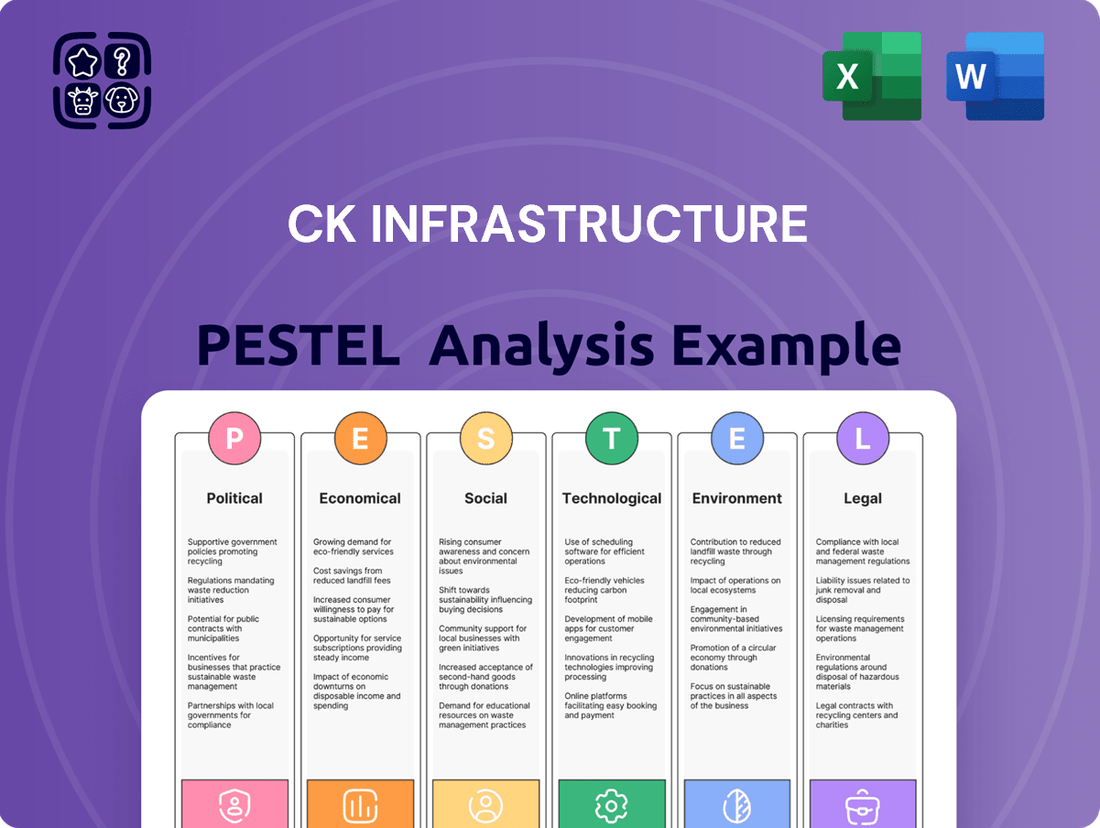

CK Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

Unlock the secrets to CK Infrastructure's strategic positioning with our comprehensive PESTLE analysis. Understand the intricate interplay of political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks that shape its operational landscape. Equip yourself with critical insights to anticipate market dynamics and make informed decisions. Purchase the full PESTLE analysis now and gain a definitive competitive advantage.

Political factors

CK Infrastructure's global operations mean that the stability of governments in its key markets, like Hong Kong and the UK, is paramount. Political shifts can significantly alter the regulatory environment and the attractiveness of investment opportunities. For instance, ongoing political discussions in the UK regarding energy policy could impact CKI's power generation assets.

Governments globally are placing a greater emphasis on infrastructure development and sustainable practices. This trend is a positive indicator for CKI, as it aligns with the company's long-term investment strategy in essential services and renewable energy projects. For example, the Australian government's commitment to renewable energy targets in 2024-2025 offers a favorable climate for CKI's investments in that sector.

Regulatory shifts in infrastructure are pivotal for CK Infrastructure (CKI). For instance, the UK's commitment to accelerating infrastructure development, including a projected £600 billion investment in the 2020s, could streamline CKI's project approvals and boost opportunities.

Australia's energy sector reforms, emphasizing renewable energy sources, directly influence CKI's strategic investments in this area. These changes can create new avenues for growth but also necessitate adaptation to evolving environmental and operational standards.

