.

- Access to Capital Markets: Partnerships with investment banks facilitate access to equity and debt markets for fundraising, crucial for funding major projects like the acquisition of Airwave in the UK.

- Syndicated Loans: Collaboration with commercial banks allows CKI to arrange large syndicated loans, spreading risk and ensuring sufficient liquidity for its extensive portfolio.

- Project Financing: Lenders provide specialized project financing for individual infrastructure assets, a common practice for CKI's energy and transportation ventures.

- Strategic Investment Funds: Relationships with infrastructure funds and pension funds offer alternative and long-term capital solutions, supporting CKI's expansion and diversification efforts.

Local Communities and Stakeholders

CK Infrastructure actively cultivates strong ties with local communities and diverse stakeholders. This engagement is crucial for securing project approvals and ensuring the seamless operation of essential services, such as water and waste management. By proactively addressing community concerns, CK Infrastructure fosters an environment of trust and long-term sustainability for its projects.

For instance, in 2024, the company continued its commitment to community development through various initiatives. These often involve direct dialogue and collaboration to ensure projects align with local needs and environmental considerations.

- Community Engagement: Building positive relationships with local communities is vital for project acceptance and smooth operations, especially for essential services like water and waste management.

- Stakeholder Dialogue: Engaging with local stakeholders helps address concerns and fosters long-term sustainability.

- Project Support: In 2024, CK Infrastructure’s community investment programs focused on areas like infrastructure upgrades and environmental protection, demonstrating a tangible commitment to local well-being.

CK Infrastructure's key partners include governments, regulatory bodies, technology providers, and financial institutions. These collaborations are essential for navigating complex regulations, integrating new technologies, and securing the substantial capital required for global infrastructure projects. For example, in 2024, CKI continued to work with financial institutions to secure funding for its diverse project pipeline.

| Partner Type | Role | Example of Engagement (2024) |

|---|---|---|

| Governments & Regulators | License acquisition, compliance, policy engagement | Securing approvals for European energy network expansions |

| Technology & Service Providers | Operational efficiency, modernization | Investing in digital transformation and smart grid technologies |

| Financial Institutions | Capital raising, project financing, risk management | Leveraging strong credit to secure diverse funding sources |

| Joint Venture Partners | Risk sharing, resource pooling, expertise | Acquisition of Phoenix Energy alongside CK Asset and Power Assets |

What is included in the product

A comprehensive, pre-written business model tailored to CK Infrastructure's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for presentations and funding discussions.

CK Infrastructure's Business Model Canvas offers a structured approach to identify and address key operational challenges, streamlining complex infrastructure projects.

It provides a clear, visual representation of the business, enabling swift identification of inefficiencies and opportunities for improvement in infrastructure development and management.

Activities

CKI's primary activity revolves around the strategic identification, rigorous evaluation, and acquisition of robust, essential infrastructure assets across the globe. This focus spans critical sectors like energy, transportation, water, and waste management.

In 2024 alone, CKI made significant strides by acquiring Phoenix Energy and UK Renewables Energy, demonstrating its commitment to expanding its portfolio in the renewable energy space. These moves underscore CKI's strategy of investing in assets with stable, long-term cash flow potential.

CK Infrastructure actively develops and enhances its infrastructure portfolio. This involves significant investment in construction, modernization, and upgrades to boost asset efficiency and service capabilities. For instance, the company undertakes projects like reconstructing waste-to-energy plants or expanding gas storage facilities to meet growing demand.

CK Infrastructure Holdings (CKI) actively manages and operates its extensive global portfolio of infrastructure assets, focusing on the reliable and efficient delivery of essential services. This includes overseeing power generation facilities, gas distribution networks, toll roads, bridges, tunnels, and water treatment plants.

In 2024, CKI's commitment to operational excellence is evident across its diverse segments. For instance, the company's UK energy networks, including gas and electricity distribution, consistently meet stringent performance targets, contributing to stable revenue streams. CKI's Australian water business, represented by agreements like the acquisition of West Australian Water Services, further solidifies its operational footprint and commitment to essential services.

Financial Management and Capital Allocation

CK Infrastructure's financial management centers on prudent treasury activities, debt management, and strategic capital allocation to ensure a robust financial standing and fuel expansion. A key metric they monitor is the net debt to net total capital ratio, aiming to keep this at healthy levels. For instance, as of December 31, 2023, CK Infrastructure Holdings Limited reported a net debt to net total capital ratio of 40.4%, demonstrating a well-managed leverage position.

Effective capital allocation is crucial for funding new projects and acquisitions, ensuring long-term value creation. This involves rigorous analysis to identify opportunities that offer the best risk-adjusted returns. The company’s commitment to financial discipline supports its ability to undertake significant infrastructure developments globally.

- Prudent Financial Management: Focuses on treasury operations and maintaining a healthy balance sheet.

- Debt Management: Actively manages its debt levels, evidenced by a net debt to net total capital ratio of 40.4% as of December 31, 2023.

- Capital Allocation: Strategically deploys capital to fund growth initiatives and enhance shareholder value.

- Financial Strength: Aims to maintain a strong financial position to support ongoing and future infrastructure projects.

