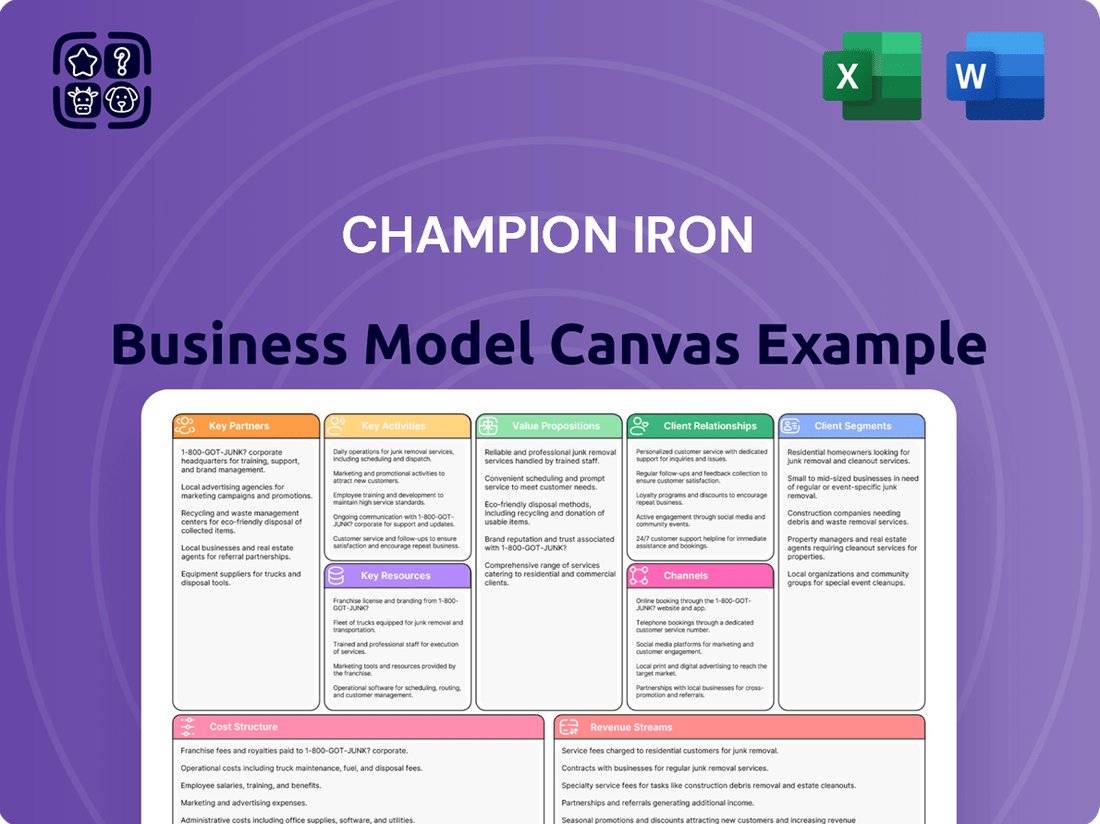

Champion Iron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Unlock the full strategic blueprint behind Champion Iron's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Champion Iron relies heavily on its logistics and shipping partners to move its iron ore concentrate from the Bloom Lake Mine to its customers worldwide. These relationships are fundamental to the entire operation.

Key partners include rail operators, such as Quebec North Shore and Labrador Railway Company, which handle the crucial overland transport of ore to port facilities. This rail link is vital for getting the product to a point where it can be loaded onto vessels.

For the ocean freight segment, Champion Iron partners with various shipping companies to ensure the iron ore reaches international markets efficiently. In the fiscal year ending March 31, 2024, Champion Iron's total sales volume was approximately 12.9 million tonnes, highlighting the scale of logistics required.

Champion Iron's operational success hinges on strong relationships with equipment and technology suppliers. These partnerships are crucial for securing advanced mining machinery, processing equipment, and automation solutions that drive efficiency and innovation in their operations.

Collaborations with manufacturers like Caterpillar, Komatsu, and FLSmidth provide access to state-of-the-art extraction and beneficiation technologies. For instance, Champion Iron's 2024 operational reports highlight the significant impact of upgraded crushing and grinding equipment on their iron ore concentrate recovery rates, directly attributable to these supplier relationships.

Champion Iron actively cultivates robust relationships with Canadian and Quebecois governmental bodies. These partnerships are crucial for obtaining and renewing vital mining permits, environmental approvals, and operating licenses, ensuring the company’s ability to conduct business. For instance, in fiscal year 2024, Champion Iron successfully navigated the regulatory landscape to advance its projects.

Compliance with evolving environmental and operational regulations is not just a legal requirement but a cornerstone of Champion Iron's social license to operate. Adhering to these standards, which are often set by provincial and federal agencies, directly impacts the company's long-term sustainability and community acceptance. The company's commitment to responsible mining practices underpins its ongoing dialogue with these key stakeholders.

Local Communities and Indigenous Groups

Champion Iron actively cultivates relationships with local communities and Indigenous groups surrounding its Bloom Lake Mine to ensure social license and operational continuity. These collaborations are vital for mutual benefit and long-term sustainability.

Partnerships often materialize through Impact and Benefit Agreements (IBAs) and other collaborative frameworks. These agreements outline commitments related to employment opportunities, procurement from Indigenous businesses, and investments in community infrastructure and social programs. For instance, in 2024, Champion Iron continued its focus on local hiring, with a significant portion of its workforce originating from the surrounding regions, reinforcing its commitment to community economic development.

