CK Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

CK Infrastructure operates in a landscape shaped by intense competition and strategic supplier relationships. Understanding the nuances of buyer power and the threat of substitutes is crucial for navigating its market.

The complete report reveals the real forces shaping CK Infrastructure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CK Infrastructure Holdings (CKI) depends heavily on specialized equipment and advanced technology providers to maintain and upgrade its vast infrastructure assets, spanning power, water, and gas sectors. The proprietary nature of certain technologies, like sophisticated smart grid systems or cutting-edge waste-to-energy components, can significantly bolster the bargaining power of these suppliers.

This leverage is amplified when CKI requires unique, high-value components for which only a limited number of suppliers can provide viable alternatives. For instance, in 2024, the global market for advanced grid management software saw a concentration of key players, potentially allowing them to dictate terms and pricing for essential upgrades to CKI's power distribution networks, impacting project costs and timelines.

CK Infrastructure Holdings (CKI) relies on a select group of large construction and engineering firms for its significant infrastructure projects, whether they involve new builds, upgrades, or essential maintenance. This reliance is particularly pronounced for complex, large-scale undertakings that demand specialized regional knowledge and adherence to stringent regulatory frameworks.

The scarcity of contractors possessing the requisite expertise and capacity for such demanding projects grants these suppliers substantial bargaining power. For instance, in 2023, major infrastructure projects globally saw bidding wars among a limited pool of top-tier engineering firms, driving up contract values. Any disruption or escalation in costs stemming from these contractors can directly affect CKI's financial performance and the timely completion of its development pipelines.

Raw material and commodity providers hold significant sway over CK Infrastructure Holdings Limited (CKI). Fluctuations in the prices of essential inputs like steel, concrete, and specialized chemicals directly affect CKI's project costs. For instance, a 10% increase in steel prices, a key component in infrastructure projects, could substantially raise capital expenditure for new developments.

The bargaining power of these suppliers is amplified when CKI relies heavily on specific commodities, such as natural gas for its gas distribution networks or coal for certain power generation facilities. While CKI’s regulated businesses offer some ability to pass on increased costs to consumers, unregulated segments are more vulnerable to price spikes, directly impacting profitability and potentially increasing supplier leverage.

Global supply chain disruptions, a recurring theme in recent years, further empower suppliers. These disruptions can limit availability and drive up prices, as seen with the volatility in shipping costs and raw material availability throughout 2023 and into 2024, forcing CKI to manage its procurement strategies more carefully.

Labor Unions and Skilled Workforce

The specialized skills needed for infrastructure operation and maintenance mean that a qualified workforce is a crucial input. In many of the regions where CK Infrastructure Holdings (CKI) operates, these skilled workers are often organized into powerful labor unions. This collective bargaining power can significantly influence labor costs and employment conditions.

Labor disputes, demands for higher wages, or simply a scarcity of individuals with the necessary expertise can directly impact CKI's operational expenses and the reliability of its services. For instance, in 2024, several infrastructure sectors globally experienced heightened union activity, leading to wage increases that added to operating costs. This situation underscores the substantial bargaining power of the workforce as a supplier of essential human capital.

- Skilled Workforce Dependency: Infrastructure projects require highly specialized technical skills for ongoing operations and maintenance, making a skilled labor pool indispensable.

- Unionization Impact: The presence of strong labor unions in key operating regions amplifies the bargaining power of employees, potentially leading to increased labor costs and stricter work conditions.

- Cost and Disruption Risks: Labor disputes, wage negotiations, and potential shortages of qualified personnel can directly increase CKI's operational expenditures and risk service disruptions.

Financing Providers (Debt and Equity)

Financing providers, including banks and capital markets, exert considerable bargaining power over CK Infrastructure (CKI). While CKI maintains a robust financial standing with significant cash reserves and favorable credit ratings, its ability to fund large-scale acquisitions and ongoing projects hinges on external debt and equity. In 2024, the impact of rising interest rates became a key factor, directly increasing the cost of capital for CKI and its peers.

Lenders and investors, particularly for substantial transactions, possess significant leverage. They can dictate crucial terms such as interest rates, repayment schedules, and equity stakes, thereby influencing CKI's potential investment returns and its capacity for future expansion. This power dynamic is amplified when the capital markets tighten, making financing more scarce and expensive.

