Cencosud SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Cencosud, a retail giant, navigates a dynamic market with significant strengths in its diverse brand portfolio and extensive geographic reach across Latin America. However, it also faces challenges from intense competition and evolving consumer preferences.

Want the full story behind Cencosud’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cencosud's diversified business portfolio is a significant strength, encompassing supermarkets, hypermarkets, home improvement, department stores, shopping centers, and financial services. This multi-format approach enables operational integration, such as placing key brands within its own malls to boost cross-selling and customer engagement.

This broad spectrum of offerings allows Cencosud to cater to a wide array of consumer needs across various channels, enhancing its market resilience. For instance, in the first quarter of 2024, Cencosud reported consolidated revenue growth of 5.7% year-on-year, demonstrating the strength of its diverse operations.

Cencosud boasts a formidable regional footprint, solidifying its status as a dominant player across key Latin American economies including Chile, Argentina, Brazil, Peru, and Colombia. This strong regional presence provides a stable foundation and significant market share in these vital territories.

The strategic acquisition of The Fresh Market in the United States marks a significant move, showcasing Cencosud's ambition to broaden its operational scope beyond its established Latin American strongholds. This expansion into a new, major market demonstrates foresight and a commitment to diversified growth.

The company's performance in 2024 underscores the efficacy of its expansion strategy, with notable double-digit revenue increases reported in the United States, Brazil, Peru, and Colombia. These impressive gains highlight the successful integration and market penetration achieved in these diverse geographic regions.

Cencosud's growing digital ecosystem and omnichannel strategy are key strengths, evidenced by significant investments in online channels and customer experience enhancements. The company is forging strategic alliances with last-mile operators and expanding its Prime program, which saw a substantial increase in subscribers throughout 2024.

The effectiveness of this digital transformation is clearly demonstrated by the double-digit growth in online sales during 2024. Initiatives like Cencosud Media, Cencosud Ventures, and CencoPay are further solidifying its digital presence and creating new avenues for customer engagement and revenue generation.

Commitment to Sustainability and Corporate Responsibility

Cencosud's dedication to sustainability is a significant strength, underpinned by a comprehensive policy focusing on Corporate Governance, People, Planet, and Products. This framework actively shapes how the company manages its operations, aiming to minimize environmental footprints and inherent risks across its entire value chain.

The company's commitment has garnered external validation, notably its consistent inclusion in the Dow Jones Sustainability Index, a testament to its robust ESG (Environmental, Social, and Governance) performance. For instance, in 2023, Cencosud reported a 10% reduction in food waste across its supermarket operations through its food rescue programs, directly contributing to its 'Planet' pillar.

- Sustainability Policy: Structured around four pillars: Corporate Governance, People, Planet, and Products.

- Risk Mitigation: Policy guides sustainable value chain management and risk reduction.

- Environmental Impact: Focus on reducing environmental impacts across operations.

- Recognition: Inclusion in the Dow Jones Sustainability Index highlights strong ESG performance.

Solid Revenue Growth in Key Markets

Cencosud demonstrated robust revenue expansion in its primary operational areas during 2024. The company achieved a notable 15.9% year-over-year revenue increase, totaling CLP $16,493,815 million, which translates to roughly USD 17,477 million. This impressive growth was primarily fueled by strong sales and double-digit adjusted EBITDA growth in strategically important markets, including Chile, the United States, and Peru.

This performance highlights Cencosud's effectiveness in boosting sales and profitability within its core geographical segments, even amidst a less-than-ideal economic climate.

- 15.9% year-over-year revenue growth in 2024.

- Revenue reached CLP $16,493,815 million (approx. USD 17,477 million).

- Key markets like Chile, the United States, and Peru showed strong performance.

- Double-digit adjusted EBITDA growth was observed in these core regions.

