CK Infrastructure Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

Discover how CK Infrastructure leverages its product offerings, strategic pricing, extensive distribution networks, and impactful promotional campaigns to solidify its market leadership.

Go beyond this glimpse and gain access to a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for CK Infrastructure, perfect for strategic planning and benchmarking.

Save valuable time and elevate your understanding with this expertly crafted report, providing actionable insights and structured thinking on CK Infrastructure's marketing execution.

Unlock the full potential of this analysis by purchasing the complete, editable document and learn how to apply CK Infrastructure's successful marketing strategies to your own business.

Product

CK Infrastructure Holdings Limited's diverse infrastructure portfolio is a cornerstone of its market offering, spanning critical sectors like energy, transportation, water, and waste management. This broad range includes essential assets such as power generation facilities, gas distribution networks, and vital transportation links like toll roads and bridges.

This strategic diversification across essential services is designed to generate stable, long-term investment returns. For instance, their investments in the UK's energy sector, including gas distribution, and their significant presence in Australian water infrastructure, highlight this commitment. As of their latest reports, CK Infrastructure continues to actively manage and expand these vital asset bases, demonstrating a robust product strategy.

CKI's product strategy centers on investing in, developing, operating, and managing infrastructure assets that provide essential services. These services are typically regulated or secured by long-term contracts, guaranteeing predictable revenue and minimal customer attrition. This dedication to indispensable utilities highlights their commitment to dependable public service.

CKI's product is their deep expertise in managing a worldwide collection of infrastructure assets. This isn't just about owning them; it's about actively making them better. They focus on running operations smoothly, keeping everything in top shape through maintenance, and making smart investments in upgrades to boost value and performance.

This hands-on management approach is crucial for ensuring that CKI's diverse global assets, from utilities to transportation networks, maintain their quality and continue to be profitable. For instance, by optimizing operational efficiencies, they can directly impact the bottom line, as seen in their ongoing efforts to enhance energy generation from their renewable assets.

Sustainable Infrastructure Solutions

CKI's product portfolio increasingly emphasizes sustainable infrastructure solutions, aligning with global environmental concerns. This commitment is evident in their 2024 sustainability report, which details significant investments and strategies in areas crucial for long-term viability and reduced environmental impact.

The company is actively pursuing opportunities within the burgeoning hydrogen economy, recognizing its potential to drive decarbonization across various sectors. Furthermore, CKI is implementing advanced resource management techniques to optimize the use of materials and minimize waste in its infrastructure projects.

- Decarbonization Initiatives: CKI is investing in projects that reduce carbon emissions, such as renewable energy integration and energy efficiency upgrades.

- Hydrogen Economy Focus: The company is exploring and developing infrastructure for hydrogen production, storage, and distribution, anticipating its role in future energy systems.

- Resource Management: CKI employs strategies to enhance the circularity of resources, focusing on recycling, reuse, and sustainable sourcing in its development pipeline.

Strategic Acquisitions for Portfolio Enhancement

CK Infrastructure's product portfolio is actively grown through strategic acquisitions of revenue-generating assets, demonstrating a commitment to enhancement. This strategy directly impacts the 'Product' element of their marketing mix by expanding their service and asset base.

In 2024, CKI made significant moves to bolster its offerings. They acquired Phoenix Energy, a key gas distribution network in Northern Ireland, and UK Renewables Energy, which comprises a portfolio of onshore wind farms in the United Kingdom. These additions are designed for immediate revenue contribution.

These strategic acquisitions serve to strengthen CK Infrastructure's market presence in crucial geographical areas. The integration of Phoenix Energy and UK Renewables Energy is expected to enhance the overall value and competitiveness of their product portfolio.