- Cost of Capital: Rising interest rates in 2024 directly increased CKI's borrowing costs, impacting project profitability.

- Deal Terms: Lenders can impose stringent conditions on large financing deals, affecting CKI's operational flexibility.

- Investor Influence: Equity investors can demand higher returns or greater control, particularly in competitive financing environments.

- Market Conditions: Tightening credit markets in 2024 gave financing providers greater leverage in setting terms for infrastructure projects.

CK Infrastructure Holdings (CKI) faces significant bargaining power from its suppliers, particularly in specialized equipment, raw materials, and skilled labor. The proprietary nature of certain technologies and the limited number of qualified contractors for large-scale projects grant these suppliers considerable leverage. For instance, the concentration in advanced grid management software in 2024 allowed key players to influence pricing for CKI's power network upgrades.

Global supply chain volatility, as seen with shipping costs and raw material availability in 2023-2024, further empowers commodity providers. Additionally, strong labor unions in CKI's operating regions can dictate terms, with heightened union activity in 2024 leading to increased labor costs across various infrastructure sectors.

Financing providers also hold substantial sway. In 2024, rising interest rates directly increased CKI's cost of capital, allowing lenders to impose stricter terms on debt and equity financing for major projects, impacting CKI's expansion capabilities and potential returns.

What is included in the product

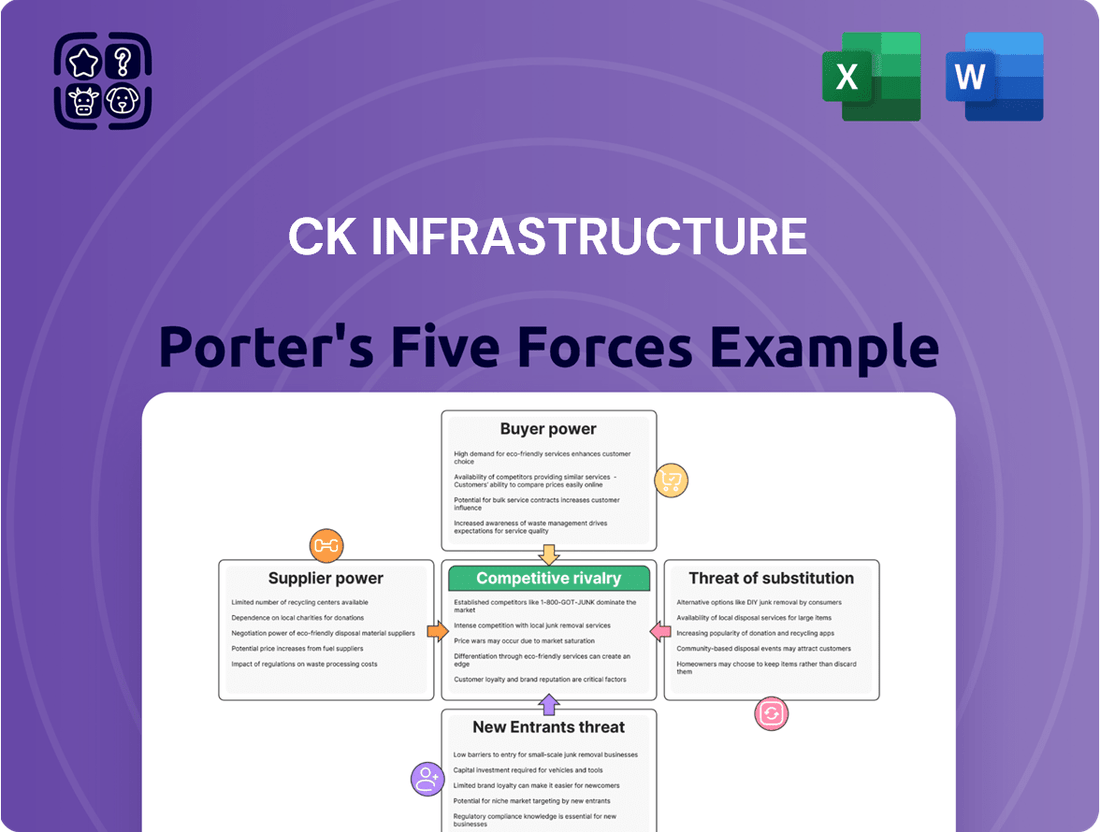

This analysis dissects the competitive forces impacting CK Infrastructure, evaluating the threat of new entrants, the bargaining power of suppliers and buyers, the intensity of rivalry, and the threat of substitutes.