Cencosud's diversified business model across various retail segments and geographies provides significant resilience. This multi-format strategy, coupled with a strong regional presence in key Latin American markets and expansion into the United States, allows the company to capture a broad customer base and mitigate risks associated with single-market dependency. The company's commitment to digital transformation and sustainability further solidifies its competitive advantage.

| Strength | Description | Supporting Data (2024) |

| Diversified Business Portfolio | Operates across supermarkets, home improvement, department stores, shopping centers, and financial services. | 5.7% consolidated revenue growth Q1 2024. |

| Strong Regional Footprint | Dominant player in Chile, Argentina, Brazil, Peru, and Colombia. | Double-digit revenue increases in Brazil, Peru, and Colombia. |

| Digital Ecosystem & Omnichannel | Investments in online channels, customer experience, and Prime program expansion. | Double-digit growth in online sales. |

| Sustainability Focus | Comprehensive ESG policy and inclusion in Dow Jones Sustainability Index. | 10% food waste reduction in supermarket operations (2023). |

What is included in the product

Delivers a strategic overview of Cencosud’s internal and external business factors, highlighting its strong brand presence and diversified retail portfolio alongside challenges like economic volatility and increasing competition.

Highlights key Cencosud vulnerabilities and opportunities for targeted strategic intervention.

Weaknesses

Argentina's persistent hyperinflation and sharp currency devaluation have significantly hampered Cencosud's financial performance. This economic instability directly contributed to a net loss reported in the first quarter of 2024, and it played a major role in the overall decline of the company's net income for the entirety of 2024.

The complex accounting and operational adjustments required to account for hyperinflation present a substantial hurdle for Cencosud. For instance, the company's 2024 financial statements showed a negative impact from inflation adjustments, underscoring the difficulty in navigating this volatile economic landscape.

Cencosud experienced a notable 20.0% decrease in its overall net income for the full year 2024 when compared to the prior year. This downturn was largely influenced by the depreciation of the Chilean peso against the U.S. dollar, which negatively impacted non-operating results, alongside the difficult economic climate prevalent in Argentina.

Cencosud faces intensified rivalry in crucial markets, particularly Brazil, where the retail sector is highly competitive and consumer spending is strained. This dynamic has directly impacted Cencosud's ability to grow revenue and its adjusted EBITDA in these areas.

To counter this, the company has had to ramp up promotional efforts, which in turn can negatively affect its gross profit margins. For instance, in Q1 2024, Cencosud reported a 2.2% decrease in revenue in its Brazilian operations year-on-year, partly attributed to this competitive pressure.

High Leverage and Debt Concerns

Cencosud's financial structure shows a notable reliance on debt. As of the first quarter of 2025, the company's total liabilities, with a significant portion being long-term debt, far exceeded its readily available cash and short-term receivables. This imbalance points to a high leverage ratio, which can amplify both gains and losses.

While Cencosud has demonstrated improvements in its earnings before interest and taxes (EBIT) and is actively managing its current debt levels, the overall substantial debt burden continues to be a key area of focus for investors and financial analysts. This high leverage can pose challenges in periods of economic downturn or rising interest rates.

- High Leverage: As of March 2025, liabilities significantly outweighed cash and short-term receivables, indicating a substantial debt load.

- Debt Scrutiny: Despite EBIT improvements and leverage management, the company's debt level remains a point of concern for stakeholders.

- Financial Risk: A high debt-to-equity ratio can increase financial risk, making the company more vulnerable to market fluctuations.

Operational Challenges in Specific Markets

Cencosud grapples with operational hurdles in specific regions, notably Colombia. Despite a general upward trend in performance, these markets demand focused attention to boost profitability and efficiency. For instance, in the first quarter of 2024, Cencosud reported that its Colombian operations contributed a smaller, albeit growing, portion to its overall revenue compared to more established markets, highlighting the need for intensified strategic refinement.

These ongoing challenges in certain markets, like Colombia, directly impact Cencosud's ability to fully capitalize on its growth potential. The company is actively implementing strategic adjustments, but the path to achieving optimal operational efficiency and profitability in these areas remains a key focus for 2024 and beyond.