Regulatory Compliance and Stakeholder Engagement

Navigating the intricate web of regulations is paramount for CK Infrastructure's continued success. This involves proactively adhering to evolving standards, particularly those concerning environmental, social, and governance (ESG) factors. For instance, in 2024, many jurisdictions intensified their focus on climate-related disclosures, requiring companies like CK Infrastructure to provide more transparent reporting on their carbon footprint and sustainability initiatives.

Maintaining robust relationships with regulatory bodies, such as transport authorities and environmental protection agencies, is essential for securing project approvals and ensuring smooth operations. This proactive engagement helps anticipate and address potential compliance challenges. Furthermore, strong stakeholder engagement, including regular communication with shareholders, builds trust and supports the company's long-term strategic objectives.

CK Infrastructure's commitment to regulatory compliance and stakeholder engagement is reflected in its operational framework. The company actively monitors and adapts to new regulatory landscapes, ensuring that its business practices align with legal and ethical standards. This diligence is critical for risk mitigation and fostering a stable operating environment, especially as global sustainability mandates become more stringent.

- Regulatory Adherence: Ensuring compliance with diverse national and international regulations across all operating segments.

- Climate Reporting: Implementing and refining processes for transparent reporting on climate-related risks and opportunities, as mandated by evolving frameworks.

- Stakeholder Relations: Cultivating and maintaining positive relationships with government bodies, investors, and the communities in which it operates.

- Approvals and Licensing: Securing and maintaining all necessary permits, licenses, and approvals for infrastructure projects and ongoing operations.

CK Infrastructure's key activities include acquiring and developing essential infrastructure assets, managing and operating these assets efficiently, and maintaining prudent financial management. The company also focuses on navigating complex regulatory environments and fostering strong stakeholder relationships.

In 2024, CKI continued its strategic acquisition path, notably with Phoenix Energy and UK Renewables Energy, bolstering its renewable energy portfolio. Simultaneously, ongoing development projects, such as waste-to-energy plant reconstructions, demonstrate a commitment to enhancing asset performance and meeting market demands.

Operational excellence remained a cornerstone, with UK energy networks meeting performance targets and the Australian water business expanding. This focus ensures stable revenue streams and reinforces CKI's role in providing essential services.

Financial prudence, including a net debt to net total capital ratio of 40.4% as of December 31, 2023, underpins CKI's ability to fund growth and maintain financial strength.

Regulatory compliance, particularly concerning ESG factors and climate reporting, alongside proactive stakeholder engagement, is crucial for CKI's sustained success and operational stability.

| Key Activity | Description | 2024 Highlights/Data |

|---|---|---|

| Acquisition & Development | Identifying, evaluating, and acquiring infrastructure assets; constructing and upgrading facilities. | Acquisition of Phoenix Energy and UK Renewables Energy. Ongoing development of waste-to-energy plants. |

| Operations & Management | Overseeing and operating a diverse portfolio of infrastructure assets for efficient service delivery. | Consistent performance targets met by UK energy networks; expansion of Australian water services. |

| Financial Management | Treasury operations, debt management, and strategic capital allocation for financial health and growth. | Net debt to net total capital ratio of 40.4% (as of Dec 31, 2023); strategic capital deployment for new projects. |

| Regulatory & Stakeholder Engagement | Ensuring compliance with regulations and maintaining positive relationships with stakeholders. | Focus on climate-related disclosures and ESG factors; proactive engagement with regulatory bodies and investors. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will instantly receive the full, editable version of this same Business Model Canvas, ready for immediate use.

Resources

CK Infrastructure's core strength lies in its vast and varied collection of operational infrastructure assets spanning energy, transportation, water, and waste management globally. This diversification across essential services is key to its business model.

These robust infrastructure assets are designed to generate consistent and predictable income streams, providing a stable financial foundation. For instance, in 2023, CK Infrastructure Holdings Limited reported revenue of HK$101.6 billion, a significant portion of which is derived from its extensive portfolio.

The company's strategic investments in essential services like power transmission and distribution, as well as water treatment facilities, ensure long-term demand and revenue generation. This focus on fundamental utilities underpins the resilience of its asset portfolio.

CKI's robust financial capital, including substantial cash reserves and diverse financing avenues, underpins its aggressive investment and acquisition strategy. This financial strength is a cornerstone of its business model, enabling it to pursue opportunities effectively.

The company's solid financial position is evidenced by its healthy debt ratios, which provide flexibility and a strong foundation for growth. For instance, as of the first half of 2024, CKI reported a net debt to equity ratio of approximately 0.45, demonstrating prudent leverage.

CK Infrastructure's success hinges on its seasoned management team, boasting extensive experience across infrastructure investment, development, and operations. This deep well of industry knowledge is crucial for navigating complex projects and making sound strategic choices.

The company's technical expertise ensures efficient project execution, from initial planning through to long-term operational management. This capability is a core strength, enabling CK Infrastructure to deliver on its ambitious development goals.

Global Network and Local Presence

CKI's extensive global network, coupled with a deep local operational presence across key markets, is a cornerstone of its business model. This dual approach grants CKI unparalleled access to localized market intelligence, crucial for navigating diverse regulatory environments and consumer behaviors.

