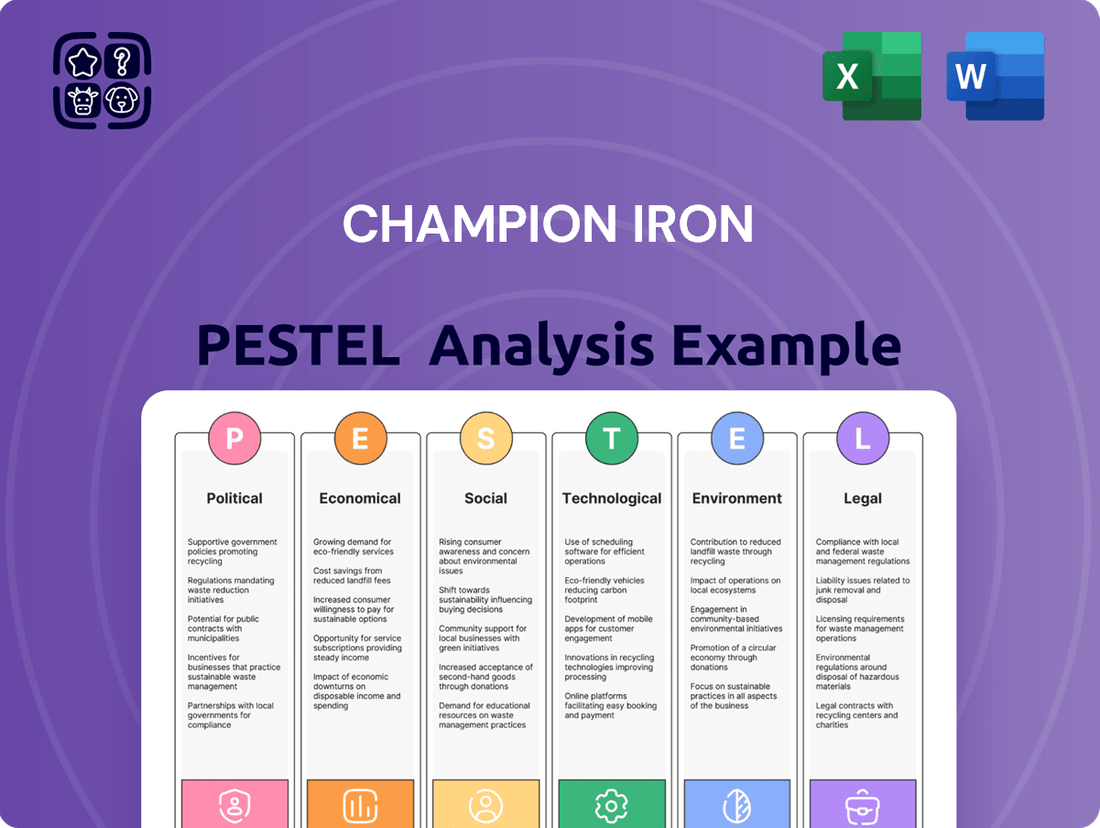

Champion Iron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Champion Iron's trajectory. Our expertly crafted PESTLE analysis provides a clear, actionable roadmap to navigate these complex external forces. Equip yourself with the strategic intelligence needed to identify opportunities and mitigate risks. Download the full version now and gain a decisive competitive advantage.

Political factors

Government policies in Quebec and Canada significantly shape Champion Iron's activities. For instance, Quebec's mining strategy, updated in 2023, emphasizes sustainable development and community engagement, potentially influencing permitting and operational costs. Changes in federal or provincial royalty structures, such as the Quebec mining tax, directly impact profitability; for example, a shift in tax rates could alter Champion Iron's net revenue from its operations.

Political stability within Canada and Quebec is paramount for long-term investments like those undertaken by Champion Iron. Predictable regulatory frameworks, including environmental standards and land access regulations, are crucial. The federal government's commitment to responsible resource development, as seen in initiatives supporting critical minerals, can create both opportunities and compliance requirements for companies like Champion Iron.

Global trade policies, including tariffs and non-tariff barriers, significantly impact Champion Iron's market access and pricing, especially concerning major steel producers like China. For instance, in early 2024, ongoing discussions around potential trade adjustments between major economies could alter the cost of exporting iron ore.

Geopolitical tensions and trade disputes pose a risk to Champion Iron's supply chain and market access. Any disruption in key export routes or imposition of new trade restrictions could directly affect the company's ability to deliver its product, impacting revenue streams.

Given that Champion Iron operates with an export-oriented model, maintaining robust international trade relationships is paramount. Strong diplomatic ties and favorable trade agreements are essential for ensuring consistent demand and competitive pricing for its high-grade iron ore in the global market.

