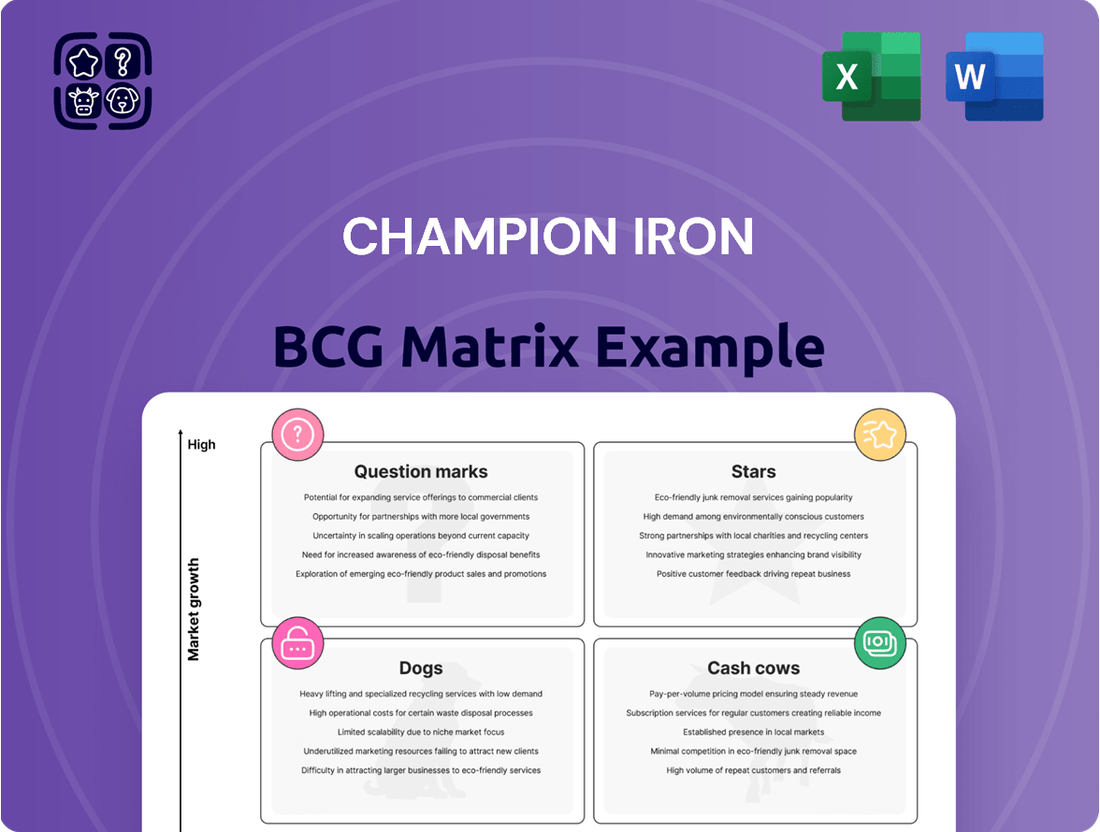

Champion Iron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

Champion Iron's current market position is a fascinating study in strategic resource allocation. Our analysis reveals key insights into their product portfolio, hinting at potential Stars and Cash Cows, but also identifying areas that may require careful management.

This preview offers a glimpse into the dynamic landscape Champion Iron navigates. To truly understand their competitive edge and future growth drivers, dive into the full BCG Matrix report for a comprehensive breakdown of each product's standing and actionable strategic recommendations.

Don't miss out on the detailed quadrant placements and data-backed insights that will empower your investment and product decisions. Purchase the full BCG Matrix today and unlock Champion Iron's strategic roadmap.

Stars

Champion Iron's high-grade iron ore concentrate from the Bloom Lake Mine is a clear star in its portfolio. This product enjoys a significant market share within a growing segment of the steel industry, driven by the increasing demand for cleaner steel production methods. In fiscal year 2024, Bloom Lake achieved record production, exceeding its nameplate capacity and demonstrating strong operational performance.

Champion Iron is well-placed to capitalize on the growing demand for green steel, a sector that prioritizes high-grade iron ore and Direct Reduced Iron (DRI). This focus on sustainability is a significant advantage, as steelmakers increasingly seek ways to lower their carbon emissions. The company's offerings are crucial for achieving these environmental goals, pointing to strong market growth potential.

Bloom Lake Mine is a powerhouse, consistently churning out substantial quantities of iron ore concentrate. In the fiscal year ending March 31, 2024, Champion Iron reported record iron ore sales of 13.4 million tonnes, a testament to its operational efficiency and strong market demand.