Instantly identify and prioritize competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic dashboard.

Customers Bargaining Power

For many of CK Infrastructure's (CKI) core businesses like energy and water, regulators act as the primary voice for customers. These independent bodies have significant sway over pricing and service quality, directly influencing CKI's earnings. For instance, past regulatory resets in the UK and Australia led to reduced allowed returns, a clear demonstration of this customer-proxy power.

For CK Infrastructure (CKI), large industrial and commercial clients can wield significant bargaining power, particularly in specialized infrastructure services like direct energy supply or major waste management contracts. Their substantial consumption volumes mean CKI has a vested interest in retaining their business, allowing these clients to negotiate for better pricing or bespoke service packages.

This leverage is amplified if these clients have access to alternative providers or the capacity to develop self-supply solutions, creating a credible threat that CKI must consider. For instance, a large manufacturing plant requiring a consistent, high-volume power supply might negotiate directly with CKI for a dedicated connection and preferential rates, especially if other energy providers or on-site generation options exist.

In 2024, the trend towards energy independence and diversified supply chains for large corporations further bolsters customer bargaining power. Companies are increasingly exploring renewable energy sources and microgrids, which can reduce their reliance on traditional infrastructure providers like CKI, giving them more room to negotiate terms on existing contracts.

Local authorities and municipalities represent a significant customer segment for CK Infrastructure (CKI), particularly in essential services like waste management and water provision. These entities often operate through competitive tender processes for long-term contracts, granting them considerable leverage.

Their power stems from controlling access to vast customer bases and dictating contract terms, service standards, and renewal stipulations. This directly influences CKI's operational reach and revenue predictability within these service areas.

For instance, in the UK, local government spending on waste management services was projected to exceed £5 billion in 2024, highlighting the substantial financial commitment and the bargaining power these authorities wield in contract negotiations.

Toll Road and Bridge Users

The bargaining power of individual toll road and bridge users is generally low. For a specific route, drivers often have no practical alternatives, making them price takers. For instance, in 2024, the absence of comparable public transport options on many major intercity routes reinforces this.

However, this low individual power can coalesce into significant collective influence. Widespread public dissatisfaction with toll rates can manifest as organized protests or political lobbying. This was evident in several regions during 2024 where public campaigns against rising toll fees led to political scrutiny and, in some cases, reviews of tolling policies, indirectly impacting revenue streams for infrastructure operators like CK Infrastructure.

- Low Individual Bargaining Power: Drivers typically lack viable alternative routes for essential commutes or freight transport.

- Potential for Collective Action: Public outcry and political pressure can emerge if tolls are perceived as excessive, influencing pricing.

- Impact on Revenue: Aggregated customer dissatisfaction can lead to regulatory intervention or public campaigns that affect toll revenue.

Diversified Customer Base

CK Infrastructure's extensive global reach and presence across multiple essential sectors significantly dilute the bargaining power of its customers. By serving millions of individuals and businesses worldwide in areas like energy, water, transportation, and waste management, the company avoids over-reliance on any single customer group.

This diversification means that while individual customers or specific segments might have some leverage, the sheer volume and variety of CKI's customer base prevent any one group from dictating terms. For instance, in 2023, CKI reported revenue from a vast array of regulated and contracted utilities, demonstrating the broad spread of its customer relationships.

- Geographic Diversification: Operations span across Europe, Australia, Asia, and North America, reducing dependence on any single regional market.

- Sectoral Diversification: Involvement in energy, water, transportation, and waste management provides resilience against downturns in any one sector.

- Large Customer Volume: Serving millions of end-users globally inherently limits the influence of any individual or small group of customers.