Geopolitical stability in key iron ore markets is crucial for Champion Iron. For instance, China, a dominant force in global steel production and a major buyer of iron ore, experienced steady economic growth through early 2024, supporting demand. However, any significant political shifts or trade policy changes in China or other major steel-producing nations could disrupt procurement and impact Champion Iron's sales.

Resource Nationalism

Resource nationalism, a growing trend where governments aim for more control and benefits from their natural resources, presents a key political consideration. This can manifest as increased taxes, higher royalties, or more stringent operating regulations for mining firms. For instance, while Canada, where Champion Iron primarily operates, is generally stable, global shifts in resource policy could still impact investor sentiment and create precedents. In 2023, several resource-rich nations saw increased discussions around nationalization or renegotiation of mining contracts, reflecting this broader trend.

Champion Iron must actively manage its relationships with host governments to navigate these potential risks. Proactive engagement and demonstrating commitment to local economic development can help mitigate the impact of resource nationalism. The company's operations in Quebec, Canada, benefit from a relatively predictable regulatory environment, but awareness of global trends remains crucial for long-term strategic planning. As of early 2024, the average mining royalty rate in Canada varies by province, but the potential for upward adjustments due to resource nationalism is a recognized risk.

- Increased Taxes and Royalties: Governments may impose higher financial burdens on mining operations.

- Stricter Operating Conditions: New regulations could impact efficiency and costs.

- Global Sentiment Impact: Shifts in international resource policies can indirectly affect investor confidence.

- Host Government Relations: Maintaining strong ties with governments is vital for risk mitigation.

Regulatory Environment for ESG

Governments globally are intensifying scrutiny on ESG performance within the mining industry. For Champion Iron, this translates to navigating a landscape of increasingly stringent environmental protection mandates, evolving labor standards, and enhanced corporate governance requirements. For instance, by the end of 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) will mandate detailed ESG disclosures for many companies, including those operating within supply chains like Champion Iron.

Adherence to these evolving standards presents both challenges and opportunities. Champion Iron will likely face increased compliance costs and the necessity for operational adjustments to meet new benchmarks. However, proactive engagement with regulatory bodies and a commitment to industry best practices can mitigate risks and potentially unlock competitive advantages.

- Increased Compliance Burden: New regulations may necessitate investment in advanced environmental monitoring technologies and updated labor welfare programs.

- Operational Adaptations: Champion Iron might need to revise its operational procedures to align with stricter emissions controls or waste management protocols.

- Strategic Engagement: Maintaining open dialogue with regulators and participating in industry working groups can help shape future regulations and ensure smoother implementation.

Government policies in Quebec and Canada, including updated mining strategies and tax structures, directly influence Champion Iron's operational costs and profitability. Political stability within these regions is crucial for long-term investment, as predictable regulatory frameworks for environmental standards and land access are essential for operations. Global trade policies and geopolitical tensions also pose risks to market access and supply chains, necessitating strong international trade relationships.

Governments are increasingly scrutinizing ESG performance, requiring Champion Iron to navigate stricter environmental, labor, and governance standards, potentially increasing compliance costs. Proactive engagement with regulators and adherence to best practices can mitigate risks and create competitive advantages. Resource nationalism is another key consideration, which could lead to increased taxes, higher royalties, or more stringent regulations for mining firms globally.

| Factor | Impact on Champion Iron | 2023/2024 Data Point |

|---|---|---|

| Quebec Mining Strategy | Influences sustainability and community engagement requirements. | Updated in 2023, emphasizing sustainable development. |

| Quebec Mining Tax | Directly impacts profitability through royalty structures. | As of early 2024, potential for upward adjustments exists. |

| Global Trade Policies | Affects market access and pricing, especially with China. | Discussions around potential trade adjustments in early 2024. |

| ESG Scrutiny | Mandates stricter environmental, labor, and governance standards. | EU's CSRD to mandate detailed ESG disclosures by end of 2024. |

What is included in the product

Champion Iron's PESTLE analysis provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on how Champion Iron can navigate political and economic shifts to mitigate operational risks.

Economic factors

Global iron ore prices are a critical determinant of Champion Iron's financial health, experiencing substantial swings due to shifts in supply and demand. For instance, in early 2024, iron ore prices hovered around $110-$130 per tonne, a significant factor for companies like Champion Iron whose revenue is directly tied to these commodity markets.

Key influences on these price movements include the pace of global steel production, particularly the demand from direct reduction steelmaking, and the introduction of new iron ore supply from various mining operations. The company's earnings are therefore highly susceptible to these commodity price fluctuations, making forecasting a challenge.

Champion Iron's high-purity iron ore is a key input for direct reduction steelmaking, a method favored for its reduced environmental impact. The growth of this greener steel production method is therefore a significant driver for Champion Iron's demand.

The global steel industry's performance is a critical factor; for instance, in 2023, global crude steel production reached an estimated 1.88 billion tonnes, a slight increase from 2022. Any slowdown in construction or manufacturing, which are major steel consumers, can directly translate to lower demand for iron ore.