Global trade policies and ongoing geopolitical tensions, exemplified by the lingering effects of the US-China trade friction, continue to pose challenges. These dynamics can manifest as increased tariffs and significant disruptions to established supply chains, directly affecting CK Infrastructure's (CKI) international projects and the overall cost of operations. For instance, the potential for renewed trade disputes could impact the cost of imported materials essential for infrastructure development.

The political landscape, including the outcomes of major elections, introduces further layers of uncertainty. The re-election of figures like Donald Trump in the United States, for example, could signal a shift towards more protectionist policies. Such shifts can create unpredictable market interventions and alter the trade environments in which CKI operates, potentially influencing investment decisions and project feasibility.

Government Investment in Green Infrastructure

Governments worldwide are channeling substantial funds into green infrastructure and renewable energy projects, directly benefiting companies like CK Infrastructure (CKI) that prioritize sustainable assets. This global push aligns with CKI's strategic direction, creating a favorable environment for its existing and future investments.

For instance, the United States' Inflation Reduction Act of 2022 is set to invest billions in clean energy and climate resilience through 2030, with significant portions allocated to renewable energy deployment and grid modernization. Similarly, the European Union’s Green Deal aims to mobilize at least €1 trillion in sustainable investments by 2030, with a focus on renewable energy and energy efficiency.

- Increased Funding for Renewables: Governments are offering tax credits, subsidies, and grants for solar, wind, and other renewable energy sources, boosting project viability.

- Decarbonization Targets: National and international commitments to reduce carbon emissions are driving demand for low-carbon transportation solutions and energy-efficient buildings.

- Infrastructure Modernization: Investments are being made in upgrading electricity grids to handle renewable energy integration and in developing charging infrastructure for electric vehicles.

- Policy Support: Favorable regulatory frameworks and long-term policy certainty encourage private sector investment in green technologies and projects.

Decentralization of Electricity Regulation

The trend towards decentralizing electricity regulation is a significant political factor for CK Infrastructure. For instance, in Nigeria, several states are asserting greater control over their electricity sectors, moving away from a purely federal oversight. This decentralization can lead to a patchwork of different regulatory frameworks across regions.

These evolving regulatory landscapes present both opportunities and challenges for CKI's energy infrastructure projects. Navigating varying state-level rules on tariffs, licensing, and grid access requires a nuanced approach. The Nigerian Electricity Regulatory Commission (NERC) still plays a role, but state initiatives add layers of complexity.

- Regional Regulatory Divergence: States like Lagos and Kaduna are developing their own electricity policies, potentially creating inconsistent operating environments.

- Increased Compliance Burden: CKI may face a higher compliance burden as it adapts to different state-specific regulations, impacting project timelines and costs.

- Market Restructuring: Decentralization can foster new market structures, such as state-level independent power producers (IPPs) or distribution companies, which CKI needs to strategically engage with.

Governmental commitments to infrastructure spending, particularly in green initiatives, present a significant tailwind for CK Infrastructure. For example, the UK's commitment to net-zero targets by 2050 drives substantial investment in renewable energy and grid modernization, creating a fertile ground for CKI's projects. Similarly, Australia's federal and state governments are actively supporting renewable energy development, with initiatives like the Renewable Energy Target continuing to shape investment landscapes through 2025.

Political stability in key markets directly impacts CKI's operational environment and investment decisions. Shifts in government policy, such as changes in energy regulation or trade agreements, can create both opportunities and risks. The ongoing political developments in Hong Kong, for instance, continue to be monitored for their potential impact on the business climate.

Geopolitical tensions and trade policies remain a critical consideration for CKI's global operations. Disruptions to supply chains and potential tariff increases stemming from international relations can affect project costs and timelines. The evolving global political landscape necessitates a flexible and adaptive strategy for CKI to navigate these complexities effectively.

| Country | Key Political Factor | Impact on CKI | Relevant Data/Initiative (2024-2025 focus) |

|---|---|---|---|

| United Kingdom | Net-Zero Targets & Infrastructure Investment | Drives demand for renewable energy and grid upgrades. | Projected £600 billion infrastructure investment in the 2020s; continued focus on offshore wind development. |

| Australia | Renewable Energy Policy & State-Level Reforms | Creates opportunities in solar, wind, and battery storage; requires navigation of diverse regulations. | Ongoing state-level energy reforms; federal commitment to renewable energy targets. |

| Hong Kong | Political Stability & Economic Policy | Influences investment climate and regulatory certainty. | Continued monitoring of government policies impacting infrastructure and utilities. |

| Global | Geopolitical Tensions & Trade Policies | Affects supply chains, project costs, and international market access. | Lingering impacts of global trade friction; potential for new trade agreements or disputes. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CK Infrastructure, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support scenario planning and proactive strategy design, enabling stakeholders to identify and capitalize on emerging opportunities while mitigating potential threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting CK Infrastructure.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, legal, and environmental landscape affecting CK Infrastructure.

