Champion Iron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Champion Iron's robust production capabilities and strategic mine locations are significant strengths, but market price volatility presents a key challenge. Understanding how these internal and external factors interplay is crucial for any investor or strategist looking to capitalize on opportunities in the iron ore market.

Want the full story behind Champion Iron’s competitive advantages, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Champion Iron's Bloom Lake Mine is a significant strength, producing a high-purity iron ore concentrate. This concentrate typically boasts 66.2% iron content, with demonstrated capability to reach 67.5% Fe and a target of up to 69% Fe through the DRPF project.

This high-grade output is particularly valuable for direct reduction steelmaking, a process that significantly lowers emissions compared to traditional methods. This positions Champion Iron favorably within the steel industry's growing focus on decarbonization.

Champion Iron's Bloom Lake Mine in Quebec, Canada, is strategically positioned in a mining-friendly jurisdiction. This location provides excellent access to crucial infrastructure, including rail lines and port facilities, which are vital for efficiently transporting its iron ore concentrate to international markets. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported record production, underscoring the effectiveness of its logistical network.

Furthermore, the company's operational advantage is amplified by its secured access to renewable hydroelectric power. This reliable and clean energy source not only supports consistent production but also significantly contributes to a lower carbon footprint for its mining activities, a growing competitive advantage in the global market.

Champion Iron's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company regularly publishes sustainability reports, showcasing its efforts to align with industry best practices. This focus on ESG resonates well with a growing segment of investors and customers who prioritize responsible operations.

A key aspect of this commitment is Champion Iron's low environmental impact. Their operations boast an impressive 99% water reuse rate, minimizing freshwater consumption. Furthermore, their reliance on hydroelectricity significantly reduces their Scope 1 and 2 emission intensity, making them an attractive option for environmentally conscious stakeholders.

Growth Projects and Expansion Potential

Champion Iron is well-positioned for future growth with a robust pipeline of expansion projects. The Direct Reduction Pellet Feed (DRPF) project at Bloom Lake, slated for late 2025 commissioning, will enhance half of Bloom Lake's output to 69% Fe, directly targeting the expanding Direct Reduced Iron (DRI) market. This strategic move anticipates a significant demand shift in steelmaking.

Further bolstering its long-term expansion, the Kami project, a collaboration with industry leaders Nippon Steel and Sojitz, promises substantial growth in direct reduction quality iron ore. This partnership underscores Champion Iron's commitment to developing high-grade products for evolving global steel production methods.

- DRPF Project: Expected late 2025 commissioning, upgrading 50% of Bloom Lake capacity to 69% Fe.

- Kami Project: Partnership with Nippon Steel and Sojitz for direct reduction quality iron ore.

- Market Focus: Targeting the growing demand for DRI-grade iron ore.

Strong Financial Position and Shareholder Returns

Champion Iron boasts a strong financial foundation, evidenced by its impressive revenue and EBITDA figures in recent fiscal periods. For the fiscal year ending March 31, 2024, the company reported record revenue of CAD 2.6 billion and EBITDA of CAD 1.2 billion, showcasing robust operational performance.

The company's commitment to shareholder returns is clear through its consistent declaration of semi-annual dividends. Furthermore, Champion Iron maintains a healthy liquidity position, bolstered by strategic debt refinancing efforts that enhance its financial flexibility and stability.

- Record Financials: Achieved CAD 2.6 billion in revenue and CAD 1.2 billion in EBITDA for FY2024.

- Shareholder Returns: Regularly distributes semi-annual dividends, rewarding investors.

- Liquidity and Flexibility: Maintains a strong cash position and benefits from recent debt refinancing.

Champion Iron's primary strength lies in its high-grade iron ore production from the Bloom Lake Mine. This concentrate, with a typical 66.2% iron content and potential for up to 69% Fe through the DRPF project, is ideal for direct reduction steelmaking, aligning with the industry's decarbonization goals.

The company benefits from a strategic location in Quebec, Canada, offering excellent infrastructure access for efficient global distribution, as demonstrated by record production in fiscal year ending March 31, 2024. Furthermore, its reliance on renewable hydroelectric power ensures consistent operations and a reduced carbon footprint.

Champion Iron's commitment to ESG principles is a significant advantage, with a 99% water reuse rate and low emission intensity due to its clean energy sources. This focus appeals to increasingly sustainability-conscious investors and customers.