CK Infrastructure's (CKI) customers, particularly large industrial and commercial entities, possess significant bargaining power. Their ability to negotiate favorable pricing and tailored services is amplified by the availability of alternative providers or the potential for self-supply, as seen with large manufacturers exploring on-site energy generation. This dynamic is further strengthened in 2024 by corporate trends towards energy independence and diversified supply chains.

Local authorities and municipalities also wield considerable influence through competitive tender processes for essential services like waste management. Their control over access to large customer bases and their ability to dictate contract terms directly impact CKI's revenue predictability. For example, UK local government spending on waste management was projected to exceed £5 billion in 2024, illustrating the financial clout of these entities.

While individual toll road users generally have low bargaining power due to a lack of alternatives, collective dissatisfaction can lead to protests and political lobbying. This was observed in 2024, where public campaigns against toll increases prompted policy reviews, indirectly affecting infrastructure operators.

CKI's extensive global and sectoral diversification, serving millions worldwide across energy, water, transport, and waste management, inherently dilutes the bargaining power of any single customer group. This broad customer base, evidenced by CKI's diverse revenue streams in 2023, prevents any one segment from dictating terms.

| Customer Segment | Bargaining Power Factors | 2024 Context/Data |

|---|---|---|

| Large Industrial/Commercial Clients | Volume, alternatives, self-supply potential | Growing interest in on-site renewables, supply chain diversification |

| Local Authorities/Municipalities | Control of customer base, tender processes, contract terms | UK waste management spending projected > £5bn in 2024 |

| Individual Toll Road Users | Low individual power, potential for collective action | Public campaigns against toll increases in 2024 led to policy reviews |

| Overall CKI Customer Base | Geographic & sectoral diversification, large volume | Revenue from diverse regulated utilities in 2023 |

Preview Before You Purchase

CK Infrastructure Porter's Five Forces Analysis

This preview showcases the complete CK Infrastructure Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

CK Infrastructure Holdings (CKI) faces fierce competition for desirable infrastructure assets worldwide. This rivalry comes from other major global infrastructure players, large pension funds, and sovereign wealth funds, all seeking stable, long-term returns. For example, in 2024, the global infrastructure investment market saw significant activity, with many deals facing multiple bids, pushing acquisition prices higher and potentially lowering expected investment returns.

The global infrastructure market, while substantial, is characterized by significant fragmentation. This means CK Infrastructure (CKI) faces a diverse array of competitors, from local utility providers to other large multinational corporations, depending on the specific region and sector it operates in. This dynamic landscape necessitates a tailored approach to competition across CKI's varied business segments.

CK Infrastructure’s (CKI) competitive rivalry is shaped by the highly regulated nature of its core assets like electricity and gas. Once a license is obtained, direct operational competition within a specific service area is typically minimal. This means rivalry often manifests in the bidding for new licenses or concessions, and in less regulated adjacent infrastructure sectors.

While regulatory resets are anticipated to be less impactful in 2025, they still play a crucial role in defining competitive dynamics. For instance, in the UK, Ofgem's RIIO framework for electricity network price controls significantly influences the profitability and investment capacity of companies like CKI, impacting their ability to compete for future projects.

Financial Strength and Investment Capacity

CK Infrastructure's robust financial standing, evidenced by approximately HK$8 billion in cash reserves at the close of 2024 and a favorable net debt-to-total capital ratio of 7.8%, significantly bolsters its competitive edge. This financial strength allows CKI to aggressively pursue substantial acquisition opportunities and maintain stability during economic downturns.

This financial muscle directly translates into a competitive advantage, enabling CKI to outbid or strategically position itself ahead of rivals with weaker financial backing, particularly in the arena of large-scale infrastructure projects.

- Financial Position: Approximately HK$8 billion in cash on hand as of end-2024.

- Leverage: Healthy net debt-to-total capital ratio of 7.8%.

- Competitive Advantage: Ability to pursue large acquisitions and outmaneuver less capitalized rivals for major infrastructure deals.

Operational Efficiency and Synergies

Competitive rivalry in infrastructure extends to operational efficiency and the realization of synergies across diverse asset portfolios. CK Infrastructure Holdings (CKI) actively pursues this by optimizing operations, reducing debt financing costs, and centralizing management functions across its regional holdings to enhance profitability.

