Champion Iron Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Champion Iron Bundle

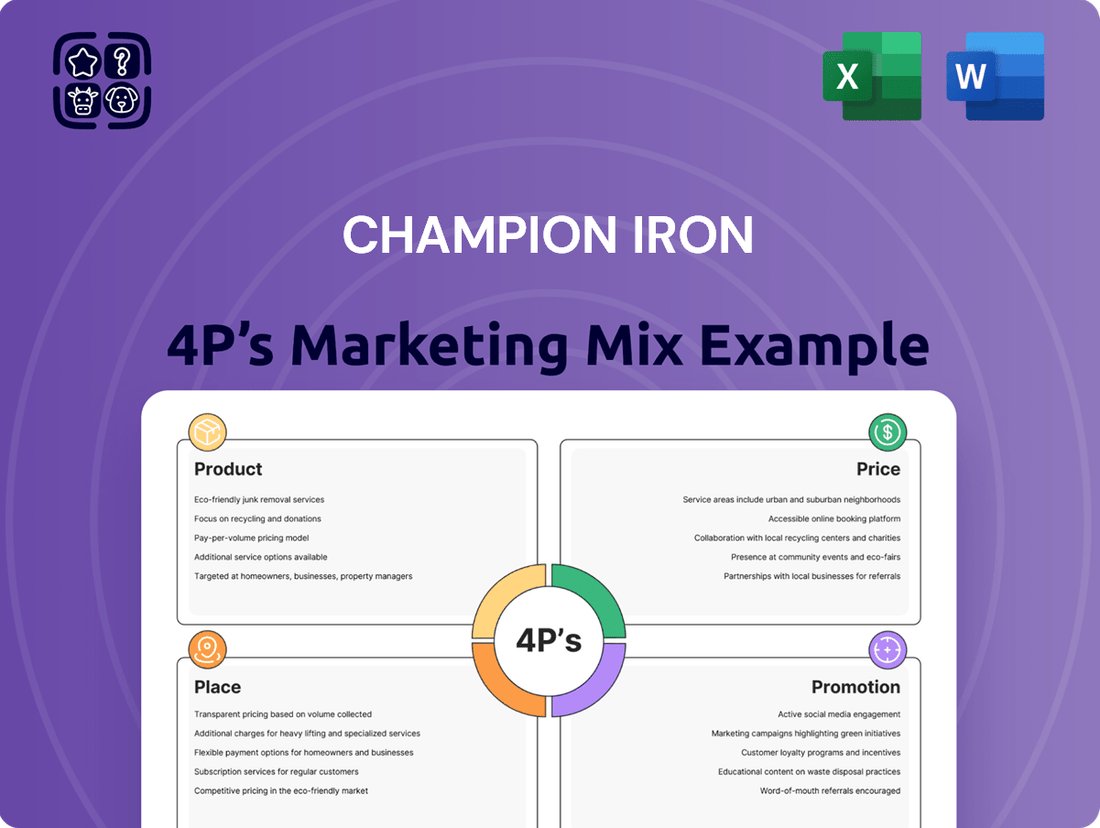

Champion Iron's marketing success hinges on a carefully orchestrated blend of its Product, Price, Place, and Promotion strategies. This analysis delves into how their high-quality iron ore offerings, competitive pricing, strategic distribution channels, and targeted promotional efforts create a powerful market presence.

Unlock the full potential of your own marketing strategy by understanding Champion Iron's winning formula. Get instant access to our comprehensive, editable 4Ps Marketing Mix Analysis, packed with actionable insights and real-world examples.

Product

Champion Iron's primary offering is a high-purity iron ore concentrate, predominantly extracted from its Bloom Lake Mine in Quebec. This product stands out due to its minimal impurities and robust iron content, averaging approximately 66.2% Fe.

The company has demonstrated a capacity to produce direct reduction quality iron ore concentrate grading at 67.5% Fe, a critical specification for advanced steelmaking processes. This high-grade concentrate is a key differentiator in the global market, appealing to steelmakers seeking efficiency and reduced environmental impact.

Champion Iron is strategically upgrading half of its Bloom Lake capacity to produce Direct Reduction (DR) grade pellet feed, targeting up to 69% Fe. This positions the company to capitalize on the increasing global demand for high-purity iron ore essential for green steel production.