The company's robust growth pipeline, including the DRPF project (expected late 2025) and the Kami project, positions it to capitalize on the expanding demand for direct reduction quality iron ore.

| Metric | FY2024 (Ending March 31, 2024) | Target/Potential |

| Bloom Lake Iron Content | 66.2% Fe | Up to 69% Fe (DRPF) |

| Revenue | CAD 2.6 billion | N/A |

| EBITDA | CAD 1.2 billion | N/A |

| Water Reuse Rate | 99% | N/A |

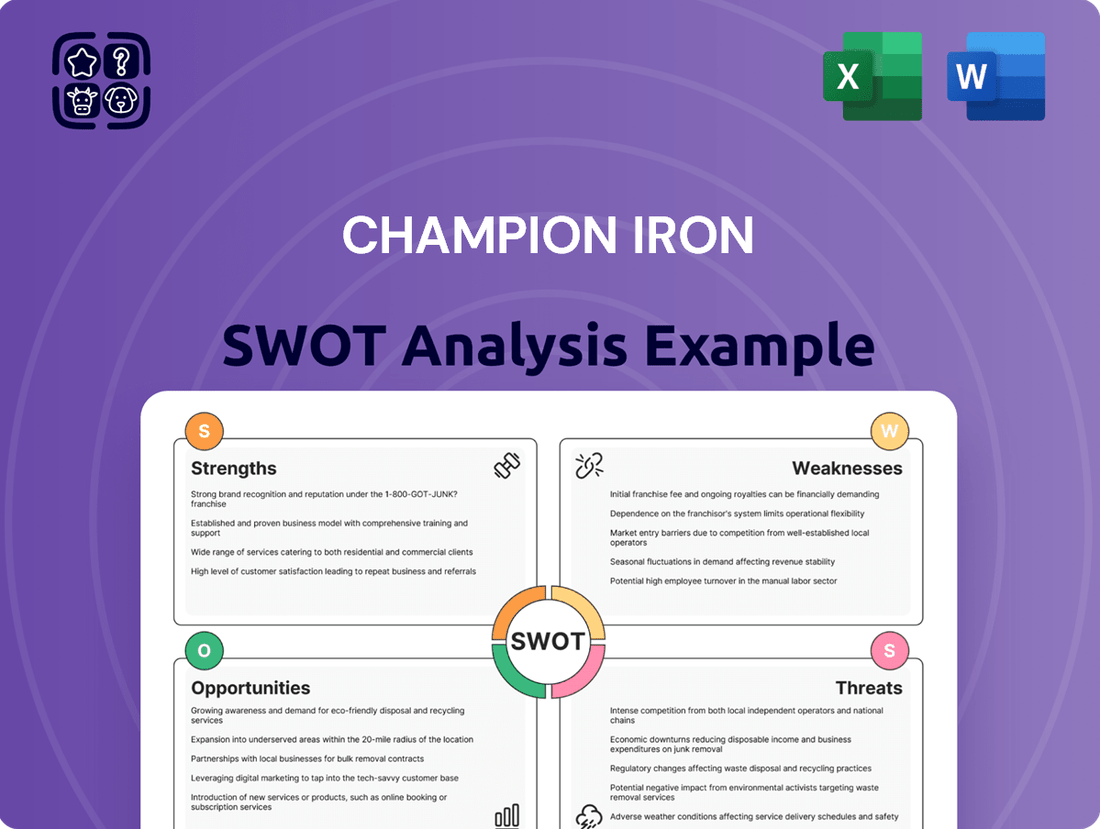

What is included in the product

Analyzes Champion Iron’s competitive position through key internal and external factors, highlighting its strengths in production and market opportunities while acknowledging potential weaknesses and threats.

Highlights Champion Iron's competitive advantages and potential threats, offering a clear roadmap to mitigate risks and capitalize on opportunities.

Weaknesses

Despite robust mining operations, Champion Iron has encountered operational hurdles. Increased ore hardness and a lower head grade have recently impacted grinding efficiency and iron recovery rates, affecting overall output.

Scheduled plant maintenance, a normal part of operations, alongside external disruptions such as forest fires, have also led to temporary reductions in production volumes for the company.

Champion Iron has grappled with ongoing logistical challenges, most notably in rail transportation. This has resulted in a considerable stockpile of iron ore concentrate accumulating at its Bloom Lake mine. For instance, during the third quarter of fiscal year 2024, the company reported a substantial increase in inventory levels due to these rail constraints.