The increasing adoption of direct reduction iron (DRI) technology, particularly in regions focused on decarbonization, presents a strong tailwind for Champion Iron. This trend is expected to continue as environmental regulations tighten and steelmakers invest in sustainable practices.

Currency exchange rate fluctuations are a key economic factor for Champion Iron. As a Canadian company selling its iron ore primarily in U.S. dollars, a stronger Canadian dollar versus the U.S. dollar directly impacts its profitability. For instance, if the CAD/USD rate moves from 0.75 to 0.80, the revenue received in USD translates to fewer CAD, squeezing profit margins.

This dynamic is particularly relevant given the global nature of commodity markets. In 2024, the Canadian dollar has shown some volatility against the U.S. dollar, with periods of strengthening. This trend, if sustained, could present a headwind for Champion Iron's reported earnings in Canadian dollars, even if U.S. dollar-denominated sales remain robust.

Global Economic Growth

The global economic outlook significantly shapes demand for iron ore, a key ingredient in steel production. Robust economic expansion, as seen with projections for a 3.2% global GDP growth in 2024 by the IMF, typically fuels infrastructure projects and manufacturing, thereby increasing steel consumption and, consequently, iron ore demand. This positive correlation means that periods of strong global growth directly benefit companies like Champion Iron.

Conversely, economic headwinds can create challenges. For instance, a slowdown in major economies or a global recession, which could materialize if inflation remains stubbornly high or geopolitical tensions escalate, would likely dampen construction and industrial activity. This reduced activity translates to lower steel demand, putting downward pressure on iron ore prices and impacting Champion Iron's revenue and profitability. The World Bank's forecast of a 2.4% global growth for 2025 highlights the ongoing sensitivity of commodity markets to these macroeconomic trends.

- Global GDP Growth Projections: The International Monetary Fund (IMF) projected 3.2% global GDP growth for 2024, indicating a generally supportive economic environment for commodity demand.

- Impact on Steel Demand: Strong economic growth drives demand for steel in construction, automotive, and manufacturing sectors, directly benefiting iron ore producers.

- Recessionary Risks: Economic slowdowns or recessions can significantly reduce steel consumption, leading to lower iron ore prices and reduced sales volumes for companies like Champion Iron.

- Future Outlook: The World Bank anticipates global growth to moderate to 2.4% in 2025, underscoring the need for companies to monitor macroeconomic shifts.

Inflation and Operating Costs

Inflationary pressures are a significant concern for Champion Iron, directly impacting its operating costs. For instance, the cost of essential inputs like energy, labor, and specialized equipment has seen notable increases. In 2024, global energy prices have remained volatile, and the demand for skilled labor in the mining sector continues to drive up wage expectations, directly affecting operational expenses.

These rising input costs can put considerable pressure on Champion Iron's profit margins if not effectively managed. Strategic procurement, focusing on long-term supply agreements and exploring more cost-efficient consumables, becomes paramount. The company’s ability to absorb or pass on these increased costs will be a key determinant of its financial performance.

- Energy Costs: Global energy prices, a major component of operating expenses, saw an average increase of approximately 5-7% in early 2024 compared to the previous year, impacting fuel and electricity expenses for mining operations.

- Labor Expenses: The mining industry faced a shortage of skilled labor in many regions throughout 2024, leading to wage inflation estimated between 4-6% for specialized roles.

- Consumables: Costs for key consumables like explosives and steel products used in mining operations have also risen, with some categories experiencing price hikes of 3-5% due to supply chain constraints and raw material costs.

- Cost of Capital: Persistent inflation in 2024 prompted central banks to maintain higher interest rates, potentially increasing the cost of capital for Champion Iron's future expansion projects and debt financing.

Global economic growth directly influences iron ore demand, with projections for 2024 indicating a 3.2% rise in global GDP according to the IMF. This expansion typically boosts construction and manufacturing, key consumers of steel. Conversely, the World Bank forecasts a moderation to 2.4% global growth in 2025, highlighting ongoing sensitivity to macroeconomic shifts that could impact steel demand and iron ore prices.

Inflationary pressures are a significant factor, driving up operating costs for Champion Iron. In 2024, energy prices remained volatile, and skilled labor shortages contributed to wage inflation, estimated between 4-6% for specialized mining roles. These rising input costs necessitate strategic cost management to maintain profitability.