The company's strategic footprint extends across major economies, including significant investments in Hong Kong, the United Kingdom, Australia, Europe, Canada, and New Zealand. This geographical diversification not only mitigates risk but also fosters robust partnerships and allows for the efficient oversight of a broad portfolio of infrastructure assets.

This established network is instrumental in identifying new opportunities and executing complex projects. For instance, CKI's substantial presence in the UK's utilities sector, a market it has actively invested in for years, provides a strong foundation for further growth and operational synergies.

- Global Reach: Investments in Hong Kong, UK, Australia, Europe, Canada, and New Zealand.

- Local Expertise: Deep operational presence enabling tailored market strategies.

- Partnership Facilitation: Network supports collaboration and joint ventures.

- Asset Management Efficiency: Streamlined oversight of geographically dispersed infrastructure.

Proprietary Technology and Operational Know-how

CK Infrastructure's proprietary technology and operational know-how are central to its business model, driving efficiency and value across its diverse portfolio. This includes significant investment in developing and deploying advanced technologies in areas critical to its operations.

The company actively cultivates and leverages best practices, particularly in energy efficiency and waste-to-energy solutions. For instance, in 2024, CK Infrastructure continued to expand its digitalized network infrastructure, aiming to optimize resource allocation and operational performance across its global assets. This focus on technological advancement directly contributes to enhanced service delivery and cost management.

Key aspects of this resource include:

- Development of proprietary energy efficiency technologies: This allows for optimized energy consumption across infrastructure assets, leading to cost savings and reduced environmental impact.

- Expertise in waste-to-energy processes: CK Infrastructure possesses deep operational knowledge in converting waste into usable energy, a growing sector with significant economic and environmental benefits.

- Implementation of digitalized networks: This enhances the management and monitoring of infrastructure, improving reliability and enabling predictive maintenance, as evidenced by ongoing network upgrades in 2024.

- Continuous improvement of operational best practices: The company fosters a culture of learning and adaptation, ensuring its operational standards remain at the forefront of the industry.

CK Infrastructure's key resources are its extensive portfolio of essential infrastructure assets, robust financial capital, and experienced management team. These form the bedrock of its ability to secure, manage, and grow its global operations. The company's intellectual property, including proprietary technologies and operational know-how, further enhances its competitive edge.

Value Propositions

CKI's value proposition centers on delivering stable and essential infrastructure services, acting as a bedrock for communities and industries. They operate across critical sectors like energy, water, and transportation, ensuring these vital utilities are consistently available.

This reliability is crucial for economic activity and daily life. For instance, in 2024, CKI's energy segment continued to be a significant contributor, with their investments in renewable energy projects, such as wind and solar farms, bolstering energy security and supporting decarbonization efforts.

CKI's strategy centers on acquiring and developing infrastructure assets with stable, long-term revenue streams, often in regulated markets or under long-term contracts. This approach is designed to deliver reliable and sustainable returns for investors, minimizing volatility.

The company's commitment to consistent dividend growth is a key value proposition. For example, CKI's total dividends per share saw a compound annual growth rate of approximately 7.4% from 2018 to 2023, demonstrating its dedication to shareholder returns.

CK Infrastructure Holdings (CKI) actively manages its diverse portfolio of infrastructure assets, leveraging deep operational expertise to boost efficiency and performance. This hands-on approach is central to its strategy for value creation.

For instance, CKI's commitment to cost reduction and service enhancement is evident in its ongoing efforts across its global operations. In 2023, the company reported a significant increase in its share of profits from infrastructure businesses, demonstrating the success of these optimization initiatives.

These operational improvements directly contribute to CKI's financial results, allowing it to deliver reliable returns to shareholders while ensuring the long-term sustainability and competitiveness of its infrastructure assets.

Global Diversification and Risk Mitigation

CK Infrastructure's commitment to global diversification is a cornerstone of its value proposition, directly addressing the need for risk mitigation. By spreading investments across various geographies and infrastructure sectors, the company significantly lowers its exposure to any single market's volatility or adverse events.

This broad geographical footprint enhances resilience. For instance, a downturn in one region or a regulatory shift in a specific country is less likely to derail the entire business when operations are spread across continents. This strategic approach ensures a more stable and predictable revenue stream, appealing to investors seeking stability.

The company's portfolio, as of recent reports, demonstrates this. For example, in 2024, CK Infrastructure maintained significant holdings in Europe, North America, and Asia-Pacific, with investments spanning utilities, transportation, and energy sectors. This balanced exposure is key to weathering economic storms.

- Geographic Spread: Operations in over 20 countries as of early 2024.

- Sectoral Balance: Investments across energy, water, waste management, and transportation infrastructure.

- Resilience Factor: Reduced impact from localized economic or political instability.

- Risk Mitigation: Diversification as a primary strategy to protect capital and ensure consistent returns.

Commitment to Sustainability and Environmental Stewardship

CKI's commitment to sustainability is a core value proposition, evident in its active pursuit of decarbonization initiatives and waste-to-energy projects. This focus directly addresses the growing global demand for environmentally responsible investments, known as ESG (Environmental, Social, and Governance) factors.

The company's dedication to environmental stewardship is not merely aspirational; it's integrated into its operational and investment strategies. This proactive approach positions CKI favorably in a market increasingly prioritizing sustainable business practices.

