CK Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

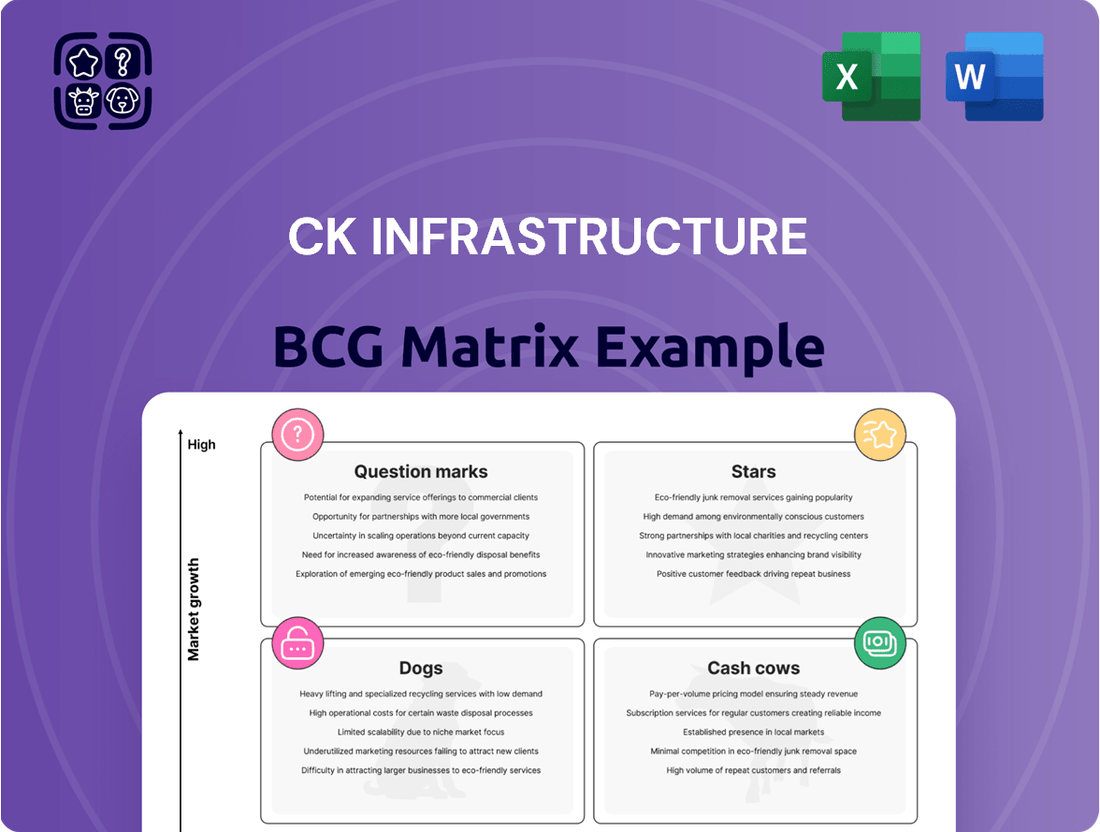

CK Infrastructure's BCG Matrix reveals a strategic portfolio balancing established giants with emerging opportunities. Understand which of their ventures are generating consistent cash flow and which require careful nurturing to become future market leaders.

This glimpse into CK Infrastructure's product landscape is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, actionable insights into growth strategies, and a clear roadmap for optimizing their diverse business units.

Don't miss out on the complete picture of CK Infrastructure's market position. The full BCG Matrix provides the essential data and strategic recommendations to confidently navigate their investments and capitalize on future growth.

Stars

CK Infrastructure's renewable energy projects, particularly in wind and solar, are positioned as Stars in the BCG Matrix. Their strategic focus on the UK market, a region experiencing robust growth driven by decarbonization efforts, highlights this.

The company's significant investments, including the acquisition of 32 UK wind farms and additional solar and wind assets in 2024, underscore their commitment. These moves are expected to capitalize on the expanding clean energy market, promising substantial future returns and market share growth.

UK Power Networks, a key electricity distributor in the UK, fits the profile of a Star in the BCG Matrix. It functions within a mature market characterized by stable electricity demand.

The company's position is strengthened by its substantial infrastructure and consistent revenue streams. In 2024, UK Power Networks continued its significant investment in network upgrades, with capital expenditure focused on enhancing reliability and supporting the shift to electric vehicles and renewable energy sources.