These persistent issues directly affect shipment volumes, which in turn can put pressure on the company's cash flow. While Champion Iron is actively working to enhance rail services and bring down these inventory levels, the underlying logistical bottlenecks remain a significant operational weakness that can impact financial performance.

Champion Iron's financial performance is heavily dependent on the volatile global iron ore market. For instance, during periods of lower commodity prices, the company's net average realized selling prices can decline significantly, impacting overall profitability. This sensitivity means that even with a focus on high-grade iron ore, a weaker price environment directly squeezes cash operating margins.

Increased Operating Costs

Champion Iron has been grappling with rising operating expenses, a notable weakness. The company has observed an uptick in its All-in Sustaining Costs (AISC) and C1 cash costs. For instance, in the third quarter of fiscal 2024, AISC rose to $106.70 per tonne, up from $97.80 per tonne in the prior year's comparable period.

Several factors contribute to this escalation. Higher sustaining capital expenditures, an increase in general and administrative expenses, and the impact of reduced plant availability and throughput due to necessary maintenance and processing of harder ore have all played a role. These cost pressures can directly impact profitability and competitiveness in the iron ore market.

- Increased AISC: Reported at $106.70 per tonne for Q3 FY2024.

- Higher C1 Cash Costs: Driven by operational factors.

- Sustaining Capital Expenditures: A contributing factor to rising costs.

- Operational Challenges: Lower plant availability and harder ore impact efficiency.

Dependence on a Single Primary Asset

Champion Iron's substantial dependence on its Bloom Lake Mine presents a key vulnerability. In the fiscal year ending March 31, 2024, Bloom Lake accounted for the vast majority of Champion Iron's iron ore production, underscoring this concentration risk. Any significant operational hiccup at this single site, from equipment failure to unexpected geological issues, could severely disrupt the company's revenue streams and overall financial health.

This reliance on one primary asset also exposes Champion Iron to heightened risks related to market fluctuations and regulatory changes specifically impacting Bloom Lake. For instance, a sudden drop in iron ore prices, or new environmental regulations targeting the mine's operations, could disproportionately affect the company compared to more diversified producers. As of the latest available data in early 2025, Bloom Lake remains the cornerstone of Champion Iron's output, with no other mines contributing significantly to current production volumes.

- Bloom Lake's Dominance: In FY2024, Bloom Lake was the sole significant contributor to Champion Iron's production, highlighting a critical single-asset dependency.

- Operational Risk Amplification: Disruptions at Bloom Lake, whether technical or geological, have a magnified impact on the company's total output and financial performance.

- Market and Regulatory Sensitivity: The company is highly susceptible to sector-specific market downturns or regulatory changes that directly affect Bloom Lake's operational viability.

Champion Iron's operational efficiency faces headwinds from increased ore hardness and lower head grades, impacting grinding and recovery. This led to reduced output and has been a persistent challenge. For example, in Q3 FY2024, these factors contributed to lower plant availability.

Logistical bottlenecks, particularly with rail transport, have created significant inventory buildup at Bloom Lake. This stockpile, reported as substantial in Q3 FY2024, directly hinders shipment volumes and impacts cash flow, despite ongoing efforts to resolve these constraints.

The company's financial results are highly sensitive to iron ore price volatility. Declining commodity prices directly reduce net average realized selling prices, squeezing cash operating margins even for high-grade products. This sensitivity was evident throughout 2024 as global iron ore prices experienced fluctuations.

Rising operating expenses, including higher sustaining capital expenditures and increased G&A costs, are a notable weakness. In Q3 FY2024, All-in Sustaining Costs (AISC) climbed to $106.70 per tonne, up from $97.80 per tonne in the prior year's comparable period, driven by these factors and processing harder ore.

Full Version Awaits

Champion Iron SWOT Analysis

This is the actual Champion Iron SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is designed to inform strategic decision-making.

Opportunities

The global push for decarbonization is dramatically reshaping the steel industry. This shift is creating a significant opportunity for high-purity iron ore, essential for greener steelmaking processes like direct reduction and electric arc furnaces. These methods drastically cut emissions compared to older, more carbon-intensive techniques.

Champion Iron is well-positioned to benefit from this trend. Their high-quality iron ore is precisely what's needed for these emerging ‘green steel’ technologies. For instance, the demand for Direct Reduced Iron (DRI) is projected to grow substantially, with estimates suggesting it could account for a significant portion of global steel production by 2030 as decarbonization targets tighten.