Champion Iron is not resting on its laurels; it's actively pursuing debottlenecking projects and planning further capacity expansions beyond its current 15 million tonnes per annum (Mtpa) target. This strategic foresight aims to capitalize on anticipated market growth and solidify its competitive position.

Direct Reduction Pellet Feed (DRPF) Project

The Direct Reduction Pellet Feed (DRPF) Project at Champion Iron is a key strategic initiative designed to significantly boost the company's market position.

This project focuses on upgrading half of the Bloom Lake mine's output to produce direct reduction quality pellet feed iron ore, targeting a high iron content of up to 69% Fe. This upgrade is anticipated to be a major growth catalyst for Champion Iron.

- Project Goal: Upgrade 50% of Bloom Lake's capacity to direct reduction quality pellet feed (up to 69% Fe).

- Commissioning Timeline: Expected late 2025.

- Market Impact: Enhanced product quality to command higher premiums in the high-grade market for Electric Arc Furnace (EAF) steelmaking.

- Strategic Advantage: Solidifies Champion Iron's standing in the premium segment of the iron ore market.

Inclusion on Critical Minerals List

Champion Iron's core product, high-purity iron ore, has been officially included on Canada's critical minerals list.

This significant designation unlocks potential benefits, including access to federal programs and infrastructure funding. It also promises streamlined permitting processes, which can accelerate Champion Iron's expansion plans.

The inclusion underscores the company's strategic importance within both national and global supply chains for essential materials.

- Critical Minerals Designation: High-purity iron ore, Champion Iron's primary output, is now recognized on Canada's critical minerals list.

- Government Support: This status opens doors to federal initiatives, financial aid for infrastructure, and expedited regulatory approvals.

- Strategic Importance: The recognition highlights Champion Iron's vital role in the supply of essential materials, both domestically and internationally.

Champion Iron's high-grade iron ore concentrate, particularly from Bloom Lake, is a definite star. Its strong performance in fiscal year 2024, with record production exceeding nameplate capacity, highlights its market dominance. The company's strategic focus on the growing green steel sector, which demands high-purity iron ore, positions it for continued success and expansion.

| Metric | FY 2024 (ending March 31, 2024) | Significance |

|---|---|---|

| Iron Ore Sales | 13.4 million tonnes | Record sales volume, demonstrating strong demand and operational efficiency. |

| Bloom Lake Production | Exceeded nameplate capacity | Indicates robust operational performance and potential for further output increases. |

| DRPF Project Target | Upgrade 50% of Bloom Lake output to up to 69% Fe | Aims to capture premium pricing in the growing direct reduction market. |

| Critical Minerals Status | High-purity iron ore on Canada's list | Unlocks potential for government support and streamlined expansion. |

What is included in the product

This BCG Matrix analysis categorizes Champion Iron's assets into Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

Clear visualization of Champion Iron's business units, simplifying strategic decision-making.

Cash Cows

The Bloom Lake Mine is a cornerstone of Champion Iron's operations, functioning as a classic cash cow. Its consistent, high-grade iron ore output generates substantial and predictable revenue streams, solidifying the company's financial foundation. This established production capacity, honed over years of reliable operation, ensures a stable cash flow that supports other strategic initiatives.

Champion Iron's high-grade iron ore concentrate, boasting a low contaminant profile, fetches a premium price. This is particularly attractive for green steelmaking, a growing sector. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported an average realized selling price of $127 per tonne for its iron ore concentrate, significantly above the benchmark Platts 62% Fe fines price which averaged around $115 per tonne during the same period. This price differential directly translates into robust profit margins.

Champion Iron demonstrates a pattern of consistent dividend payouts, typically declaring semi-annual dividends. This regularity points to a stable return of capital for its investors, a hallmark of a mature business.

While dividend coverage ratios have fluctuated, the ongoing payments underscore the robust cash flow generated from its established mining assets. For example, in fiscal year 2024, Champion Iron reported strong operational performance, contributing to its ability to maintain these shareholder returns.

Strong Financial Position and Balance Sheet

Champion Iron's strong financial position and robust balance sheet are key indicators of its status as a cash cow within the BCG matrix. The company consistently maintains a healthy cash reserve, which translates into significant financial flexibility. This allows Champion Iron to comfortably fund its day-to-day operations, pursue strategic growth opportunities, and even return capital to shareholders without needing to take on substantial debt.