CK Infrastructure's acquisition of a 40% stake in Phoenix Energy in 2024 positions it within Northern Ireland's primary natural gas distribution network. This move into a regulated utility sector offers predictable revenue streams, a key characteristic of a cash cow in the BCG matrix.

Phoenix Energy, serving over 320,000 customers across Northern Ireland, benefits from a stable regulatory environment. The network's established infrastructure and potential for growth through increased gas connections and the integration of green gases suggest a strong position for continued, albeit moderate, expansion.

Canadian Power Assets

CK Infrastructure's Canadian power assets are a significant component of its diversified energy holdings. These include a stake in the Okanagan wind farms, a prime example of its investment in the burgeoning renewable energy sector.

The renewable energy market in Canada, particularly for wind power, demonstrates strong growth potential. In 2024, Canada continued to expand its renewable energy capacity, with wind power playing a crucial role. For instance, projects like the aforementioned Okanagan wind farms contribute to a stable and growing demand for clean energy solutions.

- Canadian Power Assets: CK Infrastructure holds interests in various Canadian power generation and distribution facilities.

- Renewable Energy Focus: A key part of this portfolio includes investments in wind energy, such as the Okanagan wind farms.

- Market Dynamics: These assets operate within a Canadian market that shows consistent growth in demand for clean energy.

- Growth Potential: The stable and expanding nature of the clean energy market suggests continued high growth prospects and potential for market leadership for these assets.

Strategic Acquisitions in High-Growth Regions

CK Infrastructure demonstrates a keen strategic focus on acquiring high-growth infrastructure assets, notably in burgeoning European and Australian markets. This proactive approach targets sectors like renewable energy and waste management, areas poised for significant expansion. The company's 2024 acquisition strategy is specifically geared towards securing immediate revenue streams and solidifying its market presence in these dynamic regions.

These strategic moves are designed to capitalize on evolving market demands and regulatory shifts favoring sustainable infrastructure development. For instance, investments in renewable energy projects are aligned with global decarbonization trends, ensuring long-term value creation.

- Renewable Energy Expansion: CK Infrastructure's 2024 acquisitions in solar and wind power across Europe are projected to contribute significantly to its renewable energy portfolio.

- Waste Management Growth: The company's strategic entry into advanced waste-to-energy facilities in Australia reflects a commitment to circular economy principles and growing waste management needs.

- Market Position Enhancement: These targeted acquisitions aim to bolster CK Infrastructure's competitive standing in key high-growth infrastructure segments.

- Revenue Generation: The newly acquired assets are expected to generate substantial immediate revenues, reinforcing the company's financial performance.

CK Infrastructure's renewable energy ventures, particularly in wind and solar, are strong Stars in the BCG matrix, driven by robust market growth and strategic investments. Their significant acquisitions in 2024, like UK wind farms and solar assets, solidify their position to capture expanding clean energy demand and market share.

UK Power Networks, a leading UK electricity distributor, is also a Star. Despite operating in a mature market, its substantial infrastructure, stable revenues, and crucial investments in network upgrades for EVs and renewables ensure continued high growth prospects.

| Asset | BCG Category | Market Growth | CKI's Role/Investment | 2024 Highlight |

|---|---|---|---|---|

| UK Wind & Solar | Star | High (Decarbonization) | Significant Investments, Acquisitions | Acquisition of 32 UK wind farms |

| UK Power Networks | Star | Stable but growing (EVs, Renewables) | Major Infrastructure, Consistent Revenue | Network upgrades investment |

| Canadian Power Assets (Okanagan Wind) | Star | High (Clean Energy Demand) | Interest in Wind Farms | Continued expansion of renewable capacity |

What is included in the product

The CK Infrastructure BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investment, divestment, or maintenance for each unit.

A clear visual of CK Infrastructure's business units, instantly clarifying strategic priorities.

Cash Cows

Established UK regulated utilities, like Northern Gas Networks and Wales & West Utilities, are prime examples of cash cows within CK Infrastructure's portfolio. Their mature market positions and predictable regulatory environments, often allowing for guaranteed return on assets, translate into consistent and substantial cash flow generation. For instance, in 2023, the UK regulated gas distribution sector as a whole continued to demonstrate resilience, with companies like National Grid Gas Transmission reporting stable operational performance.

CK Infrastructure's Australian infrastructure portfolio, encompassing entities like SA Power Networks, Victoria Power Networks, and Australian Gas Networks, represents mature, cash-generating assets. These businesses are fundamental to the Australian economy, providing essential utility services.