This upgrade directly addresses the growing need for iron ore suitable for direct reduction processes, a key technology for decarbonizing the steel industry. By offering DR-grade pellets, Champion Iron is aligning its product with the future of sustainable steelmaking.

The company's investment in DR-grade pellet feed reflects a forward-looking strategy to meet evolving market requirements. As of early 2025, the global steel industry is actively seeking solutions to reduce its carbon footprint, making high-grade iron ore a critical component.

Beyond its established Bloom Lake operations, Champion Iron is advancing the Kamistiatusset (Kami) mining properties. This project holds significant promise, with projections indicating a potential production capacity of around 9 million wet metric tonnes annually of direct reduction quality iron ore. The ore is expected to boast a high iron content, grading above 67.5% Fe, making it highly desirable for advanced steelmaking processes.

A key development for the Kami project is the ongoing definitive feasibility study. This crucial study is being conducted in collaboration with established industry partners, Nippon Steel Corporation and Sojitz Corporation. Their involvement underscores the project's strategic importance and the confidence in its long-term viability, with the study expected to provide detailed economic and technical parameters by late 2024 or early 2025.

Low Contaminant Profile

Champion Iron's iron ore distinguishes itself through a remarkably low contaminant profile, a critical attribute highly valued by steelmakers. This purity directly translates into higher quality steel production, allowing Champion Iron to command premium pricing in the market. For instance, in fiscal year 2024, the company reported that its direct-shipping ore (DSO) consistently met or exceeded target specifications for low levels of deleterious elements like phosphorus and sulfur, crucial for advanced steel grades.

This low contaminant characteristic provides a significant competitive advantage. Steel producers increasingly demand raw materials that minimize processing steps and enhance final product performance. Champion Iron's product aligns perfectly with this trend, making it a preferred supplier for manufacturers focused on high-strength, low-alloy steels and other specialized applications.

- Superior Purity: Champion Iron's ore exhibits consistently low levels of impurities such as phosphorus and sulfur.

- Value Proposition: This purity enables the production of higher-grade steel, justifying premium pricing.

- Market Demand: The steel industry's growing need for cleaner inputs favors Champion Iron's product offering.

Tailored for Green Steel Initiatives

Champion Iron's high-purity and DR-grade iron ore are essential components for green steel production, a vital sector for reducing the steel industry's carbon footprint. The company's output directly supports direct reduced iron (DRI) processes, a key technology in this transition. For instance, in fiscal year 2024, Champion Iron reported an average realized selling price of $122 per dry metric ton for its iron ore products, reflecting strong demand for high-quality inputs.

This strategic focus positions Champion Iron as a key enabler of decarbonization efforts within the global steelmaking landscape. The increasing adoption of DRI, particularly when powered by renewable energy, significantly lowers emissions compared to traditional blast furnace methods.

- High-Purity Iron Ore: Essential for efficient DRI production.

- DR-Grade Focus: Directly caters to emerging green steel technologies.

- Market Demand: Growing global interest in low-carbon steelmaking.

- Fiscal Year 2024 Performance: Realized average selling price of $122 per DMT highlights product value.

Champion Iron's product is a high-purity iron ore concentrate, primarily from its Bloom Lake Mine, with an average iron content of around 66.2% Fe. The company is strategically upgrading half of its Bloom Lake capacity to produce Direct Reduction (DR) grade pellet feed, targeting up to 69% Fe, to meet the growing demand for green steel production.

| Product Attribute | Description | Market Relevance |

|---|---|---|

| Iron Content | Approximately 66.2% Fe, with DR-grade targeting up to 69% Fe. | High iron content is crucial for efficient steelmaking. |

| Purity | Low levels of phosphorus and sulfur. | Enables higher quality steel and commands premium pricing. |

| Target Grade | Direct Reduction (DR) grade pellet feed. | Essential for low-emission steel production processes. |

| Fiscal Year 2024 Realized Price | $122 per dry metric ton. | Demonstrates strong market value for high-quality ore. |

What is included in the product

This analysis provides a comprehensive examination of Champion Iron's marketing strategies, detailing its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's an ideal resource for understanding Champion Iron's market positioning, suitable for managers, consultants, and marketers seeking a grounded, data-driven marketing mix breakdown.