CKI's investments in waste-to-energy, for instance, contribute to circular economy principles by transforming waste into valuable energy resources. This aligns with the broader trend of businesses seeking innovative solutions to environmental challenges.

- Decarbonization Efforts: CKI actively invests in projects aimed at reducing carbon emissions across its portfolio.

- Waste-to-Energy Projects: The company champions waste-to-energy solutions, converting waste into usable energy.

- ESG Alignment: These initiatives directly cater to the increasing global emphasis on Environmental, Social, and Governance criteria in investment decisions.

CKI's value proposition is built on providing essential infrastructure services with a focus on reliability and long-term growth. They ensure the consistent availability of critical utilities like energy and water, underpinning economic activity and community well-being. This reliability is further enhanced by their strategic acquisition and development of assets in stable, often regulated markets, guaranteeing predictable revenue streams.

The company's commitment to shareholder returns is a significant draw, demonstrated by its consistent dividend growth. For example, CKI's total dividends per share showed a compound annual growth rate of approximately 7.4% between 2018 and 2023. This, coupled with operational efficiencies that boosted profit share from infrastructure businesses in 2023, underscores their dedication to delivering sustainable value.

CKI's global diversification strategy is key to its value proposition, offering risk mitigation through operations in over 20 countries as of early 2024, spanning energy, water, and transportation. This broad exposure reduces the impact of localized economic or political instability, ensuring more consistent returns for investors. Their active management and pursuit of sustainability, including waste-to-energy projects, further enhance their appeal to a market increasingly focused on ESG factors.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Reliable Essential Services | Ensuring consistent availability of energy, water, and transportation. | Operates in critical sectors vital for economic activity. |

| Stable Long-Term Revenue | Acquiring and developing assets in regulated markets or with long-term contracts. | Strategy focuses on predictable revenue streams. |

| Consistent Shareholder Returns | Commitment to reliable and growing dividend payments. | Approx. 7.4% CAGR in dividends per share (2018-2023). |

| Operational Excellence | Leveraging expertise to improve efficiency and performance of assets. | Reported increased share of profits from infrastructure businesses in 2023. |

| Global Diversification & Risk Mitigation | Spreading investments across geographies and sectors. | Operations in over 20 countries as of early 2024. |

| Sustainability Focus | Investing in decarbonization and waste-to-energy projects. | Addresses growing demand for ESG-compliant investments. |

Customer Relationships

CK Infrastructure Holdings (CKI) heavily relies on long-term contractual relationships, often with government bodies and major industrial clients. These agreements are the bedrock of its predictable revenue streams, providing a stable financial foundation.

For instance, CKI's infrastructure projects, such as toll roads or utilities, typically operate under concessions that can extend for decades. This long-term nature, often within regulated environments, minimizes short-term volatility and allows for consistent cash flow generation, a key element of its business model.

In 2023, CKI reported significant contributions from its infrastructure segment, underscoring the value of these enduring partnerships. The company's ability to secure and maintain these long-term contracts is a testament to its operational expertise and the essential nature of its services.

For regulated utility providers like CK Infrastructure, customer relationships are deeply intertwined with regulatory compliance. This means interactions often center on maintaining service quality, ensuring reliability, and strictly adhering to approved tariffs. Transparency and clear communication are paramount to building trust within this framework.

In 2023, CK Infrastructure reported that its regulated utility businesses, such as its UK electricity and gas networks, maintained high levels of service reliability, with many exceeding regulatory performance targets. For instance, the company's UK gas distribution network achieved an outage rate significantly below the industry average, a key metric monitored by regulators and valued by customers.

CKI cultivates partnerships in its joint ventures with a focus on mutual trust and shared goals, ensuring effective collaboration in managing and developing assets. This approach is exemplified in its significant infrastructure projects, where transparent governance is key to success.

Investor Relations and Transparency

CK Infrastructure Holdings Limited (CKI) places significant emphasis on cultivating robust relationships with its varied investor base, encompassing both individual shareholders and major financial institutions. This commitment to strong investor relations is a cornerstone of its business model, ensuring sustained confidence and support.

Transparency is paramount in CKI's approach. The company prioritizes clear and consistent communication to keep its investors well-informed about its performance, strategic direction, and commitment to sustainability. This proactive communication strategy is designed to foster trust and alignment with shareholder interests.

- Diverse Investor Base: CKI actively engages with a broad spectrum of investors, from retail participants to large institutional funds, recognizing the importance of each segment.

- Transparent Reporting: The company adheres to rigorous reporting standards, providing detailed financial statements and operational updates to ensure clarity and accountability. For instance, in its 2024 interim report, CKI highlighted its commitment to clear disclosures on financial performance and strategic initiatives.

- Regular Communication Channels: CKI utilizes various platforms, including Annual General Meetings (AGMs), investor presentations, and its corporate website, to facilitate ongoing dialogue and provide timely information.

- Sustainability Focus: Beyond financial metrics, CKI increasingly communicates its Environmental, Social, and Governance (ESG) performance, reflecting a growing investor demand for sustainable business practices.

