Champion Iron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Champion Iron operates in a market shaped by significant buyer power and the constant threat of new entrants, especially with its reliance on bulk commodities. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Champion Iron’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized mining equipment, like massive haul trucks and advanced processing plant machinery, exert moderate bargaining power over Champion Iron. These critical components are essential for the company's operational efficiency and future growth plans, and the cost and complexity of switching to a different supplier for such major equipment are significant.

The global presence of these equipment manufacturers and the availability of several alternative vendors do, however, limit their ability to dictate terms. For instance, while Caterpillar and Komatsu are dominant players in heavy mining equipment, the competitive landscape offers some recourse for large buyers like Champion Iron, preventing suppliers from leveraging excessive pricing power.

Champion Iron's reliance on hydroelectric power in Quebec significantly curtails the bargaining power of energy providers. This access to a stable, renewable energy source, unlike regions dependent on volatile fossil fuels, offers a distinct cost advantage. In 2023, Quebec's hydroelectricity rates remained competitive, contributing to Champion Iron's operational cost stability.

Champion Iron's reliance on rail operators for transporting its iron ore concentrate highlights the significant bargaining power these suppliers hold. Logistical challenges, such as those experienced with rail haulage, have led to substantial stockpiling at its Bloom Lake mine, demonstrating the impact of limited alternatives for bulk transport. In 2023, for instance, the company cited disruptions in rail services as a key factor affecting its production and sales volumes, underscoring the critical nature of these relationships.

Labor Unions and Skilled Workforce

Champion Iron recently secured a new five-year collective bargaining agreement with its unionized workforce at Bloom Lake. This demonstrates the significant bargaining power held by labor unions in the mining sector.

A highly skilled workforce is critical for the intricate processes involved in mining operations. The availability of such talent, coupled with their wage expectations, directly influences operational expenses and the overall stability of the company.

While this long-term labor agreement offers a degree of predictability, it also underscores the substantial leverage possessed by the organized workforce in negotiating terms and conditions.

- Unionized Workforce Influence: Champion Iron's recent five-year labor agreement highlights the power of organized labor in the mining industry.

- Skilled Labor Dependency: Complex mining operations rely heavily on a skilled workforce, making labor availability and wage demands key cost drivers.

- Operational Stability: The new agreement provides stability but also reflects the ongoing bargaining power of employees, impacting operational costs.

Mining Consumables and Services

Suppliers of general mining consumables like explosives, chemicals, and spare parts, as well as those providing routine maintenance, generally possess limited bargaining power. This is largely due to the standardized nature of these products and services, coupled with the availability of numerous suppliers. This competitive landscape allows Champion Iron to secure favorable pricing and terms.

However, the dynamic can shift when suppliers offer niche or proprietary consumables. In such instances, these specific vendors may gain a degree of leverage. For example, if a particular drilling bit or specialized chemical processing agent is critical and only available from a single or limited number of sources, Champion Iron's ability to negotiate may be constrained.

- Standardized Inputs: General consumables like explosives and spare parts are often commoditized, reducing supplier influence.

- Multiple Supplier Options: The existence of many providers for routine services and parts enables Champion Iron to play suppliers against each other.

- Niche Product Leverage: Proprietary or specialized consumables can grant specific vendors increased bargaining power.

- Impact on Costs: While generally low, the bargaining power of suppliers for specialized items can impact Champion Iron's operational expenses.

Suppliers of specialized mining equipment and critical components hold moderate bargaining power over Champion Iron due to the high switching costs and essential nature of their products. However, the presence of multiple global manufacturers like Caterpillar and Komatsu limits any single supplier's ability to dictate terms, as Champion Iron can leverage competition. For instance, in 2023, Champion Iron continued to rely on these major equipment providers for its fleet.

Conversely, Champion Iron benefits from strong bargaining power with energy suppliers, primarily due to its reliance on Quebec's stable and cost-effective hydroelectricity. This significantly reduces its vulnerability to the volatile energy markets that affect competitors. In 2023, hydroelectricity remained a cornerstone of Champion Iron's cost structure, providing a competitive edge.

Rail operators wield significant bargaining power over Champion Iron due to the essential nature of bulk transport for its iron ore concentrate. Disruptions in rail services, as experienced in 2023, directly impacted the company's sales volumes and inventory levels, highlighting the limited alternatives for this critical logistical function.