Simplifies Champion Iron's marketing strategy by clearly outlining how their Product, Price, Place, and Promotion decisions directly address customer needs and market challenges.

Place

The Bloom Lake Mine, Champion Iron's cornerstone operation, is strategically situated in Quebec, Canada, within the Labrador Trough. This prime location offers significant logistical advantages, including access to vital transportation networks and a reliable supply of renewable hydroelectric power, crucial for cost-effective and sustainable mining operations.

In the fiscal year ending March 31, 2024, Bloom Lake demonstrated its production capacity, with Champion Iron reporting record-breaking annual production of 12.4 million tonnes of iron ore. This output underscores the mine's importance as the primary source of product for the company, directly impacting its market presence and revenue generation.

Champion Iron's Bloom Lake Mine relies on rail transport to move its iron ore concentrate approximately 250 kilometers to the port facilities in Sept-Îles, Quebec. This crucial link in their supply chain is vital for getting the product to market. In the fiscal year ending March 31, 2024, the company reported shipping 11.7 million tonnes of iron ore concentrate, underscoring the importance of efficient rail operations.

The company has been focused on enhancing its rail shipment capacity and optimizing inventory management at the mine site. These efforts are geared towards ensuring a consistent and reliable flow of product to the port, thereby supporting their sales targets and overall operational efficiency. By managing stockpiles effectively, Champion Iron can better respond to market demand and mitigate potential disruptions in the transportation network.

Champion Iron's iron ore concentrate reaches a broad international customer base, predominantly within the global steel sector. This extensive reach ensures consistent demand for their high-quality product.

The company's products are shipped to key markets across the globe, including significant industrial hubs like China, Japan, and South Korea. In the fiscal year ending March 31, 2024, Champion Iron reported sales volumes of approximately 13.1 million tonnes, with a substantial portion destined for these Asian markets, underscoring their global customer engagement.

Beyond Asia, Champion Iron also serves customers in the Middle East, Europe, India, and Canada. This diversified geographic presence mitigates reliance on any single market and demonstrates their capability to manage complex international logistics and supply chains effectively.

Strategic Partnerships for Distribution

Champion Iron's strategic partnerships are crucial for enhancing its distribution capabilities. The collaboration with Nippon Steel Corporation and Sojitz Corporation for the Kami project is a prime example, aiming to broaden the company's reach, especially within the vital Asian markets. This alliance is designed to tap into Sojitz's extensive global trading infrastructure.

These alliances are instrumental in securing market access and optimizing the supply chain. By leveraging the established networks of partners like Sojitz, Champion Iron can efficiently deliver its products to a wider customer base.

Key aspects of these distribution partnerships include:

- Expanded Market Reach: Gaining access to new geographical regions, particularly in Asia, through established trading networks.

- Logistical Efficiencies: Utilizing partners' existing infrastructure to streamline transportation and delivery processes.

- Risk Mitigation: Sharing distribution responsibilities and market development efforts with experienced global players.

Proximity to Key Infrastructure

Champion Iron's Bloom Lake complex leverages substantial existing infrastructure, including a dedicated conveyor system linking the mine to the processing plant, a recently upgraded concentrator, and access to a multi-user berth at Pointe-Noire. This integrated approach significantly reduces logistical costs and enhances operational efficiency. In fiscal year 2024, Bloom Lake achieved record production, shipping 13.1 million tonnes of iron ore concentrate, underscoring the effectiveness of its infrastructure.

The Kami project also benefits from a strategic location, situated near readily available infrastructure, which is crucial for its development and future operational success. This proximity minimizes the need for extensive new capital expenditure on foundational elements, allowing for a more streamlined and cost-effective build-out.

Key infrastructure advantages include:

- Integrated Conveyor System: Bloom Lake's conveyor connects the mine directly to the plant, streamlining ore transport.

- Upgraded Concentrator: Enhancements at the concentrator improve processing efficiency and output quality.

- Pointe-Noire Port Access: A multi-user berth at Pointe-Noire facilitates efficient export of finished product.