Companies demonstrating superior operational optimization and a greater capacity to extract value from acquired assets inherently possess a competitive advantage. For instance, CKI's focus on integrating and managing its global infrastructure assets, such as its extensive portfolio of energy networks and transportation assets, allows for economies of scale and shared expertise.

- Operational Efficiencies: CKI's strategy centers on improving the performance of its existing infrastructure assets, leading to cost savings and increased revenue generation.

- Synergy Realization: By managing a diversified portfolio, CKI aims to achieve synergies through shared management resources, procurement advantages, and optimized capital allocation across different business units.

- Debt Cost Reduction: A key element of CKI's approach is leveraging its financial strength to lower the cost of debt across its holdings, thereby improving net returns.

- Competitive Edge: The ability to effectively integrate and manage assets, coupled with financial discipline, provides CKI with a distinct advantage in a competitive global infrastructure market.

CK Infrastructure (CKI) faces intense competition from global infrastructure giants, pension funds, and sovereign wealth funds vying for prime assets. This rivalry is amplified by the fragmented nature of the market, meaning CKI competes against a wide range of entities from local players to large multinationals. The bidding process for new concessions and licenses is a key battleground, as operational competition within regulated sectors is limited.

CKI's strong financial position, with approximately HK$8 billion in cash reserves at the end of 2024 and a low net debt-to-total capital ratio of 7.8%, provides a significant competitive advantage. This financial muscle allows CKI to pursue large-scale acquisitions and outbid competitors with weaker financial backing, securing key infrastructure projects.

Operational efficiency and synergy realization are critical competitive factors. CKI focuses on optimizing its diverse portfolio of energy and transportation assets, aiming for economies of scale and shared expertise. This strategic approach, combined with financial discipline, enhances profitability and strengthens CKI's position against rivals.

| Competitor Type | CKI's Advantage | Impact on Rivalry |

|---|---|---|

| Global Infrastructure Players | Strong financial backing, operational expertise | Intensified bidding for assets, higher acquisition costs |

| Pension Funds & Sovereign Wealth Funds | Long-term investment horizon, stable returns | Increased competition for yield-generating assets |

| Local & Multinational Corporations | Regional market knowledge, regulatory access | Fragmented competition across diverse sectors and geographies |

SSubstitutes Threaten

For essential regulated services like electricity, gas, and water distribution, direct substitutes are scarce for consumers and industries in the short to medium term. This inherent necessity means that households and businesses cannot easily switch away from these fundamental utilities, rendering the threat of substitution very low for CK Infrastructure's core regulated assets.

While direct substitutes for core utility services like water and electricity are scarce, emerging technologies present a nuanced threat. The increasing viability of decentralized renewable energy, such as widespread rooftop solar installations, offers an alternative to traditional grid-supplied power. Similarly, advancements in waste management, including sophisticated recycling techniques and the adoption of circular economy principles, could reduce reliance on conventional waste disposal methods.

CK Infrastructure actively addresses this evolving landscape by strategically investing in these very areas. In 2024, the company bolstered its renewable energy portfolio through key acquisitions, including UK Renewables Energy and Phoenix Energy. This proactive approach not only diversifies CKI’s offerings but also positions it to capitalize on, rather than be disrupted by, technological shifts in energy generation and waste management.

For transportation infrastructure like toll roads and bridges, substitutes include public transportation, alternative routes, or even shifts towards remote work. For instance, in 2024, many cities continued to invest in expanding public transit networks, potentially drawing commuters away from toll roads. A significant increase in the adoption of electric vehicles could also indirectly impact demand for traditional road infrastructure if charging infrastructure becomes more ubiquitous and convenient than driving.

Decentralization of Infrastructure

The increasing trend towards decentralization in critical sectors like energy and water poses a significant threat of substitution for companies like CK Infrastructure (CKI). In the energy sector, advancements in microgrids and widespread adoption of battery storage at the consumer level are diminishing the need for large, centralized power generation and distribution networks. For instance, by the end of 2023, global installed capacity for distributed solar generation continued its upward trajectory, with residential solar installations showing robust growth in key markets.