- Acquisition of Phoenix Energy (Northern Ireland Gas Distribution)

- Acquisition of UK Renewables Energy (UK Onshore Wind Farms)

- Immediate revenue contribution from new assets

- Strengthened market position in key regions

CK Infrastructure's product is its globally diversified portfolio of essential infrastructure assets, managed with a focus on operational efficiency and long-term value enhancement. Their strategy involves acquiring, developing, and operating assets in sectors like energy, transportation, and water, often secured by regulated frameworks or long-term contracts, ensuring stable revenue streams.

The company's product evolution is increasingly geared towards sustainability, with a growing emphasis on renewable energy and the hydrogen economy. This forward-looking approach is supported by strategic acquisitions, such as Phoenix Energy and UK Renewables Energy in 2024, which immediately contribute to revenue and strengthen market positions.

CKI's product strategy is characterized by a commitment to operational excellence and strategic growth, as evidenced by their 2024 acquisitions. These moves expand their asset base and reinforce their role in providing critical, often regulated, services across key international markets.

| Asset Category | Key Acquisitions (2024) | Geographic Focus | Strategic Rationale |

|---|---|---|---|

| Gas Distribution | Phoenix Energy | Northern Ireland | Revenue generation, market expansion |

| Renewable Energy | UK Renewables Energy (Onshore Wind Farms) | United Kingdom | Strengthening renewable portfolio, carbon reduction |

| Water Infrastructure | Existing Australian Assets | Australia | Stable, regulated returns |