In 2023, CK Infrastructure Holdings reported that its Australian segment, which includes these infrastructure assets, contributed HK$2,486 million to group profit attributable to owners, a notable increase from HK$2,039 million in 2022. This demonstrates the resilience and ongoing profitability of these operations, despite potential headwinds.

CK Infrastructure's long-standing investments in Hong Kong and Mainland China's infrastructure, including its concrete business and toll roads, are classic cash cows. These mature assets, with deeply entrenched market positions, consistently generate a stable income stream, underpinning the group's overall financial health. For instance, in 2023, CK Infrastructure reported substantial contributions from its regional infrastructure portfolio, highlighting the dependable profitability these established operations provide.

Water Treatment Facilities

CK Infrastructure's water treatment facilities, especially those in established economies, function as vital utilities. They benefit from consistent demand and predictable, regulated revenue, fitting the profile of a cash cow.

These operations typically hold a significant market position within a mature, slow-growth industry. This allows them to reliably produce substantial cash flows without requiring heavy investment in marketing or expansion. For instance, CK Infrastructure's involvement in the UK water sector, a market characterized by stable regulatory frameworks, exemplifies this cash cow status.

- High Market Share: Dominant presence in mature water treatment markets.

- Stable Demand: Essential services ensure consistent customer base.

- Regulated Income: Predictable revenue streams due to regulatory oversight.

- Strong Cash Generation: High profitability with low reinvestment needs.

Long-term Contracted Infrastructure

CK Infrastructure's substantial portfolio of assets operating under long-term contracts is a prime example of a cash cow in the BCG matrix. These contracts ensure a steady and predictable flow of revenue, bolstering the company's financial stability.

These contracted infrastructure assets typically boast high profit margins due to the secured nature of their revenue streams, minimizing the need for significant new capital expenditure. This allows them to generate consistent and substantial cash flow for CK Infrastructure.

- Predictable Revenue: Long-term contracts provide a reliable income stream, insulating the business from short-term market volatility.

- High Profit Margins: The secured nature of these contracts allows for efficient operations and strong profitability.

- Low Reinvestment Needs: Established infrastructure assets require minimal ongoing investment to maintain their cash-generating capacity.

- Consistent Cash Flow Generation: These assets are the primary engine for generating surplus cash that can be deployed to fund other business initiatives or return to shareholders.

CK Infrastructure's established utility businesses, like those in the UK and Australia, are classic cash cows. These operations benefit from mature markets and predictable regulatory environments, ensuring consistent revenue generation with minimal need for further investment.

These assets, such as SA Power Networks and Northern Gas Networks, are vital for economic stability and consistently deliver strong profits. For instance, CK Infrastructure's Australian segment saw its profit attributable to owners rise to HK$2,486 million in 2023, up from HK$2,039 million in 2022, underscoring the reliable performance of these mature infrastructure holdings.

| Asset Type | Geographic Focus | 2023 Profit Contribution (HK$ million) | Key Characteristic |

|---|---|---|---|

| Regulated Gas Networks | United Kingdom | Stable, predictable | Mature market, regulatory oversight |

| Electricity & Gas Networks | Australia | 2,486 | Essential services, consistent demand |

| Toll Roads & Concrete | Hong Kong & Mainland China | Substantial | Deeply entrenched market position |

Full Transparency, Always

CK Infrastructure BCG Matrix

The CK Infrastructure BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks or sample data; you'll get a professional, analysis-ready report designed to provide strategic insights into CK Infrastructure's portfolio. The content and layout are identical to the final deliverable, ensuring you know precisely what you're acquiring for your business planning needs.

Dogs

CK Infrastructure might hold older, less efficient infrastructure assets in markets experiencing minimal to no growth. These could be specific, aging power plants or transportation routes facing reduced demand or rising operational expenses without substantial market presence.

Such assets often become cash traps, consuming capital without generating sufficient returns. For instance, a legacy coal-fired power plant in a region with strong renewable energy policies might exemplify this, potentially requiring significant ongoing investment for compliance or facing accelerated depreciation.

In 2024, the global infrastructure sector saw varied performance, with some mature markets showing slower development. Assets in these regions, especially those with high maintenance costs and limited modernization potential, could be prime examples of underperformers within CK Infrastructure's portfolio.

Small, Non-Strategic Investments represent those smaller stakes a company holds in businesses that don't directly support its main goals or are in slow-growing markets. These might be niche ventures or minority holdings.

While these investments aren't actively losing money, their contribution to the company's overall financial health is minimal. For instance, a large infrastructure firm like CK Infrastructure Holdings (1169.HK) might hold a small percentage in a regional waste management company that doesn't fit its large-scale project focus.