Labor unions also demonstrate considerable bargaining power, as evidenced by Champion Iron's recent five-year collective bargaining agreement with its unionized workforce at Bloom Lake. This agreement underscores the leverage skilled labor possesses in the mining sector, directly influencing operational costs and stability.

| Supplier Type | Bargaining Power | Key Factors | 2023/2024 Relevance |

| Specialized Equipment Manufacturers | Moderate | High switching costs, product criticality, but competition exists | Continued reliance on major suppliers for fleet maintenance and expansion. |

| Energy Providers (Hydroelectric) | Low | Stable, cost-effective, renewable source in Quebec | Key contributor to operational cost stability and competitive advantage. |

| Rail Operators | High | Essential for bulk transport, limited alternatives, logistical disruptions | Service disruptions in 2023 impacted sales volumes and inventory. |

| Labor Unions | High | Skilled workforce dependency, collective bargaining agreements | New five-year agreement secured, providing predictability but reflecting ongoing employee leverage. |

| General Consumables & Parts | Low | Standardized products, numerous suppliers, competitive pricing | Favorable pricing secured for routine operational needs. |

What is included in the product

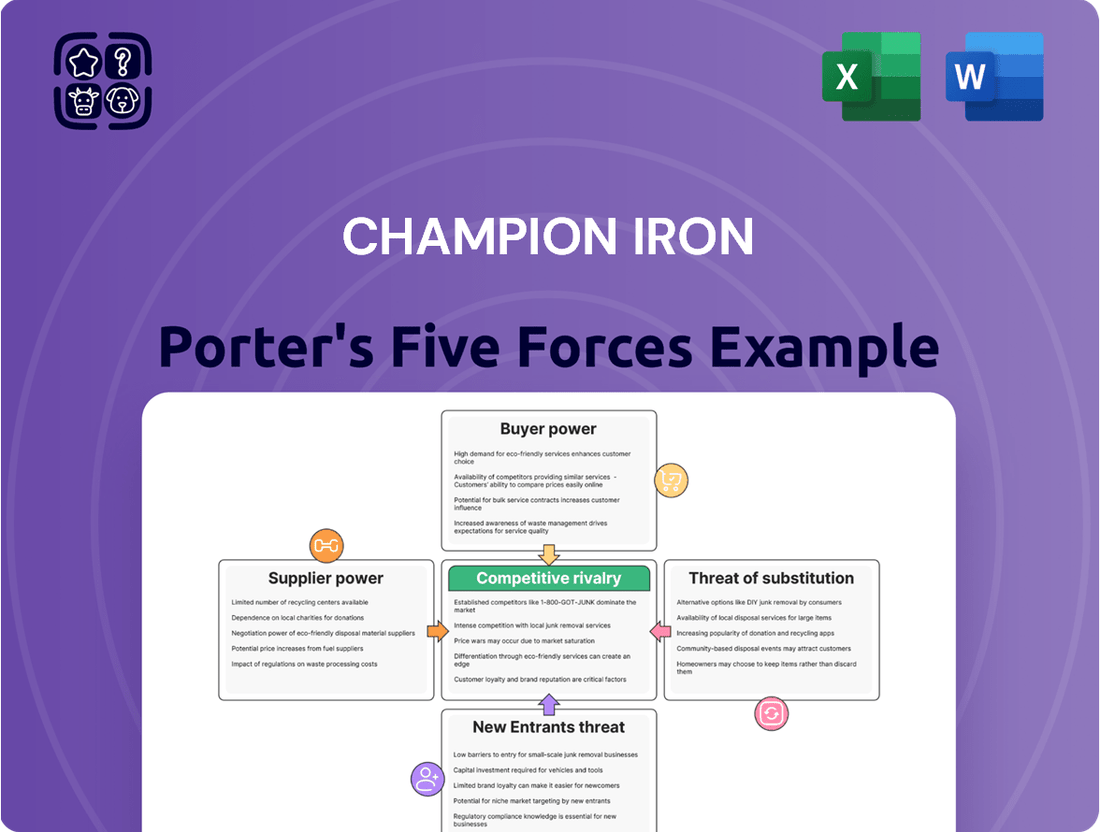

This analysis of Champion Iron's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces analysis, highlighting key threats and opportunities for Champion Iron.