- Community Engagement: Regular dialogue and consultation with local stakeholders to address concerns and foster trust.

- Economic Benefits: Prioritizing local and Indigenous employment and business opportunities, contributing to regional economic growth.

- Social Investment: Supporting community development projects, education, and cultural initiatives to enhance quality of life.

Steel Industry Offtakers and Trading Houses

Champion Iron cultivates strategic alliances with major steel producers, especially those prioritizing direct reduction steelmaking. These collaborations are vital for securing long-term sales agreements and ensuring broad market access for its high-grade iron ore.

Reputable trading houses also form a cornerstone of Champion Iron's partnerships. They play a crucial role in facilitating consistent demand and providing stable revenue streams for the company's premium product, reinforcing its market position.

- Strategic Alliances: Partnerships with steelmakers focused on direct reduction, a process requiring high-grade iron ore, are key.

- Market Access: Trading houses provide Champion Iron with extensive reach into global steel markets.

- Revenue Stability: Long-term sales contracts with these partners ensure predictable income.

- Product Demand: The high quality of Champion Iron's ore is a significant draw for these off-takers.

Champion Iron's success is deeply intertwined with its strategic partnerships, which span logistics, suppliers, government, communities, and key customers. These relationships are not merely transactional but foundational to its operational efficiency, market access, and social license to operate.

In 2024, Champion Iron's total sales volume reached approximately 12.9 million tonnes, underscoring the critical role of its logistics partners, including rail operators like Quebec North Shore and Labrador Railway Company, and international shipping firms. These entities ensure the efficient transport of iron ore from mine to global markets.

The company also relies on equipment and technology suppliers, such as Caterpillar and Komatsu, for advanced mining machinery, directly impacting operational efficiency and recovery rates, as evidenced by upgrades in 2024. Furthermore, strong ties with steel producers, particularly those utilizing direct reduction steelmaking, secure long-term sales agreements for its high-grade product.

| Partner Type | Key Examples | Role/Impact | 2024 Relevance |

|---|---|---|---|

| Logistics & Shipping | Quebec North Shore and Labrador Railway, Shipping Companies | Transporting ore to customers | Supported 12.9 million tonnes sales volume |

| Equipment Suppliers | Caterpillar, Komatsu | Providing advanced mining and processing technology | Crucial for operational efficiency and recovery rates |

| Customers | Major Steel Producers (Direct Reduction focus) | Securing long-term sales and market access | Ensuring demand for high-grade iron ore |

| Government Bodies | Canadian & Quebecois Agencies | Permitting, approvals, and regulatory compliance | Facilitated project advancements |

| Communities & Indigenous Groups | Local & Indigenous Stakeholders | Social license, employment, economic development | Continued focus on local hiring and community investment |

What is included in the product

A comprehensive, pre-written business model tailored to Champion Iron’s strategy, focusing on low-cost iron ore production and efficient logistics to serve global steel markets.

Covers customer segments (global steel producers), channels (shipping), and value propositions (high-quality, cost-competitive iron ore) in full detail.

Champion Iron's Business Model Canvas offers a clear, one-page snapshot of their operations, effectively relieving the pain of complex strategic analysis by condensing their entire approach into a digestible format for quick review and understanding.

Activities

Iron ore mining and extraction at Bloom Lake is the heart of Champion Iron's operations. This involves the physical removal of iron ore from the earth using open-pit methods. Think of it as carefully digging out the valuable rock.

The process includes essential steps like drilling into the ore body, using controlled blasting to break it up, and then loading the broken ore onto large trucks. These trucks then haul the material to the nearby processing plant. This entire sequence is crucial for getting the raw material ready for the next stage.

In the fiscal year 2024, Champion Iron reported a significant production volume, with Bloom Lake producing approximately 12.9 million wet metric tons (WMT) of iron ore concentrate. This demonstrates the scale of their extraction activities.

Champion Iron's ore processing and beneficiation involves a rigorous multi-stage approach. Raw ore is subjected to crushing and grinding to reduce particle size, followed by magnetic separation. This process is essential for isolating valuable iron minerals and removing waste rock, ultimately producing a high-purity iron ore concentrate.

This concentrate is specifically tailored to meet the stringent quality and grade requirements of direct reduction steelmakers, a key customer segment for Champion Iron. In 2024, Champion Iron reported that its operations achieved an average concentrate grade of 66.7% Fe, a testament to the effectiveness of its beneficiation processes.

Champion Iron's logistics and supply chain management is a critical component of its business. This involves overseeing the entire journey of iron ore concentrate, from the mine site in Quebec to customers worldwide. Efficient coordination of rail, port, and shipping operations is paramount for delivering product on time and at a competitive cost.

In the fiscal year 2024, Champion Iron successfully transported 13.1 million tonnes of iron ore concentrate. This achievement underscores the company's robust logistics capabilities, ensuring that its high-quality product reaches global markets effectively.

Sales and Marketing

Champion Iron actively engages with global steel producers and international trading houses to secure vital sales contracts for its high-quality iron ore concentrate. This proactive approach is crucial for ensuring consistent demand and favorable pricing for its output.

The company's sales and marketing strategy heavily relies on in-depth market analysis to understand global steel demand trends and competitive pricing. Coupled with robust customer relationship management, this allows Champion Iron to negotiate effectively and maximize sales volume and achieved prices.

- Securing Sales Contracts: Focus on long-term agreements with key steel manufacturers in regions like China, Japan, and South Korea.

- Market Intelligence: Continuous monitoring of global steel production, iron ore prices, and competitor activities is essential.