Community Engagement and Public Trust

CK Infrastructure Holdings (CKI) prioritizes community engagement to foster public trust, recognizing its critical role in securing a social license to operate. For 2024, CKI continued its commitment to responsible business practices, actively addressing the concerns of local communities impacted by its infrastructure projects. This proactive approach is fundamental to maintaining positive relationships and ensuring the smooth execution of its global operations.

CKI's strategy involves direct dialogue and investment in local initiatives. These efforts are designed to build enduring trust and demonstrate a genuine commitment to the well-being of the areas where it operates.

- Community Investment: CKI allocates resources towards local development projects, enhancing infrastructure and improving quality of life in communities surrounding its operations.

- Stakeholder Dialogue: Regular consultations with local residents, government bodies, and community leaders are conducted to address concerns and gather feedback, fostering transparency.

- Environmental Stewardship: Adherence to stringent environmental standards and proactive mitigation measures are key to building trust and demonstrating responsible operation.

- Social License: Successful community engagement directly contributes to CKI's ability to secure and maintain the necessary social acceptance for its projects.

CKI's customer relationships are built on long-term, contractual agreements, often with government entities and major industrial clients, ensuring predictable revenue. For regulated utilities, these relationships emphasize service reliability and adherence to tariffs, with 2023 data showing high performance metrics in its UK networks.

The company also focuses on transparent communication with its diverse investor base, utilizing AGMs and detailed reporting, as seen in its 2024 interim report, to maintain confidence.

Furthermore, CKI actively engages with local communities, investing in development and maintaining dialogue to secure its social license to operate, a strategy reinforced by its 2024 community initiatives.

| Relationship Type | Key Engagement Strategy | 2023/2024 Highlight |

| Government/Industrial Clients | Long-term contractual agreements, concession management | Stable revenue streams from infrastructure projects |

| Regulated Utility Customers | Service reliability, tariff adherence, transparent communication | High service reliability in UK networks, exceeding targets |

| Investors | Transparent reporting, regular communication channels (AGMs, reports) | 2024 interim report emphasized clear disclosures |

| Local Communities | Community investment, stakeholder dialogue, environmental stewardship | Continued commitment to responsible practices in 2024 |

Channels

CKI directly owns and operates a diverse portfolio of essential infrastructure assets, acting as the core channel for service delivery. This hands-on approach ensures control over quality and reliability for end-users.

This direct operational model encompasses critical sectors such as power generation, gas distribution networks, and water treatment facilities. For instance, in 2023, CKI's energy segment, which includes power plants, contributed significantly to its revenue streams.

By managing these assets directly, CKI can optimize performance and respond efficiently to market demands. This strategy underpins the company's ability to generate stable, long-term returns from its investments.

CK Infrastructure Holdings Limited (CKI) extensively utilizes joint ventures and associate companies as key channels to expand its global footprint and operational capabilities. This strategy allows CKI to tap into local expertise and share significant capital investments and associated risks across diverse infrastructure projects. For instance, in 2023, CKI's share of profit attributable to joint ventures and associates was HK$5.55 billion, demonstrating the substantial contribution of these partnerships to its overall financial performance.

These collaborative ventures enable CKI to access new markets and sectors more efficiently, leveraging the strengths and resources of its partners. This approach is particularly effective in large-scale infrastructure development where substantial upfront capital and specialized knowledge are often required. The company's involvement in projects like the Windsor wind farm in Australia, operated through a joint venture, exemplifies this channel's strategic importance in diversifying its energy portfolio.

For CK Infrastructure's regulated utility segments, existing distribution networks like electricity grids and gas pipelines are the core channels for service delivery. These established infrastructures are critical for reaching millions of customers across its operational territories.

In 2024, CK Infrastructure's regulated businesses, such as Hong Kong Electric and Power Assets, leverage these extensive networks. For instance, Hong Kong Electric's electricity grid is a vital artery, ensuring reliable power supply to over 2.4 million customers, demonstrating the direct link between the distribution network and customer reach.

The regulatory frameworks governing these utilities dictate operational standards and pricing, effectively shaping how these distribution channels function and generate revenue. These frameworks are crucial for maintaining the essential nature of the services provided through these networks.

Investor Relations Platforms

Investor Relations Platforms are crucial for CK Infrastructure's communication with its stakeholders. These channels facilitate transparency and provide essential information for decision-making. For instance, CK Infrastructure's official website serves as a primary hub, offering access to financial statements, news releases, and corporate governance information.

The company's commitment to open communication is evident through its presence on major stock exchanges. CK Infrastructure is listed on both the Hong Kong Stock Exchange (HKEX) and the London Stock Exchange (LSE), providing global investors with accessible trading and information. As of early 2024, CK Infrastructure Holdings Limited (110.HK) maintained a significant market capitalization, reflecting investor confidence.

CK Infrastructure regularly publishes comprehensive reports to keep investors informed. These include detailed annual reports, which in 2023 highlighted the company's diverse portfolio and financial performance, and sustainability reports, showcasing their commitment to environmental, social, and governance (ESG) principles. Investor presentations further elaborate on strategic initiatives and financial outlook.

- Official Website: Centralized information source for all investor-related materials.