Currency fluctuations, particularly the CAD/USD exchange rate, directly affect Champion Iron's profitability. As the company sells in USD, a stronger Canadian dollar reduces its revenue in domestic terms. The Canadian dollar experienced volatility in 2024, presenting a potential headwind for the company's reported earnings.

| Economic Factor | 2024 Projection/Status | Impact on Champion Iron |

| Global GDP Growth | IMF: 3.2% (2024) | Supports demand for steel and iron ore. |

| Global GDP Growth | World Bank: 2.4% (2025) | Potential slowdown in demand, impacting prices. |

| Inflation (Energy) | Volatile in 2024 | Increases operating costs. |

| Inflation (Labor) | 4-6% wage inflation (skilled mining roles, 2024) | Increases operating costs. |

| CAD/USD Exchange Rate | Volatile in 2024 | Stronger CAD reduces USD-denominated revenue in CAD terms. |

Full Version Awaits

Champion Iron PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Champion Iron PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping Champion Iron's strategic landscape.

Sociological factors

Champion Iron's operations in Quebec rely heavily on the availability of skilled labor, a factor that can fluctuate. In 2024, Quebec's mining sector, like many others, faced competition for specialized roles, impacting recruitment timelines and potentially labor costs. The company's ability to secure and retain qualified personnel, from geologists to heavy equipment operators, directly influences its production capacity and efficiency.

Labor relations are a critical sociological element for Champion Iron. In 2024, the company navigated existing collective bargaining agreements, aiming to maintain stable industrial relations. The potential for work stoppages or disputes can significantly disrupt operations, as seen in other resource sectors where labor actions led to production losses. Proactive engagement and fair negotiation are therefore paramount for ensuring operational continuity.

Champion Iron's operations at Bloom Lake are deeply intertwined with the well-being of the surrounding communities, necessitating a robust social license to operate. In 2023, the company reported significant local engagement, including over 70% of its workforce residing within a 100km radius of the mine, underscoring its commitment to local employment.

Maintaining positive community relations involves proactive measures such as transparent communication channels and targeted investment in local infrastructure and social programs. For instance, Champion Iron's community investment program in 2023 allocated C$2.5 million to various local initiatives, fostering goodwill and mutual benefit.

Failure to nurture these relationships can have tangible financial and operational consequences. Past instances in the mining sector have demonstrated that community opposition can lead to project delays, increased operational costs due to protests, and significant reputational damage, impacting investor confidence and future financing opportunities.

Champion Iron's operations in Quebec necessitate robust engagement with Indigenous communities, particularly the Innu and Naskapi First Nations, whose traditional lands may intersect with its mining activities. This involves navigating complex land claims and ensuring adherence to consultation protocols, which are critical for maintaining operational continuity and social license. For instance, the company has established agreements that include employment and procurement targets for Indigenous businesses, aiming to foster economic participation.

Workforce Safety and Well-being

Champion Iron views workforce safety and well-being as a paramount sociological duty and a core operational necessity. Maintaining robust safety protocols not only safeguards employees but also directly bolsters productivity and minimizes disruptions. For instance, in 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.95, demonstrating a strong commitment to minimizing workplace incidents and fostering a healthy environment.

Adherence to stringent safety standards is crucial for preventing costly outcomes such as regulatory penalties, operational shutdowns, and damage to employee morale. A safe workplace directly correlates with reduced absenteeism and a more engaged workforce, contributing positively to the company's overall performance and public image. Champion Iron's ongoing investment in safety training and equipment underscores this commitment.

- Focus on Zero Harm: Champion Iron prioritizes a zero-harm culture through continuous improvement in safety practices.

- Employee Well-being Programs: Initiatives are in place to support the physical and mental health of employees.

- Safety Performance Metrics: The company actively tracks and reports on key safety indicators like TRIFR.

- Regulatory Compliance: Strict adherence to all relevant health and safety legislation is a fundamental operating principle.

Shifting Societal Preferences for Green Steel

Societal demand for environmentally friendly products is on the rise, with a particular focus on 'green steel.' This steel is manufactured using methods that significantly reduce carbon emissions, often relying on high-purity iron ore and direct reduction processes. Champion Iron's high-quality iron ore positions it favorably to capitalize on this growing market preference.

The increasing global emphasis on sustainability and decarbonization is a significant sociological factor. By 2024, many industrial nations are implementing stricter environmental regulations, pushing industries to adopt greener practices. Champion Iron's product quality aligns well with the requirements for green steel production, offering a competitive advantage.

- Growing Market Demand: Consumer and industrial preferences are shifting towards products with lower environmental impact.

- Regulatory Tailwinds: Governments worldwide are enacting policies to encourage decarbonization in heavy industries.

- Champion Iron's Advantage: The company's high-purity iron ore is a key input for green steel production technologies.

- ESG Performance Pressure: Companies like Champion Iron face increasing scrutiny regarding their environmental, social, and governance (ESG) credentials.

Champion Iron's success is deeply tied to its workforce, with 2024 seeing continued emphasis on skilled labor acquisition and retention in Quebec's competitive mining sector. The company's commitment to community well-being is evident, with over 70% of its workforce residing locally as of 2023, fostering strong social ties and economic benefits for the region.