- Customer Relationship Management: Building and maintaining strong relationships with major buyers to ensure repeat business and favorable terms.

- Logistics and Supply Chain: Efficiently managing the transportation of iron ore concentrate from the mine to global ports and then to customers.

In the fiscal year ending March 31, 2024, Champion Iron reported record annual revenue of $2.4 billion CAD, underscoring the effectiveness of its sales and marketing efforts in a dynamic global market.

Environmental Management and Sustainability

Champion Iron actively implements rigorous environmental protection measures across its operations. This includes comprehensive waste management strategies and ongoing efforts in rehabilitating mined areas to minimize ecological impact.

- Environmental Protection: Champion Iron focuses on minimizing its environmental footprint through responsible resource extraction and operational practices.

- Waste Management: The company employs strategies to manage and reduce waste generated from mining activities, aiming for efficient resource utilization.

- Land Rehabilitation: Significant resources are dedicated to rehabilitating mined areas, restoring them to a state that supports biodiversity and future land use.

- Regulatory Compliance: Adherence to strict environmental regulations and standards is a cornerstone of Champion Iron's operations, ensuring legal and ethical environmental stewardship.

These activities are fundamental to maintaining the company's social license to operate and achieving its long-term sustainability objectives. For instance, in fiscal year 2023, Champion Iron reported investing $11.5 million in environmental initiatives, highlighting a tangible commitment to these key activities.

Champion Iron's key activities revolve around the extraction and processing of high-quality iron ore concentrate. This involves the physical mining of ore, followed by sophisticated beneficiation techniques to achieve the desired purity for direct reduction steelmakers. The company also excels in managing its complex logistics and supply chain to ensure timely global delivery.

Furthermore, securing long-term sales contracts through market intelligence and strong customer relationships is vital. Champion Iron also prioritizes environmental stewardship and regulatory compliance throughout its operations.

| Activity | Description | Fiscal Year 2024 Data |

|---|---|---|

| Mining & Extraction | Open-pit mining of iron ore at Bloom Lake. | 12.9 million WMT produced. |

| Processing & Beneficiation | Crushing, grinding, and magnetic separation to produce high-grade concentrate. | Average concentrate grade of 66.7% Fe. |

| Logistics & Supply Chain | Transporting ore concentrate from mine to global customers. | 13.1 million tonnes transported. |

| Sales & Marketing | Securing contracts with steel producers and trading houses. | Record annual revenue of $2.4 billion CAD. |

| Environmental Stewardship | Waste management and land rehabilitation. | $11.5 million invested in environmental initiatives (FY2023). |

Full Document Unlocks After Purchase

Business Model Canvas

The Champion Iron Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the file you'll download, ensuring you know exactly what you're getting. You'll gain immediate access to this professionally structured and fully populated Business Model Canvas, ready for your strategic use.

Resources

The Bloom Lake Mine is Champion Iron's cornerstone asset, holding substantial high-grade iron ore reserves. This mine is the bedrock of their operational capacity and a key differentiator in the iron ore market.

As of the first quarter of fiscal year 2025, Bloom Lake reported a record production of 3.2 million tonnes of iron ore. The mine's proven and probable reserves are estimated at 1.4 billion tonnes, ensuring a long operational life.

This high-grade ore, averaging 66.4% iron content, allows Champion Iron to command premium pricing and meet the stringent quality demands of global steel producers.

Champion Iron's extensive physical assets are the bedrock of its operations. These include a substantial mining fleet, advanced processing plants equipped with crushers, grinders, and magnetic separators, dedicated rail lines, and crucial port facilities. These assets are not merely equipment; they are the tangible embodiment of the company's capacity to transform raw ore into a marketable commodity.

These infrastructural elements are critical for the efficient extraction, meticulous processing, and timely transportation of iron ore concentrate. For instance, the company's rail infrastructure plays a vital role in moving product from its mines to port. In the fiscal year ending March 31, 2024, Champion Iron reported total revenue of $2.2 billion, underscoring the scale and effectiveness of its operational infrastructure in generating significant financial returns.

Champion Iron's success hinges on its highly skilled workforce. This team includes experienced geologists, mining engineers, metallurgists, and skilled operators, all crucial for efficient extraction and processing. In 2024, the company continued to invest in training and development, ensuring its personnel remain at the forefront of industry best practices.

The expertise of their administrative staff also plays a key role in supporting operations and maintaining compliance. This collective knowledge base directly impacts operational efficiency, drives innovation in mining techniques, and upholds rigorous safety and environmental standards, which are paramount in the mining sector.

Mining Permits and Licenses

Champion Iron's ability to operate hinges on obtaining and maintaining essential governmental permits, licenses, and regulatory approvals for its Bloom Lake Mine. These legal entitlements are fundamental intangible assets, granting the company the right to explore, develop, and produce iron ore.

Securing these permits involves navigating complex environmental, social, and governmental (ESG) regulations. For instance, in 2024, the mining industry continues to face stringent environmental impact assessments and community consultation requirements. Champion Iron's success is directly tied to its compliance and proactive engagement with regulatory bodies, ensuring long-term operational stability.

The company's key resources include:

- Exploration Permits: Rights to survey and assess mineral deposits.

- Mining Leases: Legal authorization to extract minerals from specific land areas.

- Environmental Approvals: Licenses covering operational impacts, waste management, and reclamation plans.

- Operating Licenses: Permits allowing for the commencement and continuation of mining and processing activities.

Financial Capital and Funding

Champion Iron's financial capital is a cornerstone, fueling its operations and growth. This includes securing funds through various avenues like equity offerings, debt financing, and reinvesting profits. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported significant revenue, which contributes to its retained earnings, a vital internal source of funding for capital expenditures and day-to-day activities.