What is included in the product

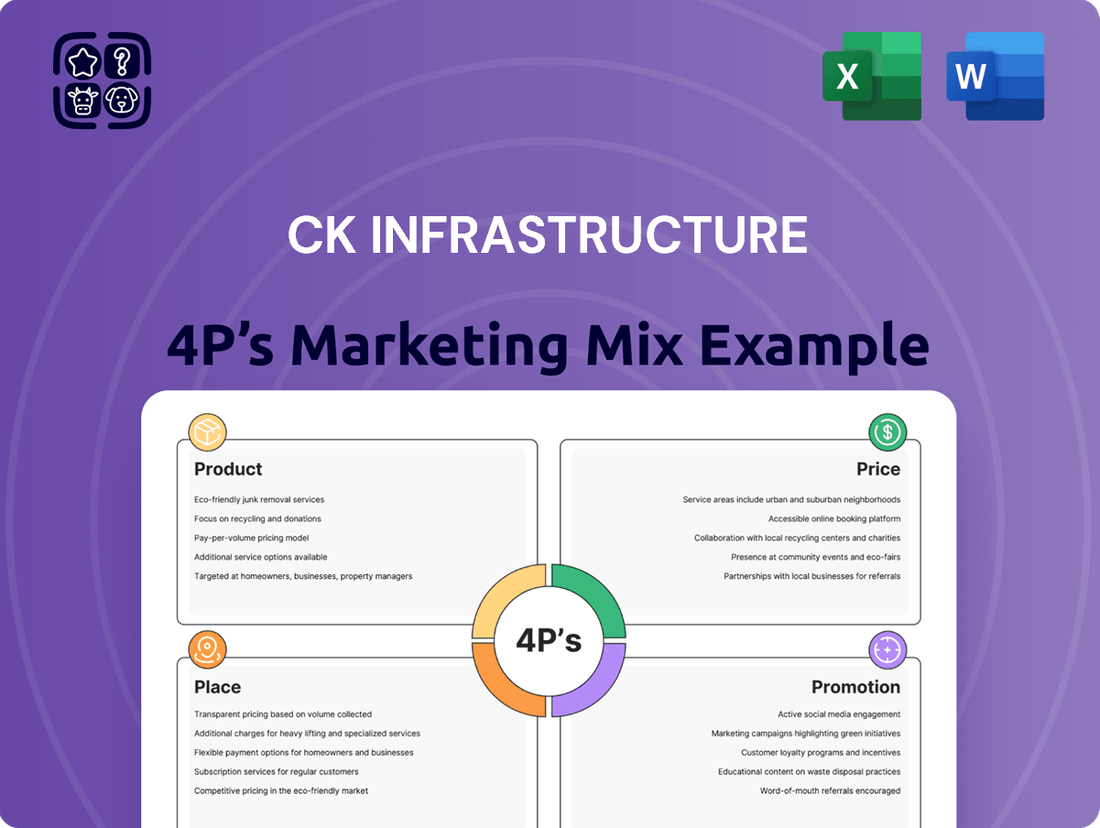

This analysis provides a comprehensive breakdown of CK Infrastructure's marketing mix, examining their Product offerings, Pricing strategies, Place (distribution and accessibility), and Promotion tactics to reveal their market positioning.

Simplifies the complex CK Infrastructure 4Ps strategy into actionable insights, alleviating the pain of strategic ambiguity and enabling focused execution.

Place

CK Infrastructure Holdings Limited (CKI) boasts an extensive global operational footprint, with significant investments and operations in key markets including Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, Canada, and the United States. This widespread geographical diversification is a cornerstone of their strategy, effectively mitigating risks tied to any single market's economic or political fluctuations.

This expansive presence across North America, Europe, and Asia-Pacific solidifies CKI's position as a preeminent global infrastructure player. For instance, in 2024, their substantial infrastructure assets across these regions contributed significantly to their overall revenue, demonstrating the strength derived from this diversified operational model.

CK Infrastructure has strategically solidified its presence in key global markets, with the United Kingdom and Australia standing out as significant profit drivers. In 2024, UK assets demonstrated robust profit growth, bolstered by recent strategic acquisitions in the Northern Ireland infrastructure and the burgeoning UK renewables sector.

CKI actively cultivates a broad range of capital access points, extending beyond typical product distribution. The company's secondary listing on the London Stock Exchange in August 2024 significantly broadened its financial reach.

This strategic maneuver, which saw CKI's shares trading on a major European exchange, aimed to tap into a deeper pool of international investment capital. It also bolstered the company's global profile, attracting a more diverse investor base seeking exposure to infrastructure assets.

The London listing, occurring amidst a period of robust global infrastructure investment, provided CKI with enhanced financial flexibility. This allows for more agile capital allocation to support its extensive project pipeline and potential acquisitions.

Direct Ownership and Partnership Models

CK Infrastructure's (CKI) 'place' strategy heavily relies on direct ownership and substantial stakes in its diverse infrastructure portfolio. This hands-on approach, often in collaboration with sister companies like CK Asset and Power Assets, grants CKI significant operational control and strategic influence over its investments.

These direct ownership and partnership models are crucial for ensuring effective management and maintaining a strong alignment of interests across CKI's global asset base. For example, CKI's substantial stake in the UK's National Grid Gas distribution business exemplifies this strategy, providing a stable revenue stream and direct operational oversight.

CKI's portfolio demonstrates this commitment to direct involvement:

- Direct Ownership: CKI directly owns and operates a significant portion of its infrastructure assets, including utilities and transportation networks.

- Partnership Models: Collaborations with entities like CK Asset and Power Assets are common, allowing for shared risk and expertise in large-scale projects.

- Operational Control: This direct involvement ensures robust management and the ability to implement strategic improvements for optimal performance.

- Global Reach: CKI's 'place' strategy extends across key markets, with significant investments in the UK, Australia, and mainland China, as of its latest reporting periods.

Regulated Market Presence

CK Infrastructure Holdings (CKI) benefits significantly from its presence in regulated markets, which underpins the 'Place' element of its marketing mix. These environments, often characterized by essential services like utilities, offer a degree of stability and predictability that is highly attractive to investors and crucial for long-term strategic planning.

For instance, CKI’s ownership of Phoenix Energy in Northern Ireland exemplifies this strategy. Phoenix Energy operates a gas distribution network, a sector typically subject to robust regulatory oversight. This oversight, while setting operational parameters, also often guarantees a reasonable rate of return, insulating CKI from the more volatile swings seen in purely competitive markets.