Labor relations are managed through collective bargaining agreements, with 2024 focusing on maintaining stable industrial relations to prevent operational disruptions. Champion Iron also prioritizes workforce safety, reporting a strong Total Recordable Injury Frequency Rate (TRIFR) of 0.95 in 2023, underscoring its dedication to employee well-being and operational continuity.

Societal demand for sustainable products, particularly 'green steel,' is a growing trend. Champion Iron's high-purity iron ore is well-positioned to meet this demand, aligning with global decarbonization efforts and stricter environmental regulations anticipated through 2024.

| Sociological Factor | 2023 Data | 2024 Outlook | Impact on Champion Iron |

|---|---|---|---|

| Local Employment | Over 70% of workforce within 100km of Bloom Lake | Continued focus on local hiring | Strong community relations, reduced labor mobility costs |

| Labor Relations | Active collective bargaining agreements | Ongoing negotiation and engagement | Operational stability, risk mitigation for work stoppages |

| Workforce Safety | TRIFR of 0.95 | Continued investment in safety protocols and training | Reduced operational disruptions, enhanced employee morale and productivity |

| Demand for Green Products | Growing market preference for low-carbon steel | Increasing regulatory pressure for decarbonization | Competitive advantage due to high-purity iron ore suitable for green steel |

Technological factors

Continuous innovation in mining techniques, like the adoption of autonomous haul trucks and advanced drilling systems, directly impacts operational efficiency and cost reduction at facilities such as Champion Iron's Bloom Lake Mine. These technologies are designed to optimize material movement and extraction, leading to lower per-tonne costs.

Improvements in beneficiation and processing technologies are paramount for Champion Iron to sustain the high-grade purity of its iron ore concentrate. For instance, advancements in magnetic separation or comminution can significantly boost the quality of the final product, a key differentiator in the market.

Embracing these technological advancements offers a tangible competitive advantage. In 2023, companies investing in automation and advanced processing saw an average of 5-10% reduction in operational expenditures, alongside improved resource recovery rates, which directly translates to higher output and profitability for miners like Champion Iron.

Champion Iron can significantly boost productivity and safety by integrating automation and digital technologies like IoT and AI into its mining processes. These advancements allow for better resource management and more informed decision-making.

The company's investment in digital infrastructure is crucial for future growth, enabling predictive maintenance and optimizing overall operational efficiency. For instance, in 2023, the mining industry saw a significant push towards AI-powered analytics, with companies reporting up to a 15% increase in operational efficiency through predictive maintenance alone.

Ongoing research and development into enhancing iron ore concentrate purity is crucial for Champion Iron's competitive edge, particularly in the direct reduction steelmaking sector. This focus on innovation, including the exploration of novel processing techniques and identifying new market applications for its high-grade product, directly supports its strategic positioning.

Champion Iron's commitment to R&D ensures it stays ahead in product quality and market relevance. For instance, in fiscal year 2024, the company continued to invest in optimizing its operations, aiming to further improve the characteristics of its iron ore concentrate to meet evolving customer demands.

Energy Efficiency Technologies

Rising energy costs and environmental regulations are making energy efficiency technologies essential for mining operations. Champion Iron can gain a competitive edge by adopting these advancements. For instance, in 2024, the global mining sector is seeing increased investment in solutions that reduce power consumption, with some operations reporting up to a 15% decrease in energy intensity through optimized grinding circuits and more efficient haulage systems.

Exploring alternative energy sources is also a key technological factor. Champion Iron could leverage solar or wind power to supplement its energy needs, potentially lowering operational expenditures and its carbon footprint. Many mining companies are setting ambitious renewable energy targets; for example, by the end of 2025, several major players aim to source over 30% of their electricity from renewables.

- Optimized Equipment: Implementing advanced control systems for mining equipment can reduce idle times and improve load efficiency, leading to significant energy savings.

- Renewable Energy Integration: Investing in on-site solar or wind farms can provide a stable, cost-effective energy supply, reducing reliance on grid power.

- Process Automation: Automation in processing plants can fine-tune operations for maximum energy efficiency, minimizing waste and energy consumption per tonne of product.

- Electrification of Fleets: Transitioning from diesel-powered vehicles to electric or hybrid models offers substantial reductions in fuel costs and emissions.

Supply Chain Optimization Technologies

Champion Iron can significantly boost its global operations by adopting cutting-edge supply chain technologies. Advanced logistics software, for instance, is crucial for fine-tuning its distribution network, making it both more efficient and robust.

Technologies like blockchain offer enhanced transparency in tracking shipments, while sophisticated analytics can predict demand with greater accuracy. These tools are instrumental in optimizing inventory levels, slashing transportation expenses, and ultimately elevating customer satisfaction.

For example, in 2024, the global logistics market was valued at over $9.6 trillion, with technology adoption being a key driver of growth. By integrating such solutions, Champion Iron can ensure its iron ore reaches international markets promptly and cost-effectively.