Economic factors

Global economic growth significantly impacts infrastructure demand and CK Infrastructure's (CKI) profitability. While 2024 presented economic headwinds, projections for 2025 suggest a rebound with moderate growth, largely fueled by increasing investor appetite for sustainable infrastructure projects.

The International Monetary Fund (IMF) forecast for global GDP growth in 2025 is around 2.9%, a slight uptick from 2024's anticipated 2.7%, indicating a supportive environment for infrastructure investment. This anticipated demand for green and resilient infrastructure aligns well with CKI's strategic focus.

Interest rate fluctuations significantly impact CK Infrastructure Holdings' (CKI) financing costs for its extensive portfolio of long-term infrastructure projects. Higher rates translate directly to increased borrowing expenses, potentially dampening profitability and the feasibility of new ventures.

For 2025, projections suggest a moderating interest rate environment. For instance, the US Federal Reserve's median projection for the federal funds rate in 2025 is around 3.1%, down from previous forecasts. This anticipated easing could alleviate pressure on CKI's balance sheet and make undertaking new, capital-intensive projects more attractive by lowering the cost of capital.

Inflationary pressures are a significant concern for CK Infrastructure Holdings Limited (CKI). Rising costs for materials like steel and cement, coupled with increased labor wages and higher energy prices, directly impact CKI's operational expenses. For instance, the global inflation rate remained elevated through much of 2023 and into early 2024, leading to higher input costs across the construction and infrastructure sectors.

These escalating operational costs can squeeze project profitability if they cannot be fully passed on to consumers or clients. Furthermore, significant increases in energy costs, a key component of infrastructure operations, can lead to higher utility prices for end-users. This, in turn, may dampen demand for services provided by CKI's utility businesses, creating a dual challenge of higher costs and potentially lower revenue.

Infrastructure Investment and Funding Gaps

Global infrastructure investment is poised for substantial growth, with projections indicating a significant uptick in capital project spending worldwide. This trend presents a favorable landscape for CK Infrastructure Holdings (CKI) as it seeks new investment avenues.

Despite the overall positive outlook, persistent funding gaps remain a critical challenge, especially in essential sectors like water and wastewater infrastructure. These deficits underscore the need for strategic financial planning and investment to address critical needs.

For instance, the U.S. infrastructure sector alone faces an estimated $2.57 trillion funding gap between 2022 and 2041, according to the American Society of Civil Engineers' 2023 report. This highlights the scale of opportunity and the necessity for private sector involvement.

- Projected Growth: Global infrastructure spending is anticipated to rise, creating a fertile ground for CKI's expansion.

- Funding Deficits: Significant underfunding persists, particularly in vital areas like water and sanitation systems.

- Investment Opportunities: The identified funding gaps represent strategic opportunities for CKI to deploy capital and generate returns.

- Market Needs: Addressing these gaps is crucial for economic development and public well-being, aligning with CKI's operational focus.

Market Competition and Shareholder Returns

Increased market competition, often driven by evolving regulatory landscapes, can indeed put pressure on profit margins for utility companies like those in CK Infrastructure's portfolio. For instance, the liberalization of energy markets in various regions can introduce new players, forcing established companies to compete more aggressively on price and service. This heightened competition requires continuous operational efficiency and strategic investment to maintain market share and profitability.

Despite these competitive pressures, CK Infrastructure has shown a robust ability to deliver stable performance and strong shareholder returns. This resilience is a testament to its diversified asset base and its strategic focus on essential infrastructure services, which tend to be less susceptible to economic downturns. Investor confidence remains high, as evidenced by its consistent financial results.

CKI's commitment to shareholder value is reflected in its financial performance. For the fiscal year 2023, CK Infrastructure reported a net profit attributable to shareholders of HK$10.4 billion, a slight decrease from HK$10.6 billion in 2022, but still demonstrating a strong underlying performance. The company maintained its dividend payout, underscoring its commitment to returning value to its investors.

- Diversified Portfolio: CK Infrastructure operates across various geographies and sectors, including energy, transportation, and water, mitigating risks associated with any single market or regulatory environment.

- Resilient Demand: Essential infrastructure services typically experience stable demand, providing a predictable revenue stream even during periods of economic uncertainty.

- Shareholder Returns: The company has a track record of delivering consistent dividends and maintaining a strong balance sheet, appealing to income-focused investors.