- Strategic Proximity: Kami's location near existing infrastructure reduces development costs and timelines.

Champion Iron's primary "Place" is its Bloom Lake Mine in Quebec, Canada, a location offering significant logistical benefits. The company leverages an integrated infrastructure, including a dedicated conveyor system and upgraded concentrator, to efficiently transport its iron ore concentrate via rail to port facilities. This robust infrastructure underpins their ability to serve a global customer base.

The company's distribution network is further strengthened by strategic partnerships, particularly in reaching key Asian markets. These alliances enhance market access and streamline supply chains, ensuring reliable delivery of their product. Champion Iron's fiscal year 2024 performance saw record production and shipments, highlighting the effectiveness of their established "Place" and distribution strategies.

| Asset | Location | Key Infrastructure | FY24 Production (Tonnes) | FY24 Shipments (Tonnes) |

|---|---|---|---|---|

| Bloom Lake Mine | Labrador Trough, Quebec, Canada | Conveyor system, upgraded concentrator, rail to Sept-Îles | 12.4 million | 13.1 million |

| Kami Project | Labrador Trough, Quebec, Canada | Proximity to existing infrastructure | N/A (Development phase) | N/A |

What You See Is What You Get

Champion Iron 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Champion Iron 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Champion Iron's marketing highlights its iron ore's high-grade quality and low impurity profile, positioning it as ideal for direct reduction iron (DRI) processes. This focus directly appeals to steel manufacturers aiming to lower their carbon emissions, a key driver in the 2024-2025 market.

The company's narrative strongly supports the green steel transition, a significant trend in the industry. Champion Iron's ore is well-suited for electric arc furnaces (EAFs) used in DRI-EAF steelmaking, a method that significantly reduces CO2 output compared to traditional blast furnaces.

In 2023, global steel production via EAFs accounted for approximately 29% of total output, a figure expected to grow. Champion Iron's emphasis on its ore's suitability for these cleaner processes directly addresses the evolving demands of environmentally conscious steelmakers.

Champion Iron prioritizes investor relations through detailed financial reporting and regular updates. The company issued its Q4 FY2024 results in August 2024, showcasing strong operational performance and a robust financial position.

These reports, along with investor presentations and conference calls, provide crucial data on production volumes, cost management, and strategic expansion plans, enabling informed decision-making for stakeholders.

For instance, in Q4 FY2024, Champion Iron reported record quarterly production of 3.3 million tonnes, highlighting efficient operations and growth momentum.

Champion Iron actively showcases its dedication to sustainability via its annual sustainability reports. These reports detail the company's environmental performance, its contributions to local communities, and its commitment to robust ESG principles. This transparency resonates strongly with investors and stakeholders who prioritize responsible corporate citizenship.

In its 2023 sustainability report, Champion Iron highlighted a 10% reduction in water intensity compared to the previous year, demonstrating tangible progress in environmental stewardship. Furthermore, the company reported investing over $5 million in community development projects in Quebec and Newfoundland and Labrador during the 2023 fiscal year, underscoring its social commitment.

Strategic Partnerships Announcements

Champion Iron's strategic partnerships are a cornerstone of its promotional strategy, highlighting its growth trajectory and global appeal. A prime example is the binding agreement for the Kami project with Nippon Steel and Sojitz, a significant development that underscores the company's capacity to forge powerful alliances within the industry. This collaboration not only validates Champion Iron's operational capabilities but also positions it for substantial expansion.

These major announcements function as powerful promotional events, effectively communicating the company's forward-thinking vision and its success in attracting world-class partners. Such strategic moves are crucial for building investor confidence and enhancing market perception. For instance, the Kami project, once operational, is projected to significantly bolster Champion Iron's production capacity, adding to its existing output from the Bloom Lake mine, which in 2023 produced approximately 13.5 million tonnes of iron ore concentrate.

- Kami Project Agreement: Binding agreement with Nippon Steel and Sojitz for the Kami project, a key growth initiative.

- Global Industry Leaders: Demonstrates Champion Iron's ability to attract and partner with major international companies.

- Market Confidence: These partnerships bolster investor confidence and enhance the company's market standing.

- Production Expansion: The Kami project is expected to significantly increase Champion Iron's iron ore output in the coming years.