The company's recent financial disclosures for the first half of 2024 indicate that while consolidated sales increased by 10.2% year-over-year, the performance in specific segments, including those in Colombia, lagged behind the group's average, underscoring the ongoing need for operational improvements.

Key areas requiring attention include:

- Supply Chain Optimization: Enhancing logistics and inventory management in markets like Colombia to reduce costs and improve product availability.

- Market-Specific Strategies: Tailoring product assortments and marketing efforts to better resonate with local consumer preferences in underperforming regions.

- Cost Control Measures: Implementing stricter cost management protocols to improve margins in challenging operational environments.

- Digital Integration: Accelerating the adoption of digital tools and e-commerce capabilities to streamline operations and reach a wider customer base in these markets.

Cencosud's significant debt load presents a considerable weakness. As of the first quarter of 2025, the company's liabilities substantially exceeded its liquid assets, signaling high leverage. This financial structure increases vulnerability to economic downturns and rising interest rates, despite ongoing efforts to manage debt levels and improvements in EBIT.

Intensified competition, particularly in Brazil, is impacting Cencosud's revenue and EBITDA growth. For instance, Q1 2024 saw a 2.2% year-on-year revenue decrease in its Brazilian operations due to this pressure, forcing increased promotional spending that can erode profit margins.

Operational challenges in specific markets, such as Colombia, continue to hinder optimal performance. While consolidated sales saw a 10.2% increase in the first half of 2024, certain segments, including Colombia, lagged behind, necessitating focused strategies for efficiency and profitability improvements.