Customers Bargaining Power

Champion Iron's primary customers are global steel producers, a sector characterized by its size and fragmentation. This broad customer base typically dilutes the bargaining power of any single buyer.

However, the landscape in 2024 presents a shift. Weak demand for high-grade iron ore, driven by squeezed steelmaking margins and an oversupply situation in China, has tilted the scales. This environment grants customers increased leverage.

China's role as the world's largest iron ore consumer is paramount. Its demand patterns directly dictate market dynamics, making its purchasing behavior a significant factor in customer bargaining power within the global steel industry.

Champion Iron's focus on high-purity iron ore concentrate, essential for direct reduction steelmaking, positions it favorably. This specialized product caters to a growing demand from steelmakers aiming to lower their carbon emissions, a trend amplified by global decarbonization efforts.

The increasing adoption of Electric Arc Furnaces (EAFs) and the Direct Reduced Iron (DRI) process directly fuels the demand for premium iron ore like Champion Iron's. This shift suggests a potentially stronger bargaining position for Champion Iron as it supplies a critical input for a more sustainable steel production pathway.

Champion Iron's reliance on a concentrated customer base, such as large steel mills or trading houses, grants these buyers significant bargaining power. For instance, if a few key clients represent over 50% of Champion Iron's revenue, they can leverage this volume to negotiate lower prices for iron ore, impacting profitability.

This concentration means that even a small shift in demand or pricing from one major customer can have a substantial effect on Champion Iron's financial performance. Buyers with the ability to purchase large quantities can often dictate terms, potentially squeezing margins for the supplier.

To mitigate this, Champion Iron could focus on diversifying its customer portfolio, potentially targeting steelmakers located nearer its port facilities to reduce logistical costs for buyers and thus potentially attract a broader range of clients.

Availability of Substitute Iron Ore Grades

Customers can often blend different iron ore grades to meet their specific steelmaking needs. If the price for high-grade ore becomes excessively high, buyers may shift to lower-grade fines or explore alternative blending approaches.

This flexibility directly enhances customer bargaining power. For instance, weak steelmaking margins observed in 2024 have already prompted some purchasers to investigate the viability of using lower-grade iron ores, signaling a potential shift in demand dynamics.

- Customer Flexibility: Buyers can substitute by blending various iron ore grades.

- Price Sensitivity: High premiums for premium grades can drive customers to lower-grade alternatives.

- 2024 Market Trend: Reduced steelmaking margins in 2024 have increased buyer interest in lower-grade ores.

- Impact on Bargaining Power: This ability to switch or blend increases customer leverage.

Customers' Backward Integration Potential

Customers' potential for backward integration, while generally low for steelmakers due to the immense capital required for iron ore mining, presents a nuanced threat to Champion Iron. Large, highly integrated steel producers might possess captive mines or secure long-term supply contracts, giving them a degree of self-sufficiency. This capability, even if not fully realized, acts as a latent pressure, subtly shaping Champion Iron's pricing power and the dynamics of its customer relationships.

While most steel manufacturers shy away from the significant investment and operational complexity of iron ore mining, some major players do maintain their own mining operations or have established long-term, exclusive supply agreements for raw materials. For instance, in 2024, global steel production reached approximately 1.9 billion tonnes, with a portion of this output coming from integrated steelmakers with upstream mining assets. This existing vertical integration, though not a direct substitute for Champion Iron's specific product, signifies a potential counter-lever for large customers.

- Limited Scope: Direct backward integration into iron ore mining is exceedingly rare for the vast majority of steelmakers due to its capital intensity and specialized expertise.

- Captive Operations: A small number of very large, integrated steel companies may operate their own mines or have secured long-term, exclusive supply agreements, providing them with a degree of raw material security.

- Latent Threat: This potential, even if not actively pursued, acts as a background influence, potentially impacting Champion Iron's pricing flexibility and negotiation leverage with these specific customers.

Champion Iron's customers, primarily global steel producers, face varying degrees of bargaining power. While a fragmented customer base generally dilutes individual buyer influence, market conditions in 2024, marked by weak steel demand and oversupply in China, have amplified customer leverage. This environment allows buyers to negotiate more favorable terms, impacting Champion Iron's pricing and profitability.