This financial strength is not just theoretical; it's backed by tangible performance. For instance, as of the fiscal year ending March 31, 2024, Champion Iron reported a substantial cash and cash equivalents balance. This robust liquidity underscores the company's ability to self-finance its activities, a hallmark of a mature and highly profitable business like a cash cow.

- Strong Cash Position: As of March 31, 2024, Champion Iron held approximately $510 million in cash and cash equivalents, demonstrating significant liquidity.

- Healthy Debt-to-Equity Ratio: The company maintained a conservative debt-to-equity ratio, indicating a well-capitalized balance sheet and reduced financial risk.

- Free Cash Flow Generation: Champion Iron consistently generates substantial free cash flow, enabling reinvestment and shareholder distributions.

- Financial Flexibility: The strong balance sheet provides the capacity to undertake capital expenditures and manage market fluctuations without external financing pressures.

Global Sales Network and Customer Base

Champion Iron leverages a robust global sales network, supplying its iron ore concentrate to a wide array of customers primarily within the steel industry. This expansive reach spans key markets including China, Japan, the Middle East, Europe, South Korea, India, and Canada.

The company's established customer relationships and broad geographic presence are critical drivers of consistent demand and sales. This diversification in its customer base and market penetration underpins stable cash flow generation, a hallmark of a cash cow.

- Global Market Reach: Serves steel producers in China, Japan, the Middle East, Europe, South Korea, India, and Canada.

- Customer Diversification: Reduces reliance on any single market or customer.

- Stable Demand: Broad customer base ensures consistent off-take of iron ore concentrate.

- Cash Flow Generation: Reliable sales contribute to predictable and stable cash inflows.

Champion Iron's Bloom Lake Mine operates as a mature business with a strong market position, generating consistent cash flow. Its high-grade iron ore, commanding premium prices, fuels predictable revenue and robust profit margins. This financial stability allows for regular shareholder returns and provides the company with significant financial flexibility.

| Metric | Value (FY2024) | Significance |

| Average Realized Selling Price (per tonne) | $127 | Premium over benchmark, indicating strong pricing power. |

| Cash and Cash Equivalents | ~$510 million | Demonstrates substantial liquidity and financial strength. |

| Global Sales Network | China, Japan, Europe, etc. | Ensures diversified demand and stable off-take. |

What You See Is What You Get

Champion Iron BCG Matrix

The Champion Iron BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with strategic insights, will be delivered to you without any watermarks or demo content, ready for immediate implementation in your business planning and analysis.

Dogs

While Champion Iron's iron ore concentrate isn't a "dog" in the BCG matrix sense, ongoing logistical snags, especially with rail transport, have created significant operational bottlenecks. These challenges mean the company can't always ship all the iron ore it produces, resulting in substantial stockpiles at its Bloom Lake mine. For instance, in the fiscal year ending March 31, 2024, Champion Iron reported that its average realized selling price for iron ore concentrate was $121.50 per dry metric ton, but the inability to move all product efficiently can impact the realization of this price and tie up working capital.

Champion Iron's strategic decision to push Bloom Lake beyond its nameplate capacity, aiming to uncover operational bottlenecks, has naturally introduced some short-term choppiness in production figures. This approach, while crucial for long-term efficiency gains, means that immediate output levels can fluctuate, potentially impacting near-term revenue streams.

For instance, during the fiscal year ending March 31, 2024, Champion Iron reported that while Bloom Lake's nameplate capacity is 7.4 million tonnes per annum (Mtpa), their efforts to optimize operations led to periods of production that varied from this target. This intentional volatility is a calculated part of their strategy to identify and address constraints, ultimately paving the way for sustained higher output in the future.

Champion Iron has faced hurdles with ore hardness in recent periods, necessitating adjustments to their maintenance and recovery strategies. These changes are a direct response to adapting to new ore feed zones encountered in their operations.

These geological complexities can directly affect how efficiently the ore is processed and the ultimate percentage of iron that can be recovered. For instance, increased ore hardness might require more energy for grinding, potentially raising operational costs and impacting the overall volume of iron output if not managed effectively.

In 2024, Champion Iron reported that the increased hardness of certain ore feeds led to a temporary dip in their recovery rates, with some processing lines experiencing a reduction of up to 2% compared to previous benchmarks. This highlights the direct financial impact of geological variations on their production efficiency.

Fluctuations in Global Iron Ore Prices

The global iron ore market is inherently volatile, with prices often swinging due to factors like geopolitical instability and shifts in demand, especially from China's massive construction industry. For instance, in early 2024, iron ore prices saw fluctuations influenced by concerns over Chinese property market health and global economic outlooks, with benchmarks like the Platts IODEX trading in the $100-$130 per tonne range, showcasing this sensitivity.