Similarly, in the water sector, decentralized solutions such as rainwater harvesting systems and localized water treatment facilities are gaining traction. These technologies offer alternatives to traditional, large-scale water infrastructure, potentially reducing demand for services provided by CKI. This shift necessitates that CKI strategically invests in and adapts to these distributed models to remain competitive and relevant in the evolving infrastructure landscape.

- Decentralized Energy: Growth in microgrids and consumer-level battery storage reduces reliance on traditional power grids.

- Decentralized Water: Rainwater harvesting and localized treatment offer alternatives to centralized water supply systems.

- Impact on CKI: Requires strategic adaptation and investment in distributed infrastructure solutions to maintain market position.

Government Policy and Behavioral Shifts

Government policies encouraging energy efficiency and water conservation can reduce the demand for infrastructure services, acting as a form of substitution. For instance, in 2024, many regions saw increased incentives for rooftop solar installations, potentially lowering reliance on grid electricity provided by infrastructure companies. These shifts, coupled with evolving consumer preferences towards sustainability, can indirectly impact the demand for CKI's core offerings.

While CK Infrastructure's regulated assets typically enjoy stable demand, long-term societal changes pose a threat. For example, a significant push towards electric vehicles and renewable energy sources might alter the demand profile for traditional energy transmission and distribution networks. By 2024, global investments in renewable energy infrastructure were projected to reach substantial figures, indicating a clear trend away from fossil fuel-dependent infrastructure.

- Reduced Demand: Policies promoting energy efficiency and water conservation indirectly reduce the need for traditional infrastructure services.

- Behavioral Shifts: Changing consumer habits, like increased adoption of electric vehicles, can alter demand patterns for CKI's assets.

- Policy Impact: Government incentives for renewable energy, such as solar power, can substitute demand for grid-based electricity.

- Strategic Adaptation: CKI may need to adjust its investment and operational focus to align with evolving societal needs and sustainability goals.

The threat of substitutes for CK Infrastructure (CKI) is generally low for its core regulated utility services, as direct alternatives for essential water and electricity distribution are scarce. However, evolving technologies and societal shifts present indirect substitution risks.

Decentralized energy solutions, like rooftop solar and battery storage, are gaining traction, potentially reducing reliance on traditional grids. For instance, by the end of 2023, global distributed solar capacity continued to grow significantly. Similarly, advancements in water management, such as rainwater harvesting, offer alternatives to centralized water infrastructure.

Government policies promoting energy efficiency and conservation, along with consumer preferences for sustainability, also act as substitutes by reducing overall demand for traditional infrastructure services. The increasing adoption of electric vehicles, for example, could alter demand for road infrastructure.

| Substitute Area | Nature of Threat | 2024 Relevance/Data Point |

|---|---|---|

| Decentralized Energy | Reduced reliance on grid electricity | Continued growth in distributed solar installations; CKI acquired UK Renewables Energy in 2024. |

| Decentralized Water | Alternatives to centralized water supply | Increasing adoption of rainwater harvesting and localized treatment systems. |

| Transportation | Shift to public transit or alternative routes | Ongoing investment in public transit expansion in urban areas; potential impact from EV charging infrastructure. |

| Energy Efficiency & Conservation | Lower overall demand for energy infrastructure | Government incentives for rooftop solar and energy-saving measures. |

Entrants Threaten

Entering the infrastructure sector, particularly for large-scale projects like power generation facilities, extensive gas distribution networks, or major toll roads, demands an extraordinary level of capital infusion. CK Infrastructure's business model is built around these highly capital-intensive assets, establishing a formidable financial hurdle for any aspiring new competitor. This substantial barrier effectively discourages all but the most financially robust and well-capitalized organizations from even considering entry, thereby significantly narrowing the field of potential rivals.

The infrastructure sector, especially utilities, faces significant regulatory burdens. New players must navigate intricate and time-consuming approval processes, obtain various licenses, and adhere to stringent compliance rules in each operating region. For instance, obtaining a new electricity generation license in a developed market can take several years and involve substantial legal and consulting fees.

CK Infrastructure Holdings (CKI) leverages its existing, well-established licenses and strong relationships with regulatory bodies. These established credentials are a formidable barrier for newcomers, as replicating the depth of experience and trust CKI possesses with regulators is both costly and protracted, effectively deterring many potential entrants.