Champion Iron's specialized high-purity iron ore concentrate caters to the growing demand for direct reduction steelmaking, a trend driven by decarbonization efforts. This positions Champion Iron favorably as steelmakers increasingly adopt Electric Arc Furnaces (EAFs) and the Direct Reduced Iron (DRI) process, potentially strengthening its negotiating stance with these specific customers.

However, Champion Iron's reliance on a concentrated customer base, where a few key clients might represent a significant portion of revenue, grants these large buyers substantial bargaining power. Their ability to purchase in bulk allows them to dictate terms, potentially squeezing supplier margins, a dynamic that requires strategic customer portfolio diversification.

Customers can substitute Champion Iron's product by blending different iron ore grades, especially when premiums for high-grade ore become excessive. The reduced steelmaking margins observed in 2024 have already prompted some buyers to explore lower-grade ore alternatives, highlighting the flexibility that enhances customer bargaining power.

| Factor | Description | 2024 Impact | Champion Iron's Position |

| Customer Concentration | Reliance on a few large buyers | High leverage for major clients | Vulnerability to price pressure |

| Market Demand | Global steel demand and China's consumption | Weak demand amplifies buyer power | Need for competitive pricing |

| Product Specialization | High-purity iron ore for DRI | Growing demand from green steel initiatives | Potential for stronger pricing |

| Customer Flexibility | Ability to blend ore grades | Increased willingness to use lower grades | Risk of substitution |

Preview the Actual Deliverable

Champion Iron Porter's Five Forces Analysis

This preview showcases the exact Champion Iron Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive look at the competitive landscape. You're viewing the final, professionally formatted document, ensuring no surprises and full readiness for your strategic planning. This detailed analysis, covering all five forces, is precisely what you'll be able to download and utilize the moment your purchase is complete.

Rivalry Among Competitors

The global iron ore market is characterized by intense competition among a few dominant players. Giants like Vale, Rio Tinto, BHP, and Fortescue Metals Group control a substantial share of the seaborne trade, creating a concentrated competitive landscape. Champion Iron, despite its position as a high-grade producer, navigates this environment where rivalry can escalate, particularly when the market experiences oversupply.

Champion Iron's strategy of producing high-grade, high-purity iron ore for direct reduction steelmaking offers a notable point of differentiation. This specialized product is becoming more attractive to steel manufacturers focused on reducing their carbon footprint, as direct reduction processes generally have lower emissions than traditional blast furnaces.

While this focus can lessen direct competition from producers of lower-grade ore, it's important to note that other industry players are also increasing their investment in high-grade iron ore production. For example, in 2024, several major iron ore projects globally announced expansions or new developments targeting higher quality output, indicating a growing trend rather than a unique advantage for any single player.

The iron ore market faces a challenging outlook for 2024-2025, with global supply expected to tick upwards while demand from key markets like China is projected to soften. This shift creates a looser market balance, potentially leading to oversupply conditions.

This anticipated oversupply directly fuels intensified competitive rivalry among iron ore producers. Companies will likely compete more aggressively for market share, potentially through pricing strategies or increased production. In this environment, overall iron ore prices are anticipated to trend downwards in the near term.

High Fixed Costs and Exit Barriers

The mining sector, including companies like Champion Iron, operates with substantial fixed costs for exploration, mine development, and ongoing operations. These significant upfront investments create high exit barriers, as companies are often compelled to continue production even in challenging market conditions to recoup their initial capital outlays.

This dynamic can lead to persistent oversupply and intense rivalry among established players. For instance, in the iron ore market, major producers must manage extensive infrastructure and equipment, making it difficult to scale back production quickly without incurring substantial losses.

- High Capital Intensity: Developing a new mine can cost billions of dollars, with significant portions allocated to exploration, infrastructure, and processing facilities.

- Operational Leverage: Once operational, mines have high fixed costs regardless of output volume, pressuring companies to maintain high production levels.

- Exit Barriers: The specialized nature of mining assets and the environmental reclamation requirements make it costly and complex for companies to cease operations.

- Competitive Response: To mitigate the impact of high fixed costs and exit barriers, companies focus on operational efficiency and cost optimization to remain competitive.

Geopolitical Factors and Trade Tensions

Geopolitical tensions and evolving trade policies, including tariffs and resource nationalism, significantly impact the iron ore market, directly affecting companies like Champion Iron. These dynamics can disrupt established global trade routes and amplify competition within specific regions. For instance, ongoing trade disputes between major economies can lead to unpredictable shifts in demand and pricing, forcing producers to reassess their market strategies and supply chain resilience.