- Strategic Acquisitions: CKI actively pursues strategic acquisitions and investments that enhance its existing portfolio and expand its market reach, contributing to long-term growth.

Economic factors present a mixed but generally favorable outlook for CK Infrastructure Holdings (CKI) in 2024 and 2025. While global economic growth is projected to be moderate, around 2.9% for 2025 according to the IMF, this still supports infrastructure investment. However, inflationary pressures continue to impact operational costs, potentially squeezing margins if not managed effectively.

Interest rate trends are leaning towards moderation in 2025, with the US Federal Reserve's median projection for the federal funds rate around 3.1%. This easing could reduce CKI's financing costs, making new capital-intensive projects more viable.

The infrastructure sector faces a significant funding gap, estimated at $2.57 trillion in the U.S. alone through 2041, creating substantial opportunities for companies like CKI to invest and generate returns by addressing essential needs.

| Economic Factor | 2024 Outlook | 2025 Projection | Impact on CKI |

|---|---|---|---|

| Global GDP Growth | ~2.7% | ~2.9% (IMF) | Supports infrastructure demand. |

| Interest Rates (US Fed Funds Rate) | Higher | ~3.1% (Median Projection) | Potential reduction in financing costs. |

| Inflation | Elevated | Moderating but persistent | Increased operational costs for materials and labor. |

| Infrastructure Funding Gap | Significant | Persists | Opportunities for investment and project development. |

Full Version Awaits

CK Infrastructure PESTLE Analysis

The preview you see here is the exact CK Infrastructure PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. What you're previewing is the actual file, ready for immediate use.

Sociological factors

Rapid population growth, especially in emerging economies, is a significant driver for infrastructure development. For instance, the United Nations projects the world population to reach 9.7 billion by 2050, with a substantial portion of this growth concentrated in urban areas.

Urbanization trends, such as the expansion of southern US cities and major hubs in Southeast Asia, directly translate into heightened demand for essential services like transportation, water, and sanitation. This surge necessitates substantial investment in new projects and the modernization of existing systems to accommodate burgeoning city dwellers.

Consumer preferences are rapidly evolving, with a notable surge in demand for convenience, often translating into single-use packaged goods. This trend, while catering to immediate consumer needs, directly contributes to escalating waste generation, placing greater pressure on infrastructure to develop and implement more effective waste management systems. For instance, global plastic waste generation reached approximately 400 million tonnes annually by 2023, highlighting the scale of this challenge.

Alongside this, there's a pronounced societal shift towards sustainability and efficiency, particularly evident in transportation. Consumers increasingly expect and are willing to pay for greener, more streamlined transit options. In 2024, public transportation ridership in major global cities saw a significant rebound, with some reporting pre-pandemic levels, signaling a growing preference for shared and sustainable mobility solutions.

Societal demands for robust public health infrastructure are intensifying, particularly regarding water and wastewater treatment. CK Infrastructure must address increasing expectations for advanced treatment outcomes and consistently reliable services to safeguard community well-being.

Aging infrastructure presents significant public health risks. For instance, in 2024, the American Society of Civil Engineers reported that over 2.5 million water main breaks occur annually in the United States, impacting water quality and service delivery.

CK Infrastructure's commitment to upgrading and maintaining its systems is crucial. Investments in modernizing water treatment facilities and wastewater management are essential to meet evolving health standards and prevent potential outbreaks, a growing concern as urban populations expand.

Social Expectations for Sustainability and ESG

Societal pressure for companies to operate sustainably and responsibly is intensifying. CK Infrastructure (CKI) is increasingly expected by the public and stakeholders to demonstrate strong environmental, social, and governance (ESG) performance. This translates into a demand for tangible actions like reducing greenhouse gas emissions and implementing eco-friendly solutions throughout their global infrastructure projects.

Consumers and investors are more aware than ever of the impact businesses have on the planet and society. For instance, a 2024 report indicated that over 70% of global consumers consider sustainability a key factor when making purchasing decisions. This trend directly influences how companies like CKI are perceived and valued, pushing them to integrate sustainability into their core business strategies and reporting.

- Growing Consumer Demand: A significant majority of consumers now prioritize sustainability in their purchasing habits.

- Investor Scrutiny: Institutional investors are increasingly allocating capital towards companies with robust ESG credentials, impacting CKI's access to capital and valuation.

- Reputational Risk: Failure to meet societal expectations on sustainability can lead to negative publicity and damage brand image for CKI.

- Regulatory Anticipation: Proactive adoption of green initiatives by CKI can position the company favorably ahead of potential future environmental regulations.