Participation in Industry Events and Webcasts

Champion Iron actively engages with stakeholders through participation in industry events and webcasts. These include their quarterly results calls, which offer a direct channel to discuss market outlooks and financial performance with investors. For instance, during their Q4 Fiscal 2024 results call in May 2024, the company highlighted strong operational performance and provided an updated outlook for the upcoming fiscal year.

Investor roadshows are another key element, allowing for in-depth conversations about project advancements and strategic direction. These events are crucial for disseminating information about Champion Iron's ongoing development projects, such as the Bloom Lake mine expansion and the Kami project, to a targeted audience of financial professionals and potential investors.

- Direct Communication: Quarterly results calls and investor roadshows facilitate direct dialogue with investors and analysts.

- Information Dissemination: These platforms are used to share updates on market conditions, operational performance, and strategic initiatives.

- Project Updates: Key advancements in projects like Bloom Lake and Kami are communicated to the investment community.

- Financial Performance Review: Discussions often center on financial results, with Q4 Fiscal 2024 reporting significant operational achievements.

Champion Iron effectively promotes its high-grade, low-impurity iron ore, emphasizing its suitability for green steel production methods like direct reduction iron (DRI) and electric arc furnaces (EAFs). This positions the company favorably within the industry's shift towards lower carbon emissions, a trend gaining significant momentum through 2024 and 2025.

The company's commitment to sustainability is a key promotional pillar, detailed in its annual reports which highlight environmental stewardship and community investment. For instance, Champion Iron reported a 10% reduction in water intensity in its 2023 sustainability report, showcasing tangible progress.

Strategic partnerships, such as the binding agreement for the Kami project with Nippon Steel and Sojitz, serve as powerful endorsements, signaling growth potential and attracting global industry leaders. This collaboration is expected to significantly boost Champion Iron's production capacity, complementing its existing output from the Bloom Lake mine, which produced approximately 13.5 million tonnes in 2023.

Champion Iron maintains robust investor relations through detailed financial reporting and direct engagement via quarterly results calls and investor roadshows. These platforms provide crucial data on operational performance and strategic expansion, as evidenced by their Q4 FY2024 results which reported record quarterly production of 3.3 million tonnes.

| Metric | FY2023 Data | Q4 FY2024 Data | Significance |

|---|---|---|---|

| Bloom Lake Production | ~13.5 million tonnes | N/A | Core operational output |

| Q4 FY2024 Record Production | N/A | 3.3 million tonnes | Demonstrates operational efficiency and growth |

| Water Intensity Reduction | N/A | 10% (vs. prior year) | Commitment to environmental stewardship |

| Community Investment | >$5 million | N/A | Social responsibility commitment |

Price

Champion Iron's high-purity iron ore commands a premium, often exceeding benchmark prices like the Platts IODEX 62% Fe. This pricing advantage stems from the superior quality of their product, which is highly sought after by steelmakers, especially those employing direct reduction methods. For instance, in early 2024, premiums for high-grade iron ore could range from $15 to $30 per tonne above the benchmark, reflecting enhanced efficiency and reduced emissions in steel production.

Champion Iron's pricing strategy is directly tied to the increasing global appetite for high-grade iron ore, a trend amplified by the steel sector's move towards greener production methods like direct reduced iron (DRI). This shift is crucial because DRI requires higher quality iron ore, which is precisely what Champion Iron produces. For instance, as of early 2024, the premium for high-grade iron ore (65% Fe) over the standard 62% Fe benchmark has widened, reflecting this demand.

The ongoing decarbonization efforts within the steel industry are a powerful tailwind for Champion Iron. As steelmakers invest in technologies that necessitate superior raw materials, the demand for Champion's product is anticipated to remain robust, supporting favorable pricing dynamics. This is particularly evident in the growing interest from regions actively pursuing net-zero emissions targets, which are prioritizing low-impurity, high-iron content ores.

Champion Iron's pricing strategy is deeply intertwined with the competitive dynamics of the high-grade iron ore market. The company faces competition from established global producers, and any shifts in their supply or pricing can directly influence Champion Iron's market position and its ability to command premium prices.