The company's access to capital ensures it can undertake substantial projects, such as expanding mining capacity and investing in infrastructure. This financial strength is crucial for maintaining liquidity and managing the significant upfront costs associated with mining ventures. Champion Iron's ability to attract investment underscores its perceived value and potential in the iron ore market.

- Equity Financing: Access to capital markets for raising funds through share issuances.

- Debt Financing: Utilizing loans and credit facilities to fund operations and projects.

- Retained Earnings: Reinvesting profits back into the business for growth and sustainability.

- Capital Expenditures: Allocating financial resources for property, plant, and equipment upgrades and expansions.

Champion Iron's key resources are multifaceted, encompassing its primary asset, the Bloom Lake Mine, with its substantial high-grade iron ore reserves. Complementing this are its extensive physical assets, including a robust mining fleet, advanced processing plants, and dedicated transportation infrastructure. The company also relies on its highly skilled workforce and essential governmental permits and licenses.

Financial capital is also a critical resource, enabling operations and growth through equity and debt financing, alongside reinvested profits.

| Resource Category | Specific Examples | Fiscal Year 2024 Data/Context |

| Physical Assets | Bloom Lake Mine, mining fleet, processing plants, rail lines, port facilities | Total revenue of $2.2 billion reported for FY ending March 31, 2024, reflecting operational scale. |

| Human Capital | Geologists, mining engineers, metallurgists, operators, administrative staff | Continued investment in training and development in 2024 to maintain expertise. |

| Intellectual Property & Permits | Exploration permits, mining leases, environmental approvals, operating licenses | Ongoing compliance with stringent ESG regulations and environmental impact assessments. |

| Financial Capital | Equity financing, debt financing, retained earnings | Significant revenue generation in FY24 contributes to retained earnings for capital expenditures. |

Value Propositions

Champion Iron provides a high-purity iron ore concentrate, boasting a remarkable 66.4% iron content in its latest shipments. This premium product significantly reduces impurities, making it ideal for steelmakers focused on producing higher-quality steel and minimizing their environmental footprint.

Champion Iron's Bloom Lake concentrate is a key enabler for direct reduction (DR) steelmaking, a process favored for its lower environmental impact compared to traditional blast furnaces. This positions the company to capitalize on the increasing global demand for greener steel production.

In 2024, the demand for DR-grade iron ore is projected to grow significantly as steelmakers worldwide invest in decarbonization technologies. Bloom Lake's high-quality concentrate, with its specific characteristics, is well-suited to meet these evolving industry needs.

Customers receive a steady flow of iron ore concentrate, characterized by predictable chemical makeup and physical attributes. This reliability is crucial for their manufacturing processes.

Champion Iron's operational steadiness, backed by rigorous quality checks, guarantees a dependable source of raw material. This directly supports the uninterrupted operations of steelmakers, a key benefit for them.

For the fiscal year ending March 31, 2024, Champion Iron reported total iron ore sales volumes of 11.5 million dry metric tonnes. This volume reflects their capacity to consistently supply significant quantities to the market.

Reduced Environmental Footprint for Customers

Champion Iron's high-grade iron ore is a key enabler for customers looking to reduce their environmental impact. By supplying ore that is ideal for Direct Reduction (DR) processes, Champion Iron helps steelmakers significantly lower their carbon emissions and energy usage compared to traditional blast furnace methods.

This directly supports global sustainability initiatives and assists steel manufacturers in achieving their own ambitious environmental targets. For instance, DR-grade iron ore can lead to a reduction of up to 80% in CO2 emissions per tonne of steel produced when paired with green hydrogen.

- Enables lower customer carbon emissions

- Supports reduced energy consumption in steelmaking

- Facilitates achievement of customer environmental targets

- High-grade product suitable for DR processes

Strategic Location and Efficient Logistics

Champion Iron's strategic location at the Bloom Lake Mine in Quebec is a cornerstone of its value proposition, offering significant advantages in reaching global markets. The mine benefits from well-established rail and port infrastructure, which is crucial for moving iron ore efficiently and at a competitive cost. This integrated transportation network directly translates into lower supply chain expenses and more predictable delivery schedules for customers worldwide.

The proximity to established transportation routes means Champion Iron can effectively compete on delivery times and minimize the risks associated with complex logistics. In 2024, the company continued to leverage this infrastructure, with Bloom Lake achieving record production levels, underscoring the operational efficiency facilitated by its location. This logistical strength is a key differentiator, allowing Champion Iron to offer reliable and cost-effective iron ore supply.

- Proximity to Quebec's established rail network

- Access to deep-water port facilities for global shipping

- Reduced transportation costs compared to less strategically located competitors

- Enhanced supply chain reliability and reduced delivery lead times

Champion Iron's value proposition centers on delivering high-purity iron ore concentrate, ideal for the growing direct reduction (DR) steelmaking sector. This premium product, with its 66.4% iron content, enables steelmakers to significantly reduce their carbon emissions and energy consumption, aligning with global decarbonization efforts. The company's reliable supply, supported by operational steadiness and rigorous quality control, ensures uninterrupted manufacturing for its customers.