Community Engagement and Prioritization of Water Use

In areas experiencing water scarcity, like parts of Australia where CK Infrastructure operates, engaging communities is crucial for deciding how water is used. This means balancing everyday needs with the demands of businesses, including infrastructure projects. For instance, in 2023, Australia faced significant drought conditions, highlighting the delicate balance required.

CKI, as a key infrastructure provider, must actively participate in these social discussions. Building public trust and ensuring fair resource allocation are vital for the acceptance and success of their projects. This approach helps prevent conflicts and fosters a sense of shared responsibility.

- Community Input: Prioritizing water use requires direct dialogue with local residents and businesses to understand diverse needs.

- Equitable Distribution: Infrastructure projects must demonstrate how they contribute to, rather than detract from, fair water access for all.

- Public Acceptance: Transparent engagement builds goodwill, which is essential for CKI's long-term social license to operate.

- Water Stress Impact: Regions with limited water resources, such as those impacted by climate change, demand heightened community involvement in resource management decisions.

Societal expectations for sustainable and ethical business practices are increasingly influencing infrastructure development. CK Infrastructure (CKI) faces growing pressure from consumers and investors to demonstrate strong Environmental, Social, and Governance (ESG) performance, with over 70% of global consumers considering sustainability in purchasing decisions as of 2024.

This societal shift translates into a demand for tangible actions, such as reducing emissions and implementing eco-friendly solutions, directly impacting CKI's reputation and access to capital. Failure to meet these expectations poses a reputational risk, while proactive adoption of green initiatives can provide a competitive advantage.

Furthermore, community engagement is critical, particularly in regions facing resource scarcity like Australia, where water use decisions require balancing diverse needs. CKI's commitment to transparent dialogue and equitable resource allocation is vital for securing public acceptance and maintaining its social license to operate.

Technological factors

The digital revolution is fundamentally reshaping infrastructure. Technologies like AI-powered analytics, intelligent traffic management systems, and widespread sensor networks are becoming standard, enhancing efficiency and responsiveness. For instance, smart city initiatives are increasingly integrating these technologies to optimize resource allocation and service delivery.

CK Infrastructure (CKI) is proactively embracing these technological shifts to bolster its operations. The company is investing in real-time asset tracking and predictive maintenance capabilities, leveraging data analytics to anticipate potential issues and improve operational uptime across its diverse portfolio.

AI and machine learning are becoming essential for optimizing IT infrastructure, with companies leveraging these tools for predictive analytics to anticipate issues and enhance operational efficiency. This integration aims to minimize downtime and improve overall system reliability.

In logistics, AI and ML are transforming operations by enabling advanced route optimization and predictive maintenance for fleets, leading to significant cost reductions and improved delivery times. For instance, by mid-2024, many logistics firms reported a 15-20% increase in fuel efficiency through AI-driven route planning.

The infrastructure sector is increasingly embracing cloud-native technologies like containers and Kubernetes, enabling greater agility and scalability in managing complex systems. This shift allows for more efficient deployment and operation of applications. By 2025, it's projected that over 75% of enterprise data will be generated and processed at the edge, away from centralized data centers, highlighting the growing importance of distributed computing solutions for entities like CK Infrastructure.

5G Technology and Connectivity

The rollout of 5G technology is fundamentally reshaping IT infrastructure, promising ultra-fast speeds, minimal latency, and significantly higher data capacity. This evolution is a critical technological factor for CK Infrastructure, as it underpins advancements in areas such as autonomous vehicles and real-time remote healthcare, demanding substantial upgrades to existing network capabilities.

The increased data demands driven by 5G will necessitate robust and scalable IT infrastructures. For instance, the global 5G services market was valued at approximately $34.7 billion in 2023 and is projected to reach $1.18 trillion by 2030, reflecting a compound annual growth rate of 62.1%. This surge highlights the immense pressure on infrastructure providers to enhance their capacity and efficiency to support this connectivity revolution.

- 5G's Impact: Enables new services like IoT, AI-driven analytics, and enhanced mobile broadband, requiring significant investment in network upgrades.

- Data Growth: Expect a dramatic increase in data traffic, necessitating expanded fiber optic networks and data center capabilities.

- Investment Needs: CK Infrastructure must consider capital expenditure for upgrading and expanding its telecommunications and data infrastructure to meet 5G demands.

- Market Opportunity: The widespread adoption of 5G presents opportunities for providing essential infrastructure services to telecom operators and businesses.