- Blockchain for enhanced supply chain transparency and traceability.

- Advanced analytics for improved demand forecasting and inventory management.

- AI-powered route optimization to reduce transportation costs and delivery times.

- Real-time tracking systems for greater visibility across the entire supply chain.

Technological advancements are pivotal for Champion Iron's operational efficiency and cost management, particularly with innovations in autonomous mining and advanced processing. These technologies are key to optimizing extraction and improving the quality of its iron ore concentrate, a critical factor in the competitive steelmaking market.

The company's investment in digital infrastructure, including AI for predictive maintenance, is projected to yield significant operational efficiency gains. For instance, the mining sector in 2023 saw up to a 15% increase in operational efficiency through such predictive analytics.

Champion Iron's focus on R&D for enhancing concentrate purity aligns with the growing demand from the direct reduction steelmaking sector. By exploring novel processing techniques, the company aims to maintain a competitive edge and meet evolving customer needs, as evidenced by its continued investment in operational optimization in fiscal year 2024.

Adopting energy-efficient technologies and exploring alternative energy sources, such as solar and wind power, presents a significant opportunity for cost reduction and environmental footprint improvement. By 2025, many mining firms are targeting over 30% of their electricity from renewables, a trend Champion Iron can leverage.

Legal factors

Champion Iron navigates a stringent regulatory environment in Canada, requiring a multitude of provincial and federal mining permits and licenses. Maintaining compliance with these permits, which involves timely renewals and strict adherence to operational stipulations, is critical for uninterrupted operations.

Non-compliance or delays in securing these essential permits can result in significant disruptions, including operational shutdowns, substantial fines, and potential legal disputes. For instance, in fiscal year 2024, the company reported successfully renewing key permits for its Bloom Lake operations, underscoring the ongoing need for diligent regulatory management.

Champion Iron operates under strict environmental legislation covering water discharge, air emissions, waste disposal, and land rehabilitation. For instance, in fiscal year 2024, the company reported significant investments in environmental monitoring and management systems to ensure compliance with Quebec's environmental standards.

Failure to meet these requirements, such as exceeding permitted emission levels or improper waste handling, can lead to substantial fines and legal challenges, impacting operational continuity and financial performance. Adherence to these rules is paramount to maintaining their license to operate and public trust.

Proactive environmental stewardship, including initiatives like progressive rehabilitation of mining sites, is crucial for Champion Iron's long-term viability and social license. This approach not only mitigates risks but also enhances the company's reputation among stakeholders and investors.

As a publicly traded entity on the Toronto Stock Exchange (TSX), Champion Iron is bound by stringent corporate governance and financial reporting regulations. These rules, enforced by bodies like the Ontario Securities Commission, demand transparency in operations and financial disclosures, crucial for maintaining investor trust and avoiding legal penalties. For instance, in its fiscal year ending March 31, 2024, Champion Iron reported total assets of CAD 4.5 billion, underscoring the scale of financial information requiring meticulous adherence to reporting standards.

Health and Safety Regulations

Mining is inherently risky, so Champion Iron must strictly follow health and safety rules. This includes adhering to Quebec and federal safety standards, regularly checking for dangers, and ensuring employees have the right training and gear. For instance, in 2023, Quebec’s mining sector reported 44 lost-time injuries per 1,000 workers, highlighting the ongoing need for vigilance.

Failure to meet these requirements can result in serious consequences for Champion Iron. These can include significant fines, workplace accidents that harm employees, and damage to the company's reputation. Staying compliant is therefore crucial for operational continuity and stakeholder trust.

Champion Iron's commitment to safety is demonstrated through initiatives like:

- Regular safety audits and inspections across all sites.

- Comprehensive training programs for all employees and contractors.

- Investment in advanced safety equipment and technologies.

- Proactive risk management and incident investigation processes.

International Trade Laws and Contracts

Champion Iron's international sales are directly influenced by a complex web of global trade regulations and bespoke customer contracts. Navigating these requirements, including import and export controls, tariffs, and the precise terms of each sales agreement, is fundamental to their operational success. For instance, in 2023, the global iron ore trade saw significant fluctuations, with prices averaging around $130 per tonne, underscoring the financial impact of regulatory changes and contractual adherence.

Failure to comply with these international trade laws or any breaches of contractual obligations can lead to severe repercussions. These might include substantial financial penalties, costly legal disputes, and, in the most extreme cases, the potential loss of access to crucial overseas markets. For example, a customs violation in a key importing nation could halt shipments and incur fines equivalent to a percentage of the cargo's value.

- Regulatory Compliance: Adherence to diverse international trade laws, including those governing mineral exports and import duties in customer nations.

- Contractual Obligations: Meeting the specific terms and conditions outlined in sales contracts with global buyers, ensuring timely delivery and quality standards.

- Risk Mitigation: Proactively managing potential disputes arising from trade law non-compliance or contract breaches to avoid financial and market access penalties.