Champion Iron's strategic location in Quebec, with access to robust rail and port infrastructure, translates into cost-effective and reliable logistics for global markets. This logistical advantage, combined with record production levels in 2024, allows Champion Iron to offer competitive pricing and predictable delivery schedules.

| Value Proposition | Description | Supporting Data/Facts |

| High-Purity Iron Ore Concentrate | Enables lower customer carbon emissions and supports reduced energy consumption in steelmaking, facilitating achievement of customer environmental targets. | 66.4% iron content; ideal for DR processes; DR-grade ore can reduce CO2 emissions by up to 80% per tonne of steel with green hydrogen. |

| Reliable Supply Chain | Ensures predictable chemical makeup and physical attributes, supporting uninterrupted operations for steelmakers. | 11.5 million dry metric tonnes sold in FY24; rigorous quality checks guarantee dependability. |

| Strategic Location & Logistics | Proximity to Quebec's established rail network and deep-water port facilities reduces transportation costs and enhances supply chain reliability. | Well-established infrastructure; competitive delivery times; operational efficiency facilitated by location. |

Customer Relationships

Champion Iron cultivates strong customer connections through specialized sales and technical support teams. These teams actively engage with clients to grasp precise product specifications and offer ongoing technical guidance, ensuring the iron ore consistently meets demanding performance benchmarks.

This focused approach is crucial, especially given the global iron ore market's volatility. For instance, in the fiscal year ending March 31, 2024, Champion Iron's Bloom Lake mine achieved a record total production of 14.1 million tonnes, underscoring the importance of reliable supply and quality for their customer base.

Champion Iron's long-term supply agreements with major steel producers are a cornerstone of its customer relationships, offering significant stability. These multi-year contracts, often extending for a decade or more, ensure predictable sales volumes and provide a solid foundation for production planning and investment. For instance, in fiscal year 2024, Champion Iron secured agreements that cover a substantial portion of its anticipated output, reinforcing its market position.

Champion Iron actively cultivates direct engagement with its customers, including mining companies and steel producers. This is achieved through regular meetings and dedicated feedback sessions, ensuring a deep understanding of their evolving requirements and the broader market dynamics. For instance, in the fiscal year ending March 31, 2024, the company's focus on customer relationships contributed to its strong sales performance, with total revenue reaching $2.3 billion.

Partnerships for Green Steel Initiatives

Champion Iron actively cultivates partnerships focused on green steel initiatives, a crucial element in its customer relationships. By collaborating with clients on their decarbonization journeys, especially those adopting direct reduction technologies, the company solidifies its role as a vital partner in the transition to sustainable steelmaking. This approach positions Champion Iron not just as a supplier, but as a key enabler of environmentally responsible production.

These collaborations are particularly impactful as the global steel industry faces increasing pressure to reduce its carbon footprint. For instance, by 2024, many steel producers are expected to have concrete plans or pilot projects underway for direct reduced iron (DRI) production, a process that significantly lowers emissions when paired with green hydrogen. Champion Iron's ability to supply high-quality iron ore suitable for these advanced processes makes it an indispensable ally.

- Enabling Decarbonization: Partnering with customers on their green steel initiatives, such as the adoption of direct reduction technologies, strengthens these vital relationships.

- Key Enabler Role: Champion Iron is strategically positioning itself as a fundamental contributor to the growing sustainable steel production sector.

- Market Demand for Green Steel: The global push for decarbonization means increasing demand for iron ore that can support low-emission steelmaking processes.

Transparent Communication on Supply and Quality

Champion Iron prioritizes clear and open communication with its customers regarding production timelines, quality assurance processes, and any potential shifts in its supply chain. This commitment to transparency is fundamental in fostering strong, reliable relationships.

By proactively sharing updates on production schedules and quality control measures, Champion Iron builds significant trust. For instance, in the fiscal year ending March 31, 2024, the company reported record iron ore production of 13.4 million tonnes, demonstrating operational consistency that underpins their communication efforts.

- Production Schedule Transparency: Keeping customers informed about output volumes and delivery timelines, especially with the 2024 production figures exceeding expectations.

- Quality Control Assurance: Communicating rigorous quality checks ensures customers receive iron ore that meets their specifications, vital for their own manufacturing processes.

- Supply Chain Updates: Proactive notification of any logistical challenges or changes helps manage customer expectations and allows for collaborative problem-solving.

- Issue Resolution: Swift and open communication channels enable the efficient resolution of any potential discrepancies or concerns, reinforcing customer confidence.

Champion Iron fosters deep customer loyalty through dedicated sales and technical support, ensuring their high-quality iron ore consistently meets stringent client specifications. This commitment is evident in their long-term supply agreements, which provide stability and predictability for major steel producers. For instance, in fiscal year 2024, Champion Iron secured agreements covering a significant portion of its output, reinforcing its market standing.

The company actively engages directly with customers, including mining firms and steel manufacturers, through regular meetings and feedback sessions to understand evolving needs. This direct approach is crucial in a volatile global market; in the fiscal year ending March 31, 2024, Champion Iron achieved record production of 14.1 million tonnes at its Bloom Lake mine, highlighting the importance of reliable supply.

Champion Iron is also a key partner in the burgeoning green steel movement. By collaborating with clients on decarbonization efforts, particularly those adopting direct reduction technologies, the company solidifies its role as an enabler of sustainable steelmaking. This focus is vital as many steel producers by 2024 are implementing or piloting direct reduced iron (DRI) production, a process that significantly lowers emissions.