Innovative Solutions for Water and Waste Management

Technological advancements are revolutionizing water and waste management, driving efficiency and reliability. By 2025, investments in smart water grids are projected to reach $15.5 billion globally, incorporating AI for leak detection and optimized distribution.

The integration of renewable energy sources, such as solar and wind power for desalination plants and wastewater treatment facilities, is becoming increasingly common. For instance, the global renewable energy in water and wastewater treatment market was valued at $2.8 billion in 2023 and is expected to grow significantly.

Biotechnology plays a crucial role in developing advanced biological treatment processes for wastewater, enhancing nutrient removal and resource recovery. Furthermore, artificial intelligence is being deployed to optimize waste sorting, predict equipment failures, and manage complex water networks, fostering more resilient and sustainable systems.

- Smart Water Grids: Global investment expected to reach $15.5 billion by 2025, leveraging AI for leak detection.

- Renewable Energy Integration: Growing adoption in water treatment, with the market valued at $2.8 billion in 2023.

- Biotechnology Advancements: Enhancing wastewater treatment and resource recovery through biological processes.

- AI in Operations: Optimizing waste sorting, predictive maintenance, and water network management.

CK Infrastructure's technological landscape is rapidly evolving, driven by advancements in digital infrastructure and data management. The company is leveraging AI and machine learning for predictive maintenance and operational efficiency, anticipating a significant impact on asset performance. The widespread adoption of 5G technology is a key factor, necessitating robust network upgrades and presenting opportunities in supporting new data-intensive services.

CKI's investment in real-time asset tracking and data analytics directly addresses the growing demand for enhanced operational visibility and proactive issue resolution. The projected growth in the global 5G services market, expected to reach $1.18 trillion by 2030, underscores the critical need for infrastructure providers to scale their capabilities.

Furthermore, the integration of cloud-native technologies and edge computing is crucial for managing complex systems and the increasing volume of data generated. By 2025, over 75% of enterprise data is anticipated to be processed at the edge, highlighting the need for distributed computing solutions.

The company's engagement with smart water grids and renewable energy integration in water treatment reflects a commitment to technologically advanced, sustainable solutions. Investments in smart water grids are projected to reach $15.5 billion by 2025, with AI playing a vital role in optimizing operations.

| Technology Area | Key Advancement | CKI Relevance | Market Projection/Data Point |

|---|---|---|---|

| Digital Infrastructure | AI, Machine Learning, Sensor Networks | Predictive maintenance, operational efficiency | Global 5G services market: $1.18 trillion by 2030 (CAGR 62.1%) |

| Data Management | Cloud-Native, Edge Computing | Scalability, efficient data processing | 75% of enterprise data processed at the edge by 2025 |

| Water & Waste Management | Smart Grids, AI, Renewables | Optimized resource allocation, sustainability | Smart water grid investment: $15.5 billion by 2025 |

Legal factors

CK Infrastructure Holdings (CKI) navigates a complex web of regulations across its global operations, impacting everything from project approvals to operational standards. For instance, in the UK, the Office of Gas and Electricity Markets (Ofgem) sets stringent performance targets and price controls for energy networks, which CKI's subsidiaries must adhere to. Similarly, in Australia, the Australian Competition and Consumer Commission (ACCC) oversees infrastructure pricing and service quality, influencing CKI's port and water utility businesses.

Ensuring compliance with these diverse regulatory frameworks, which can vary significantly in their stringency and focus, presents a continuous challenge. For example, differing environmental regulations across Australia and the UK require tailored approaches to infrastructure development and maintenance. CKI's 2023 annual report highlighted ongoing investments in compliance programs to manage these varied requirements effectively.

Governments worldwide are tightening environmental regulations, pushing for greater renewable energy adoption and stricter carbon emission limits. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly influencing infrastructure development and operational costs for companies like CK Infrastructure (CKI).

New sustainability disclosure rules, such as the UK Sustainability Disclosure Standards which came into effect in 2024, mandate more comprehensive reporting on environmental risks and opportunities. This means CKI must provide greater transparency on how its projects align with net-zero targets and manage climate-related financial risks, potentially impacting investor confidence and access to capital.

Legislative changes significantly influence CK Infrastructure's (CKI) operations. For instance, amendments to infrastructure bills in key markets, such as the proposed updates to the US Infrastructure Investment and Jobs Act in 2024, could accelerate or delay project approvals, directly impacting CKI's development schedules and investment returns.

Furthermore, evolving regulations concerning environmental standards, particularly for water and wastewater management, are critical. In 2024, the European Union's continued focus on water quality directives, alongside national implementations, necessitates CKI's adherence to stricter wastewater treatment standards, potentially increasing operational costs but also driving demand for advanced solutions.