- Stock Exchange Listings: Hong Kong Stock Exchange (HKEX) and London Stock Exchange (LSE) for global accessibility.

- Annual Reports: Detailed financial and operational performance reviews, with 2023 reports providing insights into diversified infrastructure assets.

- Sustainability Reports: Focus on ESG performance and long-term value creation.

- Investor Presentations: Strategic updates and financial outlooks shared with the investment community.

Industry Associations and Conferences

CK Infrastructure actively participates in industry associations and conferences. This engagement is crucial for networking with peers, sharing knowledge, and staying informed about evolving industry trends and potential investment prospects. For instance, in 2024, the company likely sent representatives to major infrastructure and engineering forums globally, such as the Global Infrastructure Summit or regional construction expos.

These events also serve as a platform to understand and influence emerging regulatory changes that could impact operations and future projects. By being involved, CK Infrastructure can contribute to shaping industry standards and best practices, ensuring a more predictable and favorable operating environment. The insights gained from these gatherings in 2024 would have informed strategic decisions regarding market entry or technological adoption.

- Networking Opportunities: Building relationships with key stakeholders, potential partners, and clients.

- Knowledge Exchange: Gaining insights into new technologies, project management techniques, and market intelligence.

- Industry Influence: Contributing to the development of standards and advocating for favorable policies.

- Trend Identification: Spotting emerging opportunities and potential disruptions in the infrastructure sector.

CKI's channels for reaching customers are primarily its directly owned and operated infrastructure assets, like power grids and water networks, which are essential for service delivery. Additionally, joint ventures and associate companies act as vital channels for global expansion and accessing new markets, leveraging partner expertise and shared capital. Industry associations and conferences serve as critical channels for knowledge exchange, networking, and influencing industry trends.

Customer Segments

Governments and municipalities represent a significant customer segment for CK Infrastructure, especially in the realm of regulated utilities and essential public services. These entities frequently engage CK Infrastructure for projects such as water treatment facilities, waste management systems, and public transportation networks, often securing these services through long-term contracts. For example, in 2024, numerous municipalities across various regions continued to award multi-year concessions for the operation and maintenance of their water infrastructure, reflecting a sustained demand for reliable utility management.

Large industrial and commercial businesses form a crucial customer segment, heavily relying on CK Infrastructure's core offerings like energy, water, and transportation. These entities, from manufacturing plants to major retail chains, demand consistent, high-volume services to maintain their operational efficiency and output. For example, in 2024, industrial electricity consumption in many developed economies remained robust, underscoring the continuous need for dependable power grids.

Residential consumers are the backbone of CK Infrastructure's (CKI) utility operations, directly benefiting from reliable electricity, gas, and water services. These households represent the primary customer base for CKI's regulated utility segments, such as the electricity distribution networks in Australia and the UK.

In 2024, CKI's Australian electricity distribution businesses served millions of homes, ensuring consistent power supply crucial for daily life. The demand from these residential customers underpins the stable, long-term revenue streams characteristic of regulated utility assets.

Institutional Investors and Shareholders

Institutional investors, including pension funds and asset managers, represent a core customer segment for CK Infrastructure Holdings (CKI). These investors are attracted to CKI's portfolio of essential infrastructure assets, which are known for their stable cash flows and long-term growth potential. For instance, as of the first half of 2024, CKI reported a significant portion of its revenue derived from its diversified infrastructure operations, appealing to those seeking reliable income streams.

Shareholders, both institutional and individual, are vital to CKI's financial health and strategic direction. They invest with the expectation of consistent dividend payouts and capital appreciation, underpinned by CKI's commitment to operational efficiency and strategic acquisitions. CKI's dividend history, consistently maintained or grown, demonstrates its dedication to shareholder returns.

- Institutional Investors: Pension funds, superannuation funds, and asset managers seeking stable, long-term returns from regulated utilities and infrastructure projects.

- Shareholders: A broad base of individual and institutional investors who value CKI's proven track record of dividend payments and capital growth.

- Financial Performance: Investors are drawn to CKI's resilient business model, which generated substantial revenue and profit in its core infrastructure segments throughout 2024, reflecting the essential nature of its services.

- Investment Strategy: CKI's focus on acquiring and developing infrastructure assets with predictable cash flows aligns with the risk-return profiles sought by its investor base.

Strategic Partners and Co-investors

CK Infrastructure Holdings Limited (CKI) actively engages with a crucial segment of strategic partners and co-investors. This group includes other major infrastructure companies, diverse investment funds, and large conglomerates. These entities collaborate with CKI, often through joint ventures and strategic acquisitions, recognizing the mutual benefits of resource and expertise pooling for undertaking substantial infrastructure projects.

These partnerships are vital for CKI's ability to execute large-scale, capital-intensive developments. For instance, in 2024, CKI continued to explore opportunities that leverage the financial strength and operational capabilities of such partners to expand its global footprint and diversify its project portfolio. The shared risk and reward model inherent in these collaborations allows for the pursuit of projects that might be too extensive or complex for a single entity to manage alone.

The strategic rationale for these partners often centers on gaining access to CKI's established operational expertise, its proven track record in managing complex infrastructure assets, and its extensive network. This symbiotic relationship enables the joint pursuit of significant projects, enhancing competitive positioning and maximizing potential returns for all involved parties.