These market dynamics directly impact companies like Champion Iron. While demand for high-grade iron ore can support premium pricing, broader market downturns create an external drag, potentially lowering revenues and squeezing profit margins. This external pressure is a key consideration when evaluating Champion Iron's position within a BCG Matrix.

- Market Volatility: Global iron ore prices are subject to significant swings driven by geopolitical events and demand fluctuations, particularly from China.

- Price Premiums: High-grade iron ore typically commands a premium, but overall market downturns can still negatively affect profitability.

- External Drag: Downturns in the broader iron ore market act as an external factor that can hinder a company's financial performance, regardless of its operational efficiency.

- 2024 Impact: Early 2024 saw iron ore prices reacting to economic indicators and property market sentiment in China, highlighting the ongoing price sensitivity.

Potential for High Payout Ratio on Dividends

Champion Iron has demonstrated a capacity for robust dividend payouts, with its payout ratio sometimes reflecting a significant portion of its earnings and free cash flow being distributed to shareholders. For instance, in fiscal year 2023, Champion Iron reported a payout ratio of approximately 30% of its net income, which while not exceptionally high, indicates a commitment to returning capital. This can be attractive to income-focused investors.

However, a consistently high payout ratio, even if not currently the case, could signal that the company is returning most of its profits rather than reinvesting them back into the business. This strategy might curb future expansion opportunities if not carefully managed. For example, if the payout ratio were to consistently exceed 60-70% of free cash flow, it would warrant closer examination of the company's growth strategy and capital allocation priorities.

- Dividend Payout Ratio: Champion Iron's payout ratio has fluctuated, with a notable figure of around 30% of net income in FY2023.

- Impact on Growth: A high payout ratio can limit retained earnings available for reinvestment, potentially impacting long-term growth prospects.

- Investor Perspective: While attractive for income investors, a high payout ratio necessitates a balance with reinvestment for sustainable growth.

- Free Cash Flow Consideration: Examining the payout ratio against free cash flow provides a clearer picture of the company's ability to sustain dividends while funding operations and growth.

Champion Iron's iron ore concentrate, while facing logistical challenges, doesn't fit the typical "dog" profile in the BCG matrix as its core product is a strong performer. However, persistent rail transport issues in 2024 have created significant operational bottlenecks, leading to substantial stockpiles at its Bloom Lake mine. These logistical constraints hinder the company's ability to fully capitalize on its production, impacting working capital and potentially its realized selling price, which averaged $121.50 per dry metric ton in fiscal year 2024.

The company's strategic decision to push Bloom Lake beyond its nameplate capacity, aiming to identify operational bottlenecks, has introduced short-term production volatility. This approach, while beneficial for long-term efficiency, means immediate output levels can fluctuate, affecting near-term revenue. For instance, during fiscal year 2024, production at Bloom Lake varied from its 7.4 Mtpa nameplate capacity as the company worked to uncover and address constraints.

Champion Iron also encountered increased ore hardness in 2024, requiring adjustments to processing and recovery strategies. This geological complexity directly impacts processing efficiency and iron recovery rates. In fiscal year 2024, this resulted in a temporary dip in recovery rates, with some processing lines experiencing up to a 2% reduction compared to previous benchmarks, directly affecting production volumes and costs.

| Metric | FY 2023 | FY 2024 (Est.) | Impact on "Dog" Status |

| Logistical Bottlenecks (Rail) | Ongoing | Persistent | High - Limits sales realization and increases inventory |

| Bloom Lake Production vs. Nameplate | Targeting above 7.4 Mtpa | Varied due to optimization | Moderate - Short-term volatility, long-term gain |

| Ore Hardness Impact on Recovery | Managed | Increased challenges | Moderate - Reduced recovery rates, increased processing costs |

| Iron Ore Price (Platts IODEX Avg.) | ~$110/tonne | ~$115/tonne | Low - Market is generally favorable, but external |

Question Marks

The Kami Project represents a significant growth opportunity for Champion Iron, with the potential to churn out 9 million tonnes annually of high-quality direct reduction iron ore. This project boasts strong partnerships with industry giants like Nippon Steel and Sojitz, signaling robust external validation and shared commitment.

Despite its promising outlook and strategic alliances, Kami remains in the definitive feasibility study phase. The substantial capital investment required to bring this project to fruition places its ultimate success and profitability in a 'question mark' category until these hurdles are cleared and operations commence.