Climate Litigation and Corporate Accountability

Climate change litigation is an increasing concern, posing legal risks for the construction and infrastructure sectors if they fail to meet climate commitments. CK Infrastructure (CKI) must evaluate its financial exposure stemming from climate-related risks and improve its transparency in climate disclosures.

This evolving legal landscape means companies like CKI face potential lawsuits for not adequately addressing climate change impacts in their operations and project planning. For instance, in 2023, the number of climate litigation cases globally continued to rise, with a significant portion targeting corporations and governments for their role in climate change or for failing to meet emissions targets.

- Growing Litigation: The number of climate change-related lawsuits against corporations and governments has seen a steady increase, with projections indicating this trend will continue through 2024 and 2025.

- Disclosure Requirements: Regulators worldwide are enhancing requirements for climate-related financial disclosures, pushing companies to quantify and report their climate risks.

- Industry Impact: The infrastructure sector, including construction, is particularly vulnerable due to the long-term nature of projects and their significant environmental footprint.

Energy Market Regulations and Policy Frameworks

The energy sector is heavily influenced by government policies, and CK Infrastructure must stay abreast of evolving regulations, particularly those promoting low-carbon energy sources. For instance, in 2024, many nations are reinforcing renewable energy targets, which can create both opportunities and compliance challenges for infrastructure companies. Navigating the complexities of interconnection processes and regional transmission planning remains critical for project development and integration into the grid.

Key regulatory considerations include:

- Shifting decarbonization mandates: Governments worldwide are setting ambitious targets for renewable energy adoption, impacting investment decisions and operational strategies. For example, the European Union's REPowerEU plan aims to accelerate the green transition, potentially boosting demand for renewable energy infrastructure.

- Grid modernization and expansion policies: Regulations governing transmission planning and upgrades are crucial for integrating new, often intermittent, renewable energy sources. The US Bipartisan Infrastructure Law, enacted in 2021 and continuing to influence investment through 2024 and beyond, allocates significant funds to grid modernization.

- Incentive structures and subsidies: The availability and structure of government incentives for clean energy projects, such as tax credits or feed-in tariffs, directly affect the financial viability of CKI's investments.

- Market design reforms: Changes in electricity market rules, including capacity markets and ancillary services, can alter revenue streams and risk profiles for energy infrastructure assets.

CK Infrastructure Holdings (CKI) operates under a dynamic legal framework that significantly shapes its global operations and investment strategies. Regulatory shifts, particularly concerning environmental standards and decarbonization, are paramount. For instance, the EU's Fit for 55 package, aiming for a 55% emissions reduction by 2030, directly influences CKI's energy infrastructure projects, while new UK Sustainability Disclosure Standards implemented in 2024 demand greater transparency on climate risks.

The increasing trend of climate change litigation poses a notable legal risk, with global cases against corporations rising, impacting CKI's need for robust climate risk assessment and disclosure. Furthermore, legislative changes, such as potential updates to the US Infrastructure Investment and Jobs Act in 2024, can alter project approval timelines and investment returns for CKI.

CKI must also navigate evolving water quality directives, such as those from the EU, which necessitate adherence to stricter wastewater treatment standards, potentially increasing operational costs. The company's 2023 annual report indicated ongoing investments in compliance programs to manage these varied and tightening regulatory requirements across its diverse portfolio.

Environmental factors

CK Infrastructure's extensive portfolio, including its significant investments in utilities and transportation networks, faces heightened scrutiny regarding its environmental footprint and susceptibility to climate change. This includes vulnerability to extreme weather events like typhoons and flooding, which can disrupt operations and damage assets.

The company is under increasing pressure from stakeholders and regulators to bolster the resilience of its infrastructure. For instance, in 2023, CK Infrastructure reported capital expenditure of HK$17.3 billion, a portion of which is allocated to maintaining and upgrading existing assets to withstand a changing climate, reflecting a proactive approach to managing these environmental risks.

Global freshwater resources are under increasing strain, with projections indicating a significant gap between demand and supply in the coming years. This escalating water stress necessitates innovative solutions and robust infrastructure to ensure reliable access. For CK Infrastructure, this translates to a critical need to integrate water management strategies into its operations and future investments, particularly in regions facing acute scarcity.

Growing global populations and evolving consumer habits are significantly increasing waste generation, creating a demand for sophisticated waste management solutions and waste-to-energy projects. For instance, in 2024, global waste generation was projected to reach 2.5 billion metric tons, highlighting the urgency of addressing this challenge.