- Strategic Partners: Other infrastructure firms and conglomerates.

- Investment Funds: Financial institutions seeking infrastructure exposure.

- Collaboration Avenues: Joint ventures and acquisitions for large projects.

- Mutual Benefits: Pooling resources, expertise, and risk for enhanced project execution.

CK Infrastructure's customer segments are diverse, ranging from governmental bodies and large corporations to individual households and sophisticated investors. These segments rely on CKI for essential services like utilities and transportation, with a strong emphasis on stable, long-term relationships.

The company also cultivates strategic partnerships with other major firms and investment funds, enabling the execution of large-scale projects through joint ventures and acquisitions. This broad customer base and partnership approach underscores CKI's position as a key player in the global infrastructure landscape.

| Customer Segment | Key Needs/Interests | 2024 Relevance |

|---|---|---|

| Governments & Municipalities | Reliable utility and public service provision, long-term contracts | Continued awarding of multi-year concessions for water infrastructure management. |

| Industrial & Commercial Businesses | Consistent, high-volume energy, water, and transportation services | Robust industrial electricity consumption in developed economies highlighting demand. |

| Residential Consumers | Dependable electricity, gas, and water supply for daily life | Millions of homes served by Australian electricity distribution networks, underpinning stable revenue. |

| Institutional Investors | Stable cash flows and long-term growth from infrastructure assets | Attracted by diversified operations generating substantial revenue, appealing for reliable income. |

| Shareholders | Consistent dividends and capital appreciation | Valued CKI's proven dividend history and commitment to operational efficiency. |

| Strategic Partners | Resource and expertise pooling for large infrastructure projects | Explored joint ventures and acquisitions to expand global footprint and diversify projects. |

Cost Structure

CKI's cost structure is heavily influenced by substantial capital expenditures, primarily for acquiring and developing infrastructure assets. These investments are crucial for the company's growth strategy, enabling it to expand its portfolio and enhance existing operations.

In 2024, CK Infrastructure Holdings reported significant capital expenditure commitments. For instance, its investments in the Hong Kong International Airport expansion project and various energy infrastructure developments globally represented a major outlay, underscoring the capital-intensive nature of its business model.

Operating and maintenance (O&M) costs are a significant component of CK Infrastructure's cost structure, reflecting the ongoing expenses tied to managing its extensive portfolio of assets. These costs encompass everything from the salaries of personnel who operate and maintain the infrastructure to the regular repairs and upkeep required to ensure their functionality and longevity.

In 2024, for instance, companies within the infrastructure sector often see O&M expenses representing a considerable percentage of their revenue, sometimes ranging from 15% to 30% depending on the asset type and its lifecycle stage. For CK Infrastructure, this would translate into substantial outlays for specialized equipment, energy consumption to power these assets, and the procurement of essential materials for routine maintenance and unforeseen repairs.

Financing costs, particularly interest expenses on substantial borrowings, represent a significant outlay for CK Infrastructure. Given the capital-intensive nature of their projects, managing these costs is crucial. For instance, in 2024, the company's interest expenses were a key factor influencing its overall profitability.

Regulatory and Compliance Costs

CK Infrastructure faces significant regulatory and compliance costs due to operating in multiple jurisdictions with varying legal frameworks. These expenses include obtaining and maintaining licenses, fulfilling extensive reporting obligations, and ensuring adherence to stringent environmental and safety standards across its diverse infrastructure projects.

For example, in 2024, infrastructure companies globally saw a continued rise in compliance expenditures. The International Monetary Fund (IMF) noted in its late 2024 report that increased focus on climate-related disclosures and cybersecurity mandates added an estimated 5-10% to the typical compliance budgets of large multinational corporations in the sector.

- Licensing Fees: Costs associated with permits and operating licenses in different countries and regions.

- Reporting Obligations: Expenses for preparing and submitting regular financial, operational, and environmental reports to regulatory bodies.

- Environmental, Social, and Governance (ESG) Compliance: Investments in meeting sustainability targets, pollution control, and safety protocols, which are becoming increasingly rigorous.

- Legal and Consulting Fees: Payments to legal experts and consultants to navigate complex regulatory landscapes and ensure adherence.

General and Administrative Expenses

General and administrative expenses for CK Infrastructure encompass the costs of running its global operations. This includes executive and management salaries, legal and compliance departments, IT infrastructure, and other essential corporate functions. For a company of CK Infrastructure's scale, these costs are significant, ensuring smooth and compliant business management across its diverse portfolio.

These overhead costs are crucial for maintaining the company's strategic direction and operational efficiency. In 2024, companies in the infrastructure sector often see G&A expenses ranging from 2% to 5% of revenue, depending on the complexity and geographic spread of their operations. For CK Infrastructure, managing these costs effectively is key to profitability.

- Corporate Overhead: Costs associated with central management, finance, human resources, and legal departments.

- Management Salaries: Compensation for the executive team and senior management overseeing global operations.

- Administrative Support: Expenses for administrative staff, office supplies, and IT services supporting the entire organization.

- Compliance and Regulatory Costs: Expenditures related to adhering to diverse international regulations and reporting requirements.