The concern here is that these minor assets can divert valuable management time and resources away from more critical, high-return strategic initiatives. In 2023, CK Infrastructure reported total revenue of HK$59.1 billion, and while specific figures for such minor investments aren't usually broken out, any disproportionate attention on them could impact the efficiency of managing their core, significant assets.

Divested or held-for-sale assets in CK Infrastructure's portfolio would be classified as Dogs. These are assets CK Infrastructure is looking to exit because they have low market share and low growth prospects, meaning they are not contributing to the company's long-term growth strategy. For instance, if CK Infrastructure were to divest a small, underperforming utility in a mature market, it would likely be categorized here.

Assets with Regulatory Headwinds and Low Market Share

CK Infrastructure Holdings (CKI) might identify specific assets within its portfolio that are experiencing significant regulatory headwinds and simultaneously possess a low market share. These are typically considered ‘Dogs’ in the BCG Matrix, indicating low growth and low relative market share, further exacerbated by external pressures.

For instance, an asset operating in a highly regulated utility sector where new environmental compliance costs have drastically increased, and CKI holds less than 5% of the local market, would fit this description. The inability to pass these increased operational costs onto consumers due to market saturation or price controls can severely erode profitability, making such assets a drain on resources.

Consider a hypothetical scenario where CKI has a stake in a renewable energy project in a region that has recently imposed new licensing fees and stricter operational standards. If CKI’s share of the regional renewable energy market is only 3%, and these new regulations add 15% to the project’s annual operating expenses, the asset’s viability becomes questionable. This situation exemplifies a ‘Dog’ asset struggling under regulatory burdens and a weak competitive position.

- Regulatory Impact: Assets facing increased compliance costs or operational restrictions due to new legislation.

- Market Position: Assets with a low relative market share, limiting pricing power and economies of scale.

- Profitability Concerns: Situations where the cost of compliance cannot be passed on, leading to reduced or negative margins.

- Strategic Consideration: These assets typically require careful evaluation for divestment or significant restructuring to improve their standing.

Infrastructure Materials Businesses with Declining Demand

Infrastructure materials businesses facing declining demand, often characterized by overcapacity or shifts to newer technologies, would be categorized as Dogs in CK Infrastructure's BCG Matrix. These segments struggle to generate substantial cash flow and typically have low market share. For instance, a business focused on traditional concrete production in a region where demand has fallen due to reduced construction activity or the adoption of alternative building materials would fit this profile.

Such operations would likely exhibit low profitability and minimal growth prospects. CK Infrastructure would likely avoid further investment in these areas, focusing instead on divesting or restructuring to minimize losses. In 2024, global demand for certain traditional construction materials like standard asphalt experienced a slowdown in some developed markets, impacting companies heavily reliant on these products.

- Low Market Share: Businesses in this category often possess a small portion of the overall market for their products or services.

- Declining Demand: The core issue is a shrinking customer base or reduced purchasing volume for their offerings.

- Low Profitability: Due to weak demand and potentially high fixed costs, these businesses struggle to achieve consistent profits.

- Minimal Investment: Further capital allocation is generally not recommended, as returns are unlikely to justify the expenditure.

Assets classified as Dogs within CK Infrastructure's portfolio are those with low market share and low growth prospects, often requiring divestment. These could include legacy infrastructure materials businesses facing declining demand, like concrete production, or niche, non-strategic investments that consume resources without significant returns. In 2024, a slowdown in demand for traditional construction materials in some developed markets highlights the challenges faced by such Dog assets.

Question Marks

CK Infrastructure is actively investigating new energy frontiers, with hydrogen infrastructure emerging as a key focus. This sector is characterized by its high-growth potential and significant future promise, though CK Infrastructure currently holds a relatively small market share within it.

The company's involvement in nascent technologies like hydrogen represents a speculative investment strategy. These ventures demand considerable capital for development and scaling, offering uncertain yet potentially substantial returns down the line.

For context, global investment in hydrogen energy is projected to reach hundreds of billions of dollars by 2030, with significant government backing and corporate interest driving innovation. For example, the International Energy Agency reported in 2024 that global hydrogen production capacity saw a notable increase, signaling growing momentum.

CK Infrastructure (CKI) has explored bids for struggling utility companies, such as the UK's Thames Water. This move aligns with a high-risk, high-reward approach within CKI's strategic considerations, potentially fitting into a 'question mark' category if viewed through a BCG matrix lens, signifying high market growth but low relative market share or current profitability.