Anticipated shortages in Direct Reduction (DR)-grade pellet feed, a key input for efficient steelmaking, present a significant opportunity. Champion Iron's strategic investment in its DRPF project, expected to commence production in 2026, is designed to address this anticipated deficit. This proactive measure positions the company to potentially benefit from stronger pricing power as demand for this specific grade of iron ore outstrips supply.

Provisional Pricing Adjustments and Market Fluctuations

Champion Iron's financial performance can see shifts due to provisional pricing adjustments on sales from previous quarters. These adjustments mean that the final revenue recognized can differ from initial estimates, impacting reported earnings. For instance, in their fiscal third quarter ending December 31, 2023, Champion Iron reported that provisional pricing adjustments resulted in a net decrease in revenue compared to the prior quarter's final pricing. This highlights the sensitivity of their revenue to these retrospective adjustments.

The iron ore market itself is a volatile landscape, heavily influenced by broader economic trends and the global appetite for steel. Factors such as manufacturing output in major economies like China, infrastructure spending, and geopolitical events can all contribute to significant price swings. In early 2024, benchmarks like the Platts I Ching 62% Fe fines price have shown considerable volatility, trading in a range influenced by these macroeconomic forces, directly impacting the realized selling prices Champion Iron can achieve for its product.

- Provisional Pricing Impact: Revenue can be adjusted retrospectively, creating variability in reported earnings.

- Market Volatility: Iron ore prices are sensitive to global economic conditions and steel demand.

- Macroeconomic Influence: Manufacturing activity, infrastructure projects, and geopolitical stability affect iron ore pricing.

- Price Fluctuations: In early 2024, benchmark iron ore prices exhibited noticeable volatility, impacting sales revenue.

Cost Management and Operational Efficiency

Champion Iron's commitment to cost management, particularly its C1 cash costs, is a crucial element in its overall market competitiveness. While not a direct pricing tactic, efficient operations at its Bloom Lake mine directly impact profitability, allowing the company to navigate fluctuating iron ore prices more effectively.

The company actively pursues operational efficiencies, including optimizing recovery rates and managing the hardness of its ore. These technical improvements are key to controlling production expenses.

- For the fiscal year ended March 31, 2024, Champion Iron reported C1 cash costs of $56.80 per tonne.

- The company aims to maintain or improve these costs through ongoing operational enhancements.

- Improved ore recovery and processing techniques contribute to lower per-tonne production expenses.

- This cost discipline provides a competitive edge, especially during periods of lower iron ore market prices.

Champion Iron's pricing strategy leverages the premium for its high-purity iron ore, often exceeding benchmark prices like the Platts IODEX 62% Fe. This premium is driven by the steel industry's shift towards greener production methods, such as direct reduced iron (DRI), which necessitates higher quality ore. For instance, in early 2024, premiums for high-grade iron ore were observed between $15 to $30 per tonne above the benchmark.

The company's pricing is also influenced by market dynamics, including anticipated shortages in DR-grade pellet feed, a key input for efficient steelmaking. Champion Iron's investment in its DRPF project, slated for production in 2026, is positioned to capitalize on this demand, potentially strengthening its pricing power.

However, Champion Iron's realized selling prices are subject to provisional pricing adjustments and broader market volatility. In the fiscal third quarter ending December 31, 2023, provisional pricing adjustments led to a net decrease in revenue. The iron ore market itself is volatile, with prices in early 2024 fluctuating due to global economic trends and steel demand, impacting Champion Iron's revenue.

| Metric | Value (FY ended Mar 31, 2024) | Notes |

|---|---|---|

| C1 Cash Costs per Tonne | $56.80 | Reflects operational efficiency and cost management. |

| High-Grade Premium | $15 - $30 per tonne (Early 2024) | Above Platts IODEX 62% Fe benchmark, driven by demand for quality ore. |

| DRPF Project Start | 2026 | Aims to address anticipated shortages in DR-grade pellet feed. |

4P's Marketing Mix Analysis Data Sources

Our Champion Iron 4P's Marketing Mix Analysis leverages a robust blend of official corporate disclosures, including annual reports, investor presentations, and press releases, to understand product strategy and pricing. We also incorporate industry reports and market intelligence to assess distribution channels and promotional activities.