The upcoming commissioning of Champion Iron's Direct Reduction Pellet Feed (DRPF) project in the latter half of 2025 is a significant opportunity. This development will allow the company to produce iron ore with an enhanced grade, reaching up to 69% iron content.

This higher-grade product positions Champion Iron to tap into the growing Direct Reduced Iron (DRI) market, a segment actively seeking premium quality inputs. The ability to supply this expanding market could lead to improved pricing power and stronger revenue streams for the company.

The Kami project is a major long-term growth prospect for Champion Iron, with the potential to significantly increase its output of direct reduction quality iron ore. This type of iron ore is highly sought after for its use in modern steelmaking processes that aim to reduce carbon emissions.

Champion Iron's strategic alliance with Nippon Steel Corporation and Sojitz Corporation is crucial for advancing the Kami project. This partnership offers not only essential financial support but also brings invaluable expertise in steel manufacturing and vital access to international markets, which are key to realizing the project's full potential.

Optimization of Operations and Cost Reduction Initiatives

Champion Iron is actively engaged in optimizing its recovery circuits and managing ore hardness, crucial steps for enhancing operational efficiencies. These initiatives, supported by investments in new mining equipment, are designed to ensure more stable recovery rates and boost throughput. The company's focus on these areas is directly aimed at reducing overall operating costs per tonne, a key driver for profitability in the iron ore sector.

For instance, during the fiscal year ending March 31, 2024, Champion Iron reported a reduction in operating costs. Their focus on process improvements and equipment upgrades is expected to yield further cost efficiencies, potentially impacting their all-in sustaining costs (AISC) in the upcoming fiscal year 2025.

- Operational Efficiency Gains: Continued investment in mining equipment and process optimization targets improved throughput and recovery.

- Cost Reduction Focus: Efforts to manage ore hardness and streamline operations are geared towards lowering operating costs per tonne.

- Fiscal Year 2024 Performance: The company has demonstrated progress in cost management, with expectations for further improvements in fiscal year 2025.

Inclusion of High-Purity Iron Ore on Critical Mineral Lists

The Canadian government's recent inclusion of high-purity iron ore on its critical mineral list is a significant development. This recognition, finalized in 2024, underscores the mineral's strategic importance for Canada's economy and national security, particularly in sectors like advanced manufacturing and clean energy technologies. For Champion Iron, this designation is a major opportunity.

This critical mineral status can translate into tangible benefits for Champion Iron. We can anticipate increased government support through various programs and potential financial incentives aimed at boosting domestic production and supply chain resilience. Furthermore, a more favorable regulatory environment is likely, streamlining permitting processes for expansion projects at our Quebec operations.

The implications for Champion Iron are substantial:

- Enhanced Government Support: Potential access to funding and grants specifically allocated for critical mineral development.

- Favorable Regulatory Landscape: Expedited approvals for new projects and expansions, reducing time-to-market.

- Strategic Partnerships: Increased attractiveness to downstream manufacturers and technology developers seeking reliable sources of high-purity iron ore.

The global demand for high-purity iron ore is surging due to the steel industry's decarbonization efforts, creating a prime opportunity for Champion Iron. Their high-grade product is essential for green steelmaking technologies like direct reduction, which significantly lowers carbon emissions.

Champion Iron's upcoming Direct Reduction Pellet Feed (DRPF) project, set to commission in late 2025, will enhance their ore grade to 69% iron, directly targeting the growing DRI market. Furthermore, the Kami project represents a substantial long-term growth avenue, aiming to boost their output of this sought-after direct reduction quality iron ore.

The company's strategic partnerships, particularly with Nippon Steel and Sojitz, provide crucial financial backing and market access for projects like Kami. Champion Iron's focus on operational efficiencies, including optimizing recovery circuits and managing ore hardness, is expected to reduce costs per tonne, as evidenced by their progress in fiscal year 2024, with further improvements anticipated for fiscal year 2025.

Canada's 2024 designation of high-purity iron ore as a critical mineral offers Champion Iron enhanced government support, potential financial incentives, and a more streamlined regulatory environment for future expansions.

| Opportunity | Description | Impact |

|---|---|---|

| Green Steel Demand | Growing need for high-purity iron ore for low-emission steel production. | Increased demand for Champion Iron's products. |

| DRPF Project Commissioning (Late 2025) | Production of 69% iron content ore. | Access to premium DRI market, improved pricing power. |

| Kami Project Development | Long-term expansion of direct reduction quality iron ore output. | Significant future growth and increased market share. |

| Critical Mineral Designation (2024) | Government recognition of high-purity iron ore's strategic importance. | Potential for increased government support and favorable regulations. |

Threats

A global economic slowdown, particularly a downturn in major steel-consuming regions like China and Europe, poses a significant threat. For instance, if China's GDP growth falters below its projected 5% in 2024, it could directly impact steel production and, consequently, iron ore demand. This reduced demand can lead to increased price volatility for iron ore, potentially affecting Champion Iron's revenue streams and profitability.