Acquiring a distressed utility like Thames Water, which faced significant financial and operational challenges in 2023 and 2024, presents a scenario demanding substantial capital investment for turnaround. While essential services offer long-term growth potential, the immediate hurdles, including regulatory scrutiny and debt management, make their future prospects uncertain, requiring careful strategic evaluation.

CK Infrastructure's early-stage waste-to-energy projects in nascent markets would likely be classified as Question Marks in the BCG Matrix. These ventures target high-growth environmental sectors but face uncertainty regarding market acceptance and technological maturity. For instance, as of 2024, the global waste-to-energy market is projected to grow significantly, but adoption in emerging economies often requires substantial upfront capital and regulatory support to overcome initial hurdles.

Unproven Digital Infrastructure Investments

Investments in unproven digital infrastructure, such as nascent smart city technologies or novel data transmission methods, fall into the question mark category of the BCG matrix. These ventures represent high-growth potential but also carry significant risk due to uncertain market adoption and substantial capital outlays. For instance, the global smart cities market was projected to reach $1.5 trillion by 2025, indicating massive future opportunity, but the specific technologies within this space are still maturing.

- High Risk, High Reward Potential: These investments target rapidly evolving sectors with the possibility of capturing significant market share if successful.

- Uncertain Market Adoption: The success of new digital infrastructure depends heavily on consumer and business acceptance, which is difficult to predict.

- Significant Capital Requirements: Developing and deploying unproven technologies often demands extensive upfront investment with no guarantee of return.

- Strategic Evaluation Needed: Companies must carefully assess the competitive landscape and technological viability before committing resources to these areas.

Expansion into Emerging Market Infrastructure

CK Infrastructure's (CKI) expansion into emerging market infrastructure aligns with its global diversification strategy, targeting regions with substantial infrastructure development needs. These markets, while presenting significant growth opportunities, often start with CKI having a relatively low market share.

The inherent risks in these developing economies, coupled with the substantial capital required to build a strong presence, position these ventures as potential 'question marks' in a BCG matrix analysis. For instance, by 2024, many emerging economies were still grappling with significant infrastructure deficits, with the Asian Development Bank estimating that developing Asia needs $1.7 trillion annually in infrastructure investment through 2030.

- High Growth Potential: Emerging markets often experience rapid economic expansion, driving demand for new and upgraded infrastructure like power grids, transportation networks, and utilities.

- Low Initial Market Share: CKI's entry into these markets typically begins with a limited existing presence, requiring substantial investment to gain traction and compete effectively.

- Higher Risk Profile: Factors such as political instability, regulatory uncertainty, and currency fluctuations in emerging markets can increase the risk associated with infrastructure projects.

- Capital Intensive: Establishing a foothold in these markets demands significant upfront capital for project development, construction, and operational setup.

Question Marks in CK Infrastructure's portfolio represent investments in high-growth potential sectors where the company currently holds a small market share. These ventures, like hydrogen infrastructure or early-stage waste-to-energy projects, demand significant capital and face market adoption uncertainties. For example, global investment in hydrogen energy is projected to reach hundreds of billions by 2030, highlighting the sector's growth trajectory.

CKI's exploration of acquiring distressed utilities, such as Thames Water, also fits the Question Mark profile. While essential services offer long-term growth, the immediate challenges and capital needs make their future prospects uncertain. The global smart cities market, projected to reach $1.5 trillion by 2025, illustrates the potential but also the nascent stage of some digital infrastructure investments.

Emerging market infrastructure development, requiring substantial capital and facing higher risk profiles, also falls into this category. Developing Asia alone needs $1.7 trillion annually in infrastructure investment through 2030, indicating the scale of opportunity and the initial low market share for new entrants like CKI.

| Investment Area | Market Growth Potential | CKI Market Share | Capital Requirement | Risk Level |

|---|---|---|---|---|

| Hydrogen Infrastructure | High | Low | High | High |

| Waste-to-Energy (Nascent Markets) | High | Low | High | High |

| Nascent Digital Infrastructure (e.g., Smart City Tech) | High | Low | High | High |

| Emerging Market Infrastructure | High | Low | High | High |

| Distressed Utility Acquisition (e.g., Thames Water) | Medium to High (depending on turnaround) | Low (initially) | High | High |

BCG Matrix Data Sources

Our CK Infrastructure BCG Matrix leverages a robust blend of public financial disclosures, industry-specific market research, and expert analyses to provide a comprehensive view of portfolio performance.