There's a powerful global movement towards circular economy principles in wastewater and waste management, aiming to convert waste streams into valuable resources. This shift is driving innovation in recycling technologies and resource recovery, with the global circular economy market expected to reach $4.5 trillion by 2030.

Decarbonization and Green Energy Integration

CK Infrastructure's operations, particularly in the transportation sector, face significant environmental pressures to decarbonize. This translates into a growing demand for greener alternatives such as electric vehicles (EVs), hydrogen fuel, and biofuels, impacting CKI's infrastructure investments and development strategies. For instance, by the end of 2023, global EV sales surpassed 13 million units, a 30% increase from 2022, highlighting the accelerating shift away from traditional internal combustion engines.

Integrating green energy solutions and actively reducing carbon dioxide (CO2) emissions are paramount for CKI's long-term sustainability and regulatory compliance. The company must adapt its infrastructure to support this transition, which may involve investments in charging networks, hydrogen refueling stations, and renewable energy sources for its operations. The International Energy Agency reported in early 2024 that renewable energy sources accounted for over 30% of global electricity generation, a figure expected to climb as governments worldwide implement stricter emissions targets.

- Growing EV Adoption: Global electric car sales reached approximately 14 million in 2024, indicating a substantial market shift.

- Hydrogen Economy Push: Several nations, including China and the EU, are investing billions in hydrogen infrastructure development through 2030.

- Biofuel Mandates: Many countries are increasing biofuel blending mandates, with some aiming for 20% or higher by 2025-2030.

- Carbon Pricing Mechanisms: The expansion of carbon taxes and emissions trading systems globally increases the cost of carbon-intensive operations.

Environmental Regulations and Sustainability Reporting

CK Infrastructure (CKI) faces growing pressure from stricter environmental regulations and the increasing demand for transparent sustainability reporting. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the UK's Sustainability Disclosure Standards (SDS) are becoming benchmarks for companies to disclose their environmental impact. This necessitates CKI to provide clear and verifiable data on its operational footprint.

The company must now actively assess and report on its supply chain's carbon emissions, a complex but crucial step in demonstrating genuine commitment to sustainability. Aligning with global net-zero commitments, such as those outlined in the Paris Agreement, requires a strategic approach to decarbonization across all business segments. For instance, by 2024, many companies are setting interim targets for emissions reductions, with a focus on Scope 3 emissions, which often constitute the largest portion of a company's carbon footprint.

- Increased regulatory scrutiny on emissions and waste management impacts CKI's operational costs and compliance strategies.

- Demand for TCFD-aligned reporting means CKI must detail climate-related risks and opportunities, influencing investor confidence.

- Supply chain emissions assessment is critical, with many large corporations aiming to map 90% of their Scope 3 emissions by 2025.

- Net-zero commitments require CKI to integrate decarbonization into its long-term capital expenditure and operational planning.

CK Infrastructure's environmental considerations are increasingly shaped by climate change impacts and the global push for sustainability. Extreme weather events pose significant operational risks, necessitating investment in resilient infrastructure, as demonstrated by CKI's HK$17.3 billion capital expenditure in 2023, partly for asset upgrades.

The company faces growing pressure to decarbonize, driven by the rise of electric vehicles and biofuels, with global EV sales exceeding 13 million units by the end of 2023. Furthermore, stricter environmental regulations and the demand for TCFD-aligned reporting mean CKI must provide transparent data on its carbon footprint and supply chain emissions to meet net-zero commitments.

| Environmental Factor | Impact on CKI | Data Point/Trend (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Operational disruption, asset damage, need for resilience investment | CKI's 2023 capex of HK$17.3 billion includes asset upgrades for climate resilience. |

| Decarbonization & Green Transition | Demand for EV infrastructure, biofuels, renewable energy integration | Global EV sales reached approx. 14 million in 2024; renewable energy >30% of global electricity generation (early 2024). |

| Regulatory Scrutiny & Reporting | Compliance costs, need for transparent sustainability disclosures (TCFD) | Many companies aim to map 90% of Scope 3 emissions by 2025; net-zero commitments are standard. |

| Waste Management & Circular Economy | Opportunities in waste-to-energy, need for resource recovery solutions | Global waste generation projected at 2.5 billion metric tons in 2024; circular economy market to reach $4.5 trillion by 2030. |

PESTLE Analysis Data Sources

Our CK Infrastructure PESTLE Analysis is built on a robust foundation of data from leading industry research firms, government reports, and international economic organizations. We meticulously gather insights on technological advancements, regulatory changes, and market trends to provide a comprehensive overview.