The strategic importance of iron ore as a foundational commodity for global industrial activity places it at the center of international economic and security discussions. This inherent strategic value means that geopolitical factors can introduce substantial volatility and uncertainty into the market. Companies must remain agile, adapting their supply chain operations and actively exploring new markets to mitigate risks associated with these global pressures. In 2024, the global iron ore trade remained a critical component of international commerce, with China's continued demand being a primary driver, though its economic performance and trade relations with key suppliers are closely watched.

The heightened risk of trade disruptions necessitates a proactive approach to market engagement and operational planning for iron ore producers. Companies are increasingly focused on diversifying their customer base and securing long-term supply agreements to buffer against the impacts of protectionist measures or geopolitical instability. The strategic importance of iron ore means that its trade flows are often subject to political considerations, influencing investment decisions and market access for producers worldwide.

- Trade Policy Impact: Tariffs and trade barriers can increase the cost of exporting iron ore, affecting profitability and market competitiveness.

- Resource Nationalism Concerns: Countries rich in iron ore may implement policies favoring domestic processing or prioritize national supply security, potentially limiting export opportunities.

- Supply Chain Vulnerability: Geopolitical events can disrupt shipping routes and logistics, leading to delays and increased operational costs for companies like Champion Iron.

- Market Volatility: Tensions between major trading nations contribute to price fluctuations and uncertainty in the global iron ore market, impacting strategic planning.

The competitive rivalry in the iron ore sector is fierce, driven by a few large global players and the industry's capital-intensive nature. Champion Iron's focus on high-grade ore offers some differentiation, but the market is seeing increased investment in similar products. Anticipated oversupply in 2024-2025, coupled with high fixed costs and exit barriers, intensifies competition, potentially leading to price pressures.

SSubstitutes Threaten

The threat of substitutes for Champion Iron's product, primarily iron ore, is intensifying due to the growing adoption of Direct Reduced Iron (DRI) and scrap steel. These materials are increasingly replacing traditional blast furnace ironmaking, a process that heavily relies on iron ore. For instance, in 2023, global steel production via Electric Arc Furnaces (EAFs), which utilize DRI and scrap, accounted for approximately 30% of total output, a figure expected to rise as decarbonization efforts accelerate.

This shift towards EAFs fundamentally alters the demand for raw materials. As steelmakers prioritize lower-carbon production methods, the demand for iron ore suitable for blast furnaces may see a relative decline, while the demand for DRI and high-quality scrap steel is projected to grow. This trend directly impacts companies like Champion Iron, as it necessitates adaptation to evolving steelmaking technologies and raw material preferences.

The increasing viability of hydrogen-based steelmaking presents a substantial threat to traditional iron ore producers like Champion Iron. This technology aims to decarbonize steel production by replacing coal with hydrogen, a shift that could fundamentally alter the demand for iron ore. For instance, H2 Green Steel's pilot plant in Sweden, expected to commence operations in 2025, signifies a tangible step towards this future, potentially impacting the market for high-grade iron ore.

While steel is a cornerstone in construction and manufacturing, emerging materials like advanced composites, aluminum, and engineered wood pose a potential long-term threat. These alternatives, particularly in niche applications, could chip away at steel demand, indirectly impacting iron ore consumption. For instance, the global market for engineered wood products was projected to reach over $100 billion by 2024, showcasing significant growth in alternative building materials.

However, steel's inherent versatility, durability, and cost-effectiveness remain significant barriers to widespread substitution. The sheer scale of steel production, with global crude steel output reaching approximately 1.89 billion tonnes in 2023, underscores its entrenched position. This robust demand, driven by infrastructure and construction projects worldwide, continues to anchor the market for iron ore.

Lower-Grade Iron Ore Blending

For steelmakers not solely focused on direct reduction, the ability to blend lower-grade iron ore fines presents a viable substitute. This option becomes particularly attractive if the premiums for high-grade iron ore become prohibitive, allowing buyers to control their costs, especially during periods of squeezed steelmaking margins.

Market observations in 2024 suggest that demand for high-grade fines will likely remain subdued unless the price differential, or discount, for low-grade fines widens significantly. This dynamic highlights the cost-sensitivity of steel producers and their willingness to explore alternative sourcing strategies.