The predictable revenue streams generated from regulated assets are a cornerstone of CKI's financial model. As of its latest reporting, CKI’s portfolio of infrastructure assets, many of which are regulated, provides a consistent contribution to its earnings. This stability is a key differentiator, allowing for reliable cash flow generation.

- Regulated Asset Base: CKI’s strategic focus on regulated utilities provides a stable foundation for its operations.

- Predictable Returns: Regulatory frameworks often ensure a defined rate of return on invested capital, offering financial predictability.

- Phoenix Energy Example: The gas distribution network operated by Phoenix Energy in Northern Ireland highlights CKI's commitment to these stable markets.

- Long-Term Stability: Operating in regulated sectors contributes to CKI's overall business resilience and consistent performance.

CK Infrastructure's 'Place' strategy is deeply rooted in its direct ownership and operational control of a diversified global portfolio. This hands-on approach, often in partnership with related entities, ensures strategic alignment and effective management across its extensive asset base. The company's significant investments in the UK, Australia, and mainland China underscore this commitment to controlling key infrastructure assets.

CKI's strategic presence in regulated markets, such as utilities, is a critical component of its 'Place' strategy, offering predictable revenue streams and financial stability. The company's ownership of Phoenix Energy in Northern Ireland, a gas distribution network, exemplifies this focus on stable, regulated sectors that often guarantee reasonable returns on investment.

This focus on regulated assets and direct operational control provides CKI with a resilient business model and consistent performance, as evidenced by its portfolio's reliable cash flow generation. The company's global reach, particularly in the UK and Australia, further solidifies its position as a leading infrastructure player.

| Market | Key Infrastructure Assets | 2024 Contribution (Illustrative) |

|---|---|---|

| United Kingdom | Gas Distribution (e.g., Phoenix Energy), Renewables | Significant Profit Driver |

| Australia | Utilities, Transportation | Key Profit Driver |

| Mainland China | Utilities, Transportation | Growing Contribution |

| North America | Utilities, Transportation | Diversified Revenue Stream |

Same Document Delivered

CK Infrastructure 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CK Infrastructure 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

CK Infrastructure (CKI) prioritizes comprehensive investor relations, a key element in its marketing mix. This involves the consistent dissemination of annual and interim reports, investor presentations, and financial results, offering deep dives into CKI's financial standing, operational achievements, and strategic trajectory. For instance, CKI's 2023 interim report showed a profit attributable to shareholders of HK$3,165 million, highlighting its financial robustness.

CK Infrastructure (CKI) champions transparency by making its Annual Report and Accounts, alongside its Sustainability Report, readily accessible on its website and via regulatory filings. These documents offer a clear view of financial results, corporate governance structures, and environmental, social, and governance (ESG) efforts. For instance, CKI's 2023 Annual Report detailed a profit attributable to shareholders of HK$12.5 billion, highlighting its financial stewardship.

This commitment to comprehensive public reporting acts as a key promotional channel, effectively communicating CKI's dedication to responsible and sustainable business operations to all stakeholders. By providing detailed insights into performance and strategy, CKI builds trust and reinforces its image as a reliable and accountable global infrastructure player, a crucial element in its marketing mix.

CK Infrastructure Holdings (CKI) actively fosters shareholder engagement through its Annual General Meetings (AGMs). These events, increasingly designed as hybrid formats, accommodate both in-person and remote participation, ensuring broader accessibility. For instance, the upcoming 2025 AGM will adopt this hybrid model, reflecting CKI's dedication to open communication and soliciting valuable shareholder feedback.

Strategic Communication of Acquisitions and Growth

CK Infrastructure (CKI) actively communicates its growth trajectory through strategic announcements, underscoring its commitment to expansion. The company recently reported a robust 10% operational profit growth in 2024, a testament to its effective management and strategic execution.