What You See Is What You Get

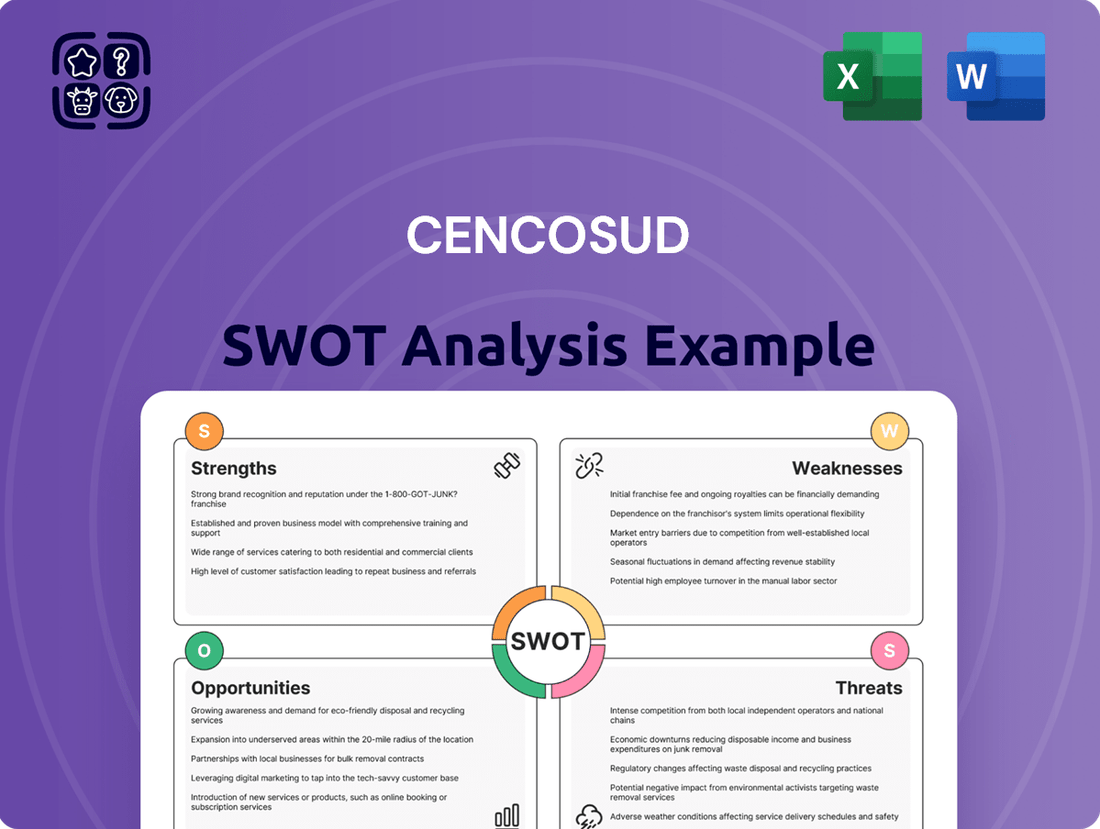

Cencosud SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the comprehensive Strengths, Weaknesses, Opportunities, and Threats impacting Cencosud. Purchase this report to gain full access to all insights and actionable strategies.

Opportunities

Cencosud's strategic push into the United States, backed by a substantial USD $610 million investment plan for 2025, represents a prime opportunity. This plan includes the launch of 28 new stores, with a significant portion, 12, earmarked for the US market.

This targeted expansion into the US, a market known for its high growth potential and profitability, offers Cencosud a chance to broaden its revenue sources and attract new customer segments. It diversifies the company's geographical footprint, reducing reliance on its existing core markets.

Cencosud's ongoing investment in its digital ecosystem, encompassing Cencosud Media, Cencosud Ventures, and CencoPay, presents a significant avenue for expansion. By further integrating these platforms, the company can create a more cohesive and engaging customer journey.

Strengthening online channels and digital capabilities is crucial for enhancing customer experiences and fostering loyalty. This digital push is expected to translate into improved operational efficiencies across Cencosud's diverse business units, driving growth.

For instance, Cencosud's e-commerce sales saw a notable increase, with digital channels contributing a significant portion of revenue in recent reporting periods, demonstrating the tangible impact of these digital transformation efforts.

Cencosud's strategic acquisitions, like the recent addition of Supermercados Makro and Basualdo in Argentina, highlight a deliberate move to bolster its market position and diversify into formats such as Cash & Carry. These moves, completed in late 2023 and early 2024, are key to expanding its reach and capabilities.

By continuing to identify and integrate synergistic acquisitions, Cencosud can effectively drive market consolidation. This strategy not only enhances its overall market share but also broadens its portfolio of services and product offerings, creating a more robust and competitive business model.

Enhancing Private Label and Product Mix Optimization

Cencosud's strategic emphasis on private label expansion is yielding significant results, evidenced by a robust 15.9% growth in private label sales during the first quarter of 2024. This performance underscores the company's ability to effectively leverage its own brands.

By actively optimizing its product mix, Cencosud is positioning itself for enhanced profitability. Private labels often command higher profit margins compared to national brands, directly contributing to improved financial performance.

This focus on private labels also fosters increased customer loyalty. Offering unique, cost-effective products under its own brands helps Cencosud differentiate itself in a competitive retail landscape, building a stronger connection with its customer base.

- Private Label Sales Growth: 15.9% increase in Q1 2024.

- Profit Margin Enhancement: Potential for higher margins through private label offerings.

- Competitive Differentiation: Unique and cost-effective products create a distinct market position.

- Brand Loyalty Building: Strengthening customer relationships via proprietary product lines.

Leveraging Sustainability for Brand Value and Operational Efficiency

Cencosud's ongoing investment in sustainability, evidenced by initiatives like reducing plastic bag usage and improving energy efficiency across its stores, presents a significant opportunity to bolster its brand image. This commitment resonates strongly with a growing segment of consumers who prioritize environmental and social responsibility in their purchasing decisions. For instance, by the end of 2023, Cencosud reported a 15% reduction in single-use plastic bags across its Chilean operations compared to 2022, a tangible step that enhances consumer perception.