- Cost Management: Steelmakers can blend lower-grade ores to mitigate the impact of high-grade premiums.

- Demand Sensitivity: Increased demand for high-grade fines is contingent on wider discounts for lower-grade alternatives.

- Market Flexibility: The availability of blending options provides buyers with greater purchasing flexibility.

Technological Advancements in Steel Production

Technological advancements in steel production present a significant threat of substitutes for high-purity iron ore. Continuous innovation, moving beyond direct reduced iron (DRI) or hydrogen-based methods, could introduce novel efficiencies or alternative feedstocks that diminish the demand for traditional iron ore inputs. For instance, research into advanced smelting techniques or novel material composites could offer viable alternatives for steel manufacturing.

The exploration of various low-carbon steelmaking routes is a key driver of this threat. The ultimate cost-competitiveness of these emerging processes will be a crucial determinant in their adoption and their impact on the iron ore market. By 2024, several pilot projects for green steel production were operational, demonstrating the growing feasibility of these alternatives.

- Emerging Steelmaking Technologies: Innovations like advanced electrolysis or novel binding agents for scrap could bypass the need for virgin iron ore.

- Cost-Competitiveness: The economic viability of low-carbon steel production methods is critical; if they become cheaper than traditional methods, demand for high-purity iron ore will decrease.

- Feedstock Diversification: Companies are actively researching the use of recycled materials and alternative mineral inputs to reduce reliance on mined iron ore.

- Market Adoption Rates: The speed at which new, less iron-ore-intensive steelmaking technologies are adopted by major manufacturers will directly influence the threat of substitutes.

The threat of substitutes for Champion Iron's core product, iron ore, is evolving with the rise of Direct Reduced Iron (DRI) and steel scrap. These materials are increasingly favored in Electric Arc Furnace (EAF) steelmaking, a process that bypasses traditional blast furnaces reliant on iron ore. In 2023, EAFs accounted for roughly 30% of global steel production, a share anticipated to grow as decarbonization efforts intensify and favor lower-carbon processes.

Emerging steelmaking technologies, such as hydrogen-based reduction, also present a substantial threat by aiming to replace coal and, by extension, the need for iron ore in blast furnaces. Pilot projects, like H2 Green Steel's facility slated for 2025, underscore the tangible shift towards these greener, less iron-ore-intensive methods. Furthermore, while steel remains dominant, advanced composites, aluminum, and engineered wood are carving out niche applications, potentially impacting long-term steel demand and, consequently, iron ore consumption. The engineered wood market alone was projected to exceed $100 billion by 2024.

However, steel's inherent strengths in durability and cost-effectiveness, coupled with global infrastructure demand, maintain its entrenched market position, with approximately 1.89 billion tonnes of crude steel produced in 2023. Steelmakers also have flexibility; they can blend lower-grade iron ore fines to manage costs, especially when premiums for high-grade ore increase. Market trends in 2024 indicate that demand for high-grade fines will likely remain subdued unless the price gap with lower-grade alternatives widens significantly, highlighting the cost-sensitivity of steel producers.

| Substitute Material | Primary Use Case | 2023/2024 Relevance | Potential Impact on Iron Ore Demand |

|---|---|---|---|

| Direct Reduced Iron (DRI) | EAF Steelmaking | ~30% of global steel production via EAFs in 2023 | Reduces demand for traditional iron ore inputs |

| Steel Scrap | EAF Steelmaking | Significant component in EAF production | Directly replaces virgin iron ore requirements |

| Hydrogen-based Steelmaking | Emerging Low-Carbon Steel Production | Pilot projects operational, e.g., H2 Green Steel (2025) | Aims to eliminate coal and reduce iron ore need in blast furnaces |

| Advanced Composites, Aluminum, Engineered Wood | Construction, Automotive, Manufacturing | Engineered wood market projected >$100 billion by 2024 | Potential long-term erosion of steel demand in specific applications |

Entrants Threaten

Entering the iron ore mining sector, particularly for operations of Bloom Lake's scale, demands immense capital. Think billions of dollars for everything from initial exploration and site development to the construction of essential infrastructure like processing plants and transportation links. This massive financial hurdle naturally discourages many potential new players from even attempting to enter the market.