Champion Iron operates under a strict legal framework, encompassing mining permits, environmental regulations, health and safety standards, and corporate governance. Compliance with these multifaceted legal requirements is essential for maintaining operational licenses, avoiding financial penalties, and preserving stakeholder trust.

The company's adherence to Quebec's environmental standards, for example, involves significant investment in monitoring systems, as noted in fiscal year 2024. Furthermore, as a publicly traded entity, Champion Iron must comply with stringent financial reporting regulations enforced by bodies like the Ontario Securities Commission, ensuring transparency and investor confidence. The scale of its operations, with total assets of CAD 4.5 billion reported in fiscal year ending March 31, 2024, necessitates meticulous adherence to these reporting standards.

International trade laws and bespoke customer contracts also present significant legal considerations for Champion Iron's global sales. Navigating import/export controls, tariffs, and contractual obligations is critical to avoid penalties and maintain market access. For instance, in 2023, global iron ore prices averaged around $130 per tonne, highlighting the financial sensitivity to regulatory shifts and contractual adherence in international markets.

Environmental factors

Champion Iron is navigating a landscape of intensifying scrutiny regarding its environmental impact, particularly concerning carbon emissions. Global climate change objectives and evolving Canadian regulations are compelling the company to actively reduce its carbon footprint. This pressure extends across its operations, from the energy-intensive mining equipment and processing facilities to the transportation of its iron ore products.

The company must strategically manage emissions generated throughout its value chain. This involves exploring and adopting lower-emission technologies for its fleet and processing plants, which could include electrification or alternative fuels. Furthermore, Champion Iron may need to engage with or prepare for participation in carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, which are becoming increasingly prevalent in Canada to incentivize emission reductions.

For instance, Canada's federal carbon pricing system, implemented in 2019 and strengthened over time, applies to fossil fuels. While specific exemptions for the mining sector can exist, the overarching trend is towards broader application. Companies like Champion Iron are therefore evaluating investments in energy efficiency and cleaner energy sources to mitigate the financial implications of carbon pricing and ensure long-term operational sustainability and market acceptance. In 2023, Canadian industrial emitters faced a carbon price of C$65 per tonne of CO2 equivalent, set to rise to C$170 per tonne by 2030, highlighting the growing financial imperative for emission reduction.

Champion Iron's mining and beneficiation processes are inherently water-intensive, requiring careful management of this vital resource. In 2023, the company reported significant water usage across its operations in Quebec, with specific figures detailed in its sustainability reports, highlighting the need for robust water management strategies.

Compliance with stringent environmental regulations regarding water sourcing, consumption, and discharge is paramount. Champion Iron must ensure its operations minimize ecological impact, especially within Quebec's sensitive watershed areas, as evidenced by their ongoing environmental monitoring programs.

The company's commitment to sustainable practices necessitates efficient water recycling and treatment systems. By investing in advanced technologies, Champion Iron aims to reduce its freshwater footprint and maintain operational viability in the long term, aligning with broader industry trends towards water stewardship.

Champion Iron faces significant environmental hurdles in managing mine tailings and waste. The company must comply with stringent regulations governing the stability and containment of tailings storage facilities to prevent any environmental contamination. For instance, in 2023, the company reported on its ongoing efforts to reinforce its tailings management facilities, aligning with evolving environmental standards.

The industry is seeing a growing emphasis on developing and implementing innovative strategies for waste reduction and repurposing. This includes exploring methods to minimize the volume of tailings generated and finding beneficial uses for waste materials, turning a potential liability into an opportunity. Champion Iron's commitment to sustainable practices involves continuous evaluation of these advanced waste management techniques.

Biodiversity Protection and Land Reclamation

Mining operations inherently affect local ecosystems. Champion Iron acknowledges this and is committed to minimizing its environmental impact by safeguarding local plant and animal life. This commitment is crucial for maintaining a positive environmental record.

Champion Iron actively engages in progressive land reclamation as part of its mine closure strategies. This proactive approach aims to restore disturbed areas, demonstrating a dedication to ecological recovery and responsible resource management. For instance, as of their 2023 reporting, the company highlighted reclamation activities at their Bloom Lake mine, focusing on progressive rehabilitation of tailings storage facilities.

Their efforts in biodiversity protection and land reclamation are key components of their environmental stewardship. This focus not only addresses regulatory requirements but also builds trust with stakeholders and enhances the company's social license to operate. Champion Iron's 2024 sustainability report is expected to provide updated metrics on reclamation progress and biodiversity monitoring initiatives.

- Biodiversity Monitoring: Champion Iron conducts ongoing monitoring of local flora and fauna to assess and mitigate impacts from its mining activities.

- Progressive Reclamation: The company implements phased reclamation plans, rehabilitating disturbed land concurrently with ongoing operations where feasible.