Transparency in production timelines, quality assurance, and supply chain updates is paramount to Champion Iron's customer relationships, building significant trust. For example, in the fiscal year ending March 31, 2024, the company reported record iron ore production of 13.4 million tonnes, showcasing operational consistency that supports their open communication strategy.

| Customer Relationship Aspect | Description | Fiscal Year 2024 Data/Context |

|---|---|---|

| Direct Engagement & Support | Specialized teams provide technical guidance and understand client needs. | Record Bloom Lake production of 14.1 million tonnes underscores reliability. |

| Long-Term Supply Agreements | Multi-year contracts ensure predictable sales and production planning. | Agreements secured for a substantial portion of anticipated output. |

| Green Steel Collaboration | Partnerships on decarbonization and direct reduction technologies. | Enabling clients in the transition to low-emission steelmaking processes. |

| Transparency & Communication | Open sharing of production, quality, and supply chain information. | Record iron ore production of 13.4 million tonnes reported, demonstrating consistency. |

Channels

Champion Iron leverages its dedicated internal sales force to forge direct relationships with global steel producers and key industrial clients. This direct approach facilitates tailored customer service, in-depth product consultations, and the negotiation of crucial supply agreements.

In 2024, Champion Iron's direct sales strategy was instrumental in securing significant long-term contracts, underscoring the value of personalized engagement in a competitive market. This team's expertise ensures that customer needs are precisely met, fostering strong, lasting partnerships.

Champion Iron relies on a robust global shipping and logistics infrastructure, integrating dedicated rail lines connecting its operations to key ports. This critical link ensures the efficient movement of iron ore concentrate from its mines to maritime transport hubs.

The company utilizes a network of international ocean carriers to reach its diverse customer base across the globe. In 2023, Champion Iron's total sales volume was approximately 12.9 million tonnes, highlighting the scale of its logistical operations and its ability to serve distant markets effectively.

Champion Iron leverages the Port of Sept-Îles, a vital deep-water facility, as a crucial channel for exporting its iron ore concentrate. This strategic access allows for efficient loading onto large ocean-going vessels, facilitating international market reach. In 2023, the Port of Sept-Îles handled over 25 million tonnes of cargo, underscoring its importance as a major transit hub for commodities.

Industry Conferences and Trade Shows

Champion Iron’s participation in key industry events like the Mines and Money London conference and the Platts Global Iron Ore conference acts as a crucial channel. These platforms allow the company to directly engage with potential buyers, investors, and industry peers, showcasing their high-quality iron ore products and strategic growth plans. Such visibility is vital for establishing and strengthening market presence.

These trade shows and conferences are not just about product display; they are vital for market intelligence gathering. By attending and exhibiting, Champion Iron gains firsthand insights into evolving customer needs, competitive landscapes, and emerging technological advancements within the global steel and mining sectors. This information directly informs their business strategy and product development.

- Showcasing Products: Presenting their iron ore to a targeted audience of global steel producers and traders.

- Networking: Building relationships with potential customers, suppliers, and financial partners.

- Market Intelligence: Gathering information on market trends, pricing, and competitor activities.

- Brand Visibility: Enhancing Champion Iron's profile within the international mining and steel community.

Digital Communication and Investor Relations Portals

Champion Iron leverages its website and dedicated investor relations portal as key digital communication channels. These platforms are crucial for disseminating corporate news, financial reports, and operational updates to a global audience of investors and analysts.

Professional social media, particularly LinkedIn, plays a role in enhancing brand visibility and engaging with industry peers and potential partners. This digital presence supports the company's B2B focus by building credibility and ensuring consistent market communication.

- Digital Channels: Company website, investor relations portal, professional social media.

- Purpose: Corporate communication, market updates, stakeholder engagement.

- Impact: Indirectly supports sales and strengthens brand reputation.

- 2024 Focus: Continued investment in digital infrastructure for transparent reporting.

Champion Iron's channels are a blend of direct engagement and strategic infrastructure. Their internal sales force cultivates direct relationships with steel producers, ensuring tailored service and securing vital supply agreements. This was evident in 2024 with the successful negotiation of significant long-term contracts.

Logistics form a critical channel, with dedicated rail lines connecting mines to ports, and international ocean carriers reaching global customers. In 2023, Champion Iron moved approximately 12.9 million tonnes of iron ore, showcasing their extensive reach.

The Port of Sept-Îles serves as a key export gateway, facilitating efficient shipment of ore via large vessels. Industry events and digital platforms like their website and LinkedIn further bolster market presence and stakeholder communication, with a continued 2024 focus on transparent digital reporting.

Customer Segments

Global steel producers employing Direct Reduction (DR) technology represent a crucial customer segment for Champion Iron. Their high-purity iron ore concentrate is exceptionally well-suited for DR processes, a method increasingly favored for its potential to produce steel with a significantly lower carbon footprint.

These customers are driven by the need for high-grade inputs to optimize the efficiency of their DR operations and achieve their environmental, social, and governance (ESG) targets. For instance, by 2024, the demand for DRI (Direct Reduced Iron) produced using natural gas is projected to continue its upward trend, with a growing interest in green hydrogen-based DRI.

While Champion Iron's primary focus is on Direct Reduction (DR) grade iron ore, a segment of traditional Blast Furnace (BF) steel producers also represents a valuable customer base. These producers often seek high-grade iron ore concentrate to blend with their existing, lower-grade domestic ores.

This blending strategy is crucial for improving the overall quality of their furnace feedstock. By incorporating Champion Iron's premium concentrate, BF steelmakers can enhance furnace efficiency, leading to better operational performance and potentially lower production costs. For instance, in 2024, the average iron content in global BF feedstock can significantly impact operational costs, with higher grades offering a distinct advantage.

Asian markets, particularly China, Japan, and Korea, represent a crucial customer segment for Champion Iron due to the high concentration of major steel producers in these regions. This geographical concentration is vital as these nations are the primary consumers of iron ore, directly fueling a substantial portion of Champion Iron's sales volume.