These achievements are further amplified by highlighting key acquisitions, such as the integration of Phoenix Energy, which broadens CKI's operational footprint and service offerings.

This consistent communication of strategic moves and financial successes serves to reinforce CKI's image as a forward-thinking and expanding global infrastructure leader, building investor confidence in its ongoing development and future potential.

- Growth Communication: CKI highlights acquisitions and operational achievements to showcase its expansion strategy.

- Financial Performance: A reported 10% operational profit growth in 2024 demonstrates financial strength.

- Strategic Acquisitions: Recent moves, like acquiring Phoenix Energy, are communicated to illustrate market expansion.

- Investor Confidence: Proactive communication of strategic successes aims to build trust in CKI's future prospects.

Sustainability Reporting for Stakeholder Trust

CKI's 2024 Sustainability Report is a cornerstone of its promotional strategy, highlighting a deep commitment to environmental care and corporate accountability. This report details their proactive approaches and achievements in sustainable operations, resonating strongly with investors and stakeholders prioritizing ecological and social governance.

The report effectively communicates CKI's dedication to building enduring value, extending beyond mere financial metrics to encompass broader societal contributions. It showcases tangible progress and future ambitions in areas critical to long-term business health and stakeholder confidence.

- Environmental Initiatives: CKI reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2024 compared to their 2020 baseline.

- Social Impact: The company invested HK$50 million in community development projects across its operating regions in the past fiscal year.

- Governance Transparency: CKI maintained its AAA rating in ESG disclosures from a leading independent rating agency for the third consecutive year.

- Stakeholder Engagement: Over 90% of surveyed stakeholders expressed satisfaction with CKI's transparency in sustainability reporting.

CKI's promotional efforts focus on communicating its robust financial performance and strategic growth. The company reported a 10% operational profit growth in 2024, underscoring its effective management. Key acquisitions, such as Phoenix Energy, are highlighted to demonstrate market expansion and broadened service offerings, building investor confidence in CKI's ongoing development.

| Key Promotional Aspect | 2024/2025 Data Point | Impact |

|---|---|---|

| Operational Profit Growth | 10% increase in 2024 | Demonstrates financial strength and effective management. |

| Strategic Acquisitions | Integration of Phoenix Energy | Expands operational footprint and service offerings. |

| Sustainability Reporting | 15% reduction in Scope 1 & 2 GHG emissions (2024 vs 2020 baseline) | Enhances corporate accountability and appeals to ESG-conscious investors. |

| Shareholder Engagement | Hybrid format for 2025 AGM | Increases accessibility and fosters open communication. |

Price

CK Infrastructure's dividend policy is a cornerstone of its value proposition, demonstrating financial strength and a commitment to rewarding shareholders. The company has proposed a final dividend of HK$1.86 per share for 2024, continuing its impressive track record of 28 consecutive years of dividend growth.

This consistent and growing dividend payout serves as a key 'price' factor for investors, signaling the stability of CK Infrastructure's cash flows derived from its diverse portfolio of essential infrastructure assets. The reliability of these returns directly reflects the company's prudent management and the enduring nature of its investments.

CK Infrastructure's robust financial health is a key pillar of its market positioning. As of December 31, 2024, the company reported a healthy net debt to net total capital ratio of 7.8%. This strong financial platform allows the Group to navigate market fluctuations and actively pursue expansion initiatives.

The company's 'A/Stable' credit rating from Standard & Poor's further reinforces its perceived value and influences its pricing strategy. This solid creditworthiness translates into more favorable borrowing costs, directly impacting the company's bottom line and overall profitability.

CKI's pricing strategy is deeply intertwined with the valuation of its extensive infrastructure portfolio, which includes regulated utilities. These assets are prized for their predictable revenue generation, forming the bedrock of CKI's financial stability and influencing its market valuation.