CK Infrastructure's cost structure is dominated by its substantial capital expenditures for asset acquisition and development, alongside ongoing operating and maintenance expenses. Financing costs, particularly interest on debt, and significant regulatory and compliance outlays also form key components. General and administrative expenses support its global operations.

| Cost Category | Key Components | 2024 Relevance/Examples |

|---|---|---|

| Capital Expenditures | Asset acquisition, project development | Hong Kong International Airport expansion, global energy infrastructure investments. |

| Operating & Maintenance (O&M) | Personnel, repairs, energy, materials | Estimated 15-30% of revenue for infrastructure assets, depending on type and lifecycle. |

| Financing Costs | Interest expenses on borrowings | Crucial factor influencing profitability due to capital-intensive projects. |

| Regulatory & Compliance | Licenses, reporting, ESG, legal fees | Increased by 5-10% in 2024 due to climate disclosures and cybersecurity mandates. |

| General & Administrative (G&A) | Corporate overhead, management salaries, IT | Typically 2-5% of revenue for infrastructure companies, supporting global operations. |

Revenue Streams

Regulated utility tariffs and fees form a cornerstone of CK Infrastructure Holdings Limited's (CKI) revenue. These are essentially the prices CKI charges for essential services like electricity, gas, and water distribution. The predictability is high because these rates are set by regulatory bodies, often with built-in adjustments for inflation, ensuring a consistent income stream. For instance, in 2023, CKI's infrastructure segment, which heavily relies on these regulated revenues, continued to demonstrate resilience.

Revenue streams from toll and usage fees are generated by charging users for access to transportation infrastructure like roads, bridges, and tunnels. This income is directly tied to the volume of traffic utilizing these assets.

For example, in 2024, many major toll road operators reported consistent revenue growth driven by increased commuter and commercial traffic. The performance of these assets is a key indicator of economic activity and mobility trends.

CK Infrastructure generates income through fees for waste management services, covering collection, processing, and disposal. This provides a steady revenue stream from essential public services.

A significant portion of revenue also comes from selling energy produced via waste-to-energy (WTE) facilities. For instance, in 2023, the company's WTE operations contributed substantially to its diversified income, showcasing the profitability of converting waste into a valuable energy resource.

Dividends from Investments and Joint Ventures

CKI generates revenue through dividends received from its substantial equity stakes in a diverse portfolio of infrastructure projects and strategic joint ventures. This income stream is a crucial component of its financial performance, reflecting the profitability of its operational assets.

For instance, in the first half of 2024, CK Infrastructure Holdings (CKI) reported a significant contribution from its investments. Dividends received from associates and joint ventures amounted to HK$2,568 million, a notable increase from the previous year, underscoring the growing returns from its global infrastructure holdings.

- Dividends from Equity Interests: CKI earns revenue by receiving dividend payouts from companies where it holds a significant ownership stake, such as its investments in the UK water sector and Australian infrastructure assets.

- Joint Venture Profit Sharing: A portion of the profits generated by jointly owned infrastructure projects, like toll roads or energy facilities, are distributed to CKI as dividends, contributing directly to its revenue.

- Performance-Based Distributions: The amount of dividends received often correlates with the operational performance and profitability of the underlying investments and joint ventures, providing a variable but potentially high-yield revenue source.

Infrastructure Materials Sales

CK Infrastructure’s revenue streams include the sale of essential infrastructure materials. These materials, such as cement, concrete, asphalt, and aggregates, are key components in construction projects.

The company primarily markets these materials within Hong Kong and Mainland China, leveraging its established presence in these significant construction markets. This localized approach allows for efficient distribution and catering to regional demand.

For example, in 2023, the construction materials sector in Hong Kong saw continued activity driven by ongoing infrastructure development. While specific figures for CK Infrastructure’s material sales aren't always broken out separately, the overall market performance indicates a robust demand environment.

- Cement Sales: Providing foundational materials for concrete production.

- Concrete and Asphalt: Supplying ready-mix concrete and asphalt for road construction and building.

- Aggregates: Offering crushed stone and sand essential for various construction applications.

CKI's revenue is significantly bolstered by dividends from its substantial equity stakes in various infrastructure projects and joint ventures globally. This income reflects the profitability of its operational assets and is a key financial performance driver.

The company's investments, such as those in the UK water sector and Australian infrastructure, consistently generate these dividend revenues. For the first half of 2024, CKI reported HK$2,568 million in dividends from associates and joint ventures, a notable increase that highlights the growing returns from its international holdings.

| Revenue Stream | Description | Key Drivers | 2024 Data (H1) |

|---|---|---|---|

| Dividends from Equity Interests | Income from ownership stakes in other companies | Profitability of underlying assets, investment performance | HK$2,568 million |

| Joint Venture Profit Sharing | Distributions from profits of jointly owned projects | Operational success of ventures, contract terms | Included in overall dividend figures |

| Performance-Based Distributions | Variable income linked to asset performance | Efficiency, market demand, regulatory environment | Correlated with dividend growth |

Business Model Canvas Data Sources

The CK Infrastructure Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial projections, and expert industry analysis. These data sources ensure each element of the canvas, from key resources to cost structure, is informed by current trends and realistic operational capabilities.