Beyond brand enhancement, these sustainable practices are directly translating into operational efficiencies. Waste reduction programs and investments in energy-saving technologies, such as LED lighting retrofits in its supermarkets, are yielding measurable cost savings. Cencosud's 2024 sustainability report highlighted a 7% decrease in energy consumption per square meter in its retail spaces, directly impacting the bottom line and contributing to long-term financial resilience.

The company can further capitalize on this by:

- Expanding its portfolio of eco-friendly private label products, appealing to a wider base of conscious consumers.

- Communicating its sustainability achievements more prominently through marketing campaigns to attract and retain customers.

- Seeking certifications and partnerships that validate its environmental and social commitments, further solidifying trust.

- Exploring circular economy models for packaging and product lifecycles to drive innovation and reduce resource dependency.

Cencosud's strategic expansion into the United States, with a USD $610 million investment plan for 2025 including 12 new stores, offers significant growth potential. This move diversifies revenue streams and taps into a high-growth market, reducing reliance on existing operations.

The company's investment in its digital ecosystem, including Cencosud Media and CencoPay, is crucial for enhancing customer experience and driving operational efficiencies. This digital focus has already shown tangible results, with e-commerce sales contributing a notable portion of revenue.

Strategic acquisitions, such as Supermercados Makro and Basualdo in Argentina, bolster Cencosud's market share and diversify its retail formats. Continued synergistic acquisitions can drive further market consolidation and broaden its service offerings.

A strong emphasis on private label expansion, evidenced by a 15.9% growth in Q1 2024, enhances profitability through higher margins and builds customer loyalty by offering unique, cost-effective products.

Cencosud's commitment to sustainability, including a 15% reduction in single-use plastic bags in Chile by the end of 2023 and a 7% decrease in energy consumption per square meter in 2024, enhances brand image and drives operational efficiencies.

Threats

Cencosud's diverse operations across Latin America mean it's vulnerable to significant macroeconomic headwinds. Countries like Argentina have experienced very high inflation rates, which can erode purchasing power and impact consumer spending. For instance, Argentina's inflation rate in 2023 was reported to be over 200%, a stark figure that highlights the volatility Cencosud navigates.

Currency fluctuations present a direct financial challenge. The depreciation of the Chilean peso against the US dollar, for example, directly affects Cencosud's financial statements, particularly its non-operating results and overall profitability. In early 2024, the Chilean peso saw periods of weakness against the dollar, which would have negatively impacted the translated value of dollar-denominated assets and liabilities.

Cencosud operates in a retail environment characterized by fierce competition, facing off against both strong local contenders and well-established international brands across its key markets. This crowded field can trigger aggressive price wars and necessitate higher spending on advertising and promotions, directly impacting profitability. For instance, during 2024, the retail sector in countries like Brazil saw a noticeable uptick in promotional activities as companies fought for market share, a trend that puts pressure on Cencosud's margins.

Economic slowdowns and shifts in consumer spending, like a move towards less discretionary purchases or a greater focus on value, can significantly affect Cencosud's sales and profits. The company has already observed these slower consumption patterns in certain regions.

For instance, during the first quarter of 2024, Cencosud reported a 2.5% decrease in same-store sales in Chile, partly attributed to a more cautious consumer environment. This highlights the direct correlation between macroeconomic conditions and the company's performance.

Supply Chain Disruptions and Inflationary Pressures

Global and regional supply chain vulnerabilities remain a significant threat, potentially impacting Cencosud's ability to source products efficiently. Persistent inflationary pressures, particularly on energy and raw materials, are also a concern. For instance, rising electricity rates in Latin America directly increase operational costs for Cencosud's retail and home improvement segments.

These combined pressures can lead to extended inventory days as companies manage stock levels amidst uncertainty, and directly elevate operating expenses, thereby squeezing profit margins. Cencosud, like many retailers, faces the challenge of absorbing or passing on these increased costs to consumers.