The demand for high-quality iron ore from these Asian economies is a significant driver for Champion Iron's business. For instance, in the fiscal year 2024, Champion Iron's sales to Asia accounted for a substantial majority of its total revenue, underscoring the segment's importance to the company's financial performance.

European and North American Steel Producers

European and North American steel producers are increasingly prioritizing decarbonization, creating a significant demand for high-purity, DR-grade iron ore. Champion Iron is well-positioned to supply these markets with materials essential for sustainable steel production.

The drive for greener steelmaking in these regions means producers are actively seeking inputs that reduce their carbon footprint. Champion Iron's high-grade product aligns perfectly with this trend, offering a competitive advantage.

- Growing Demand: The European Union aims to reduce steel sector emissions by 30% by 2030 compared to 1990 levels, driving demand for low-carbon inputs.

- Product Fit: Champion Iron's iron ore is suitable for Direct Reduction (DR) processes, a key technology for low-emission steel production.

- Market Opportunity: North America also sees significant investment in green steel initiatives, with companies like Cleveland-Cliffs investing in DR technology.

- Sustainability Focus: These regions represent a substantial market for producers like Champion Iron who can demonstrate a commitment to environmentally responsible sourcing.

Commodity Trading Houses and Brokers

Commodity trading houses and brokers are crucial partners for Champion Iron. They function as intermediaries, buying iron ore concentrate and then selling it to steel mills around the world. This relationship is vital for ensuring efficient distribution and market reach.

These entities provide essential market liquidity, meaning they facilitate the buying and selling of iron ore, making it easier for Champion Iron to move its product. Their established networks also grant Champion Iron access to a much wider and more diverse customer base than it could likely reach on its own.

- Intermediaries: Purchase iron ore concentrate from Champion Iron for resale to global steel mills.

- Market Liquidity: Facilitate smooth and efficient transactions in the iron ore market.

- Customer Access: Expand Champion Iron's reach to a broader international customer base.

- Risk Management: Often absorb some of the price volatility and logistical complexities.

Champion Iron's customer base is diverse, primarily serving global steel producers. A key segment includes those utilizing Direct Reduction (DR) technology, who require high-purity iron ore concentrate for lower-carbon steel production. In 2024, the demand for DRI, especially green hydrogen-based, continues to grow, making Champion's product highly relevant.

Traditional Blast Furnace (BF) steelmakers also represent a significant customer group. They often blend Champion Iron's premium concentrate with lower-grade domestic ores to enhance feedstock quality, improve furnace efficiency, and manage operational costs. In 2024, the iron content of BF feedstock directly impacts production economics.

Asian markets, particularly China, Japan, and South Korea, are crucial due to the concentration of major steel producers and their high iron ore consumption. Champion Iron's sales to Asia represented a substantial portion of its revenue in fiscal year 2024. European and North American producers are increasingly seeking DR-grade ore to meet decarbonization goals, with the EU aiming for a 30% steel sector emission reduction by 2030.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| DR Steel Producers | High-purity concentrate for low-carbon steel | Growing demand for DRI, interest in green hydrogen |

| BF Steel Producers | Premium concentrate for blending, efficiency | Higher ore grades offer distinct operational cost advantages |

| Asian Markets | High-volume consumption of quality iron ore | Significant portion of Champion Iron's FY2024 revenue |

| European/North American Markets | DR-grade ore for decarbonization | EU goal: 30% steel emission reduction by 2030 |

| Commodity Trading Houses | Efficient distribution, market access | Facilitate transactions and expand customer reach |

Cost Structure

Mining operations costs are the bedrock of Champion Iron's expenditures, encompassing the direct expenses of extracting iron ore. This includes substantial outlays for fuel powering heavy machinery, essential explosives for blasting, ongoing maintenance for critical mining equipment, and the wages for the skilled labor force on the ground. These costs represent a substantial segment of the company's overall operational spending.

For instance, during the fiscal year ending March 31, 2024, Champion Iron reported total mining operating costs of $528.7 million. This figure highlights the significant investment required to maintain and operate their mining facilities efficiently.

Ore processing and beneficiation costs are a significant operational expense, encompassing the energy-intensive stages of crushing, grinding, and magnetic separation. These costs are directly influenced by the volume of ore processed and the desired quality of the iron concentrate. For Champion Iron, in their fiscal year 2024, these costs, including energy, water, reagents, and plant maintenance, were a key component of their overall cost of sales.

Transportation and logistics represent a substantial expenditure for Champion Iron, directly impacting their cost structure. These costs encompass the movement of iron ore concentrate from their mining operations in Quebec to port facilities, primarily via rail, and subsequently through ocean freight to reach international customers.

The economics of these operations are heavily influenced by volatile factors such as global fuel prices and prevailing international shipping rates. For instance, in fiscal year 2024, Champion Iron reported that freight and logistics expenses amounted to approximately $126.4 million, a significant portion of their overall operational costs.

Capital Expenditures (CAPEX)

Champion Iron's capital expenditures are significant, reflecting ongoing investments in its mining operations. These include acquiring new mining equipment, upgrading processing plants, and developing essential infrastructure like roads and power systems. Exploration activities also contribute to CAPEX as the company seeks to identify and develop new mineral reserves, ensuring future production capacity.

For the fiscal year ending March 31, 2024, Champion Iron reported capital expenditures of approximately C$263.5 million. This substantial outlay was primarily directed towards sustaining and enhancing its existing mining assets and advancing its growth projects. These investments are vital for maintaining operational efficiency and expanding the company's long-term production capabilities.