- Ecological Restoration Goals: Specific targets for vegetation establishment and habitat restoration are set as part of their environmental management plans.

- Stakeholder Engagement: Champion Iron collaborates with environmental agencies and local communities on biodiversity conservation and land management strategies.

Renewable Energy Adoption and Decarbonization

The global push for decarbonization is accelerating, with renewable energy adoption becoming a critical factor for mining companies like Champion Iron. This transition offers a significant opportunity to reduce operational costs and environmental impact. For instance, by 2024, the mining industry is increasingly exploring solar and wind power to supplement or replace traditional diesel and grid electricity, aiming to cut Scope 1 and Scope 2 emissions. Champion Iron can leverage this trend by investing in on-site renewable energy generation or securing power purchase agreements for green electricity. This strategic move not only aligns with evolving environmental, social, and governance (ESG) expectations but also provides a hedge against volatile fossil fuel prices.

Integrating renewables presents a clear path to lower operational emissions and enhance Champion Iron's environmental stewardship. By 2025, many mining jurisdictions are expected to have stricter regulations on carbon emissions, making a proactive approach essential. Champion Iron could explore partnerships for large-scale solar or wind projects to power its operations, potentially reducing its carbon footprint by a substantial margin. This aligns with the broader industry trend of achieving net-zero targets, a commitment many major mining firms are making.

Champion Iron's commitment to renewable energy adoption can yield several benefits:

- Reduced Operational Emissions: Shifting away from fossil fuels directly lowers greenhouse gas output.

- Cost Savings: Renewable energy sources often offer more stable and predictable long-term energy costs compared to fossil fuels.

- Enhanced ESG Profile: Demonstrating a commitment to sustainability can improve investor relations and attract capital.

- Regulatory Compliance: Proactive adoption of renewables helps meet current and future environmental regulations.

Champion Iron faces increasing pressure to decarbonize its operations, driven by global climate goals and evolving Canadian regulations. The company is actively exploring ways to reduce its carbon footprint across mining, processing, and transportation, with a focus on adopting lower-emission technologies and potentially participating in carbon pricing mechanisms. For instance, Canadian industrial emitters faced a carbon price of C$65 per tonne of CO2 equivalent in 2023, projected to rise to C$170 by 2030, underscoring the financial incentive for emission reduction.

Water management is critical, with Champion Iron's operations in Quebec being water-intensive. Strict adherence to regulations concerning water sourcing, usage, and discharge is essential to minimize ecological impact, particularly in sensitive watershed areas. The company is investing in efficient water recycling and treatment systems to reduce its freshwater footprint and ensure long-term operational sustainability.

Managing mine tailings and waste is another significant environmental challenge. Champion Iron must comply with stringent regulations for tailings storage facility stability and containment, as demonstrated by their ongoing reinforcement efforts reported in 2023. The company is also exploring innovative waste reduction and repurposing strategies to minimize environmental liabilities.

Champion Iron is committed to minimizing its impact on local ecosystems through biodiversity protection and progressive land reclamation. As of 2023 reporting, reclamation activities were underway at their Bloom Lake mine. The company's 2024 sustainability report is anticipated to detail progress on reclamation and biodiversity monitoring, reflecting a dedication to ecological restoration and responsible resource management.

The adoption of renewable energy presents a key opportunity for Champion Iron to lower operational costs and environmental impact. By 2025, stricter carbon emission regulations are expected, making a proactive shift towards solar and wind power crucial for reducing Scope 1 and Scope 2 emissions. This strategic move enhances the company's ESG profile and provides a hedge against volatile fossil fuel prices.

| Environmental Factor | Impact on Champion Iron | Key Initiatives/Considerations |

|---|---|---|

| Carbon Emissions | Increasing regulatory scrutiny and financial implications from carbon pricing. | Adoption of lower-emission technologies, evaluation of carbon pricing mechanisms (e.g., C$65/tonne CO2e in 2023, rising to C$170/tonne by 2030). |

| Water Management | High water intensity requires careful resource management and compliance with discharge regulations. | Investment in water recycling and treatment systems, focus on minimizing freshwater footprint in Quebec's watershed areas. |

| Mine Tailings & Waste | Need for secure containment and compliance with strict waste management regulations. | Reinforcement of tailings facilities (as reported in 2023), exploration of waste reduction and repurposing strategies. |

| Biodiversity & Land Reclamation | Minimizing impact on local ecosystems and restoring disturbed areas. | Progressive land reclamation (e.g., Bloom Lake mine), biodiversity monitoring, setting ecological restoration goals. |

| Renewable Energy | Opportunity to reduce emissions and operational costs. | Exploration of solar and wind power integration, aiming to cut Scope 1 and 2 emissions by 2025. |

PESTLE Analysis Data Sources

Our Champion Iron PESTLE analysis is meticulously constructed using data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of political, economic, and social factors impacting the iron ore sector.