- Supply Chain Volatility: Continued disruptions in global shipping and logistics can delay product availability.

- Inflationary Impact: Rising costs for goods, energy, and transportation directly affect operational expenditures.

- Inventory Management: Increased lead times and cost of goods may necessitate higher inventory holding, tying up capital.

- Profit Margin Squeeze: The inability to fully pass on cost increases to consumers can negatively impact profitability.

Regulatory and Political Risks in Operating Countries

Cencosud's international presence exposes it to a complex web of varying regulatory frameworks and political climates across its operating countries. Fluctuations in government policies, trade agreements, and tax legislation, particularly in key markets like Chile and Brazil, can significantly impact its operational costs and investment strategies. For instance, shifts in consumer protection laws or import duties could directly affect Cencosud's retail and financial services segments.

Political instability or sudden changes in leadership within any of its operating regions pose a tangible threat. Such events can lead to disruptions in supply chains, alter consumer confidence, and even prompt unexpected changes in economic policies. Cencosud's exposure to these risks is substantial, given its operations span several South American nations, each with its unique political dynamics.

The company's financial performance is intrinsically linked to the stability of these environments. For example, in 2024, economic uncertainty in Argentina, a significant market for Cencosud, has already presented challenges through currency devaluation and inflation, impacting profitability and requiring strategic adjustments to pricing and inventory management.

- Exposure to diverse regulatory landscapes: Cencosud operates in countries with differing consumer protection laws, labor regulations, and environmental standards, requiring constant adaptation.

- Impact of political instability: Changes in government or geopolitical tensions in markets like Peru or Colombia could disrupt operations and affect consumer spending.

- Tax law variations: Cencosud must navigate a patchwork of tax laws, with potential increases in corporate tax rates or introduction of new levies in countries like Brazil or Chile impacting net income.

- Trade policy shifts: Alterations in import/export regulations or tariffs between countries where Cencosud sources and sells goods can affect its cost of goods sold and overall competitiveness.

Cencosud faces significant threats from macroeconomic volatility across Latin America, with high inflation rates in countries like Argentina, exceeding 200% in 2023, eroding consumer purchasing power. Currency fluctuations, such as the depreciation of the Chilean peso against the US dollar in early 2024, directly impact its financial reporting and profitability.

Intense competition from local and international brands forces Cencosud into price wars and increased promotional spending, as seen with heightened promotional activities in Brazil during 2024, squeezing profit margins. Economic slowdowns and cautious consumer spending, evidenced by a 2.5% decrease in Cencosud's Chilean same-store sales in Q1 2024, directly affect revenue.

Supply chain disruptions and rising operational costs due to inflation, particularly for energy and raw materials, are ongoing concerns, with increased electricity rates in Latin America impacting Cencosud's segments. These factors can lead to higher inventory holding costs and reduced profitability.

The company's international operations expose it to diverse and changing regulatory and political landscapes. Shifts in government policies, tax laws, and trade agreements in key markets like Chile and Brazil can significantly alter operational costs and investment strategies, while political instability in regions such as Peru or Colombia could disrupt operations and consumer confidence.

| Threat | Description | Impact | Example Data |

| Macroeconomic Volatility | High inflation and currency depreciation in operating countries. | Reduced consumer spending, eroded profitability. | Argentina inflation >200% (2023); Chilean Peso weakness (early 2024). |

| Intense Competition | Aggressive pricing and promotional activities from rivals. | Margin compression, increased marketing costs. | Increased promotional activity in Brazil (2024). |

| Supply Chain Issues | Disruptions and rising costs of goods and energy. | Higher operational expenses, inventory management challenges. | Rising electricity rates in Latin America. |

| Regulatory & Political Risk | Varying laws and political instability across markets. | Operational disruptions, altered investment strategies. | Economic uncertainty in Argentina impacting operations (2024). |

SWOT Analysis Data Sources

This Cencosud SWOT analysis is built upon a robust foundation of data, including publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.