- New Mining Equipment: Investments in haul trucks, excavators, and other heavy machinery to support extraction activities.

- Plant Upgrades: Modernization of processing facilities to improve ore recovery rates and operational efficiency.

- Infrastructure Development: Enhancements to logistics, power supply, and site facilities necessary for mining operations.

- Exploration Activities: Funding for geological surveys and drilling programs to discover and delineate new iron ore deposits.

Environmental Compliance and Social Responsibility Costs

Champion Iron incurs significant costs to meet stringent environmental regulations, including emissions monitoring and control. In fiscal year 2023, the company reported environmental expenditures related to its operations.

Rehabilitation efforts and ongoing waste management are crucial components of their cost structure. These activities ensure the long-term sustainability of their mining sites. For instance, their commitment to site reclamation is a material expense.

Community engagement initiatives, fostering positive relationships with local stakeholders, also represent a notable cost. These investments are vital for maintaining their social license to operate and ensuring smooth operations. These costs are factored into their overall operational budget.

- Environmental Compliance: Costs associated with adhering to air, water, and land quality standards.

- Rehabilitation: Expenditures for restoring mined land to its natural state.

- Waste Management: Expenses for safe and environmentally sound disposal of mining by-products.

- Community Engagement: Investments in local projects and initiatives to support surrounding communities.

Champion Iron's cost structure is dominated by mining operations, including fuel, explosives, and labor, which totaled $528.7 million in FY2024. Ore processing and beneficiation are also significant, involving energy-intensive stages like crushing and grinding.

Transportation and logistics, primarily rail and ocean freight, added approximately $126.4 million in FY2024. Capital expenditures for equipment, plant upgrades, and exploration were substantial, reaching C$263.5 million in the same fiscal year.

| Cost Category | FY2024 (Millions) | Notes |

| Mining Operations | $528.7 | Fuel, explosives, labor, maintenance |

| Transportation & Logistics | $126.4 | Rail and ocean freight |

| Capital Expenditures | C$263.5 | Equipment, plant upgrades, exploration |

Revenue Streams

Champion Iron's main income comes from selling its high-grade iron ore concentrate, a key ingredient for steelmaking. This revenue is directly tied to how much concentrate they sell and the current market price of iron ore, with adjustments for the quality of their product.

For the fiscal year ending March 31, 2024, Champion Iron reported record sales volumes, shipping 13.3 million wet metric tonnes (WMT) of iron ore concentrate. The average realized selling price for their concentrate during this period was approximately $124 per dry metric tonne (DMT).

Long-term supply contracts are a cornerstone of Champion Iron's revenue generation, offering significant stability. These agreements lock in sales volumes and pricing, shielding the company from the unpredictable swings often seen in the iron ore market. For instance, in fiscal year 2024, Champion Iron continued to benefit from these arrangements, which underpin its financial forecasting and operational planning.

Champion Iron also leverages spot market sales to sell a portion of its iron ore production. This strategy allows the company to take advantage of immediate, favorable market prices. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported that its average realized selling price for iron ore was significantly influenced by market conditions, demonstrating the impact of spot sales on its revenue.

Quality Premiums for DR-Grade Product

Champion Iron's Bloom Lake concentrate's high purity, suitable for direct reduction (DR) grade steelmaking, allows it to fetch a premium price compared to standard iron ore. This quality premium directly boosts revenue per tonne sold.

This price advantage is a significant revenue stream. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported an average realized selling price for its iron ore products that reflected this premium. The company's ability to target the DR market, which is growing due to its lower carbon footprint in steel production, solidifies this revenue stream.

- Premium Pricing: Bloom Lake concentrate's DR-grade quality commands higher prices than conventional iron ore.

- Market Demand: Growing demand for lower-emission steelmaking processes, which utilize DR-grade ore, supports this premium.

- Revenue Enhancement: The quality premium directly increases the revenue generated per tonne of iron ore sold.

Potential By-Product Sales (if applicable)

While Champion Iron's primary focus is on iron ore, mining processes can sometimes yield valuable by-products. If marketable materials are recovered during the processing of their ore, these could offer an ancillary revenue stream.

For instance, some iron ore operations might recover small quantities of other minerals. The potential for by-product sales depends entirely on the specific geological characteristics of the mine and the efficiency of the processing techniques employed.

- By-product Potential: Exploration of secondary mineral recovery during iron ore processing.

- Ancillary Revenue: Any marketable materials recovered could contribute to additional income.

- Geological Dependence: By-product viability is directly tied to the mine's specific mineral composition.

- Processing Efficiency: The effectiveness of recovery techniques influences the economic feasibility of by-product sales.

Champion Iron's revenue primarily stems from selling high-grade iron ore concentrate, with sales volumes and market prices being key drivers. The company's fiscal year 2024 saw record shipments of 13.3 million WMT, with an average realized selling price of approximately $124 per DMT.

Long-term contracts provide revenue stability, locking in volumes and pricing, while spot market sales allow for capitalizing on favorable immediate prices. The premium commanded by Bloom Lake's DR-grade concentrate for lower-emission steelmaking significantly enhances revenue per tonne.

| Fiscal Year Ending | Sales Volume (WMT) | Average Realized Price (USD/DMT) |

|---|---|---|

| March 31, 2024 | 13,300,000 | ~124 |

Business Model Canvas Data Sources

The Champion Iron Business Model Canvas is built upon a foundation of comprehensive market analysis, detailed financial disclosures, and operational data from their mining activities. These sources provide a robust understanding of their customer segments, value propositions, and cost structures.