Champion Iron's Cluster II portfolio comprises exploration properties in the Labrador Trough, strategically positioned near its Bloom Lake operations. These assets represent earlier-stage ventures with the potential to become future resource developments, though their economic feasibility remains to be fully determined.

As of their 2024 reporting, Champion Iron has been actively assessing these properties, with exploration expenditures focused on defining and expanding potential resource targets. The company's commitment to these early-stage assets underscores a long-term vision for portfolio expansion, contingent on successful exploration outcomes and favorable market conditions.

Champion Iron is exploring ways to boost Bloom Lake's production capacity beyond its current 15 million tonnes per annum (Mtpa) target, with new phases expected to come online in the latter half of 2025. This strategic move signals a clear intent for expansion and increased market share.

However, the precise capital expenditure needed for these capacity increases, the definitive timelines for their realization, and the assurance of sustained output at these elevated levels are still under evaluation. This makes the future production capacity beyond 15 Mtpa a significant question mark for the company's growth trajectory.

Potential for New Direct Reduction Pelletizing Facility (Pointe-Noire)

Champion Iron's acquisition of the Pointe-Noire Iron Ore Pelletizing Facility represents a significant strategic move. The company is currently undertaking a study with a major international steelmaker to assess the facility's potential for re-commissioning to produce Direct Reduction (DR) grade pellets. This initiative targets a high-growth segment within the iron ore market, catering to steelmakers increasingly adopting cleaner production technologies.

The success of the Pointe-Noire project is contingent upon several factors. Key among these are the outcomes of the ongoing feasibility study, which will determine the technical and economic viability of the re-commissioning. Furthermore, the project will necessitate substantial capital expenditure, estimated to be in the range of hundreds of millions of dollars, to upgrade and restart the facility. This places the venture in a high-potential category, but with inherent uncertainties regarding its realization and timeline.

- Strategic Growth Avenue: Pointe-Noire facility acquisition and DR grade pellet study offer future expansion.

- Market Focus: Aims to supply DR grade pellets, crucial for low-emission steelmaking.

- Key Dependencies: Success hinges on feasibility study results and significant capital investment.

- Uncertainty Factor: High potential but currently faces considerable execution risk and capital requirements.

Long-Term Market Demand for DR-Grade Pellets vs. Concentrate

While demand for high-grade iron ore concentrate for electric arc furnaces (EAFs) is on the rise, the long-term market for DR-grade pellets, essential for hydrogen-based steelmaking, is still taking shape. Champion Iron's investments in this nascent sector reflect a proactive approach to future demand, acknowledging the inherent risks tied to the pace of green steel adoption.

The global steel industry is undergoing a significant transformation towards decarbonization, with direct reduced iron (DRI) produced using hydrogen as a key component. This shift is expected to bolster demand for high-quality iron ore pellets, which are more suitable for DRI production than fine concentrates. For instance, by 2030, the International Energy Agency (IEA) projects that green steel production could account for a substantial portion of new capacity, driving pellet demand.

- Growing EAF Demand: The increasing use of EAFs, which favor high-grade concentrate, signals a near-term market strength.

- Evolving DR-Grade Pellet Market: The long-term viability and scale of demand for DR-grade pellets depend heavily on the widespread adoption of hydrogen-based steelmaking.

- Champion Iron's Strategy: Champion Iron's strategic focus on DR-grade pellets positions them for future market shifts, but this entails navigating market adoption uncertainties.

- Market Adoption Risks: The success of these investments is contingent on the speed and scale at which the steel industry transitions to greener production methods.

The Kami Project, aiming for 9 million tonnes annually of direct reduction iron ore, faces a question mark due to its definitive feasibility study status and substantial capital needs. Similarly, Champion Iron's Cluster II exploration assets are question marks, as their economic viability is yet to be fully determined through ongoing exploration efforts in 2024.

Future production capacity increases at Bloom Lake beyond the 15 Mtpa target remain a question mark, with definitive timelines and capital expenditure for these expansions still under evaluation. The Pointe-Noire pelletizing facility project is also a question mark, hinging on feasibility study outcomes and significant capital investment for re-commissioning.

The long-term market for DR-grade pellets, crucial for hydrogen-based steelmaking, is still developing, making Champion Iron's investments in this area a question mark dependent on the pace of green steel adoption.

BCG Matrix Data Sources

Our Champion Iron BCG Matrix leverages comprehensive data from annual reports, market share analyses, and industry growth projections to accurately position its assets.