The timeline for bringing a new mine online is also a significant deterrent. It can easily take five to ten years, or even longer, from the initial discovery of a viable ore body to the point where production actually begins. During this extended period, substantial investments are made with no immediate return, further amplifying the financial risk for any new entrant.

For instance, the Bloom Lake mine itself required significant upfront investment. Champion Iron has consistently reported substantial capital expenditures. In fiscal year 2024, the company continued its focus on capital projects, including expansions and upgrades, demonstrating the ongoing need for significant financial commitment in this industry.

Access to high-quality iron ore deposits, particularly those suitable for direct reduction, presents a substantial barrier to new entrants in the iron ore sector. These prime resources are scarce and often situated in remote or challenging terrains, making their acquisition and development costly and complex. For instance, by the end of 2023, global direct shipping ore (DSO) reserves, the most sought-after type, remained concentrated among established producers, limiting readily available high-grade feedstock for newcomers.

The mining sector faces significant regulatory and permitting challenges, acting as a substantial deterrent to new companies. Stringent environmental, social, and governance (ESG) standards are increasingly becoming non-negotiable, requiring extensive compliance measures. For instance, in 2024, the average time to obtain major mining permits in Canada, a key jurisdiction for iron ore, could extend over several years, involving detailed environmental impact assessments and community consultations.

Economies of Scale and Operational Expertise

Established players like Champion Iron leverage significant economies of scale in iron ore production, processing, and global logistics. This cost advantage is difficult for newcomers to replicate. For instance, in 2024, major iron ore producers often operate mines with capacities exceeding 20 million tonnes per annum, enabling lower per-unit extraction and transportation costs.

New entrants would face immense challenges in achieving comparable efficiencies without substantial upfront investment to match existing production volumes. This makes competing on price a considerable hurdle.

- Economies of Scale: Larger operations lead to lower per-unit costs in mining, processing, and transportation.

- Operational Expertise: Decades of experience in complex mining operations provide a critical advantage.

- Capital Intensity: New entrants require massive capital to build infrastructure and achieve competitive scale.

- Logistical Networks: Established players have secured, cost-effective access to ports and shipping routes.

Infrastructure Requirements and Logistics

Developing the substantial infrastructure needed to transport bulk commodities, like Champion Iron's ore, presents a formidable barrier. This includes the significant capital investment and time required to establish essential elements such as rail lines and port facilities. For instance, the cost to build a new rail line can run into hundreds of millions of dollars per mile, making it an exceptionally high hurdle for potential competitors.

Champion Iron benefits from its established infrastructure, including its direct rail access to port facilities. This existing network is a crucial competitive advantage, as new entrants would face immense challenges and considerable expense in replicating or securing similar logistical capabilities. In 2024, the ongoing upgrades and maintenance of such infrastructure represent a continuous cost that new players must also absorb.

- High Capital Outlay: Building dedicated rail lines and port facilities for bulk commodity transport can cost billions of dollars.

- Logistical Complexity: Securing rights-of-way, environmental permits, and operational expertise for large-scale logistics is a complex and lengthy process.

- Existing Network Advantage: Champion Iron's established infrastructure reduces its per-unit transportation costs, a benefit new entrants lack.

The threat of new entrants in the iron ore sector, particularly for operations like Champion Iron's Bloom Lake, is significantly mitigated by the colossal capital requirements. Establishing a mine of this magnitude necessitates billions of dollars for exploration, infrastructure, and processing. For example, in 2024, the ongoing expansion projects at major iron ore mines often involve capital expenditures in the hundreds of millions, underscoring the immense financial barrier to entry.

Furthermore, the lengthy development timelines, often spanning five to ten years from discovery to production, coupled with stringent regulatory and permitting processes, deter potential competitors. In 2024, securing all necessary environmental and operational permits in key mining jurisdictions could easily take several years, adding to the risk and cost for any new player.

The scarcity of high-quality, direct shipping ore deposits and the established economies of scale enjoyed by existing producers like Champion Iron, who operate mines with capacities often exceeding 20 million tonnes per annum, create formidable competitive advantages. These factors, combined with the substantial investment needed for logistical networks, make the threat of new entrants relatively low.

Porter's Five Forces Analysis Data Sources

Our Champion Iron Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and filings with regulatory bodies like SEDAR. We also incorporate insights from industry-specific publications and market research reports to capture a comprehensive view of the iron ore sector's competitive landscape.