The infrastructure sector, particularly for companies like CK Infrastructure (CKI), is characterized by exceptionally long project development and payback periods. These can span decades, from initial planning and securing permits to construction and eventual revenue generation. For instance, major infrastructure projects often take 5-10 years just for planning and approvals before construction even begins, with payback taking another 20-30 years or more.

This extended timeline, coupled with significant upfront capital requirements and inherent construction risks, acts as a substantial barrier to entry. New companies looking for faster returns will find this sector less appealing. Established players like CKI, with their deep pockets and long-term investment strategies, are better positioned to weather these extended cycles and capitalize on the stability offered by such projects.

Access to Expertise and Established Networks

New entrants face significant hurdles in acquiring the specialized expertise needed to operate and manage diverse infrastructure assets. This includes deep technical, operational, and managerial knowledge, which CKI has honed over decades. For instance, in 2024, CKI's extensive portfolio across sectors like energy, transportation, and water management demonstrates a breadth of specialized skills that are not easily replicated.

Building established relationships with local governments, communities, and existing supply chains is another critical barrier. Newcomers would find it challenging to quickly replicate the trust and collaborative frameworks CKI has cultivated globally. These networks are vital for securing permits, ensuring smooth operations, and fostering long-term project viability.

- Specialized Expertise: CKI's operational success hinges on deep technical and managerial know-how in areas like power generation, toll road management, and airport operations.

- Established Networks: Decades of global presence have allowed CKI to build crucial relationships with regulatory bodies and local communities, facilitating project execution.

- Knowledge Accumulation: The sheer volume of industry knowledge and best practices accumulated by CKI is a significant intangible asset that deters new entrants.

Incumbency Advantage and Scale Economies

CK Infrastructure (CKI) enjoys a substantial incumbency advantage, largely due to significant economies of scale and operational efficiencies built over years of development. These established players leverage their extensive networks and integrated operations, making it difficult for newcomers to match their cost structures or service quality, particularly in mature, regulated infrastructure sectors where existing assets are already in place.

CKI's global footprint, encompassing diverse infrastructure assets, further solidifies this advantage. For instance, as of its 2023 annual report, CKI's portfolio included significant investments in energy, transportation, and water infrastructure across multiple continents, demonstrating a scale that is inherently difficult for new entrants to replicate quickly or cost-effectively.

- Economies of Scale: CKI's large-scale operations, particularly in energy transmission and distribution, allow for lower per-unit costs.

- Operational Efficiencies: Decades of experience have honed CKI's operational processes, leading to greater efficiency and reliability.

- Established Networks: CKI's existing infrastructure networks represent a significant barrier to entry for new competitors.

- Global Diversification: A broad international presence mitigates risks and enhances CKI's ability to absorb shocks, making it a more resilient competitor.

The threat of new entrants for CK Infrastructure (CKI) is generally low due to extremely high capital requirements, extensive regulatory hurdles, and the need for specialized expertise. These factors create significant barriers that deter most potential competitors from entering the infrastructure sector, especially for large-scale projects.

CKI's established relationships with regulatory bodies and its accumulated knowledge base further solidify its position, making it difficult for new players to gain traction. The long development cycles and substantial upfront investments inherent in infrastructure projects also favor established companies with long-term investment horizons.

Economies of scale and operational efficiencies derived from CKI's global diversification also present a considerable challenge for new entrants aiming to compete on cost and service quality.

| Barrier Type | Impact on New Entrants | CKI's Advantage |

|---|---|---|

| Capital Requirements | Extremely High | CKI's substantial financial resources and access to capital markets. |

| Regulatory Hurdles | Significant & Time-Consuming | CKI's established licenses and strong government relationships. |

| Specialized Expertise | High Need | CKI's decades of operational experience across diverse infrastructure assets. |

| Incumbency & Scale | Economies of Scale | CKI's existing infrastructure networks and global operational footprint. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CK Infrastructure leverages data from their annual reports, investor presentations, and public stock exchange filings. We supplement this with industry-specific market research reports and news from reputable financial publications to capture competitive dynamics.