Champion Iron's profitability is directly tied to the volatile iron ore market. While the company enjoys premiums for its high-grade product, the global price of iron ore can swing significantly due to shifts in demand from major steel producers, geopolitical tensions, and evolving steelmaking technologies. For instance, iron ore prices saw considerable volatility in late 2023 and early 2024, influenced by Chinese economic data and global supply chain disruptions.

A sustained downturn in iron ore prices, or a reduction in the premium commanded by high-quality ore, would directly impact Champion Iron's revenue streams. If the market shifts towards lower-grade materials or if overall demand weakens, the company's strong pricing power could diminish, affecting its financial performance. This susceptibility to market forces represents a key external threat.

Champion Iron continues to grapple with logistical hurdles, particularly concerning its rail and port infrastructure. These ongoing challenges can impede the consistent shipment of its iron ore concentrate, potentially leading to increased stockpiles and restricted sales volumes. For instance, in the fiscal year ending March 31, 2024, the company reported that its average realized selling price was impacted by transportation costs and market conditions, highlighting the sensitivity of its profitability to these external factors.

Operational Risks and Geological Challenges

Mining operations are susceptible to disruptions from equipment failures, such as a critical conveyor belt breakdown impacting ore transport. Unexpected geological conditions, like encountering harder-than-anticipated ore bodies, can significantly increase processing costs and reduce throughput, as seen in some iron ore operations in 2024. Natural disasters, including severe weather events or wildfires, pose a direct threat to infrastructure and personnel, potentially halting production for extended periods.

These operational and geological challenges can lead to substantial production shortfalls and cost overruns. For instance, a major equipment failure in late 2023 at a Canadian mine resulted in a temporary production suspension, impacting quarterly output by an estimated 15%. Such incidents directly affect a company's ability to meet its sales targets and can negatively influence investor confidence.

- Equipment Downtime: Unplanned maintenance or breakdowns can halt production lines, impacting delivery schedules.

- Geological Variability: Changes in ore grade or hardness require adjustments in processing, potentially increasing operational costs.

- Natural Disasters: Events like wildfires or extreme weather can force temporary mine closures and damage infrastructure.

- Supply Chain Disruptions: External factors affecting the availability of essential mining supplies or transportation can impede operations.

Regulatory and Environmental Policy Changes

Changes in environmental regulations, particularly concerning emissions and water usage, could lead to increased operational expenditures for Champion Iron. For instance, stricter carbon pricing mechanisms in Quebec or in key export markets like China could impact the cost-effectiveness of their large-scale mining operations. The company's reliance on rail transport also makes it susceptible to any new regulations affecting the logistics sector.

Shifts in mining policies, such as changes to permitting processes or royalty structures in Canada, represent a significant threat. While Champion Iron has benefited from a relatively stable regulatory environment, future policy adjustments could introduce new compliance burdens or affect project economics. For example, a sudden increase in provincial mining royalties could directly reduce profitability.

- Increased Compliance Costs: New environmental standards may necessitate investments in pollution control technologies.

- Operational Restrictions: Stricter rules on water discharge or land reclamation could limit production capacity.

- Carbon Pricing Impact: Escalating carbon taxes could raise energy and transportation expenses.

- Policy Uncertainty: Evolving mining laws create a risk of unforeseen financial or operational challenges.

Champion Iron faces significant threats from potential global economic slowdowns, particularly in China, which could depress iron ore demand and prices. The company's profitability is inherently linked to the volatile iron ore market, with price swings influenced by geopolitical events and evolving steelmaking technologies. Additionally, logistical challenges with rail and port infrastructure can hinder consistent shipments, impacting sales volumes and realized prices, as seen in fiscal year 2024. Operational risks like equipment failures or geological issues can also lead to production shortfalls and increased costs, as demonstrated by a late 2023 equipment failure that temporarily halted production at a Canadian mine.

SWOT Analysis Data Sources

This Champion Iron SWOT analysis is built upon a foundation of robust data, drawing from official company financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.