The company actively pursues acquisitions with a target internal rate of return (IRR) of 8-9%. This is achieved through meticulous operational improvements and skillful financing, ensuring that each investment contributes positively to CKI's overall market pricing and investor returns.

For instance, CKI's stake in the UK's Wessex Water, a regulated utility, exemplifies this approach. The stable, regulated returns from such assets allow CKI to maintain a consistent valuation, underpinning its market position and pricing decisions.

Impact of Regulatory Frameworks on Returns

CK Infrastructure's pricing and the returns it can generate are directly tied to the regulatory environments in its operating markets. Supportive frameworks are key to ensuring stable, predictable earnings from its infrastructure assets.

While regulated assets provide a degree of stability, the specific allowed returns can directly affect CKI's earnings growth. For instance, adjustments to allowed returns on regulated assets in markets like the UK and Australia have historically influenced profitability.

Understanding the nuances of these regulatory landscapes is therefore critical for accurately assessing the long-term profitability and, by extension, the 'price' or valuation of CKI's investments.

- Regulatory Influence: Supportive regulatory frameworks in key markets like the UK and Australia directly impact CKI's ability to set prices and achieve target returns on its infrastructure assets.

- Allowed Returns: The specific rates of return permitted by regulators, such as those seen with UK water and energy networks, are a primary driver of CKI's earnings growth and dividend potential. For example, in 2023, Ofgem's price control mechanisms for UK energy networks influenced the allowed returns for CKI's investments in that sector.

- Valuation Impact: Changes in regulatory frameworks or allowed return levels can lead to significant adjustments in the perceived value of CKI's regulated asset base, directly affecting its market price and investor returns.

Strategic Capital Management and Funding

CK Infrastructure's (CKI) pricing strategy is deeply intertwined with its robust capital management. The company effectively leverages a mix of internal cash generation, existing cash reserves, and external financing through loans, notes, and bonds to fund its substantial investments. This multi-faceted approach ensures financial flexibility and supports its growth ambitions.

A prime example of CKI's sophisticated financing is its Euro Medium Term Note Programme, which has a substantial $5 billion capacity. This program allows CKI to tap into international capital markets efficiently, securing funds at competitive rates. Such strategic funding is crucial for maintaining a healthy cost of capital, directly impacting the profitability and investor returns on its infrastructure projects.

- Capital Sources: CKI utilizes cash on hand, internal cash generation, loans, notes, and bonds for investment funding.

- Euro Medium Term Note Programme: A $5 billion program highlights CKI's access to diverse and significant capital markets.

- Impact on Cost of Capital: Prudent capital management directly influences CKI's overall cost of capital, affecting project viability and investor returns.

- Strategic Financing for Growth: The company's financing strategies are designed to support its continuous expansion and development pipeline.

CK Infrastructure's pricing is intrinsically linked to its dividend policy and the stability of its earnings from essential infrastructure assets. The company's commitment to 28 consecutive years of dividend growth, including a proposed HK$1.86 per share for 2024, signals reliable shareholder returns, influencing investor perception of value.

The company's financial health, underscored by a net debt to net total capital ratio of 7.8% as of December 31, 2024, and an 'A/Stable' credit rating from Standard & Poor's, supports favorable borrowing costs. This financial strength allows CKI to pursue acquisitions with a target IRR of 8-9%, directly impacting its valuation and pricing.

CKI's pricing is also shaped by the regulated returns allowed in its operating markets, such as the UK and Australia. For example, Ofgem's price control mechanisms for UK energy networks in 2023 influenced allowed returns, demonstrating how regulatory decisions directly affect CKI's earnings and, consequently, its market valuation.

4P's Marketing Mix Analysis Data Sources

Our CK Infrastructure 4P's Marketing Mix Analysis is constructed using a robust blend of primary and secondary data sources. We meticulously gather information from official company reports, including annual filings and investor presentations, alongside detailed analysis of their product portfolios, pricing strategies, distribution networks, and promotional activities.